Market Overview

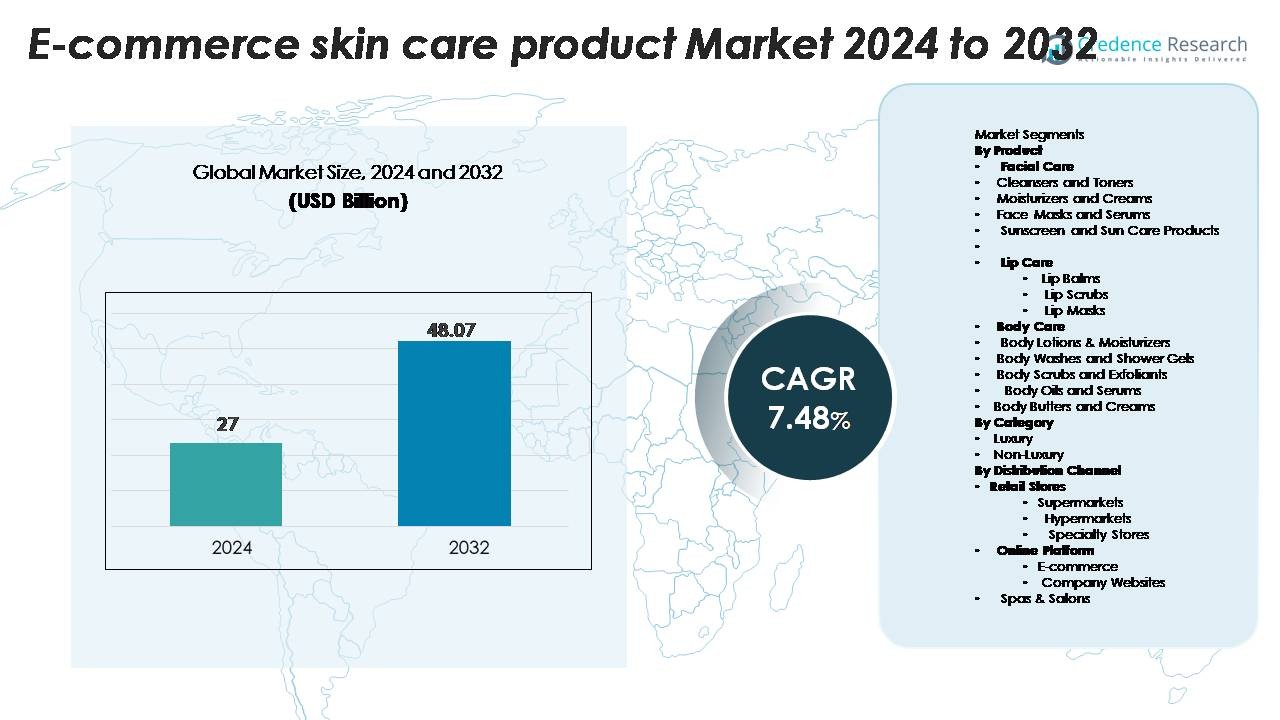

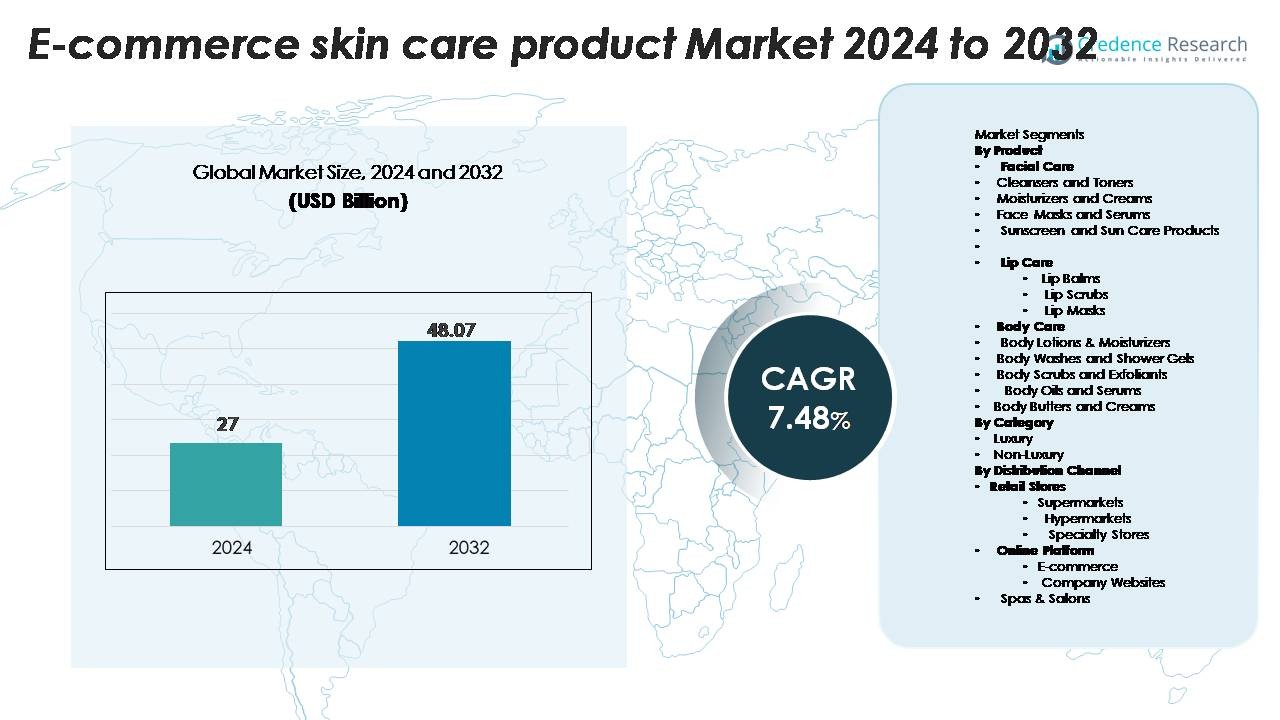

E-commerce Skin Care Product Market was valued at USD 27 billion in 2024 and is anticipated to reach USD 48.07 billion by 2032, growing at a CAGR of 7.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E-commerce Skin Care Product Market Size 2024 |

USD 27 Billion |

| E-commerce Skin Care Product Market, CAGR |

7.48% |

| E-commerce Skin Care Product Market Size 2032 |

USD 48.07 Billion |

Asia-Pacific leads the e-commerce skin care product market with a 45% share, driven by high smartphone penetration, strong beauty culture, and rapid adoption of digital shopping. Major companies such as Estée Lauder Companies Inc., Beiersdorf AG, Johnson & Johnson, M·A·C Cosmetics, Colgate-Palmolive Company, Shiseido Company Limited, Unilever PLC, The Procter & Gamble Company, and L’Oréal Group compete through online-exclusive launches, personalized skin analysis tools, and influencer marketing. These brands strengthen e-commerce sales by offering direct-to-consumer delivery, loyalty rewards, and ingredient-transparent product pages. North America and Europe follow with notable shares supported by premium skincare demand and high customer trust in dermatologist-backed formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The e-commerce skin care product market reached a multi-billion USD value in 2024 and is projected to grow at a strong CAGR through 2032.

- Rising demand for moisturizers, face serums, and sunscreen drives online sales as consumers prefer quick delivery, reviews, and ingredient transparency.

- AI-based personalization, virtual skin assessments, and influencer-led social commerce shape major trends, boosting conversions among younger and urban shoppers.

- Strong competition continues between premium global brands and fast-growing direct-to-consumer labels offering clean-label, dermatologist-approved products at competitive prices.

- Asia-Pacific leads with 42.43% market share, followed by North America and Europe, while facial care dominates product segments due to daily-use routines and high adoption of creams, serums, and sun care products.

Market Segmentation Analysis:

By Product

Facial care remains the largest segment in the e-commerce skin care product market, driven by strong demand for moisturizers, face serums, and sunscreen products. Within this segment, moisturizers and face creams hold the dominant share due to daily usage, skin hydration needs, and expanding product variants such as anti-aging and brightening formulas. Rising consumer awareness toward UV protection also increases online sales of sunscreen and sun care products. Convenient doorstep delivery, product comparison, ingredient transparency, and digital promotions encourage shoppers to buy facial care online, supported by influencer-led marketing and dermatology-backed formulations.

- For instance, L’Oréal’s proprietary Skin Genius analysis engine scans over 8,000 skin pixels per photo and compares results against a dermatology dataset containing more than 10,000 clinical images to identify hydration loss and fine-line depth with micrometer-level precision.

