Market Overview

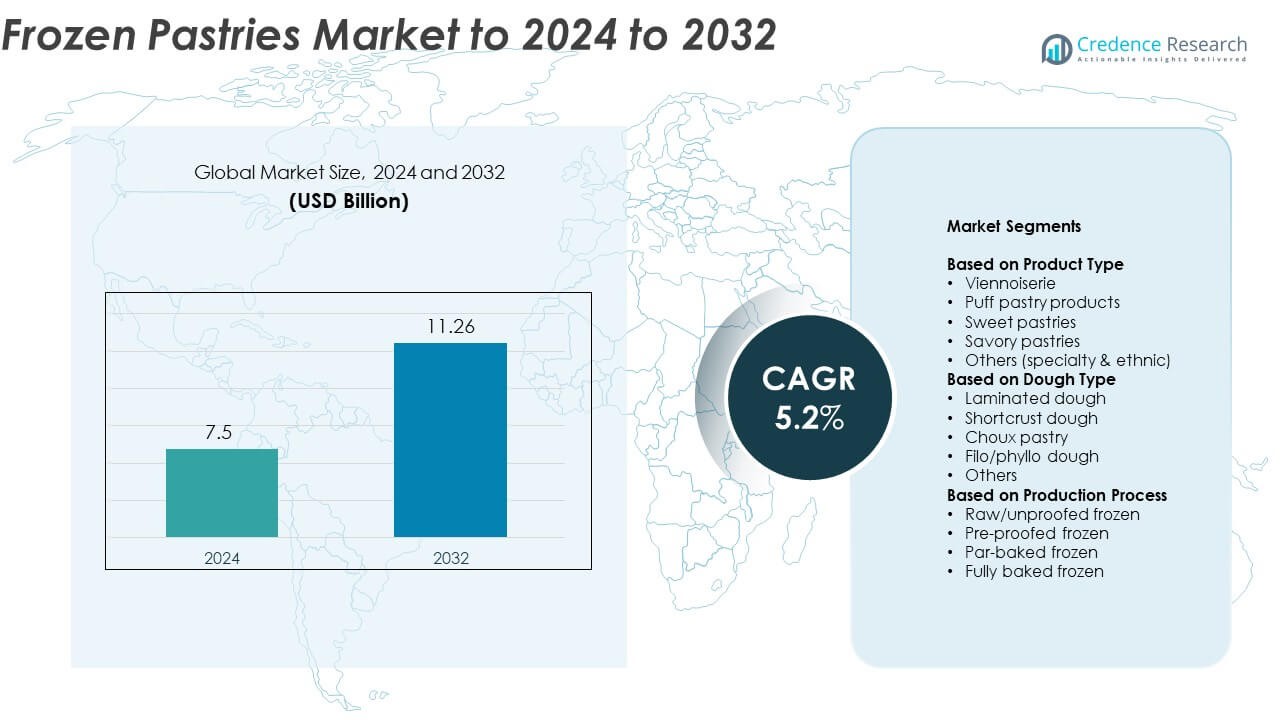

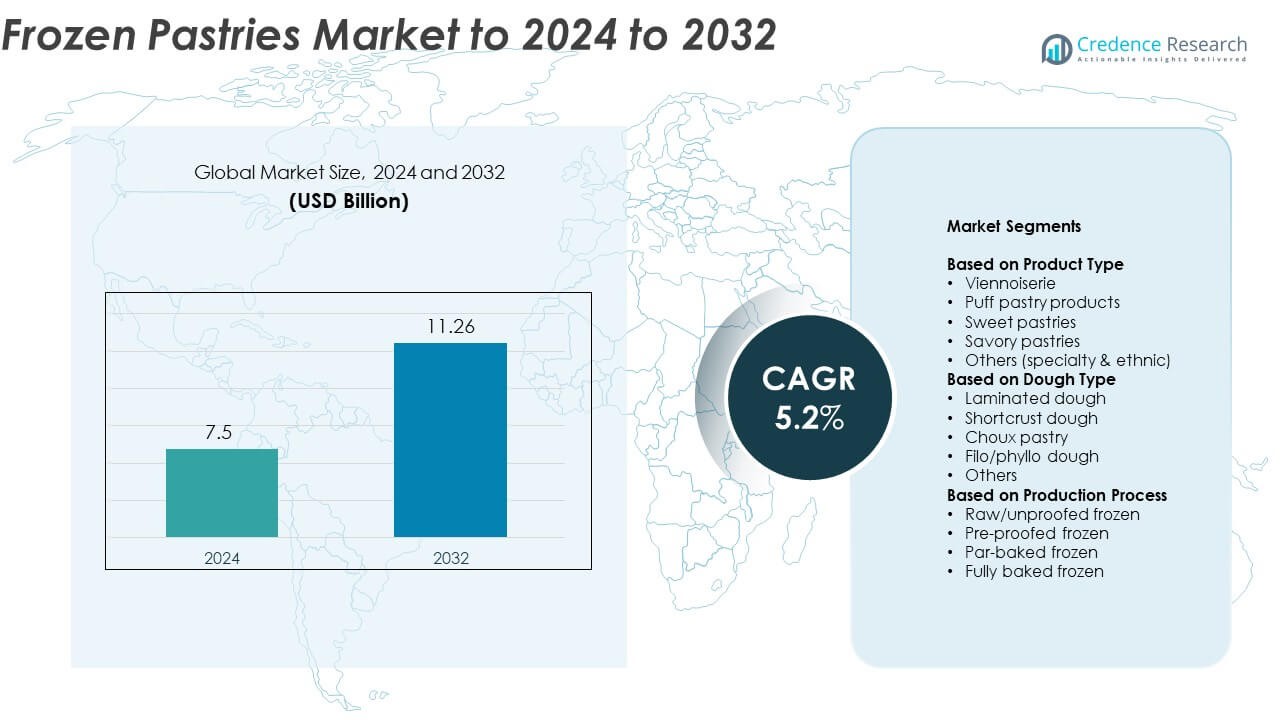

Frozen Pastries Market size was valued at USD 7.5 Billion in 2024 and is anticipated to reach USD 11.26 Billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen Pastries Market Size 2024 |

USD 7.5 Billion |

| Frozen Pastries Market, CAGR |

5.2% |

| Frozen Pastries Market Size 2032 |

USD 11.26 Billion |

The frozen pastries market is led by prominent players including General Mills Inc., Rich Products Corporation, Aryzta AG, Kellanova, Lantmännen Unibake, Europastry S.A., J&J Snack Food Corp., Grupo Bimbo, and Dawn Foods / Dawn Food Products. These companies dominate through extensive product portfolios, advanced freezing technologies, and strong distribution networks across retail and foodservice channels. North America leads the global market with approximately 36.8% share in 2024, driven by high consumption of ready-to-bake and ready-to-eat bakery items. Europe follows closely with 32.5% share, supported by well-established café culture and premium bakery trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The frozen pastries market was valued at USD 7.5 Billion in 2024 and is projected to reach USD 11.26 Billion by 2032, growing at a CAGR of 5.2%.

- Demand for convenient, ready-to-bake, and ready-to-eat bakery products is driving steady growth, supported by urbanization and rising quick-service restaurant penetration.

- Key trends include clean-label innovations, premium product launches, and growing interest in gluten-free and vegan frozen pastries catering to health-conscious consumers.

- The market remains competitive with major players expanding through automation, strategic retail partnerships, and sustainable packaging initiatives, while small regional producers add price competition.

- North America leads with 36.8% share, followed by Europe at 32.5%, while the viennoiserie segment holds 41.6% share globally, supported by increasing café culture and evolving consumer preferences for premium bakery items.

