Market Overview

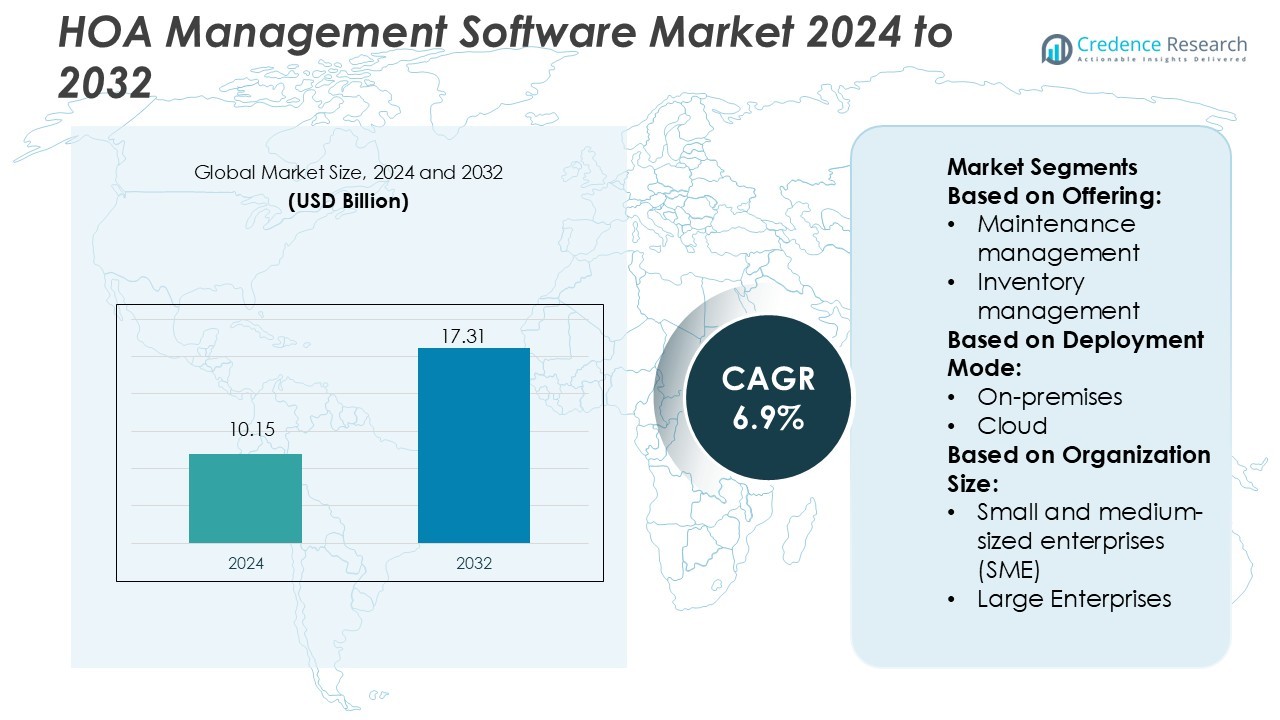

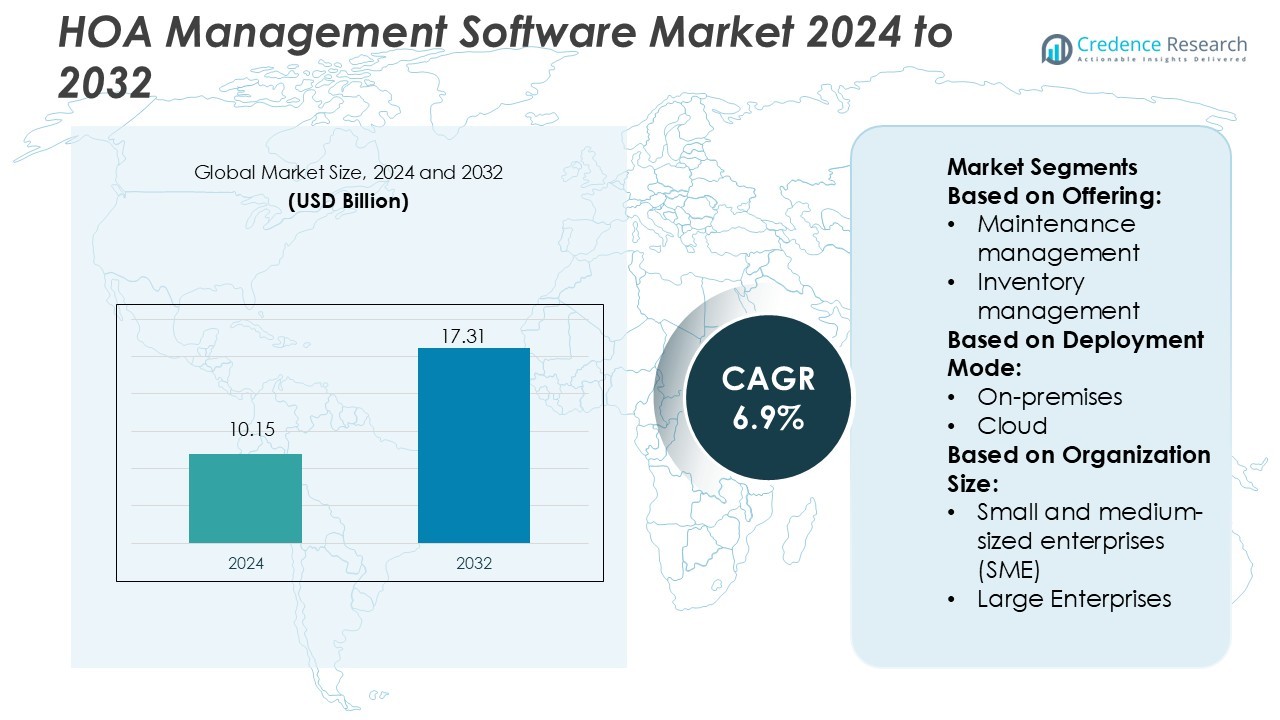

HOA Management Software Market size was valued USD 10.15 billion in 2024 and is anticipated to reach USD 17.31 billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| HOA Management Software Market Size 2024 |

USD 10.15 Billion |

| HOA Management Software Market, CAGR |

6.9% |

| HOA Management Software Market Size 2032 |

USD 17.31 Billion |

The HOA Management Software Market features key players such as Block, Inc., Adobe Inc., SAP, Oracle, McAfee Corporation, VMware Inc., Microsoft, IBM Corporation, NortonLifeLock Inc., and Intuit Inc. These companies leverage robust technology portfolios to deliver end‑to‑end community management platforms encompassing billing, resident portals, and cloud‑based services. The leading region is North America, which holds approximately 43.0% of the global market share, driven by a high density of home owners associations, advanced infrastructure, and widespread digital adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The HOA Management Software Market was valued at USD 10.15 billion in 2024 and is anticipated to reach USD 17.31 billion by 2032, growing at a CAGR of 6.9% during the forecast period.

- Increasing demand for automated billing, maintenance tracking, and resident communication tools is driving market growth, particularly in North America.

- The market is trending toward cloud-based platforms, with modular and subscription models offering flexibility to associations of various sizes.

- The competitive landscape is dominated by players such as Block, Inc., Adobe Inc., and Oracle, who lead with advanced software solutions that cater to diverse community management needs.

