Market Overview:

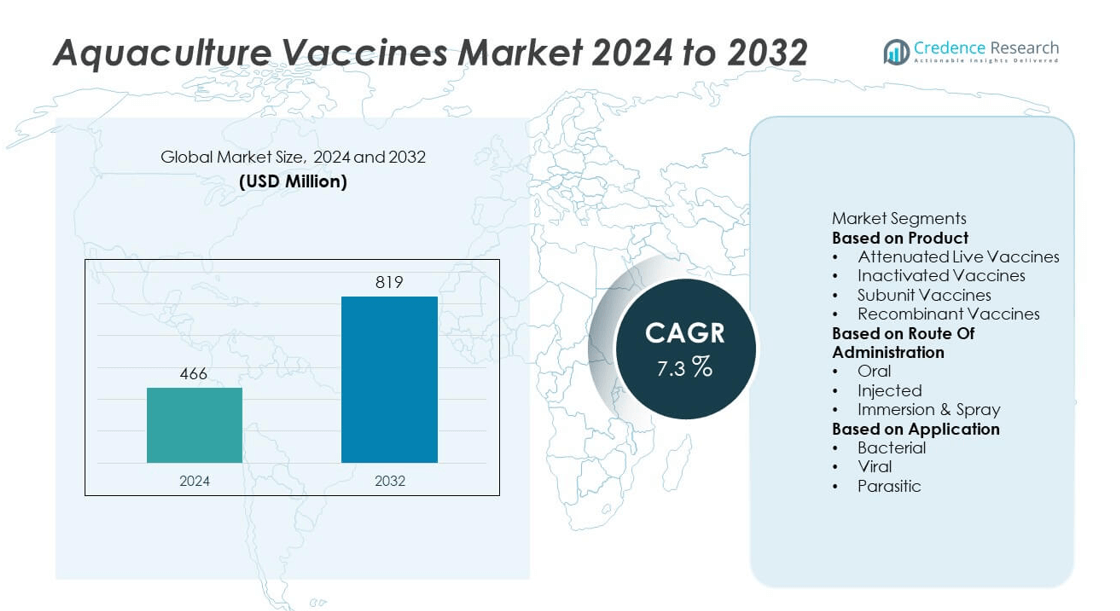

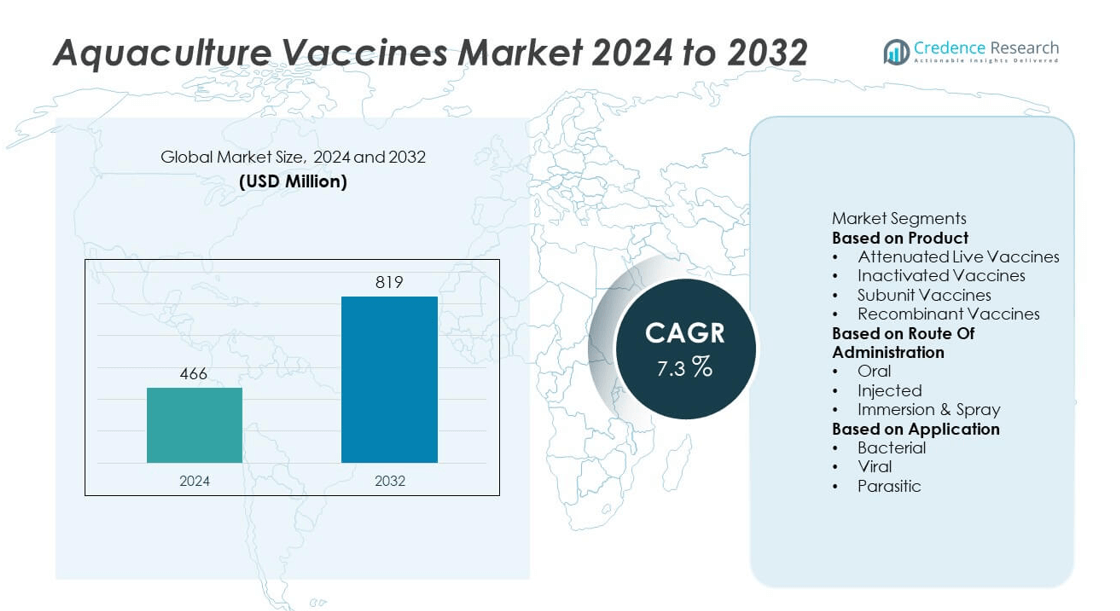

The global aquaculture vaccines market was valued at USD 466 million in 2024 and is projected to reach USD 819 million by 2032, expanding at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aquaculture Vaccines Market Size 2024 |

USD 466 million |

| Aquaculture Vaccines Market , CAGR |

7.3% |

| Aquaculture Vaccines Market Size 2032 |

USD 819 million |

The aquaculture vaccines market is led by major players including HIPRA, Elanco, Kyoto Biken Laboratories, Inc., Vaxxinova International BV, Phibro Animal Health Corporation, Zoetis, Nisseiken Co., Ltd., KBNP, Merck & Co., Inc., and CAVAC. These companies focus on developing advanced inactivated, recombinant, and multivalent vaccines to combat bacterial and viral infections in fish and shrimp. Europe dominated the global market with a 34.2% share in 2024, supported by strong salmon farming activity and robust regulatory frameworks. North America followed with 37.5%, while Asia Pacific held a 20.1% share, emerging as the fastest-growing region due to rising aquaculture output and government-led vaccination programs.

Market Insights

- The aquaculture vaccines market was valued at USD 466 million in 2024 and is projected to reach USD 819 million by 2032, growing at a CAGR of 7.3%.

- Rising outbreaks of bacterial and viral infections in fish species are driving demand for preventive vaccination and reducing reliance on antibiotics.

- Advancements in recombinant and multivalent vaccines are shaping market trends by offering broader protection and longer immunity for farmed fish.

- Key players such as HIPRA, Zoetis, and Elanco are expanding their portfolios through innovation and partnerships to enhance disease management efficiency.

