Market Overview

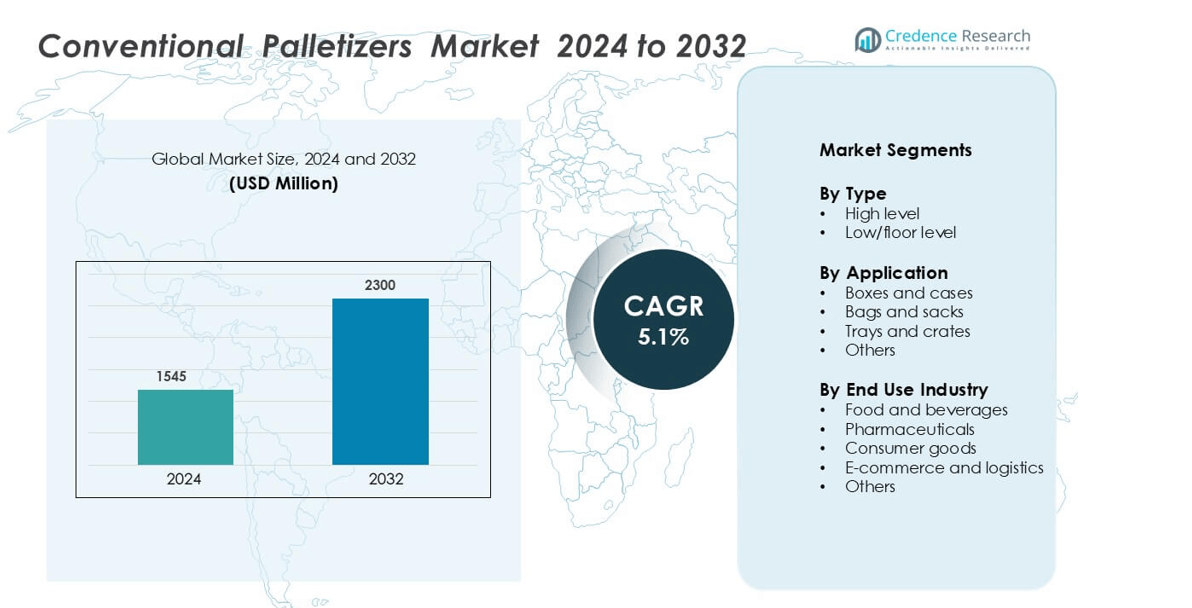

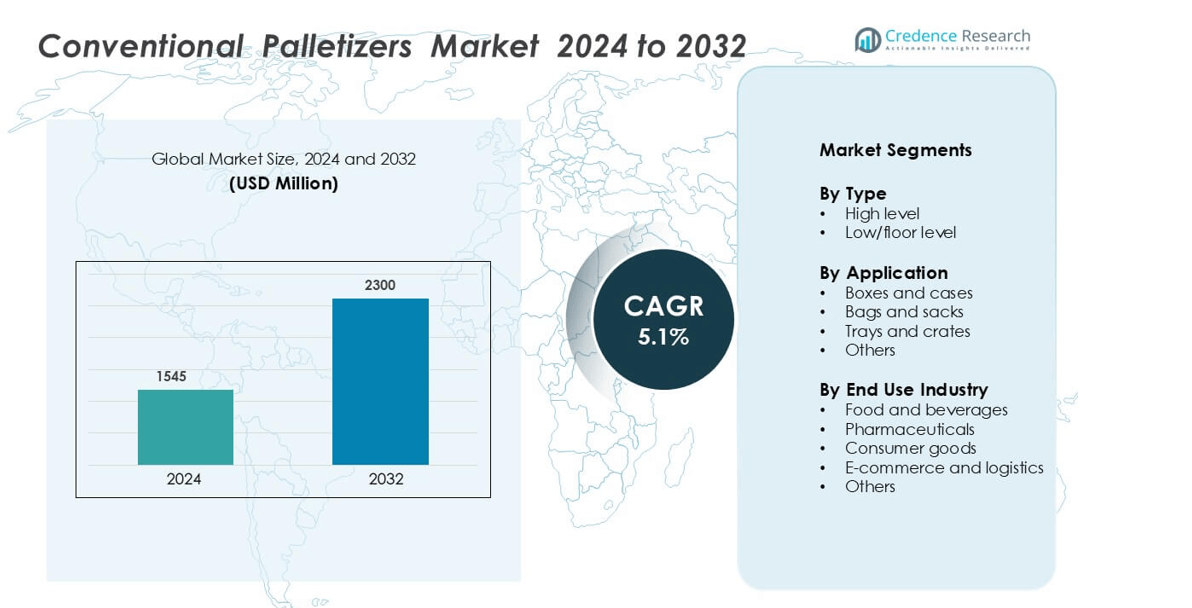

Conventional Palletizers Market was valued at USD 1545 million in 2024 and is anticipated to reach USD 2300 million by 2032, growing at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conventional Palletizers Market Size 2024 |

USD 1545 million |

| Conventional Palletizers Market, CAGR |

5.1% |

| Conventional Palletizers Market Size 2032 |

USD 2300 million |

The Conventional Palletizers Market is led by prominent players including KUKA AG, Columbia Machine Inc, PAYPER SA, Concetti SpA, MSK Covertech, Brenton Engineering, OCME Srl, BW Flexible Systems, Baust & Co GmbH, and Okura Yusoki. These companies focus on enhancing productivity through automation, precision stacking, and energy-efficient systems. KUKA AG and Columbia Machine Inc hold strong positions due to their advanced robotic integration and high-speed palletizing lines. Concetti SpA and PAYPER SA emphasize customized end-of-line packaging solutions catering to diverse industries. Regionally, North America dominates the market with a 36% share, driven by high automation adoption across food, beverage, and logistics sectors, supported by established manufacturing infrastructure and robust R&D investments.

Market Insights

- The Conventional Palletizers Market was valued at USD 1545 million in 2024 and is projected to reach USD 2300 million by 2032, growing at a CAGR of 5.1%.

- Rising automation in packaging and material handling across food, beverage, and logistics industries drives market expansion, enhancing productivity and reducing operational costs.

- Key trends include integration of smart sensors, PLC controls, and energy-efficient systems that improve precision, uptime, and cost efficiency across automated production lines.

- The competitive landscape is dominated by KUKA AG, Columbia Machine Inc, Concetti SpA, and PAYPER SA, focusing on modular designs, global partnerships, and Industry 4.0-enabled systems.

