Market Overview

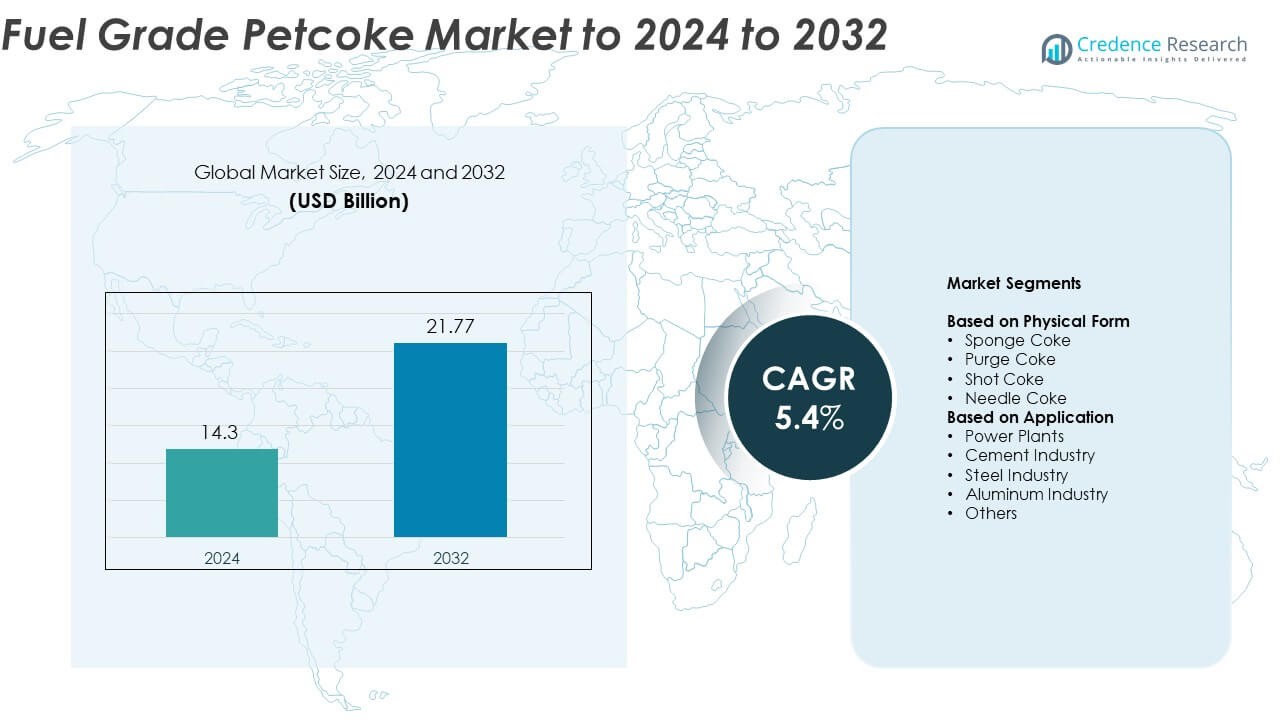

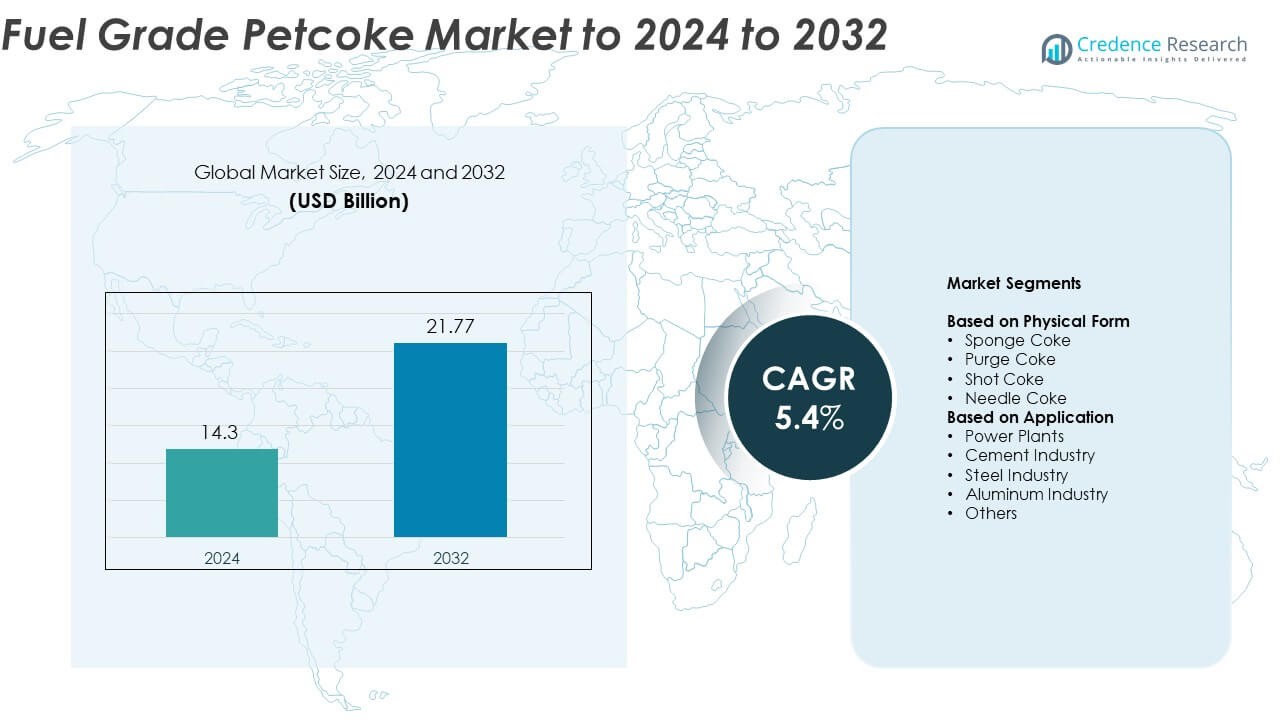

Fuel Grade Petcoke market size was valued at USD 14.3 Billion in 2024 and is anticipated to reach USD 21.77 Billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fuel Grade Petcoke market Size 2024 |

USD 14.3 Billion |

| Fuel Grade Petcoke market , CAGR |

5.4% |

| Fuel Grade Petcoke market Size 2032 |

USD 21.77 Billion |

The fuel grade petcoke market is highly competitive, with leading players including Exxon Mobil, Reliance Industries, Chevron, Valero, BP, Saudi Aramco, Indian Oil, and Bharat Petroleum dominating global operations. These companies maintain a strong foothold through large-scale refinery capacities, extensive coker unit installations, and established supply networks. North America leads the market with around 34.7% share in 2024, supported by robust refining infrastructure and high export volumes. Asia-Pacific follows with nearly 32.9% share, driven by surging industrialization and rising energy demand across China and India. Ongoing investments in cleaner production and efficient logistics continue to shape competitive growth worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The fuel grade petcoke market was valued at USD 14.3 Billion in 2024 and is projected to reach USD 21.77 Billion by 2032, growing at a CAGR of 5.4%.

• Rising demand from power and cement industries, supported by cost-effective and high-energy fuel properties, remains the primary driver of market growth.

• Technological advancements in combustion efficiency and emission control are shaping market trends, promoting cleaner and more sustainable industrial applications.

• The market is moderately consolidated, with leading players focusing on refinery expansion, product optimization, and export growth to strengthen competitiveness.