- North America led the market with a 37.5% share in 2024, followed by Europe with 34.2%, while Asia Pacific held 20.1% and remained the fastest-growing region; by product, inactivated vaccines accounted for a 46.3% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Inactivated vaccines dominated the aquaculture vaccines market with a 46.3% share in 2024. These vaccines are favored for their high stability, safety, and broad effectiveness against bacterial pathogens. They induce a strong and consistent immune response without the risk of virulence reversion, making them suitable for large-scale aquaculture systems. Their use is particularly widespread in salmon, tilapia, and catfish farming to prevent Aeromonas and Vibrio infections. Pharmaq, a Zoetis subsidiary, continues to advance inactivated vaccine formulations that improve survival rates and yield performance across major aquaculture-producing regions.

- For instance, Pharmaq, a Zoetis subsidiary, is a leading global producer of inactivated fish vaccines with production sites including Norway and Chile, and has produced hundreds of millions of doses annually covering numerous aquaculture species such as salmonids and tilapia.

By Route of Administration

The injected route held the largest share of 49.5% in 2024, supported by its superior precision and long-term immunity. This method ensures uniform vaccine delivery and higher protection levels for species like salmon, trout, and sea bass. Injectable vaccines remain the gold standard in intensive aquaculture systems due to reliable dosing and strong disease resistance outcomes. Elanco Animal Health provides injectable vaccines designed for single-dose protection against major bacterial diseases. Advances in automated vaccination technologies are streamlining large-scale administration, reducing stress in fish, and improving production efficiency across commercial hatcheries.

- For instance, MSD Animal Health’s AquaVac® line provides single-injection protection against several fish pathogens, such as infectious pancreatic necrosis, furunculosis, and pancreas disease in Atlantic salmon, with some systems able to vaccinate thousands of fish per hour.