- North America leads the market with a 36% share, followed by Europe at 28% and Asia Pacific at 25%, while the high-level palletizer segment accounts for the largest share due to high throughput and multi-line handling capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The high-level palletizers segment dominated the Conventional Palletizers Market with the largest share. These systems are widely adopted due to their high throughput, accuracy, and ability to handle heavy loads in large-scale manufacturing. Industries prefer high-level palletizers for their superior stacking precision and integration with automated conveyor systems. Their capability to manage multiple product lines enhances operational efficiency, reducing downtime and labor dependency. The segment’s growth is driven by the rising automation of packaging lines in food, beverage, and consumer goods industries, where speed and consistency are essential to maintain productivity.

- For instance, Columbia Machine Inc. introduced the HL9200 high-level palletizer capable of handling up to 200 cases per minute, with multi-line feed capability.

By Application

Boxes and cases held the dominant share in the application segment, supported by widespread use across logistics, food, and consumer goods sectors. Conventional palletizers efficiently handle uniform-shaped boxes and ensure stable stacking, minimizing product damage during transportation. The demand for automation in bulk packaging further strengthens the adoption of box-handling systems. Manufacturers favor these palletizers for their ability to accommodate varying box sizes while maintaining stacking precision. Their reliability in managing repetitive packaging operations makes them indispensable in high-output production environments.

- For instance, Brenton Engineering’s HL1000 conventional palletizer can process from 30 to over 100 cases per minute, ensuring precise box alignment through advanced layer forming technology, which often incorporates servo-driven systems.

