Market Overview

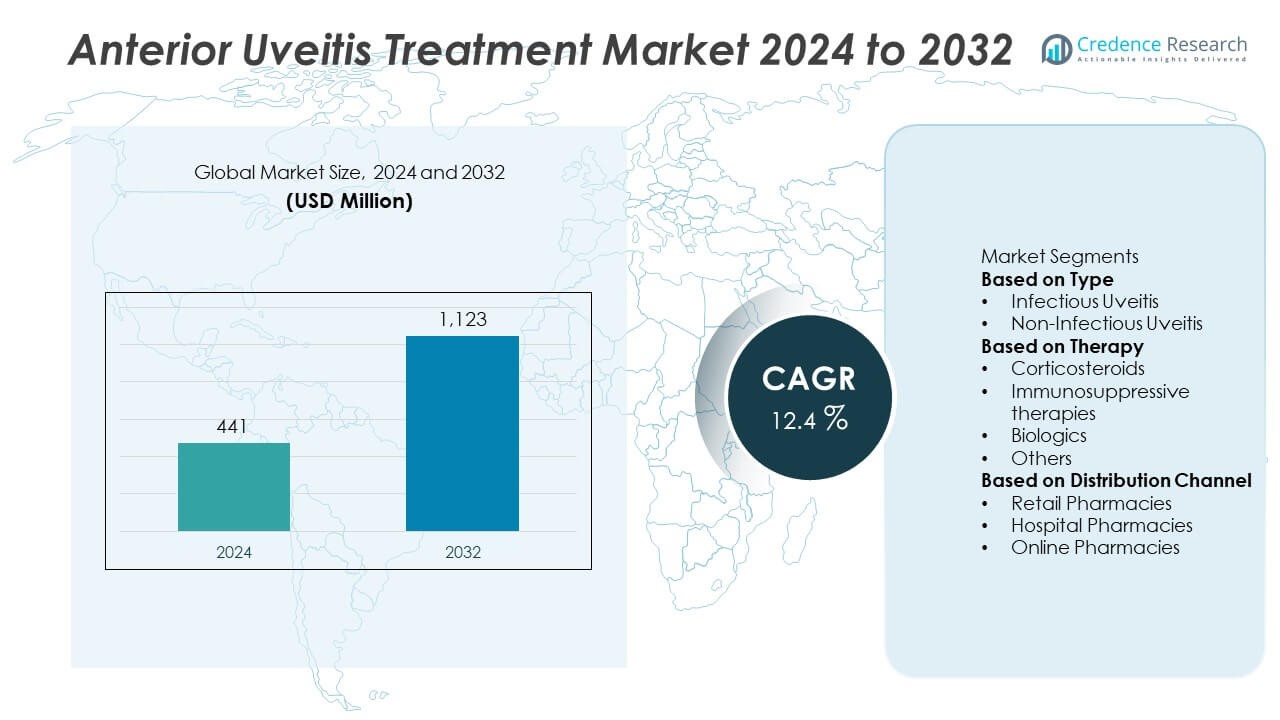

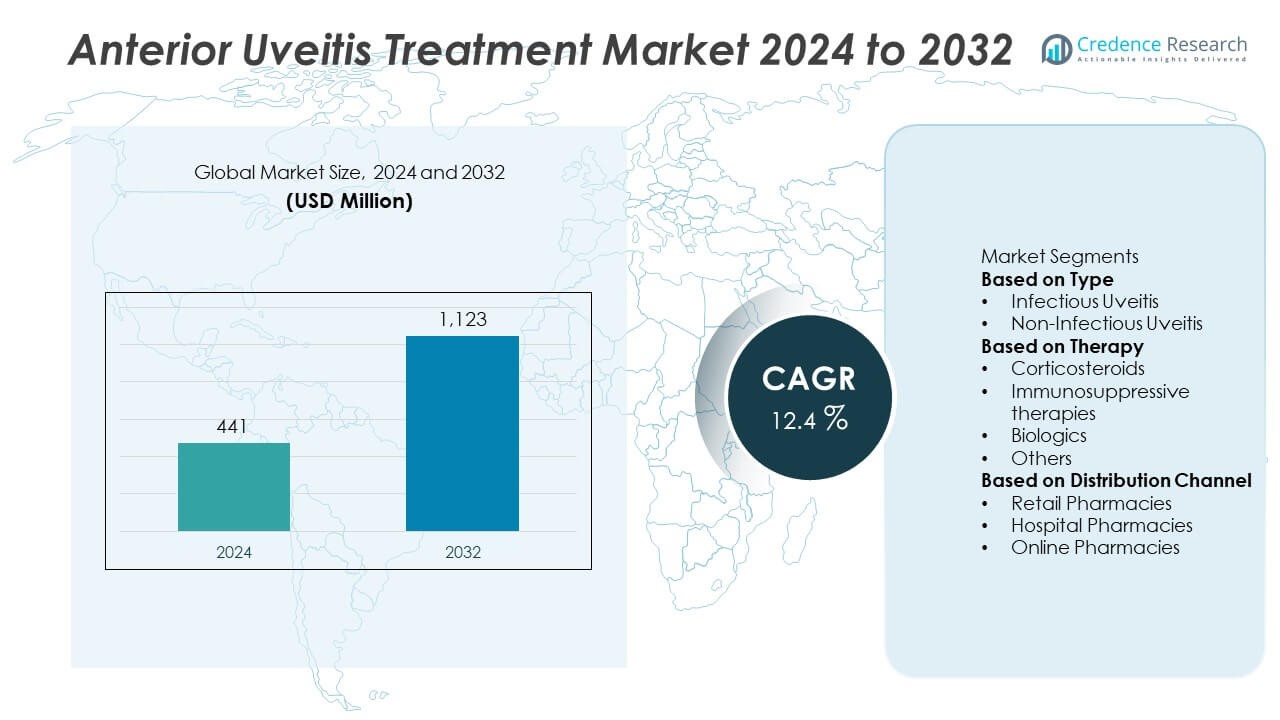

The Anterior Uveitis Treatment Market was valued at USD 441 million in 2024 and is projected to reach USD 1,123 million by 2032, growing at a CAGR of 12.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anterior Uveitis Treatment Market Size 2024 |

USD 441 Million |

| Anterior Uveitis Treatment Market, CAGR |

12.4% |

| Anterior Uveitis Treatment Market Size 2032 |

USD 1,123 Million |

The anterior uveitis treatment market is led by major companies including AbbVie Inc., Lux Biosciences, Inc., Clearside Biomedical, UCB S.A., Aciont Inc., Novartis AG, Santen Pharmaceutical Co., Ltd., Aldeyra Therapeutics, Inc., Kiora Pharmaceuticals, Inc., and Sirion Therapeutics, Inc. These players dominate through advanced corticosteroid formulations, biologic therapies, and targeted drug delivery innovations. Strategic collaborations and clinical research in biologics and immunomodulators strengthen their competitive position. North America remains the leading region with a 38.6% share in 2024, supported by advanced healthcare systems and high adoption of biologics. Europe follows with a 28.3% share, driven by strong ophthalmic research infrastructure and supportive reimbursement policies.

Market Insights

Market Insights

- The anterior uveitis treatment market was valued at USD 441 million in 2024 and is projected to reach USD 1,123 million by 2032, growing at a CAGR of 12.4% during the forecast period.

- Rising cases of autoimmune and inflammatory disorders such as ankylosing spondylitis and sarcoidosis are major factors driving demand for anterior uveitis treatments.

- The market is witnessing strong trends toward biologic and targeted therapies, with corticosteroids holding a 47.2% share as the leading therapeutic category.

- Key players such as AbbVie Inc., Novartis AG, Santen Pharmaceutical Co., Ltd., and Clearside Biomedical dominate the competitive landscape through innovation in biologics and ocular drug delivery systems.

- North America leads the market with a 38.6% share, followed by Europe at 28.3% and Asia-Pacific at 24.1%, while Latin America and the Middle East & Africa show steady growth supported by improving healthcare access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The non-infectious uveitis segment dominated the anterior uveitis treatment market in 2024, accounting for a 68.5% share. This dominance is attributed to the higher prevalence of autoimmune and idiopathic cases compared to infectious causes. Growing awareness about early diagnosis and improved imaging technologies have enhanced detection rates. Advances in immunomodulatory therapy and corticosteroid combinations also support effective disease management. Increasing incidence of systemic inflammatory conditions such as ankylosing spondylitis and rheumatoid arthritis further fuels demand for non-infectious uveitis treatments globally.

