Market Overview:

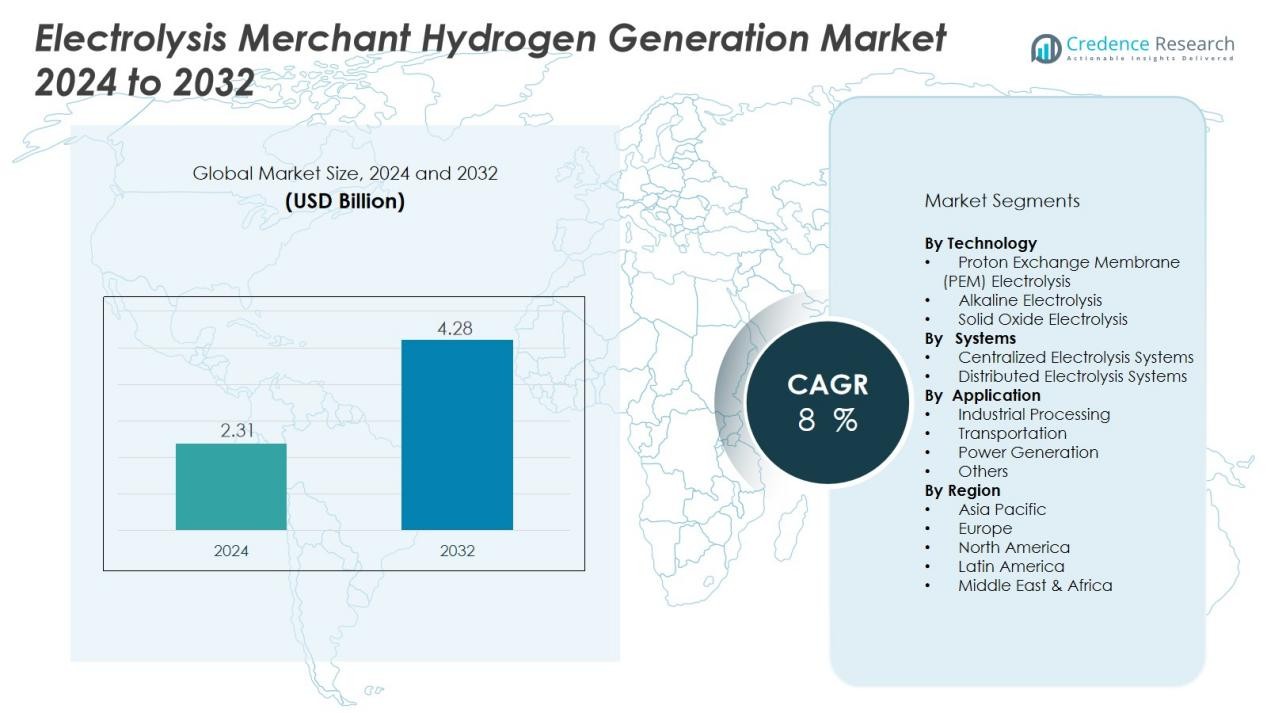

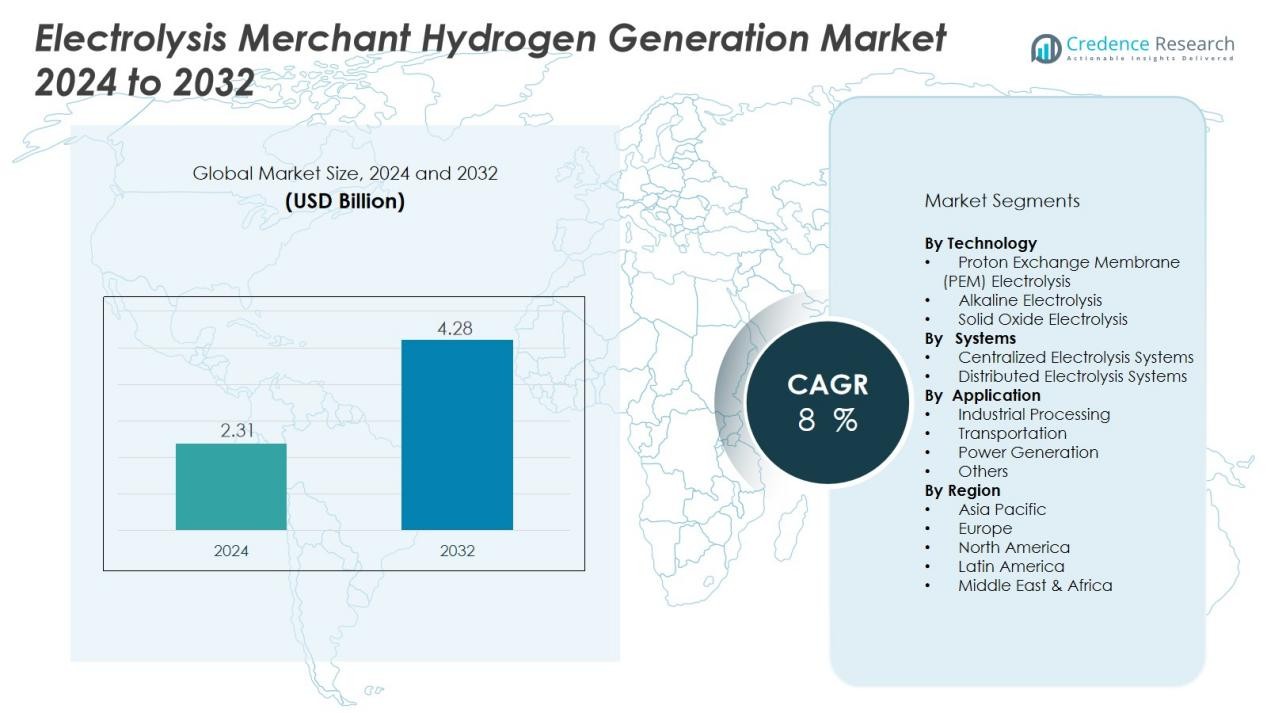

The Electrolysis Merchant Hydrogen Generation Market size was valued at USD 2.31 billion in 2024 and is anticipated to reach USD 4.28 billion by 2032, at a CAGR of 8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrolysis Merchant Hydrogen Generation Market Size 2024 |

USD 2.31 Billion |

| Electrolysis Merchant Hydrogen Generation Market, CAGR |

8% |

| Electrolysis Merchant Hydrogen Generation Market Size 2032 |

USD 4.28 Billion |

The market is driven by rising global efforts to decarbonize heavy industries, mobility, and energy generation. Growing support from governments through subsidies, carbon reduction targets, and hydrogen strategies fuels market adoption. Advancements in electrolyzer technologies, including PEM and alkaline systems, enhance production efficiency and reduce costs, encouraging large-scale hydrogen production for commercial applications.

Regionally, Europe holds the dominant share due to early adoption of clean hydrogen policies and large-scale electrolyzer installations in countries like Germany, France, and the Netherlands. North America follows, supported by U.S. initiatives for clean fuel production and infrastructure development. Asia-Pacific emerges as the fastest-growing region, led by Japan, China, and South Korea, driven by robust energy transition programs and industrial decarbonization projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electrolysis Merchant Hydrogen Generation Market was valued at USD 2.31 billion in 2024 and is projected to reach USD 4.28 billion by 2032, growing at a CAGR of 8% during the forecast period.

- Europe leads with a 42% market share, driven by strong hydrogen policies, large-scale electrolyzer deployment, and renewable integration in Germany, France, and the Netherlands.

- North America holds a 30% share, supported by U.S. tax incentives under the Inflation Reduction Act and Canada’s clean hydrogen roadmap promoting industrial and mobility applications.

- Asia-Pacific accounts for 22% and stands as the fastest-growing region, led by Japan, China, and South Korea, where national hydrogen roadmaps and industrial decarbonization initiatives fuel expansion.

- The alkaline electrolysis segment dominates with 51% share due to its scalability, cost efficiency, and proven operational reliability across large industrial setups.

Market Drivers:

Rising Focus on Decarbonization Across Industries

The Electrolysis Merchant Hydrogen Generation Market grows rapidly with industries shifting toward low-carbon operations. Governments and corporations adopt hydrogen as a clean fuel alternative to meet emission reduction targets. The industrial, transportation, and power sectors increasingly integrate green hydrogen to replace fossil fuels. It supports sustainability goals while reducing dependence on carbon-intensive energy sources.

