Market Overview

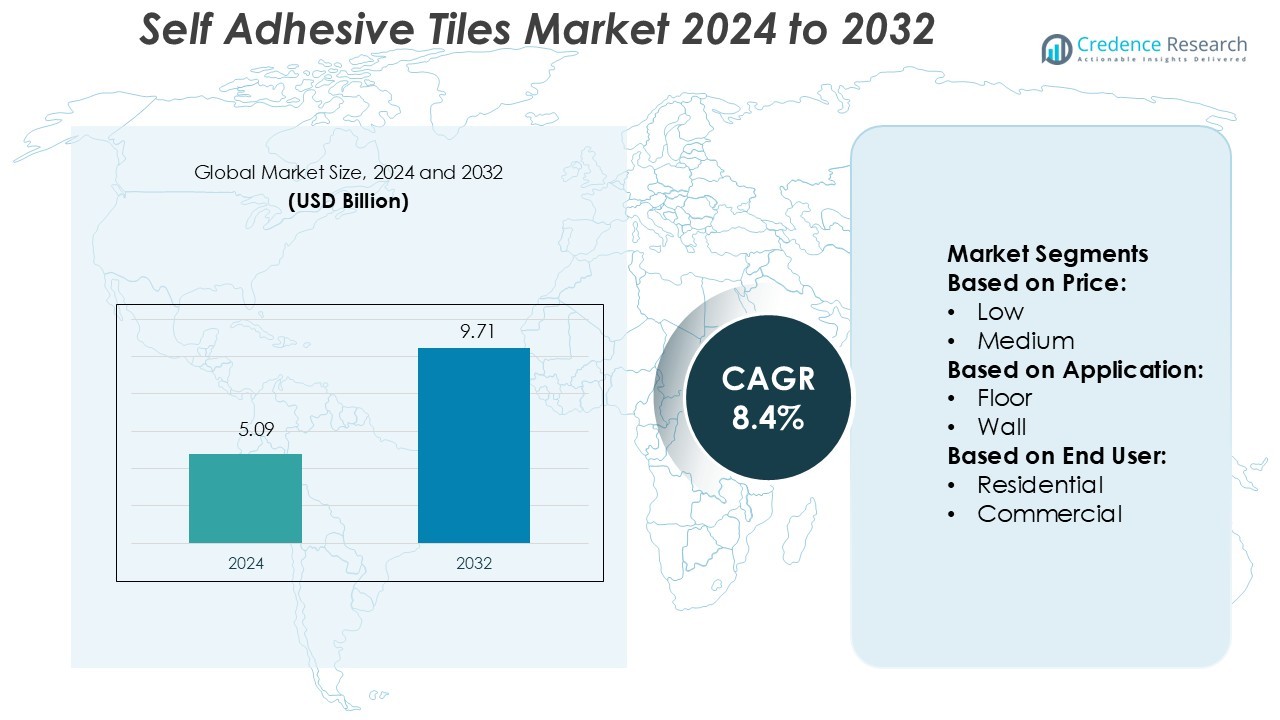

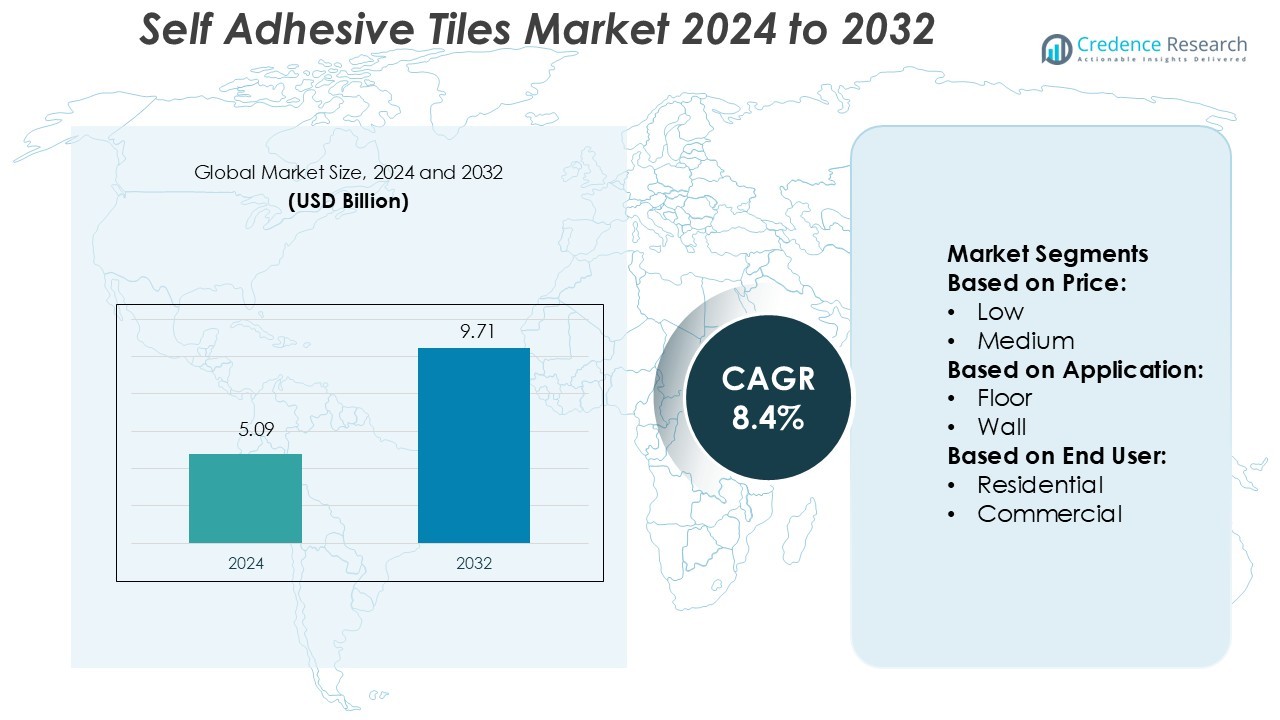

Self Adhesive Tiles Market size was valued USD 5.09 billion in 2024 and is anticipated to reach USD 9.71 billion by 2032, at a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Self Adhesive Tiles Market Size 2024 |

USD 5.09 Billion |

| Self Adhesive Tiles Market, CAGR |

8.4% |

| Self Adhesive Tiles Market Size 2032 |

USD 9.71 Billion |

The Self-Adhesive Tiles Market features strong competition among leading players focusing on design diversity, durability, and user convenience. Key companies such as Mosaic Tile Company, Armstrong Flooring Inc., Interface Inc., Gerflor Group, FloorPops by Brewster, Achim Importing Co. Inc., Forbo Flooring Systems, Dumaplast NV, InHome, and Mohawk Industries Inc. drive innovation through improved adhesive technologies and eco-friendly materials. These firms prioritize lightweight, moisture-resistant, and customizable tile solutions for both residential and commercial applications. North America leads the global market with a 36% share, supported by strong demand for DIY home renovations, high consumer spending on interior aesthetics, and widespread adoption of sustainable flooring options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Self-Adhesive Tiles Market was valued at USD 5.09 billion in 2024 and is projected to reach USD 9.71 billion by 2032, at a CAGR of 8.4%.

- Increasing demand for easy-to-install and low-maintenance flooring drives strong adoption across residential renovation projects.

- Growing preference for eco-friendly and moisture-resistant tiles supports innovation in material composition and product design.

- Leading companies focus on expanding product lines through advanced adhesive technology and customizable aesthetics for diverse applications.

- North America dominates the market with a 36% share, while the residential segment leads with over 55% contribution due to rising DIY and remodeling activities.

Market Segmentation Analysis:

By Price

The medium-priced segment dominates the Self-Adhesive Tiles Market with a 46% share. This category offers an optimal balance between cost and quality, making it a preferred choice for both residential and light commercial applications. Consumers favor these tiles for their durability, aesthetic versatility, and easy installation. Manufacturers are focusing on advanced vinyl and polymer-based products that replicate premium finishes at affordable prices. The growing renovation and remodeling activities, especially in urban households, further drive demand for mid-range options that combine modern design with cost efficiency.

