Market Overview

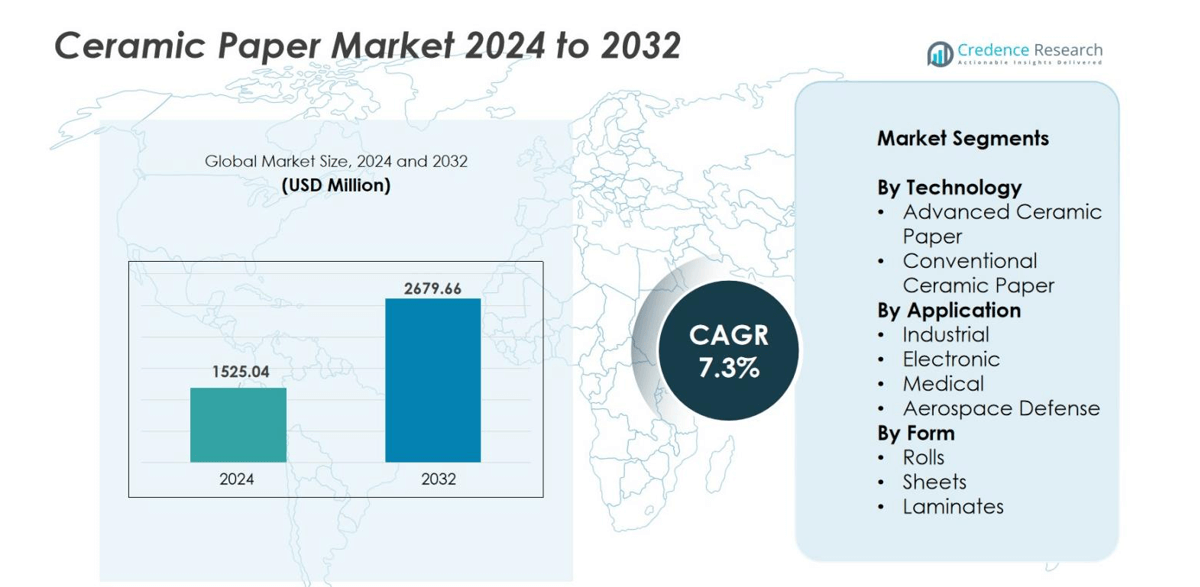

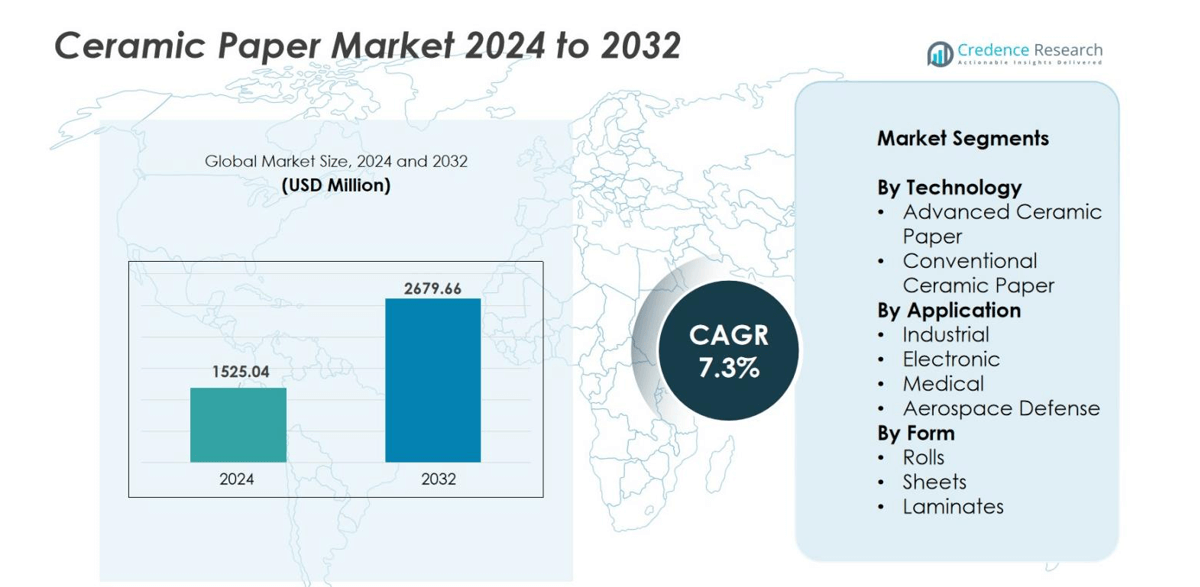

Ceramic Paper market size was valued USD 1525.04 million in 2024 and is anticipated to reach USD 2679.66 million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Paper Market Size 2024 |

USD 1525.04 million |

| Ceramic Paper Market, CAGR |

7.3% |

| Ceramic Paper Market Size 2032 |

USD 2679.66 million |

The Ceramic Paper market features strong participation from global manufacturers, including Morgan Thermal Ceramics, Unifrax, Shandong Luyang Share Co., Ltd., Isolite Insulating Products Co., Ltd., Nutec Inc., Rath Inc., Vitcas Ltd., and Galaxy Enterprise. These companies compete through high-temperature product innovation, lightweight insulation designs, and customized grades for industrial, aerospace, and electronics applications. Asia-Pacific remains the leading region with a 38% market share due to large-scale manufacturing, rapid industrial expansion, and strong demand from steel, petrochemical, and battery production industries. North America follows with 27% share, driven by aerospace, defense, EV development, and strict thermal safety regulations. Europe holds a 24% share, supported by advanced industrial infrastructure and strong automotive and aviation activities.

Market Insights

- Ceramic Paper market size reached USD 1525.04 million in 2024 and is projected to hit USD 2679.66 million by 2032, growing at a 7.3% CAGR during the forecast period.

- Industrial applications lead the market with a 48% segment share due to high usage in furnaces, kilns, and metal processing units, supported by demand for lightweight high-temperature insulation.

- A key market trend includes rising adoption in electric vehicles, aerospace, and electronics, where ceramic paper acts as a thermal barrier for batteries, sensors, exhaust systems, and fire protection components.

- Competition remains strong, with major manufacturers focusing on advanced ceramic fiber technology, low-dust formulations, and customized grades to serve automotive, petrochemical, and aerospace customers.