By Category

Non-luxury skin care products command the dominant share in the online channel as they offer affordable pricing, wide product availability, and frequent discounts. Mass-market brands benefit from strong consumer trust, large distribution networks, and rapid adoption among young shoppers. Luxury products continue to gain traction, but at a slower pace, supported by premium packaging, exotic ingredients, and exclusive online launches. Virtual try-ons, reviews, and personalized recommendations help bridge the gap between in-store and online luxury shopping, but non-luxury products still lead due to high repeat purchases and price-sensitive buyers.

- For instance, Unilever’s AI tools, such as the consumer-facing “Pond’s Skin Institute AI Expert” or the broader “BeautyHub PRO” platform, use machine-learning models trained on extensive data to track metrics like pore size and hydration levels and recommend products from brands like Dove and Pond’s matched to specific, quantified skin concerns.

By Distribution Channel

Online platforms hold the leading share of e-commerce skin care sales, driven by e-commerce marketplaces and brand-owned websites. E-commerce platforms offer broad selections, subscription plans, flash sales, and bundled discounts, which increase repeat buying. Company websites also expand due to loyalty programs, direct-to-consumer pricing, and exclusive launches. Retail stores, including hypermarkets and specialty outlets, remain relevant for customers who prefer physical product testing, but online platforms dominate due to convenience, delivery speed, and growing adoption of secure digital payment methods.

Key Growth Drivers

Rising Digital Buying Behavior and Mobile Shopping

Digital adoption is a major growth driver in the e-commerce skin care product market. Consumers use mobile apps, brand websites, and online marketplaces to browse, compare, and buy products without visiting stores. Fast-growing smartphone access, secure payment methods, and same-day delivery services make online buying easier. Many shoppers follow beauty influencers, dermatologists, and social media campaigns, which increases product awareness and purchase intent. Online tutorials, reviews, and personalized recommendations reduce hesitation and support repeat purchases. Younger consumers prefer online-first shopping because it saves time, provides better discounts, and offers more product variety than offline channels. As a result, digital buying behavior continues to accelerate e-commerce sales of creams, serums, masks, oils, and sun care products.

- For instance, Estée Lauder reported that over 80% of its online traffic now originates from mobile devices, and its AI-powered iMatch Skin Tone Expert captures up to 1,500 data points (or “metrics”) per session to recommend foundation and serum matches with laboratory-verified color accuracy at 95%.

Ingredient Transparency and Clean-Label Product Demand

Consumers now read product labels, search for ingredient benefits, and prefer safe formulations. E-commerce platforms allow detailed ingredient listings, certifications, and dermatologist-backed claims, which help buyers make informed decisions. Clean-label skin care, including paraben-free, sulfate-free, cruelty-free, and vegan options, shows greater online traction. Many brands also highlight natural extracts, gentle actives, and science-based formulas to gain trust. Online shoppers easily compare ingredients, check authenticity, and view clinical test results. Rising awareness of allergies and sensitive skin supports strong demand for fragrance-free and dermatologically tested products. Transparency tools, such as ingredient checkers, digital guides, and consumer forums, also drive online sales, helping brands win repeat customers through education and transparency.

- For instance, Beiersdorf’s EcoBeautyScore system assigns environmental grades using an A to E grading scale based on a numerical lifecycle model that measures various environmental impacts including packaging weight, recyclability, and CO₂ footprint. The specific product, Nivea’s Naturally Good face moisturizer, likely has an EcoBeautyScore in this A-E format, and its packaging has a high recyclability rate, with specific claims suggesting that 98g of its 100g packaging mass can be verified as recyclable, a key factor in its overall grade.

Growth of Direct-to-Consumer (D2C) and Subscription Models

D2C brands have reshaped the online skin care space by selling directly to consumers through company websites and social media stores. They offer lower prices, personalized recommendations, and exclusive online-only products without middle-men. Subscription models for moisturizers, face washes, sunscreen, and creams encourage repeat buying and reduce customer churn. Predictive replenishment, auto-delivery, and loyalty benefits create strong brand loyalty. D2C brands also collect real-time customer data to improve formulas and launch faster product updates. Influencer-led promotions and targeted digital ads help new brands gain visibility, while user reviews increase trust. This model supports faster global reach, cost efficiency, and premium customer experience, which strengthens growth in the e-commerce skin care market.