- For instance, AbbVie developed adalimumab, which became the first FDA-approved biologic for non-infectious intermediate, posterior, and panuveitis. Clinical studies demonstrated that adalimumab reduced treatment failure risk by 50% in controlled trials involving 217 patients.

By Therapy

The corticosteroids segment held the largest share of 47.2% in 2024, remaining the first-line therapy for anterior uveitis management. These drugs provide rapid inflammation control and symptom relief, making them a preferred option among ophthalmologists. The availability of topical, oral, and injectable forms allows personalized treatment approaches. However, long-term steroid use risks have led to rising adoption of biologics and immunosuppressive therapies. The biologics segment is expanding steadily, supported by the development of targeted monoclonal antibodies offering improved efficacy and reduced side effects.

- For instance, Santen Pharmaceutical evaluated its sirolimus intravitreal formulation (DE-109, later branded as Opsiria) in a Phase II trial (SAVE study) and a large Phase III program (SAKURA). In the Phase II trial, all subjects with active uveitis at baseline showed a reduction in vitreous haze of at least one step at six months, and 40% showed a reduction of two or more steps.

By Distribution Channel

Hospital pharmacies led the anterior uveitis treatment market with a 42.6% share in 2024, driven by high patient inflow for specialized ophthalmic care and prescription-based therapies. Hospitals serve as primary centers for diagnosis, advanced imaging, and administration of biologic infusions. Retail pharmacies followed closely, supported by strong sales of corticosteroid eye drops and oral medications. Online pharmacies are witnessing growing traction due to rising digital healthcare adoption, offering convenient access and home delivery for maintenance therapies. The expansion of tele-ophthalmology services further strengthens this distribution channel.

Key Growth Drivers

Rising Incidence of Autoimmune and Inflammatory Disorders

Increasing prevalence of autoimmune diseases such as ankylosing spondylitis, rheumatoid arthritis, and sarcoidosis is significantly driving the anterior uveitis treatment market. These conditions frequently cause non-infectious uveitis, necessitating long-term management. Growing awareness of early diagnosis and expanding access to ophthalmic care further support treatment uptake. Pharmaceutical companies are developing advanced corticosteroid and immunosuppressive therapies to address inflammation effectively, reducing recurrence and vision loss risks among patients.

- For instance, UCB S.A. developed certolizumab pegol, a PEGylated anti–TNF-α monoclonal antibody fragment, and data from a multicenter, retrospective observational study involving 80 patients with immune-mediated inflammatory diseases showed an 82% to 87% reduction in the acute anterior uveitis flare incidence rate during 48 weeks of treatment compared to the pre-treatment period.

Advancements in Biologic and Targeted Therapies

The growing adoption of biologics and targeted immunotherapies is transforming anterior uveitis management. These treatments, including monoclonal antibodies and TNF-alpha inhibitors, offer superior efficacy with fewer side effects compared to conventional corticosteroids. Continuous R&D investments by leading pharmaceutical players are introducing novel formulations that address the root inflammatory pathways. This therapeutic progress enhances patient outcomes, particularly in refractory or chronic cases where standard therapies show limited effectiveness.

- For instance, Novartis AG introduced secukinumab, an IL-17A inhibitor that has shown high efficacy in several multicenter Phase III trials in patients with moderate-to-severe plaque psoriasis (FIXTURE, ERASURE, SCULPTURE, CLEAR), psoriatic arthritis (FUTURE 1, FUTURE 2), and ankylosing spondylitis (MEASURE 1, MEASURE 2), leading to its approval for these conditions.

Increasing Access to Specialized Ophthalmic Care

Expanding ophthalmic infrastructure and increased healthcare spending are improving patient access to advanced treatment options. Many hospitals now offer specialized uveitis clinics supported by trained ophthalmologists and imaging technologies. Governments and healthcare organizations are implementing screening programs to promote early detection. The growing role of tele-ophthalmology, particularly in developing countries, is ensuring continuity of care and improving treatment adherence, thus fostering consistent market growth.

