Market Overview

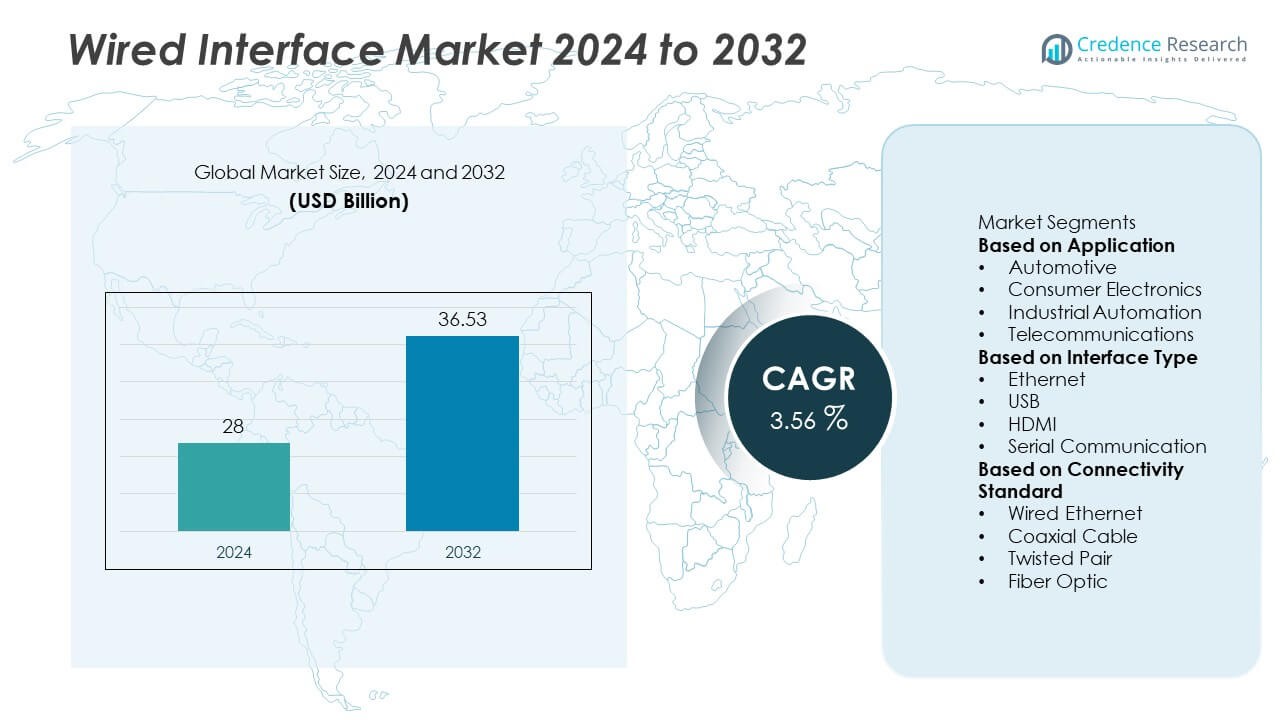

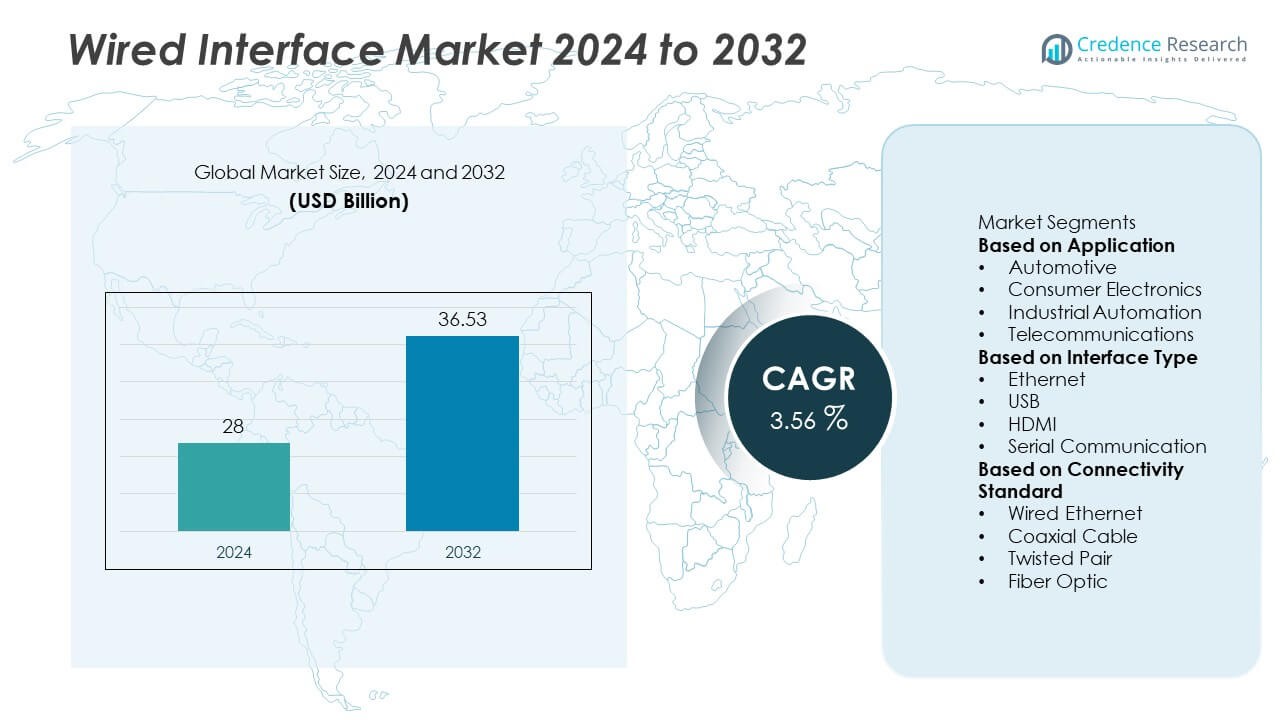

The Wired Interface Market was valued at USD 28 billion in 2024 and is projected to reach USD 36.53 billion by 2032, growing at a CAGR of 3.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wired Interface Market Size 2024 |

USD 28 Billion |

| Wired Interface Market, CAGR |

21.96% |

| Wired Interface Market Size 2032 |

USD 36.53 Billion |

The wired interface market is led by key players such as Texas Instruments Incorporated, Analog Devices, Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, Microchip Technology Inc., Broadcom Inc., Cypress Semiconductor Corporation, Maxim Integrated, and Renesas Electronics Corporation. These companies focus on delivering high-speed, reliable connectivity solutions for automotive, industrial, and consumer applications. North America dominates the market with a 37.4% share in 2024, driven by strong demand from data centers, telecom, and automation sectors. Europe follows with a 28.6% share, supported by advanced automotive innovation, while Asia-Pacific, holding a 24.9% share, emerges as the fastest-growing region due to large-scale electronics manufacturing and expanding industrial infrastructure.

Market Insights

- The wired interface market was valued at USD 28 billion in 2024 and is projected to reach USD 36.53 billion by 2032, growing at a CAGR of 3.56% during the forecast period.

- Rising demand for high-speed data transmission in automotive, consumer electronics, and industrial automation drives market growth. The consumer electronics segment leads with a 41.8% share, supported by increasing device connectivity needs.

- Advancements in Ethernet, USB4, and HDMI 2.1 standards are shaping market trends, enabling faster, more efficient, and reliable communication across applications.

- Major players such as Texas Instruments, Analog Devices, and STMicroelectronics focus on innovation, product integration, and expansion into emerging industrial and automotive connectivity solutions.

