Market Overview:

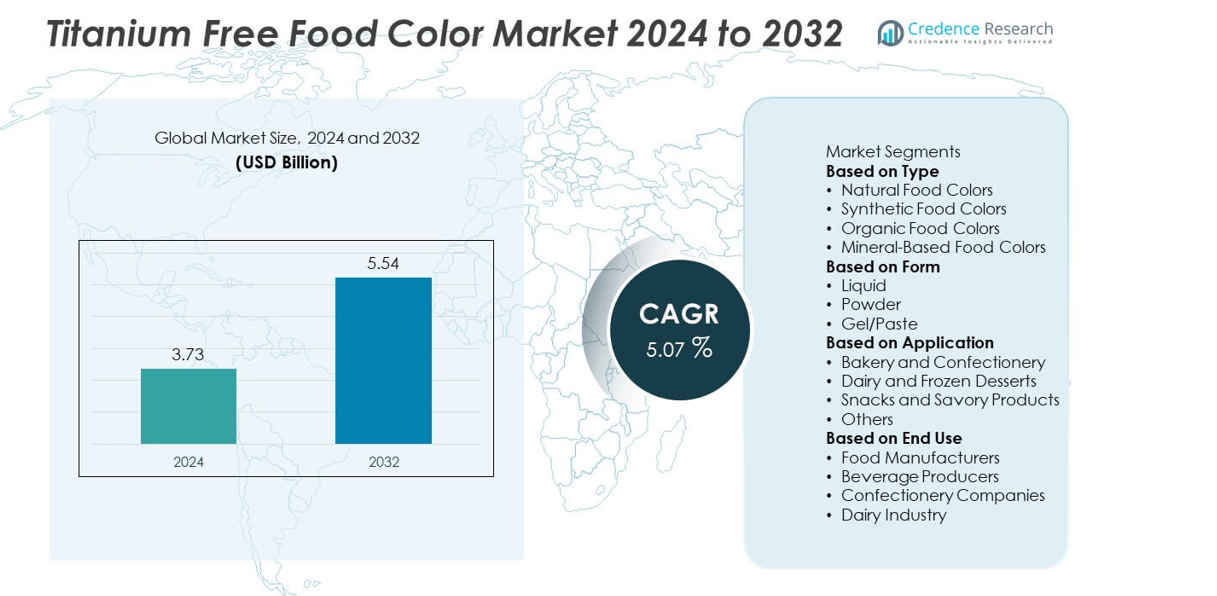

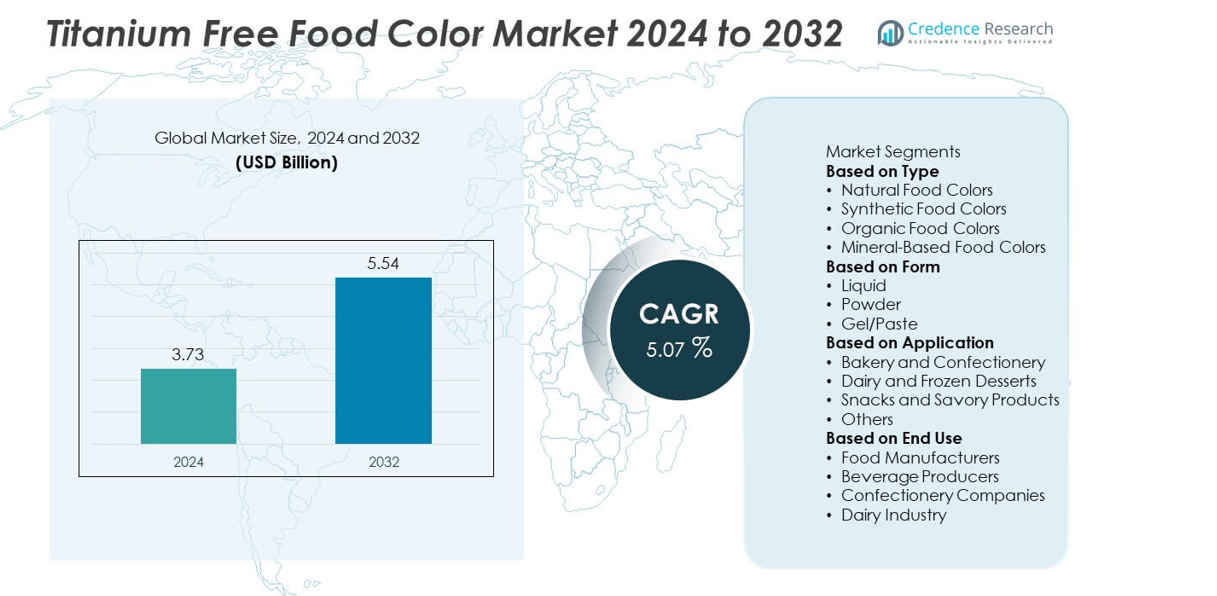

The Titanium Free Food Color market was valued at USD 3.73 billion in 2024 and is projected to reach USD 5.54 billion by 2032, expanding at a CAGR of 5.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Titanium Free Food Color Market Size 2024 |

USD 3.73 billion |

| Titanium Free Food Color Market, CAGR |

5.07% |

| Titanium Free Food Color Market Size 2032 |

USD 5.54 billion |

The Titanium Free Food Color market is led by major players including ADM, Givaudan S.A., Sensient Technologies Corporation, DDW The Color House, Chr. Hansen Holding A/S, Kalsec Inc., Naturex S.A., Roha Dyechem Pvt. Ltd., Döhler Group, and Symrise AG. These companies are advancing product innovation through natural pigment extraction, microencapsulation, and clean-label solutions. North America dominated the market in 2024 with a 36.8% share, driven by strong regulatory compliance and consumer demand for natural, titanium-free alternatives. Europe followed with a 33.2% share, supported by the titanium dioxide ban and growing adoption of plant-based, sustainable coloring systems across food and beverage manufacturing.

Market Insights

- The Titanium Free Food Color market was valued at USD 3.73 billion in 2024 and is projected to reach USD 5.54 billion by 2032, growing at a CAGR of 5.07%.

- Market growth is driven by increasing demand for clean-label, natural, and plant-based food colorants as manufacturers replace titanium dioxide due to safety concerns and regulatory restrictions.