• North America leads with a 34.7% share, followed by Asia-Pacific with 32.9%, while the sponge coke segment dominates the market with 46.8% share in 2024, driven by its high efficiency and widespread industrial use.

Market Segmentation Analysis:

By Physical Form

The sponge coke segment dominates the fuel grade petcoke market, accounting for around 46.8% share in 2024. Its dominance is driven by high porosity, low metal content, and excellent combustion efficiency, making it ideal for power generation and cement kilns. Sponge coke is widely used in industries requiring consistent heating value and low ash residue. The growing use of sponge coke as an economical substitute for coal in developing countries further strengthens its market position. Expanding refinery operations and increased coking capacity globally support steady demand growth.

- For instance, Nayara Energy produces 2 million tonnes per annum of petroleum coke at its Vadinar complex, supplying sponge-coke qualities for industrial fuel use.

By Application

The power plants segment leads the fuel grade petcoke market with nearly 39.5% share in 2024. This leadership stems from the rising adoption of petcoke as a cost-effective and high-energy fuel alternative to coal. Its higher calorific value and lower price enhance operational efficiency for large-scale thermal plants. Countries with limited coal reserves increasingly depend on fuel-grade petcoke to meet energy demand. Continuous expansion of captive power generation facilities across cement and metallurgical industries further boosts segment growth globally.

- For instance, Mitsubishi Heavy Industries built Frontier Energy Niigata’s boiler to fire 100% petroleum coke, with stable operation from 35–100% load since July 2005.

