Market Overview:

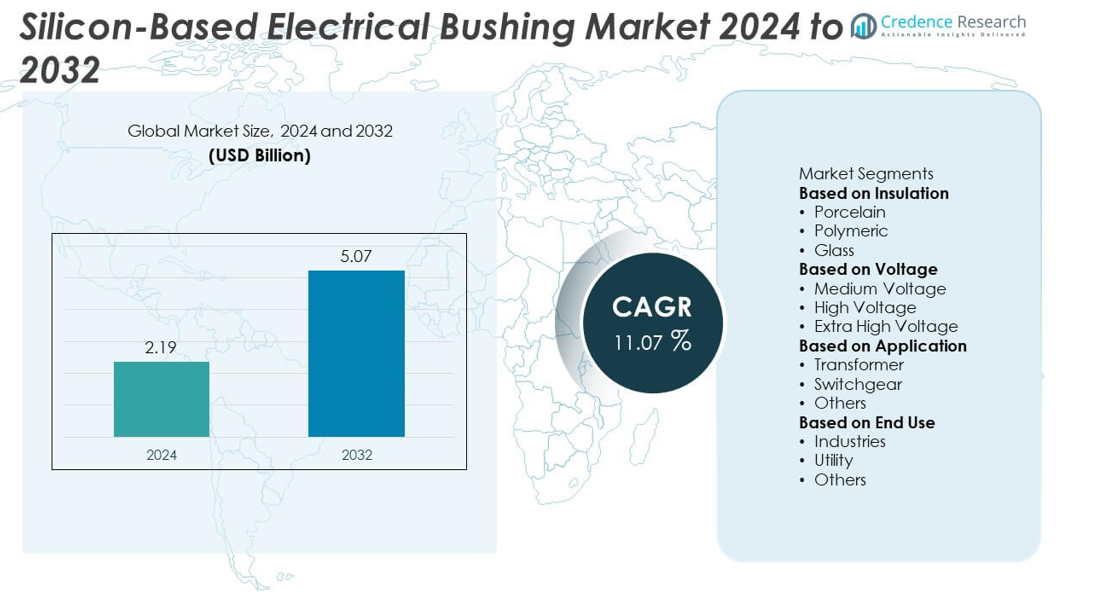

The Silicon-Based Electrical Bushing market was valued at USD 2.19 billion in 2024 and is projected to reach USD 5.07 billion by 2032, growing at a CAGR of 11.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicon-Based Electrical Bushing Market Size 2024 |

USD 2.19 billion |

| Silicon-Based Electrical Bushing Market, CAGR |

11.07% |

| Silicon-Based Electrical Bushing Market Size 2032 |

USD 5.07 billion |

The Silicon-Based Electrical Bushing market is driven by leading companies such as Hitachi Energy, ABB, Eaton, General Electric, Barberi Rubinetterie Industriali S.r.l., Hubbell, CG Power and Industrial Solutions, Jiangxi Johnson Electric Co., Ltd., Elliot Industries, and GIPRO. These players focus on innovation in silicone and polymeric insulation technologies to enhance efficiency, reliability, and resistance to harsh environmental conditions. Strategic investments in smart grid infrastructure and renewable integration strengthen their global presence. Asia-Pacific dominated the market with a 34.9% share in 2024, followed by Europe with 31.6% and North America with 28.4%, driven by large-scale transmission upgrades and sustainable energy expansion.

Market Insights

- The Silicon-Based Electrical Bushing market was valued at USD 2.19 billion in 2024 and is projected to reach USD 5.07 billion by 2032, growing at a CAGR of 11.07%.

- Rising investments in transmission and distribution upgrades, along with renewable energy expansion, are major drivers fueling market growth across utilities and industrial sectors.

- Key trends include increased use of polymeric and silicone-insulated bushings offering better durability, hydrophobicity, and compatibility with smart grid monitoring systems.

- The market is competitive, with leading players such as Hitachi Energy, ABB, Eaton, General Electric, and CG Power focusing on innovation, efficiency, and sustainability through advanced insulation technologies.