- For instance, Arctech has deployed more than 91 GW of solar tracking and racking systems globally. Utility-level projects account for a majority of this capacity, showcasing Arctech’s technological ability to scale renewable integration.

By Application

The floor segment holds the largest share of 58% in the Self-Adhesive Tiles Market. High traction, water resistance, and durability make these tiles ideal for kitchens, bathrooms, and living areas. Their ability to adhere securely without additional adhesives enhances installation convenience. Increasing home improvement spending and expanding commercial flooring applications support the segment’s growth. Innovations in surface texture and finish, such as anti-slip coatings and UV protection, strengthen adoption across residential and commercial flooring projects. The segment’s dominance is also supported by rising demand for sustainable vinyl-based flooring materials.

- For instance, GameChange Solar’s MaxSpan fixed-tilt racking system uses a low number of posts per megawatt (MW), with recent reports indicating as few as 96 posts per MW. Configurations like the 3-up portrait have used as few as 120 posts per MW, while earlier 2-up portrait designs have used higher post counts.

By End User

The residential segment leads the Self-Adhesive Tiles Market with a 62% share. Rapid urbanization, rising disposable income, and growing interest in DIY home décor are driving adoption in this segment. Homeowners increasingly prefer peel-and-stick tiles for quick upgrades and aesthetic flexibility. The easy replacement and minimal maintenance of these tiles make them suitable for temporary and permanent housing solutions. Additionally, increased online retail availability and customization options encourage consumer adoption. Continuous product innovation in eco-friendly and scratch-resistant designs supports market expansion within residential renovations and interior design applications.

Key Growth Drivers

Rising Demand for Affordable Interior Solutions

The growing preference for cost-effective home renovation materials drives the Self-Adhesive Tiles Market. These tiles provide a quick, low-maintenance alternative to traditional flooring and wall materials. Easy installation without specialized tools attracts DIY homeowners and small contractors. Expanding urban housing and rental properties further increase adoption. Consumers favor self-adhesive tiles for their modern designs and reusability, which reduce renovation costs. The affordability factor continues to be a primary growth catalyst, particularly in developing economies focused on budget-friendly remodeling solutions.

- For instance, Interface’s “The Standard” carpet tile product uses a tufted yarn weight of 15 oz/yd² (509 g/m²), a pile height of 0.12 in (3 mm), and a pile density of 7,297 oz/yd³ (270,571 g/m³).

Expanding Commercial Construction Activities

Rising investments in commercial infrastructure, such as retail outlets, offices, and hospitality spaces, significantly boost market demand. Self-adhesive tiles meet the need for fast, durable, and aesthetic installations in commercial projects. Businesses prefer these tiles for their ease of replacement, sound insulation, and slip resistance. Growing emphasis on quick renovation cycles in malls and restaurants further accelerates adoption. The demand for vinyl and composite-based products suitable for high-traffic areas strengthens this driver, enhancing productivity and reducing downtime in commercial environments.

- For instance, Gerflor’s GTI MAX CONNECT tile offers an overall thickness of 0.24 in (6.0 mm) and a wear-layer thickness of 0.08 in (≈ 2.0 mm), engineered for heavy-duty use in high-traffic zones.

Technological Advancements in Tile Materials

Continuous innovation in material science has improved the performance of self-adhesive tiles. Manufacturers now offer moisture-resistant, UV-protected, and anti-slip designs that extend durability. The use of advanced adhesives ensures stronger bonding and longer lifespan. Product developments, including 3D textures and eco-friendly composites, appeal to modern consumers seeking aesthetic versatility and sustainability. Such innovations enhance tile applications across varied environments, from kitchens to commercial spaces. The introduction of recyclable and VOC-free materials also aligns with global green building standards, expanding the market’s eco-conscious consumer base.

Key Trends & Opportunities

Growing Popularity of DIY Home Improvement

The rising trend of do-it-yourself home improvement projects supports the growth of self-adhesive tiles. Consumers prefer these tiles for quick upgrades, requiring minimal effort and expertise. E-commerce platforms have made a wide range of designs and materials accessible to homeowners globally. The DIY movement, combined with social media tutorials, drives awareness and experimentation. This trend offers manufacturers opportunities to introduce user-friendly kits and creative designs. As more homeowners focus on personalization and convenience, the DIY segment continues to strengthen market growth.

