Market Overview:

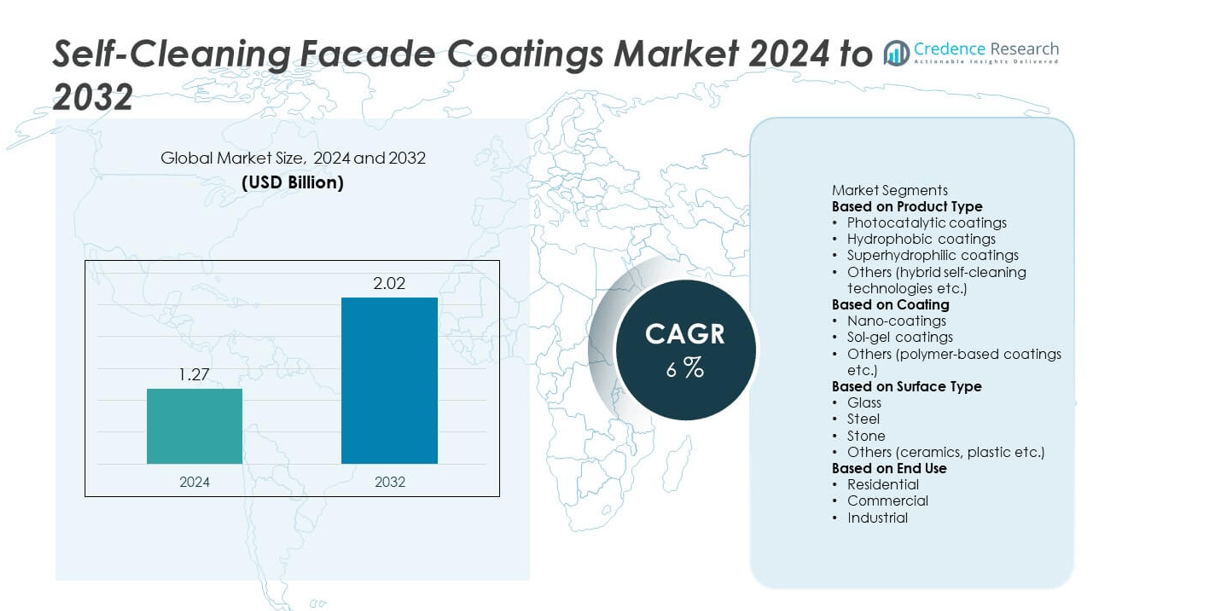

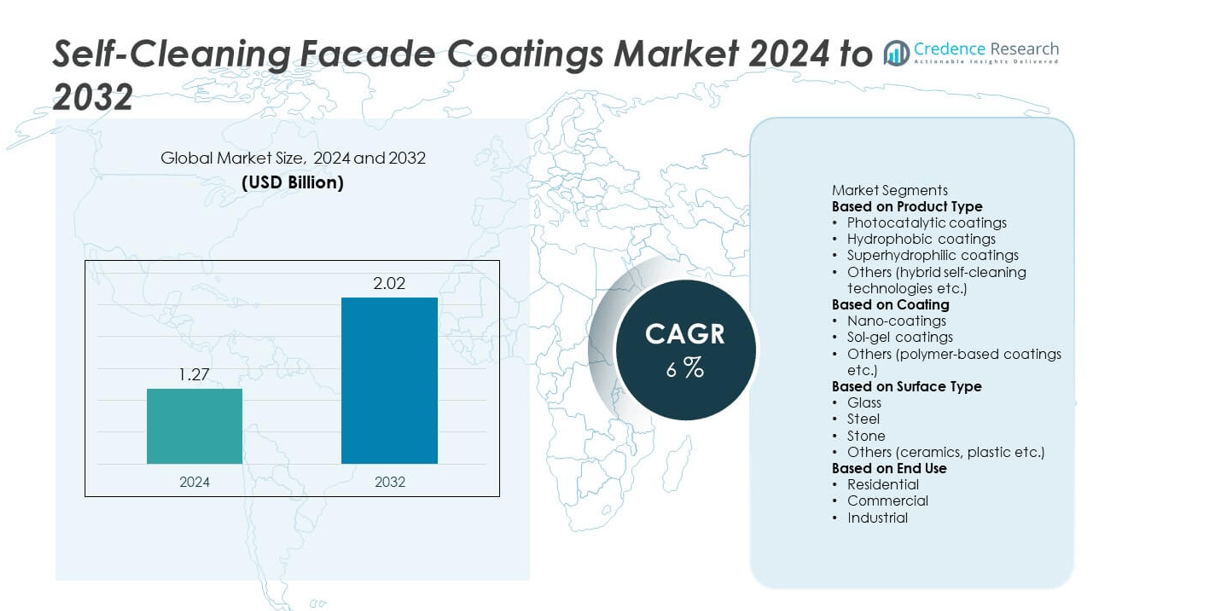

The self-cleaning facade coatings market was valued at USD 1.27 billion in 2024 and is projected to reach USD 2.02 billion by 2032, registering a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Self-Cleaning Facade Coatings Market Size 2024 |