- Asia-Pacific held 34.9%, followed by Europe with 31.6% and North America with 28.4%, while the polymeric insulation segment led with 49.2% share, reflecting strong demand for high-performance, lightweight, and maintenance-free electrical bushings worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

mj

Market Segmentation Analysis:

By Insulation

The polymeric segment dominated the Silicon-Based Electrical Bushing market in 2024 with a 49.2% share. Its dominance is attributed to superior mechanical strength, hydrophobic surface properties, and resistance to environmental degradation. Polymeric bushings offer lightweight design and better safety under polluted or high-humidity conditions compared to porcelain and glass types. Growing adoption in outdoor substations and renewable energy projects strengthens their demand. The porcelain segment continues to serve traditional utilities, while glass insulation finds niche use in compact transmission systems due to its dielectric stability and low maintenance needs.

- For instance, ABB Ltd. developed a 1,100 kV polymeric composite bushing using high-consistency silicone rubber insulation and a fiberglass-reinforced epoxy tube. The bushing weighs significantly less than porcelain alternatives—potentially around 40% lighter—and maintains hydrophobicity, which ensures stable performance with low leakage current in polluted and coastal installations.

By Voltage

The high-voltage segment accounted for the largest share of 44.6% in 2024, driven by its widespread use in transmission substations and large power transformers. High-voltage bushings ensure efficient insulation performance under high electric stress and temperature variations. The growing expansion of smart grids and cross-border power networks supports this segment’s growth. Medium-voltage bushings are gaining traction in industrial facilities and renewable energy connections, while extra-high-voltage bushings see rising installation in long-distance transmission systems demanding enhanced reliability and reduced power losses.

- For instance, Hitachi Energy engineered a 550 kV resin-impregnated paper (RIP) bushing with a rated current of 4,000 A and partial discharge levels below 5 pC at maximum voltage. The bushing is designed for operation in ambient temperatures ranging from –40 °C to +60 °C and has been installed in multiple grid interconnection projects across Asia to support long-distance transmission reliability.

By Application

The transformer segment held a dominant 57.8% share in 2024, supported by the rising deployment of high-efficiency power and distribution transformers globally. Silicon-based bushings in transformers enhance insulation, reduce partial discharge, and ensure long service life under high load conditions. Increasing investment in grid modernization and renewable energy integration accelerates demand for reliable transformer insulation systems. Switchgear applications follow, driven by compact substation designs and operational safety requirements, while other applications include testing equipment and specialized high-voltage devices requiring compact, durable insulation performance.

Key Growth Drivers

Expansion of Power Transmission Infrastructure

The global expansion of transmission and distribution networks is a major growth driver. Utilities are upgrading existing systems to manage increasing electricity demand and renewable integration. Silicon-based electrical bushings provide excellent insulation, low current leakage, and improved reliability for high-voltage equipment. Their resistance to environmental stress and thermal variations supports stable performance in outdoor substations and transformers. As governments modernize outdated infrastructure, the adoption of advanced bushing technologies continues to rise across major power networks.

- For instance, CG Power and Industrial Solutions supplied 765 kV class power transformers and reactors to Power Grid Corporation of India Limited’s (PGCIL) transmission projects, securing its largest single order to date.

Rising Renewable Energy Installations

The growing shift toward renewable energy sources such as wind and solar is fueling market growth. Silicon-based bushings are preferred in renewable power systems due to their hydrophobic properties and ability to withstand fluctuating environmental conditions. They offer reliable insulation in grid-connected transformers and switchgear used for renewable integration. Expansion of solar farms and wind installations in Asia-Pacific and Europe further strengthens product demand in high-voltage and medium-voltage applications supporting clean energy goals.

- For instance, GIPRO is a known manufacturer of epoxy resin and silicone insulated components, including bushings for medium and high voltage applications, produced at their manufacturing site in Peggau, Austria. GIPRO has been identified as a supplier to Siemens Ltd, according to global trade data.