- Key trends include innovations in pigment extraction, encapsulation technologies, and the expansion of mineral and fruit-based coloring ingredients to enhance product stability and brightness.

- Leading players such as ADM, Givaudan, Sensient, Chr. Hansen, and Döhler focus on sustainable sourcing, regional expansion, and partnerships to strengthen global market presence.

- Regionally, North America holds 36.8% share, followed by Europe with 33.2%, while the natural food colors segment dominates with 43.8% share, supported by high consumer preference for chemical-free, titanium-free formulations in bakery and confectionery products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The natural food colors segment dominated the Titanium Free Food Color market in 2024, holding a 43.8% share. The shift away from titanium dioxide in response to regulatory restrictions and health concerns has accelerated the use of natural pigments derived from plants, fruits, and vegetables. Growing consumer preference for clean-label and chemical-free ingredients supports strong adoption in bakery, beverage, and dairy applications. Natural alternatives such as spirulina, beetroot, turmeric, and anthocyanins offer stable coloring while aligning with sustainable and transparent production trends across global food industries.

- For instance, Chr. Hansen’s FruitMax® range includes a spirulina extract standardized at 6 g/L phycocyanin concentration, providing consistent blue shades in confectionery and dairy. Independent stability tests showed less than 5 % pigment degradation after 30 days at 40 °C, confirming its performance as a titanium-free replacement under extended storage conditions.

