Market Overview

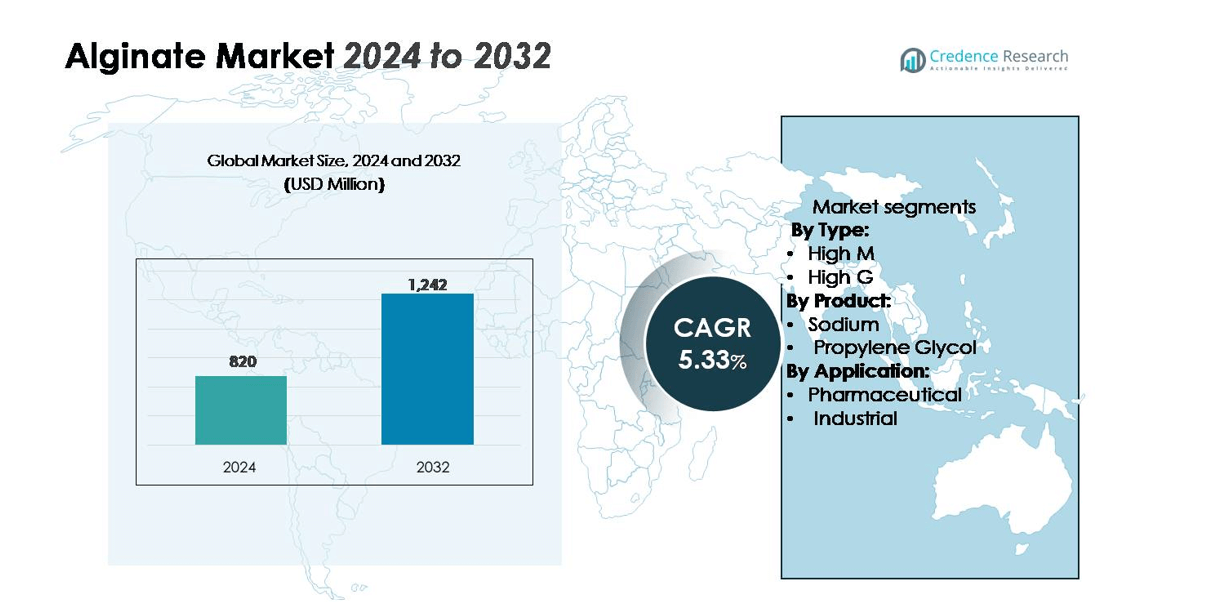

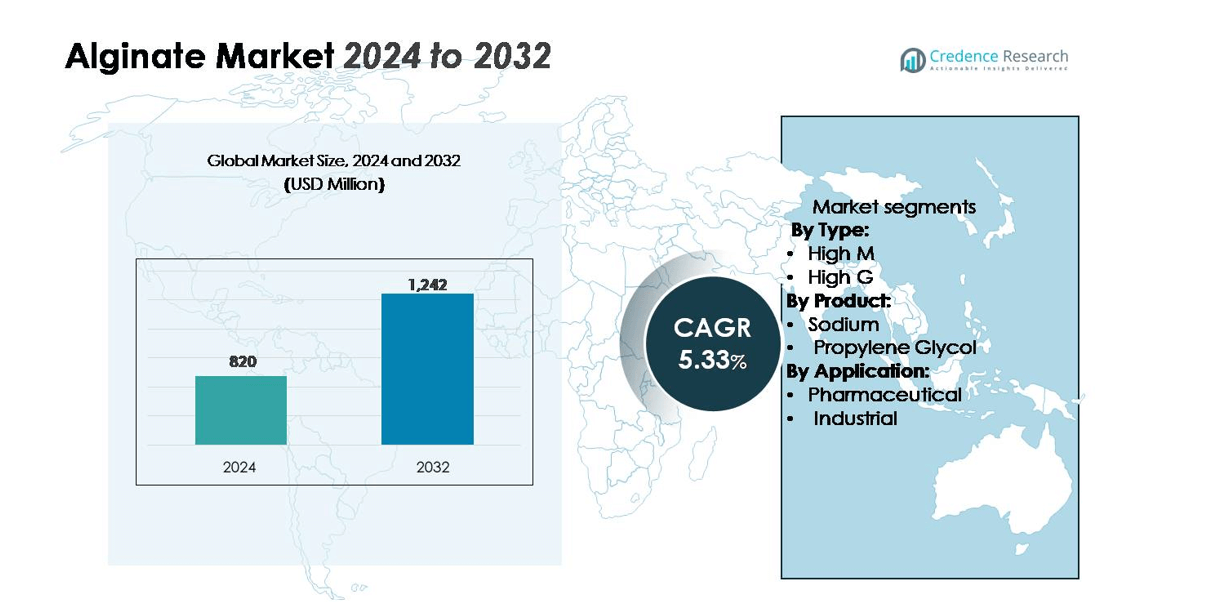

The Alginate Market was valued at USD 820 million in 2024 and is projected to reach USD 1,242 million by 2032, growing at a CAGR of 5.33% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alginate Market Size 2024 |

