Market Overview

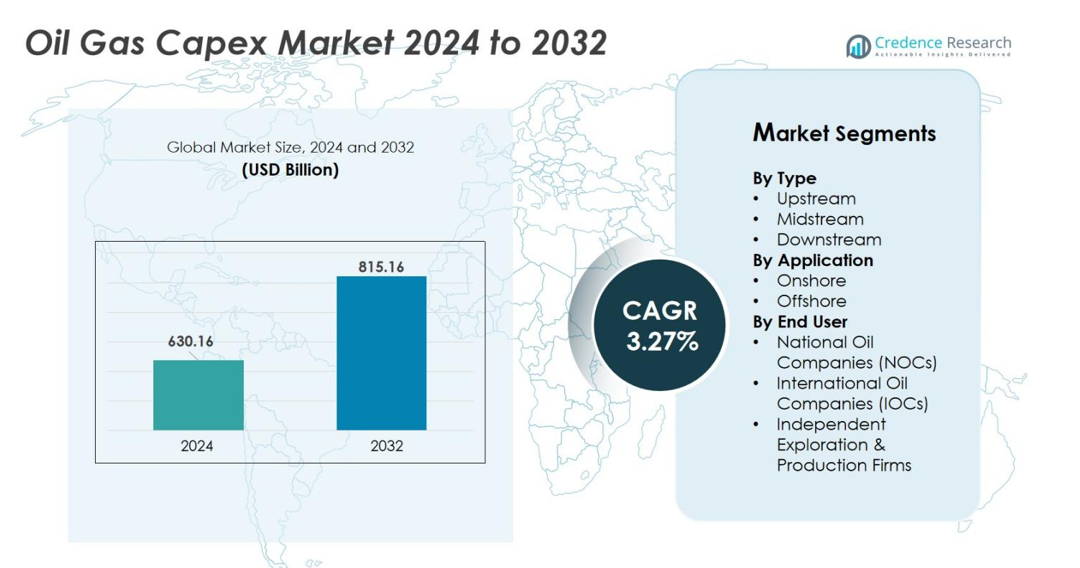

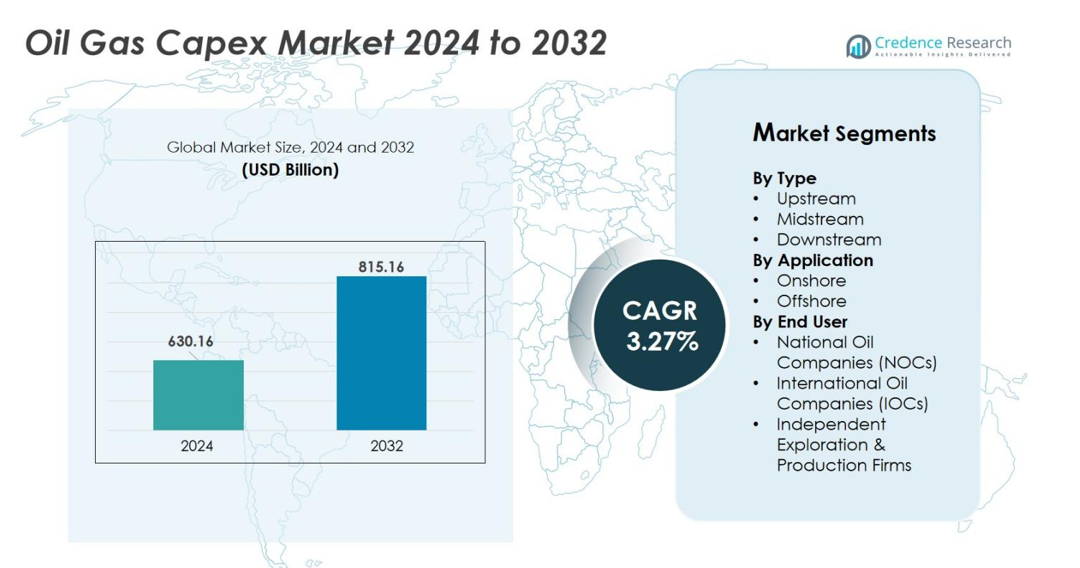

Oil and Gas Capex Market size was valued USD 630.16 Billion in 2024 and is anticipated to reach USD 815.16 Billion by 2032, at a CAGR of 3.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oil Gas Capex market Size 2024 |

USD 630.16 Billion |

| Oil Gas Capex market, CAGR |

7.5% |

| Oil Gas Capex market Size 2032 |

USD 815.16 Billion |

The Oil Gas Capex market features major players including BP plc, Shell plc, Chevron Corporation, TotalEnergies SE, Exxon Mobil Corporation, ONGC, CNPC, Cairn Oil Gas (Vedanta Limited), Petrobras, and Equinor ASA. These companies invest in exploration, deep-water production, LNG terminals, and refinery modernization to secure reserves and expand global supply. National oil companies continue to lead spending on domestic infrastructure, while international majors focus on high-yield offshore and shale projects. Asia-Pacific remains the leading region with 34% market share, supported by rising energy demand, large refinery expansions, and strong government-backed exploration programs.

