Market Overview

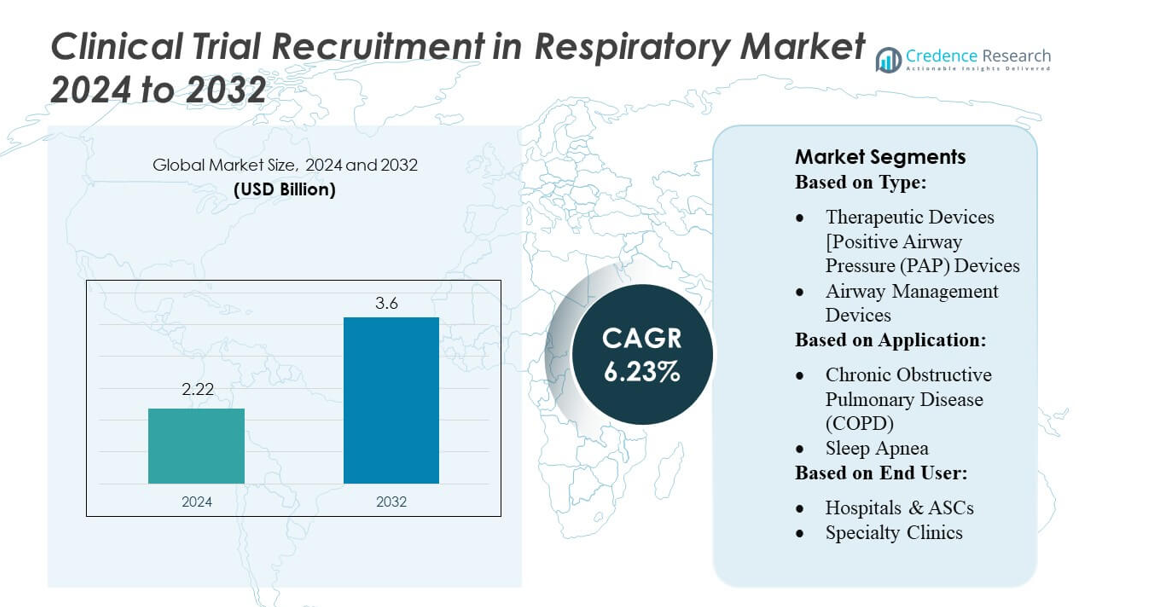

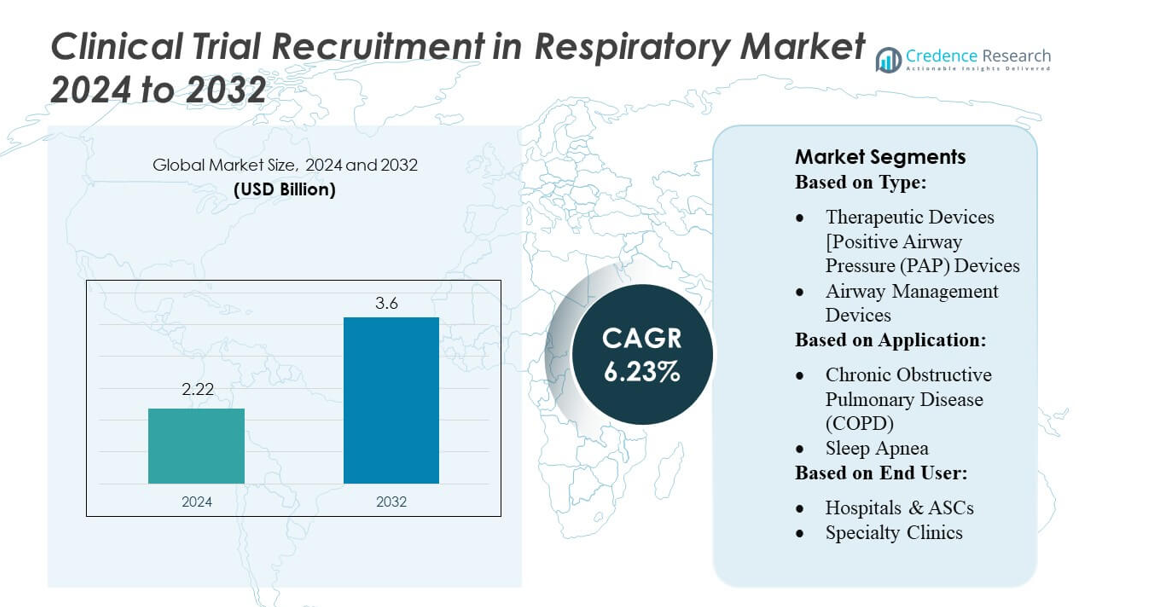

Clinical Trial Recruitment in Respiratory Market size was valued USD 2.22 billion in 2024 and is anticipated to reach USD 3.6 billion by 2032, at a CAGR of 6.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clinical Trial Recruitment in Respiratory Market Size 2024 |

USD 2.22 billion |

| Clinical Trial Recruitment in Respiratory Market, CAGR |

6.23% |

| Clinical Trial Recruitment in Respiratory Market Size 2032 |

USD 3.6 billion |

The Clinical Trial Recruitment in Respiratory Market is supported by a diverse ecosystem of global CROs, biopharmaceutical companies, and digital recruitment platforms that specialize in accelerating enrollment for COPD, asthma, sleep apnea, and infectious respiratory disease studies. Competitors strengthen their capabilities through AI-assisted patient screening, decentralized trial models, and integrated respiratory monitoring technologies that enhance both recruitment speed and participant retention. North America leads the market with 38% share, driven by robust research infrastructure, extensive pulmonary care networks, and strong adoption of digital recruitment tools that enable efficient identification of diverse and phenotype-specific patient cohorts.

