Market Overview:

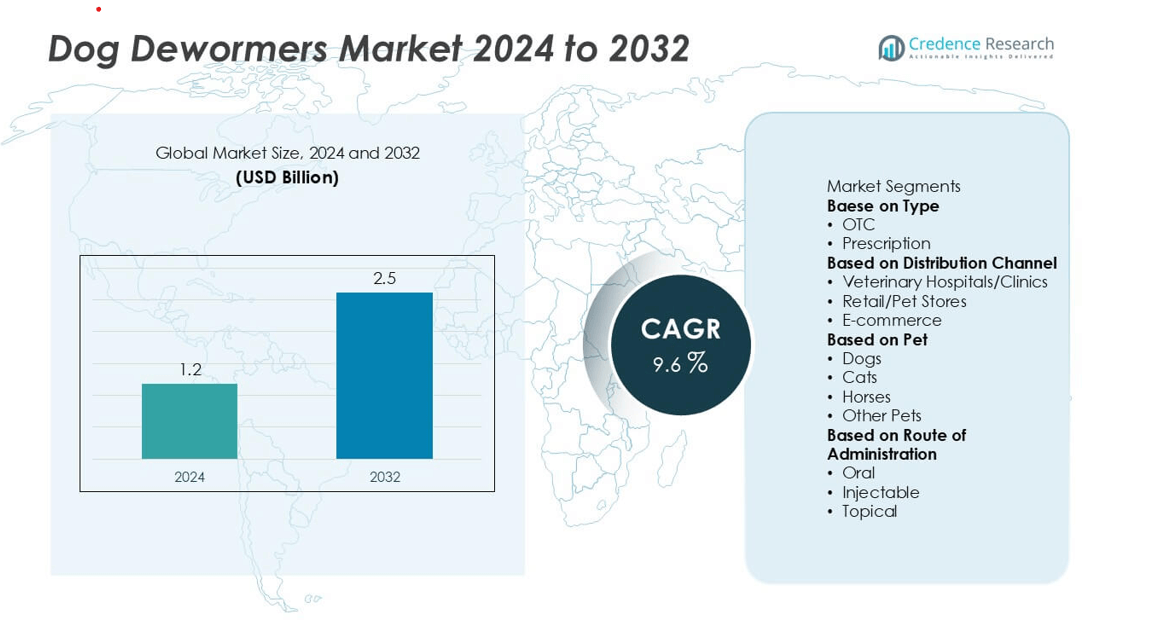

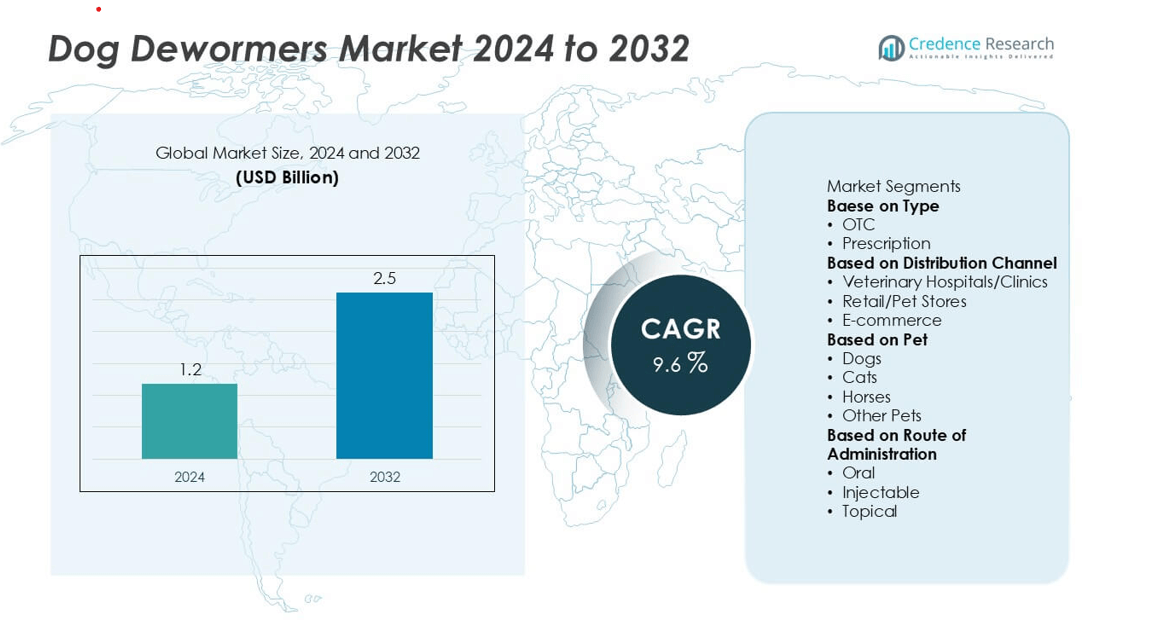

The global dog dewormers market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.5 billion by 2032, growing at a compound annual growth rate CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dog Dewormers Market Size 2024 |