Market Insights

- The Oil Gas Capex market is valued at USD 630.16 Billion in 2024 and is projected to reach USD 815.16 Billion by 2032, expanding at a CAGR of 3.27%.

- Rising exploration programs, shale expansion, and deep-water drilling drive capital spending, with upstream accounting for around 61% share as companies prioritize long-term reserve replacement and production security.

- Digital oilfields, automated drilling, LNG development, and refinery modernization shape market trends as operators adopt advanced analytics, remote monitoring, and low-carbon technologies to improve operational efficiency.

- The market remains competitive with global players such as BP, Shell, ExxonMobil, Chevron, TotalEnergies, ONGC, and CNPC investing in offshore projects, pipeline infrastructure, and petrochemical capacity to strengthen global supply.

- Asia-Pacific leads with nearly 34% share, followed by North America at 28% and Middle East & Africa at 24%, supported by large energy demand, refinery expansions, offshore fields, and favorable government-backed exploration programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

Upstream dominates the Oil Gas Capex market with nearly 61% share, supported by rising exploration programs, deep-water drilling, and investments in new oilfield discoveries. Producers allocate higher capital to boost recovery rates, improve seismic imaging, and expand shale output. Midstream accounts for close to 23% as countries add pipelines, LNG terminals, and storage capacity. Downstream holds around 16%, driven by refinery modernization and petrochemical expansion. Upstream leads because companies prioritize reserve replacement and long-term supply security.

- For instance, Chevron’s 2025 capital expenditure budget includes about $13 billion focused on upstream projects like the Permian Basin and Gulf of Mexico deepwater developments.

By Application

Onshore holds about 68% share of total capital spending due to lower drilling costs, simpler logistics, and faster development cycles than offshore operations. Operators invest in shale wells, enhanced recovery, and redevelopment of mature fields to sustain output. Offshore accounts for around 32%, supported by deep-water and ultra-deep-water projects with strong long-term resource potential. Onshore maintains dominance because producers can scale production quickly and reduce operational risks.

- For example, ExxonMobil is investing $1.5 billion in Nigeria’s Usan deep-water oilfield development through 2027, targeting enhanced offshore production.

By End User

National Oil Companies (NOCs) lead the market with nearly 54% share, backed by state-funded exploration, refinery expansion, and strategic energy programs. NOCs continue to boost upstream and midstream assets to strengthen domestic supply and export capacity. International Oil Companies (IOCs) hold about 33%, focusing on deep-water, LNG, and unconventional resources, while independent E&P firms account for close to 13% through selective investment in high-return shale and tight oil assets. NOCs dominate due to control over reserves and long development pipelines.

Key Growth Drivers

Rising Exploration and Redevelopment of Oilfields

Oil Gas Capex spending continues to increase as companies expand exploration activities to secure new reserves and sustain long-term output. Many producers focus on deep-water, ultra-deep-water, and shale projects where undiscovered or underdeveloped resources offer strong production potential. Mature oilfields in the Middle East, North America, and Asia also attract capital through enhanced oil recovery, advanced seismic imaging, and horizontal drilling. These techniques boost extraction efficiency and extend the life of existing wells. Governments support exploration through favorable licensing rounds, foreign investment policies, and tax incentives, encouraging both national and international companies to commit large budgets.

- For instance, Cairn Oil Gas, part of the Vedanta Group, is ramping up offshore exploration with drilling planned in the deep-water Kutch Basin. The company aims to increase its hydrocarbon output from 103,200 boepd to 300,000 boepd, supported by a $3-4 billion investment over five years.

Infrastructure Expansion for LNG, Pipelines, and Storage Terminals

Growing demand for cross-border energy trade is another key driver behind higher capital expenditure. Many countries increase investment in pipelines, LNG export terminals, and underground storage facilities to meet domestic needs and global export commitments. Natural gas is gaining importance as a cleaner fuel for power generation and industrial usage, prompting heavy investment in liquefaction and regasification terminals. Midstream infrastructure also improves the efficiency of crude transportation from wells to refineries, reducing bottlenecks and freight costs. These projects attract multinational companies and governments that aim to become regional energy hubs.