- North America leads the market with approximately 43.0% share, followed by Europe and Asia-Pacific, driven by rapid urbanization and increasing adoption of smart community management solutions.

Market Segmentation Analysis:

By Offering

In the offering segment for HOA management software, the software sub‑segment dominates with an estimated 72 % share. This strong position is driven by widespread demand for automated modules such as asset tracking, maintenance management, inventory control, calibration workflows, and inspection management. Services such as consulting, implementation & integration, and support & maintenance complement the core software, yet they fill the remaining share. Customers prioritise integrated software platforms that can unify tracking of community assets and streamline inspections, making the software portion the key revenue driver in this market.

- For instance, WebTMS Limited provides a comprehensive IP management platform with automated docketing capabilities. Its Data Sync tool can access trademark data from over 180 jurisdictions, and the system includes features such as workflow management and automated updates from official registries.

By Deployment Mode

Among the deployment modes, on‑premises solutions currently hold a leading share of approximately 62 %. This dominance stems from associations’ preference for controlling data and maintaining infrastructure within their existing IT environment. On‑premises systems also benefit organisations with strict compliance or data sovereignty needs. Cloud deployments are gaining traction, but legacy preferences and custom integration requirements mean on‑premises remains the dominant choice for now.

- For instance, Oracle’s Cloud Infrastructure offers a unified set of 150+ cloud services in each region to support multi‑module deployment and integration.