By End Use Industry

The food and beverages industry emerged as the leading end-use segment in the Conventional Palletizers Market. The sector benefits from the need for efficient handling of bottled, canned, and packaged goods. Palletizers streamline post-production logistics by ensuring quick and hygienic stacking of products ready for shipment. Growing consumer demand and rising production volumes have encouraged food processors to adopt automation for improved safety and efficiency. Furthermore, strict hygiene standards and space optimization in production facilities have accelerated the integration of high-speed conventional palletizing systems in this sector.

Key Growth Drivers

Rising Automation in Packaging and Material Handling

The growing demand for automation in packaging and logistics is a major driver for the conventional palletizers market. Manufacturers are replacing manual palletizing with automated systems to enhance productivity and reduce operational costs. Conventional palletizers offer consistent stacking, improved safety, and higher efficiency in handling repetitive tasks. The integration of programmable logic controllers (PLCs) and motion control systems has improved precision and reduced cycle times. For instance, companies like Krones AG and Columbia Machine, Inc. have developed advanced palletizers with multi-line handling and automatic changeover features, enabling higher throughput in manufacturing plants. These advancements align with the global trend of Industry 4.0, promoting smart manufacturing and efficient material flow across industries such as food, beverages, and consumer goods.

- For instance, the Krones AG Modulpal Pro 3A palletizer typically integrates modern control systems such as Siemens S7 PLCs and can handle up to 360 layers per hour for non-returnable packs and up to 500 layers per hour for returnable packs, depending on the specific gripper system and configuration.

Expanding Food and Beverage Industry

The food and beverage sector significantly boosts demand for conventional palletizers due to its large-scale packaging and distribution needs. Rising consumption of packaged goods, beverages, and ready-to-eat meals has increased production volumes, requiring efficient end-of-line automation. Conventional palletizers handle diverse packaging formats, ensuring fast and reliable stacking for storage and transport. For instance, companies like Brenton Engineering and Schneider Packaging Equipment deliver palletizers capable of managing high-speed beverage lines while minimizing product damage. The growing focus on maintaining hygiene and reducing manual labor in food production facilities further drives adoption. Additionally, global food processing plants are investing in automation to maintain supply chain stability, contributing to the sustained growth of conventional palletizing systems.

- For instance, The Brenton Engineering MP1000 layer palletizer’s machine operates at a rate of up to two layers per minute, not 40 cases per minute.

Increasing Need for Operational Efficiency and Cost Reduction

Businesses across manufacturing and logistics sectors are focusing on reducing downtime and optimizing labor costs, driving the adoption of conventional palletizers. These systems improve workflow efficiency by automating repetitive stacking operations, reducing reliance on manual labor, and ensuring consistent load quality. Their robust design and adaptability make them suitable for continuous operations in high-volume facilities. For instance, Premier Tech and Honeywell Intelligrated have introduced palletizers with enhanced speed control and low maintenance requirements, offering better return on investment. Additionally, the cost benefits derived from reduced workplace injuries, improved ergonomics, and efficient space utilization are prompting industries to modernize palletizing operations, reinforcing the market’s long-term growth trajectory.

Key Trends & Opportunities

Integration of Smart Sensors and PLCs for Enhanced Precision

Technological advancements are transforming conventional palletizers with the integration of smart sensors and programmable logic controllers (PLCs). These innovations enable real-time monitoring, fault detection, and predictive maintenance, improving machine uptime and accuracy. For instance, ABB and Siemens are integrating IoT-enabled sensors into palletizing systems, allowing operators to track performance metrics remotely and optimize machine efficiency. Enhanced motion control and automated error correction reduce material wastage and ensure consistent stacking alignment. This trend reflects the ongoing digitalization in industrial automation, offering manufacturers opportunities to boost efficiency while maintaining lower operational costs.

- For instance, ABB’s IRB 660 palletizing system incorporates advanced motor control and position sensors that provide a high position repeatability of 0.1 mm. When integrated with ABB Ability™ Connected Services, the system transmits performance and health data through the cloud for remote monitoring, predictive maintenance, and analytics, which helps maintain this high level of precision over time and enables collision detection.