By Form

The powder segment led the Titanium Free Food Color market in 2024 with a 49.5% share. Powdered formulations are preferred for their long shelf life, high stability, and easy blending across dry food mixes and confectionery applications. They provide better consistency and storage efficiency compared to liquid or gel forms. The rise of processed foods and packaged snacks has fueled demand for powder-based colorants that maintain vibrancy under varying temperatures. Additionally, powdered natural pigments are gaining popularity among manufacturers seeking convenient, titanium-free alternatives that retain visual appeal and performance in bulk production.

- For instance, Sensient Technologies’ Avalanche™ Ultra powder system delivers light reflectance above 85 L* on the CIELAB scale while maintaining particle size under 10 µm. Performance evaluation in bakery coatings recorded full opacity at only 0.25 g per kg of mix, demonstrating the formulation’s efficiency and dispersion control without titanium dioxide.

By Application

The bakery and confectionery segment accounted for the largest 38.6% share of the Titanium Free Food Color market in 2024. Its dominance is driven by widespread use of coloring agents in cakes, candies, chocolates, and pastries to enhance visual appeal and brand differentiation. The ban on titanium dioxide in the European Union has prompted confectionery manufacturers to switch to fruit and plant-based colorants. Increasing consumer preference for clean-label sweets and bakery items further accelerates the transition toward natural and mineral-based color systems, ensuring safety compliance and meeting regulatory and consumer transparency standards.

Key Growth Drivers

Rising Demand for Clean-Label and Natural Ingredients

The growing consumer awareness about health and ingredient transparency is a major driver of the Titanium Free Food Color market. Shoppers increasingly prefer natural and plant-derived colorants over synthetic or titanium dioxide-based alternatives. Food manufacturers are reformulating products with clean-label ingredients to meet this demand. Regulatory restrictions on titanium dioxide in regions like Europe further encourage adoption of safer, natural substitutes such as spirulina, beetroot, and turmeric extracts. This shift supports sustained growth across bakery, confectionery, and beverage applications.

- For instance, Döhler Group’s natural white formulation derived from rice starch and calcium carbonate contains 1.2 g of mineral solids per 100 g of base powder. Stability tests conducted in yogurt and beverage applications recorded over 90 % light reflectance after 60 days at 25 °C, confirming its performance as a titanium-free, clean-label whitening alternative.

Stringent Food Safety and Regulatory Standards

Tightening global food safety regulations significantly drive the transition to titanium-free colorants. The European Food Safety Authority (EFSA) and other regulatory bodies have raised concerns over titanium dioxide’s safety, prompting its removal from approved additives. Manufacturers are proactively replacing it with natural pigments to maintain compliance and consumer trust. These regulatory measures are accelerating investment in R&D for stable and safe alternatives that meet both performance and labeling requirements. This compliance-driven transformation continues to reshape the global food coloring landscape.

- For instance, Givaudan’s Vegebrite® White is a rice starch-based alternative designed to replace titanium dioxide in applications where functional opacity is required, such as panned candies. The product helps manufacturers formulate clean-label products that comply with regulatory standards for natural food colorings, including those in the EU, following the restrictions on titanium dioxide (E171) use.

Growing Innovation in Natural Color Extraction and Stability

Advancements in pigment extraction, encapsulation, and stabilization are boosting the performance of titanium-free food colorants. Manufacturers are investing in technologies that enhance color intensity, heat stability, and pH resistance of natural pigments. Microencapsulation and emulsion-based delivery systems are helping improve product consistency across different food matrices. These innovations make natural alternatives more suitable for high-processing applications such as baked goods, dairy, and beverages. The focus on improving shelf life and color retention is enabling broader adoption of natural coloring solutions worldwide.