USD 820 million |

| Alginate Market, CAGR |

5.3% |

| Alginate Market Size 2032 |

USD 1,242 million |

The alginate market is led by major players including DuPont de Nemours, Inc., FMC Corporation, KIMICA Corporation, Shandong Jiejing Group Corporation, and SNAP Natural & Alginate Products Pvt. Ltd. These companies focus on high-quality production, advanced extraction technologies, and sustainable seaweed sourcing to maintain competitiveness. They cater to diverse end-use industries such as pharmaceuticals, food, and industrial manufacturing. Asia-Pacific leads the global alginate market with a 34% share, supported by abundant seaweed reserves, large-scale production facilities, and strong export activities. North America and Europe follow, driven by increasing demand for pharmaceutical-grade and bio-based alginate applications.

Market Insights

- The Alginate Market was valued at USD 820 million in 2024 and is projected to reach USD 1,242 million by 2032, growing at a CAGR of 5.33% during the forecast period.

- Rising demand from pharmaceutical, food, and industrial applications drives market growth, with alginates widely used in drug delivery, wound care, and food stabilization.

- Growing adoption of bio-based materials and advancements in 3D bioprinting represent key market trends enhancing innovation and sustainability.

- The market is moderately consolidated, with leading players such as DuPont, FMC Corporation, and KIMICA focusing on high-purity alginate production and sustainable sourcing practices.

- Asia-Pacific dominates with a 34% share, followed by North America at 31% and Europe at 27%; by type, High M alginate holds 57%, and by product, Sodium alginate accounts for 61%, reflecting strong regional and segmental concentration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The High M segment dominates the alginate market with a market share of 57%. High M alginates offer superior gel flexibility and viscosity, making them highly suitable for food and pharmaceutical applications. Their excellent water-binding properties enhance texture in dairy products and act as effective thickeners in drug formulations. In contrast, High G alginates deliver firmer gels preferred in industrial and biomedical uses. Growing demand from the food processing and wound care industries continues to drive the adoption of High M alginates globally.

- For instance, KIMICA Corporation produces high-M alginates with a viscosity of 400 mPa·s at a 1% concentration, enabling superior texture control in dairy desserts and controlled-release drug formulations.

By Product

The Sodium Alginate segment holds the largest market share of 61%, driven by its wide applicability in pharmaceuticals, textiles, and food processing. Sodium alginate is favored for its biocompatibility, film-forming ability, and stability under varying pH levels. It serves as a thickening, stabilizing, and gelling agent in drug delivery systems and dairy products. Propylene glycol alginate, although smaller in share, is gaining traction in beverage stabilization and salad dressing formulations due to its superior emulsifying capacity.

- For instance, Ceamsa’s propylene glycol alginate demonstrates emulsification stability exceeding 96 hours in acidic beverage systems, ensuring consistent product quality during storage and transport.

By Application

The Pharmaceutical segment leads the alginate market with a 49% share, supported by its extensive use in wound care, dental molds, and controlled drug release systems. Alginates’ biocompatibility and biodegradability make them ideal for biomedical applications. Demand is also rising for alginate-based capsules and excipients that enhance drug stability. The Industrial segment continues to grow steadily, particularly in textiles, paper, and wastewater treatment, where alginates improve viscosity control and binding efficiency.

Key Growth Drivers

Rising Demand from Pharmaceutical and Biomedical Applications

The pharmaceutical industry remains a key growth driver for the alginate market due to its increasing use in wound care, drug delivery, and dental applications. Alginates’ non-toxic, biocompatible, and biodegradable nature makes them ideal for biomedical formulations. They are widely used in the development of controlled-release capsules and hemostatic agents. Growing demand for advanced wound dressings that support moisture retention and healing further boosts consumption. Continuous research in tissue engineering and regenerative medicine also increases alginate’s relevance in pharmaceutical innovations, ensuring sustained demand across healthcare applications.

- For instance, FMC Corporation (now part of IFF Pharma Solutions) manufactures Protanal LF 200S sodium alginate, which is widely used in pharmaceutical research and oral formulations to enhance gel strength and facilitate controlled drug release.

