Market Overviews

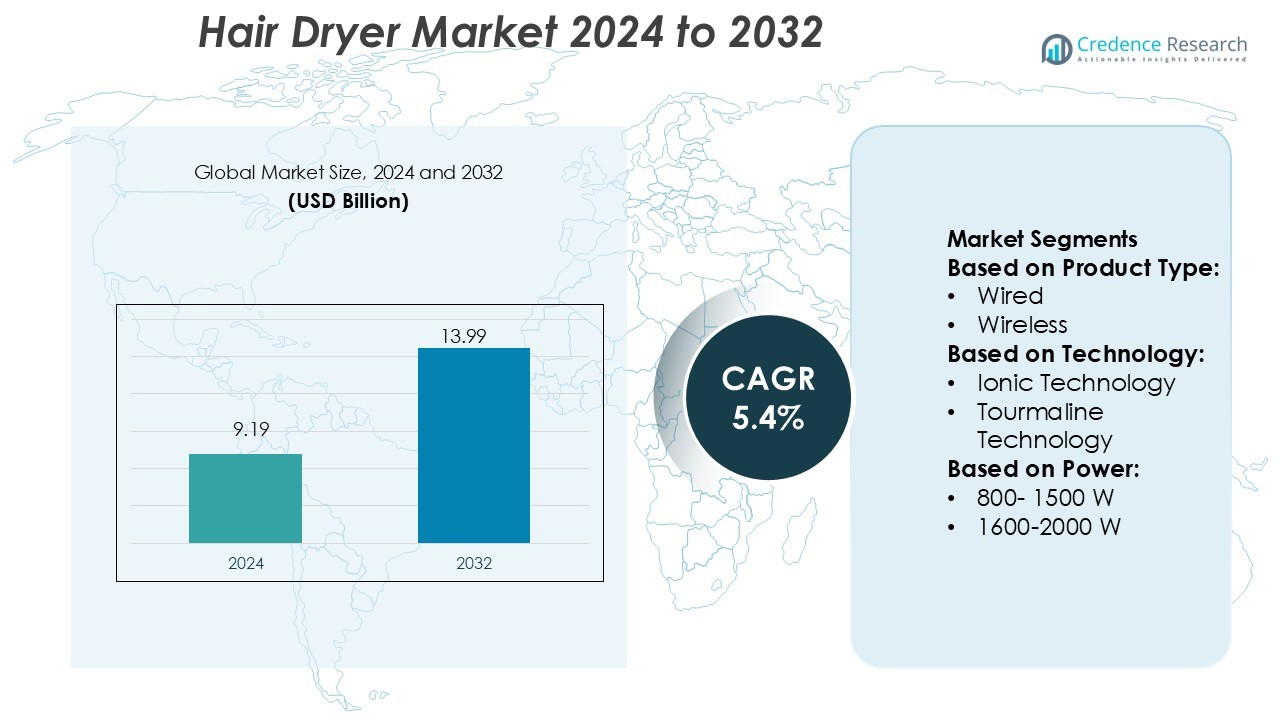

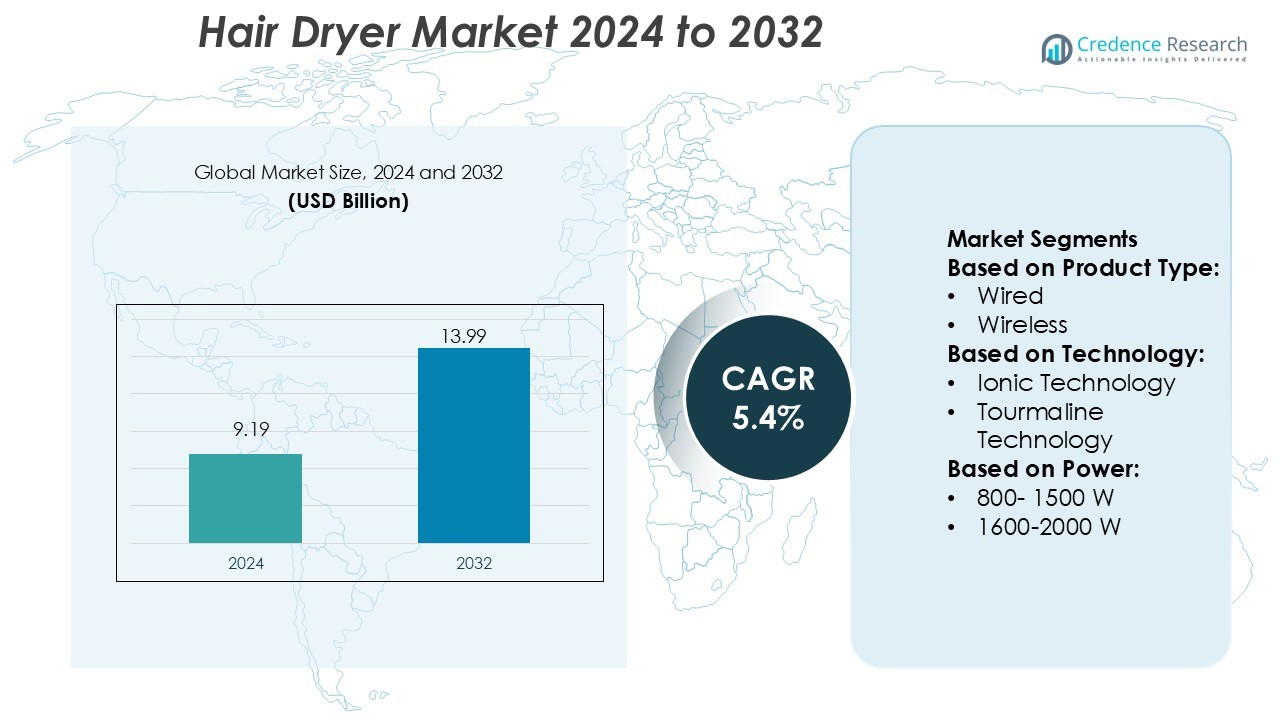

Hair Dryer Market size was valued USD 9.19 billion in 2024 and is anticipated to reach USD 13.99 billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hair Dryer Market Size 2024 |

USD 9.19 Billion |

| Hair Dryer Market, CAGR |

5.4% |

| Hair Dryer Market Size 2032 |

USD 13.99 Billion |

The hair dryer market features leading companies such as Harry Josh Pro Tools, Dyson Limited, Braun GmbH, Helen of Troy Limited, Revlon Inc., Spectrum Brands Inc. (Remington), Conair Corporation, Ghd hair (Jemella Ltd.), Koninklijke Philips N.V., and Panasonic Holdings Corporation. These firms invest heavily in new technologies and distribution channels to gain competitive advantage. The North American region leads the global market with a share of approximately 33.6 %, supported by strong consumer demand for premium and professional‑grade hair styling tools and widespread retail penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hair dryer market was valued at USD 9.19 billion in 2024 and is anticipated to reach USD 13.99 billion by 2032, growing at a CAGR of 5.4% during the forecast period.

- The market is driven by increasing consumer demand for high‑quality, durable hair dryers with advanced technologies like ionic and ceramic heating systems, which reduce damage and enhance performance.

- Key trends include the growing adoption of smart hair dryers, with features such as temperature control, automatic shutoff, and mobile app integration, which offer a more personalized user experience.

- North America leads the market with approximately 33.6% share, fueled by strong demand for premium, professional‑grade dryers and established distribution networks.

- The market faces challenges such as high product costs and increasing competition, which could limit the growth of lower‑priced models. However, innovation and new product features are expected to drive long‑term growth.

Market Segmentation Analysis:

By Product Type