- For instance, FloorPops tiles come in slab sizes of 12 in × 12 in (304.8 mm × 304.8 mm) per sheet and a nominal thickness of 0.06 in (≈ 1.52 mm) for the 12″ × 12″ vinyl tile version.

Integration of Sustainable and Recyclable Materials

Sustainability has become a key market differentiator. Manufacturers are increasingly using recyclable PVC and bio-based materials to reduce environmental impact. Eco-friendly adhesives and low-emission tiles meet global sustainability standards, appealing to conscious consumers. Companies emphasizing green certifications and transparent sourcing are gaining competitive advantages. This shift also opens avenues for product innovations in biodegradable and carbon-neutral materials. As environmental awareness rises, sustainable self-adhesive tiles will remain a major opportunity for long-term growth.

- For instance, Mohawk’s “SolidTech® R” engineered waterproof vinyl uses recycled single-use plastic and natural stone; the company reports repurposing nearly 1.5 billion pounds of waste wood and up-cycling almost 50 million pounds of discarded tires in 2024.

Expansion into Smart and Modular Designs

The adoption of smart and modular tile systems presents new opportunities. Advanced self-adhesive technologies allow interlocking and repositionable tiles suitable for flexible spaces. Integration with temperature-sensitive adhesives and digital printing expands design customization. These innovations cater to both residential and commercial users seeking high functionality and aesthetic appeal. As modular interior design trends grow, the market benefits from flexible and reconfigurable tiling systems that enhance both performance and visual impact.

Key Challenges

Durability and Adhesion Limitations

Despite their convenience, self-adhesive tiles often face durability challenges in high-moisture or high-traffic areas. Poor-quality adhesives can lead to peeling, warping, or detachment over time. Exposure to extreme temperatures or humidity weakens adhesion strength, reducing lifespan. Such limitations affect consumer confidence, especially in regions with varying climates. To overcome this, manufacturers must invest in high-performance adhesives and moisture-resistant materials that ensure consistent product reliability and long-term stability.

Intense Market Competition and Price Pressure

The market experiences strong competition from local and international players offering low-cost alternatives. This results in price pressure and reduced profit margins for premium manufacturers. Consumers often prioritize price over quality, challenging brands to balance affordability with performance. Additionally, counterfeit and low-grade imports dilute brand reputation. To address this, companies must focus on differentiation through design innovation, quality assurance, and sustainability-driven marketing to retain market share amid rising competition.

Regional Analysis

North America

North America leads the Self Adhesive Tiles Market with a 32% share, driven by the rising adoption of easy-to-install flooring solutions across residential and commercial projects. The U.S. dominates due to strong demand for vinyl and luxury peel-and-stick tiles in remodeling activities. Technological advancements, such as moisture-resistant adhesives and eco-friendly backing materials, further enhance product appeal. Canada follows with increasing construction of modern housing and offices supporting market expansion. The region benefits from established retail networks and high consumer preference for durable, cost-effective, and low-maintenance interior solutions, positioning it as a major contributor to global revenue growth.

Europe

Europe accounts for a 27% share of the Self Adhesive Tiles Market, fueled by increasing home renovation activities and the rising popularity of sustainable building materials. The UK, Germany, and France lead due to strong emphasis on aesthetics, durability, and environmental performance in interior design. Growing usage of recyclable tiles and water-based adhesives aligns with the region’s stringent environmental regulations. Advanced manufacturing and innovation in design textures boost consumer adoption. Favorable housing renovation incentives and growing demand from hospitality and retail sectors strengthen the European market’s position as a key hub for premium self-adhesive tile products.

Asia-Pacific

Asia-Pacific holds a 29% market share and is the fastest-growing region in the Self Adhesive Tiles Market. Growth is driven by expanding urban infrastructure, rising disposable income, and rapid residential construction in China, India, and Southeast Asia. Local manufacturers are increasing production of affordable, customizable tile solutions catering to middle-income households. The preference for DIY home improvement and the availability of cost-effective peel-and-stick products further enhance adoption. With technological innovation and strong retail presence, Asia-Pacific continues to attract investments in lightweight, durable, and moisture-resistant adhesive tiles, ensuring long-term dominance in both residential and commercial applications.

