Market Overview:

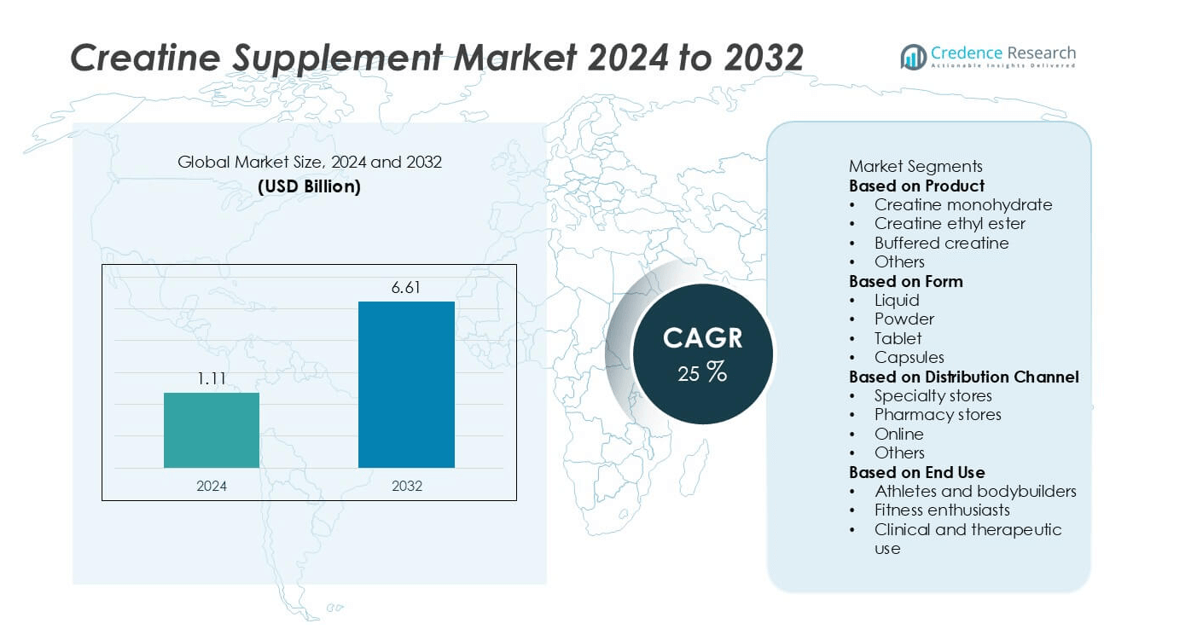

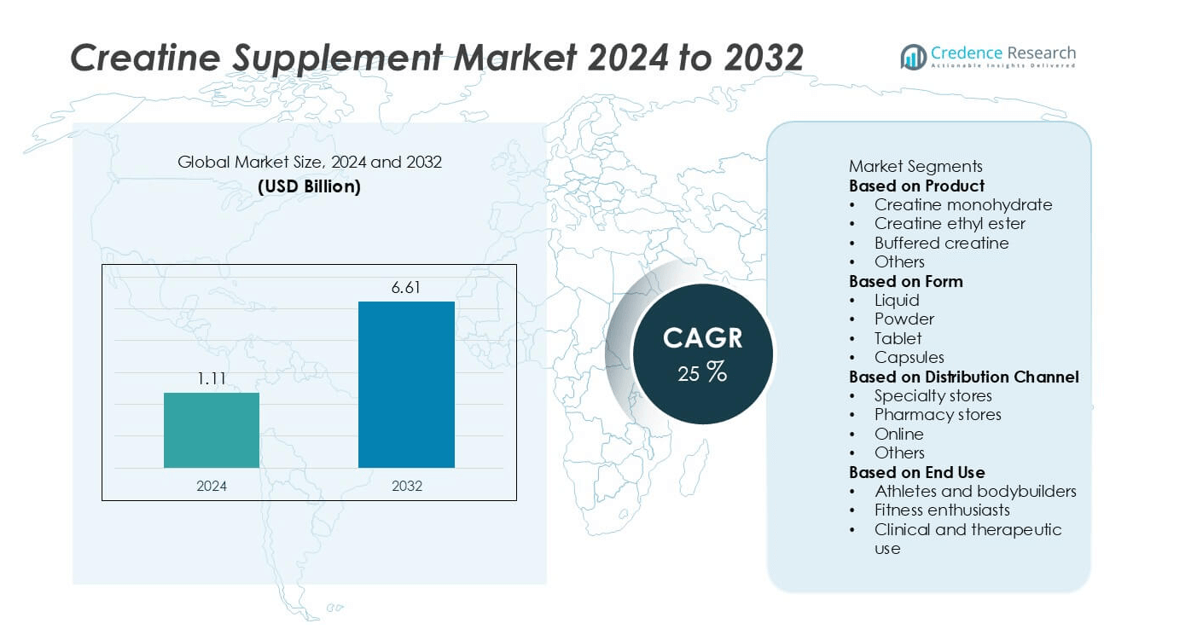

The global creatine supplement market was valued at USD 1.11 billion in 2024 and is projected to reach USD 6.61 billion by 2032, growing at a compound annual growth rate CAGR of 25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Creatine Supplement Market Size 2024 |

USD 1.11 billion |

| Creatine Supplement Market, CAGR |

25% |

| Creatine Supplement Market Size 2032 |

USD 6.61 billion |

The creatine supplement market is driven by prominent players such as Dymatize, Optimum Nutrition, BSN, Nutricia (Danone), Universal Nutrition, AlzChem AG, Muscletech, NOW Foods, Glanbia Nutritionals, and Cellucor, who collectively hold a substantial portion of global revenue. These companies focus on innovation, quality enhancement, and expanding product lines to meet rising consumer demand for performance and recovery supplements. North America leads the global market with a 38% share in 2024, supported by a strong fitness culture, established supplement brands, and widespread online retail penetration. Europe follows with 27%, driven by increasing adoption of clean-label sports nutrition and growing awareness of creatine’s health benefits.

Market Insights

- The global creatine supplement market was valued at USD 1.11 billion in 2024 and is projected to reach USD 6.61 billion by 2032, registering a CAGR of 25% during the forecast period.

- Market growth is driven by the rising adoption of fitness lifestyles, increasing participation in sports activities, and expanding applications in clinical nutrition for muscle and cognitive health.

- Emerging trends include the growing demand for vegan, clean-label, and plant-based creatine formulations, as well as the integration of creatine into functional foods, beverages, and ready-to-drink products.