USD 1.27 billion |

| Self-Cleaning Facade Coatings Market, CAGR |

6% |

| Self-Cleaning Facade Coatings Market Size 2032 |

USD 2.02 billion |

The self-cleaning facade coatings market is led by major players including AkzoNobel, BASF, PPG Industries, Jotun, Hempel, Beckers Group, Brillux, FN Nano, Dow, and Mavro. These companies dominate through advanced product portfolios focused on photocatalytic, hydrophobic, and nano-based technologies that enhance surface durability and energy efficiency. Strategic partnerships and R&D investments strengthen their positions in sustainable construction applications. Europe leads the market with a 32.6% share, driven by strong green building policies and architectural innovation, followed by North America at 28.4% and Asia-Pacific at 27.9%, supported by smart city developments and infrastructure modernization projects.

Market Insights

- The self-cleaning facade coatings market was valued at USD 1.27 billion in 2024 and is projected to reach USD 2.02 billion by 2032, growing at a CAGR of 6.0% during the forecast period.

- Rising demand for sustainable and low-maintenance building materials is driving adoption, with photocatalytic coatings holding a 46.8% share in 2024 due to superior self-cleaning and air-purifying performance.

- Advancements in nanotechnology and hybrid coating formulations are shaping market trends, enhancing durability, UV resistance, and transparency for glass and steel façades.

- The market is highly competitive, with key players such as AkzoNobel, BASF, PPG Industries, Jotun, and Hempel focusing on innovation, eco-friendly solutions, and regional expansion to strengthen their global footprint.

- Regionally, Europe leads with a 32.6% share, followed by North America at 28.4% and Asia-Pacific at 27.9%, driven by rapid urbanization and growth in smart infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The photocatalytic coatings segment dominated the self-cleaning facade coatings market in 2024 with a 46.8% share. These coatings use titanium dioxide (TiO₂) to break down organic pollutants and reduce surface maintenance, driving their adoption in modern architectural facades. Their strong UV-activated cleaning mechanism and air-purifying capability make them ideal for urban and high-rise applications. Growing emphasis on sustainable and low-maintenance building materials across commercial infrastructure projects continues to strengthen this segment’s leadership, while hydrophobic and superhydrophilic coatings gain traction for niche applications.

- For instance, Saint-Gobain’s “Glassolutions” range employs TiO₂ coatings to provide self-cleaning and air-purifying functions for commercial buildings, reducing maintenance costs over time.

By Coating

The nano-coatings segment accounted for the largest market share of 54.2% in 2024, supported by superior durability and self-cleaning efficiency at the nanoscale. Nano-engineered layers enhance transparency, resistance to dirt accumulation, and long-term performance, making them highly preferred for glass and steel surfaces. Expanding applications in smart cities and green construction projects are fueling their use. Additionally, advancements in sol-gel coating technologies are driving innovation toward multi-functional coatings with anti-corrosive and UV-resistant properties, though they still trail behind nano-coatings in adoption rate.

- For instance, PPG Industries has developed nano-coatings that improve corrosion resistance and UV protection for architectural glass, supporting sustainable building initiatives.

By Surface Type

The glass surface segment held the dominant share of 48.6% in 2024, driven by extensive use in commercial towers, residential complexes, and public buildings. Self-cleaning coatings on glass minimize manual cleaning costs and maintain optical clarity, particularly in high-rise structures. Growing deployment of energy-efficient glazing and façade modernization initiatives in Asia-Pacific and Europe are further supporting growth. Steel and stone surfaces also show rising demand as construction projects integrate self-cleaning technologies for aesthetic preservation and maintenance reduction in both interior and exterior designs.

Key Growth Drivers

Rising Adoption of Green and Sustainable Construction

The growing preference for eco-friendly and energy-efficient buildings is a major driver for self-cleaning facade coatings. These coatings minimize water usage and reduce chemical-based cleaning needs, supporting green certification goals such as LEED and BREEAM. Increasing awareness among builders and architects about sustainable materials boosts demand. Urban infrastructure projects in Europe and Asia-Pacific increasingly integrate self-cleaning coatings to achieve long-term cost savings and lower environmental footprints, reinforcing their adoption across commercial and residential structures.

