Market Overview

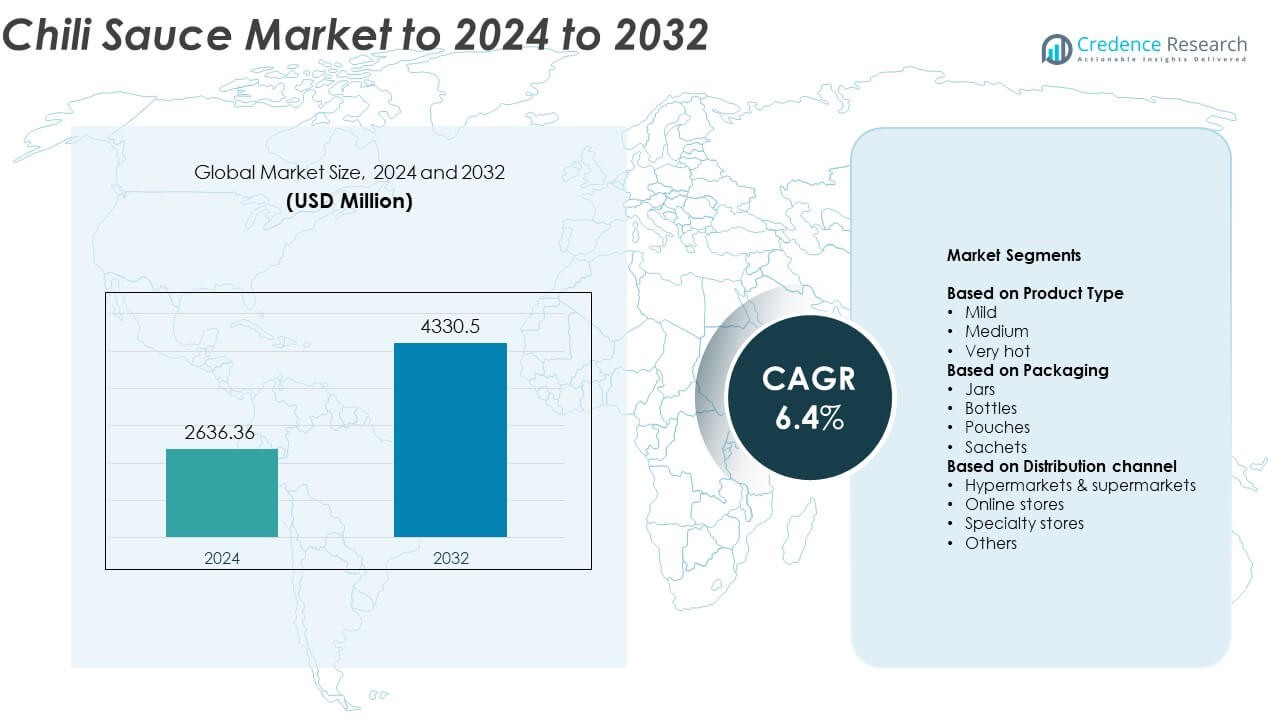

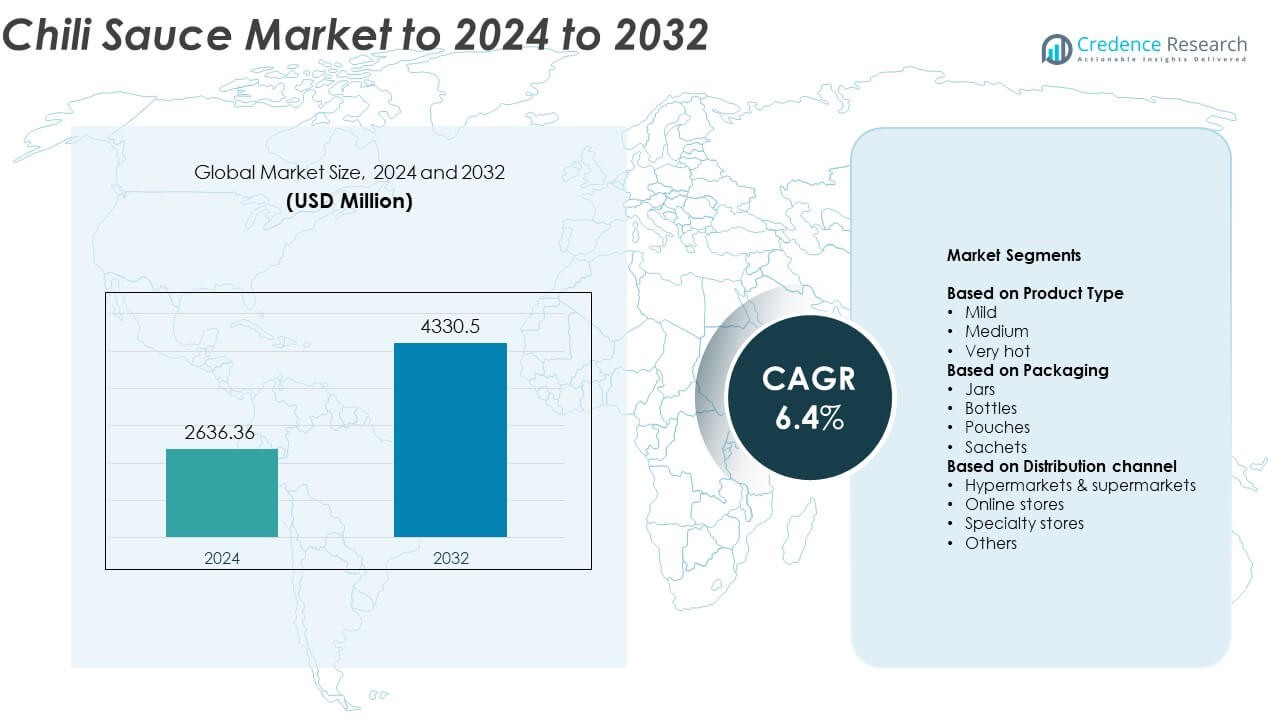

The Chili Sauce Market size was valued at USD 2636.36 million in 2024 and is anticipated to reach USD 4330.5 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chili Sauce Market Size 2024 |

USD 2636.36 Million |

| Chili Sauce Market, CAGR |

6.4% |

| Chili Sauce Market Size 2032 |

USD 4330.5 Million |

The Chili Sauce Market is led by prominent players including Kraft Heinz, Huy Fong Foods, Nando’s, Lee Kum Kee, Cholula Hot Sauce, Laoganma, Lingham & Sons, MegaMex Foods, ThaiTheparos, Chung Jung One, and Real Thai (Thai Foods). These companies dominate through extensive product portfolios, strong regional distribution, and innovation in flavor diversity. North America leads the global market with a 36% share in 2024, supported by the high demand for spicy condiments and well-established retail networks. Europe follows with 27% share, driven by growing interest in ethnic cuisines and premium sauces, while Asia Pacific captures 24%, fueled by traditional consumption and expanding export demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chili sauce market was valued at USD 2636.36 million in 2024 and is projected to reach USD 4330.5 million by 2032, expanding at a CAGR of 6.4%.

• Rising global preference for spicy and bold flavors, along with increasing use of sauces in fast food and ready meals, drives consistent market growth.

• Product innovation with natural ingredients, organic variants, and sustainable packaging trends are reshaping consumer demand across premium and mainstream segments.

• The market is highly competitive, with established global and regional brands focusing on new flavor launches and strategic retail partnerships to strengthen market share.