- For instance, Oil India Limited completed the Numaligarh-Siliguri Product Pipeline upgrade in October 2025, increasing its capacity from 1.77 MMTPA to 5.50 MMTPA to align with refinery expansion plans and support regional energy demands.

Refinery Modernization and Petrochemical Capacity Growth

Downstream Capex increases as countries upgrade refineries, add desulfurization units, and expand petrochemical complexes to meet global fuel quality standards and chemical demand. Many refineries invest in digital automation, carbon-reduction systems, and energy-efficient technologies to improve operating margins. The expansion of petrochemical plants supports the growing need for plastics, solvents, and industrial chemicals across automotive, construction, and consumer goods markets. Asian and Middle Eastern nations lead investment, aiming to boost export competitiveness and convert crude oil into high-value products.

Key Trends & Opportunities

Shift Toward Digital Oilfields and Advanced Analytics

Digitalization is a strong trend that reshapes Capex planning, allowing operators to reduce field downtime and increase recovery rates. Producers adopt IoT sensors, real-time monitoring, predictive maintenance, and automated drilling systems to optimize well performance and reduce operational costs. Data analytics improves reservoir modeling and reduces project delays. Companies also integrate drones, robotics, and cloud-based asset management tools to monitor pipelines, offshore rigs, and refinery assets. This shift creates new investment opportunities in digital infrastructure, smart wells, and remote operation centers. As digital technology lowers production risks, more operators are allocating dedicated Capex budgets to intelligent field systems.

- For instance, TotalEnergies established the SmartRoom Real Time Support Center that aggregates IoT sensor data from global drilling rigs to improve safety and predictive drilling performance.

Rapid Expansion of Gas-Based and Low-Carbon Projects

Global energy transition encourages a strong investment shift toward natural gas and low-carbon technologies. Many oil producers allocate funds to blue hydrogen, carbon capture and storage (CCS), and gas-to-chemicals plants to reduce emissions and meet climate regulations. LNG export projects gain momentum as Asian and European countries increase long-term LNG import commitments. National oil companies partner with technology firms to develop cleaner refining processes, renewable-powered pumping stations, and methane-reduction programs. This opens new Capex opportunities in gas infrastructure and climate-aligned innovation, while still supporting energy security.

- For instance, National oil companies like Indian Oil Corporation Ltd (IOCL) and NHPC have formed strategic alliances to develop renewable-powered pumping stations and renewable energy projects that support cleaner energy infrastructure.

Key Challenges

High Project Costs and Long Payback Periods

Large-scale offshore fields, LNG terminals, and refinery upgrades demand multi-billion-dollar investments with long construction timelines. Volatile oil prices, inflation, and higher material and labor costs increase financial risks. Smaller companies struggle to secure funding for deep-water or unconventional projects, which require advanced technology and strong cash flow. Delays in pipeline approvals, environmental clearances, and political constraints can further extend project timelines. These cost pressures make operators cautious and may slow down new investments during economic downturns.

Stringent Environmental Regulations and Energy Transition Pressure

Global climate policies encourage lower carbon intensity, pushing companies to invest in cleaner production methods. However, compliance with emission laws, methane monitoring, and carbon-reduction mandates increases operational costs. Some financial institutions limit funding for fossil-fuel projects, reducing capital availability for exploration and refinery expansions. Public demand for renewable energy also forces producers to diversify beyond crude operations. While companies adopt CCS, hydrogen, and flaring-reduction systems, these technologies require high spending and long development cycles. Environmental expectations therefore create a major challenge for traditional oil and gas Capex planning.

Regional Analysis

North America

North America holds nearly 28% share of the Oil Gas Capex market, supported by strong spending in shale, offshore Gulf of Mexico projects, and refinery upgrades. The United States leads capital allocation with investments in horizontal drilling, LNG export terminals, and pipeline expansions to serve domestic and global demand. Canada continues to invest in oil sands, carbon-reduction systems, and cross-border pipeline capacity. The region benefits from advanced technology, stable regulations, and steady private funding. Growing natural gas trade with Europe and Asia also increases investment in liquefaction and storage facilities.

Asia-Pacific

Asia-Pacific accounts for the largest share at around 34%, driven by rising energy consumption, refinery expansions, and large-scale LNG import terminals. China, India, and Southeast Asian countries invest in onshore exploration, petrochemical complexes, and pipeline networks to reduce import dependence and support industrial growth. National oil companies lead spending on offshore fields and gas transportation infrastructure. Strong demand for petrochemicals and cleaner fuels pushes refineries to upgrade processing units and sulfur reduction systems. The region also increases investment in technology partnerships and offshore deep-water drilling.

