Market Overview:

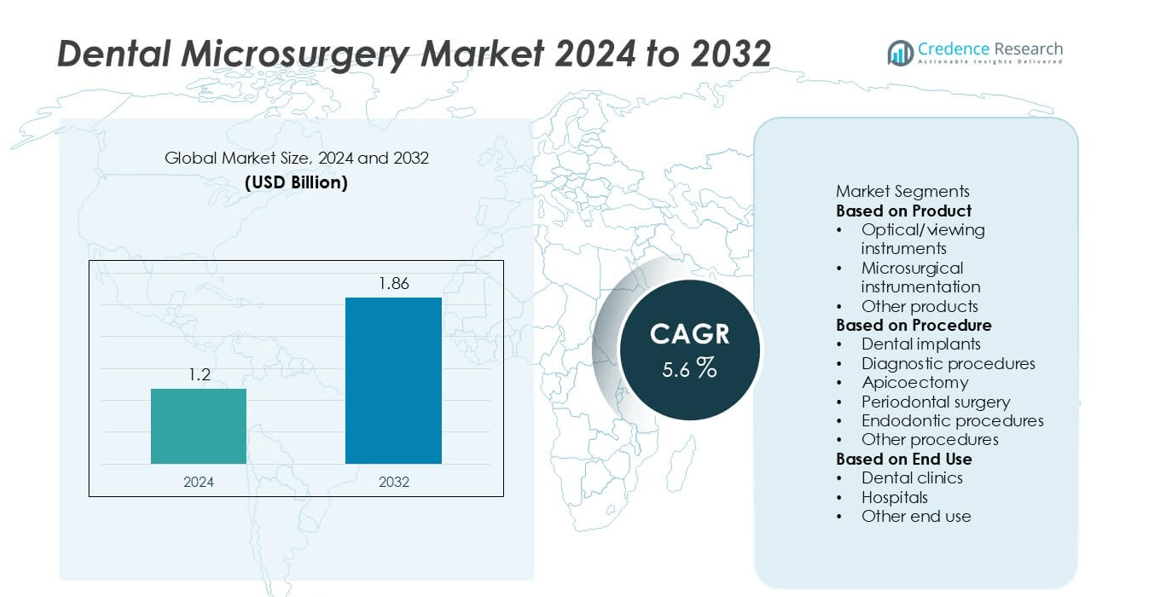

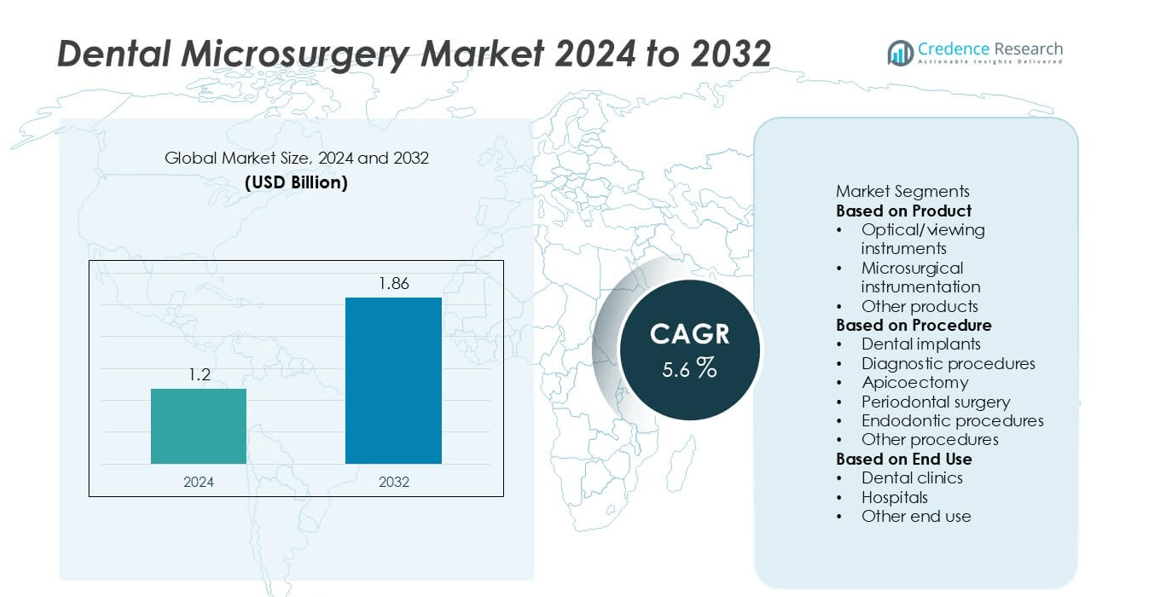

The global Dental Microsurgery market was valued at USD 1.2 billion in 2024 and is projected to reach USD 1.86 billion by 2032, growing at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Microsurgery Market Size 2024 |

