Market Overview

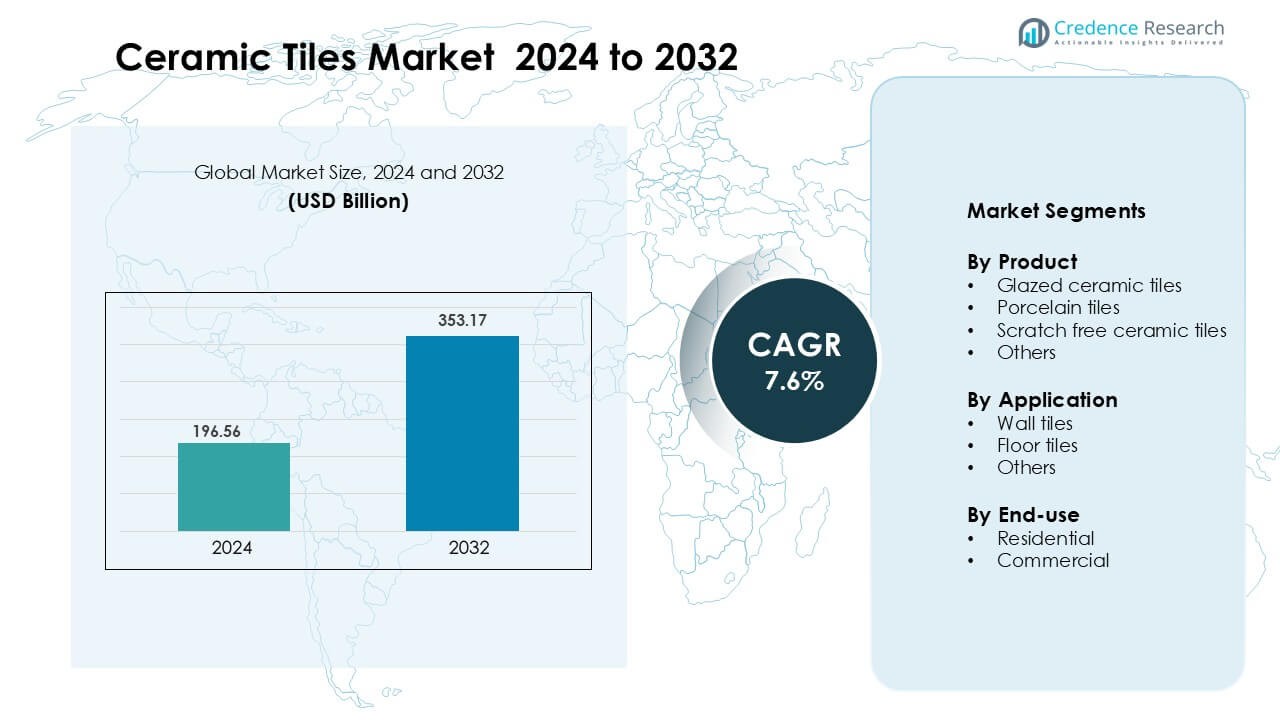

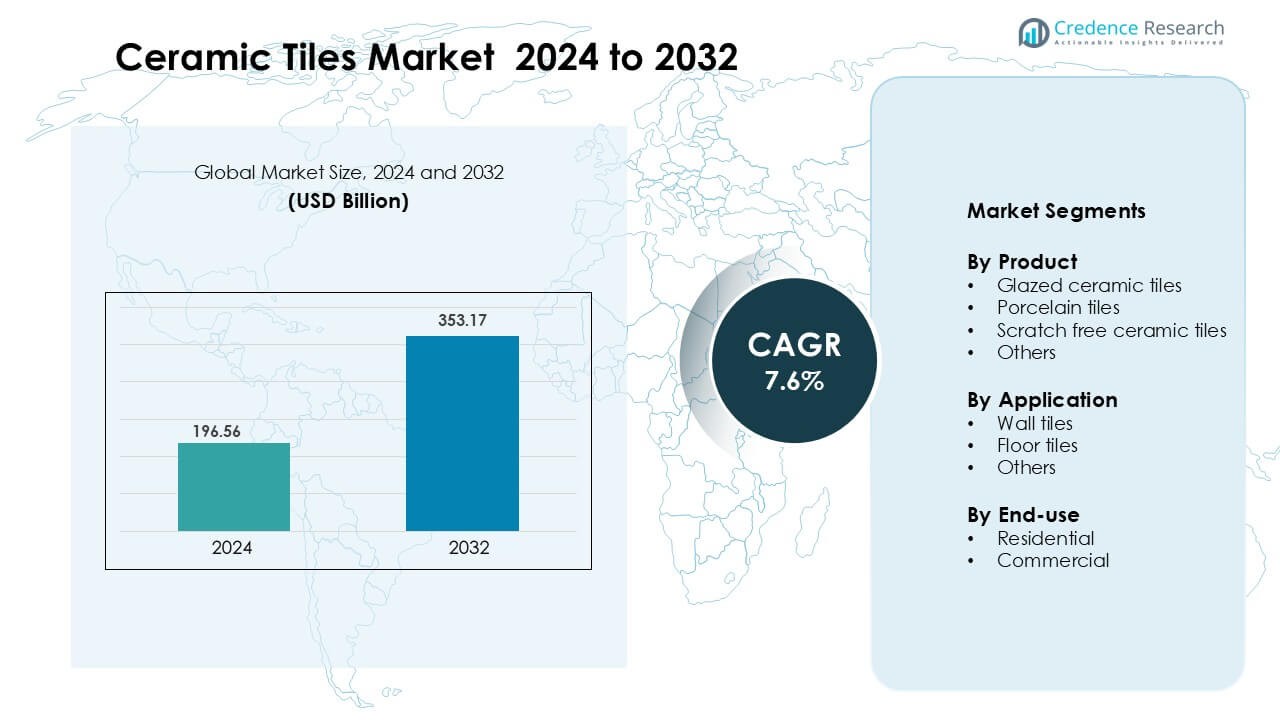

Ceramic Tiles Market was valued at USD 196.56 billion in 2024 and is anticipated to reach USD 353.17 billion by 2032, growing at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Tiles Market Size 2024 |

USD 196.56 Billion |

| Ceramic Tiles Market, CAGR |

7.6% |

| Ceramic Tiles Market Size 2032 |

USD 353.17 Billion |

The ceramic tiles market features strong competition among global and regional manufacturers. Key players include China Ceramics Co. Ltd., GRUPPO CERAMICHE RICCHETTI S.p.A., Florida Tile Inc., RAK Ceramics, PORCELANOSA Grupo A.I.E., Kajaria Ceramics Limited, Cerámica Saloni, Crossville Inc., Mohawk Industries Inc., and Atlas Concorde S.p.A. These companies compete through innovations in digital printing, scratch resistance, large-format designs, and eco-friendly production. Many brands expand distribution networks and target premium residential and commercial projects. Asia-Pacific leads the market with a 54% share, supported by large production capacity, infrastructure growth, and strong domestic consumption across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The ceramic tiles market was valued at USD 196.56 billion in 2024 and is projected to grow at a CAGR of 7.6 % during the forecast period.

- Strong demand from residential and commercial construction drives installation volumes, with porcelain tiles leading the product segment due to a 48% share supported by durability and low water absorption.

- Large-format, marble-finish, and digitally printed tiles gain traction as modern interior styles, outdoor living spaces, and renovation trends influence buying behavior in premium and mid-range housing.

- Competition remains high among Mohawk Industries, RAK Ceramics, China Ceramics Co. Ltd., and Kajaria Ceramics, with companies expanding design portfolios, eco-friendly production, and export capacity to maintain pricing and quality advantages.

