Market Overview:

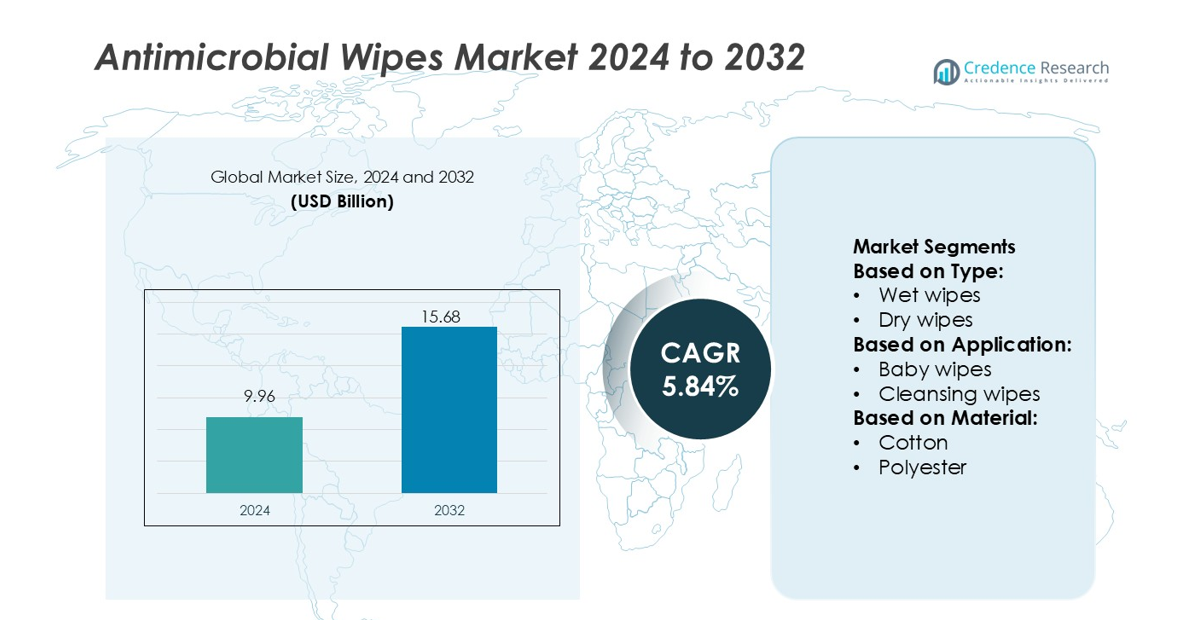

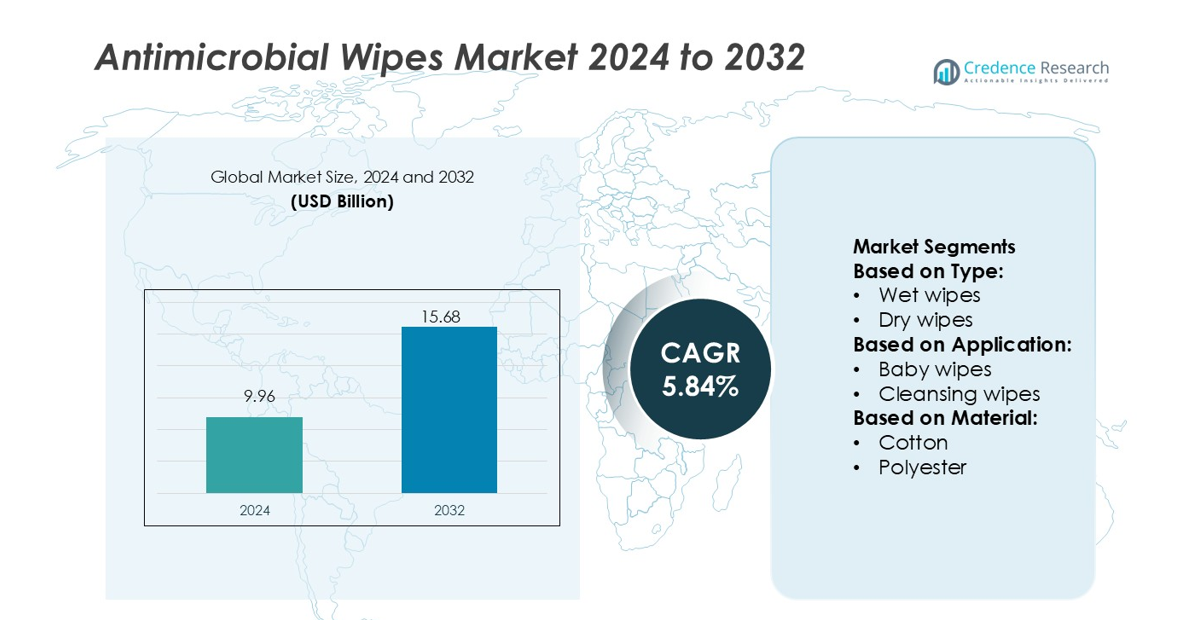

Antimicrobial Wipes Market size was valued USD 9.96 billion in 2024 and is anticipated to reach USD 15.68 billion by 2032, at a CAGR of 5.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antimicrobial Wipes Market Size 2024 |