By Application

The bacterial segment accounted for the largest market share of 57.8% in 2024, driven by the prevalence of bacterial infections including vibriosis, furunculosis, and streptococcosis. Increasing restrictions on antibiotic use have shifted focus toward preventive vaccination to ensure sustainable fish health management. Continuous production of bacterial vaccines for freshwater and marine species is strengthening global aquaculture resilience. HIPRA expanded its vaccine portfolio to cover Aeromonas salmonicida and Vibrio anguillarum, offering enhanced protection against recurrent bacterial outbreaks and supporting antibiotic-free aquaculture operations in key farming regions worldwide.

Key Growth Drivers

Rising Incidence of Aquatic Diseases

Increasing outbreaks of bacterial, viral, and parasitic infections are driving vaccine adoption in global aquaculture. Pathogens such as Vibrio anguillarum, Aeromonas hydrophila, and Infectious Salmon Anaemia Virus continue to cause major losses in fish farms. Norway, Chile, and Scotland have strengthened surveillance and immunization programs following repeated disease events in salmon populations. Government-backed initiatives, including the World Organisation for Animal Health (WOAH) Aquatic Animal Health Strategy, are promoting vaccine-based disease prevention as a primary biosecurity measure. The growing intensity of aquaculture production systems further reinforces the need for reliable immunization to sustain yields.

- For instance, Benchmark Animal Health supports health programs for more than 20 fish species across Europe, Asia, and Latin America, with their genetics division operating four in-house breeding programs for salmon and shrimp.

Shift Toward Antibiotic-Free Aquaculture

Global regulations from authorities such as the European Medicines Agency (EMA) and the U.S. FDA are increasingly restricting antibiotic use in aquaculture. Countries including Norway, Canada, and Chile now rely primarily on preventive vaccination to control bacterial infections. This shift aligns with international antimicrobial resistance (AMR) action plans and consumer demand for residue-free seafood. Major producers are adopting vaccination as a sustainable and traceable disease control strategy, improving fish survival rates and environmental outcomes. Collaborative programs between vaccine developers and aquafeed companies are also expanding integrated, antibiotic-free farming solutions.

- For instance, MSD Animal Health’s AQUAVAC® program has delivered over 2 billion fish vaccine doses globally, contributing to antibiotic usage reduction in more than 40 commercial aquaculture operations spanning 15 countries.

Technological Advancements in Vaccine Development

Progress in genomics, proteomics, and molecular diagnostics is accelerating vaccine innovation. Recombinant DNA and subunit vaccines are being designed to stimulate species-specific immune pathways with improved safety profiles. Research institutions such as the University of Stirling and the Norwegian Veterinary Institute are working on thermostable vaccines that maintain potency at up to 30 °C, reducing cold-chain dependence. Biotech firms are integrating nanoparticle delivery systems and oral encapsulation technologies to enhance mucosal immunity in tilapia, carp, and shrimp. These advancements are improving protection rates and supporting faster regulatory approvals for next-generation vaccines.

Key Trends & Opportunities

Growing Adoption of Multivalent Vaccines

Multivalent formulations combining protection against several pathogens in a single dose are gaining traction across intensive aquaculture systems. These vaccines reduce handling frequency, improve animal welfare, and optimize farm labor efficiency. Companies such as PHARMAQ (a Zoetis subsidiary) and Hipra have developed injectable vaccines covering multiple bacterial diseases affecting salmon and trout. Their use has significantly lowered disease recurrence and enhanced production stability in Norway and Chile. The ongoing shift toward all-in-one solutions aligns with the industry’s goal of maximizing yield with minimal operational disruption.

- For instance, PHARMAQ’s ALPHA JECT micro 7 ILA vaccine is a widely used vaccine in Atlantic salmon aquaculture across regions including Europe and South America, which helps improve fish survival against several bacterial pathogens, such as furunculosis and vibriosis, as well as viral diseases like Infectious Pancreatic Necrosis (IPN) and Infectious Salmon Anaemia (ISA).