USD 1.2 billion |

| Dog Dewormers Market, CAGR |

9.6% |

| Dog Dewormers Market Size 2032 |

USD 2.5 billion |

The dog dewormers market is highly competitive, with leading players including Elanco Animal Health, Hester Biosciences Limited, Zoetis, Ceva Sante Animale, Boehringer Ingelheim, Intas Pharmaceuticals Ltd., Vetoquinol, Merck & Co. Inc., Virbac, and Dechra Pharmaceuticals Plc. These companies dominate the global market through extensive product portfolios, veterinary partnerships, and continuous innovation in broad-spectrum and easy-to-administer formulations. North America leads the market with a 38% share in 2024, supported by advanced veterinary infrastructure, high pet ownership, and strong brand presence. Europe follows with 28%, driven by stringent health regulations and robust veterinary networks, while Asia Pacific emerges as the fastest-growing region due to rising pet adoption and expanding e-commerce penetration.

Market Insights

- The global dog dewormers market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.5 billion by 2032, registering a CAGR of 9.6% during the forecast period.

- Rising pet ownership, growing awareness of zoonotic diseases, and increased spending on preventive pet healthcare are driving market growth, with the OTC segment holding 62% share due to its easy availability and affordability.

- Key trends include the shift toward natural, broad-spectrum formulations and the rapid growth of e-commerce sales channels, enhancing accessibility and consumer convenience.

- The market is moderately consolidated, with major players such as Zoetis, Elanco Animal Health, Boehringer Ingelheim, and Merck & Co. Inc. leading through innovation, product expansion, and digital engagement.

- North America leads with 38% of the market, followed by Europe with 28% and Asia Pacific with 22%, driven by rising pet populations and improved veterinary infrastructure across emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The OTC (Over-the-Counter) segment dominated the dog dewormers market in 2024, accounting for around 62% of the total market share. Its leadership stems from the growing availability of non-prescription deworming products through retail and online platforms, coupled with increasing pet owner awareness of routine parasite prevention. OTC formulations are favored for their affordability, convenience, and ease of administration. Meanwhile, the prescription segment is expected to grow steadily, driven by rising veterinary recommendations for targeted parasite treatments and growing demand for advanced, veterinarian-approved formulations.

- For instance, the anthelminthic product, originally developed by Bayer and now sold as Drontal® by Vetoquinol in the European Economic Area and UK, and as Drontal® Plus by Elanco in other regions, contains the active ingredients praziquantel, pyrantel pamoate, and febantel, targeting several intestinal parasite species.

By Distribution Channel

The veterinary hospitals and clinics segment held the largest share of about 48% in 2024, driven by the credibility and trust associated with professional veterinary care. Pet owners increasingly rely on veterinarians for accurate diagnoses, dosage guidance, and premium deworming solutions, boosting sales through this channel. However, the e-commerce segment is expanding rapidly due to the convenience of online ordering, competitive pricing, and wide product accessibility. Retail and pet stores continue to contribute significantly, catering to impulse and routine purchases by pet owners seeking quick access to OTC products.

- For instance, Zoetis’s products, including its Simparica Trio and Revolution lines, are available through various authorized veterinary clinics and pharmacies, which can include both physical locations and online platforms like Chewy and PetMeds, where they are sold with a valid prescription.

By Pet

The dog segment accounted for the dominant share of nearly 55% in 2024, underpinned by the high global dog population and increased awareness of canine health management. Rising adoption rates and growing expenditure on pet healthcare further support this dominance. The cat segment follows closely, fueled by the rising number of feline owners and susceptibility of cats to internal parasites. While horses and other pets represent smaller market shares, these categories are gaining attention as awareness of parasite control among broader animal groups increases, supporting market expansion beyond household pets.

Key Growth Drivers

Rising Pet Ownership and Humanization of Pets

The rapid increase in global pet ownership, particularly dogs, continues to fuel demand for deworming products. As pets are increasingly regarded as family members, owners are prioritizing preventive healthcare and routine parasite control. This shift has led to higher spending on premium veterinary care and wellness products. Additionally, the growing adoption of rescue and shelter dogs, along with expanding urban pet populations, significantly boosts the frequency of deworming treatments, thereby driving sustained market growth.