Key Growth Drivers

Rising Demand from Power and Cement Industries

The increasing use of fuel grade petcoke in power and cement industries remains a major growth driver. Its higher energy content and lower cost compared to coal make it an attractive alternative fuel. Cement producers rely heavily on petcoke for kiln operations, especially in regions with limited coal availability. The rapid industrialization in Asia-Pacific and the Middle East further amplifies consumption, as countries seek affordable and efficient energy sources to support infrastructure expansion and manufacturing growth.

- For instance, Nayara Energy operates 1,000-ton silos with 24×7 rake loading to supply cement kilns and captive power units.

Expansion of Refinery and Coking Capacities

The global rise in refinery throughput and coker unit installations has significantly boosted petcoke availability. Refineries are upgrading to delayed coking units to convert heavy residues into valuable products, generating larger volumes of fuel-grade petcoke. The U.S., China, and India have emerged as leading producers with ongoing capacity expansions. This increase in production ensures steady raw material supply to energy-intensive industries and supports stable pricing in global markets.

- For instance, Sinopec processed 252.3 million tonnes of crude in 2024, underpinning coker feed and petcoke output for downstream users.

Shift Toward Low-Cost, High-Efficiency Fuels

Growing energy cost pressures across industrial sectors are accelerating the shift toward low-cost and high-efficiency fuels. Fuel-grade petcoke offers higher calorific value and reduced consumption per unit of energy produced. Industries such as aluminum, steel, and power generation are adopting it to enhance operational efficiency. The global focus on cost optimization and energy security strengthens the role of petcoke as a reliable and economically viable alternative to conventional fuels.

Key Trends and Opportunities

Increasing Utilization in Emerging Economies

Emerging economies are rapidly integrating fuel-grade petcoke into their industrial energy mix due to its affordability and availability. Nations like India, Vietnam, and Indonesia are witnessing growing imports to support cement and power sectors. Infrastructure development projects and rising electricity demand create new opportunities for market expansion. Additionally, favorable government policies supporting industrial growth in these regions are further stimulating long-term adoption.

- For instance, Shree Cement operated with a 95% petcoke fuel mix in Q4 FY25 (January-March 2025), demonstrating a high level of petcoke adoption in its cement kilns for that period.

Technological Advancements in Petcoke Combustion Systems

Innovations in combustion and emission control technologies are improving the environmental performance of petcoke-based systems. Advanced burners, gasification units, and flue-gas desulfurization technologies are reducing sulfur emissions, making petcoke a cleaner option for industrial users. These improvements enhance compliance with environmental regulations and open new opportunities for sustainable usage across power and manufacturing sectors globally.

- For instance, GE Vernova (GE Power)’s wet-FGD systems for NTPC are designed for 97.1% SO₂ removal efficiency, supporting cleaner combustion of high-sulfur fuels like petcoke.

Key Challenges

Environmental Regulations and Carbon Emission Concerns

Stringent emission norms and rising environmental concerns pose significant challenges to fuel-grade petcoke adoption. High sulfur and carbon content lead to increased greenhouse gas emissions during combustion, attracting restrictions on imports and usage in several countries. Regulatory agencies are tightening standards to control pollution levels, forcing industries to invest in costly emission control systems. These environmental constraints could limit market growth in regions emphasizing carbon reduction.

Volatility in Crude Oil and Refinery Operations

The market’s dependence on refinery output makes it vulnerable to fluctuations in crude oil production and refining margins. Any disruption in refinery operations directly impacts petcoke availability and pricing. Variations in crude quality and refinery upgrades also affect petcoke characteristics, influencing its suitability for specific applications. Such operational uncertainties create supply inconsistencies and price volatility, challenging long-term procurement planning for end users.

Regional Analysis

North America

North America holds the largest share of the fuel grade petcoke market, accounting for around 34.7% in 2024. The region benefits from extensive refinery infrastructure and high coker unit capacity, particularly in the United States. Strong demand from power generation and cement industries drives steady consumption. Growing exports of petcoke to Asia and Latin America also support market expansion. Favorable production economics and continuous refinery modernization sustain North America’s leadership, while environmental compliance investments help balance energy efficiency and emission reduction goals across industrial sectors.

Europe

Europe accounts for approximately 18.6% share of the fuel grade petcoke market in 2024. The region’s demand is supported by the cement and metal industries, particularly in countries such as Germany, Spain, and Italy. However, stricter carbon emission standards limit large-scale adoption in the power sector. Imports from the United States and Middle East continue to meet industrial requirements. Ongoing research into cleaner combustion technologies and co-firing applications is helping maintain stable utilization while aligning with the region’s long-term decarbonization strategies.