Key Trends & Opportunities

AI-Based Personalization and Virtual Skin Analysis

AI tools and virtual skin tests are becoming popular trends in online beauty shopping. Shoppers upload photos or answer skin-related questions, and algorithms suggest products based on skin type, tone, and concerns. These tools reduce confusion and help buyers feel confident about online choices. Virtual try-ons also let users preview product textures or shades before purchasing. Brands use personalization engines to offer tailored product combos, boosting cross-selling and upselling. This trend creates strong opportunities for companies to improve product relevance, reduce returns, and increase customer retention. As consumers seek premium, customized skincare plans, AI-enabled platforms continue unlocking high value in the digital beauty market.

- For instance, L’Oréal’s ModiFace AR engine performs real-time facial analysis and feature tracking. The technology is generally described as tracking 68 facial landmarks or parameters for applications such as virtual makeup try-ons.

Growth of Dermatologist-Backed and Science-Based Skin Care

Consumers prefer clinically tested, dermatologist-approved, and science-backed formulas for acne care, aging, pigmentation, and daily hydration. E-commerce platforms highlight active ingredients like retinol, niacinamide, vitamin C, and hyaluronic acid with clear usage benefits. Brands launch transparent product pages showing lab results, patch-test reports, and customer ratings. Many companies collaborate with skin experts for digital consultations, live sessions, or treatment guides to support informed buying. This trend creates a major opportunity for clinical brands entering online markets, especially those offering high-efficacy products at competitive prices. As result, demand for expert-guided, science-driven skincare continues to rise across online channels.

· For instance, the Neutrogena Hydro Boost Water Gel line underwent clinical evaluation on 29 women in a kinetic moisturization study. Skin surface hydration was measured using standard clinical methods, such as corneometer readings, with a statistically significant increase observed through 72 hours after a single application. This testing helps to validate the product’s ability to retain moisture within the skin’s surface.

Key Challenges

Presence of Counterfeit or Low-Quality Products

Counterfeit cosmetics and unauthorized sellers remain a major challenge in the e-commerce skincare space. Fake or diluted products may use harmful chemicals, non-approved ingredients, or unsafe packaging. These products damage consumer trust and create negative brand perception. Marketplaces often host third-party sellers, making authenticity checks difficult. Brands invest in verified seller tags, QR code authentication, sealed packaging, and brand-only stores to fight counterfeits. However, counterfeit supply networks continue to shift platforms and create new listings. Consumers also fear skin infections, allergies, or ineffective results when buying online. This challenge pushes companies to strengthen monitoring, digital tracking, and customer awareness programs.

Limited Product Experience Compared to Offline Stores

Many consumers hesitate to buy skincare online because they cannot test the texture, scent, or shade before purchasing. While reviews and product photos help, they cannot fully replace in-person sampling. Products like serums, sunscreen, and creams often require touch and feel to ensure suitability. Customers with sensitive skin prefer physical guidance from beauty advisors. Although virtual try-ons and sample delivery programs are improving experiences, returns and replacements remain high. This challenge is stronger in regions with low digital awareness or limited trust in online shopping. Brands must focus on detailed product descriptions, customer support, trial packs, and dermatology-backed advice to overcome hesitation.

Regional Analysis

North America

North America leads e-commerce skin care due to high digital spend and DTC strength. Retailers such as Amazon, Sephora, and Ulta drive discovery with subscriptions and fast delivery. Dermatologist-backed brands win share through tele-derm and targeted sampling. Social commerce and marketplace ads lift repeat rates in the US and Canada. Regulation around claims and data privacy shapes acquisition costs. Private labels gain traction in cleansing and sun care. North America holds about 36.5% of the online cosmetics market in 2024, a close proxy for e-commerce skin care share, confirming regional leadership.

Europe

Europe’s e-commerce skin care market benefits from strong cross-border logistics and strict sustainability rules. Consumers prefer dermatologist-tested, fragrance-free, and reef-safe formulas. Pure-players and pharmacies expand click-and-collect and next-day delivery. The UK, Germany, and France anchor premium online sales, while Southern Europe accelerates via marketplaces. Returns policies and packaging compliance add costs but build trust. Subscription boxes and loyalty apps support retention. Europe accounts for ~30% of global online beauty and personal care revenue in 2024, a solid benchmark for e-commerce skin care share across the region’s digital channels.

