Market Overview:

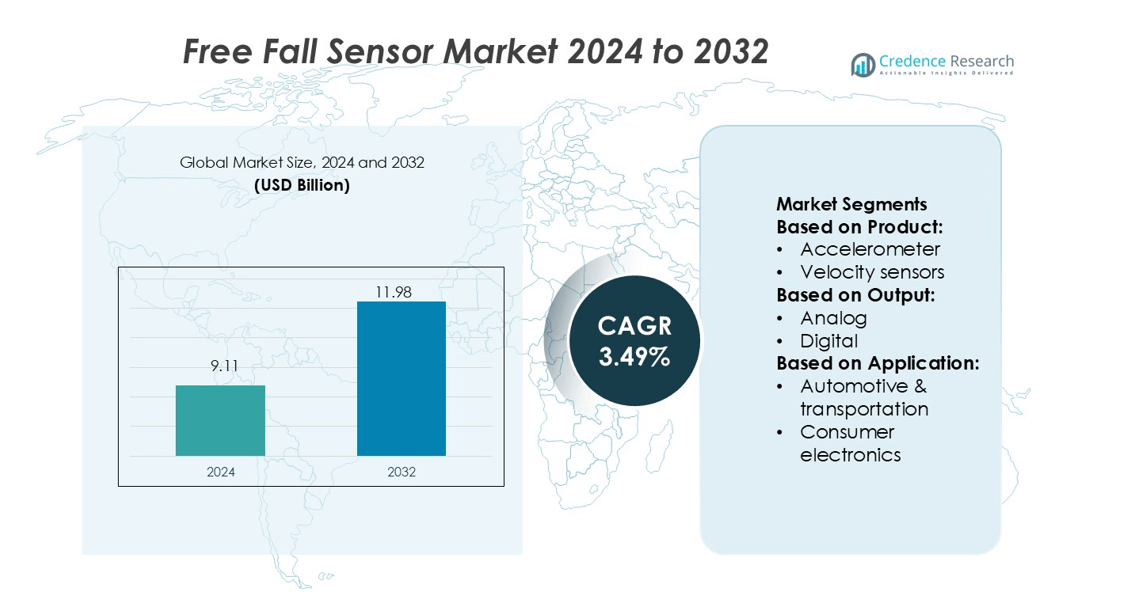

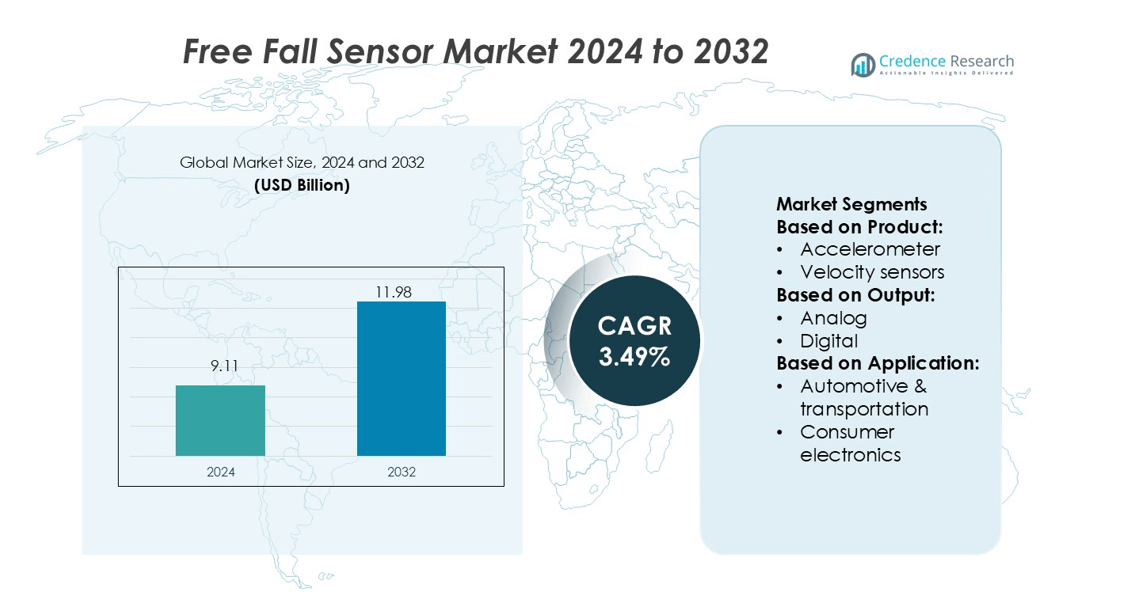

Free Fall Sensor Market size was valued USD 9.11 billion in 2024 and is anticipated to reach USD 11.98 billion by 2032, at a CAGR of 3.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Free Fall Sensor Market Size 2024 |