Key Trends & Opportunities

Expansion of Plant and Mineral-Based Color Sources

The industry is witnessing a surge in the use of plant and mineral-derived colorants as titanium-free alternatives. Ingredients sourced from fruits, vegetables, algae, and minerals are gaining traction for their safety and sustainability. Manufacturers are exploring sources like spirulina for blue, beetroot for red, and turmeric for yellow shades. The shift aligns with the clean-label movement and the demand for naturally functional food ingredients. This diversification of raw materials presents opportunities for innovation and regional supply chain expansion.

- For instance, Kalsec Inc. developed its Durabrite™ Blue Spirulina Extract standardized at 8.5 g/L phycocyanin concentration, offering consistent color intensity across beverage and confectionery applications. Shelf-life testing confirmed color stability for 180 days under pH 4.2 conditions, demonstrating the extract’s suitability as a heat-tolerant, titanium-free pigment for plant-based formulations.

Increasing Adoption in Processed and Packaged Foods

The rising consumption of ready-to-eat and packaged foods creates new opportunities for titanium-free colorants. Food manufacturers are focusing on visual appeal without compromising safety or natural positioning. Titanium-free pigments provide vibrant hues suitable for snacks, dairy products, and confectionery while meeting health-conscious consumer expectations. As global food processing continues to expand, titanium-free formulations are becoming a standard feature in reformulated and premium product lines, ensuring compliance with both regulatory and market-driven demands.

- For instance, Roha Dyechem Pvt. Ltd. offers the Niveous range as a natural alternative to titanium dioxide, utilizing rice-derived ingredients and calcium carbonate to achieve a white color. The Niveous products have demonstrated good stability in various food applications, including bakery items, where they maintain whiteness under high-temperature baking conditions.

Key Challenges

Higher Production Costs of Natural Colorants

Producing titanium-free natural colorants involves complex extraction and processing methods, leading to higher production costs. The need for large quantities of raw plant material and specialized stabilization technology increases overall expenses. These factors limit accessibility for small and mid-scale manufacturers. Although natural colorants provide long-term benefits in brand positioning and compliance, cost constraints remain a key barrier in price-sensitive markets. Industry players are focusing on scaling production and improving extraction efficiency to reduce costs and support wider market adoption.

Limited Color Stability and Compatibility Issues

Despite advancements, titanium-free colorants often face challenges related to stability and compatibility under varying temperature, light, and pH conditions. Natural pigments can fade or change shade during processing and storage, affecting product appearance. This limits their use in certain applications like beverages and baked goods that require high stability. Manufacturers are investing in encapsulation and blending technologies to overcome these issues. However, maintaining consistent color performance across diverse food categories remains a technical challenge in the market’s growth trajectory.

Regional Analysis

North America

North America held the largest share of 36.8% in the Titanium Free Food Color market in 2024. The region’s dominance is driven by strong consumer demand for clean-label, non-toxic, and natural food products. Manufacturers in the U.S. and Canada are actively reformulating products to replace titanium dioxide with plant and mineral-based pigments. Stringent FDA regulations and growing health awareness further support this transition. The widespread use of titanium-free colorants in bakery, confectionery, and dairy products enhances regional growth. Leading companies are also investing in research to improve pigment stability and expand sustainable sourcing.

Europe

Europe accounted for 33.2% share of the global Titanium Free Food Color market in 2024. The ban on titanium dioxide by the European Food Safety Authority (EFSA) significantly accelerated adoption of natural and mineral-based colorants. Countries such as Germany, France, and the U.K. lead in product innovation and clean-label reformulation. The region’s mature food processing industry and consumer preference for organic ingredients strengthen market demand. Increasing collaborations between pigment suppliers and food producers are enhancing product stability and expanding the use of titanium-free formulations across packaged foods and confectionery products.

Asia Pacific

Asia Pacific captured 21.6% share of the Titanium Free Food Color market in 2024. Rapid population growth, rising disposable incomes, and increasing health awareness are fueling the shift toward natural additives. Countries such as China, India, and Japan are seeing strong adoption of titanium-free colors across bakery, beverage, and snack categories. Expanding processed food industries and government focus on food safety standards drive regional growth. Local manufacturers are also leveraging cost-effective natural raw materials like turmeric, paprika, and beetroot, supporting the production of affordable titanium-free coloring alternatives.