- For instance, AkzoNobel introduced the world’s first coil-applied self-cleaning facade coating at WINDOOR 2025, which cuts washing costs by 70% and preserves facade color gloss for 25 years, proving its durability in polluted or coastal environments and supporting sustainable building maintenance.

Advancements in Nanotechnology-Based Coatings

Continuous innovation in nanotechnology enhances the efficiency and durability of self-cleaning coatings. Nanoparticles improve photocatalytic reactions and hydrophobic behavior, enabling surfaces to repel dust and degrade organic matter effectively. Manufacturers are developing advanced TiO₂ and silica-based nanostructures to ensure high transparency and long-lasting protection. The growing use of nano-coatings in smart façades and glass panels across airports, skyscrapers, and institutional buildings is significantly expanding the market’s technological edge and value proposition.

- For instance, Pilkington Group introduced its Activ™ self-cleaning glass, utilizing a unique silica-based nano-coating that enables glass panels to break down organic dirt and repel water, now widely installed in institutional buildings and airports.

Increasing Urbanization and Infrastructure Investment

Rapid urbanization and rising infrastructure development are fueling the adoption of self-cleaning facade coatings worldwide. Governments and private sectors are investing heavily in commercial complexes, transportation hubs, and public buildings requiring aesthetic and maintenance-efficient materials. The coatings reduce manual cleaning costs and extend surface lifespan, which appeals to large-scale urban projects. Asia-Pacific, in particular, shows accelerated growth due to smart city programs and increased construction of energy-efficient buildings across China, India, and Southeast Asia.

Key Trends & Opportunities

Integration with Smart Building Technologies

Self-cleaning coatings are increasingly incorporated into smart façade systems with integrated monitoring and environmental control. These technologies optimize surface temperature, light reflection, and pollution degradation. The trend aligns with the rise of IoT-enabled building management systems aimed at reducing operational costs. Manufacturers are exploring sensor-linked coatings that signal cleaning effectiveness or degradation levels, offering new revenue opportunities in automated maintenance and predictive performance analytics.

- For instance, Staticus Care has pioneered IoT-enabled façades embedded with sensors that collect real-time data on thermal and air quality performance, facilitating predictive maintenance and enhanced resource management.

Shift Toward Hybrid and Multifunctional Coatings

Manufacturers are focusing on hybrid coatings that combine photocatalytic, hydrophobic, and antimicrobial properties. This multifunctional approach improves performance in diverse environmental conditions and broadens application across materials such as glass, steel, and concrete. Hybrid solutions also enhance UV resistance and chemical durability. As demand for long-lasting and self-regenerative surfaces rises, these innovations create opportunities for customized coatings tailored to regional climates and building types.

- For instance, Alistagen Corporation’s Caliwel BNA is an EPA-approved antimicrobial coating with a microencapsulated calcium hydroxide formula that remains effective against over 20 microbes, including influenza, for up to six years, providing long-lasting protection on surfaces like glass and concrete.

Key Challenges

High Production and Application Costs

The complex manufacturing process and high raw material costs limit the affordability of self-cleaning coatings. Nanomaterials like titanium dioxide and silica demand advanced synthesis methods and specialized application equipment, raising expenses. These costs restrict adoption in low- and mid-scale projects, particularly in developing economies. To overcome this, manufacturers are working on scalable sol-gel and spray coating methods to reduce processing costs without compromising performance quality.

Performance Limitations in Polluted and Shaded Environments

The effectiveness of photocatalytic coatings depends on light exposure and environmental conditions. In shaded or highly polluted urban areas, coatings may underperform due to limited UV activation and particle buildup. This limits their use in densely constructed zones. Manufacturers are developing visible-light-activated formulations to maintain cleaning efficiency in low-light settings. However, balancing long-term durability and cost remains a challenge, hindering full-scale market penetration in such regions.

Regional Analysis

North America

North America held a 28.4% share of the self-cleaning facade coatings market in 2024, driven by strong demand for sustainable and low-maintenance building materials. The U.S. leads regional adoption due to widespread use in commercial skyscrapers, airports, and institutional buildings. Government emphasis on green building standards and energy efficiency further supports market growth. Leading construction firms and coating manufacturers are investing in advanced photocatalytic and nano-based products. Increasing renovation projects in major cities like New York and Toronto continue to expand the application of self-cleaning coatings in modern architecture.

Europe

Europe accounted for a 32.6% share in 2024, emerging as the leading region in the self-cleaning facade coatings market. The region’s dominance stems from stringent environmental regulations, strong adoption of green architecture, and high investment in smart city infrastructure. Countries such as Germany, the UK, France, and Italy are leading users of photocatalytic coatings in glass façades and public infrastructure. The EU’s commitment to reducing carbon emissions and promoting eco-friendly materials strengthens market growth. Innovation in sol-gel and hybrid coating technologies continues to enhance performance and expand regional market penetration.