The wired hair dryer segment leads the market, holding the largest share due to its consistent power and performance. Wired dryers provide a reliable airflow, which is essential for achieving fast and effective drying, especially for thick or long hair. They are commonly used in both households and professional settings due to their stability and stronger power output. On the other hand, wireless hair dryers are gaining traction for their convenience and portability. These models are particularly appealing for people who travel frequently or have limited space, as they offer flexibility and ease of use. However, their shorter battery life and lower power output compared to wired models still limit their market share.

- For instance, Helios Lifestyle Private Limited supplies grooming tools under the Bombay Shaving Company brand that use stainless-steel blades, and many models feature rechargeable lithium-ion batteries supporting 90 minutes or more of continuous trimming.

By Technology

In terms of technology, ionic hair dryers dominate the market, as they are highly effective at reducing frizz and enhancing shine. The negative ions produced by ionic technology break down water droplets quickly, which speeds up the drying process and leaves hair smoother and less static. Tourmaline and ceramic technologies are also growing in popularity. Tourmaline dryers emit both negative ions and infrared heat, making them effective at drying hair faster while minimizing damage. Ceramic dryers, which evenly distribute heat, are favored for their gentler approach to drying, making them ideal for those with fine or color-treated hair. The demand for these technologies is driven by consumers’ growing preference for faster, more efficient drying solutions that also protect hair health.

- For instance, P&G’s Braun SkinPro 2.0 technology for this specific model (also sometimes referred to as the Pro 5 series). Official product documentation and marketing materials consistently confirm that the sensor checks the skin tone 80 times per second.