USD 9.11 billion |

| Free Fall Sensor Market, CAGR |

3.49% |

| Free Fall Sensor Market Size 2032 |

USD 11.98 billion |

The free‑fall sensor market features strong participation from major companies such as Hansford Sensors, Analog Devices Inc., TE Connectivity, Bosch Sensortec GmbH, ASC GmbH, National Instruments Corp, Dytran Instruments Incorporated, Baumer, Honeywell International Inc., and Safran. These firms compete by advancing sensor precision, miniaturization, and integration into automotive, aerospace, and consumer devices. Regionally, North America leads the market with a share of around 30 %, driven by established electronics manufacturing, significant automotive safety regulation, and high adoption of advanced sensor solutions.

Market Insights

- The Free Fall Sensor Market was valued at USD 9.11 billion in 2024 and is anticipated to reach USD 11.98 billion by 2032, growing at a CAGR of 3.49% during the forecast period.

- The market is driven by the increasing adoption of free fall sensors across industries like automotive, aerospace, and consumer electronics for safety and impact detection.

- Key trends include the miniaturization of sensors and integration with smart systems for real‑time monitoring and predictive maintenance in IoT applications.

- North America leads the market with around 30% share, driven by strong automotive safety regulations, advanced manufacturing capabilities, and high adoption of sensor technologies.

- The market faces challenges related to high production costs and the complexity of integrating sensors in various environments, limiting adoption in price‑sensitive sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

In the free‑fall sensor market, the accelerometer sub‑segment holds the dominant position due to its broad use in detecting orientation changes and impacts. Accelerometers account for the largest share, driven by their integration into consumer electronics, automotive safety systems, and industrial monitoring. Their ability to measure rapid deceleration and provide drop‑detection enables protective mechanisms such as hard‑drive head parking and airbag deployment. The wide availability, standardisation and falling costs of MEMS accelerometers support their dominance and form the backbone of free‑fall sensing solutions.

- For instance, Hansford Sensors offers an HS‑150 series industrial accelerometer with a standard sensitivity of 100 mV/g and variants spanning 10 mV/g to 500 mV/g.

By Output

Within the output segmentation, the digital output sub‑segment leads due to its superior signal integrity, ease of integration with microcontrollers and enhanced compatibility with IoT systems. Digital sensors reduce noise and allow direct communication via protocols like I²C or SPI, which simplifies system design. This makes them favoured for applications requiring precise monitoring or automated response. The dominance of digital output sensors is further backed by their scalability in embedded systems and growing adoption in smart devices and industrial automation.

- For instance, Analog Devices, Inc.’s ADXL345 digital 3‑axis accelerometer offers a 13‑bit resolution and supports I²C or SPI communication, with ranges up to ±16 g. The device also includes drop/free‑fall detection through its 32‑level FIFO buffer and interrupt functionality.

By Application

In the application segment, consumer electronics emerge as the leading category, capturing the greatest share thanks to the widespread integration of free‑fall sensors into smartphones, laptops and wearables. These devices rely on drop‑detection to protect components and improve durability, driving heavy demand. Moreover, the expansion of portable electronics and rising concerns for device reliability in everyday use significantly bolster application growth. Though other sectors like automotive and aerospace adopt these sensors, consumer electronics currently dominate the market footprint.

Key Growth Drivers

Widespread Adoption in Consumer Electronics

The rise of smartphones, tablets, and laptops has significantly increased demand for free‑fall sensors that protect components when devices are dropped. These sensors detect sudden drops and trigger protective modes like hard‑drive head parking or shock absorption systems. With consumer electronics becoming more compact and feature‑rich, manufacturers are integrating free‑fall sensors directly onto PCBs to enhance durability. This trend drives growth by making these sensors essential in everyday devices across multiple segments.

- For instance, TE Connectivity 830M1 supports measurement ranges from ±25 g up to ±2,000 g and delivers a frequency bandwidth reaching 15,000 Hz. Its surface mount format (12‑LCC package, weight ~1 g) allows direct PCB integration in portable devices.