USD 1.2 billion |

| Dental Microsurgery Market, CAGR |

8.6% |

| Dental Microsurgery Market Size 2032 |

USD 1.86 billion |

The dental microsurgery market is driven by leading players such as Dentsply Sirona, Danaher, B. Braun Melsungen, Institut Straumann, Hu-Friedy, Global Surgical, MediThinQ, Kerr, Henry Schein, and Microsurgery Instruments. These companies focus on developing advanced microsurgical tools, high-precision optical systems, and digital imaging technologies to enhance clinical efficiency and patient outcomes. North America leads the global market with a 38% share, supported by strong technological adoption, a large base of skilled dental professionals, and robust healthcare infrastructure. Europe follows with a 30% share, driven by advanced dental systems and regulatory support, while Asia Pacific, holding 22%, emerges as the fastest-growing region due to expanding dental tourism and rising healthcare investments.

Market Insights

- The global Dental Microsurgery market was valued at USD 1.2 billion in 2024 and is projected to reach USD 1.86 billion by 2032, growing at a CAGR of 5.6% during the forecast period.

- Key market drivers include rising prevalence of dental disorders, increasing demand for minimally invasive and cosmetic procedures, and continuous technological advancements in optical and microsurgical instruments.

- Emerging trends such as integration of digital imaging, 3D visualization, and robotic-assisted systems are enhancing precision and boosting adoption across advanced dental practices.

- The competitive landscape is dominated by major players including Dentsply Sirona, Danaher, B. Braun Melsungen, Institut Straumann, and Hu-Friedy, focusing on innovation, mergers, and clinician training programs.

- Regionally, North America holds 38%, Europe 30%, and Asia Pacific 22% of the market share, while by product, optical/viewing instruments lead with 45%, and by end use, dental clinics account for 58% of the total share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The dental microsurgery market by product is segmented into optical/viewing instruments, microsurgical instrumentation, and other products. Optical/viewing instruments dominated the segment in 2024, accounting for over 45% of the market share. Their dominance is driven by the widespread adoption of advanced dental microscopes and magnification systems that enhance precision and visibility during complex procedures. Increasing technological innovations, such as high-definition imaging and ergonomic designs, further support segment growth. The demand for optical systems continues to rise as clinicians increasingly emphasize accuracy, patient comfort, and minimally invasive treatment outcomes.

- For instance, Carl Zeiss Meditec introduced the EXTARO 300 dental microscope equipped with 4K imaging and integrated fluorescence visualization. The device offers magnification up to 24x and incorporates a digital documentation system for chairside image capture.

By Procedure

Based on procedure, the market is divided into dental implants, diagnostic procedures, apicoectomy, periodontal surgery, endodontic procedures, and other procedures. Endodontic procedures held the leading position in 2024 with approximately 32% of the market share. The growth of this segment is primarily driven by the rising incidence of dental caries and pulp infections, which require precise root canal treatments performed under magnification. Increased awareness of microsurgical benefits, coupled with a surge in cosmetic and restorative dentistry, has further boosted demand for advanced microsurgical tools in endodontic applications.

- For instance, Leica Microsystems launched the M320 F12 dental microscope featuring apochromatic optics with a working distance of 200–300 mm and integrated LED illumination exceeding 100,000 lux intensity. The system allows precise visualization of fine root canal structures and provides digital video recording at 1080p resolution.

By End Use

In terms of end use, the market includes dental clinics, hospitals, and other end users. Dental clinics emerged as the dominant segment in 2024, capturing nearly 58% of the market share. This leadership is attributed to the growing number of private dental practices and the increasing availability of specialized microsurgical equipment in clinic settings. Clinics are rapidly adopting dental microscopes and precision instruments to enhance treatment quality and efficiency. The shift toward outpatient care, cost-effectiveness, and personalized treatment approaches further strengthens the position of dental clinics as the primary end-use segment in this market.

Key Growth Drivers

Rising Prevalence of Dental Disorders

The increasing global incidence of dental conditions such as caries, periodontal disease, and tooth loss is driving demand for advanced microsurgical interventions. Patients and practitioners are increasingly opting for precision-based treatments that reduce recovery time and improve procedural outcomes. As oral health awareness grows, early diagnosis and minimally invasive procedures are becoming more common, fueling the adoption of dental microsurgical equipment and technologies across both developed and emerging markets.

- For instance, Dentsply Sirona’s X-Smart iQ endodontic system integrates torque and speed sensors with Bluetooth connectivity for precise canal shaping control.