- For instance, Air Liquide commissioned a 20 MW electrolyzer plant in Bécancour, Canada, in January 2021 that produces 8.2 tonnes of low-carbon hydrogen per day, directly supplying local industry with clean hydrogen for decarbonization efforts.

Advancements in Electrolyzer Technologies

Continuous innovation in electrolyzer technology strengthens production efficiency and reduces hydrogen generation costs. Developments in proton exchange membrane (PEM), alkaline, and solid oxide electrolyzers improve system durability and flexibility. It enhances hydrogen purity and supports large-scale deployment across multiple end uses. These advancements make electrolysis-based hydrogen production more competitive compared to conventional methods.

- For instance: Siemens Energy’s Silyzer 300 PEM electrolyzer achieves a system efficiency of 75.6%, demonstrating the capability of advanced membrane designs to substantially reduce electricity consumption per kilogram of hydrogen produced.

Supportive Government Policies and Investments

Government incentives, funding programs, and hydrogen strategies accelerate market adoption. Initiatives in Europe, the United States, and Asia-Pacific encourage renewable-based hydrogen projects and infrastructure expansion. Policy frameworks such as carbon pricing and clean energy mandates attract private investments in electrolyzer manufacturing and distribution networks. It reinforces long-term confidence among stakeholders and drives sustainable growth.

Expanding Demand from Energy and Mobility Sectors

The energy and transportation sectors increasingly depend on hydrogen to meet clean energy targets. Power utilities use hydrogen for grid balancing, while mobility solutions include hydrogen fuel cell vehicles and refueling stations. It creates a strong commercial opportunity for merchant hydrogen suppliers. The rising adoption of hydrogen-powered public transport and logistics systems continues to boost market growth globally.

Market Trends:

Integration of Renewable Energy Sources into Hydrogen Production

The Electrolysis Merchant Hydrogen Generation Market witnesses a strong shift toward renewable-powered electrolysis systems. Solar and wind energy are increasingly integrated into hydrogen plants to achieve carbon-neutral production. Governments and energy firms collaborate to create large-scale hydrogen hubs powered by renewable grids. It helps stabilize energy storage, balancing intermittent renewable output with hydrogen generation. Hybrid power models that combine solar and wind improve operational efficiency and reliability. Leading energy companies invest in co-located renewable hydrogen projects to reduce production costs. This integration supports long-term energy security and aligns with global net-zero goals.

- For Instance, Air Liquide did commission its 20 MW proton exchange membrane (PEM) electrolyzer in Bécancour, Canada, in January 2021. The facility is powered by renewable energy from Hydro-Québec (hydropower) and produces up to 8.2 tonnes of low-carbon hydrogen per day for industrial clients and mobility markets in North America.

Expansion of Large-Scale Hydrogen Infrastructure Projects

Global investments in hydrogen infrastructure expand rapidly to support supply chain efficiency and commercialization. Major economies invest in hydrogen pipelines, storage facilities, and refueling networks to enhance distribution capacity. It enables industrial users and transport operators to access green hydrogen more conveniently. Public-private partnerships drive the establishment of regional hydrogen corridors linking production centers with demand hubs. Technological partnerships among electrolyzer manufacturers, utilities, and energy developers promote standardized systems and cost optimization. Growing focus on export-oriented hydrogen production strengthens cross-border collaboration, particularly between Europe, Asia-Pacific, and the Middle East. The expansion of these infrastructure projects establishes a foundation for scalable and competitive hydrogen economies worldwide.

- For instance, the Genesee County green hydrogen project in New York, operated by Plug Power at the Western New York Science, Technology and Advanced Manufacturing Park (STAMP), is planned to produce 74 tons of green hydrogen per day using low-cost hydropower from the New York Power Authority (NYPA) to support large-scale logistics and industrial applications, and it includes a dedicated 450 MW substation.

Market Challenges Analysis:

High Capital and Operational Costs

The Electrolysis Merchant Hydrogen Generation Market faces challenges due to high initial investment and maintenance costs. Electrolyzer systems require expensive materials, such as platinum and iridium, which raise equipment prices. It increases the overall cost of hydrogen production, limiting adoption among small and mid-sized enterprises. The energy-intensive process demands consistent access to low-cost renewable power to remain competitive. Limited economies of scale in early-stage projects further restrict cost reductions. This financial barrier slows large-scale commercialization and discourages investors from entering emerging markets.