• North America leads with 36% share, followed by Europe at 27% and Asia Pacific at 24%, while the medium chili sauce segment dominates globally with 47% share due to balanced heat levels and wide consumer acceptance.

Market Segmentation Analysis:

By Product Type

The medium chili sauce segment dominates the market, holding nearly 47% share in 2024. Its balance between heat and flavor makes it the most preferred choice among consumers globally. Medium sauces cater to a wide range of taste preferences, driving strong demand in both household and foodservice applications. Increasing product innovation with natural ingredients, low-sodium variants, and ethnic flavor blends continues to support growth. Expanding international cuisines and rising consumption of ready-to-eat foods further strengthen the segment’s leadership across major markets.

- For instance, Cholula launched a total of 11 new products in May 2025, and the launch included both medium-heat and mild-heat options. The new product lineup of 11 items included one mild seasoning mix (Pork Carnitas Mild Seasoning Mix), one medium seasoning mix (Original Fajita Medium Seasoning Mix), and other items with varying heat levels like cooking sauces with mild to medium heat, cremosa sauces, and a chili crisp.

By Packaging

The bottles segment leads the chili sauce market with approximately 52% share in 2024. Bottled packaging ensures convenience, portion control, and extended shelf life, which are key preferences among retail consumers. Manufacturers are introducing sustainable bottle materials and smart labeling to attract eco-conscious buyers. The growing demand from restaurants, catering services, and home users enhances this segment’s dominance. Transparency in glass bottles also promotes brand visibility and product appeal, making bottles the most widely adopted packaging format in both premium and mass-market categories.

- For instance, Heinz introduced a 100% recyclable squeezy cap for bottles in 2021.