Stringent Safety Regulations in Industrial Sectors

Industrial and automotive safety standards now often require free‑fall or impact‑detection sensors to prevent damage and ensure worker safety. As workplaces automate and liability concerns increase, sensors are being embedded into machinery, robotics and transport systems to detect sudden shifts or falls. These regulations push companies to adopt more reliable sensing solutions, generating demand across sectors like automotive and industrial equipment. The result is enhanced sensor penetration into applications that previously may not have required such devices.

- For instance, Bosch’s BMA253 triaxial accelerometer offers a shock‑resistance specification of 10,000 g × 200 μs, while maintaining a noise density of 220 µg/√Hz in its ±2 g range.

Integration with IoT and Smart Systems

The emergence of the Internet of Things (IoT) and Industry 4.0 manufacturing is creating opportunities for free‑fall sensors that can communicate data remotely. Sensor‑equipped devices now send alerts via connected systems to initiate protective measures or maintenance protocols. This connectivity adds value by enabling real‑time analytics and system responses, increasing demand among industrial automation, consumer electronics and healthcare applications. The collaboration between sensor makers and IoT platforms amplifies growth by expanding use‑cases beyond traditional drop detection.

Key Trends & Opportunities

Miniaturization and Multi‑Sensor Fusion

Free‑fall sensors are becoming smaller and more efficient, enabling integration into thin devices like wearables and tablets. The trend toward sensor fusion—combining accelerometers, gyroscopes and displacement sensors—improves accuracy and reduces false triggers. These advances offer opportunities for device manufacturers to add more motion‑detection capabilities without increasing size or cost. As hardware becomes more compact, adoption in new form‑factors and applications expands.

- For instance, Dytran Instruments Model 3200B5 features a rugged stainless‑steel housing weighing just 6 g, a natural frequency above 90 kHz, and an input range rated up to 70,000 g for severe shock measurement.

Expansion in Emerging Markets

Regions such as Asia‑Pacific and Latin America present growing opportunities for free‑fall sensors as consumer electronics and automotive manufacturing expand. Lower cost sensors tailored to regional needs and local manufacturing bases drive wider adoption. Companies can tap into these markets by offering region‑specific sensor modules that meet local regulatory and cost requirements, thereby unlocking new demand.

- For instance, ASC GmbH’s MEMS capacitive accelerometer models (such as the 5421MF/5425MF series) offer measurement ranges up to ±200 g, noise densities as low as 10 µg/√Hz, and frequency responses up to 7 kHz, while being qualified for shock loads up to 6,000 g.

Key Challenges

High Cost and Complexity of Advanced Sensors

Developing high‑precision free‑fall sensors involves costly manufacturing and calibration, which increases unit prices and limits adoption in cost‑sensitive segments. For example, sensors designed for automotive or aerospace require strict reliability and testing, which raises barrier to entry. This high cost can delay deployment in lower‑margin applications or emerging markets and slows broader market growth.

Performance Reliability Under Real‑World Conditions

Free‑fall sensors must function accurately across diverse environments and must avoid false positives or missed events. Variability in installation, vibration, temperature and impact conditions challenge sensor designers. Failure to maintain consistent performance undermines trust and adoption, especially in safety‑critical sectors like automotive or aerospace. Meeting reliability standards while keeping costs manageable remains a key hurdle for the market.

Regional Analysis

North America

The North American free‑fall sensor market holds approximately 30% of the global share. This dominance results from strong adoption across consumer electronics, automotive, and industrial safety equipment sectors. Extensive R&D investment and established manufacturing infrastructure support regional growth. OEMs based in the United States and Canada integrate sensors into laptops, smartphones, and machinery to meet safety regulations and product durability expectations. The mature market also benefits from high unit values and frequent technology upgrades, contributing steadily to the region’s leading position.

Europe

Europe accounts for around 25% share in the global free‑fall sensor market. Growth in this region is powered by stringent safety and regulatory norms, widespread automotive production, and high demand from industrial automation. Countries such as Germany, France, and the UK support adoption via advanced manufacturing and strong electronics ecosystems. The region’s emphasis on sensor reliability and quality drives investments in MEMS and other motion‑detection technologies, assisting suppliers to expand into automotive and aerospace segments.

Asia‑Pacific

The Asia‑Pacific region controls nearly 35% of the free‑fall sensor market share, making it the largest segment globally. Rapid industrialization, high consumer‑electronics production in China, India, and Southeast Asia, and growing automotive markets bolster demand. Local electronics manufacturers increasingly integrate drop‑sensing accelerometers into smartphones, tablets, and wearable devices, which fuels regional growth. Lower production costs and expanding manufacturing capacities further reinforce the region’s leadership in both volume and regional share.