- Asia-Pacific leads the global market with a 54% regional share backed by large-scale manufacturing, urban housing demand, and government infrastructure investments, while Europe holds a 21% share driven by premium product adoption and strict sustainability standards.

Market Segmentation Analysis:

By Product

Porcelain tiles hold the dominant position with a 48% market share due to high durability, low water absorption, and suitability for heavy-traffic spaces. Builders and homeowners prefer porcelain for long life and resistance to stains and frost. Glazed ceramic tiles also remain popular in budget-friendly residential projects because of their wide color options and smooth finishes. Scratch-free ceramic tiles gain traction in kitchens, schools, and healthcare areas where surface protection matters. Continuous design innovations and digital printing expand the aesthetic appeal across all product types.

- For instance, VitrA Çanakkale Seramik reports its porcelain tiles achieve water absorption of ≤ 0.5 % and a breaking strength of > 1,300 N for thickness ≥ 7.5 mm.

By Application

Floor tiles lead the segment with a 63% market share, driven by rising residential construction and commercial flooring renovations. Their strength, slip resistance, and easy maintenance make them suitable for malls, offices, and homes. Wall tiles grow in bathrooms and kitchens due to moisture protection and decorative appeal. Developers also adopt specialized tiles for outdoor pathways and facades. The shift toward modern interior styles and larger tile formats continues to boost demand across both residential and commercial properties.

- For instance, Mosa produces unglazed vitrified floor tiles whose water absorption is less than 0.05 % and whose underside absorption is ≤ 0.3 % while achieving a guaranteed slip-resistance classification of R10 even after prolonged intensive use.

By End-use

Residential construction holds the largest share at 58%, supported by urban housing, home renovation, and premium interior designs. Consumers choose porcelain and glazed tiles for living rooms, bathrooms, and balconies due to durability and style variety. Commercial demand rises in hotels, restaurants, airports, and corporate spaces where foot traffic is high and hygiene standards are strict. Developers prefer large-format porcelain tiles in commercial buildings to reduce maintenance and enhance visual appearance. Smart city projects and retail expansions further strengthen installation volumes.

Key Growth Drivers

Expanding Residential and Commercial Construction

Growing construction activities in residential and commercial sectors significantly boost ceramic tile demand. Urban housing projects, modern apartment complexes, hotels, malls, and office renovations drive continuous installation volumes. Developers prefer porcelain and glazed ceramic tiles due to long life, moisture resistance, and low maintenance. Homeowners also focus on premium flooring and attractive wall designs, increasing adoption of digital-printed and large-format tiles. In commercial buildings, slip-resistant and high-strength tiles help reduce upkeep costs in high-traffic zones. Infrastructure upgrades, real estate investments, and smart city expansion across emerging economies continue to create strong tile installation opportunities.

- For instance, RAK Ceramics P.J.S.C. reports an annual tile production capacity of 118 million square metres, supporting large-scale real-estate installations globally.

Advancements in Tile Design and Manufacturing Technologies

Technological progress supports the market through enhanced printing, texture replication, and material strength improvements. Digital printing allows manufacturers to imitate wood, stone, and marble surfaces, enabling premium finishes at lower cost. Nano-coating increases stain resistance and brightness, while rectified edges support seamless installation. Energy-efficient kilns and automatic polishing machines reduce production time and waste. Manufacturers also introduce scratch-free and anti-bacterial variants to meet hygiene and durability needs in healthcare and commercial spaces. These innovations strengthen market competitiveness and encourage faster product upgrades by both developers and homeowners.

- For instance, Florida Tile s HDP High-Definition Porcelain® process uses digital printing with a graphic variation up to 16 times greater than previous methods, and designs that do not repeat for up to 80 feet of tile run.