- Asia-Pacific dominates the market with a 38% regional share, followed by North America at 27% and Europe at 24%, supported by large-scale industrialization, EV production, and strict energy-efficiency regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Technology

Advanced ceramic paper holds the dominant share of 62% due to its superior thermal insulation, low heat conductivity, and high chemical resistance. Manufacturers prefer advanced variants for applications requiring lightweight, high-temperature durability and improved mechanical strength. Growth in metal processing, petrochemicals, and high-temperature sealing boosts demand. Conventional ceramic paper remains relevant in cost-sensitive industries, but the shift toward energy-efficient and eco-friendly materials continues to strengthen the adoption of advanced technology. Increasing furnace upgrades and insulation retrofits in developed economies further support segment expansion.

- For instance, Morgan Advanced Materials introduced their Superwool® XTRA ceramic fiber paper, targeting metal processing sectors with improved durability and reduced energy consumption documented in process trials.

By Application

The industrial segment leads with a 48% market share, driven by widespread use in furnaces, kilns, boilers, and high-temperature processing systems. Industries select ceramic paper because of its high heat resistance, low thermal shrinkage, and ease of installation. Growing investments in glass, metals, and chemical processing foster segment growth. The aerospace and defense sector shows rising adoption for thermal barriers and fire protection components. Electronics and medical applications also expand due to demand for lightweight thermal insulation materials in sensors, batteries, and medical devices.

- For instance, Saint-Gobain uses ceramic fiber paper extensively as lining material for industrial furnaces and kilns to improve energy efficiency and reduce heat loss.