Latin America

Latin America represented 5.1% share of the Titanium Free Food Color market in 2024. Growth in Brazil, Mexico, and Argentina is supported by rising consumer awareness of food safety and natural product benefits. Regional food manufacturers are reformulating confectionery and snack items to comply with evolving regulatory frameworks. The shift toward sustainable and plant-derived ingredients is gaining momentum among premium brands. However, limited access to advanced extraction technology and higher production costs slow widespread adoption. Increased collaboration with global suppliers is expected to strengthen the market presence over the forecast period.

Middle East & Africa

The Middle East & Africa accounted for 3.3% share in the Titanium Free Food Color market in 2024. The region’s growth is supported by expanding food and beverage industries and growing consumer preference for clean-label products. Countries such as the UAE and Saudi Arabia lead in adopting titanium-free colorants in bakery, beverage, and confectionery applications. Rising health awareness and alignment with international food safety regulations further promote demand. However, limited local production and reliance on imported natural colorants continue to pose challenges, making cost optimization and supply chain expansion key strategic priorities.

Market Segmentations:

By Type

- Natural Food Colors

- Synthetic Food Colors

- Organic Food Colors

- Mineral-Based Food Colors

By Form

By Application

- Bakery and Confectionery

- Dairy and Frozen Desserts

- Snacks and Savory Products

- Others

By End Use

- Food Manufacturers

- Beverage Producers

- Confectionery Companies

- Dairy Industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Titanium Free Food Color market includes key players such as ADM (Archer Daniels Midland Company), Givaudan S.A., Sensient Technologies Corporation, DDW The Color House, Chr. Hansen Holding A/S, Kalsec Inc., Naturex S.A., Roha Dyechem Pvt. Ltd., Döhler Group, and Symrise AG. These companies compete through continuous innovation, sustainable sourcing, and expansion of clean-label product portfolios. Leading players focus on developing stable, plant-based pigments that replace titanium dioxide without compromising color vibrancy or performance. Strategic partnerships with food manufacturers, along with investments in extraction and encapsulation technologies, enhance color stability and shelf life. Companies are also expanding their presence in Asia Pacific and Latin America to meet growing regional demand for natural colorants. Increasing R&D spending, compliance with global food safety standards, and emphasis on eco-friendly production methods continue to define the competitive dynamics of this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Döhler Group developed mineral-based colour emulsions and fermented rice-derived whiteners to enable clean-label titanium-free reformulation in sauces, frozen desserts and candy coatings.

- In July 2025, Innophos Inc. introduced VersaCal Bright, a calcium-phosphate-based white opacifier designed as a titanium dioxide replacement, approved by the U.S. FDA for specific food applications.

- In 2023, DDW The Color House (via its blog) announced emSeal® White — a clean-label, universally approved clouding/whitening agent designed to substitute TiO₂ in foods and beverages (particularly for opacity and cloud effects)

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand due to growing consumer preference for clean-label and natural colorants.

- Regulatory bans on titanium dioxide will continue driving reformulation across food sectors.

- Innovation in pigment stabilization and microencapsulation will enhance product shelf life.

- Demand for plant and mineral-based pigments will rise across confectionery and beverage industries.

- Manufacturers will invest in sustainable sourcing and environmentally friendly extraction methods.

- North America and Europe will remain the key markets due to strong regulatory compliance.

- Asia Pacific will witness high growth as food manufacturers adopt natural coloring alternatives.

- Partnerships between pigment suppliers and food brands will accelerate technology transfer.

- Cost optimization and supply chain localization will improve competitiveness in emerging markets.

- Continuous R&D in natural pigment intensity and stability will define the next phase of market evolution.