Market Overview:

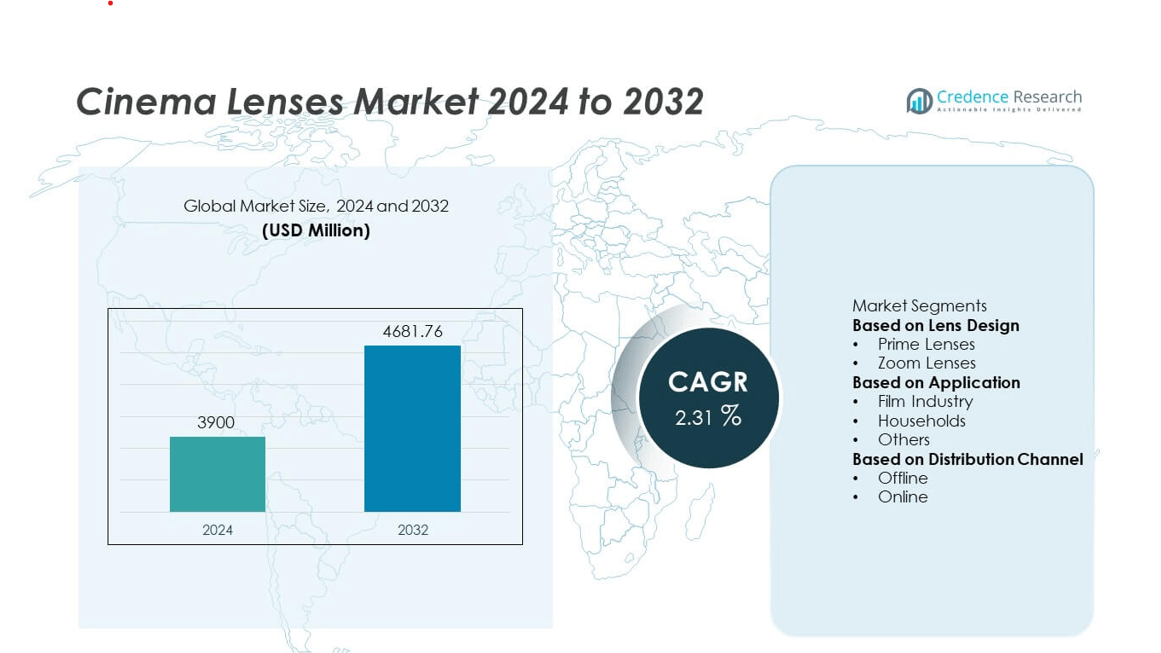

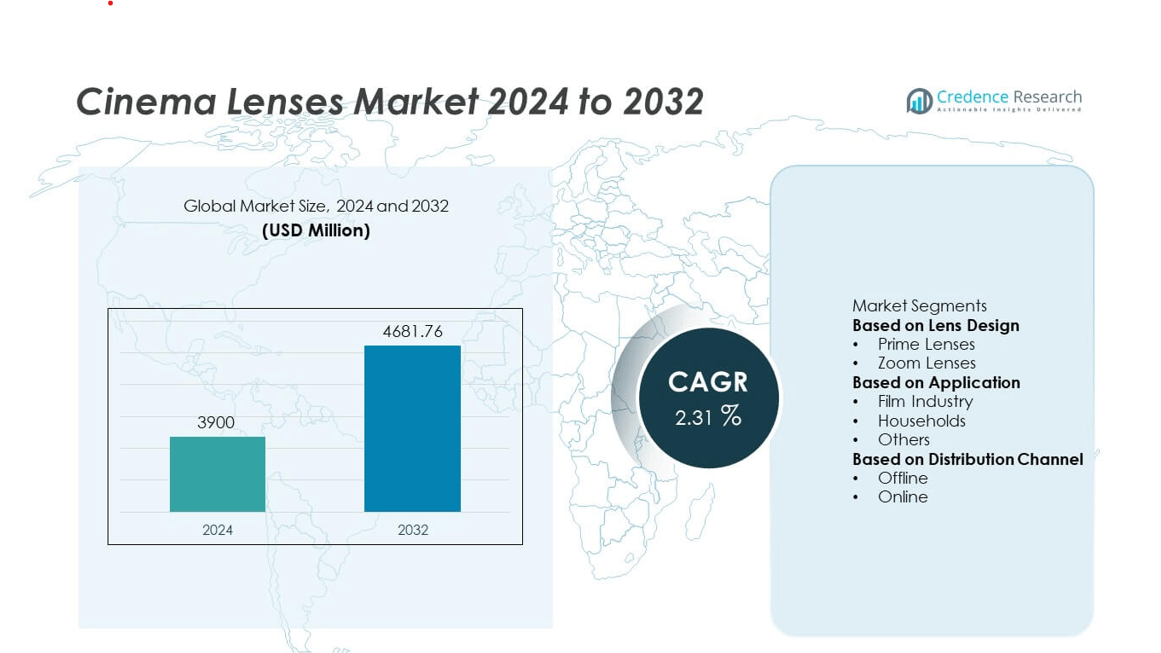

The Cinema Lenses market was valued at USD 3900 million in 2024 and is projected to reach USD 4681.76 million by 2032, expanding at a CAGR of 2.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cinema Lenses Market Size 2024 |