By Form

The Green Logistics Market is segmented by form into Rolls, Sheets, and Laminates. Among these, rolls dominate the market, accounting for approximately 45% of the market share. Rolls are widely used for bulk packaging and wrapping, especially in eco-friendly supply chains, due to their lightweight nature and recyclability. Sheets follow with around 35% of the market share, primarily used for pallet liners and load boards, where sustainability and reusability are critical. Laminates, making up 20% of the market, are used for multi-layer packaging materials offering high barrier properties and recyclability. Each segment is driven by the increasing demand for sustainable packaging solutions and regulatory pressures promoting eco-friendly logistics practices.

Key Growth Drivers

Rising Demand for High-Temperature Insulation Materials

The Ceramic Paper market experiences strong growth as industries shift to high-temperature insulation solutions for furnaces, kilns, boilers, and petrochemical processing units. Ceramic paper offers low thermal conductivity, excellent heat resistance, and lightweight installation, making it a preferred alternative to conventional refractory bricks or mineral wool. Manufacturers in metal processing, power generation, and glass production increasingly adopt ceramic fiber insulation to reduce heat loss and improve energy efficiency. Industrial modernization programs and expansion of manufacturing plants across Asia-Pacific further drive consumption. In addition, stricter workplace safety and emission control regulations encourage industrial operators to use efficient thermal barriers, heat shields, and gaskets that can withstand extreme temperatures.

- For instance, Morgan Thermal Ceramics expanded its product portfolio through acquisitions to better serve power generation industries with advanced ceramic insulation materials.

Expansion of Aerospace, Defense, and Automotive Applications

Ceramic paper usage increases in aerospace, defense, and advanced automotive systems due to the need for light, strong, and thermally stable materials. Aircraft engine components, exhaust systems, and heat shielding structures increasingly rely on ceramic fiber paper to maintain safety in extreme heat conditions. Defense agencies accept ceramic insulation for fireproofing, thermal protection blankets, and missile casings. In the automotive sector, demand rises from electric vehicle battery protection, catalytic converters, and exhaust insulation. Lightweight ceramic insulation improves performance while reducing overall component weight, supporting fuel efficiency and heat management goals. As global production of EVs, military equipment, and aircraft grows, the requirement for compact thermal insulation materials strengthens.

- For instance, NASA research shows that ceramic matrix composites, such as SiC/SiC, are being used in turbine engine components, including exhaust nozzles, to withstand extreme temperatures and improve fuel efficiency in aircraft engines.

Increasing Focus on Energy Efficiency and Industrial Sustainability

Industrial operators are adopting energy-efficient insulation materials to reduce fuel consumption and maintain temperature stability. Ceramic paper helps minimize heat loss, optimize thermal operations, and lower operational costs for industries such as steel, glass, petrochemicals, and cement. Governments enforce energy conservation standards and carbon-emission regulations, leading to faster adoption of ceramic fiber-based insulation. Many companies retrofit older furnaces and boilers with ceramic paper linings to boost performance without major structural changes. Growing interest in eco-friendly and recyclable insulation materials also supports demand. As industries push toward low-emission production, ceramic paper becomes a strategic material for green manufacturing initiatives.

Key Trends & Opportunities

Growing Use in Electric Vehicles and Battery Safety Systems

The rise of electric vehicles unlocks new opportunities for ceramic paper manufacturers. EV battery modules generate heat during charging and operation, creating a need for fire-resistant liners and thermal barriers. Ceramic fiber paper acts as a lightweight, non-flammable insulation layer inside battery packs and electronic control units. Automakers use ceramic insulation for high-temperature gaskets, wiring protection, and exhaust systems in hybrid models. Increasing investment in gigafactories and EV production lines worldwide fuels long-term demand. As governments encourage EV adoption through subsidies and emission policies, ceramic insulation gains market penetration across power electronics, battery assemblies, and thermal protection modules.

- For instance, Morgan Advanced Materials supplies ceramic papers like their EST Compression Papers, which are used for thermal insulation between battery cells and outer packaging, providing high thermal stability with low thermal conductivity to improve EV battery safety and performance.