Expanding Use in Food and Beverage Industry

Alginate’s ability to form gels, stabilize emulsions, and improve texture has accelerated its adoption in the food and beverage sector. It is extensively used in ice creams, yogurts, jellies, and restructured food products to enhance consistency and shelf life. Rising consumer demand for plant-based and low-calorie ingredients drives manufacturers to replace synthetic additives with alginate-based alternatives. The ingredient’s GRAS (Generally Recognized as Safe) status encourages broader acceptance by food manufacturers. The growing clean-label trend continues to fuel global alginate consumption in the food processing industry.

Growing Adoption in Industrial and Textile Applications

The industrial sector increasingly relies on alginate for applications such as textile printing, paper coating, and water treatment. In textile printing, alginate-based thickeners ensure color uniformity and easy washing, enhancing production quality. In wastewater treatment, alginates act as natural flocculants, improving purification efficiency. Their eco-friendly and renewable origin aligns with sustainability initiatives across industries. As manufacturing sectors in Asia-Pacific expand, industrial-grade alginate demand continues to grow, supported by increasing investments in sustainable production technologies.

Key Trends & Opportunities

Expansion in Sustainable and Bio-Based Materials

The shift toward eco-friendly materials presents significant opportunities for alginate manufacturers. Derived from brown seaweed, alginate aligns with the growing preference for renewable and biodegradable polymers. Researchers are exploring new formulations for bioplastics, coatings, and packaging materials. Several companies are investing in seaweed farming and extraction technologies to ensure a stable supply chain. The global push for reducing plastic waste positions alginate as a sustainable alternative for multiple industries, including packaging and cosmetics, driving innovation and new revenue streams.

- For instance, research into alginate-based bioplastic films shows promise, with some experimental composites achieving tensile strengths up to 70 MPa in specific studies, though typical values range lower. These films offer potential as a biodegradable packaging substitute due to their good oxygen barrier properties in low-moisture environments.

Advancements in Biomedical Research and 3D Bioprinting

Recent advancements in 3D bioprinting and tissue engineering create lucrative opportunities for alginate use in biomedical applications. Alginate hydrogels serve as scaffolding materials due to their tunable mechanical strength and cell compatibility. In tissue regeneration, these materials support cell encapsulation and nutrient transport. Ongoing research focuses on modifying alginate structures to enhance printability and crosslinking efficiency. The integration of alginate in personalized medicine and regenerative therapies is expected to redefine its role in next-generation healthcare technologies.

- For instance, KIMICA Corporation supplies high-purity, low-endotoxin alginates that are suitable for demanding biomedical and biofabrication applications, with various studies in the field demonstrating high cell viability (often exceeding 80% or 90% depending on the specific conditions and cell type) in alginate-based hydrogels over several days.

Key Challenges

Fluctuations in Raw Material Supply and Seaweed Harvesting

The alginate market faces supply-side challenges due to its dependence on brown seaweed, primarily harvested from coastal regions. Variations in ocean temperature, climate change, and over-harvesting affect raw material availability and pricing. Seasonal supply fluctuations disrupt production stability for many manufacturers. Environmental regulations and sustainability concerns related to large-scale seaweed extraction further intensify these issues. Companies are investing in aquaculture and synthetic biology approaches to overcome dependency and stabilize supply chains.

Complex Extraction and High Production Costs

The alginate extraction process involves multiple purification and conversion stages, leading to high operational costs. The requirement for specialized equipment and controlled conditions adds to capital expenditure. Smaller producers face challenges in maintaining product consistency and purity across batches. Furthermore, competition from low-cost synthetic substitutes in industrial applications pressures pricing margins. Addressing these challenges requires technological advancements in extraction efficiency, waste minimization, and process automation to improve cost-effectiveness and profitability.

Regional Analysis

North America

North America holds a 31% share of the global alginate market, driven by strong demand from the pharmaceutical and food industries. The United States leads the region due to its advanced biomedical research and adoption of alginate-based wound care and drug delivery systems. Increasing consumption of functional foods and dietary supplements further supports market growth. Companies are also focusing on sustainable sourcing of seaweed to meet regulatory and consumer expectations. Expanding applications in bioplastics and biotechnology continue to strengthen North America’s dominance in high-value alginate segments.