USD 3900 million |

| Cinema Lenses Market, CAGR |

2.31% |

| Cinema Lenses Market Size 2032 |

USD 4681.76 million |

The Cinema Lenses market is led by major players including Canon Inc., ZEISS Group, Cooke Optics Ltd., ARRI AG, Sony Corporation, FUJIFILM Corporation, Sigma Corporation, Angénieux (Thales Group), Leica Camera AG, and Samyang Optics Co., Ltd. These companies dominate through innovation in full-frame and large-format lenses, offering superior image quality and compatibility with high-resolution digital cameras. North America led the global market with a 39.5% share in 2024, supported by advanced film production infrastructure and strong demand from Hollywood studios. Europe followed with a 27.8% share, while Asia-Pacific emerged as the fastest-growing region driven by rising investments in film and streaming content production.

Market Insights

- The Cinema Lenses market was valued at USD 3900 million in 2024 and is projected to reach USD 4681.76 million by 2032, growing at a CAGR of 2.31%.

- Rising demand for high-quality visual content in films, streaming platforms, and advertising is driving market growth, supported by increasing adoption of large-format and high-resolution cameras.

- Advancements in lightweight lens construction, autofocus technology, and full-frame optics are shaping industry trends, enabling greater flexibility and precision for cinematographers.

- The market is moderately competitive, with key players such as Canon, ZEISS, Cooke Optics, and Sony focusing on product innovation, strategic partnerships, and expansion in professional filmmaking equipment.

- North America dominated the market with a 39.5% share in 2024, followed by Europe at 27.8%, while the prime lenses segment led by design with a 58.6% share due to its superior image quality and optical performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Lens Design

Prime lenses dominated the Cinema Lenses market in 2024, accounting for 58.6% of the total share. Their popularity is driven by superior optical performance, wider apertures, and precise control over depth of field, which are essential for cinematic production. Professional filmmakers prefer prime lenses for their ability to deliver sharp, high-quality images and consistent color rendering across focal lengths. The growing use of full-frame cameras and large-sensor formats in both movies and high-end commercials has further boosted demand for premium prime lenses.

- For instance, ZEISS Group introduced the Supreme Prime Radiance lenses featuring seven focal lengths ranging from 21mm to 100mm, each built with T1.5 maximum aperture and a specially developed T blue coating that enhances flare control and contrast for large-format cinematography.

By Application

The film industry held the largest share of 64.1% in the Cinema Lenses market in 2024. Its dominance is supported by the rising production of high-resolution films, web series, and streaming content globally. Demand for professional-grade lenses with superior contrast and color fidelity continues to grow among cinematographers. Expanding digital film production in countries like the United States, China, and India fuels steady market growth. The increasing use of anamorphic and large-format lenses in major studio projects also reinforces the segment’s leadership.

- For instance, ARRI AG’s Signature Prime lens range covers 16 focal lengths from 12mm to 280mm, with the majority of lenses having a consistent T1.8 maximum aperture. The 200mm lens has a T2.5 maximum aperture and the 280mm lens has a T2.8 maximum aperture.

By Distribution Channel

Offline distribution accounted for 70.4% of the Cinema Lenses market share in 2024, driven by the preference for direct purchasing and professional consultation. Filmmakers and production houses often rely on specialized camera stores and authorized distributors to ensure authenticity, after-sales support, and customization. The offline channel benefits from hands-on testing and expert guidance in selecting lens systems. However, the online channel is growing steadily as e-commerce platforms and brand websites expand availability, offering competitive pricing and accessibility to independent filmmakers and small studios.

Key Growth Drivers

Increasing Demand for High-Resolution Content Production

The growing shift toward 4K, 6K, and 8K filmmaking is driving demand for advanced cinema lenses capable of delivering superior sharpness and color accuracy. Streaming platforms and production studios are investing heavily in high-definition content, pushing cinematographers to upgrade to premium lens systems. The demand for lenses that maintain optical performance across large sensors and wide apertures is rising. This trend is further supported by the adoption of digital cinematography and large-format cameras across global film and advertising industries.