Key Trends & Opportunities

Shift Toward Personalized and Combination Therapies

Personalized medicine is gaining importance as clinicians tailor treatment plans based on disease severity, cause, and patient response. Combination therapies involving corticosteroids and biologics are showing improved efficacy and faster recovery. Pharmaceutical firms are developing sustained-release drug implants and eye drops that provide controlled dosage and reduce systemic exposure. These advancements represent a major opportunity for companies seeking to improve patient compliance and minimize relapse.

- For instance, Clearside Biomedical developed the proprietary SCS Microinjector for delivering a specific formulation of triamcinolone acetonide (known as Xipere) into the suprachoroidal space, with the pivotal Phase 3 PEACHTREE trial showing a mean visual acuity gain of 13.9 letters in the treated arm (compared to 3.0 letters in the control arm) across patients with non-infectious uveitis associated macular edema.

Growing Adoption of Digital and Tele-Ophthalmology Solutions

The integration of digital health technologies is enhancing anterior uveitis diagnosis and monitoring. Telemedicine platforms enable remote consultations, follow-ups, and prescription refills, improving accessibility in underserved regions. AI-based imaging tools are being used for early detection and inflammation assessment, improving diagnostic precision. This digital shift supports patient retention and helps healthcare providers manage chronic cases more efficiently, creating long-term opportunities for digital therapeutics providers.

- For instance, Santen Pharmaceutical has engaged in collaborations to utilize AI-assisted diagnostic support and digital health technologies in ophthalmology. One AI model, “CorneAI”, developed for diagnosing cataracts and corneal diseases, was shown to improve ophthalmologists’ diagnostic accuracy from 79.2% to 88.8% in a study, demonstrating the potential of AI in telemedicine applications.

Key Challenges

High Cost of Advanced Biologic Therapies

The high price of biologic and targeted therapies limits their accessibility, especially in low- and middle-income countries. Many patients depend on conventional corticosteroids due to cost-effectiveness despite potential side effects. Limited insurance coverage for biologic drugs further constrains adoption. Pharmaceutical companies are under pressure to balance innovation with affordability, while governments explore policies and partnerships to increase access to advanced treatments.

Limited Awareness and Delayed Diagnosis

Lack of awareness about early symptoms often leads to delayed diagnosis and treatment, increasing the risk of vision impairment. In many regions, limited availability of specialized ophthalmologists and diagnostic facilities further hinders timely care. This challenge is especially prevalent in rural and low-resource settings. Educational campaigns, improved screening programs, and healthcare collaborations are essential to bridge this gap and reduce the disease burden effectively.

Regional Analysis

North America

North America dominated the anterior uveitis treatment market in 2024 with a 38.6% share, driven by high prevalence of autoimmune and inflammatory eye disorders. Strong healthcare infrastructure, advanced diagnostic technologies, and the presence of key pharmaceutical players such as Pfizer Inc., AbbVie, and Johnson & Johnson support regional growth. The United States leads due to increasing adoption of biologics and corticosteroid implants. Expanding insurance coverage and clinical trials focused on novel immunotherapies further strengthen market expansion. Continuous innovation in ophthalmic care and rising awareness about early disease management sustain North America’s leading position.

Europe

Europe accounted for a 28.3% share of the anterior uveitis treatment market in 2024, supported by advanced healthcare systems and strong demand for biologic and immunosuppressive therapies. Germany, the U.K., and France lead in treatment adoption, driven by the availability of specialized ophthalmology centers and supportive reimbursement policies. The region benefits from government-backed research on ocular inflammation and growing collaborations between hospitals and pharmaceutical firms. Rising geriatric population and improved screening programs for autoimmune eye conditions continue to boost regional market expansion across both Western and Central Europe.

Asia-Pacific

Asia-Pacific held a 24.1% share in 2024 and emerged as the fastest-growing regional market. The growth is driven by rising cases of infectious and autoimmune uveitis across India, China, and Japan. Increasing healthcare spending, improving ophthalmic infrastructure, and awareness of eye health are enhancing access to early treatment. Governments and private players are investing in clinical training and diagnostic advancements. Regional manufacturers are expanding their portfolios with affordable corticosteroids and biologics, addressing the needs of a price-sensitive population. Rapid urbanization and wider insurance penetration further contribute to sustained market development.