Technological Advancements in High-Purity and Low-Shot Ceramic Products

Manufacturers invest in advanced ceramic fiber papers with improved purity, smooth surfaces, and low shot content to ensure better insulation and reduced dust generation. High-purity formulations enhance chemical resistance, dimensional stability, and suitability for sensitive applications such as aerospace, medical instruments, fuel cells, and semiconductor equipment. Companies develop flexible grades that maintain tensile strength and thermal stability under continuous exposure to extreme temperatures. Automation in manufacturing and new fiber-spinning technologies also improve product consistency and reduce production costs. The availability of customized, application-specific ceramic papers broadens end-use adoption and opens premium market segments.

- For instance, Kerui Refractory employs advanced production processes to create ceramic fiber paper with low slag ball content, resulting in smoother surfaces, superior fire resistance, and excellent mechanical strength for high-temperature kiln applications.

Key Challenge

High Production Costs and Raw Material Volatility

The cost of producing ceramic fiber paper remains higher than traditional insulation materials due to energy-intensive fiber processing, controlled manufacturing environments, and strict quality standards. Raw materials like alumina and silica also experience price fluctuations tied to mining activities and industrial demand. Many small and medium industries choose cheaper insulation alternatives such as calcium silicate boards, mineral wool, or fiberglass. High product cost limits large-scale adoption in cost-sensitive regions and low-budget industrial applications. Manufacturers face pressure to reduce pricing without compromising purity, thermal resistance, or tensile strength. These factors create profitability challenges for suppliers and slow penetration in emerging economies.

Health and Regulatory Concerns Related to Fiber Handling

Ceramic fibers require careful handling because airborne fibers may pose respiratory hazards during installation or disposal. Regulatory bodies in several countries enforce safety guidelines, protective gear usage, and fiber emission limits at manufacturing sites. Compliance increases production and operational expenses for manufacturers. Some industries hesitate to adopt ceramic paper due to concerns over dust release, fiber shedding, and disposal protocols. Environmental restrictions on synthetic fibers further impact manufacturing flexibility. Companies must invest in safer production technologies, low-dust products, and worker protection systems. These regulatory and health-related challenges restrain adoption, especially in small-scale industrial environments.

Regional Analysis

North America

North America holds a 27% share of the Ceramic Paper market, driven by strong adoption in metal processing, aerospace, defense, and advanced automotive manufacturing. The United States leads regional demand due to high-temperature insulation needs across furnaces, turbines, and battery systems. Electric vehicle production and aerospace engine upgrades encourage the use of lightweight ceramic insulation for thermal stability and fire protection. Strict industrial safety laws and emission control policies also push factories to replace outdated insulation materials. Canada shows growing usage in power generation and petrochemical sectors, while Mexico expands demand through automotive component manufacturing.

Europe

Europe accounts for a 24% market share, supported by advanced manufacturing, industrial modernization, and strict environmental regulations. Germany, France, and the United Kingdom lead consumption due to strong aerospace, automotive, and metallurgical sectors. Ceramic paper is used widely in high-temperature processing units, power plants, and electric vehicle battery systems. EU energy efficiency rules encourage industries to adopt lightweight thermal insulation for emission reduction. Growth in aircraft production and turbine upgrades also contributes to higher demand. Continuous investments in renewable energy infrastructure and hydrogen fuel equipment further support market expansion across the region.

Asia-Pacific

Asia-Pacific dominates the Ceramic Paper market with a 38% share, driven by large-scale industrialization and manufacturing expansion. China, India, and Japan contribute significant demand from steelmaking, cement kilns, petrochemicals, and electronics. Rapid growth in electric vehicles and battery production increases the use of ceramic insulation for thermal safety. The region benefits from large furnace installations, low-cost manufacturing, and expanding aerospace programs. Government initiatives promoting energy efficiency and industrial modernization support adoption. Ceramic paper suppliers expand production capability in China and Southeast Asia to meet rising industrial insulation requirements.