Latin America

Latin America holds about 7% of the global free‑fall sensor market share. This emerging region benefits from growing electronics manufacturing and rising demand for automotive safety systems, especially in Brazil and Mexico. Market growth is constrained by lower per‑capita spending and less extensive sensor integration compared to mature markets. However, increasing local investment in electronics and industrial equipment offers potential expansion unless pricing and supply‑chain limitations are addressed.

Middle East & Africa (MEA)

The Middle East & Africa region represents roughly 3% of the global free‑fall sensor market share. Growth is beginning in urban centres and industrial zones, where safety monitoring and electronics production are improving. However, the region’s limited manufacturing infrastructure, fewer advanced consumer‑electronics installations, and lower penetration of specialized sensors restrict higher market share. Nonetheless, investment in smart manufacturing and infrastructure upgrades offers long‑term opportunities for free‑fall sensor adoption in MEA.

Market Segmentations:

By Product:

- Accelerometer

- Velocity sensors

By Output:

By Application:

- Automotive & transportation

- Consumer electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The free fall sensor market is highly competitive, with key players such as Hansford Sensors, Analog Devices, Inc., TE Connectivity, Bosch Sensortec GmbH, ASC GmbH, NATIONAL INSTRUMENTS CORP, Dytran Instruments Incorporated, Baumer, Honeywell International Inc., and SAFRAN. The free fall sensor market is highly competitive, with numerous companies continuously innovating to improve product performance, precision, and reliability. Manufacturers are focusing on developing advanced sensor technologies such as MEMS (Micro-Electro-Mechanical Systems) and piezoelectric sensors, which provide better accuracy and faster response times. The demand for free fall sensors is driven by applications across various industries, including automotive safety, industrial machinery, aerospace, and consumer electronics. As industries increasingly adopt automation and smart systems, the need for sensors that offer real-time monitoring and predictive maintenance is growing. Additionally, with the emphasis on minimizing failure rates and enhancing overall system efficiency, companies are investing heavily in R&D to meet the evolving requirements of the market, ensuring long-term growth and product differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hansford Sensors

- Analog Devices, Inc.

- TE Connectivity

- Bosch Sensortec GmbH

- ASC GmbH

- NATIONAL INSTRUMENTS CORP

- Dytran Instruments Incorporated

- Baumer

- Honeywell International Inc.

- SAFRAN

Recent Developments

- In March 2025, Vestas has secured a 495 MW order from Copenhagen Infrastructure Partners (CIP) for the Fengmiao I offshore wind project off the coast of Taichung, Taiwan, underscoring demand for advanced vibration monitoring in large-class turbines.

- In March 2025, Texas Instruments launched the TPS1685 48 V hot-swap eFuse capable of protecting 6 kW server loads, supporting AI workloads that require refined thermal and vibration oversight.

- In July 2024, Gamgee, an Amsterdam-based tech company, launched its Wi-Fi Fall Protection system, an AI-powered and advanced Wi-Fi fall detection system for elderly care. This innovative system enhances the lives of seniors by offering instant alerts to family members and caregivers through an app.

- In February 2024, Mount Prospect Senior Living partnered with SafelyYou, Inc., a provider of real-time AI video technology for dementia care and 24/7 remote clinical support. This collaboration aimed to establish higher standards for fall detection care by addressing fall incidents, providing reassurance to families, and attracting new residents to senior living communities.

Report Coverage

The research report offers an in-depth analysis based on Product, Output, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The free fall sensor market will benefit from broad consumer electronics adoption, especially in smartphones and laptops.

- Growth will accelerate as automotive and aerospace sectors require precise motion‑detection sensors for safety systems and impact prevention.

- Integration with IoT and Industry 4.0 will drive sensor demand for connected machinery and remote monitoring platforms.

- Miniaturized and multi‑axis sensors will open new applications in wearables and compact devices, offering opportunities for market expansion.

- Emerging markets in Asia‑Pacific and Latin America will present significant opportunities as industrial automation and electronics manufacturing scale up.

- Demand for sensors with higher reliability and broader temperature ranges will expand use in industrial and aerospace environments.

- Manufacturers will invest in low‑power sensors that extend battery life in portable equipment and wearables.

- Rising raw‑material and semiconductor costs may challenge sensor pricing and manageability in cost‑sensitive segments.

- Supply‑chain disruptions and component shortages will force sensor makers to diversify manufacturing and maintain local inventories.

- As applications become more safety‑critical, certification and performance validation will become key differentiators among sensor suppliers.