Technological Advancements in Microsurgical Tools

Continuous innovation in optical and microsurgical instruments has significantly enhanced the precision, ergonomics, and visualization capabilities of dental procedures. The introduction of high-resolution microscopes, digital imaging systems, and micro-instrumentation has improved treatment accuracy and patient comfort. These advancements enable dentists to perform complex procedures with greater control and efficiency, encouraging wider adoption across clinics and hospitals. As digital integration and automation continue to evolve, technological innovation remains a major catalyst for market expansion.

- For instance, Global Surgical Corporation introduced the A-Series Dental Microscope, with models featuring options for three, four, or six steps of magnification, with the A6 series providing up to 19.2x magnification. The microscope incorporates a bright integrated LED light source, providing over 100,000 lux of illumination.

Growing Demand for Aesthetic and Restorative Dentistry

The surge in cosmetic dental procedures is a major growth driver for the dental microsurgery market. Increasing consumer preference for aesthetic enhancements, such as dental implants and smile correction, is propelling demand for microsurgical techniques that offer precision and minimal scarring. Rising disposable incomes, coupled with greater access to advanced dental care, are further stimulating market growth. Microsurgery allows practitioners to deliver superior cosmetic outcomes with reduced invasiveness, aligning with patient expectations for high-quality, aesthetically pleasing results.

Key Trends & Opportunities

Integration of Digital and Robotic Technologies

The integration of digital imaging, 3D visualization, and robotic-assisted systems is transforming dental microsurgery. These technologies enable enhanced precision, real-time guidance, and improved procedural outcomes. The use of AI-driven diagnostics and robotic tools in endodontic and implant procedures is gaining momentum, particularly in advanced dental centers. This digital shift presents a major opportunity for manufacturers to develop integrated microsurgical platforms, combining imaging, navigation, and instrument control to streamline complex interventions.

- For instance, Neocis Inc. developed the Yomi robotic system, the first FDA-cleared robotic platform for dental implant surgery. The system provides haptic guidance and real-time 3D visualization, achieving drilling accuracy within 0.2 millimeters.

Expanding Adoption in Emerging Economies

Emerging markets such as India, China, and Brazil are witnessing rapid adoption of dental microsurgery due to improving healthcare infrastructure and increasing investment in dental technology. The expansion of dental tourism and a growing number of trained professionals are creating significant opportunities for market penetration. As awareness of advanced dental care rises and cost-effective microsurgical solutions become available, these regions are expected to contribute substantially to future market growth.

- For instance, Planmeca Oy has installed numerous Planmeca ProMax 3D imaging units in various dental clinics and scan centers in India. Each unit offers an endodontic imaging mode that delivers an exceptionally high resolution with a voxel size of 75 micrometers (µm), and the accompanying software, Planmeca Romexis, integrates CAD/CAM data for digital workflow compatibility.

Key Challenges

High Equipment and Training Costs

The high cost of microsurgical instruments, optical systems, and advanced imaging devices poses a major challenge for widespread adoption, particularly among small and mid-sized dental practices. Additionally, dental microsurgery requires specialized training and skill development, which adds to the overall expense. These financial barriers limit accessibility in price-sensitive markets and slow down the adoption rate, particularly in developing regions with constrained healthcare budgets.

Limited Awareness and Standardization

Despite technological advancements, awareness about the benefits and applications of dental microsurgery remains limited among practitioners and patients in certain markets. Moreover, the lack of standardized clinical protocols and training frameworks hinders consistent implementation. Variations in procedural techniques and outcomes can reduce practitioner confidence and patient trust, thereby restraining market growth. Expanding educational programs and regulatory support is essential to overcome these limitations and ensure broader clinical integration

Regional Analysis

North America

North America dominated the dental microsurgery market in 2024, accounting for 38% of the global market share. The region’s leadership is driven by the strong presence of advanced dental infrastructure, high adoption of precision surgical tools, and early integration of digital and optical technologies. The United States, in particular, benefits from a large base of dental professionals and increasing demand for minimally invasive and cosmetic procedures. Continuous innovation by key manufacturers, coupled with favorable reimbursement policies and increased patient awareness, continues to strengthen North America’s position in the global dental microsurgery landscape.

Europe

Europe held a significant share of the dental microsurgery market in 2024, capturing 30% of the total market. The region’s growth is supported by a well-established dental care system, rising investments in technological advancements, and a growing geriatric population with high dental care needs. Countries such as Germany, the United Kingdom, and Switzerland lead in adopting dental microscopes and microsurgical tools. Stringent quality standards, strong clinical training programs, and government initiatives to enhance oral health care are further contributing to market expansion across Europe.