- The market is moderately consolidated, with key players such as Optimum Nutrition, Dymatize, Muscletech, and AlzChem AG focusing on innovation, digital marketing, and global distribution to strengthen competitiveness.

- North America leads with 38% market share, followed by Europe (27%) and Asia-Pacific (22%), while the powder segment holds the largest share of 50%, driven by high consumer preference for convenience and effectiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The creatine supplement market is segmented into creatine monohydrate, creatine hydrochloride, creatine ethyl ester, buffered creatine, and others. Among these, creatine monohydrate dominated the market in 2024, accounting for over 45% of the global share. Its dominance is driven by its proven efficacy, affordability, and extensive availability across retail and online channels. Growing consumer preference for scientifically backed performance enhancers and the product’s widespread use in sports nutrition formulations further support segment growth, particularly among professional athletes and fitness enthusiasts seeking strength and endurance improvement.

- For instance, Optimum Nutrition introduced its Micronized Creatine Monohydrate containing 3 or 5 grams of 100% pure creatine monohydrate per serving, certified by Informed Choice for quality assurance.

By Form

Based on form, the market is divided into powder, capsule, liquid, and tablet formats. The powder segment held the largest share of around 50% in 2024, owing to its high solubility, ease of mixing with beverages, and better absorption rate. The segment’s growth is fueled by the rising popularity of pre- and post-workout drinks and protein blends containing creatine. Additionally, consumers prefer powdered forms due to customizable dosing and cost-effectiveness, making it a preferred choice across gyms, health clubs, and e-commerce platforms.

