Market Overview

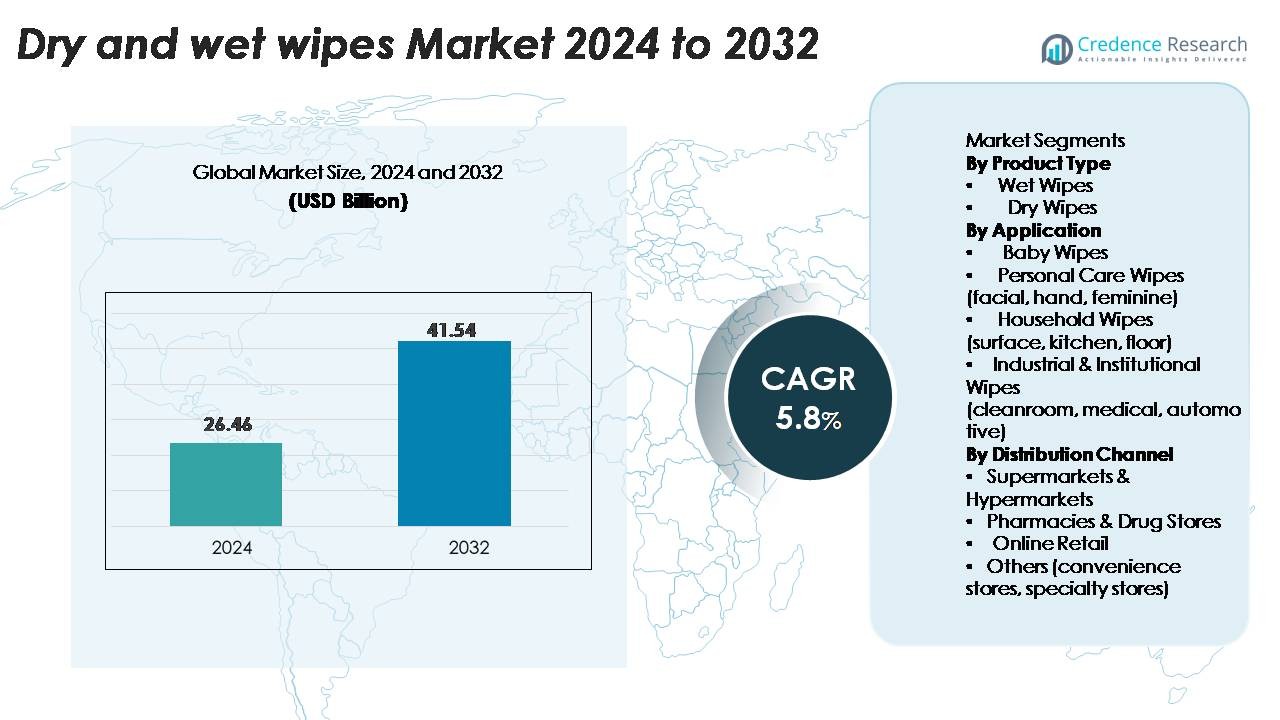

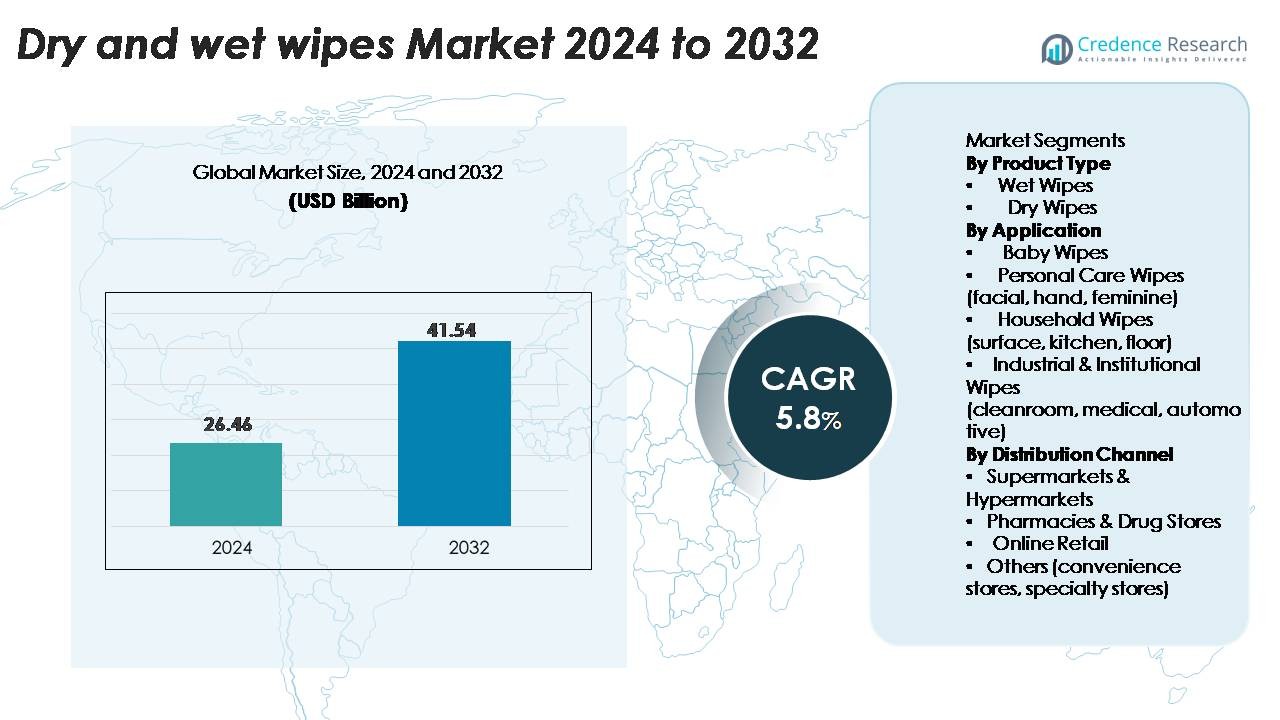

The dry and wet wipes market was valued at USD 26.46 billion in 2024 and is projected to reach USD 41.54 billion by 2032, growing at a CAGR of 5.8% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry And Wet Wipes Market Size 2024 |

USD 26.46 Billion |

| Dry And Wet Wipes Market, CAGR |

5.8% |

| Dry And Wet Wipes Market Size 2032 |

USD 41.54 Billion |

The dry and wet wipes market includes global and regional brands that focus on hygiene, baby care, household cleaning, and medical use. Key players such as Cotton Babies, Inc., Kirkland, Unicharm Corporation, Medline, The Himalaya Drug Company, Johnson & Johnson Pvt. Ltd., Hengan International Group Company Limited, Babisil Products Ltd., Pampers (Procter & Gamble), and Moony invest in soft, skin-safe fabrics and safe cleansing formulations. Their strong distribution networks across supermarkets, pharmacies, and online platforms help drive steady sales. North America leads the market with 36.2% share due to high spending on baby wipes, personal care, and disinfecting products, while Asia-Pacific continues to grow with rising hygiene awareness and urban lifestyles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The dry and wet wipes market reached USD 5.6 billion in 2024 and is expected to grow at a CAGR of 5.2% through 2032, supported by rising household and personal hygiene spending across key economies.

- Growing demand for baby wipes, antibacterial surface wipes, and makeup removal wipes drives steady adoption in homes, hospitals, and travel use. Supermarkets and online retail platforms boost visibility and product accessibility, pushing higher sales among premium and eco-friendly brands.

- Companies focus on plant-based fabrics, biodegradable materials, and skin-friendly lotions. Many brands promote alcohol-free and fragrance-free lines, meeting sensitive skin needs and supporting product credibility among parents and healthcare buyers.

- Strict disposal rules, plastic waste concerns, and raw material price fluctuations limit growth. Low-cost regional brands create strong price competition in developing markets, pressuring global manufacturers to balance quality with affordability.

- North America holds 36.2% share, driven by baby wipes and disinfecting surface wipes, while Asia-Pacific holds 24.6% share with rapid growth. Baby wipes remain the top segment with 42% share, supported by high daily use and expanding newborn populations in urban regions.