Technological Advancements in Insulation Materials

Ongoing innovation in insulation materials is improving product durability and performance. The development of advanced silicone and polymeric compounds enhances hydrophobicity, erosion resistance, and dielectric strength. These innovations reduce maintenance frequency and extend service life in demanding electrical environments. Manufacturers are also integrating smart sensors within bushings for real-time condition monitoring, minimizing failure risks. Continuous improvements in insulation technology are helping utilities and industries achieve higher efficiency and reliability in energy transmission systems.

Key Trends & Opportunities

Shift Toward Smart Grid Deployment

The transition toward smart grid infrastructure is opening new opportunities for silicon-based bushings. Modern grids require components capable of managing higher voltages, automation, and data connectivity. Silicon-based bushings support these needs by maintaining high dielectric stability and enabling integration with monitoring systems. Their use enhances grid reliability, minimizes outages, and supports real-time performance tracking. Rising investments in intelligent and automated power transmission networks continue to create growth prospects for bushing manufacturers.

- For instance, General Electric (GE) offers high-voltage bushings, including those for 800 kV UHVDC systems, and provides digital solutions for condition-based monitoring. GE’s Asset Performance Management (APM) software, which runs on the Predix platform, uses data from sensors on industrial assets to provide predictive diagnostics.

Adoption of Eco-Friendly and Lightweight Materials

Sustainability trends are driving the adoption of eco-friendly and lightweight materials in electrical systems. Polymeric and silicone-based bushings are gaining preference over porcelain alternatives due to their recyclability and reduced carbon impact. Their lighter structure allows easier handling, transport, and installation, cutting operational costs in power projects. As environmental compliance becomes more stringent, manufacturers are emphasizing sustainable production and material innovation to align with green energy and safety regulations.

- For instance, Eaton’s Xiria medium voltage switchgear utilizes halogen-free, recyclable insulation materials with a design that eliminates the use of environmentally damaging SF₆ gas. Using life cycle assessments (LCA), Eaton demonstrated that the Xiria system has a reduced CO₂ impact, including a potential saving of 1,500 kg CO₂ over a 30-year lifespan from energy savings alone compared to typical SF₆ units.

Key Challenges

High Manufacturing and Installation Costs

The advanced design and specialized materials used in silicon-based bushings result in higher manufacturing costs. Production requires precision molding and testing to meet strict performance standards, increasing overall expenses. Smaller utilities often hesitate to adopt these products due to limited budgets and preference for lower-cost alternatives. This price barrier can slow adoption, particularly in emerging economies where infrastructure modernization is still developing. Cost optimization and process innovation remain essential to broader market penetration.

Technical Failures and Maintenance Complexity

Despite strong performance, silicon-based bushings can face issues such as surface tracking or partial discharge when exposed to extreme environments. These problems arise from moisture, pollution, or thermal stress over extended use. Regular maintenance and diagnostic testing are essential to ensure reliability but require skilled personnel and advanced tools. Limited technical expertise in some regions can delay repairs and increase operational costs, presenting an ongoing challenge for market expansion.

Regional Analysis

North America

North America held a 28.4% share of the Silicon-Based Electrical Bushing market in 2024. Growth is driven by large-scale grid modernization projects and increasing renewable power installations in the United States and Canada. The region’s utilities are focusing on high-voltage transmission upgrades to improve reliability and efficiency. Adoption of polymeric and silicone-insulated bushings is expanding due to stricter energy safety standards and reduced maintenance needs. Leading manufacturers in the region are investing in advanced insulation technologies, supporting long-term demand across industrial, commercial, and utility applications.

Europe

Europe accounted for a 31.6% share of the global market in 2024, supported by ongoing investments in smart grids and renewable integration. Countries such as Germany, France, and the United Kingdom are upgrading aging power infrastructure to improve efficiency and meet emission reduction targets. The adoption of eco-friendly polymeric bushings aligns with the region’s sustainability goals. European utilities also benefit from strong regulatory frameworks promoting high-performance insulation systems. Growing offshore wind and solar projects further drive the use of durable, silicon-based bushings in advanced electrical equipment.

