Market Overview:

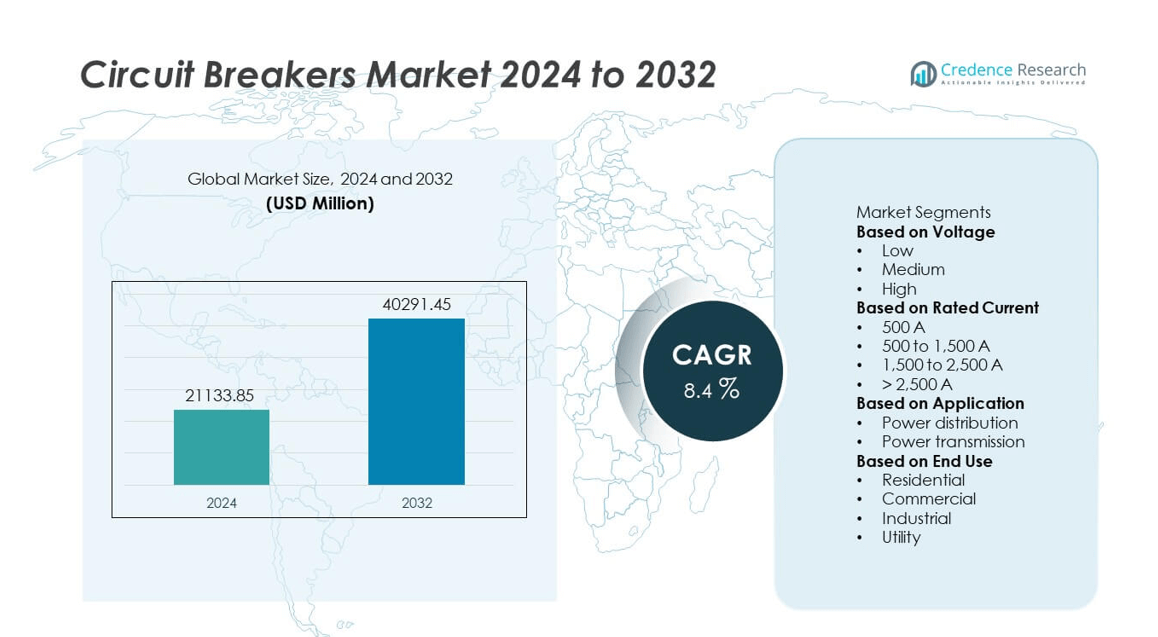

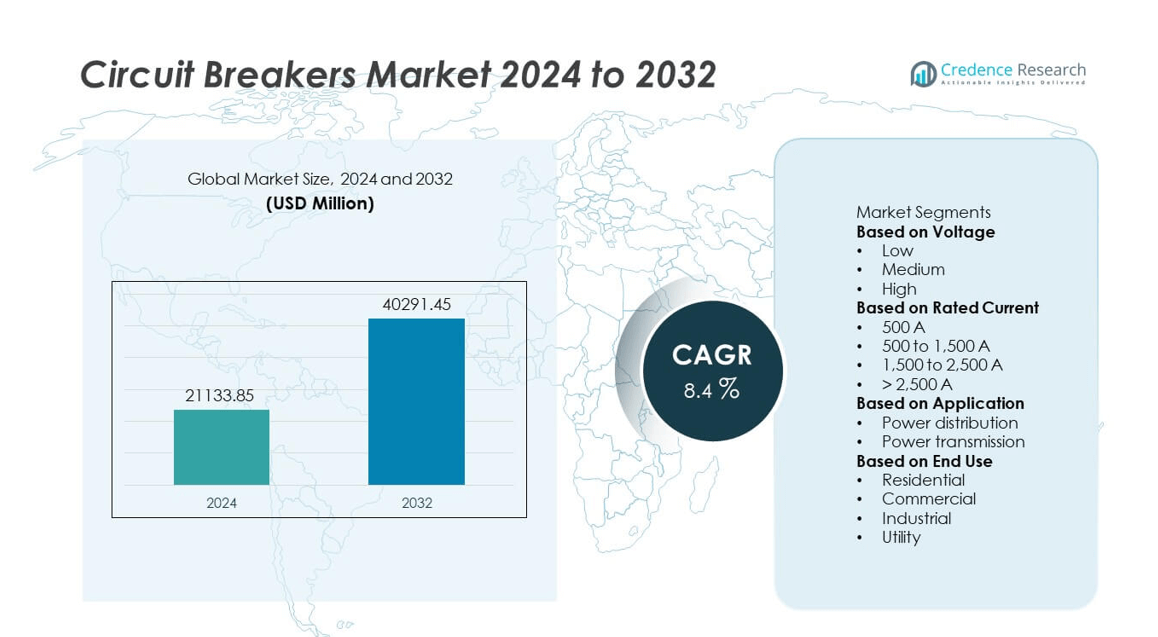

The global circuit breakers market was valued at USD 21,133.85 million in 2024 and is projected to reach USD 40,291.45 million by 2032, expanding at a compound annual growth rate (CAGR) of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Circuit Breakers Market Size 2024 |

