Market Overview

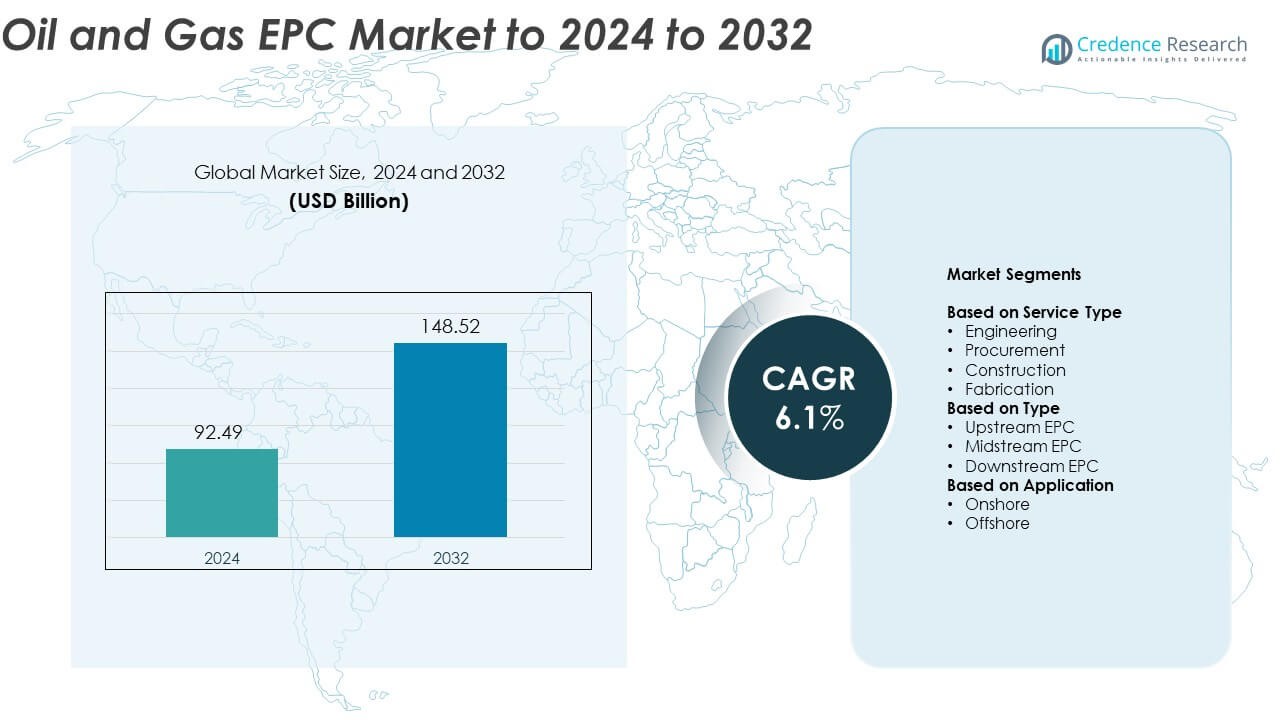

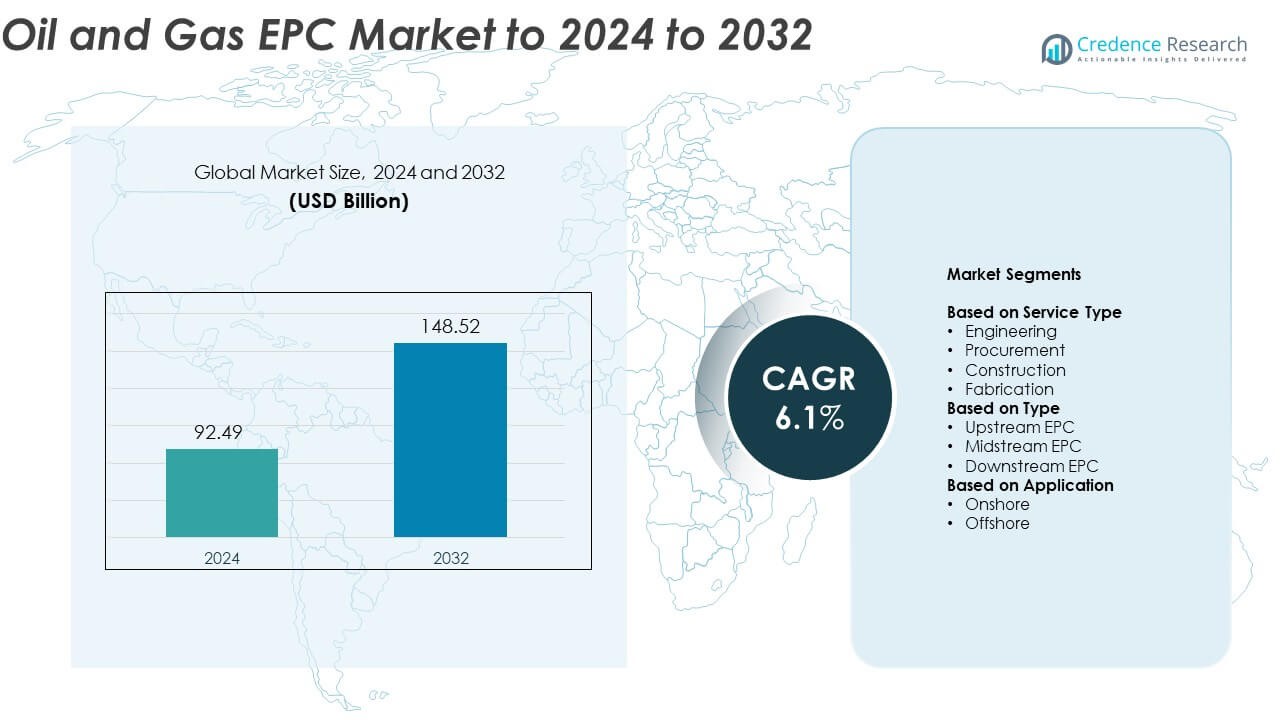

The Oil and Gas EPC Market size was valued at USD 92.49 Billion in 2024 and is anticipated to reach USD 148.52 Billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oil and Gas EPC Market Size 2024 |

USD 92.49 Billion |

| Oil and Gas EPC Market , CAGR |

6.1% |

| Oil and Gas EPC Market Size 2032 |

USD 148.52 Billion |

The oil and gas EPC market is led by major companies such as Larsen & Toubro Limited, Fluor Corporation, Bechtel Corporation, TechnipFMC plc, Worley, Samsung E&A, SAIPEM SpA, Petrofac Limited, McDermott, and KBR Inc. These firms dominate through large-scale project execution, technological expertise, and strong global partnerships. Asia Pacific holds the largest share at about 28% in 2024, driven by rising energy demand and refinery expansion. North America follows with 34% share, supported by shale and LNG projects, while Europe accounts for nearly 22% due to refinery modernization and sustainability initiatives across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The oil and gas EPC market was valued at USD 92.49 Billion in 2024 and is projected to reach USD 148.52 Billion by 2032, expanding at a CAGR of 6.1% during the forecast period.

- Increasing global energy demand and the need for modern infrastructure are driving new EPC contracts in refinery, LNG, and pipeline projects.

- Adoption of modular construction, digital monitoring, and sustainable project design is transforming operational efficiency and safety standards across the industry.

- The market remains competitive, with major players focusing on technology integration, strategic alliances, and diversification into low-carbon projects to maintain leadership.

- North America holds 34% share, followed by Asia Pacific at 28%, and Europe at 22%, while the construction segment dominates with 48% share due to rising investment in large-scale refinery and petrochemical facilities.

Market Segmentation Analysis:

By Service Type