- For instance, Myprotein’s Creatine Monohydrate Powder delivers 5 grams per serving and achieved Informed Sport verification, ensuring purity and compliance with athletic standards

By Distribution Channel

The creatine supplement market is categorized into online retail, specialty stores, supermarkets/hypermarkets, and others. The online retail segment emerged as the dominant channel in 2024, capturing over 40% of the market share. Its expansion is driven by increasing digitalization, widespread internet access, and consumer inclination toward convenient purchasing options. E-commerce platforms offer broader product availability, competitive pricing, and easy access to international brands, contributing to strong online growth. Moreover, social media marketing and influencer endorsements play a crucial role in boosting online sales and brand visibility within this segment.

Key Growth Drivers

Rising Adoption of Sports and Fitness Lifestyles

The growing global emphasis on fitness and active living is a major driver of the creatine supplement market. Increasing participation in gyms, sports clubs, and endurance activities has boosted demand for muscle-enhancing and performance-boosting supplements. Millennials and Gen Z consumers, in particular, are fueling sales through their focus on physical appearance and health optimization. Additionally, the rise of fitness influencers and digital training platforms has increased awareness of creatine’s proven benefits, further stimulating product adoption across both professional and recreational athletes.

- For instance, Thorne HealthTech partnered with CrossFit to develop its NSF Certified Creatine Monohydrate, providing 5 grams of pharmaceutical-grade creatine per serving. The formulation underwent over 30 rounds of purity and solubility testing to meet elite athlete safety standards.

Expanding Applications in Clinical Nutrition

Beyond sports performance, creatine is gaining traction in clinical and therapeutic nutrition. Studies highlighting its role in improving muscle function, cognitive health, and recovery among elderly and patient populations have expanded its use in medical nutrition products. Healthcare professionals increasingly recommend creatine as a supportive supplement for conditions involving muscle wasting and neurodegenerative disorders. This diversification into healthcare applications broadens the market base and enhances long-term growth potential, driving demand across pharmaceutical and nutraceutical industries alike.

- For instance, Alzchem Group AG produces Creapure®, a high-purity creatine monohydrate manufactured under stringent quality controls including GMP and FSSC 22000 standards. This product is widely recognized as a premium ingredient in sports nutrition and general health supplements, with studies showing its benefits for muscle maintenance and strength in adults over 55 when combined with resistance training, a claim approved by the EU.

Product Innovation and Ingredient Advancements

Continuous innovation in formulation and delivery forms is propelling market growth. Manufacturers are introducing micronized, buffered, and plant-based creatine products to enhance solubility, absorption, and consumer appeal. The integration of creatine into functional foods, beverages, and ready-to-drink formulations is further expanding its accessibility. Additionally, sustainable and vegan-certified product launches align with evolving consumer preferences for clean-label, ethical nutrition products. These advancements not only attract new consumer groups but also strengthen brand differentiation and market competitiveness.

Key Trends & Opportunities

Rising Popularity of E-commerce and Digital Marketing

E-commerce platforms are becoming a dominant sales channel for creatine supplements, offering global reach and convenience. Online retailers provide extensive product options, transparent ingredient information, and customer reviews that influence purchase decisions. Moreover, social media and influencer marketing campaigns significantly enhance brand visibility and consumer engagement. This digital transformation creates vast opportunities for emerging and established brands to expand their presence, particularly among younger, tech-savvy consumers seeking trusted performance-enhancing products online.

- For instance, Optimum Nutrition (owned by Glanbia) has leveraged Google Cloud AI to develop a proprietary metric called ‘Product Edge’ to measure market performance based on consumer insights.