Rising Demand from E-commerce and Logistics Sectors

The rapid expansion of e-commerce and global logistics has created new opportunities for palletizer adoption. Conventional palletizers are increasingly used in distribution centers to handle boxed goods, ensuring fast order fulfillment and reliable product stacking. E-commerce giants and 3PL providers are investing in automated palletizing solutions to streamline warehouse operations. For instance, Daifuku and Dematic have developed palletizing systems optimized for mixed SKU handling in fulfillment centers. These systems improve storage density and reduce manual sorting time, supporting the growing need for rapid deliveries and high-volume packaging efficiency in logistics operations.

- For instance, Daifuku’s robotic palletizing solutions use advanced software and algorithms to calculate optimal, stable stacking patterns for mixed SKU configurations and efficient space utilization.

Growing Shift Toward Sustainable Manufacturing Practices

Sustainability is emerging as a critical trend shaping the palletizers market. Manufacturers are developing energy-efficient systems with reduced power consumption and recyclable components. For example, Kawasaki Robotics and Fuji Yusoki Kogyo Co. Ltd. have launched palletizers using energy recovery drives and lightweight frames to minimize environmental impact. Companies are also optimizing pallet patterns to maximize load capacity, reducing packaging material use and transportation emissions. This shift aligns with global sustainability goals and environmental regulations, encouraging industries to adopt eco-friendly automation technologies that balance productivity with environmental responsibility.

Key Challenges

High Initial Investment and Maintenance Costs

One of the major challenges restraining market growth is the high upfront cost of installation and integration of conventional palletizers. Small and medium-sized manufacturers often find it difficult to allocate capital for such automation systems. Beyond purchase costs, maintenance, training, and software upgrades add to operational expenses. For instance, setting up a fully automated palletizing line with conveyors, sensors, and safety enclosures can significantly impact initial budgets. Additionally, downtime during maintenance or technical failure can disrupt production schedules. These cost-related barriers limit widespread adoption, particularly in price-sensitive markets and industries with low automation maturity.

Limited Flexibility Compared to Robotic Palletizers

While conventional palletizers are efficient for high-volume and uniform product handling, they lack flexibility for varied product types and frequent line changes. Industries with diverse packaging needs are gradually shifting toward robotic palletizers that offer adaptable configurations and faster changeovers. For instance, robotic systems from FANUC and Yaskawa Motoman can handle mixed pallet loads with minimal programming, outperforming traditional setups in flexibility. This technological shift poses a long-term challenge for conventional systems, compelling manufacturers to innovate and enhance their adaptability to stay competitive in an evolving automation landscape.

Regional Analysis

North America

North America dominated the Conventional Palletizers Market with a 36% share in 2024. The region’s leadership is supported by advanced manufacturing infrastructure, widespread automation adoption, and strong investments in end-of-line packaging systems. The United States drives demand due to high production volumes in food, beverage, and consumer goods sectors. Leading companies focus on developing energy-efficient and high-speed palletizing solutions to improve throughput. Additionally, the growing e-commerce and logistics industries enhance the need for automated pallet handling systems, reinforcing North America’s position as a technology-driven and innovation-centric market for palletizing equipment.

Europe

Europe accounted for 28% of the global Conventional Palletizers Market share in 2024, supported by a well-established industrial base and strong regulatory standards for workplace automation. Countries such as Germany, Italy, and France lead the adoption of palletizing systems across food, beverage, and pharmaceutical industries. The emphasis on operational efficiency, sustainability, and energy conservation drives investments in advanced palletizing machinery. Additionally, European manufacturers are focusing on integrating smart sensors and robotic assistance in traditional palletizers to meet growing automation needs, ensuring precise stacking and reduced energy consumption across high-volume packaging facilities.

Asia Pacific

Asia Pacific held a 25% share of the Conventional Palletizers Market in 2024 and is the fastest-growing regional market. Rapid industrialization in China, India, and Southeast Asia is fueling automation in packaging and logistics. Expanding food and beverage manufacturing, coupled with growing export-oriented industries, strengthens regional demand. Government initiatives promoting smart factories and the presence of cost-effective manufacturing hubs also encourage adoption. Local and international players are establishing partnerships to meet the rising demand for efficient and affordable palletizing solutions, solidifying Asia Pacific’s position as a critical growth hub in the global market.