USD 9.96 billion |

| Antimicrobial Wipes Market, CAGR |

5.84% |

| Antimicrobial Wipes Market Size 2032 |

USD 15.68 billion |

The antimicrobial wipes market features strong participation from major manufacturers such as Reckitt Benckiser Group PLC, Ecolab, Costco Wholesale Corporation, Diamond Wipes International, Inc, Beiersdorf AG, KIMBERLY‑CLARK CORPORATION, The Clorox Company, Johnson & Johnson Services, Inc, Procotech Ltd and 3M. These firms differentiate through robust research and development, expanded global distribution, and branded product portfolios spanning personal care, household cleaning, and institutional use. Regional analysis highlights North America as the leading region, capturing roughly 30.6% of global market share in 2024, which underscores the region’s mature hygiene infrastructure and high consumer awareness.

Market Insights

- The antimicrobial wipes market was valued at USD 9.96 billion in 2024 and is projected to reach USD 15.68 billion by 2032, growing at a CAGR of 5.84% during the forecast period.

- The market is driven by rising hygiene awareness, increased demand for convenience, and stringent cleanliness regulations in industries like healthcare and foodservice.

- Key trends include the growing demand for eco-friendly and biodegradable wipes, with companies focusing on sustainable products and packaging.

- The competitive landscape is characterized by strong participation from major players like Reckitt Benckiser, Ecolab, and 3M, who lead the market through product innovation, geographic expansion, and strategic partnerships.

- North America holds the largest market share, with approximately 30.6% in 2024, driven by high consumer awareness and mature hygiene standards. Europe and Asia-Pacific follow, with strong growth prospects in emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Within the antimicrobial wipes market by type, the wet‑wipes sub‑segment commands the largest share, representing approximately 67% of revenue in 2025. This dominance stems from consumers and institutions favouring pre‑moistened substrates that deliver antimicrobial agents directly and conveniently. Key drivers include heightened hygiene awareness following global health crises and the need for rapid surface and skin sanitisation in both personal‑care and facility settings. Dry‑wipes retain relevance for bulk cleaning but trail wet‑wipes in growth and usage intensity.

- For instance, Reckitt Benckiser Group PLC’s hygiene business delivered an LFL volume growth of 0.9 % in the third quarter of 2024 and price/mix improvements of 1.4 % on net revenue of £1,525 million in that period, aiding the firm’s push in germ‑protection wipes.

By Application

In the application segment, personal‑care wipes emerge as the leading category, capturing about 46% of the overall market share in 2024. This strength is driven by rising demand for on‑the‑go hygiene, baby care cleaning, hand cleansing and personal‑hygiene wipes amid changing lifestyles. Growth is further propelled by growing online retail penetration and increased urbanisation. Meanwhile, household and industrial uses grow steadily, supported by institutional sanitation mandates and commercial surface‑disinfection protocols.

- For instance, Ecolab introduced its Disinfectant 1 Wipe – the first EPA‑registered, 100% plastic‑free, wood‑pulp‑derived wipe that achieved a 94.3% relative biodegradation in 15 days and demonstrated a 30‑second kill time against SARS‑CoV‑2.

By Material

On the materials front, cotton‑based wipes lead the market, holding the dominant share in 2024. This preference reflects cotton’s attributes such as softness, high absorbency and suitability for skin‑sensitive personal‑care applications. Other materials, notably polyester and viscose, follow as cost‑effective alternatives in surface and industrial contexts. Material innovation and sustainability trends—including biodegradable blends and non‑woven substrates—are becoming important drivers for future growth and differentiation.

Key Growth Drivers

Increased Hygiene Awareness

The rise in global health concerns, especially following the COVID-19 pandemic, has significantly heightened hygiene awareness among consumers and institutions. This has resulted in an increasing demand for antimicrobial wipes across various sectors such as healthcare, foodservice, and household cleaning. The growing recognition of the importance of regular disinfection has led to greater reliance on easy-to-use, effective products like antimicrobial wipes for hand hygiene, surface cleaning, and equipment sanitation. As hygiene becomes an integral part of daily life, this growing awareness is expected to drive sustained demand in the market.