Latin America

Latin America captured a 5.3% share of the anterior uveitis treatment market in 2024, fueled by increasing prevalence of infectious uveitis and autoimmune eye disorders. Brazil and Mexico remain major contributors due to expanding healthcare coverage and growing ophthalmic clinics. The rise of local pharmaceutical manufacturing and import partnerships improves product availability. However, high treatment costs and limited access to biologics in rural areas hinder wider adoption. Ongoing awareness initiatives and collaborations between hospitals and research institutions are expected to improve early diagnosis and patient outcomes across the region.

Middle East & Africa

The Middle East & Africa accounted for a 3.7% share of the global anterior uveitis treatment market in 2024, supported by gradual improvements in healthcare access and ophthalmology services. Countries such as Saudi Arabia, the UAE, and South Africa are leading markets, driven by urbanization and lifestyle-related autoimmune conditions. Government initiatives to improve eye care infrastructure and disease screening are strengthening patient management. However, limited specialist availability and high biologic therapy costs restrict broader treatment access. International partnerships and expanding hospital networks are expected to drive steady market growth over the forecast period.

Market Segmentations:

By Type

- Infectious Uveitis

- Non-Infectious Uveitis

By Therapy

- Corticosteroids

- Immunosuppressive therapies

- Biologics

- Others

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the anterior uveitis treatment market is characterized by strong participation from leading players such as AbbVie Inc., Lux Biosciences, Inc., Clearside Biomedical, UCB S.A., Aciont Inc., Novartis AG, Santen Pharmaceutical Co., Ltd., Aldeyra Therapeutics, Inc., Kiora Pharmaceuticals, Inc., and Sirion Therapeutics, Inc. These companies focus on advancing biologic and corticosteroid-based therapies to improve treatment outcomes and reduce recurrence rates. Strategic collaborations, product launches, and clinical trials for targeted immunomodulators are key competitive approaches. AbbVie and Novartis lead through extensive R&D investments in monoclonal antibodies and sustained-release corticosteroid formulations. Emerging biopharmaceutical firms such as Clearside Biomedical and Aldeyra Therapeutics are driving innovation with novel ocular drug delivery systems. The market’s competitive intensity is further influenced by the growing shift toward non-invasive treatment methods and tele-ophthalmology support systems that enhance patient adherence and long-term disease management.

Key Player Analysis

- AbbVie Inc.

- Lux Biosciences, Inc.

- Clearside Biomedical

- UCB S.A.

- Aciont Inc.

- Novartis AG

- Santen Pharmaceutical Co., Ltd.

- Aldeyra Therapeutics, Inc.

- Kiora Pharmaceuticals, Inc.

- Sirion Therapeutics, Inc.

Recent Developments

- In March 2024, Kiora Pharmaceuticals, Inc. announced publication of a Phase 1 study showing that topical KIO-101 (same active molecule class as KIO-104) was well tolerated and reduced ocular inflammation in healthy volunteers and patients with eye inflammation.

- In January 2024, Tarsier Pharma Ltd. received the FDA agreement for the Tarsier-04 Phase 3 clinical trial of TRS01 eye drop under a Special Protocol Assessment (SPA).

- In July 2023, Harrow, Inc. acquired Santen Pharmaceutical Co., Ltd.’s branded ophthalmic portfolio to expand the company’s product portfolio and strengthen its market presence.

- In April 2023, Novartis AG’s division “Sandoz” received marketing authorization from the European Commission for Hyrimoz to expand its distribution. This includes all the indications by the reference medicine for various diseases, including uveitis.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Therapy, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biologic and targeted immunotherapies will continue to grow rapidly.

- Advancements in sustained-release corticosteroid formulations will improve long-term disease control.

- Increasing R&D investments will lead to the development of safer, more effective treatment options.

- Adoption of personalized medicine approaches will enhance patient outcomes and treatment precision.

- Tele-ophthalmology and digital diagnostic tools will expand patient access to care.

- Emerging markets in Asia-Pacific will witness strong growth due to expanding healthcare infrastructure.

- Collaboration between pharmaceutical companies and research institutes will accelerate drug innovation.

- Rising awareness of early diagnosis and preventive eye care will drive treatment uptake.

- Biosimilar drug launches will improve affordability and accessibility of advanced therapies.

- Regulatory approvals for novel biologics and ocular implants will strengthen market expansion.

Market Insights

Market Insights