USD 21,133.85 million |

| Circuit Breakers Market, CAGR |

8.4% |

| Circuit Breakers Market Size 2032 |

USD 40,291.45 million |

The circuit breakers market is led by major players including ABB, Eaton, Mitsubishi Electric, General Electric, HD Hyundai Electric, LS Electric, CG Power, Powell Industries, Kirloskar Electric, and Alfanar Group. These companies dominate through advanced technologies, smart grid integration, and expansion into sustainable, SF₆-free solutions. Asia-Pacific emerged as the leading region with a 34.8% market share in 2024, driven by rapid industrialization, urbanization, and renewable energy projects. North America followed with 27.6%, supported by grid modernization and digital infrastructure upgrades. Europe held 25.3%, propelled by energy transition goals and adoption of environmentally compliant circuit protection systems.

Market Insights

- The global circuit breakers market was valued at USD 21,133.85 million in 2024 and is projected to reach USD 40,291.45 million by 2032, growing at a CAGR of 8.4%.

- Key drivers include rising investments in power infrastructure, growing renewable energy integration, and increased emphasis on electrical safety and smart grid modernization.

- Major trends involve the adoption of IoT-enabled breakers, digital monitoring systems, and a shift toward SF₆-free eco-friendly solutions in line with sustainability targets.

- The market is highly competitive with leading companies such as ABB, Eaton, Mitsubishi Electric, General Electric, and HD Hyundai Electric focusing on product innovation and smart technologies.

- Asia-Pacific held the largest regional share of 34.8% in 2024, followed by North America with 27.6% and Europe with 25.3%, while the low-voltage segment dominated the market with a 52.4% share due to high demand in commercial and residential sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage

Low-voltage circuit breakers dominated the market with a 52.4% share in 2024. Their widespread use in residential, commercial, and light industrial applications drives this dominance. These breakers ensure protection against overload and short circuits in low-voltage systems up to 1 kV. The segment benefits from rapid urbanization, smart grid integration, and renewable power expansion. Increasing investments in building automation and compact breaker technologies further strengthen growth. Medium- and high-voltage segments are expanding steadily due to rising utility and transmission infrastructure development across developing economies.

- For instance, ABB introduced the SACE Emax 3 air circuit breaker featuring integrated sensors and digital trip units capable of managing up to 6,300 A and interrupting fault currents of 150 kA. This model enhances reliability in smart grids and industrial low-voltage applications through built-in communication and predictive maintenance functions.

By Rated Current

The 500 to 1,500 A rated current segment held the largest share of 41.8% in 2024. This range is widely preferred for medium-scale industrial and commercial power systems, offering a balance of performance, reliability, and cost efficiency. Growing installation of backup power systems and renewable energy inverters contributes to segment expansion. Circuit breakers within this current range are increasingly integrated with digital monitoring and arc fault detection systems. Meanwhile, breakers above 2,500 A are gaining attention in heavy industrial and grid-scale installations requiring higher fault tolerance and operational safety.

- For instance, Eaton launched its Power Defense MCCB series supporting rated currents up to 1,600 A, equipped with PXR trip units and embedded communication modules. These breakers feature onboard energy metering with ±1% accuracy and fault diagnostics, improving protection reliability in distributed power networks.

By Application

Power distribution accounted for the dominant share of 56.7% in 2024, driven by large-scale adoption in residential, commercial, and industrial facilities. The growing need for stable and secure power delivery across decentralized networks supports this segment’s leadership. Smart distribution networks, automation, and IoT-based fault management systems further enhance breaker deployment. Rising electrification in developing regions and infrastructure modernization projects are also propelling demand. Power transmission applications are expanding as utilities focus on grid reliability and high-voltage network upgrades to accommodate renewable energy integration.

Key Growth Drivers

Rising Investments in Power Infrastructure

Global expansion of power generation and distribution networks is a major growth catalyst for circuit breakers. Governments are modernizing aging grids and developing high-voltage transmission lines to meet rising electricity demand. Rapid urbanization and industrialization in Asia-Pacific and the Middle East further boost installations of low- and medium-voltage breakers. The shift toward renewable energy integration, such as solar and wind farms, also increases the need for reliable protection systems, ensuring uninterrupted operation and grid stability across diverse power networks.