By Power

In the power segment, hair dryers with a power range of 1600–2000 W hold the largest share due to their optimal combination of drying speed and heat control. These models are suitable for most hair types, providing an efficient drying process without causing excessive heat damage. They are commonly used in households and salons for their balance of performance and affordability. Hair dryers with lower power, in the 800–1500 W range, are less effective for thick or long hair, leading to longer drying times. On the other hand, high‑power models above 2100 W are suitable for professional or high‑demand environments, offering fast drying but often at the cost of higher energy consumption and a premium price. This limits their widespread adoption among average consumers, as they are considered more energy‑intensive and costly.

Key Growth Drivers

Rising Demand for Premium Hair Care Solutions

Consumers are increasingly willing to invest in high-end hair dryers that offer advanced features like ionic technology, heat protection, and faster drying times. This shift is driven by the growing awareness of hair health and the desire for salon-quality results at home. As consumers prioritize hair care, especially those with thick, long, or damaged hair, the demand for premium dryers continues to rise, driving growth in the market.

- For instance, Sally Hansen’s “Complete Salon Manicure” formula incorporates a keratin complex that delivers up to 64 % stronger nails and up to 10 days of chip-resistant wear.

Technological Advancements in Hair Drying Technology

The continuous advancement of hair dryer technology is a significant growth driver. The integration of features like ceramic, tourmaline, and infrared technologies helps improve drying time while minimizing heat damage. Additionally, the introduction of smart hair dryers that automatically adjust temperature and speed settings based on hair type is attracting consumers seeking more customized solutions. These innovations improve product efficiency and appeal to a broader customer base.

- For instance, Emjoi eRase e6 is specifically marketed as a “revolutionary compact epilator designed to remove the shortest (0.3 mm) and finest hairs with pinpoint precision”. Product documentation and highlights consistently state that the device’s tweezers “open and close 180 times a second”.

Increasing Consumer Awareness of Hair Health

There is a growing trend towards consumers prioritizing hair health, which is boosting the demand for hair dryers that minimize heat damage. The use of ionic technology, which reduces frizz and promotes smoother hair, is particularly popular among those with sensitive or damaged hair. As consumers become more informed about the potential harm of excessive heat, the market is seeing a shift toward products that balance performance with hair protection, contributing to sustained growth.

Key Trends & Opportunities

Sustainability and Eco-friendly Products

Sustainability is becoming a major trend in the hair dryer market. Consumers are increasingly concerned about the environmental impact of their purchases, leading manufacturers to develop more energy-efficient and eco-friendly products. Hair dryers made from recyclable materials, with energy-saving features and reduced plastic usage, are gaining popularity. Companies that emphasize sustainability in their product designs and manufacturing processes can tap into the growing market of environmentally conscious consumers.

- For instance, Nair™ Hair Remover Cream with Aloe & Lanolin (Material No. 42016528) from Church & Dwight uses Potassium Thioglycolate as a depilating agent plus Aloe barbadensis leaf juice as a botanical skin-conditioning component.

Rise of Smart and Connected Hair Dryers

Smart hair dryers that integrate with mobile apps or have built-in sensors to adjust heat and speed based on hair type are becoming more prevalent. These devices allow for a personalized drying experience, offering consumers control and convenience. As consumers increasingly value convenience and technological integration, smart hair dryers present a significant opportunity for market growth, especially as more people embrace connected devices in their daily lives.

- For instance, the Philips Bodygroom 7000 (BG7030/49) offers 80 minutes of cordless use from a 1-hour charge, supports 5 trim-length settings (3 mm to 11 mm), and uses a 4-direction pivoting head with hypo-allergenic foil for skin comfort.

Key Challenges

High Cost of Premium Hair Dryers

The rising demand for high-performance hair dryers with advanced technologies such as ionic and ceramic features often comes with a higher price tag. This makes premium models less accessible to budget-conscious consumers, limiting market expansion in certain demographics. Manufacturers must balance advanced features with affordability to capture a broader audience while maintaining profitability.

Intense Market Competition

The hair dryer market is highly competitive, with numerous brands offering a wide range of products at varying price points. This intense competition can lead to price wars, limiting the ability of companies to maintain strong profit margins. Additionally, with so many choices available, consumer loyalty is harder to secure, and brands must continually innovate to stand out in a crowded marketplace.

Regional Analysis

North America

The North American hair dryer market holds approximately 35% of global share, making it the largest regional segment. High disposable income, strong salon culture and rapid uptake of premium, technology‑rich dryers support its dominance. Major retail channels and robust e‑commerce infrastructure further accelerate reach. Demand for cordless and smart models is rising, particularly among younger consumers. Manufacturers benefit from the region’s readiness to invest in high‑end hair care tools, positioning North America as a key market for innovation, service, and growth.