Middle East & Africa

Middle East & Africa holds about 24% share, supported by vast reserves, low production costs, and state-backed expansion plans. Saudi Arabia, UAE, and Qatar invest in upstream capacity, LNG export terminals, and downstream petrochemical projects to strengthen export capability. Africa attracts multinational firms for offshore exploration in Angola, Nigeria, and Mozambique. Governments launch long-term development programs aimed at refinery modernization, gas monetization, and enhanced oil recovery. Favorable fiscal policies and national energy goals keep Capex spending steady across both regions.

Europe

Europe captures near 9% share, with a focus on natural gas infrastructure, carbon capture systems, and refinery upgrades that meet clean fuel standards. North Sea investments remain active in the United Kingdom and Norway, targeting mature field redevelopment and deep-water opportunities. LNG import terminals expand as European countries diversify away from pipeline gas suppliers. Companies allocate budgets to hydrogen projects, methane reduction, digital monitoring, and renewable-powered extraction systems. Despite energy transition pressure, strategic spending continues in offshore gas fields and refining, ensuring supply stability.

Latin America

Latin America holds around 5% share, with Brazil, Mexico, and Argentina leading regional Capex. Brazil invests in deep-water and pre-salt developments, making it one of the fastest-growing offshore hubs. Mexico focuses on exploration, refinery rehabilitation, and pipeline improvements to increase domestic production. Argentina advances shale spending in the Vaca Muerta formation with partnerships and technology upgrades. Political instability and funding challenges remain, yet the region draws foreign investment due to strong long-term resource potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations

By Type

- Upstream

- Midstream

- Downstream

By Application

By End User

- National Oil Companies (NOCs)

- International Oil Companies (IOCs)

- Independent Exploration & Production Firms

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Oil Gas Capex market includes a mix of national oil companies, international oil majors, and independent exploration firms competing through large-scale investments, technology upgrades, and regional expansion strategies. Leading players such as BP, Shell, Chevron, TotalEnergies, ExxonMobil, and CNPC allocate significant capital to deep-water fields, LNG supply chains, and refinery modernization to secure long-term reserves and improve profitability. National oil companies like Saudi Aramco, ADNOC, and ONGC invest heavily in upstream and midstream infrastructure to strengthen domestic output and export capacity. Many operators adopt digital drilling, automated rigs, and enhanced recovery systems to reduce operating costs and improve well productivity. Partnerships for hydrogen, carbon capture, and gas-to-chemicals projects are also growing as companies align with energy transition goals. Mergers and acquisitions remain common, enabling access to new reserves and advanced technology. Overall, competitive intensity remains high as producers seek operational efficiency, market share expansion, and energy security advantages.

Key Player Analysis

Recent Developments

- In November 2025, Eni and Petronas formed a joint venture to merge their upstream oil and gas assets in Indonesia and Malaysia, with planned investments exceeding USD 15 billion to strengthen exploration and production operations in Southeast Asia.

- In July 2025, Baker Hughes announced the acquisition of Chart Industries for USD 13.6 billion, aiming to expand its footprint in LNG, hydrogen, and carbon capture technologies to accelerate its clean energy transition efforts.

- In May 2025, Tourmaline Oil Corp. announced two strategic acquisitions in the NEBC Montney region, expected to add approximately 20,000 boepd of production and 4 million barrels of oil equivalent (mmboe) in reserves, strengthening its Canadian upstream portfolio.

- In 2025, EQT Corporation completed the USD 1.8 billion acquisition of Olympus Energy Holdings, gaining 500 MMscf/D of production capacity and 90,000 net acres in the Marcellus and Utica shale basins of Pennsylvania, expanding its natural gas operations.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Capital spending will increase as companies expand deep-water and ultra-deep-water drilling.

- Digital oilfields and automation will reduce operating costs and improve production efficiency.

- More investment will move toward LNG export facilities and gas transportation networks.

- Refinery modernization will continue to meet clean fuel standards and petrochemical demand.

- National oil companies will lead spending through long-term government-backed expansion plans.

- Energy transition will push companies to fund carbon capture and hydrogen projects.

- Shale producers will adopt advanced drilling technologies to increase recovery rates.

- Partnerships and joint ventures will grow to share project risks and access new resources.

- Offshore projects in Brazil, the Middle East, and Africa will attract strong foreign investment.

- Asset digitalization, predictive maintenance, and remote monitoring will become standard in Capex planning.