Latin America

Latin America holds an 7% market share, led by Mexico and Brazil. Industrial sectors such as metals, ceramics, power generation, and automotive components increasingly adopt ceramic fiber paper for furnace linings, exhaust systems, and heat shields. Economic growth and new manufacturing investments encourage modernization of insulation systems across factories. Mexico’s expanding vehicle production drives demand for lightweight thermal components, while Brazil’s mining and metals industry uses ceramic insulation for temperature control in smelting and processing units. Although adoption is slower than other regions, rising safety regulations and energy-efficiency goals support long-term opportunities.

Middle East & Africa

The Middle East & Africa region accounts for a 4% market share, with demand concentrated in oil refineries, petrochemical plants, and power generation units. Ceramic paper supports high-temperature sealing, insulation, and fire protection in pipeline networks and furnace operations. The UAE, Saudi Arabia, and South Africa lead consumption, while energy diversification projects drive new applications in industrial furnaces and turbine systems. Growth remains moderate but steady, supported by modernization of thermal equipment and increased foreign investment in manufacturing and metals processing. As industrial infrastructures expand, ceramic paper usage continues to gain momentum.

Market Segmentations

By Technology

- Advanced Ceramic Paper

- Conventional Ceramic Paper

By Application

- Industrial

- Electronic

- Medical

- Aerospace Defense

By Form

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ceramic Paper market is moderately consolidated, with leading manufacturers focusing on high-temperature performance, purity enhancement, and customized insulation grades. Companies such as Morgan Thermal Ceramics, Unifrax, Shandong Luyang Share Co., Ltd., and Isolite Insulating Products Co., Ltd. dominate supply due to large manufacturing capacities and strong global distribution. These players invest in advanced ceramic fiber technologies to improve tensile strength, reduce shot content, and increase thermal efficiency. Product innovation targets aerospace, EV batteries, petrochemicals, and industrial furnaces, creating differentiated offerings for specialized applications. Mid-size companies like Rath Inc., Vitcas Ltd., and Nutec Inc. strengthen regional presence through tailored insulation solutions and competitive pricing. Strategic partnerships with metal processing plants, power generation facilities, and furnace manufacturers boost market reach. As demand accelerates in Asia-Pacific and North America, companies expand production units and pursue mergers to gain cost advantages and shorten delivery cycles. Competitive pressure continues to increase as suppliers focus on lighter, cleaner, and more durable insulation materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2024, Alkegen announced that it will supply advanced thermal protection solutions for JLR’s (Jaguar Land Rover) next-generation electric vehicles.

- In April 2024, Morgan Advanced Materials announced the full market launch of its high-performance, low-biopersistent fiber product line, Superwool® XTRA, which includes an insulation paper segment and is classified for use up to 1450 °C (2642 °F)”.

- In July 2023, Morgan Advanced Materials expanded its Yixing plant, increasing its capacity by over 50%. The facility produces TJM Insulating Firebricks (IFBs), including specialty thermal joint material (TJM) Bubble Alumina bricks used in high-temperature industrial applications.

- In April 2023, RATH Group announced its strategic partnership with Kanthal Corporation to expand its combined offerings in industrial technology.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise in electric vehicle battery insulation and thermal protection systems.

- Aerospace and defense sectors will adopt more lightweight ceramic fiber materials for heat shields.

- Manufacturers will focus on producing high-purity, low-dust ceramic paper for sensitive applications.

- Industrial furnace upgrades and retrofits will continue to drive long-term consumption.

- Asia-Pacific will strengthen its lead as production capacity and industrial output expand.

- Automation and advanced fiber-spinning technologies will improve product quality and consistency.

- Ceramic paper will gain more use in electronics cooling, sensors, and power control units.

- Environmental and energy-efficiency regulations will support faster replacement of older insulation materials.

- Strategic mergers and capacity expansions will help suppliers reduce cost and increase supply reach.

- Custom grades designed for aerospace, medical, and semiconductor applications will open new high-value opportunities.