- For instance, Boehringer Ingelheim’s NexGard portfolio achieved €1.2 billion in sales revenue in 2023, reflecting rising pet healthcare investment. The chewable formulation provides monthly protection against internal and external parasites using afoxolaner and milbemycin oxime.

Increasing Awareness of Zoonotic Diseases

Heightened awareness of zoonotic infections-diseases transmitted from animals to humans-is a major driver of the dog dewormers market. Pet owners and veterinary professionals are increasingly recognizing the importance of routine deworming to prevent parasites such as roundworms, hookworms, and tapeworms. Government health initiatives and educational campaigns by veterinary associations further reinforce the need for parasite control. This proactive approach toward zoonotic risk mitigation is encouraging the adoption of preventive deworming programs, strengthening market demand globally.

- For instance, Virbac promotes parasite prevention awareness through various initiatives and offers products like Effipro Duo, which is a combination of fipronil and pyriproxyfen designed to eliminate fleas and ticks and prevent flea multiplication in the pet’s environment.

Expansion of E-commerce and Veterinary Services

The rise of online retail platforms and improved access to veterinary services have transformed product availability and consumer reach. E-commerce channels enable pet owners to conveniently purchase a wide range of OTC deworming products, often at competitive prices. Meanwhile, growing veterinary infrastructure in emerging economies enhances access to professional diagnosis and prescription dewormers. This dual-channel expansion-online and clinical-supports both preventive and therapeutic product segments, driving consistent sales growth across developed and developing markets.

Key Trends & Opportunities

Shift Toward Natural and Broad-Spectrum Formulations

A growing trend toward natural, chemical-free, and broad-spectrum dewormers is reshaping the market landscape. Consumers increasingly prefer formulations that minimize side effects while targeting multiple parasites simultaneously. This has encouraged manufacturers to innovate using herbal or biologically derived ingredients. Furthermore, the development of advanced formulations combining multiple active compounds enhances treatment efficacy and convenience. The rising inclination toward sustainable and pet-safe products presents a significant opportunity for differentiation among market players.

- For instance, the veterinary pharmaceutical company KRKA developed the product line Fypryst, a range of spot-on and spray solutions containing the active chemical ingredient fipronil for flea and tick control in dogs and cats. Fypryst products work by disrupting the central nervous system of parasites, providing effective control against fleas and ticks.

Growth in Preventive Healthcare and Subscription Models

The shift from reactive to preventive pet healthcare is a key market opportunity. Pet owners are adopting routine parasite prevention programs rather than waiting for infections to occur. Subscription-based models offering periodic dewormer deliveries and reminders are gaining traction, ensuring treatment compliance and recurring revenue streams for manufacturers. This approach strengthens customer loyalty and aligns with the growing emphasis on consistent pet wellness management, providing a long-term growth avenue for industry participants.

- For instance, Ceva Santé Animale engages in numerous collaborations and has recently concluded its 2024 Call For Projects, which identified several innovative digital health solutions designed to enhance pet care.

Key Challenges

Growing Risk of Anthelmintic Resistance

The emergence of drug-resistant parasite strains poses a critical challenge to the dog dewormers market. Overuse and misuse of deworming medications, especially in OTC products, contribute to reduced drug efficacy. This growing resistance undermines treatment reliability and necessitates continuous research into novel active ingredients. Manufacturers face increasing pressure to develop innovative, resistance-mitigating formulations while ensuring regulatory compliance. Without effective intervention, anthelmintic resistance could significantly constrain long-term market growth.

Regulatory Complexity and Compliance Costs

Stringent regulatory frameworks governing veterinary pharmaceuticals can delay product approvals and increase compliance expenses. Variations in regional regulations, labeling requirements, and safety assessments complicate market entry for new formulations. Smaller manufacturers, in particular, face financial and administrative hurdles in meeting global quality and safety standards. These challenges can slow innovation and restrict access to certain markets, emphasizing the need for harmonized regulatory policies to support sustainable industry development.

Regional Analysis

North America

North America held the largest share of around 38% of the global dog dewormers market in 2024, driven by high pet ownership rates, strong veterinary infrastructure, and growing awareness of pet health. The United States dominates regional demand due to the widespread use of preventive healthcare products and established veterinary guidelines promoting routine deworming. Increasing expenditure on pet wellness and the presence of major pharmaceutical companies further strengthen market growth. Additionally, rising adoption of advanced formulations and online retail channels supports continued expansion across the U.S. and Canada during the forecast period.