Latin America

Latin America represented 7% of the Conventional Palletizers Market share in 2024, driven by increasing investments in manufacturing automation and infrastructure development. Brazil and Mexico are the leading contributors, with significant growth in food processing and consumer goods packaging industries. Companies are adopting conventional palletizers to reduce labor dependency and enhance packaging precision. The region’s focus on cost-effective automation solutions supports the adoption of low-floor palletizers in medium-scale operations. Growing logistics and distribution networks across key economies further strengthen the market’s outlook in Latin America, positioning it for gradual modernization in palletizing technologies.

Middle East & Africa

The Middle East & Africa accounted for a 4% share of the Conventional Palletizers Market in 2024. The growth is supported by expanding industrial automation in the Gulf Cooperation Council (GCC) countries and South Africa’s manufacturing sectors. Food processing, pharmaceuticals, and e-commerce operations are adopting palletizing solutions to improve supply chain efficiency. The UAE and Saudi Arabia are leading adopters, focusing on high-speed palletizing systems to support modern logistics centers. Although adoption remains lower compared to other regions, ongoing investments in industrial modernization and packaging automation signal steady future growth in the MEA market.

Market Segmentations:

By Type

- High level

- Low/floor level

By Application

- Boxes and cases

- Bags and sacks

- Trays and crates

- Others

By End Use Industry

- Food and beverages

- Pharmaceuticals

- Consumer goods

- E-commerce and logistics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Conventional Palletizers Market features strong competition among global and regional players focused on innovation, efficiency, and system reliability. Key companies such as KUKA AG, Columbia Machine Inc, PAYPER SA, Concetti SpA, MSK Covertech, Brenton Engineering, OCME Srl, BW Flexible Systems, Baust & Co GmbH, and Okura Yusoki dominate the market landscape. These manufacturers emphasize advanced automation, energy efficiency, and modular system designs to meet diverse industrial needs. For instance, KUKA AG integrates precision control and smart sensor technologies to enhance stacking accuracy and productivity, while Columbia Machine Inc offers multi-line palletizing solutions with quick changeover capabilities. Partnerships with logistics providers, expansion into emerging markets, and investment in Industry 4.0-compatible machinery further strengthen their competitive position. Continuous technological upgrades, service optimization, and regional customization remain core strategies driving long-term market growth and customer retention among leading palletizer manufacturers worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KUKA AG

- Columbia Machine Inc

- PAYPER SA

- Concetti SpA

- MSK Covertech

- Brenton Engineering

- OCME Srl

- BW Flexible Systems

- Baust & Co GmbH

- Okura Yusoki

Recent Developments

- In November 2024, Columbia Machine Inc launched the FLD2500-SW, a floor-level infeed conventional palletizer equipped with a fully integrated stretch wrapper.

- In July 2024, BW Flexible Systems launched SYMACH 3500S, push-type conventional palletizer. The palletizer delivers superior high-speed stacking and palletizing performance for bags, bales and crates. The SYMACH 3500S merges with the original Thiele Master 3500 palletizer with the SYMACH palletizing platform.

- In October 2023, Qimarox expanded its product portfolio with a palletizer for frozen foods (IQF Products). The Qimarox Highrunner HR8 palletizer is capable of stacking boxes of frozen foods into sturdy and stable pallets. The developed palletizer features dual hoist design combined with an electric overhead row pusher, reducing its footprint by 40%, compared to other floor-level palletizers with similar output capacities

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated palletizing systems will rise with growing industrial digitalization.

- Integration of IoT and AI technologies will improve accuracy and reduce downtime.

- High-level palletizers will continue dominating due to superior speed and efficiency.

- Food and beverage manufacturers will increasingly adopt automation for packaging consistency.

- Emerging economies in Asia Pacific will drive new installation and expansion projects.

- Energy-efficient and low-maintenance palletizers will gain preference among manufacturers.

- Collaboration between equipment suppliers and logistics firms will enhance supply chain efficiency.

- Modular and customizable palletizing systems will see increased adoption across industries.

- Sustainability initiatives will push companies to adopt eco-friendly palletizer designs.

- Continuous innovation and global competition will shape market evolution and pricing strategies.