Increasing Demand for Vegan and Natural Formulations

With growing awareness of sustainability and ethical consumption, vegan-friendly creatine supplements are gaining traction. Manufacturers are shifting toward natural, plant-based raw materials to cater to vegetarian and vegan consumers. This trend opens lucrative opportunities for innovation in formulation and branding, as consumers increasingly prioritize transparency and clean-label ingredients. Additionally, partnerships with sustainable suppliers and certifications supporting ethical production practices strengthen brand reputation and appeal to environmentally conscious buyers.

- For instance, Transparent Labs introduced its Vegan Creatine HMB, produced using 100% fermented corn glucose as a non-animal creatine source, containing 5 grams of creatine and 1.5 grams of beta-hydroxy-beta-methylbutyrate per serving.

Integration into Functional Foods and Beverages

The inclusion of creatine in functional foods, energy bars, and sports beverages represents a promising market opportunity. Consumers seeking convenient, multipurpose nutrition options are driving this shift toward everyday consumable formats. Food and beverage brands are leveraging creatine’s performance-enhancing benefits to differentiate products and target the growing market of health-focused individuals. This trend supports market expansion beyond traditional supplements, fostering cross-industry collaborations and product diversification.

Key Challenges

Misconceptions and Lack of Consumer Awareness

Despite its proven benefits, misconceptions about creatine’s safety and side effects remain prevalent. Some consumers associate it with harmful substances or assume it causes dehydration or kidney issues, deterring potential buyers. Limited education and misinformation, particularly in emerging markets, hinder market penetration. To overcome this challenge, manufacturers and health organizations must invest in awareness campaigns, transparent labeling, and evidence-based marketing to build consumer trust and encourage informed purchasing decisions.

Stringent Regulatory Standards and Quality Concerns

Regulatory compliance and product standardization pose significant challenges for manufacturers in the creatine supplement market. Variations in international labeling laws, ingredient approvals, and dosage limits complicate market entry across regions. Moreover, the proliferation of counterfeit and substandard products in online markets undermines consumer confidence and brand credibility. Ensuring quality assurance, third-party testing, and adherence to Good Manufacturing Practices (GMP) are essential to maintaining market integrity and sustaining long-term growth in this competitive landscape.

Regional Analysis

North America

North America held the largest share of around 38% of the global creatine supplement market in 2024, driven by a strong fitness culture, high disposable incomes, and widespread awareness of sports nutrition. The United States dominates the regional market, supported by a large base of athletes, gym-goers, and health-conscious consumers. Increasing adoption of advanced supplement formulations and a well-established distribution network across online and offline channels further enhance regional growth. Moreover, ongoing research into the clinical benefits of creatine and the popularity of personalized nutrition trends continue to stimulate sustained market expansion across North America.

Europe

Europe accounted for around 27% of the global creatine supplement market in 2024, supported by a robust sports and fitness infrastructure and a growing preference for clean-label nutritional products. Countries such as Germany, the United Kingdom, and France lead regional consumption, driven by the popularity of endurance training and bodybuilding. The rising trend of vegan and plant-based creatine formulations has also fueled market penetration. Strict regulatory standards encourage high-quality product development, fostering consumer trust. Moreover, the increasing inclusion of creatine in sports drinks and functional foods continues to strengthen the region’s growth prospects.

Asia-Pacific

The Asia-Pacific region captured around 22% of the global creatine supplement market in 2024 and is projected to record the fastest growth through 2032. Rapid urbanization, expanding middle-class populations, and increasing participation in fitness and recreational sports are key growth drivers. China, India, Japan, and Australia represent major markets, supported by growing awareness of muscle recovery and strength-enhancing supplements. E-commerce expansion and aggressive marketing by international brands are improving accessibility and affordability. Additionally, rising health consciousness among young consumers and a shift toward Western fitness habits continue to boost market growth across the region.

Latin America

Latin America represented around 8% of the global creatine supplement market in 2024, driven by increasing sports participation and growing gym memberships across Brazil, Mexico, and Argentina. The rising popularity of bodybuilding and athletic training, coupled with growing awareness of dietary supplementation, has contributed to market expansion. The proliferation of online retail platforms and fitness influencers has improved product visibility and accessibility. However, limited consumer education and price sensitivity remain challenges. Nonetheless, strategic marketing initiatives and the introduction of cost-effective product variants are expected to strengthen regional growth over the forecast period.