Infrastructure Limitations and Supply Chain Constraints

Hydrogen infrastructure remains underdeveloped across several regions, restricting smooth distribution and storage. It requires dedicated transport pipelines, refueling networks, and advanced compression systems to ensure efficiency. The absence of standardized regulations for hydrogen purity and safety complicates project execution. Manufacturing bottlenecks for electrolyzers and hydrogen storage components create delays in project deployment. Limited technical expertise and workforce availability slow operational readiness. These infrastructure and supply constraints reduce the scalability of hydrogen projects, especially in developing economies.

Market Opportunities:

Growing Role in Industrial Decarbonization Initiatives

The Electrolysis Merchant Hydrogen Generation Market offers significant opportunities through industrial decarbonization programs. Energy-intensive industries such as steel, cement, and chemicals adopt green hydrogen to replace fossil fuels in production. It supports clean manufacturing and helps companies meet emission reduction targets. Government-backed projects focused on green industrial hubs create stable demand for hydrogen suppliers. Collaboration between electrolyzer manufacturers and industrial firms accelerates technology transfer and cost optimization. Rising corporate sustainability commitments across global supply chains enhance long-term market potential.

Emerging Hydrogen Mobility and Export Markets

Hydrogen mobility and international trade expansion present new revenue opportunities for producers. Countries in Asia-Pacific, the Middle East, and Europe invest in hydrogen refueling stations and export terminals. It supports the transition of transport fleets, marine vessels, and heavy-duty trucks toward zero emissions. Growth in ammonia and liquid hydrogen exports establishes new trade routes between renewable-rich and high-demand regions. Strategic partnerships among energy companies, logistics providers, and port operators strengthen global supply chains. Rising focus on hydrogen-powered public transport systems enhances infrastructure development and boosts merchant demand.

Market Segmentation Analysis:

By Technology

The Electrolysis Merchant Hydrogen Generation Market is segmented into proton exchange membrane (PEM), alkaline, and solid oxide electrolyzer technologies. Alkaline electrolysis holds the largest share due to its proven reliability, scalability, and lower cost of operation. PEM technology gains strong traction for its ability to operate under variable renewable energy input and produce high-purity hydrogen. It supports compact designs ideal for decentralized hydrogen generation units. Solid oxide electrolysis, though at an early stage, shows potential for high efficiency when integrated with waste heat recovery systems.

- For Instance, Nel Hydrogen has delivered over 3,800 water electrolyzers globally, including both alkaline and PEM units. The company utilizes its A-series alkaline systems in large-scale hydrogen plants, with a core unit capable of producing up to 5,000 Nm³/h of hydrogen.

By Systems

The market includes centralized and distributed electrolysis systems. Centralized systems dominate due to large-scale hydrogen production for industrial and energy applications. It enables efficient use of renewable power and reduces per-unit production costs. Distributed systems grow steadily, supported by demand from refueling stations and small industrial users. Modular designs and lower installation requirements make distributed setups suitable for local supply and off-grid operations.

- For Instance, Accelera by Cummins’ 20 MW PEM electrolyzer system installed at Air Liquide’s facility in Bécancour, Quebec producing over 3,000 tons of hydrogen annually using clean hydropower, establishing the largest operating PEM electrolyzer globally.

By Application

The market serves applications across industrial processing, transportation, and power generation. Industrial processing leads the segment, driven by demand from chemical, steel, and refining industries. It supports emission reduction and sustainable fuel substitution goals. The transportation segment grows rapidly with the expansion of hydrogen-powered vehicles and refueling networks. Power generation applications gain attention through the use of hydrogen for energy storage and grid balancing.

Segmentations:

By Technology

- Proton Exchange Membrane (PEM) Electrolysis

- Alkaline Electrolysis

- Solid Oxide Electrolysis

By Systems

- Centralized Electrolysis Systems

- Distributed Electrolysis Systems

By Application

- Industrial Processing

- Transportation

- Power Generation

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe Leads with 42% Share Driven by Strong Policy Support

Europe holds 42% share of the Electrolysis Merchant Hydrogen Generation Market, supported by robust policy frameworks and early adoption of green hydrogen strategies. Countries such as Germany, France, and the Netherlands lead in large-scale electrolyzer installations and renewable integration. The European Union’s Hydrogen Strategy and REPowerEU plan accelerate deployment across industries and transport. It benefits from strong funding under the Important Projects of Common European Interest (IPCEI) initiative. Growing industrial alliances and partnerships strengthen the regional hydrogen ecosystem. The region also focuses on export-oriented projects linking renewable energy hubs in Spain and the Nordics to wider European demand.