By Distribution Channel

The hypermarkets and supermarkets segment dominates the chili sauce market with around 43% share in 2024. Wide product availability, frequent promotional discounts, and strong visibility of multiple brands drive consumer preference for offline retail formats. These outlets allow customers to compare flavors, packaging, and prices directly, enhancing purchase confidence. Growing expansion of organized retail chains in Asia-Pacific and Europe continues to support this segment’s leadership. However, online stores are showing rapid growth due to the rising popularity of e-commerce and doorstep delivery services.

Key Growth Drivers

Rising Global Demand for Spicy Flavors

The growing consumer preference for spicy and bold flavors is driving strong demand for chili sauces worldwide. Changing eating habits and the increasing popularity of Asian, Latin American, and African cuisines are expanding the market base. Food manufacturers are incorporating chili-based condiments into diverse products to meet evolving taste preferences. This widespread acceptance of spicy flavors across restaurant chains, fast food outlets, and home cooking continues to strengthen market growth.

- For instance, TABASCO Original Red measures 2,500–5,000 Scoville Heat Units.

Expansion of Foodservice and Quick-Service Restaurants

Rapid growth in the global foodservice and quick-service restaurant sectors significantly boosts chili sauce consumption. Restaurants and fast-food chains use chili sauces as key flavor enhancers, sauces, and condiments in multiple dishes. The rising trend of dining out and takeaway culture further increases bulk demand from commercial kitchens. Product partnerships between condiment producers and QSR brands enhance supply chains, supporting consistent growth across urban and semi-urban markets.

- For instance, McDonald’s reports over 44,000 locations in 100+ countries worldwide.

Innovation in Product Formulation and Packaging

Continuous product innovation through new flavors, organic ingredients, and sustainable packaging fuels market expansion. Manufacturers are investing in cleaner labels, additive-free options, and environment-friendly packaging to attract health-conscious consumers. Portable packaging formats such as squeezable bottles and single-serve sachets are improving convenience and shelf appeal. These developments not only enhance brand differentiation but also expand the consumer base across multiple demographics and retail channels.

Key Trends & Opportunities

Growing Popularity of Ethnic and Fusion Cuisines

The global rise of ethnic and fusion cuisines offers major growth opportunities for chili sauce manufacturers. Consumers are increasingly experimenting with cross-cultural flavors, blending traditional chili sauces into new culinary experiences. Food producers are capitalizing on this trend by introducing regional spice blends and premium artisanal products. This shift toward authentic and experimental food experiences is creating fresh avenues for premiumization and brand expansion.

- For instance, Lao Gan Ma produces more than 3 million bottles of hot sauce daily, thanks to automated and smart manufacturing processes, supporting global fusion use.

Rising Adoption of E-commerce and Direct-to-Consumer Channels

The rapid expansion of online retailing has emerged as a key opportunity for chili sauce brands. E-commerce platforms offer extensive product reach, ease of comparison, and personalized marketing options. Direct-to-consumer models allow brands to engage customers with subscription services and customized flavor assortments. Growing internet penetration and digital marketing strategies are reshaping purchasing behavior, accelerating sales across developed and emerging markets.

- For instance, TRUFF produced a three-part docuseries titled “The Secret to Selling 100 million dollars worth of hot sauce,” which was released on their YouTube channel in January and February 2023.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in the prices of raw materials such as chili, vinegar, and packaging components remain a major concern. Weather uncertainties, supply disruptions, and rising transportation costs affect production stability and profitability. Manufacturers face challenges in maintaining consistent product pricing while ensuring quality and availability. Long-term supply contracts and regional sourcing strategies are increasingly vital to counter this volatility and stabilize production costs.

Intense Market Competition and Product Imitation

The chili sauce market faces high competition from numerous global and regional players offering similar products. Price-based rivalry and imitation of successful formulations reduce differentiation and brand loyalty. Maintaining innovation, flavor authenticity, and marketing consistency becomes essential for sustained growth. Smaller brands often struggle to compete with large multinational companies with stronger distribution networks and promotional budgets.

Regional Analysis

North America

North America holds the largest share of the chili sauce market, accounting for nearly 36% in 2024. The region’s dominance is driven by the high consumption of spicy foods and the widespread use of chili sauces in fast food and casual dining chains. Product innovation featuring cleaner ingredients and regional flavors supports strong demand. The United States leads the market with a strong retail presence and robust foodservice sector. Increasing Hispanic population influence and the popularity of ethnic cuisines continue to expand the market in both the U.S. and Canada.