- For instance, Canon Inc. developed its Sumire Prime series featuring seven lenses ranging from 14mm to 135mm, all designed with large-format coverage and consistent T1.3 to T3.1 apertures, ensuring high optical resolution suitable for 8K production and cinematic color balance across full-frame sensors.

Rapid Expansion of the Entertainment and Streaming Industry

The surge in content creation for streaming platforms such as Netflix, Amazon Prime, and Disney+ is fueling the Cinema Lenses market. Production houses are increasing investments in professional-grade filming equipment to meet higher production standards. The rise of independent and regional film industries has also expanded the customer base for mid-range and rental cinema lenses. The growing preference for high-quality visual storytelling continues to boost global lens adoption across varied production environments.

- For instance, Sony Corporation’s CineAlta lens system (model SCL-PK6-F) offers a set of six Super 35mm lenses covering 20mm to 135mm focal lengths with T2.0 apertures, certified for 4K capture, and widely adopted in original content productions across global streaming platforms when used with compatible cameras like the Sony F5/F55 or the Venice series via a PL mount.

Technological Advancements in Lens Design

Ongoing advancements in optical engineering, autofocus technology, and lightweight materials are transforming cinema lens design. Manufacturers are introducing compact, high-speed lenses compatible with modern digital cameras. Hybrid lenses that blend traditional cinematic quality with digital flexibility are gaining popularity among filmmakers. Features such as improved flare resistance, consistent color reproduction, and lens metadata integration enhance workflow efficiency. These innovations enable smoother production processes and cater to both large studios and independent creators seeking versatility and performance.

Key Trends & Opportunities

Rising Popularity of Full-Frame and Large-Format Lenses

Full-frame and large-format cinema lenses are witnessing increasing adoption due to their ability to capture greater detail and dynamic range. Cinematographers prefer these lenses for their cinematic depth and shallow focus effects. The trend aligns with the growing use of high-resolution digital cameras in both films and commercials. Manufacturers are expanding product portfolios to offer cost-effective large-format lens options. As visual storytelling becomes more immersive, demand for lenses supporting enhanced sensor coverage and optical precision continues to rise.

- For instance, FUJIFILM Corporation introduced the Premista large-format zoom lens series, featuring three models—Premista 19-45mm T2.9, 28-100mm T2.9, and 80-250mm T2.9-3.5—each designed for 46.3 mm image circles, enabling full-frame coverage and maintaining consistent optical performance across entire focal ranges in 8K production environments.

Growth in Lens Rental and Subscription Services

The increasing cost of professional cinema lenses has led to rapid growth in rental and subscription-based models. Production houses and freelancers are opting for rental services to access premium lenses without long-term financial commitments. Rental companies are expanding their global presence with digital platforms offering flexible packages and doorstep delivery. This trend benefits lens manufacturers through steady aftermarket demand and wider product exposure. The rental ecosystem is also promoting sustainability by extending the lifecycle of high-value optical equipment.

- For instance, Cooke Optics partnered with rental firm Panavision to supply its S7/i Full Frame Plus lenses—comprising 16 focal lengths from 18mm to 350mm—through more than 50 rental outlets worldwide, allowing production teams to access precision-calibrated optics supporting 6K and 8K digital cinema workflows.

Key Challenges

High Cost of Premium Cinema Lenses

The significant price of professional cinema lenses remains a key barrier to wider adoption, especially among independent filmmakers and small production studios. High-quality lenses require precision manufacturing and advanced optical coatings, leading to elevated costs. This limits affordability and drives reliance on rental models. Manufacturers face the challenge of balancing innovation with cost efficiency. The market’s expansion into developing regions may slow unless more budget-friendly lens options are introduced without compromising performance.

Competition from Advanced Mirrorless Camera Lenses

The increasing quality and versatility of mirrorless camera lenses pose a competitive challenge to traditional cinema lenses. Modern hybrid lenses offer strong optical performance at lower prices, appealing to small studios and digital content creators. As mirrorless systems evolve with better autofocus, stabilization, and video capabilities, the distinction between still and cinema lenses continues to blur. To maintain relevance, cinema lens manufacturers must innovate in design, durability, and workflow integration to cater to evolving filmmaker preferences.

Regional Analysis

North America

North America dominated the Cinema Lenses market in 2024, accounting for 39.5% of the total share. The region’s leadership is driven by a well-established film and television industry, major production studios, and strong demand for high-end cinematography equipment. The United States remains a key contributor with continuous investment in advanced filming technologies and digital cinema. Growing content production for OTT platforms and advertising agencies fuels market expansion. The increasing adoption of full-frame and large-format cameras by professional cinematographers continues to support steady demand for premium cinema lenses across the region.