- North America dominates the market with a 37.4% share, followed by Europe with 28.6%, and Asia-Pacific with 24.9%, driven by large-scale electronics production and rapid digital infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The consumer electronics segment dominates the wired interface market, holding a 41.8% share in 2024, driven by the widespread use of smartphones, laptops, gaming consoles, and entertainment systems requiring high-speed data transfer. The growing demand for reliable wired connectivity for streaming, charging, and multimedia transmission continues to fuel adoption. Advancements in HDMI and USB technologies are enhancing data transmission speeds and compatibility across devices. Automotive and industrial automation segments are also witnessing strong growth due to the need for low-latency communication and robust data exchange in connected systems and production environments.

- For instance, Microchip Technology Inc. introduced its USB705x SmartHub family supporting USB Type-C with USB 3.1 data rates of up to 5 Gb/s, enabling high-bandwidth data and charging functions in mobile and entertainment devices.

By Interface Type

The Ethernet segment leads the wired interface market with a 46.3% share in 2024, supported by its superior reliability, high bandwidth capacity, and secure data transmission. Ethernet remains the backbone of enterprise networks, data centers, and industrial automation due to its scalability and stability. The increasing use of Gigabit and 10-Gigabit Ethernet solutions across industries is enhancing connectivity efficiency. USB and HDMI interfaces follow closely, driven by their broad adoption in consumer electronics and computing devices, while serial communication maintains relevance in industrial and embedded system applications.

- For instance, the HDMI Forum released the HDMI 2.2 specification supporting bandwidth up to 96 Gb/s, facilitating Ultra-High-Definition and next-generation display and multimedia systems.

By Connectivity Standard

The wired Ethernet segment dominates the market, accounting for a 48.7% share in 2024, primarily due to its strong presence in networking, enterprise infrastructure, and IoT-enabled industrial systems. Its ability to deliver stable, high-speed connectivity over long distances makes it essential for both commercial and residential applications. Fiber optic connectivity is growing rapidly, driven by increasing data consumption, cloud services, and 5G backhaul demand. Twisted pair and coaxial cables continue to serve traditional networking and broadcast systems, but fiber optics are increasingly favored for future-ready, high-bandwidth communication networks.

Key Growth Drivers

Rising Demand for High-Speed Data Transmission

The growing need for faster and more reliable data transfer across devices is driving the wired interface market. Increasing consumption of high-definition content, cloud computing, and real-time data processing has boosted the use of Ethernet, USB, and HDMI connections. Industries such as telecommunications, data centers, and consumer electronics rely heavily on wired interfaces for stability and low latency. The introduction of advanced standards like USB4 and HDMI 2.1 further supports high-speed connectivity and enhances user experience in both professional and consumer environments.

- For instance, Broadcom Inc. introduced its BCM57608 PCIe Gen5 Ethernet adapter offering 400 Gb/s throughput and supporting PCIe 5.0 x16 slot integration.

Expansion of Industrial Automation and IoT Applications

Rapid industrial digitalization and the rise of Industry 4.0 are key drivers for the wired interface market. Ethernet-based networks are increasingly used in manufacturing facilities for machine-to-machine communication, process automation, and predictive maintenance. Wired interfaces ensure robust, interference-free connectivity essential for controlling industrial robots and smart sensors. The need for real-time monitoring and data reliability in industrial IoT environments continues to strengthen the role of wired systems despite growing wireless adoption.

- For instance, an industrial solution using single-pair Ethernet reported a reduction in assembly time by over 65 % through simplified connectivity in manufacturing panel installations.

Growth of Automotive Electronics and In-Vehicle Connectivity

The surge in advanced automotive technologies such as infotainment systems, ADAS, and EV charging infrastructure is fueling wired interface adoption. Vehicles increasingly integrate Ethernet and USB interfaces to support high-speed communication among electronic control units. The rise of autonomous driving and connected vehicle ecosystems requires secure and stable data transmission, where wired interfaces outperform wireless alternatives. Automotive manufacturers are investing in next-generation cabling systems to enhance performance, reliability, and electromagnetic compatibility.