Market Segmentation Analysis:

By Product Type

The viennoiserie segment dominates the frozen pastries market, holding nearly 41.6% share in 2024. Its leadership stems from high global demand for croissants, brioche, and Danish pastries as convenient breakfast and snack options. Growing urbanization and rising café culture in North America and Europe support consumption. Manufacturers are innovating with clean-label ingredients, reduced trans-fat formulations, and premium fillings to enhance appeal. Sweet and savory pastries are also gaining ground due to expanding quick-service restaurant offerings and rising adoption of ready-to-bake products among retail consumers.

- For instance, Vandemoortele operates 32 high-quality production sites across Europe and the United States and exports to 71 countries worldwide, supporting global availability of its viennoiserie and other bakery products.

By Dough Type

Laminated dough leads the market with about 44.3% share in 2024, driven by its versatility in creating layered, flaky textures ideal for croissants and puff pastries. The segment benefits from strong demand in commercial bakeries and retail chains seeking consistent quality and ease of preparation. Advancements in freezing technology maintain product integrity and texture after thawing. Shortcrust and filo doughs are also expanding, supported by innovation in gluten-free and low-fat formulations targeting health-conscious consumers.

- For instance, Lantmännen Unibake runs 36 bakeries located in approximately 20 countries (with bakeries in countries such as the United States, United Kingdom, Poland, and several European nations) and sells in over 60 markets worldwide, anchoring laminated-dough supply.

By Production Process

The par-baked frozen segment dominates the market with around 47.2% share in 2024. Its advantage lies in offering partially baked products that require minimal finishing time, making it ideal for foodservice outlets and retail bakeries. This format ensures uniform baking quality and extended shelf life while reducing operational time. Increasing adoption of par-baked pastries in supermarkets and hotel chains supports growth. The fully baked frozen category is also rising, boosted by consumer preference for ready-to-eat convenience products requiring no preparation.

Key Growth Drivers

Rising Demand for Convenient Bakery Products

Growing urban lifestyles and busy consumer routines are driving demand for ready-to-bake and ready-to-eat bakery goods. Frozen pastries provide long shelf life, consistent taste, and minimal preparation time, making them ideal for both households and foodservice outlets. The expanding café culture in North America and Europe supports product adoption. Retail expansion and e-commerce bakery delivery networks further enhance market reach, while advancements in freezing and packaging technologies preserve freshness and quality.

- For instance, General Mills’ Pillsbury supplies frozen biscuit dough in 216-count bulk cases for high-throughput operations.

Expansion of Quick-Service Restaurants and Cafés

The increasing number of quick-service restaurants and café chains globally has strengthened demand for frozen pastries. These establishments rely on par-baked and pre-proofed pastries to ensure speed and consistency across locations. Rising consumer inclination toward premium bakery experiences supports volume growth. Companies are introducing high-quality croissants, puff pastries, and sweet rolls with regional flavors to match evolving tastes. The trend toward branded frozen bakery products in the retail sector also fuels market expansion.

- For instance, Greggs ended 2024 with 2,618 shops after opening 226 new outlets that year.

Innovation in Healthier and Premium Varieties

Health awareness among consumers is pushing manufacturers to develop frozen pastries with low-fat, gluten-free, and organic formulations. The introduction of clean-label and high-protein ingredients enhances product acceptance. Premiumization through artisanal fillings, natural butter, and reduced additives attracts health-conscious and luxury-oriented buyers. Continuous research in frozen dough stabilization and flavor retention supports product diversification, helping brands target niche segments such as vegan and allergen-free bakery products.

Key Trends & Opportunities

Rising Penetration of Retail and E-Commerce Channels

The growth of modern retail chains and online grocery platforms is expanding frozen pastry accessibility. Supermarkets and hypermarkets are improving cold chain infrastructure to store and display frozen bakery items effectively. E-commerce channels enable direct-to-consumer delivery, enhancing market presence for emerging brands. Strategic partnerships with delivery services and digital marketing campaigns are widening product reach, particularly among young urban consumers seeking convenience and variety in bakery products.