Asia-Pacific

Asia-Pacific captured a 27.9% share in 2024 and is projected to register the fastest growth through 2032. Rapid urbanization, infrastructure development, and government-led smart city initiatives in China, India, and Japan drive regional demand. Rising construction of commercial towers and residential complexes fuels the adoption of self-cleaning coatings to lower maintenance costs. Local producers are focusing on cost-effective nano-coating formulations to meet growing demand. Increasing environmental awareness and the expansion of energy-efficient building codes further accelerate adoption across key economies within the region.

Latin America

Latin America represented a 6.1% share of the global market in 2024, supported by rising investment in commercial and hospitality infrastructure. Brazil and Mexico lead the adoption due to growth in urban construction and sustainable design initiatives. The region’s humid climate also supports the demand for hydrophobic and hybrid coatings that resist water and dirt accumulation. However, limited awareness and higher coating costs pose challenges. Ongoing partnerships between local developers and international coating manufacturers are improving product accessibility and expanding regional adoption in both new and retrofit building projects.

Middle East & Africa

The Middle East & Africa region accounted for a 5.0% share in 2024, driven by large-scale infrastructure and real estate developments. Countries such as the UAE, Saudi Arabia, and South Africa are incorporating self-cleaning coatings in glass and steel façades to combat dust and heat. Government investments in sustainable construction and smart city projects boost market growth. Harsh climatic conditions increase the demand for durable hydrophobic coatings. The region’s expanding architectural modernization efforts and growing preference for maintenance-efficient materials continue to create significant opportunities for global and regional coating suppliers.

Market Segmentations:

By Product Type

- Photocatalytic coatings

- Hydrophobic coatings

- Superhydrophilic coatings

- Others (hybrid self-cleaning technologies etc.)

By Coating

- Nano-coatings

- Sol-gel coatings

- Others (polymer-based coatings etc.)

By Surface Type

- Glass

- Steel

- Stone

- Others (ceramics, plastic etc.)

By End Use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the self-cleaning facade coatings market is characterized by the strong presence of key players such as AkzoNobel, BASF, PPG Industries, Jotun, Hempel, Beckers Group, Brillux, FN Nano, Dow, and Mavro. These companies focus on developing advanced nanotechnology-based and hybrid coating solutions that enhance durability, UV resistance, and self-cleaning efficiency. Strategic collaborations, product launches, and sustainable innovation are central to their growth strategies. Leading firms are investing heavily in R&D to expand applications across glass, steel, and stone surfaces. Regional players are also entering the market with cost-effective formulations to meet local construction demands. Continuous technological advancement and adoption of green building standards are intensifying competition among global and regional participants, driving further market consolidation and innovation across product lines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, PPG Industries, Inc. introduced its PPG ENVIROLUXE™ Plus powder coatings, featuring up to 18% recycled plastic content and a 30% lower carbon footprint compared to conventional products. Designed without PFAS, this innovation supports sustainable exterior and façade applications.

- In October 2025, AkzoNobel N.V. launched the world’s first coil-applied self-cleaning façade coating at the WINDOOR 2025 Expo. The hydrophilic resin-based formulation reduces façade washing requirements by around 70% while maintaining color and gloss for up to 25 years under harsh environmental conditions.

- In September 2025, AkzoNobel, BASF SE, and Arkema S.A. expanded their sustainability partnership to lower the carbon footprint of AkzoNobel’s Interpon D architectural powder coatings by up to 40%, integrating bio-based raw materials and advanced lifecycle data.

- In April 2024, Henkel AG completed the acquisition of Seal for Life Industries LLC, strengthening its portfolio of protective coating and sealing solutions for infrastructure and architectural applications

Report Coverage

The research report offers an in-depth analysis based on Product Type, Coating, Surface Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and low-maintenance building materials will continue to rise.

- Nanotechnology-based coatings will gain wider adoption for enhanced performance and durability.

- Hybrid self-cleaning coatings combining photocatalytic and hydrophobic properties will become more common.

- Smart façade integration with IoT monitoring systems will create new application opportunities.

- Construction of energy-efficient and green-certified buildings will drive consistent market growth.

- Asia-Pacific will witness the fastest expansion due to urbanization and smart city projects.

- Manufacturers will focus on developing visible-light-activated coatings for shaded environments.

- Collaboration between coating producers and construction firms will increase innovation speed.

- Regulatory support for sustainable materials will further accelerate market penetration.

- Cost reduction in nano-coating production will expand accessibility across mid-scale projects.