Market Segmentation Analysis:

By Product Type

Wet wipes lead the product type segment with the largest share due to strong use in baby care, personal hygiene, and household cleaning. Consumers prefer ready-to-use wipes for faster cleaning and convenience in homes, travel, and outdoor activities. Brands focus on biodegradable fabrics, alcohol-free ingredients, and skin-safe formulations to meet demand from parents and sensitive-skin users. Dry wipes grow steadily in hospitals and beauty salons, where professionals prefer disposable nonwoven sheets for sterilized cleaning. The expansion of healthcare services and grooming centers supports market use across both sub-segments.

- For instance, Pampers Aqua Pure baby wipes are made with 99% purified water and 1% dermatologically-tested gentle ingredients, and are commonly available in various counts, such as a single pack of 56 wipes or a multi-pack containing 112 wipes (two packs of 56).

By Application

Baby wipes hold the dominant share across applications because parents favor dermatologically tested and hypoallergenic formulations. Rising awareness of infant hygiene and frequent diaper changes continue to boost adoption in both developed and emerging markets. Personal care wipes gain traction among teens and adults for facial cleansing, hand sanitation, makeup removal, and feminine hygiene. Household wipes witness steady use in kitchens, bathrooms, and electronic surfaces as consumers shift from liquid cleaners to ready-to-use formats. Industrial and institutional wipes grow in hospitals, laboratories, automotive workshops, and cleanrooms that require antibacterial and lint-free surfaces.

- For instance, “JOHNSON’S® Baby Skincare Wipes are manufactured with ultra-fine cotton-blend or non-woven fibers and hold triple their dry weight in moisturising lotion.

By Distribution Channel

Supermarkets and hypermarkets command the largest market share due to wide product availability, regular promotions, and bulk-buying options. These stores display private-label and premium brands, influencing retail sales across urban regions. Pharmacies and drug stores carry dermatologist-tested and medical-grade wipes that attract health-conscious buyers. Online retail grows faster because consumers prefer doorstep delivery, subscription packs, and brand comparisons on e-commerce platforms. Convenience stores and specialty shops supply travel-friendly packs, driving impulse purchases for personal and household use.

Key Growth Drivers

Rising Demand for Convenient Hygiene Products

Consumers prefer fast and easy cleaning solutions for childcare, travel, homes, and workplaces. Wet wipes replace traditional water-based cleaning because they save time and reduce effort. Baby wipes support infant hygiene, while facial, hand, and disinfectant wipes serve personal care needs. Pandemic-driven habits increased interest in pocket-size antibacterial packs for outdoor use. Hospitals also use wipes for surface cleaning and infection control. Product innovation, such as biodegradable fabrics and alcohol-free formulations, attracts buyers who want safe and skin-friendly options. This shift toward hassle-free hygiene continues to push global sales across retail and institutional spaces.

- For instance, Pampers Aqua Pure wipes are produced with 99% purified water and dermatologically tested formulation, and each pack contains 112 sheets sealed using moisture-lock closure to prevent drying, according to Pampers’ technical product sheet.

Growing Use in Healthcare and Professional Environments

Hospitals, labs, clinics, and senior-care facilities use dry and wet wipes for daily cleaning. Medical wipes replace reusable cloths because they offer single-use sterilized cleaning and reduce cross-contamination. Elderly-care homes use body wipes for hygiene support and patient comfort. Cleanroom wipes remove dust and lint in electronics, pharmaceutical, and optical manufacturing. Beauty salons, spas, and grooming centers use dry wipes for cosmetic and skincare treatments. Rising healthcare spending and expansion of clinical facilities boost bulk orders. Strong demand from medical and professional sectors plays a major role in market growth.

- For instance, Medline Remedy® Cleansing Body Cloths (and related products like Medline ReadyBath® bathing cloths) are typically produced in large 8 x 8 inch (approximately 20 cm x 20 cm) sheets and packed in sets of 8 wipes per pouch for complete bathing of non-ambulatory patients.