Asia Pacific

The Asia Pacific region accounted for 22% of the global dental microsurgery market in 2024 and is expected to witness the fastest growth during the forecast period. Increasing healthcare expenditure, expanding dental tourism, and rising awareness of advanced dental treatments are key drivers. Rapid urbanization, a growing middle-class population, and improved access to modern dental facilities in countries such as China, India, Japan, and South Korea are fueling market development. Additionally, global manufacturers are investing in local production and partnerships to cater to the region’s expanding demand for cost-effective microsurgical solutions.

Latin America

Latin America represented 6% of the dental microsurgery market in 2024, with steady growth driven by expanding dental care infrastructure and increasing adoption of modern surgical instruments. Brazil and Mexico are the primary contributors due to a growing number of trained dental professionals and clinics adopting minimally invasive technologies. Rising disposable incomes, coupled with government efforts to improve oral healthcare access, are supporting market progress. However, high equipment costs and limited awareness in rural areas continue to pose challenges to broader market penetration in the region.

Middle East & Africa

The Middle East & Africa held 4% of the global dental microsurgery market in 2024, driven by the gradual development of dental care infrastructure and growing investment in healthcare modernization. The United Arab Emirates and Saudi Arabia are leading regional markets due to increasing dental tourism and the presence of advanced clinical facilities. Growing awareness of oral health and rising demand for aesthetic dentistry are contributing to regional growth. However, limited access to specialized equipment and trained professionals in several African countries remains a key restraint to wider market expansion.

Market Segmentations:

By Product

- Optical/viewing instruments

- Microsurgical instrumentation

- Other products

By Procedure

- Dental implants

- Diagnostic procedures

- Apicoectomy

- Periodontal surgery

- Endodontic procedures

- Other procedures

By End Use

- Dental clinics

- Hospitals

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dental microsurgery market features key players such as Dentsply Sirona, Hu-Friedy, Global Surgical, B. Braun Melsungen, Institut Straumann, MediThinQ, Kerr, Henry Schein, Microsurgery Instruments, and Danaher. These companies focus on technological innovation, product diversification, and strategic collaborations to strengthen their global presence. Market leaders are investing heavily in research and development to introduce advanced optical systems, ergonomic microsurgical tools, and digital imaging solutions that enhance procedural precision. Strategic mergers, acquisitions, and partnerships are common strategies to expand distribution networks and product portfolios. Additionally, several players are prioritizing clinician training programs and after-sales support to increase product adoption. Competition is further intensifying with emerging manufacturers entering the market with cost-effective solutions, particularly in Asia Pacific and Latin America. Continuous innovation, combined with an emphasis on minimally invasive techniques and digital integration, remains central to maintaining a competitive edge in the evolving dental microsurgery market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dentsply Sirona

- Hu-Friedy

- Global Surgical

- Braun Melsungen

- Institut Straumann

- MediThinQ

- Kerr

- Henry Schein

- Microsurgery Instruments

- Danaher

Recent Developments

- In August 2025, Henry Schein and Henry Schein One launched “LinkIt™”, a seamless digital workflow for users of Dentrix® practice-management software to connect imaging/planning/design systems in the U.S. & Canada.

- In July 2025, B. Braun Melsungen AG published insights that its procurement transformation programme (Procure One) with partner H&Z is enhancing procurement efficiency and collaboration across more than 40,000 suppliers globally.

- In June 2025, Henry Schein, Inc. selected IFS Cloud to optimise global field-service operations, consolidate processes and move to a unified cloud platform.

- In July 2024, Danaher Corporation released its 2024 Sustainability Report which noted its supply-chain governance enhancements including supplier risk-assessment frameworks covering its direct-material suppliers.

- In September 2023, Dentsply Sirona and 3Shape announced expanded workflow integrations enabling dental professionals to use DS Core with 3Shape Unite in a scan-to-lab workflow

Report Coverage

The research report offers an in-depth analysis based on Product, Procedure, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The dental microsurgery market is expected to experience steady growth driven by increasing demand for minimally invasive dental treatments.

- Advancements in optical and digital imaging technologies will continue to enhance procedural accuracy and treatment outcomes.

- Growing awareness of oral health and preventive care will fuel adoption of microsurgical techniques among dental professionals.

- Expansion of dental tourism in emerging economies will create new opportunities for market participants.

- Integration of artificial intelligence, robotics, and 3D visualization will transform clinical workflows and enhance efficiency.

- Leading manufacturers will focus on strategic collaborations and product innovations to strengthen their global footprint.

- Training programs and skill development initiatives will expand the pool of qualified dental microsurgeons worldwide.

- Demand from private dental clinics will remain strong due to the preference for advanced, patient-centric procedures.

- Government support for oral healthcare infrastructure will boost adoption in developing regions.

- The market will evolve toward cost-effective and digitally integrated solutions, improving accessibility and global competitiveness.