Europe

Europe accounts for around 27% share of the chili sauce market in 2024, supported by growing consumer interest in international cuisines. The United Kingdom, Germany, and France dominate the regional demand with a strong preference for Asian and Latin American flavors. Rising popularity of gourmet condiments and premium chili sauces is reshaping the market landscape. Manufacturers are focusing on low-sugar and organic formulations to align with health-conscious trends. Expanding retail distribution networks and increased multicultural dining habits further drive consistent market growth across major European economies.

Asia Pacific

Asia Pacific represents about 24% of the chili sauce market in 2024, fueled by the region’s rich culinary diversity and growing urbanization. Countries such as China, Thailand, and India are major contributors, driven by the long-standing use of chili sauces in traditional dishes. Rapid expansion of food processing industries and international restaurant chains supports strong demand. Rising disposable incomes and exposure to global cuisine trends are encouraging premium product adoption. Local manufacturers are also innovating with unique flavor profiles to appeal to a broad range of consumers.

Latin America

Latin America holds nearly 8% share of the chili sauce market in 2024, with strong cultural integration of chili-based condiments in daily meals. Mexico and Brazil lead the regional demand due to high consumption of spicy sauces in local cuisines. Expanding retail penetration and growing exports of regional hot sauce brands are boosting overall sales. The region’s increasing tourism and popularity of Latin flavors in international markets enhance brand visibility. However, limited product standardization and fragmented distribution networks remain minor challenges to faster growth.

Middle East and Africa

The Middle East and Africa region accounts for around 5% share of the chili sauce market in 2024. Rising demand for spicy condiments in countries such as South Africa, the UAE, and Saudi Arabia drives market expansion. The influence of Asian and Mediterranean cuisines is shaping local flavor preferences. Growing urban populations and expanding modern retail channels are creating new sales opportunities. However, economic fluctuations and varying consumer spending patterns slightly restrict rapid penetration. Increasing investments by international brands are expected to strengthen market presence across emerging economies.

Market Segmentations:

By Product Type

By Packaging

- Jars

- Bottles

- Pouches

- Sachets

By Distribution channel

- Hypermarkets & supermarkets

- Online stores

- Specialty stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the chili sauce market features leading players such as Kraft Heinz, Huy Fong Foods, Nando’s, Lee Kum Kee, Cholula Hot Sauce, Laoganma, Lingham & Sons, MegaMex Foods, ThaiTheparos, Chung Jung One, and Real Thai (Thai Foods). The market is characterized by intense competition, driven by strong brand positioning, product diversification, and expanding global distribution networks. Companies focus on flavor innovation, regional spice blends, and clean-label formulations to attract broader consumer segments. Many manufacturers are investing in automation and sustainable packaging to enhance production efficiency and reduce environmental impact. Strategic collaborations with restaurants, retailers, and e-commerce platforms strengthen brand visibility and sales channels. Increasing marketing investments in digital promotions and influencer campaigns also play a key role in driving consumer engagement. The overall competitive environment is expected to remain dynamic, with rising demand for premium, health-oriented, and regionally inspired chili sauce variants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kraft Heinz

- Huy Fong Foods

- Nando’s

- Lee Kum Kee

- Cholula Hot Sauce

- Laoganma

- Lingham & Sons

- MegaMex Foods

- ThaiTheparos

- Chung Jung One

- Real Thai (Thai Foods)

Recent Developments

- In 2025, Cholula Hot Sauce Launched Cholula Extra Hot, a hotter version of its iconic sauce to meet fan demand with extra spicy heat and authentic Mexican flavor.

- In 2023, Kraft Heinz launched the Heinz Hot Varieties line, which includes three new spicy ketchups—Chipotle, Jalapeño, and Habanero—along with a new Heinz Hot 57 Sauce, a twist on their classic 57 Sauce

- In 2023, MegaMex Foods, operating under its HERDEZ® brand, launched a new Habanero Hot Sauce made with real habanero peppers to meet consumer demand for spicier flavor profiles.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing global appetite for spicy and ethnic flavors will continue driving market expansion.

- Increasing demand for clean-label and natural ingredient formulations will shape product innovation.

- Sustainable and recyclable packaging solutions will gain stronger adoption among manufacturers.

- E-commerce and direct-to-consumer channels will become key sales growth drivers.

- Partnerships with quick-service restaurants will strengthen supply chains and brand visibility.

- Premium and artisanal chili sauces will gain popularity among urban consumers.

- Emerging markets in Asia and Latin America will offer high-growth potential for producers.

- Technological advancements in processing will improve flavor consistency and shelf life.

- Health-oriented product variants with low sodium and sugar will see rising demand.

- Intense competition will push companies toward continuous innovation and strategic acquisitions.