By Organization Size

Large enterprises (i.e., associations managing over 1,000 units) lead the market in terms of uptake, commanding around 55 % of the total share. These organisations often require comprehensive modules and support for multiple community sites, which drives their adoption of full‑scale HOA management platforms. SMEs still represent a meaningful market, especially for simplified and modular solutions, but the bulk of revenue and complex implementations originate from large‑scale association groups.

Key Growth Drivers

Growing digital transformation in community associations

Homeowners associations (HOAs) are increasingly adopting digital platforms to replace manual processes. This shift is driven by the need for better billing, maintenance tracking, and resident communication. As many board members now prefer digital tools for managing these tasks, the demand for HOA management software is growing. More communities are moving away from spreadsheets and traditional methods, boosting the software market.

- For instance, VMware Inc. launched its Workspace ONE Intelligence suite—which aggregates and correlates data across users, apps, networks and devices—for a client base spanning more than 53,000 students at one district.

Expansion of planned residential communities and urbanisation

With the rapid growth of cities and the increase in residential developments, the demand for HOA management software is rising. Many new gated communities and apartment complexes are being built, and they need efficient systems to manage operations and resident services. This trend of urbanisation is driving more developers and property managers to adopt HOA software.

- For instance, Microsoft’s Azure IoT platform supports bidirectional communication for millions of connected devices and enables 10–20% savings in energy usage at enterprise campuses through its smart‑building solutions.

Cloud accessibility and scalability of software solutions

Cloud-based HOA software is becoming more popular because it is cost-effective and easy to scale. Smaller associations are finding it easier to adopt these systems because they don’t need to invest in expensive infrastructure. The cloud model also allows easy updates and mobile access, making it more convenient for users, which is fueling the market’s growth.

Key Trends & Opportunities

Integration of mobile apps, AI and IoT for smarter community management

Many HOA software providers are now integrating mobile apps, AI, and IoT into their platforms. These technologies help improve communication with residents, automate maintenance requests, and track performance. This trend offers new opportunities for software providers to offer more advanced features that improve the overall community management experience.

- For instance, NortonLifeLock Inc. maintains a portfolio of over 1,000 U.S. and international patents underpinning its IoT‑enabled threat‑detection technology.

Shift toward modular and subscription‑based service delivery models

HOA software is moving towards modular and subscription-based models. This allows associations to choose the specific features they need, making the software more affordable and flexible. Smaller associations are especially drawn to these models because they lower the upfront costs and allow them to pay for only what they use.

- For instance, QuickBooks platform supports integrations across 100s of applications listed in the marketplace, enabling users to selectively add or remove modules based on need.

Emerging‑market penetration and retrofit potential in older associations

In regions like Asia-Pacific and Latin America, rapid urbanisation is driving the need for HOA management software. Many older associations are still using manual methods and outdated systems, creating an opportunity for vendors to offer software upgrades and cloud-based solutions. This trend presents a significant market opportunity for providers to tap into these underserved regions.

Key Challenges

Resistance to change and legacy‑system inertia

Many HOAs are slow to adopt new software due to a reluctance to move away from familiar manual methods. Board members may be hesitant to invest in new systems or worry about the learning curve involved. This resistance to change, particularly in smaller associations, slows the adoption of HOA management software.

Data security and privacy concerns in community platforms

As HOA software handles sensitive resident information, concerns about data security and privacy remain a major challenge. Many associations are cautious about storing personal and financial data online. Providers must ensure that their software is secure and complies with privacy regulations to gain the trust of users and encourage adoption.

Regional Analysis

North America

North America holds approximately 40% of the global HOA management software market share, supported by high digital adoption among associations and advanced infrastructure. The United States leads the region, where many community associations already use management platforms for billing, maintenance tracking, and resident portals. This strong foundation and willingness to invest in technology give the region a competitive edge. With mature market conditions, growth here remains steady, and vendors focus on feature enhancement and service innovation to capture incremental demand.

Europe

Europe commands about 30% of the market and benefits from regulatory focus on transparency and efficiency in homeowners associations. Countries such as the UK, Germany and France drive demand for platforms that meet GDPR compliance and integrate mobile access. Many European associations operate across borders or manage multilingual communities, prompting interest in scalable and customisable solutions. Growth in the European region is supported by an uptick in technology migration and replacement of outdated management systems.