Europe

Europe accounts for 27% of the global alginate market, supported by stringent environmental regulations and a robust food processing sector. Countries such as the United Kingdom, France, and Germany lead in production and consumption, especially for food stabilizers and pharmaceutical formulations. The region’s emphasis on clean-label and bio-based ingredients promotes alginate’s use in cosmetics and nutraceuticals. European manufacturers are also investing in marine biotechnology and sustainable extraction processes. Rising healthcare investments and consumer preference for natural additives continue to drive regional demand.

Asia-Pacific

Asia-Pacific dominates the global alginate market with a 34% share, led by China, Japan, and South Korea. The region benefits from abundant seaweed resources and large-scale industrial processing. Rapid growth in the food and textile industries, coupled with increased pharmaceutical manufacturing, fuels regional expansion. China remains a major exporter of sodium alginate, while Japan drives innovation in biomedical and food-grade applications. Growing investments in seaweed aquaculture and government initiatives for sustainable production enhance supply stability. Asia-Pacific’s expanding consumer base continues to position it as the key growth hub for alginates.

Latin America

Latin America captures a 5% share of the global alginate market, with Chile emerging as a key producer due to its extensive coastal resources. The regional market benefits from rising exports of raw seaweed and processed alginates to North America and Europe. Brazil and Mexico are expanding applications in food processing and pharmaceuticals. Increasing government support for marine biotechnology and sustainable aquaculture strengthens supply reliability. Although smaller in scale, the region’s growing industrial base and export potential present long-term growth opportunities for alginate manufacturers.

Middle East & Africa

The Middle East & Africa hold a 3% share of the global alginate market, driven by growing demand in the food, pharmaceutical, and water treatment sectors. Countries such as South Africa and the UAE are witnessing gradual adoption of alginate-based formulations in processed foods and personal care products. Limited seaweed availability leads to dependence on imports from Asia-Pacific. However, research into marine resource utilization and regional investments in food manufacturing are expected to stimulate future demand. Industrial expansion and healthcare sector development will gradually enhance market penetration across the region.

Market Segmentations:

By Type:

By Product:

By Application:

- Pharmaceutical

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The alginate market is moderately consolidated, with key players focusing on product innovation, capacity expansion, and sustainable sourcing to strengthen their market position. Leading companies such as DuPont de Nemours, Inc., FMC Corporation, KIMICA Corporation, SNAP Natural & Alginate Products Pvt. Ltd., and Shandong Jiejing Group Corporation dominate global supply. These firms emphasize developing high-purity alginates for pharmaceutical and food-grade applications while investing in eco-friendly extraction processes. Strategic partnerships with seaweed farmers and investments in biopolymer research are enhancing supply chain stability and product diversification. European and Asian manufacturers are expanding exports to North America and Latin America to meet growing demand for bio-based ingredients. Continuous R&D efforts targeting advanced biomedical and biodegradable material applications underscore the industry’s shift toward innovation-driven growth. Overall, the competitive landscape remains dynamic, shaped by sustainability initiatives, technological advancements, and rising global consumption across healthcare and industrial sectors.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DuPont de Nemours, Inc.

- Algae

- Marine Biopolymers Limited

- Ceamsa

- Ingredients Solutions, Inc.

- KIMICA

- Shandong Jiejing Group Corporation

- American Express Company

- BREADFX Euro Prepaid Algaia

Recent Developments

- In March 2023, Algaia SA was acquired by JRS Group, a leading hydrocolloid and fiber company that uses plant-based raw materials. The acquisition would enable the companies to jointly address the rising demand for alginate and seaweed-based solutions globally, catering to the feed, food, pharma, home & personal care, and agriculture sectors.

- In February 2023, Algaia announced the commencement of the expansion work of its R&D center premises in Saint Lô, France, with the aid of fundings obtained from Saint Lô Agglo. The project involves the building of new laboratories with advanced equipment, along with a workshop for producing seaweed extracts on a semi-industrial scale, before being manufactured at the company’s Lannilis plant on an industrial scale

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for alginate will continue to rise across pharmaceutical and food industries.

- Manufacturers will focus on sustainable seaweed sourcing and eco-friendly extraction methods.

- Advancements in bioprinting and tissue engineering will expand biomedical applications.

- Alginates will gain traction as natural stabilizers in clean-label food products.

- Increased use of alginate in bioplastics will support the shift toward green packaging.

- Emerging economies will boost production capacity through seaweed aquaculture expansion.

- Strategic mergers and acquisitions will enhance global market consolidation.

- Continuous R&D will improve alginate purity, functionality, and performance in high-end applications.

- Industrial applications in textiles and water treatment will strengthen growth prospects.

- Asia-Pacific will remain the leading region due to strong supply chains and manufacturing dominance.