The construction segment dominates the oil and gas EPC market, accounting for nearly 48% share in 2024. Its leadership is driven by extensive infrastructure development, including pipelines, refineries, and offshore platforms. The demand for advanced construction solutions is growing as operators focus on safety compliance, cost optimization, and faster project delivery. Increasing investment in modular construction, automation, and digital project management tools further enhances efficiency and scalability. The expansion of large-scale projects across the Middle East and Asia-Pacific continues to boost construction service adoption in the EPC sector.

- For instance, Fluor reports installing more than 200,000 miles of onshore pipelines across 6 continents.

By Type

The downstream EPC segment leads the market with around 44% share in 2024. This dominance stems from rising refinery expansions, petrochemical facility upgrades, and growing fuel processing capacity worldwide. Companies are prioritizing projects that support cleaner fuel production and energy diversification. Strong investment in refining capacity in India, China, and Saudi Arabia reinforces downstream EPC growth. Additionally, increasing demand for advanced process control systems and emission-reduction technologies supports sustained investment in downstream operations, making it a key revenue contributor in the global EPC landscape.

- For instance, Bechtel’s Sabine Pass LNG has six operational trains with about 30 million tonnes per annum total capacity.

By Application

The onshore segment holds the largest share of about 63% in 2024, driven by its cost-effectiveness and accessibility for project execution. Onshore operations dominate due to extensive infrastructure development, including refineries, pipelines, and processing plants. The segment benefits from lower operational risks and simpler logistics compared to offshore projects. Expanding investments in shale oil extraction, refinery modernization, and renewable integration within existing facilities further strengthen onshore EPC demand. Governments and private operators continue to fund large-scale onshore expansion projects, sustaining this segment’s market leadership globally.