- For instance, Diamond Wipes International, Inc developed its Hero Wipes™ decontamination product that removes up to 98% of harmful flame‑retardant TCEP and 83 % of carcinogen benzopyrene from firefighters’ skin.

Convenience and Portability

Antimicrobial wipes are increasingly popular due to their convenience and portability. These ready-to-use products are easy to carry, store, and apply, making them ideal for on-the-go hygiene. Their widespread use in personal care routines, as well as in public and shared spaces, has been a major factor in their growth. Consumers and businesses are now seeking quick, efficient solutions for cleanliness, and antimicrobial wipes provide an easy way to maintain hygiene without the need for water or other cleaning agents. This demand for quick and portable solutions will continue to fuel market expansion.

- For instance, Beiersdorf AG announced the foundation of its new Innovation Center—spanning approximately 14,000 m² and backed by a €139 million investment—designed to accelerate development from idea to product.

Regulatory Hygiene Standards

The enforcement of stringent hygiene standards and regulations in industries such as healthcare, foodservice, and public facilities has created consistent demand for antimicrobial wipes. Regulatory bodies require that facilities maintain high levels of sanitation, particularly in areas prone to infections or contamination. Antimicrobial wipes have become an essential tool in meeting these standards, providing effective, easy-to-use solutions for maintaining cleanliness. These regulations, combined with an increasing emphasis on infection control in workplaces, hospitals, schools, and food establishments, have contributed to the steady growth of the antimicrobial wipes market.

Key Trends & Opportunities

Sustainable and Eco-Friendly Materials

As consumers become more environmentally conscious, there is an increasing demand for sustainable, biodegradable, and eco-friendly alternatives in the antimicrobial wipes market. This trend is driven by a growing focus on reducing single-use plastic waste and a shift towards products that are both effective and environmentally responsible. Manufacturers are seizing the opportunity to innovate by developing antimicrobial wipes made from biodegradable nonwoven fabrics, natural fibers, and eco-friendly packaging. This shift towards sustainability presents an opportunity for companies to differentiate themselves by offering products that meet the rising demand for environmentally friendly solutions.

- For instance, Kimberly‑Clark Corporation reports that since 2020 its nonwovens innovation team has achieved plastics reduction/avoidance totaling over 19,000 metric tons globally.

Expanding Markets in Emerging Regions

While the antimicrobial wipes market is well-established in regions like North America and Europe, there is significant growth potential in emerging markets such as Asia-Pacific and Latin America. As hygiene standards improve and disposable income increases in these regions, demand for antimicrobial wipes is expected to rise. These regions present opportunities for market expansion, as consumers in emerging markets are increasingly adopting hygiene products due to urbanization, changing lifestyles, and heightened awareness of cleanliness. Manufacturers can capitalize on this trend by tailoring their products to meet the needs of these growing markets.

- For instance, Johnson & Johnson Services, Inc.’s JOHNSON’S® Baby Hand & Face Wipes product description reports that the wipes remove “95 % of dirt and germs” from delicate hands and faces in a travel‑friendly pack of 25 wipes, demonstrating their suitability for mobile, emerging‑market usage.

Key Challenges

Environmental Impact of Disposal

Despite their growing popularity, antimicrobial wipes face criticism for contributing to environmental pollution, especially due to their single-use nature and non-biodegradable materials. The improper disposal of wipes, particularly when flushed, has led to significant environmental concerns, including clogging sewage systems and contributing to plastic waste. As awareness of environmental issues grows, there is mounting pressure on manufacturers to address the sustainability of their products. Developing wipes that are both effective and eco-friendly presents a challenge that the industry must address to meet consumer demands for environmentally responsible products.

High Manufacturing Costs

The production of antimicrobial wipes often involves higher manufacturing costs due to the use of specialized materials and antimicrobial agents. The cost of raw materials, such as antimicrobial chemicals, nonwoven fabrics, and packaging, can increase production expenses, which may be passed on to consumers. This can limit the affordability of wipes, particularly in price-sensitive markets or regions where disposable income is lower. Manufacturers face the challenge of balancing the cost of production with consumer price sensitivity while maintaining the quality and effectiveness of the product.

Regional Analysis

North America

North America led the antimicrobial wipes market in 2024, capturing roughly 30 % of global revenues. The region’s dominance stems from well‑established hygiene protocols in healthcare and commercial sectors, as well as high consumer awareness of sanitation products. The U.S. market, in particular, benefits from stringent regulation and widespread adoption across both household and institutional users. Growth is supported by innovation in product formulations and online distribution channels, enabling manufacturers to meet the demand for convenient and effective wipes across multiple use‑cases.