- For instance, HD Hyundai Electric supplied over 200 high-voltage gas-insulated switchgear units rated up to 245 kV for grid expansion projects in Saudi Arabia. These breakers were designed to withstand fault currents of 40 kA and improve the reliability of large-scale solar and wind power interconnections.

Growing Emphasis on Safety and Reliability

The increasing focus on electrical safety and operational reliability is driving circuit breaker adoption in both commercial and industrial sectors. These devices prevent equipment damage and electrical hazards caused by overloads or short circuits. Advanced features such as arc fault detection, remote monitoring, and automatic fault isolation are gaining traction. Manufacturers are incorporating digital protection systems and predictive maintenance capabilities to reduce downtime and enhance performance, aligning with global safety regulations and standards in energy-intensive industries.

- For instance, Schneider Electric developed its PremSet medium-voltage switchgear equipped with vacuum circuit breakers rated at up to 12 kV (or up to 15 kV/17.5 kV in some versions) and embedded sensors for real-time temperature and partial discharge monitoring.

Expansion of Smart Grids and Renewable Integration

The rise of smart grid infrastructure and renewable power integration is significantly boosting demand for intelligent circuit breakers. These breakers facilitate real-time monitoring, load balancing, and fault detection across distributed energy systems. Increasing deployment of solar, wind, and microgrid projects requires adaptive protection solutions capable of handling variable loads. The growing use of IoT-enabled and AI-assisted breakers enhances energy efficiency and operational flexibility, supporting global sustainability goals and promoting the transition to a decentralized energy ecosystem.

Key Trends & Opportunities

Adoption of Digital and IoT-Enabled Circuit Breakers

The integration of IoT and digital communication technologies is transforming circuit breaker functionality. Smart breakers equipped with sensors enable real-time fault diagnostics and predictive maintenance, reducing energy losses and downtime. Utilities and industries are adopting these systems to improve efficiency and compliance with energy management standards. This trend supports the development of intelligent power systems, offering lucrative opportunities for manufacturers developing compact, software-integrated circuit protection solutions for advanced industrial and commercial applications.

- For instance, Schneider Electric introduced its Masterpact MTZ air circuit breaker featuring embedded Ethernet and Class 1 energy metering accuracy. The breaker supports up to 6,300 A rated current and integrates with EcoStruxure IoT platform, allowing cloud-based monitoring, fault analytics, and remote firmware updates for predictive maintenance.

Shift Toward Eco-Friendly and SF₆-Free Solutions

Growing environmental concerns are driving the shift from sulfur hexafluoride (SF₆)-based breakers to eco-friendly alternatives. Manufacturers are developing vacuum and gas-insulated designs using sustainable dielectric materials to minimize greenhouse gas emissions. Regulatory frameworks promoting carbon neutrality in power infrastructure are accelerating this transition. The trend opens significant growth opportunities for companies innovating in green circuit breaker technologies that maintain high insulation performance while meeting international environmental standards and supporting clean energy infrastructure.

- For instance, Mitsubishi Electric launched its 72.5 kV vacuum circuit breaker using dry air insulation technology, achieving interruption capability up to 31.5 kA without SF₆ gas. This design reduces greenhouse gas emissions by nearly 99% compared to conventional models while ensuring reliable performance in high-voltage transmission systems.

Key Challenges

High Initial Costs and Maintenance Complexity

Despite their benefits, advanced circuit breakers involve high installation and maintenance costs, particularly for high-voltage applications. The need for specialized components, insulation systems, and skilled labor increases project expenditure. Small and medium-scale utilities often delay upgrades due to budget constraints, limiting market penetration. Additionally, maintaining complex electronic and hybrid systems demands regular monitoring and technical expertise, posing operational challenges in developing regions with limited access to skilled technicians.

Supply Chain Disruptions and Raw Material Volatility

Fluctuating prices of essential materials such as copper, aluminum, and insulating gases affect manufacturing costs for circuit breakers. Global supply chain disruptions caused by geopolitical tensions and logistical delays further impact timely production and delivery. Manufacturers face challenges in balancing inventory, cost control, and meeting growing demand. Dependence on specific material sources and limited local production capabilities in emerging economies increase vulnerability, prompting companies to diversify suppliers and enhance regional manufacturing resilience.

Regional Analysis

North America

North America held a 27.6% share of the global circuit breakers market in 2024, driven by modernization of aging electrical grids and the expansion of renewable energy projects. The United States leads the regional market with strong investments in smart grid infrastructure and industrial automation. Growing adoption of digital and IoT-enabled circuit breakers enhances energy efficiency and safety compliance. Canada’s increasing renewable capacity and demand for medium-voltage breakers in utilities further strengthen growth. Supportive government policies for energy reliability and sustainable infrastructure continue to encourage market expansion across industrial and residential applications.