Europe

Europe accounted for about 28% of the global market share in 2024, supported by strong regulatory frameworks and high awareness of zoonotic disease prevention. The region benefits from well-established veterinary care networks and government initiatives promoting responsible pet ownership. The United Kingdom, Germany, and France represent key markets, driven by increasing demand for prescription-based and natural deworming products. Growing urban pet populations and the trend toward premium pet care solutions further enhance market growth. The presence of major global and regional brands ensures competitive innovation and steady adoption across European countries.

Asia Pacific

The Asia Pacific region captured around 22% of the dog dewormers market in 2024 and is expected to register the fastest growth during the forecast period. Rising pet adoption in countries such as China, India, Japan, and Australia is driving strong demand for affordable and effective deworming products. Increasing disposable incomes and expanding veterinary service access further boost market penetration. Additionally, heightened awareness of parasite-related health risks and rapid digitalization of pet product sales are fostering e-commerce growth. The region’s growing middle-class population and evolving pet care culture continue to create substantial market opportunities.

Latin America

Latin America represented around 7% of the global market share in 2024, with Brazil and Mexico being key contributors. Expanding pet ownership, particularly among urban households, and increasing awareness of preventive veterinary care are propelling market growth. Local manufacturers and distributors are introducing affordable deworming solutions to cater to the price-sensitive consumer base. Although the region’s market remains fragmented, rising partnerships between veterinary clinics and pharmaceutical firms are improving product accessibility. Continued efforts to educate pet owners on parasite prevention and improved veterinary infrastructure are expected to sustain moderate growth in the coming years.

Middle East & Africa

The Middle East & Africa region held about 5% of the global dog dewormers market in 2024, reflecting steady but growing demand. Rising awareness of animal health and a gradual increase in pet ownership, especially in urban centers such as the UAE and South Africa, are supporting market expansion. Limited veterinary access and lower income levels in certain areas currently restrain broader adoption. However, ongoing investments in veterinary healthcare infrastructure and the entry of international pet care brands are gradually improving product availability, positioning the region for consistent growth through the forecast period.

Market Segmentations:

By Type

By Distribution Channel

- Veterinary Hospitals/Clinics

- Retail/Pet Stores

- E-commerce

By Pet

- Dogs

- Cats

- Horses

- Other Pets

By Route of Administration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dog dewormers market is characterized by the presence of major players such as Bayer AG, Boehringer Ingelheim, Elanco Animal Health, Zoetis Inc., Virbac, Ceva Santé Animale, Vetoquinol, and Merck Animal Health. These companies collectively dominate a substantial share of the global market through extensive product portfolios, strong distribution networks, and ongoing investments in research and development. Strategic initiatives such as product innovations, mergers, and veterinary partnerships strengthen their market positions. Players are focusing on developing broad-spectrum, easy-to-administer formulations to enhance pet owner compliance and treatment outcomes. Additionally, the growing prominence of e-commerce distribution channels has prompted key manufacturers to strengthen their digital presence. Intense competition drives continuous innovation, while smaller regional players contribute by offering cost-effective, locally tailored deworming solutions. Overall, market participants emphasize quality assurance, regulatory compliance, and brand loyalty to maintain a competitive edge in an expanding global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Merck & Co., Inc. (via its Merck Animal Health division) presented new data at the WAAVP congress highlighting improved parasite-prevention/treatment options for dogs.

- In January 2025, Elanco Animal Health launched Credelio Quattro™, a monthly chewable tablet for dogs covering roundworms, hookworms, tapeworms, heartworms, ticks and fleas.

- In April 2024, Boehringer Ingelheim introduced NexGard SPECTRA® in India, a monthly chewable for dogs targeting internal worms plus external parasites such as fleas & ticks

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channel, Pet, Route of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The dog dewormers market will continue to grow steadily, supported by rising global pet ownership and increasing awareness of preventive healthcare.

- Technological advancements will lead to the development of more effective, broad-spectrum, and easy-to-administer deworming formulations.

- E-commerce platforms will play a crucial role in expanding product accessibility and consumer reach worldwide.

- Veterinary hospitals and clinics will maintain dominance as trusted distribution channels, supported by growing professional pet care services.

- Natural and herbal-based dewormers will gain popularity as consumers seek safer and more sustainable treatment options.

- Manufacturers will invest heavily in research to address growing concerns over anthelmintic resistance.

- Asia Pacific will emerge as the fastest-growing regional market, driven by economic development and increased pet healthcare spending.

- Regulatory harmonization across regions will simplify product approvals and encourage market expansion.

- Subscription-based deworming programs will enhance treatment compliance and customer retention.

- Strategic collaborations, mergers, and product innovations will remain key competitive strategies for market leaders.