Europe

Europe accounted for approximately 29 % of the antimicrobial wipes market in 2024. The region’s sizeable share derives from strong regulation on disinfectant products, robust infrastructure in healthcare and public hygiene, and growing demand for eco‑friendly wipe formats. Countries such as Germany, the UK and France are investing in surface‑sanitisation solutions and hygiene‑driven consumer goods. With increased public hygiene awareness and a shift toward sustainable materials, Europe presents opportunities for premium and environmentally conscious wipe products.

Asia‑Pacific

The Asia‑Pacific region held an estimated 20–22 % share in the antimicrobial wipes market as of 2024 and is projected to record the fastest growth rate. Expansion in this region is driven by rising urbanisation, expanding healthcare infrastructure, and increasing consumer standards of hygiene in countries such as China and India. The region’s growth is further supported by growing retail and e‑commerce networks and increasing penetration of western‑style hygiene habits, positioning Asia‑Pacific as a key opportunity zone for manufacturers.

Latin America

Latin America represented around 7 % of the global antimicrobial wipes market in 2023‑24. While the share is modest, growth momentum is strong, driven by urbanisation, improved sanitation infrastructure and rising disposable incomes. Brazil and Mexico lead adoption in household and institutional segments. However, the market faces challenges related to price sensitivity and distribution in rural markets. Nonetheless, opportunities exist for cost‑effective formats and tailored product offerings to accelerate adoption.

Middle East & Africa (MEA)

The Middle East & Africa region accounted for about 5 % of the antimicrobial wipes market around 2024. Growth is being fuelled by heightened hygiene protocols in public facilities, infrastructure investment and increased awareness in urban centres. However, adoption remains uneven due to affordability issues and infrastructural limitations in certain countries. Manufacturers looking to expand in the MEA region must adapt to local distribution dynamics and economic constraints while leveraging increasing demand for hygiene solutions in commercial and public‑sector settings.

Market Segmentations:

By Type:

By Application:

- Baby wipes

- Cleansing wipes

By Material:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The antimicrobial wipes market is highly competitive, with key players such as Reckitt Benckiser Group PLC, Ecolab, Costco Wholesale Corporation, Diamond Wipes International, Inc, Beiersdorf AG, KIMBERLY-CLARK CORPORATION, The Clorox Company, Johnson & Johnson Services, Inc, Procotech Ltd, and 3M. The antimicrobial wipes market is characterized by intense competition, driven by ongoing product innovation, geographic expansion, and strategic partnerships. Companies in the industry are heavily investing in research and development to create advanced formulations that improve efficacy and meet the increasing demand for eco-friendly and sustainable products. There is also a growing focus on offering convenient, ready-to-use solutions that cater to various consumer needs, such as personal hygiene, surface cleaning, and industrial sanitation. To enhance their market position, companies are utilizing e-commerce platforms and direct sales channels, while also exploring collaborations and mergers to diversify product offerings and expand their reach into emerging markets. The increasing emphasis on hygiene and cleanliness across both consumer and institutional sectors is further fueling competition within the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

Recent Developments

- In July 2024, Ecolab launched the Disinfectant 1 Wipe, which is the first EPA-registered disinfectant wipe made entirely from 100% plastic-free, readily degradable wood pulp fibers. This innovative wipe addresses the urgent need for sustainable solutions in healthcare settings, where traditional plastic-based disinfectant wipes have raised environmental concerns.

- In May 2024, Medicare Hygiene Limited, a well-known manufacturer and exporter of medical bandages and medical non-woven disposable products entered the cosmetics segment with the launch of Earthika Eco-friendly Wet Wipes made from ethically sourced, eco-friendly materials, designed to provide users with instant freshness and a boost of confidence.

- In May 2024, Cugo launched eco-friendly baby wipes made with 99.9% water and plant-based materials, available with aloe extract. The company stated this launch reflects their commitment to providing high-quality, sustainable baby care products.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The antimicrobial wipes market is expected to continue growing as hygiene awareness remains high globally.

- Demand for eco-friendly and biodegradable wipes will increase, driven by consumer preference for sustainable products.

- E-commerce will play a larger role in the distribution of antimicrobial wipes, enabling wider accessibility.

- Product innovation focusing on multi-purpose, effective, and skin-safe formulations will drive market expansion.

- Regulatory requirements for cleanliness in sectors like healthcare and foodservice will further fuel the demand.

- The rise in urbanization and changing lifestyles will contribute to the increased use of wipes in both personal and commercial settings.

- Emerging markets, especially in Asia-Pacific and Latin America, will present significant growth opportunities for manufacturers.

- Manufacturers will focus on enhancing product packaging, improving convenience, and reducing environmental impact.

- Continued investment in research and development will lead to the creation of more efficient and cost-effective wipe products.

- Increased competition will encourage companies to diversify their product lines and strengthen their market presence through strategic partnerships.