Rising Demand for Durable and Eco-Friendly Building Materials

Environmental awareness and regulatory standards push demand for tiles made from recycled materials and low-emission production processes. Ceramic tiles offer long service life, non-toxic surfaces, and better indoor air quality, making them suitable for green buildings. Water-saving glazing technologies and solar-powered kilns further reduce carbon footprints. Government incentives for sustainable construction increase demand from public and private projects. Certifications such as LEED support adoption in commercial spaces. As consumers choose eco-friendly flooring and wall materials over synthetic alternatives, ceramic tiles gain a stronger position in global construction.

Key Trends & Opportunities

Growth of Large-Format and Designer Tile Collections

Large-format tiles become popular in living rooms, airports, luxury hotels, and retail spaces due to seamless looks and reduced grout lines. Manufacturers introduce marble-effect, metallic, and 3D textured surfaces to match modern interior designs. Designer collections appeal to premium buyers who prefer customized patterns and statement walls. These tiles also help reduce cleaning effort, creating value in residential and commercial projects. The trend encourages brands to expand design studios, collaborate with architects, and develop specialized product lines for high-value installations.

- For instance, Absolute White 1800×1200 mm Vitrified Marble‑Look Tile is specified at a size of 1,800×1,200 mm with a 9 mm thickness, enabling expansive coverage with minimal joints.

Faster Demand Through Online Sales and Export Expansion

Online platforms help customers compare designs, select sizes, and order with doorstep delivery. Virtual room visualization tools allow users to preview layouts before purchase, increasing confidence in premium tiles. Export opportunities rise as Asian manufacturers supply cost-efficient porcelain and glazed tiles to Europe, the Middle East, and Africa. Competitive pricing and modern designs attract global buyers, supporting expansion of manufacturing capacity. Distributors and e-commerce partners improve logistics networks, making high-quality tiles accessible to small retail markets as well.

- For instance, Asiano Ceramic offers a visualiser tool allowing users to upload their room photo and preview tile layouts, while operating a manufacturing capacity of 1.2 million sq m per month and exporting to 59 + countries.

Key Challenges

Fluctuating Raw Material and Energy Costs

Ceramic tile manufacturing depends on feldspar, clay, sand, and natural gas for firing and glazing. Volatile raw material prices and rising fuel costs increase overall production expenses. Small and medium producers struggle to maintain stable pricing, resulting in margin pressure and slower capacity expansion. Some manufacturers invest in energy-efficient technologies and alternative fuels, but installation requires high capital. Frequent global supply disruptions and rising transportation costs also affect export competitiveness. Maintaining price stability against fluctuating input costs remains a major challenge for the industry.

Strong Competition from Low-Cost Imports and Substitute Materials

Local producers face pricing pressure from imported tiles that enter markets at lower rates, especially in developing economies. Some low-cost imports lack quality certifications, creating unfair competition for established brands. Alternative flooring options like vinyl, laminates, SPC, and engineered wood gain traction due to quick installation and lower labor needs. To compete, ceramic tile manufacturers must focus on product differentiation, advanced textures, enhanced durability, and certification standards. The need to balance pricing, brand image, and innovation adds complexity to market growth.

Regional Analysis

Asia-Pacific

Asia-Pacific holds the dominant position with a 54% market share due to rapid urbanization, large-scale infrastructure projects, and expanding residential construction. China, India, and Vietnam lead production with strong manufacturing capacity, low labor costs, and rising domestic consumption. Government-backed housing schemes and commercial real estate growth further drive ceramic tile installations. Export demand is also high, as regional producers supply cost-effective porcelain and glazed tiles to Europe, Africa, and the Middle East. The region benefits from technological upgrades, digital printing adoption, and growing preference for durable flooring in both premium and budget-friendly developments.

Europe

Europe accounts for a 21% market share, supported by advanced manufacturing, premium tile designs, and strict sustainability standards. Italy and Spain remain key producers, known for high-quality porcelain and designer collections. Renovation of aging infrastructure and demand for energy-efficient buildings fuel installation volumes across residential and commercial sectors. Consumers prefer large-format and textured tiles that replicate stone, marble, and wood finishes. Eco-friendly production methods and recyclable materials help companies meet environmental regulations. Increased exports to North America and Middle Eastern markets add revenue opportunities for European manufacturers.