Asia-Pacific

Asia-Pacific dominated the Silicon-Based Electrical Bushing market with a 34.9% share in 2024. Rapid industrialization, urban expansion, and renewable energy development in China, India, and Japan are key growth contributors. The region’s utilities are expanding high-voltage transmission lines to meet surging electricity demand. Governments are emphasizing energy security and reliability, encouraging adoption of advanced bushing technologies. Local manufacturing capabilities and cost advantages also support large-scale production. Increasing investment in smart grids and cross-border power connections strengthens Asia-Pacific’s leadership in the global market.

Latin America

Latin America captured a 3.2% share of the market in 2024, driven by gradual modernization of transmission and distribution systems. Brazil and Mexico are leading regional growth through renewable energy expansion and utility reform initiatives. Adoption of silicon-based bushings is increasing in medium-voltage and industrial power networks. The region’s focus on reducing power losses and enhancing grid stability supports rising demand for reliable insulation solutions. Investment in hydro and solar projects continues to strengthen opportunities for advanced electrical components.

Middle East & Africa

The Middle East & Africa region held a 1.9% share of the global market in 2024. Expansion of power infrastructure and large-scale renewable projects in Saudi Arabia, the UAE, and South Africa are driving demand. Silicon-based bushings are increasingly used in desert and high-temperature environments due to their strong thermal and contamination resistance. Ongoing investments in transmission capacity and interconnection projects enhance regional market potential. Governments are also prioritizing energy diversification, promoting adoption of durable, maintenance-free bushing technologies in grid and substation applications.

Market Segmentations:

By Insulation

- Porcelain

- Polymeric

- Glass

By Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

By Application

- Transformer

- Switchgear

- Others

By End Use

- Industries

- Utility

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Silicon-Based Electrical Bushing market features key players such as Hitachi Energy, Eaton, Jiangxi Johnson Electric Co., Ltd., General Electric, Barberi Rubinetterie Industriali S.r.l., Hubbell, CG Power and Industrial Solutions, Elliot Industries, ABB, and GIPRO. These companies focus on product innovation, material advancement, and expansion of production capacities to strengthen their global presence. Major players are investing in high-performance polymeric and silicone-based insulation technologies to enhance efficiency and reliability under extreme environmental conditions. Strategic partnerships with utilities and power equipment manufacturers are helping firms expand their distribution networks. Continuous R&D in smart monitoring systems and lightweight materials also supports differentiation. Additionally, mergers, acquisitions, and new facility setups in Asia-Pacific and Europe reflect an increasing emphasis on localization and energy transition projects. The competitive intensity remains high as companies prioritize sustainability, cost efficiency, and compliance with international safety standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2023, Hitachi Energy launched a dry-type high-voltage transformer bushing rated for 550 kV using advanced composite insulation (RIP) material.

- In 2025, GIPRO announced a new polymeric composite bushing line for wind-farm converters, rated for 42 kV system voltage and 1,250 A current, built with silicone rubber sheds for offshore conditions.

- In July 2025, Yash Highvoltage Ltd. and Quality Power Electrical Equipments Ltd. announced the acquisition of a 100% stake in Sukrut Electric Company Pvt. Ltd., a Pune-based transformer component manufacturer formerly owned by a German multinational.

Report Coverage

The research report offers an in-depth analysis based on Insulation, Voltage, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for silicon-based electrical bushings will grow with expansion of renewable power networks.

- Polymeric and silicone materials will gain wider use due to superior durability and insulation strength.

- Integration of smart monitoring sensors will enhance reliability and maintenance efficiency.

- Utilities will prioritize silicon-based solutions for grid modernization and substation upgrades.

- Asia-Pacific will continue leading the market, supported by strong industrial and energy infrastructure growth.

- Manufacturers will focus on developing eco-friendly, lightweight, and recyclable insulation materials.

- Partnerships between equipment manufacturers and utilities will strengthen product innovation and adoption.

- High-voltage transmission projects will drive steady demand for advanced bushing technologies.

- Digitalization and smart grid deployment will create new opportunities for real-time performance tracking.

- Continuous R&D investment will help improve product efficiency, lifespan, and cost competitiveness across all regions.