Latin America

Latin America captures a 7% share of the Self Adhesive Tiles Market, supported by growing urbanization and infrastructure modernization in Brazil and Mexico. The region’s focus on affordable housing and low-cost renovation solutions drives adoption of peel-and-stick tiles in residential projects. Expanding retail availability through online and offline channels strengthens product accessibility. Manufacturers are introducing tiles with heat- and humidity-resistant adhesives suitable for tropical climates. The commercial sector, particularly hospitality and small business spaces, is increasingly opting for quick-installation flooring materials. Despite moderate growth, rising consumer awareness and evolving design trends are expected to enhance regional market potential.

Middle East & Africa

The Middle East & Africa region holds a 5% market share in the Self Adhesive Tiles Market, with demand concentrated in the UAE, Saudi Arabia, and South Africa. Rapid commercial construction, hospitality expansion, and interior renovation projects drive market penetration. The popularity of luxury vinyl and decorative adhesive tiles is growing among urban households and developers. Increasing investments in retail infrastructure and smart home design further boost demand. However, high import dependency and limited local manufacturing pose challenges. Ongoing diversification in non-oil construction and increased use of durable adhesive materials support the region’s steady market growth trajectory.

Market Segmentations:

By Price:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Self Adhesive Tiles Market is highly competitive, featuring key players such as Mosaic Tile Company, Armstrong Flooring Inc., Interface, Inc., Gerflor Group, FloorPops by Brewster, Achim Importing Co. Inc., Forbo Flooring Systems, Dumaplast NV, InHome, and Mohawk Industries, Inc. The Self Adhesive Tiles Market features intense competition driven by innovation, design diversity, and sustainability-focused production. Companies emphasize advanced adhesive technologies, improved durability, and eco-friendly materials to meet rising consumer expectations across residential and commercial applications. The market is witnessing a surge in demand for customizable, water-resistant, and easy-to-install tile options that reduce renovation time and labor costs. Manufacturers are investing in digital printing and surface protection technologies to enhance product aesthetics and lifespan. Additionally, expanding online retail channels and strategic collaborations with construction and interior design firms strengthen market reach. Sustainability initiatives, including recyclable vinyl materials and low-emission adhesives, further define competitive differentiation in this evolving market.

Key Player Analysis

- Mosaic Tile Company

- Armstrong Flooring Inc.

- Interface, Inc.

- Gerflor Group

- FloorPops by Brewster

- Achim Importing Co. Inc.

- Forbo Flooring Systems

- Dumaplast NV

- InHome

- Mohawk Industries, Inc.

Recent Developments

- In October 2024, RAK Ceramics partnered with Sobha Constructions LLC to supply premium ceramics and porcelain tiles for Sobha’s upcoming projects. With this partnership, RAK Ceramics increases its customer base in the construction industry.

- In June 2023, H & R Johnson, a company that is part of Prism Johnson Limited, launched a new collection at an event in Kolkata, India. The collection featured over 3,000 new ceramic tile designs, intended for a variety of spaces to meet the demand of architects and designers.

- In February 2023, Mohawk Industries, Inc. acquired Elizabeth Revestimentos in Brazil. This acquisition added four new production facilities, geographically complementing existing operations and creating opportunities for sales and operational synergies—such development solidifying Mohawk’s position as the leading ceramic tile supplier in Brazil.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Price, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for quick renovation solutions will boost product adoption in residential projects.

- Growing focus on easy-to-install flooring options will enhance market penetration.

- Increasing use of eco-friendly and recyclable materials will strengthen sustainability goals.

- Expansion of commercial and retail construction will create consistent growth opportunities.

- Advancements in adhesive and backing technology will improve tile durability and lifespan.

- Online retail platforms will play a major role in product distribution and consumer reach.

- Customization trends will drive innovation in texture, design, and finish options.

- Smart home renovation projects will increase demand for aesthetic and functional flooring.

- Expanding urban housing projects will drive large-scale installation in new developments.

- Strategic partnerships between manufacturers and designers will accelerate global market expansion.