Expansion of Oral and Immersion Delivery Methods

Oral and immersion vaccination technologies are emerging as scalable alternatives to injection-based administration. These methods enable immunization of large fish populations—particularly larvae and juveniles—without inducing stress. Leading aquaculture biotech firms are investing in microencapsulation systems that preserve antigen stability in feed for up to 6 months under controlled conditions. Field trials in shrimp and tilapia farms across Southeast Asia and Latin America have shown improved survival and immune responses through oral dosing. Continued development of cost-effective and thermostable formulations is expected to expand accessibility in low-resource aquaculture regions.

- For instance, research is ongoing into the development of experimental oral vaccines capable of delivering antigens via nanoparticles, with some studies in laboratory settings demonstrating high protection rates (up to 80-90%) in fish such as tilapia.

Key Challenges

High Production and Development Costs

Developing effective aquaculture vaccines demands extensive research, multi-phase clinical trials, and strict regulatory validation. Production of live and recombinant vaccines involves maintaining cold-chain logistics between 2 °C and 8 °C, which raises transportation and storage expenses. DNA vaccine projects can require over USD 10 million in R&D and pre-commercial testing before approval. The complex bioprocessing steps—such as cell culture fermentation, purification, and quality control—further elevate costs. To overcome these challenges, leading producers are investing in modular biomanufacturing systems, single-use bioreactors, and public-private technology transfer initiatives to reduce overheads and improve cost efficiency.

Limited Vaccine Coverage Across Species

Current vaccine portfolios remain concentrated on salmonid species like Atlantic salmon and rainbow trout, while high-volume tropical fish such as tilapia, catfish, and pangasius remain under-protected. The genetic and immunological variation across these species complicates antigen targeting and limits cross-protection. Vaccine efficacy trials often require large sample sizes and extended aquatic field testing periods of 8 to 12 months, slowing commercialization for new species. This limited spectrum encourages greater antibiotic dependence in Asian and African aquaculture sectors. Ongoing genomic research, adjuvant innovation, and multi-species antigen mapping are key to expanding effective coverage and strengthening biosecurity in global aquaculture.

Regional Analysis

North America

North America held a 37.5% share of the aquaculture vaccines market in 2024, driven by advanced fish farming practices and strong adoption of preventive healthcare solutions. The United States and Canada lead with well-established salmon and trout farming industries that rely heavily on vaccination to reduce antibiotic use. Government-supported disease control programs and technological collaborations with biotech firms strengthen market expansion. For instance, companies like Elanco Animal Health and Merck Animal Health are investing in innovative multivalent vaccines to enhance production efficiency and fish survival rates across commercial aquaculture systems.

Europe

Europe accounted for a 34.2% share in 2024, supported by extensive salmon farming and stringent regulatory frameworks promoting sustainable aquaculture. Norway, Scotland, and Denmark dominate production, emphasizing vaccination as a core component of biosecurity strategies. The region’s strong R&D ecosystem fosters continuous innovation in inactivated and recombinant vaccine technologies. For instance, Pharmaq and HIPRA are advancing customized vaccine programs for Atlantic salmon and cod. Growing consumer demand for antibiotic-free seafood and government initiatives supporting disease monitoring further strengthen Europe’s leadership in the global aquaculture vaccine market.

Asia Pacific

Asia Pacific captured a 20.1% market share in 2024 and is projected to grow fastest through 2032. China, India, Vietnam, and Indonesia are major contributors, driven by rapid aquaculture expansion and increasing disease outbreaks. Government programs encouraging sustainable fish farming practices are promoting vaccine adoption. Local manufacturers are developing affordable vaccines for high-volume species such as tilapia and carp. For instance, Virbac and China Animal Husbandry Group are focusing on oral vaccine innovations to improve large-scale immunization. Rising seafood demand and improved veterinary infrastructure continue to drive regional market growth.