Key Trends & Opportunities

Adoption of Next-Generation Connectivity Standards

Emerging standards such as USB4, HDMI 2.1, and 10G Ethernet are reshaping the wired interface market by delivering higher speed, bandwidth, and power efficiency. These advancements support 8K video, virtual reality, and cloud-based computing applications. As devices demand greater performance, compatibility across multiple interfaces becomes crucial. Companies investing in standardization and interoperability solutions are expected to gain a competitive advantage. The ongoing evolution of connectivity protocols presents significant opportunities for innovation and new product development.

- For instance, the USB-IF specification for USB4 defines symmetric data rates of 80 Gbit/s and supports asymmetric modes up to 120 Gbit/s/40 Gbit/s using certified cables.

Increasing Integration of Wired and Wireless Technologies

Hybrid connectivity models that combine wired stability with wireless flexibility are gaining traction. Industries are adopting mixed infrastructures to balance reliability, mobility, and cost. In data centers, for instance, fiber optic and Ethernet cables are used alongside Wi-Fi and 5G for seamless communication. The trend toward converged networks enhances scalability and operational efficiency. Manufacturers offering solutions that enable interoperability between wired and wireless systems are likely to capture emerging opportunities across multiple end-use sectors.

- For instance, in an industrial edge deployment, a single-pair Ethernet backbone (wired) was demonstrated to handle connectivity for over 100 smart sensors while interfacing with local Wi-Fi modules for mobile-agent data aggregation, significantly reducing network segmentation.

Key Challenges

High Installation and Maintenance Costs

Despite their reliability, wired interfaces often involve higher installation and maintenance costs compared to wireless alternatives. Large-scale deployments in industrial and enterprise settings require extensive cabling, network management, and infrastructure upgrades. These expenses can deter adoption, particularly in small and medium enterprises. Furthermore, the need for skilled technicians and periodic maintenance adds to operational costs. Manufacturers must focus on developing cost-effective cabling solutions and modular systems to address this challenge and encourage wider adoption.

Competition from Wireless Connectivity Technologies

The rapid growth of wireless technologies such as Wi-Fi 6, Bluetooth 5.3, and 5G poses a major challenge to the wired interface market. Wireless systems offer flexibility, scalability, and easy deployment, which appeal to modern industries and consumers. However, wired interfaces still hold an edge in speed, stability, and security. To maintain market relevance, manufacturers must innovate through hybrid solutions and highlight the superior reliability of wired connections in mission-critical applications like automation, data centers, and automotive systems.

Regional Analysis

North America

North America leads the wired interface market with a 37.4% share in 2024, driven by strong demand from data centers, consumer electronics, and industrial automation sectors. The United States remains the primary growth engine due to early adoption of advanced Ethernet and fiber-optic technologies. Increasing deployment of high-speed connectivity in automotive and telecom infrastructure further boosts market growth. The region’s focus on digital transformation and the integration of wired networks with IoT and AI systems strengthen its technological dominance. Canada contributes through expanding industrial connectivity and fiber broadband rollout initiatives.

Europe

Europe accounts for a 28.6% share in 2024, supported by significant investments in telecommunication infrastructure, smart manufacturing, and automotive innovation. Germany, the United Kingdom, and France are major contributors, with rapid adoption of Ethernet-based systems and fiber-optic networks. The region’s push toward Industry 4.0 and electrification in vehicles fuels wired interface integration for reliable communication and automation. Government-backed projects promoting high-speed connectivity and sustainable digitalization also stimulate market growth. Strong R&D in electronic components and industrial connectivity solutions enhances Europe’s competitive position globally.

Asia-Pacific

Asia-Pacific holds a 24.9% share in 2024, emerging as the fastest-growing region due to large-scale electronics production and expanding industrial infrastructure. China, Japan, South Korea, and India are at the forefront of adoption, driven by robust demand for Ethernet, USB, and HDMI interfaces in consumer electronics and telecommunications. The rise of smart factories and data centers across developing economies fuels significant growth. Government initiatives promoting broadband expansion and digital connectivity further enhance regional potential. Asia-Pacific’s manufacturing leadership and cost-effective production capabilities make it a key hub for wired interface innovation and export.