Innovation in Eco-Friendly and Skin-Safe Formulations

Brands launch biodegradable, plastic-free, and flushable wipes to address environmental concerns. Many products use plant-based fibers, organic extracts, and dermatologically tested ingredients. Sensitive-skin and baby-safe wipes remain key focus areas for premium brands. Manufacturers reduce fragrance and alcohol levels, keeping wipes gentle on skin. Growing awareness of allergies and rashes encourages users to select clinically proven products. Companies invest in recyclable packaging, refill packs, and compostable materials to appeal to eco-conscious buyers. Sustainable innovation supports brand loyalty and helps companies meet global regulatory standards.

Key Trends & Opportunities

Growth of Online Retail and Subscription Models

Online marketplaces offer wide brand choices, discounts, and doorstep delivery. Digital ads, influencer marketing, and parenting blogs push product visibility. Subscription packs allow customers to receive monthly wipes without store visits. E-commerce helps niche brands target eco-friendly and dermatologist-tested categories. Rapid urbanization and smartphone adoption encourage consumers to shift toward online buying. Companies gain detailed consumer data and launch targeted promotions.

- For instance, Pampers’ online subscription pack delivers 504 baby wipes per shipment, packed in 6 sealed units of 84 wipes each, designed for long-term storage without moisture loss.

Shift Toward Natural, Hypoallergenic, and Biodegradable Products

Consumers read labels and avoid harsh chemicals, parabens, and artificial fragrances. Plant-based and compostable wipes gain momentum in households and childcare. Flushable wipes become popular in urban areas with modern sanitation systems. Brands promote allergy-tested and pH-balanced formulas. Sustainability messaging creates strong differentiation and premium pricing opportunities. Governments encourage eco-friendly packaging, leading to more product launches.

- For instance, Pampers Aqua Pure wipes are made with 99% purified water and contain a plant-derived substrate, packaged in units of 56, 112, and 504 wipes, according to Pampers’ product documentation.

Key Challenges

Environmental Disposal and Plastic Waste Concerns

Many wipes contain synthetic fibers that take years to break down. Improper disposal blocks sewage lines and increases landfill pressure. Environmental groups raise awareness about plastic content in wipes. Governments impose rules on labeling, flushability, and packaging waste. Companies must redesign materials without losing product strength or softness. Bio-based raw materials increase production cost for manufacturers.

Competition from Low-Cost and Private-Label Brands

Private-label wipes from supermarkets sell at lower prices and attract budget buyers. Small brands struggle to compete on pricing and placement. Shelf space remains limited for new entrants. Price pressure affects profit margins and slows R&D spending. Companies must differentiate through skin-safe formulas, fragrance options, and eco-friendly claims. Marketing and distribution costs remain high for premium brands.

Regional Analysis

North America

North America dominates the global dry and wet wipes market with around 36.2% share in 2024. The region’s leadership stems from high hygiene awareness, strong retail networks, and widespread use of premium wipes across baby care, household, and personal hygiene applications. Manufacturers such as Kimberly-Clark and Procter & Gamble lead innovation in flushable, biodegradable, and antimicrobial formulations. Growing e-commerce penetration and product diversification into healthcare and institutional segments further strengthen market demand. However, strict environmental regulations are pushing companies toward eco-friendly raw materials and recyclable packaging solutions.

Europe

Europe holds nearly 27% share of the global dry and wet wipes market in 2024. Demand is driven by advanced hygiene standards, sustainability goals, and increased preference for biodegradable wipes. Countries such as Germany, the U.K., and France lead the market with strong healthcare, personal care, and household applications. Key players like Essity AB and Ontex focus on product reformulation and recyclable packaging to comply with EU sustainability mandates. Institutional demand from hospitals, nursing homes, and cleaning services also supports regional consumption, while innovation centers emphasize compostable and water-dispersible wipe materials.

Asia Pacific

Asia Pacific accounts for about 24.6% share of the global dry and wet wipes market in 2024. The region’s rapid growth is attributed to urbanization, rising disposable income, and increasing hygiene awareness in China, India, and Southeast Asia. Expanding supermarket and online retail networks are improving product accessibility. Companies such as Unicharm and Nice Group are localizing products with affordable, skin-safe materials suited for tropical climates. Governments promoting public health and sanitation programs are also driving usage. The region’s market is shifting toward natural fiber wipes and eco-certified raw materials to meet sustainability expectations.