Latin America

Latin America represented a 5.1% share in 2024, supported by the expanding aquaculture industries in Chile and Brazil. The region’s strong salmon and tilapia farming sectors are investing in vaccines to combat bacterial and viral diseases. Government-led disease control programs and collaborations with international pharmaceutical firms are enhancing vaccine accessibility. For instance, HIPRA and Benchmark Holdings have introduced localized vaccine solutions to address region-specific pathogens. Increasing export demand for high-quality seafood and the shift toward antibiotic-free production methods are accelerating the adoption of vaccination practices across Latin American aquaculture farms.

Middle East & Africa

The Middle East & Africa accounted for a 3.1% market share in 2024, driven by gradual expansion of aquaculture activities and growing interest in sustainable fish production. Egypt, Saudi Arabia, and South Africa are key contributors, focusing on improving disease prevention in freshwater and marine fish species. Regional initiatives promoting food security and diversification of protein sources are boosting investment in aquaculture health management. For instance, regional collaborations with global companies such as Zoetis and HIPRA are helping enhance vaccine availability and awareness, supporting long-term industry development in emerging aquaculture markets.

Market Segmentations:

By Product

- Attenuated Live Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- Recombinant Vaccines

By Route Of Administration

- Oral

- Injected

- Immersion & Spray

By Application

- Bacterial

- Viral

- Parasitic

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the aquaculture vaccines market is characterized by strong research capabilities and global expansion strategies among major players such as HIPRA, Elanco, Kyoto Biken Laboratories, Inc., Vaxxinova International BV, Phibro Animal Health Corporation, Zoetis, Nisseiken Co., Ltd., KBNP, Merck & Co., Inc., and CAVAC. These companies focus on developing innovative multivalent and recombinant vaccines to enhance fish health and reduce dependency on antibiotics. Strategic collaborations with aquaculture producers and biotechnology firms are strengthening their product portfolios and regional presence. Leading players are also investing in oral and immersion vaccine technologies to simplify administration and improve fish welfare. Continuous investment in R&D, disease-specific vaccine development, and regulatory approvals enable these companies to maintain a competitive edge. Additionally, expanding distribution networks across Asia Pacific and Latin America supports market accessibility and addresses growing demand from emerging aquaculture hubs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HIPRA

- Elanco

- Kyoto Biken Laboratories, Inc.

- Vaxxinova International BV

- Phibro Animal Health Corporation

- Zoetis

- Nisseiken Co., Ltd.

- KBNP

- Merck & Co., Inc.

- CAVAC

Recent Developments

- In September 2025, Zoetis’ PHARMAQ reported research showing a 0.05 ml six-component salmon vaccine dose yielded 8% higher weights than a 0.1 ml dose in a Norwegian trial.

- In April 2025, HIPRA launched ICTHIOVAC ERM for European salmon, an immersion vaccine against Yersinia ruckeri.

- In February 2024, Elanco announced the sale of its aqua unit to MSD Animal Health, which includes the DNA vaccine CLYNAV and sea-lice treatment IMVIXA.

Report Coverage

The research report offers an in-depth analysis based on Product, Route Of Administration, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising global fish consumption will continue to drive vaccine adoption in aquaculture.

- Development of multivalent vaccines will improve disease prevention and reduce handling stress.

- Expansion of oral and immersion vaccine delivery will enhance ease of administration.

- Biotechnology innovations will enable faster production of targeted and recombinant vaccines.

- Increasing restrictions on antibiotics will further accelerate vaccination programs in fish farming.

- Government support for sustainable aquaculture will strengthen vaccination awareness and adoption.

- Asia Pacific will emerge as the fastest-growing market with strong investment in fish health management.

- Partnerships between vaccine producers and aquaculture farms will improve large-scale disease control.

- Automation and robotic vaccination technologies will boost operational efficiency in intensive aquaculture systems.

- Continuous R&D in species-specific and thermostable vaccines will expand accessibility across diverse aquatic species.