Latin America

Latin America represents a 5.2% share in 2024, driven by increasing investments in communication networks and industrial automation. Brazil and Mexico are key contributors, focusing on upgrading manufacturing systems and expanding fiber-optic infrastructure. Growing adoption of high-speed Ethernet connections across businesses and smart city projects supports regional growth. However, economic disparities and infrastructure limitations pose challenges to large-scale deployment. Continued public-private partnerships and increased adoption of connected technologies in automotive and telecom sectors are expected to enhance market penetration in the coming years.

Middle East & Africa

The Middle East & Africa region captures a 3.9% share in 2024, with demand rising across telecommunications, oil and gas, and industrial automation sectors. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are leading adoption through infrastructure modernization and smart city initiatives. The increasing rollout of fiber-optic networks and data centers supports steady market growth. However, limited technological readiness in some parts of Africa restrains expansion. Ongoing government investment in broadband development and cross-border connectivity is expected to strengthen future market opportunities.

Market Segmentations:

By Application

- Automotive

- Consumer Electronics

- Industrial Automation

- Telecommunications

By Interface Type

- Ethernet

- USB

- HDMI

- Serial Communication

By Connectivity Standard

- Wired Ethernet

- Coaxial Cable

- Twisted Pair

- Fiber Optic

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the wired interface market highlights the presence of major players such as Texas Instruments Incorporated, Analog Devices, Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, Microchip Technology Inc., Broadcom Inc., Cypress Semiconductor Corporation, Maxim Integrated, and Renesas Electronics Corporation. These companies focus on developing high-performance wired interface solutions supporting Ethernet, USB, HDMI, and serial communication standards. The market is moderately consolidated, with established players investing in advanced IC designs, signal conditioning technologies, and low-power connectivity solutions. Strategic partnerships with OEMs and system integrators are enhancing product integration across automotive, industrial, and consumer electronics sectors. Continuous innovation in high-speed data transmission, miniaturization, and fiber-optic compatibility strengthens competitiveness. Additionally, expansion into emerging markets and customization for Industry 4.0 applications remain key strategies driving sustained leadership in the wired interface ecosystem.

Key Player Analysis

- Texas Instruments Incorporated

- Analog Devices, Inc.

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Infineon Technologies AG

- Microchip Technology Inc.

- Broadcom Inc.

- Cypress Semiconductor Corporation

- Maxim Integrated (now part of Analog Devices)

- Renesas Electronics Corporation

Recent Developments

- In October 2025, Broadcom Inc. announced the “Thor Ultra” ethernet network interface card capable of 800 Gb/s data throughput and supporting PCIe Gen6 ×16 form factor.

- In October 2025, Infineon Technologies AG announced an extension to its CAN FD transceiver portfolio which included the TLE9351BVSJ/BSJ series, supporting loop delay symmetry and data rates up to 5 Mbit/s.

- In November 2024, Renesas Electronics Corporation introduced the RZ/T2H quad-core MPU featuring four integrated Ethernet ports and supporting up to nine-axis servo motor control for real-time industrial communication.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Interface Type, Connectivity Standard and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-speed and low-latency wired connectivity will continue to grow across industries.

- Ethernet and USB technologies will remain the preferred standards for stable data transmission.

- Advancements in fiber-optic communication will enhance bandwidth and reduce signal loss.

- Automotive applications will expand due to increasing use of advanced infotainment and ADAS systems.

- Industrial automation and smart factory initiatives will drive wired interface adoption.

- Integration of wired and wireless technologies will create hybrid connectivity ecosystems.

- Miniaturization and energy-efficient interface chips will gain traction in consumer electronics.

- Data centers will increasingly rely on wired connections for reliable and secure operations.

- Manufacturers will focus on developing cost-effective and scalable connectivity solutions.

- Asia-Pacific will emerge as the fastest-growing region due to industrial expansion and strong electronics manufacturing.