Latin America

Latin America represents roughly 7.8% share of the global dry and wet wipes market in 2024. Brazil and Mexico lead regional demand, supported by population growth, modern retail expansion, and growing hygiene consciousness. Mid-priced wipes dominate due to consumer price sensitivity, while local brands expand through supermarket chains and digital platforms. Companies like Alicorp and Grupo Familia are investing in biodegradable product lines to appeal to environmentally aware buyers. The healthcare sector also contributes significantly, with hospitals and clinics increasingly using disinfectant and sterilizing wipes for infection control.

Middle East & Africa

The Middle East & Africa region captures around 4.4% share of the global dry and wet wipes market in 2024. Market growth is supported by expanding healthcare infrastructure, increasing awareness of personal hygiene, and the spread of modern retail outlets. Gulf countries like Saudi Arabia and the UAE drive regional consumption with premium and scented wipes. In Africa, affordable baby and household wipes gain traction among middle-income households. Multinational players such as Johnson & Johnson and P&G are focusing on local manufacturing to reduce costs and improve market penetration across emerging economies.

Market Segmentations:

By Product Type

By Application

- Baby Wipes

- Personal Care Wipes (facial, hand, feminine)

- Household Wipes (surface, kitchen, floor)

- Industrial & Institutional Wipes (cleanroom, medical, automotive)

By Distribution Channel

- Supermarkets & Hypermarkets

- Pharmacies & Drug Stores

- Online Retail

- Others (convenience stores, specialty stores)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dry and wet wipes market features intense competition led by global brands, regional manufacturers, and private-label suppliers targeting different price segments. Multinational companies focus on premium formulations, biodegradable fabrics, dermatologically tested ingredients, and innovations such as flushable and plant-based wipes. Baby wipes, makeup-removal wipes, and antibacterial surface wipes remain key revenue drivers for major players with strong retail presence. Private-label brands from supermarkets and pharmacies capture cost-sensitive buyers, increasing price competition across markets. Companies invest in skin-safe ingredients, recyclable packaging, and sustainability certifications to meet consumer and regulatory expectations. Strategic partnerships with pharmacies, e-commerce platforms, and healthcare distributors help widen product reach. Firms also expand production capacity and manufacturing technologies to offer hypoallergenic, alcohol-free, and fragrance-free variants. Marketing campaigns targeting parents, beauty users, and hygiene-conscious consumers enhance brand visibility. As sustainability and safety standards evolve, competitive strategies continue to shift toward eco-friendly innovations and specialized product portfolios.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cotton Babies, Inc.

- Kirkland

- Hengan International Group Company Limited

- Pampers (Procter & Gamble)

- Babisil Products Ltd.

- Johnson & Johnson Pvt. Ltd.

- Unicharm Corporation

- The Himalaya Drug Company

- Medline

- Moony

Recent Developments

- In February 2025, the company announced the construction of a third factory in India aimed at expanding production capacity for hygiene products including wipes.

- In July 2024, Pampers partnered with Olympic athlete Allyson Felix to support NICU families via a donation initiative of up to one million Preemie Swaddlers diapers.

Report Coverage

The research report offers an in-depth analysis based on Product type, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- More brands will offer biodegradable and compostable wipes to reduce landfill waste.

- Demand for alcohol-free and skin-safe formulations will grow among sensitive users.

- Hospital and clinical wipes will expand with higher infection control standards.

- Premium baby wipes with plant-based fibers and organic lotions will gain traction.

- Online sales will increase as consumers shift to subscription and bulk delivery.

- Manufacturers will add recyclable packaging to meet sustainability goals.

- Travel-friendly pocket packs and resealable formats will attract frequent travelers.

- Private-label wipes from retail chains will rise due to competitive pricing.

- Smart disinfecting wipes with strong antiviral and antibacterial claims will see higher demand.

- Asia-Pacific markets will grow faster due to urbanization, hygiene awareness, and new product launches.