Middle East & Africa

The Middle East & Africa accounted for around 5% of the global creatine supplement market in 2024, with increasing adoption among fitness-conscious youth and professional athletes driving growth. The United Arab Emirates and South Africa are leading markets, supported by expanding gym networks and a growing focus on sports nutrition. Rising disposable incomes and the popularity of international supplement brands are further boosting sales. Although awareness levels remain comparatively low, government initiatives promoting health and wellness and expanding retail availability are expected to enhance the market’s potential throughout the forecast period.

Market Segmentations:

By Product

- Creatine monohydrate

- Creatine ethyl ester

- Buffered creatine

- Others

By Form

- Liquid

- Powder

- Tablet

- Capsules

By Distribution Channel

- Specialty stores

- Pharmacy stores

- Online

- Others

By End Use

- Athletes and bodybuilders

- Fitness enthusiasts

- Clinical and therapeutic use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the creatine supplement market features key players such as Dymatize, Optimum Nutrition, BSN, Nutricia (Danone), Universal Nutrition, AlzChem AG, Muscletech, NOW Foods, Glanbia Nutritionals, and Cellucor. These companies compete through product innovation, brand differentiation, and extensive distribution networks across retail and online platforms. Market leaders focus on expanding their portfolios with advanced formulations such as micronized and plant-based creatine to cater to evolving consumer preferences. Strategic partnerships, sponsorships with athletes, and digital marketing initiatives enhance brand visibility and consumer engagement. Additionally, research-driven companies like AlzChem AG emphasize quality assurance and raw material innovation, strengthening their position in the supply chain. The competitive environment remains moderately consolidated, with established brands holding a significant market share while emerging players increasingly penetrate niche segments such as vegan, clean-label, and functional food-based creatine products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dymatize

- Optimum Nutrition

- BSN

- Nutricia (Danone)

- Universal Nutrition

- AlzChem AG

- Muscletech

- NOW Foods

- Glanbia Nutritionals

- Cellucor

Recent Developments

- In October 2025, Dymatize launched a new Creatine Monohydrate with Creapure® offering 5 g per scoop, no fillers, and Informed Choice certification.

- In October 2025, Alzchem Group AG (via its human-nutrition division) partnered with Ehrmann to introduce “High Protein Creatine” products featuring Creavitalis® from Alzchem (puddings, drinks, bars) in stores.

- In March 2025, Alzchem organised the “Creatine Conference 2025” in Munich (March 12-15) to showcase the latest research on creatine applications beyond sports (e.g., ageing, female health, cognitive).

- In January 2025, Alzchem announced it had established a Scientific Advisory Board (SAB) to steer creatine research in areas including pregnancy, PMS, long-COVID, aging muscle loss

Report Coverage

The research report offers an in-depth analysis based on Product, Form, Distribution Channel, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The creatine supplement market will experience strong growth driven by increasing global fitness participation and health awareness.

- Expanding applications of creatine in clinical nutrition will enhance its adoption beyond sports and bodybuilding.

- Rising demand for vegan, clean-label, and plant-based formulations will reshape product innovation strategies.

- Digital marketing and e-commerce will remain key channels for consumer engagement and sales expansion.

- Technological advancements in formulation will improve solubility, absorption, and overall product performance.

- Emerging markets in Asia-Pacific and Latin America will offer significant growth opportunities through urbanization and lifestyle shifts.

- Strategic collaborations between supplement brands and fitness influencers will strengthen brand visibility and loyalty.

- Regulatory alignment and quality certifications will become critical for maintaining consumer trust and market credibility.

- Integration of creatine into functional foods and beverages will diversify product portfolios and attract new consumers.

- Leading manufacturers will continue to invest in R&D, sustainability, and innovative delivery formats to gain a competitive edge.