Asia‑Pacific

Asia‑Pacific accounts for roughly 15% of the market share and stands as a fast‑emerging region for HOA management software adoption. Rapid urbanisation, expansion of residential communities and increasing middle‑class home ownership all drive interest in digital association tools. Local vendors and global players are expanding in markets such as India, China and Southeast Asia with cloud‑based solutions tailored to smaller associations. Strong growth prospects here reflect untapped demand and rising technology acceptance.

Latin America

Latin America holds around 8% of market share, with Brazil, Mexico and Argentina emerging as key growth markets for HOA software solutions. Growth in this region is driven by increasing residential development and socio‑economic changes leading to better organised homeowner associations. However, slower technology infrastructure rollout and varying investment capabilities among associations reduce adoption speed. Vendors in Latin America focus on affordable subscription models and regional partnerships to enhance penetration.

Middle East & Africa (MEA)

The Middle East & Africa region contributes about 7% of the total market share and exhibits considerable potential driven by new residential and mixed‑use community developments. Gulf Cooperation Council (GCC) countries, as well as South Africa, are increasingly investing in smart‑community platforms and HOA management solutions. Adoption is supported by infrastructure investment and digital government initiatives. Nonetheless, fragmented markets and varying association maturity levels pose challenges for unified growth.

Market Segmentations:

By Offering:

- Maintenance management

- Inventory management

By Deployment Mode:

By Organization Size:

- Small and medium-sized enterprises (SME)

- Large Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the HOA Management Software Market features key players such as Block, Inc., Adobe Inc., SAP, Oracle, McAfee Corporation, VMware Inc., Microsoft, IBM Corporation, NortonLifeLock Inc., and Intuit Inc. The HOA Management Software Market is marked by a diverse range of companies offering a variety of technological solutions aimed at improving the efficiency of community management. These companies are increasingly focusing on cloud-based solutions, leveraging AI, automation, and predictive analytics to enhance operational efficiency, streamline communication, and optimize maintenance workflows. The market is seeing a shift toward modular, subscription-based models that allow smaller associations to access scalable tools without large upfront investments. Additionally, the growing importance of data security and compliance with privacy regulations is driving innovation in secure, user-friendly platforms. Strategic partnerships, acquisitions, and ongoing software enhancements are key strategies for companies looking to capture market share and address the evolving needs of homeowners associations. This highly competitive environment is characterized by continuous innovation and a strong emphasis on customer service and user experience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Block, Inc.

- Adobe Inc.

- SAP

- Oracle

- McAfee Corporation

- VMware Inc.

- Microsoft

- IBM Corporation

- NortonLifeLock Inc.

- Intuit Inc.

Recent Developments

- In February 2025, Oracle enhanced its supply chain management platform by integrating AI capabilities. This update enables the automation of various tasks for procurement professionals, such as generating standardized product descriptions and providing supplier recommendations, which can significantly streamline procurement processes.

- In January 2025, Block, a technology, announced the launch of Goose, an open-source AI agent designed to empower developers with customizable tools. Goose allows users to leverage various large language models, providing flexibility in its application across different tasks and industries.

- In November 2024, Microsoft unveiled cloud-connected software that enables customers to deploy Azure computing, networking, storage, and application services across various environments, including edge locations, on-premises data centers, and hybrid cloud setups.

- In February 2024, Schneider Electric launched ECOSTRUXURE plant lean management, a solution aimed at increasing productivity and digitalization in manufacturing. The solution aggregates and collects information across industrial processes to develop key performance indicators (KPIS) for short-interval management meetings.

Report Coverage

The research report offers an in-depth analysis based on Offering, Deployment Mode, Organization Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing number of planned residential communities worldwide will boost demand for HOA management software.

- Growing preference for cloud‑based deployment provides scalability and drives adoption among associations of various sizes.

- Rising expectations for resident engagement and mobile access will push software providers to enhance communication and portal features.

- Integration of AI and automation for tasks like maintenance tracking, billing, and violation management will become more common.

- Modular subscription‑based delivery models that reduce upfront investment will widen access for smaller associations.

- Expansion of associations in emerging markets presents untapped opportunities for software vendors.

- Retrofits of manual or legacy systems in older associations will create a strong market for replacement solutions.

- Partnerships between software providers and service companies (like maintenance or accounting) will grow value‑added offerings.

- Data security and compliance demands will drive investment in secure, auditable platforms for board‑governed communities.

- Increased use of mobile apps, IoT sensors and resident self‑service features will transform how associations operate and demand evolves.