North America

North America holds a 14% market share, driven by continuous home renovation trends, commercial remodeling, and higher spending on premium interiors. The United States leads demand for porcelain flooring in kitchens, bathrooms, hotels, and office spaces. Builders prefer large-format and slip-resistant tiles due to durability and low maintenance. Import dependence from Asia and Europe remains high, although local production increases through expansion by key tile manufacturers. Growth in luxury housing, outdoor living spaces, and environmentally certified buildings continues to strengthen tile usage across the region.

Middle East & Africa

The Middle East & Africa region represents a 7% market share, supported by high commercial construction, hospitality investments, and government-led infrastructure projects. GCC countries adopt porcelain and marble-finish tiles in hotels, malls, and luxury villas. Hot climate conditions boost demand for heat-resistant and moisture-resistant flooring over wood or carpet options. Africa sees rising consumption in urban housing and retail expansion, though price sensitivity favors affordable ceramic products. Import flows from Asia and Europe remain strong, with growing opportunities for distributors and local wholesalers.

Latin America

Latin America holds a 4% market share, with Brazil and Mexico as major markets for ceramic and porcelain tiles. Residential construction, urban redevelopment, and replacement of older flooring materials support demand. Manufacturers expand production capacity and introduce digital-printed designs that replicate stone and wood textures. Affordability, easy cleaning, and strength make tiles suitable for homes, retail outlets, restaurants, and healthcare buildings. Despite economic fluctuations and import competition, regional brands stay competitive through cost-efficient manufacturing and broad product portfolios.

Market Segmentations:

By Product

- Glazed ceramic tiles

- Porcelain tiles

- Scratch free ceramic tiles

- Others

By Application

- Wall tiles

- Floor tiles

- Others

By End-use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ceramic tiles market features a mix of global manufacturers, regional producers, and specialized design-focused brands. Leading companies such as Mohawk Industries, Porcelanosa Grupo, RAK Ceramics, China Ceramics Co. Ltd., and Kajaria Ceramics expand portfolios with porcelain, glazed, textured, and large-format tiles to serve residential and commercial projects. Many players invest in digital printing and nano-coating to enhance durability, stain resistance, and aesthetic appeal. European manufacturers emphasize premium collections and eco-friendly production, while Asian producers focus on cost efficiency and high-volume exports. Strategic partnerships with distributors, architects, and construction firms help strengthen market presence. Companies also increase investments in automation, energy-efficient kilns, and sustainability certifications to meet global building standards. Continuous innovation in design themes such as marble-effect, metallic finishes, and anti-bacterial coatings keeps competition intense, with brands targeting both mass-market and luxury segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Florida Tile launched the Claymont porcelain collection. The line adds 10 colors with a soft matte finish and relief textures. It targets handmade-look designs for walls and floors.

- In August 2024, Gruppo Cerdisa Ricchetti announced its Cersaie 2024 showcase. The group combined brands in a 360 m² stand to debut new collections. The move increased space versus 2023 to highlight product synergy.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise in residential construction as urban housing and home renovation continue to expand.

- Large-format and designer tiles will gain stronger adoption in premium interiors and commercial spaces.

- Manufacturers will increase use of digital printing and textured finishes to meet aesthetic preferences.

- Eco-friendly and recyclable tiles will see higher demand due to sustainability regulations and green building projects.

- Automation and energy-efficient kilns will improve production speed and reduce operating costs.

- Anti-bacterial, scratch-resistant, and stain-resistant tiles will gain traction in healthcare and hospitality projects.

- Companies will strengthen distribution networks through e-commerce channels and retail partnerships.

- Export opportunities will grow, especially for cost-competitive producers in Asia.

- Replacement and remodeling activities will boost tile sales in mature markets.

- Custom designs and personalized patterns will support higher margins in the premium segment.