Europe

Europe accounted for 25.3% of the global circuit breakers market in 2024, supported by rapid transition toward carbon-neutral power systems and grid modernization. Countries such as Germany, France, and the United Kingdom are investing heavily in renewable integration and electric mobility infrastructure. The growing deployment of SF₆-free circuit breakers aligns with the EU’s environmental regulations. Industrial automation, energy-efficient buildings, and smart substations also drive demand. Continuous digital transformation in power distribution systems, coupled with stringent safety standards, reinforces Europe’s position as a leading hub for advanced circuit protection technologies.

Asia-Pacific

Asia-Pacific dominated the global market with a 34.8% share in 2024, driven by large-scale industrialization, urban expansion, and rising electricity consumption. China, India, and Japan are major contributors due to investments in transmission networks and renewable projects. Government initiatives for rural electrification and grid reliability are boosting low- and medium-voltage circuit breaker installations. The growing manufacturing sector and expanding data center infrastructure further elevate demand. Adoption of smart grid systems and eco-friendly breaker technologies positions the region as the fastest-growing market globally, with substantial opportunities in emerging economies.

Latin America

Latin America captured an 8.1% share of the global circuit breakers market in 2024, driven by growing energy demand and infrastructure development across Brazil, Mexico, and Chile. Expanding renewable energy generation and industrialization are key growth enablers. The rise in construction of transmission and distribution networks enhances the adoption of medium- and high-voltage breakers. Governments are prioritizing grid reliability and safety compliance, leading to modernization of existing systems. The growing emphasis on energy-efficient technologies and local manufacturing is further contributing to steady regional growth.

Middle East & Africa

The Middle East and Africa accounted for 4.2% of the global market share in 2024, supported by strong investments in power generation and utility upgrades. The Gulf countries are leading with large-scale renewable and smart city projects that require reliable protection equipment. In Africa, rural electrification initiatives and expanding industrial zones are driving demand for low- and medium-voltage breakers. Increasing grid interconnections and oil and gas infrastructure development further support market growth. Government-backed energy diversification programs and regional manufacturing expansion continue to strengthen the market outlook.

Market Segmentations:

By Voltage

By Rated Current

- 500 A

- 500 to 1,500 A

- 1,500 to 2,500 A

- > 2,500 A

By Application

- Power distribution

- Power transmission

By End Use

- Residential

- Commercial

- Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The circuit breakers market features strong competition among leading manufacturers such as ABB, Eaton, Mitsubishi Electric, General Electric, HD Hyundai Electric, LS Electric, CG Power, Powell Industries, Kirloskar Electric, and Alfanar Group. These companies focus on product innovation, digital integration, and expansion of eco-friendly technologies to strengthen their market presence. The competition is shaped by advancements in smart grid infrastructure, renewable energy integration, and automation-driven industrial demand. Players are investing in IoT-enabled and SF₆-free circuit breaker technologies to meet sustainability goals and regulatory standards. Strategic collaborations, mergers, and regional manufacturing expansions are key tactics to enhance distribution networks and customer reach. Additionally, continuous development of medium- and high-voltage breakers for industrial and utility applications reinforces the leadership of top players while encouraging smaller manufacturers to adopt digital protection systems to remain competitive in the evolving power infrastructure landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, ABB unveiled its new air circuit breaker SACE Emax 3, which incorporates built-in real-time power sensors, a touchscreen interface, and complies with IEC 62443 Security Level 2 certification.

- In July 2025, a credit rating rationale update for Kirloskar Electric Company Limited (KECL) was published by CRISIL, noting that the company had been classified as “non-cooperative” by a previous credit rating agency, CARE Ratings Limited, as of March 19, 2025, due to a non-furnishing of information for monitoring of ratings.

- In February 2025, LS Electric participated in the ELECS Korea 2025 (Electric Energy Conference & Show) and the co-located Korea Smart Grid Expo 2025 exhibitions, held from February 12 to 14 in Seoul.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Rated Current, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by global power infrastructure modernization.

- Smart grid expansion will accelerate demand for intelligent and IoT-enabled circuit breakers.

- Increasing renewable energy integration will strengthen the need for advanced protection systems.

- Manufacturers will focus on developing SF₆-free and eco-friendly breaker technologies.

- Rising industrial automation will boost adoption of digital and high-performance circuit breakers.

- Emerging economies will invest heavily in power distribution and electrification projects.

- Technological innovation will enhance remote monitoring and predictive maintenance capabilities.

- Strategic collaborations and mergers will support global market expansion.

- Regulatory emphasis on energy efficiency and safety compliance will shape product design.

- Asia-Pacific will remain the dominant regional market, supported by strong manufacturing and infrastructure growth.