Europe

Europe commands around 34% share of the global hair dryer market, positioning it as a significant region. Growing interest in sustainable, energy‑efficient appliances and demand for salon‑grade tools in home settings drive growth. Consumers in key markets such as Germany, France and the UK favour brands that merge performance with eco‑credentials, which makes innovation in materials and design especially important in Europe. The region’s matured distribution networks and well‑established professional hair care sector reinforce its strong position.

Asia‑Pacific

The Asia‑Pacific region accounts for about 23% of the global hair dryer market, representing strong growth potential. Rapid urbanisation, rising middle‑class incomes and increasing awareness of styling and grooming trends underpin its growth. Countries like China and India are expanding adoption of premium and mid‑market hair dryers as salons proliferate and home styling becomes more common. Manufacturers aiming for volume growth focus heavily on Asia‑Pacific, tailoring products to regional preferences and affordability.

Latin America

Latin America contributes roughly 5% of the global hair dryer market share. Growth in this region is driven by urbanisation, rising interest in personal grooming and increasing retail penetration. However, price sensitivity and limited access to premium brands moderate adoption rates. Brands success depends on offering value‑oriented models and building distribution in growing markets like Brazil and Mexico. As consumers’ styling habits evolve, Latin America presents emerging opportunities despite its smaller current share.

Middle East & Africa (MEA)

The Middle East & Africa region holds around 3% of the global hair dryer market share. Growth is supported by rising demand for personal care appliances among young urban consumers and expanding retail infrastructure. Challenges such as economic instability, lower brand awareness outside major cities and less mature distribution networks limit higher growth. However, the region presents niche prospects for lightweight, portable and travel‑friendly hair dryers catering to mobile lifestyles and expatriate populations.

Market Segmentations:

By Product Type:

By Technology:

- Ionic Technology

- Tourmaline Technology

By Power:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hair dryer market is highly competitive, with key players such as Harry Josh Pro Tools, Dyson Limited, Braun GmbH, Helen of Troy Limited, Revlon Inc., Spectrum Brands Inc. (Remington), Conair Corporation, Ghd hair (Jemella Ltd.), Koninklijke Philips N.V., and Panasonic Holdings Corporation. The hair dryer market is characterized by intense competition, with companies continuously innovating to enhance product performance, design, and technology. Manufacturers are focusing on improving drying efficiency, reducing heat damage, and incorporating features such as ionic and ceramic technologies to promote healthier hair. The growing consumer demand for high-performance, lightweight, and eco-friendly models is driving product development. Additionally, the rise of smart features such as temperature control, heat protection, and noise reduction is gaining traction. Companies are also targeting specific consumer segments, offering both professional-grade and affordable models to meet the needs of various demographics. As a result, the market is evolving with a diverse range of products catering to both high-end and budget-conscious consumers.

-

-

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

-

Key Player Analysis

- Harry Josh Pro Tools

- Dyson Limited

- Braun GmbH

- Helen of Troy Limited

- Revlon Inc.

- Spectrum Brands Inc. (Remington)

- Conair Corporation

- Ghd hair (Jemella Ltd.)

- Koninklijke Philips N.V.

- Panasonic Holdings Corporation

Report Coverage

-

The research report offers an in-depth analysis based on Product Type, Technology, Power and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The hair dryer market will continue expanding as personal grooming and styling become daily priorities for consumers across demographics.

- Innovation around heat‑damage reduction and protective technologies will drive adoption of premium hair dryers incorporating ionic, ceramic, and infrared systems.

- Smart connectivity features—such as app control, voice commands, and adaptive heat sensors—will emerge as key differentiators in next‑generation hair dryers.

- Eco‑friendly designs, energy‑efficient motors, and sustainable materials will appeal to consumers increasingly concerned about environmental impact and product lifecycle.

- Emerging markets in Asia‑Pacific and Latin America will present major expansion opportunities as middle‑income populations increase spending on styling tools.

- Travel‑friendly and compact models will gain popularity as consumers prioritise portability and convenience along with performance.

- Single‑use and professional‑grade appliances will converge, with salon‑quality features becoming accessible for home users seeking high performance.

- Subscription services, product bundles, and direct‑to‑consumer platforms will reshape how hair dryers are sold and distributed.

- Mounting raw‑material costs and global supply‑chain disruptions will push manufacturers to optimise production and explore modular, upgradable designs.

- Competitive pressure will stimulate value‑oriented innovations, requiring brands to balance advanced features with cost‑effectiveness for wider market penetration.