Asia Pacific

Asia Pacific dominates online beauty adoption through super-apps, live-commerce, and K-beauty influence. China, South Korea, and Japan push dermocosmetics and high-SPF hybrids, while India and Southeast Asia scale mass-premium lines. Cross-border shipping from Korea and Japan accelerates new-product cycles. Influencer marketplaces compress launch timelines and build rapid trials. Mobile-first payments and festivals lift conversion. Regulatory changes on ingredients and claims guide product localization. Asia Pacific represents 42.43% of global e-commerce personal care value in 2024, a strong proxy for e-commerce skin care share given skin care’s category weight online.

Latin America

Latin America’s e-commerce skin care expands on rising smartphone penetration and marketplace reach. Brazil and Mexico lead with dermocosmetics distributed via pharmacies and pure-play platforms. Local brands use social commerce and micro-influencers to cut CACs. Logistics partnerships improve last-mile reliability in tier-two cities. Currency swings and import duties shape pricing and inventory choices. Installment payments and COD options widen access. Latin America holds ~5% of global online beauty and personal care revenue in 2024, a practical stand-in for e-commerce skin care’s regional share as digital channels scale.

Middle East & Africa

ME&A e-commerce skin care grows from a smaller base, supported by premiumization in GCC and rising pharmacy e-stores. Saudi Arabia and UAE drive dermocosmetics, sun care, and halal-certified lines. Influencer-led campaigns and same-day delivery build trust. Africa’s growth centers on marketplace bundles and affordable routines. Regulatory harmonization and heat-stable packaging matter for compliance and performance. Cross-border fulfillment enables niche brands to reach new cohorts. The region contributes ~2% of global online beauty and personal care revenue in 2024, a reasonable proxy for e-commerce skin care’s share as adoption increases.

Market Segmentations:

By Product

- Cleansers and Toners

- Moisturizers and Creams

- Face Masks and Serums

- Sunscreen and Sun Care Products

- Lip Balms

- Lip Scrubs

- Lip Masks

- Body Lotions & Moisturizers

- Body Washes and Shower Gels

- Body Scrubs and Exfoliants

- Body Oils and Serums

- Body Butters and Creams

By Category

By Distribution Channel

- Retail Stores

- Supermarkets

- Hypermarkets

- Specialty Stores

- Online Platform

- E-commerce

- Company Websites

- Spas & Salons

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The e-commerce skin care product market features intense competition between global beauty brands, fast-growing direct-to-consumer labels, and online-exclusive startups. Established companies strengthen their presence through brand websites, influencer-led campaigns, and dermatologist-backed product lines. Many brands invest in subscription plans, skin analysis tools, and loyalty programs to boost repeat sales. Digital-first companies gain traction with clean-label formulations, transparent ingredient disclosures, and personalized recommendations. Online marketplaces also shape competition by offering wide product ranges, fast delivery, and seasonal discounts that attract price-sensitive customers. Premium brands rely on high customer trust and scientific claims, while emerging players compete through affordable, trend-driven formulas. As customer reviews and social media endorsements strongly influence buying decisions, companies focus on digital engagement, virtual consultations, and user-generated content. Research collaborations, limited-edition launches, and quick product innovation keep competition active, making branding, authenticity, and customer experience key factors for long-term success in the online skin care market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, M·A·C announced the US launch via Sephora both in-store and online in early 2026, expanding its e-commerce reach in the prestige beauty segment.

- In June 2025, Apparel Group India Pvt. Ltd. announced a strategic move in India to introduce additional global brands from its portfolio and boost its presence across e-commerce and direct platforms.

- In May 2025 highlighted efforts to blend skincare with aesthetic medicine and high-tech beauty, aimed at enhancing its digital and e-commerce engagement.

Report Coverage

The research report offers an in-depth analysis based on Product, Category, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital-first beauty brands will expand faster through direct-to-consumer channels.

- Subscription models will grow as customers prefer automatic replenishment of daily-use products.

- AI skin analysis and virtual consultations will improve product matching and reduce returns.

- Clean-label, vegan, and dermatologist-tested formulas will gain stronger online demand.

- Live-stream shopping and influencer collaborations will boost conversion rates.

- Premium and science-based skincare will attract higher spending from urban buyers.

- Loyalty rewards, personalized offers, and trial-size packs will increase repeat purchases.

- Faster delivery networks and easy return policies will strengthen online trust.

- Social commerce will rise on platforms where shoppers discover and buy in one place.

- Smart packaging with QR authentication will help fight counterfeit products and improve brand credibility.