Europe

Europe held a 27.8% share of the global Cinema Lenses market in 2024, supported by its thriving film production hubs in the United Kingdom, France, and Germany. The region benefits from government-backed initiatives promoting film and creative media production. European cinematographers increasingly prefer lightweight, high-resolution lenses compatible with modern digital cinema cameras. The growing number of independent film projects and cross-border productions further stimulates demand. Expanding lens rental services and strong adoption of anamorphic lenses in high-end filmmaking continue to strengthen the region’s position in the global market.

Asia-Pacific

Asia-Pacific accounted for 22.7% of the Cinema Lenses market share in 2024 and is projected to witness the fastest growth during the forecast period. Rapid expansion of the entertainment industry in China, India, South Korea, and Japan drives market demand. Increasing investments in regional film production, coupled with government support for creative industries, enhance market penetration. The rise of digital streaming platforms and large-scale domestic film projects accelerates lens adoption. Growing preference for cost-effective yet high-quality optics among regional filmmakers contributes to Asia-Pacific’s growing influence in the global cinema lens landscape.

Latin America

Latin America captured 6.4% of the Cinema Lenses market share in 2024, fueled by expanding film production in Brazil, Mexico, and Argentina. The region is witnessing rising investments from international studios and streaming platforms in local content creation. Independent and documentary filmmakers are increasingly adopting high-quality yet affordable lenses for regional productions. Growth in digital content, commercials, and online video creation supports market demand. The strengthening presence of rental service providers and gradual technological adoption are contributing to consistent market development across Latin America’s entertainment sector.

Middle East & Africa

The Middle East & Africa held a 3.6% share of the Cinema Lenses market in 2024, supported by expanding media and entertainment industries in the Gulf Cooperation Council (GCC) countries and South Africa. Government initiatives promoting film production and tourism-related media are driving equipment investments. The region is seeing increased use of professional lenses in commercials, documentaries, and regional films. However, high import costs and limited production facilities pose challenges to wider adoption. Ongoing development of regional film festivals and collaborations with global studios are expected to gradually strengthen market growth.

Market Segmentations:

By Lens Design

By Application

- Film Industry

- Households

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cinema Lenses market is highly competitive, featuring key players such as Canon Inc., ZEISS Group, Cooke Optics Ltd., ARRI AG, Sony Corporation, FUJIFILM Corporation, Sigma Corporation, Angénieux (Thales Group), Leica Camera AG, and Samyang Optics Co., Ltd. These companies focus on developing high-performance lenses with superior optical precision, color consistency, and durability to meet the growing demand for cinematic-quality visuals. Strategic initiatives such as product innovation, partnerships with camera manufacturers, and expansion of global distribution networks are central to strengthening their market position. Leading brands continue to invest in lightweight and large-format lenses compatible with high-resolution digital cameras. The rise of mirrorless and hybrid cinematography further encourages manufacturers to design versatile lens systems. Continuous advancements in coatings, autofocus integration, and ergonomic design remain key differentiators enhancing competition across professional and independent filmmaking sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Canon Inc.

- ZEISS Group

- Cooke Optics Ltd.

- ARRI AG

- Sony Corporation

- FUJIFILM Corporation

- Sigma Corporation

- Angénieux (Thales Group)

- Leica Camera AG

- Samyang Optics Co., Ltd.

Recent Developments

- In September 2025, Canon Inc. announced the CINE-SERVO 11-55 mm T2.95-3.95 lens, scheduled to ship in November 2025 with RF and PL mounts.

- In June 2025, Sigma Corporation announced its “Aizu Prime” large-format cinema lens lineup offering a consistent T1.3 aperture across all focal lengths (18mm-125mm) for PL- and E-mount systems.

Report Coverage

The research report offers an in-depth analysis based on Lens Design, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Cinema Lenses market will grow steadily with rising investments in film and digital content production.

- Advancements in full-frame and large-format lenses will enhance cinematic image quality.

- Demand for lightweight and compact lens designs will increase among mobile production teams.

- Integration of autofocus and electronic control systems will become a key development trend.

- Manufacturers will focus on developing cost-effective lenses for independent filmmakers and small studios.

- The rental and subscription-based lens model will continue expanding across global markets.

- Collaboration between lens and camera makers will drive innovation in compatibility and performance.

- Asia-Pacific will witness strong growth due to expanding regional film industries and OTT content creation.

- Sustainability and eco-friendly manufacturing practices will gain importance in lens production.

- Continuous R&D in optical coatings and sensor-optimized lenses will define future competition among major brands.