Asia-Pacific

Asia-Pacific represents about 32.9% share of the global fuel grade petcoke market in 2024. China and India dominate regional demand due to rapid industrialization, rising electricity needs, and cement manufacturing expansion. Favorable fuel economics and limited domestic coal reserves accelerate petcoke adoption as an efficient energy substitute. Expanding refinery capacity in China, India, and South Korea enhances local availability. The region’s infrastructure and construction boom, coupled with growing investment in heavy industries, continues to strengthen its position as a key global growth hub.

Latin America

Latin America holds nearly 8.3% share of the fuel grade petcoke market in 2024. Brazil and Mexico are the primary consumers, driven by their strong cement and metallurgical industries. The availability of petcoke from regional refineries supports steady supply. Industrial modernization and infrastructure projects are expanding energy demand, promoting wider usage of cost-efficient fuels. Although environmental regulations are tightening, adoption remains strong due to its economic benefits in power and materials production. The region continues to show moderate but stable growth potential.

Middle East & Africa

The Middle East & Africa region accounts for around 5.5% share of the global fuel grade petcoke market in 2024. The presence of large-scale refineries in Saudi Arabia, Kuwait, and the UAE ensures ample supply for export and domestic industries. Rising cement production and power generation demand drive steady growth. Africa’s emerging economies are increasingly turning to petcoke as an affordable energy source for industrial applications. Investments in refinery infrastructure and energy diversification strategies are expected to enhance regional consumption in the coming years.

Market Segmentations:

By Physical Form

- Sponge Coke

- Purge Coke

- Shot Coke

- Needle Coke

By Application

- Power Plants

- Cement Industry

- Steel Industry

- Aluminum Industry

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fuel grade petcoke market includes major global and regional players such as Exxon Mobil, Reliance Industries, Chevron, Valero, BP, Saudi Aramco, Indian Oil, Bharat Petroleum, Marathon Petroleum, Oxbow, Aminco Resources, Cenovus, Shell, Cocan Graphite, and Shamokin Carbons. These companies focus on expanding refinery capacities, optimizing coker unit operations, and improving product quality to strengthen market positions. Strategic partnerships, long-term supply contracts, and distribution network enhancements support stable customer reach across industrial sectors. Many participants are investing in advanced desulfurization and gasification technologies to meet tightening environmental norms and enhance fuel performance. Rising competition among refiners and trading companies fosters innovation in refining efficiency and logistics management. The market also witnesses increasing export-oriented strategies, particularly from the U.S. and Middle East, to meet growing demand in Asia-Pacific. Continuous investments in cleaner production and refinery modernization ensure long-term competitiveness in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Exxon Mobil

- Reliance Industries

- Chevron

- Valero

- BP

- Saudi Aramco

- Indian Oil

- Bharat Petroleum

- Marathon Petroleum

- Oxbow

- Aminco Resources

- Cenovus

- Shell

- Cocan Graphite

- Shamokin Carbons

Recent Developments

- In 2025, Saudi Aramco continued to advance its downstream integration including refinery and petrochemical expansions that indirectly support its fuel grade petcoke production.

- In 2025, ExxonMobil announced the use of a new lightweight proppant that mixes petroleum coke with sand to boost the efficiency of its hydraulic fracturing operations in the Permian Basin.

- In 2023, Chevron Lummus Global LLC, a joint venture between Chevron U.S.A. Inc. and Lummus Technology, signed an agreement with TAQAT Development Company to construct a 75,000 TPA needle coke/synthetic graphite complex in Rabigh.

Report Coverage

The research report offers an in-depth analysis based on Physical Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand from power and cement industries will continue to drive global market expansion.

- Increasing refinery coking capacities worldwide will enhance fuel-grade petcoke supply stability.

- Asia-Pacific will remain the fastest-growing region due to rapid industrialization and energy needs.

- Adoption of advanced emission control technologies will improve environmental compliance and usage.

- Shifting focus toward low-cost, high-efficiency fuels will strengthen market penetration across industries.

- Export opportunities from the U.S. and Middle East will expand to meet global consumption growth.

- Technological advancements in combustion systems will improve operational efficiency and energy yield.

- Tightening environmental policies may encourage cleaner blending and gasification applications.

- Integration of petcoke in co-firing systems with coal will create sustainable energy solutions.

- Long-term investments in infrastructure and industrial sectors will sustain consistent market growth.