Key Growth Drivers

Rising Global Energy Demand

The growing global energy consumption continues to drive investment in oil and gas infrastructure. Rapid industrialization, urbanization, and transportation needs are boosting exploration and production activities. EPC companies benefit from expanding project pipelines across developing regions. Governments are supporting new refinery and LNG facility construction to ensure energy security. This consistent demand for hydrocarbons sustains long-term opportunities for EPC contractors across both upstream and downstream projects, making energy demand a critical growth engine for the market.

- For instance, BP targets 2.3–2.5 million barrels of oil equivalent per day by 2030.

Expansion of Refinery and Petrochemical Projects

Refinery and petrochemical plant expansions are a major growth catalyst for the EPC market. Increasing demand for cleaner fuels and high-value chemical derivatives is encouraging global investments. Countries in Asia-Pacific and the Middle East are prioritizing refining upgrades to meet domestic consumption and export goals. EPC firms are gaining from large-scale project contracts focused on efficiency improvements, emissions reduction, and modernization. This trend ensures steady business opportunities for construction and engineering service providers.

- For instance, Technip Energies is delivering a low-carbon ammonia plant sized around 1.4 million metric tons per year.

Adoption of Digital and Modular Construction Technologies

The growing integration of digital solutions and modular construction enhances project speed, safety, and cost efficiency. Technologies such as BIM, digital twins, and AI-driven monitoring are improving project design and execution. Modular fabrication reduces on-site labor needs and minimizes project delays. EPC players adopting these innovations are achieving higher productivity and better project control. The increasing preference for technology-driven project execution strengthens the market’s competitiveness and supports faster delivery of complex oil and gas projects.

Key Trends & Opportunities

Transition Toward Low-Carbon and Sustainable Energy Projects

The oil and gas EPC market is increasingly shifting toward sustainable and low-emission projects. Companies are investing in carbon capture, hydrogen production, and renewable integration to align with global decarbonization goals. EPC contractors are securing contracts for biofuel plants, LNG terminals, and hybrid facilities combining renewable sources. This transition is opening new avenues for EPC service providers to diversify portfolios and meet sustainability mandates while maintaining profitability in the evolving energy ecosystem.

- For instance, Northern Lights Phase 1 is ready to store 1.5 million tonnes of CO₂ per year, with plans to expand to at least 5 million tonnes.

Rising Offshore Development Activities

Offshore exploration is regaining momentum due to new deepwater discoveries and improved subsea technology. EPC firms are expanding their presence in offshore projects to capture growing investment in FPSO units and offshore platforms. Technological advancements have lowered drilling costs, making deepwater projects more viable. The trend supports market growth across regions with strong offshore potential, including Africa, South America, and the North Sea, offering sustained opportunities for specialized EPC contractors.

- For instance, Petrobras’ FPSO Guanabara reached processing capacity of 180,000 barrels of oil per day in the Mero field.

Key Challenges

Volatility in Crude Oil Prices

Fluctuations in crude oil prices pose a major challenge to EPC market stability. Price volatility affects investment decisions, delaying exploration and production projects. When prices drop, companies cut capital expenditure, reducing demand for new EPC contracts. This uncertainty impacts long-term planning and profitability for service providers. Maintaining flexibility and diversifying portfolios across oil, gas, and renewables becomes essential for mitigating risks associated with market volatility.

Project Delays and Cost Overruns

Large-scale EPC projects often face delays and cost escalation due to complex designs, regulatory approvals, and supply chain disruptions. Rising material costs, labor shortages, and geopolitical uncertainties further strain budgets. These challenges reduce contractor margins and erode client confidence. Companies are addressing these issues through digital project management tools and risk-based planning, but execution inefficiencies remain a key restraint that can limit profitability and timely project delivery.

Regional Analysis

North America

North America holds around 34% share of the oil and gas EPC market in 2024. The region benefits from strong investment in shale exploration, pipeline expansion, and LNG infrastructure. The United States leads with significant refinery upgrades and offshore projects in the Gulf of Mexico. Canada supports EPC growth through oil sands and gas processing developments. Focus on digitalized construction and modular fabrication enhances operational efficiency. Rising demand for cleaner fuels and energy exports further drives EPC activities across upstream and downstream sectors, maintaining North America’s leadership position in the global market.