North America Accounts for 30% Share with Expanding Infrastructure

North America holds 30% market share, driven by increasing investments in clean hydrogen production and infrastructure. The United States leads with the Inflation Reduction Act offering tax incentives for low-carbon hydrogen projects. Canada follows with national strategies promoting renewable hydrogen for industrial decarbonization and mobility. It experiences rising demand from power utilities and refueling networks for fuel cell vehicles. Collaborations between electrolyzer manufacturers and energy firms improve scalability and cost efficiency. The region’s focus on public-private partnerships strengthens long-term hydrogen deployment goals.

Asia-Pacific Holds 22% Share and Emerges as Fastest-Growing Region

Asia-Pacific holds 22% market share and records the fastest growth rate due to large-scale national hydrogen roadmaps. Japan, China, and South Korea spearhead production and consumption for industrial and mobility sectors. It benefits from strong government funding and integration of solar and wind resources with electrolysis plants. Expanding hydrogen export hubs in Australia and partnerships with Japan and South Korea create global trade links. Growing focus on carbon neutrality and industrial electrification supports continuous market expansion. Regional manufacturers also innovate cost-effective electrolyzer solutions tailored to domestic energy systems.

Key Player Analysis:

- Air Liquide International S.A

- Air Products and Chemicals, Inc

- Hydrogenics Corporation

- INOX Air Products Ltd.

- Iwatani Corporation

- Linde Plc

- Matheson Tri-Gas, Inc.

- Messer

- SOL Group

- Tokyo Gas Chemicals Co., Ltd.

Competitive Analysis:

The Electrolysis Merchant Hydrogen Generation Market remains moderately consolidated, with key players focusing on technological innovation and capacity expansion. Major companies include Air Liquide International S.A., Air Products and Chemicals, Inc., Hydrogenics Corporation, INOX Air Products Ltd., Iwatani Corporation, Linde Plc, and Matheson Tri-Gas, Inc. It emphasizes large-scale green hydrogen production and strategic collaborations to secure long-term contracts across industrial, mobility, and power sectors. Leading firms invest heavily in renewable-integrated electrolysis projects to achieve cost parity with conventional hydrogen. Global partnerships and government-backed hydrogen initiatives drive competitive differentiation. Continuous R&D efforts in electrolyzer efficiency and scalability strengthen players’ positions in emerging markets.

Recent Developments:

- In August 2025, Air Liquide signed a binding agreement to acquire DIG Airgas in South Korea for €2.85 billion ($3.31 billion), with the transaction expected to close in the first half of 2026.

- In September 2025, Air Products and Chemicals, Inc. commissioned a new air separation facility in Cleveland, Ohio, supplying gaseous oxygen, nitrogen, and liquid argon for industrial clients in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Technology, Systems, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Electrolysis Merchant Hydrogen Generation Market will experience accelerated adoption driven by global decarbonization commitments and renewable integration.

- Governments will expand hydrogen roadmaps and financial incentives to attract private investments in green hydrogen production.

- Technological improvements in PEM and solid oxide electrolyzers will enhance efficiency and lower production costs.

- It will witness growing demand from industrial sectors such as steel, cement, and chemical manufacturing seeking cleaner alternatives.

- Hydrogen-powered transportation, including heavy trucks, buses, and marine vessels, will create new commercial opportunities.

- Expansion of regional hydrogen corridors and refueling infrastructure will strengthen market scalability and accessibility.

- Cross-border hydrogen trade between Europe, Asia-Pacific, and the Middle East will intensify, supported by export terminals and shipping innovation.

- Public-private partnerships will increase to accelerate project deployment and supply chain development.

- Investment in hydrogen storage, pipelines, and grid integration will improve energy security and distribution flexibility.

- Digital monitoring and AI-based optimization will enhance electrolyzer performance, supporting a competitive and efficient global hydrogen economy.