- For instance, Ocado Retail averaged 442,000 orders per week in 2024 and reached 1.1 million active customers.

Adoption of Sustainable and Clean-Label Ingredients

Consumers are increasingly preferring frozen pastries made with natural and sustainable ingredients. Brands are replacing artificial additives with organic sweeteners, whole grains, and plant-based fats. The shift toward recyclable and biodegradable packaging supports eco-conscious purchasing behavior. Manufacturers are also investing in green production processes and sourcing traceable ingredients to meet sustainability goals. This focus on clean-label products is helping companies strengthen brand credibility and capture premium market segments.

- For instance, Puratos’ Sunset Glaze yields up to 10% more units than egg wash and shows a 59% lower environmental impact.

Regional Product Diversification and Flavor Innovation

Manufacturers are expanding product portfolios by incorporating region-specific flavors such as matcha, almond, and tropical fruit fillings. This strategy caters to diverse cultural preferences and enhances export opportunities. Innovation in frozen dough technologies allows better texture and freshness retention, even for delicate pastry varieties. The rising influence of multicultural cuisines and seasonal product launches provides opportunities for differentiation and customer engagement in competitive markets.

Key Challenges

High Energy and Storage Costs

The frozen pastries market faces operational challenges due to high energy consumption and temperature-controlled logistics. Maintaining the cold chain from production to retail shelves increases costs and limits small-scale manufacturer participation. Fluctuations in electricity prices and storage expenses impact profit margins. Companies are investing in energy-efficient freezers and sustainable refrigeration systems to reduce operational costs while maintaining product quality and safety standards.

Limited Shelf Life and Quality Degradation Risks

Despite freezing technologies, frozen pastries face risks of texture loss and flavor degradation over extended storage. Improper handling during distribution or temperature variations can affect quality and customer satisfaction. Ensuring consistent product freshness across different climates remains a challenge for global manufacturers. Continuous innovation in moisture control, packaging, and thaw-stable formulations is necessary to overcome these limitations and maintain consumer trust in frozen bakery offerings.

Regional Analysis

North America

North America leads the frozen pastries market with nearly 36.8% share in 2024. The region’s dominance stems from the strong presence of bakery chains, high per capita consumption, and well-established cold chain infrastructure. The United States remains the largest market, supported by rising demand for croissants, puff pastries, and breakfast-ready items. Canada is witnessing growth through retail expansion and clean-label product launches. Increasing health awareness has encouraged brands to develop low-calorie and organic variants, while the popularity of convenience foods continues to drive consistent sales across supermarkets and foodservice outlets.

Europe

Europe holds about 32.5% share in the global frozen pastries market in 2024. Strong bakery traditions, premium product positioning, and widespread acceptance of viennoiseries fuel growth. France, Germany, and the United Kingdom remain key markets, driven by café culture and rising consumer demand for artisanal and pre-proofed pastries. The adoption of frozen bakery products in hotels and restaurants further boosts sales. Manufacturers are focusing on high-quality ingredients and sustainable packaging solutions. Expanding retail distribution and growing demand for plant-based pastries are strengthening Europe’s role as a leading producer and consumer of frozen bakery products.

Asia Pacific

Asia Pacific accounts for approximately 20.7% share in 2024, emerging as the fastest-growing region. Rising disposable incomes, rapid urbanization, and increasing adoption of Western-style bakery products are driving demand. China, Japan, and India are key growth markets, with strong performance in urban retail and quick-service chains. Expanding cold storage facilities and evolving consumer preferences for premium bakery experiences enhance market penetration. The region’s younger population favors convenient snack formats, supporting frozen pastry adoption. Manufacturers are introducing locally inspired flavors and innovative packaging solutions to cater to diverse cultural and taste preferences across major cities.