Europe

Europe accounts for nearly 22% share of the oil and gas EPC market in 2024. The region’s focus on energy transition, refinery modernization, and offshore field redevelopment supports steady EPC demand. Countries such as Norway and the United Kingdom continue to invest in offshore wind and subsea infrastructure linked to oil and gas assets. EPC firms benefit from stringent environmental standards driving sustainable project designs. The ongoing shift toward hydrogen and carbon capture projects also creates new opportunities for contractors in engineering and construction services across Western and Northern Europe.

Asia Pacific

Asia Pacific dominates the market with about 28% share in 2024, supported by expanding energy demand and refining capacity. China, India, and Indonesia are major contributors, with continuous investment in petrochemical and LNG infrastructure. The region experiences rapid EPC contract growth in both onshore and offshore segments. Government-backed refinery expansion and energy diversification programs strengthen industry development. Technological adoption in project management and sustainable plant construction further enhances competitiveness. The large-scale infrastructure pipeline positions Asia Pacific as one of the fastest-growing EPC markets globally through the forecast period.

Middle East and Africa

The Middle East and Africa together represent roughly 12% share of the global oil and gas EPC market in 2024. Gulf Cooperation Council nations continue leading refinery expansions and offshore projects, with Saudi Arabia and the UAE driving high-value contracts. Africa’s investments in gas processing and LNG facilities contribute to regional growth. EPC firms gain from ongoing national initiatives to boost production and downstream integration. Increased collaboration between local and international contractors supports capacity building, while government-backed projects sustain the region’s role as a key energy development hub.

Latin America

Latin America captures nearly 8% share of the oil and gas EPC market in 2024. The region’s growth is fueled by offshore exploration in Brazil and Mexico, supported by new field discoveries. Refinery upgrades and LNG terminal developments are boosting EPC demand. Governments are liberalizing investment policies to attract foreign participation in infrastructure projects. Rising interest in natural gas and renewable integration encourages EPC expansion. Improved regulatory frameworks and digital project execution enhance efficiency, positioning Latin America as an emerging opportunity area within the global oil and gas EPC industry.

Market Segmentations:

By Service Type

- Engineering

- Procurement

- Construction

- Fabrication

By Type

- Upstream EPC

- Midstream EPC

- Downstream EPC

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the oil and gas EPC market includes leading companies such as Larsen & Toubro Limited, Fluor Corporation, Técnicas Reunidas S.A., Samsung E&A, NMDC Group, Bechtel Corporation, McDermott, SAIPEM SpA, Petrofac Limited, TechnipFMC plc, Worley, KBR Inc., and John Wood Group PLC. The market remains moderately consolidated, with top firms dominating through large-scale projects, advanced engineering capabilities, and strong global networks. Competition focuses on technological innovation, project execution efficiency, and sustainability-driven designs. Companies are increasingly adopting digital project management, AI-based monitoring, and modular construction to enhance cost control and reduce project delays. Strategic collaborations and long-term service agreements with national oil companies strengthen market positioning. The shift toward energy transition projects, including hydrogen and carbon capture facilities, is reshaping business strategies and investments. Global EPC providers continue to expand their portfolios, aligning with decarbonization goals and regional infrastructure development to maintain a competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Larsen & Toubro Limited

- Fluor Corporation

- Técnicas Reunidas S. A.

- Samsung E&A

- NMDC Group

- Bechtel Corporation

- McDermott

- SAIPEM SpA

- Petrofac Limited

- TechnipFMC plc

- Worley

- KBR Inc.

- John Wood Group PLC

Recent Developments

- In 2025, TechnipFMC was awarded a large iEPCI™ contract by Equinor for the Johan Sverdrup Phase 3 development in the Norwegian North Sea

- In 2025, Fluor, in a joint venture with JGC Corporation, was awarded the Front-End Engineering and Design (FEED) contract for the proposed second phase expansion of the LNG Canada facility in British Columbia.

- In 2025, L&T’s Hydrocarbon Business won an ultra mega offshore contract for the North Field Production Sustainability Offshore Compression Project in Qatar.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digitalization and automation will enhance project efficiency and reduce operational risks.

- Growing demand for cleaner fuels will drive investments in refinery modernization.

- Modular construction techniques will gain traction for faster and cost-effective project delivery.

- Expansion of LNG and gas processing facilities will remain a key growth focus.

- Integration of renewable and hybrid energy projects will increase EPC diversification.

- Offshore exploration and deepwater projects will see steady recovery and new investments.

- Advanced project management tools will improve scheduling and cost control.

- Sustainability targets will push adoption of low-carbon and energy-efficient EPC solutions.

- Strategic partnerships between global and regional contractors will strengthen market reach.

- Government policies supporting energy infrastructure will boost long-term EPC market growth.