Latin America

Latin America represents around 6.4% share of the frozen pastries market in 2024. Growth is driven by the increasing availability of frozen bakery items in supermarkets and convenience stores. Brazil and Mexico lead the regional market due to expanding café networks and the growing popularity of frozen breakfast items. Rising urbanization and a shift toward ready-to-bake products strengthen regional consumption. Manufacturers are improving cold storage and logistics infrastructure to ensure quality preservation. The introduction of affordable frozen pastry lines and partnerships with retail chains are helping brands expand reach across mid-income consumer groups.

Middle East & Africa

The Middle East & Africa region holds nearly 3.6% share in 2024, with steady growth projected over the coming years. The expansion of modern retail channels and quick-service restaurants is boosting frozen pastry demand in Gulf countries and South Africa. Rising tourism and hospitality investments create new opportunities for premium bakery offerings. Consumers are increasingly embracing European-style pastries, supported by the influence of Western dining trends. Limited cold chain infrastructure remains a restraint, but ongoing developments in frozen food logistics and rising disposable incomes are expected to enhance market accessibility and product diversity.

Market Segmentations:

By Product Type

- Viennoiserie

- Puff pastry products

- Sweet pastries

- Savory pastries

- Others (specialty & ethnic)

By Dough Type

- Laminated dough

- Shortcrust dough

- Choux pastry

- Filo/phyllo dough

- Others

By Production Process

- Raw/unproofed frozen

- Pre-proofed frozen

- Par-baked frozen

- Fully baked frozen

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The frozen pastries market is highly competitive, with leading players such as General Mills Inc., Rich Products Corporation, Aryzta AG, Kellanova, Lantmännen Unibake, Europastry S.A., J&J Snack Food Corp., Grupo Bimbo, and Dawn Foods / Dawn Food Products driving global expansion through product innovation and strategic distribution networks. Companies are focusing on premiumization and introducing clean-label, low-fat, and gluten-free variants to meet evolving consumer preferences. Continuous investment in frozen dough technology and automation enhances production efficiency and quality consistency. Retail partnerships and collaborations with foodservice operators strengthen brand visibility across developed and emerging markets. Sustainability remains a key differentiator, with firms adopting recyclable packaging and energy-efficient cold chain logistics. The market also witnesses growing competition from regional bakeries offering artisanal frozen pastries with local flavors. Overall, innovation in product formulation, distribution expansion, and consumer engagement through digital marketing define the evolving competitive dynamics of the frozen pastries industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- General Mills Inc.

- Rich Products Corporation

- Aryzta AG

- Kellanova

- Lantmännen Unibake

- Europastry S.A.

- J&J Snack Food Corp.

- Grupo Bimbo

- Dawn Foods / Dawn Food Products

Recent Developments

- In 2025, General Mills Retail Foodservice showcased an expansive line of Pillsbury frozen bread dough solutions at the International Dairy Deli Bakery Association (IDDBA) trade show, highlighting convenient, easy-to-use frozen and par-baked bread products.

- In 2024, Grupo Bimbo expanded its presence in Brazil by acquiring local bakery group Wickbold, adding four factories to support growth in frozen and fresh bakery goods.

- In 2023, Dawn Foods launched a vegan sponge cake mix, certified with the V-label, offering a plant-based alternative that maintains the texture and taste of conventional sponge cake mixes.

Report Coverage

The research report offers an in-depth analysis based on ProductType, Dough Type, Production Process and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for frozen pastries will grow steadily with increasing preference for convenience foods.

- Expansion of café chains and quick-service restaurants will boost product adoption.

- Clean-label and organic frozen pastries will gain strong consumer acceptance.

- Growth in online grocery and delivery platforms will enhance product accessibility.

- Manufacturers will invest in energy-efficient freezing and sustainable packaging technologies.

- Premiumization with artisanal and gourmet flavors will attract urban consumers.

- Asia Pacific will emerge as the fastest-growing regional market.

- Innovation in vegan and gluten-free pastries will broaden customer base.

- Improved cold chain logistics will support consistent product quality worldwide.

- Strategic collaborations between bakery brands and retailers will strengthen market presence.