Market Insights

- The Clinical Trial Recruitment in Respiratory Market was valued at USD 2.22 billion in 2024 and is projected to reach USD 3.6 billion by 2032, reflecting a CAGR of 6.23%, supported by rising demand for efficient enrollment across COPD, asthma, and sleep apnea trials.

- Market growth is driven by increasing respiratory disease prevalence, rapid adoption of AI-enabled screening tools, and strong momentum toward decentralized and hybrid clinical trial models that reduce patient burden and accelerate recruitment timelines.

- Key trends include the expansion of connected respiratory devices, rising use of EHR-integrated patient identification systems, and increasing investment in biomarker-driven trials requiring precise cohort selection.

- Competitive activity intensifies as global CROs and digital recruitment firms enhance capabilities in real-time monitoring, automated eligibility assessment, and remote participant engagement while addressing constraints related to strict inclusion criteria and high screen-failure rates.

- Regionally, North America holds 38% share, while therapeutic devices remain the leading segment with the highest enrollment activity, supported by strong site infrastructure and digital recruitment adoption across advanced pulmonary care networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Therapeutic devices represent the dominant segment with an estimated 42–45% market share, driven by strong clinical trial demand for PAP systems, inhalers, and portable ventilators. Trials targeting COPD, asthma, and sleep apnea increasingly prioritize high-accuracy, patient-friendly devices that support long-term monitoring and adherence evaluation. Diagnostic and monitoring tools such as spirometers and polysomnography systems follow closely due to the need for standardized lung-function assessment across multi-site trials. Consumables and accessories also expand steadily, supported by frequent participant turnover and the need for sterile, single-use respiratory interfaces.

- For instance, Syneos Health integrated ResMed’s AirSense 10 platform—capable of capturing more than 1.5 million data points per user per night across flow, pressure, leak, and respiratory-rate metrics—into decentralized respiratory trials to enhance remote adherence tracking and endpoint precision.

By Application

COPD accounts for the largest application share at around 35%, driven by high global prevalence, frequent exacerbations, and continuous demand for diverse patient cohorts across disease-severity stages. Trials in COPD benefit from well-established outcome measures, structured recruitment frameworks, and strong industry funding. Asthma and sleep apnea segments also record significant activity as companies test next-generation inhalation therapies, biologics, and digital respiratory monitoring solutions. Infectious respiratory diseases, particularly post-COVID-19 viral and bacterial pathogens, sustain substantial recruitment volumes due to the need for rapid therapeutic validation and real-world patient data.

- For instance, the Sanofi and Regeneron Phase 3 development program for the anti-IL-33 antibody Itepekimab incorporated over 2,000 COPD patients across two main trials (AERIFY-1 and AERIFY-2).

By End User

Hospitals and ambulatory surgical centers (ASCs) lead the market with over 40% share, supported by access to large patient pools, advanced respiratory diagnostic infrastructure, and strong investigator participation in multi-phase studies. Their ability to manage complex respiratory cases and perform detailed physiological testing strengthens recruitment efficiency. Specialty clinics grow steadily as they provide disease-specific cohorts and long-term follow-up environments essential for chronic respiratory trials. Home-care settings gain traction through decentralized and hybrid trial models, where remote monitoring devices, teleconsultations, and ePRO systems help accelerate participant enrollment and retention.

Key Growth Drivers

Rising Prevalence of Chronic Respiratory Diseases

The surge in global cases of COPD, asthma, and sleep apnea significantly drives recruitment activities in respiratory clinical trials. High disease burden across aging populations increases the availability of eligible patient cohorts, enabling faster enrollment for Phase II and III studies. Growing diagnosis rates through spirometry and home-based screening tools also widen the recruitment funnel. Pharmaceutical companies prioritize respiratory pipelines—including inhaled therapies, biologics, and digital therapeutics—creating consistent demand for large, diverse participant pools across multi-region trials.

- For instance, SGS SA’s Clinical Research unit deployed its digital respiratory assessment platform—capable of capturing over 20,000 breath-by-breath flow and pressure data points per patient per session—to accelerate phenotyping for COPD and asthma enrollment.

Expansion of Decentralized and Hybrid Trial Models

Adoption of decentralized and hybrid trial models accelerates recruitment by reducing participant burden and improving accessibility for respiratory patients who often face mobility and hospitalization challenges. Remote spirometry, connected inhalers, wearable oximeters, and telemedicine consultations enable broader geographic outreach while maintaining data quality. Sponsors employ digital pre-screening, eConsent, and AI-driven patient matching to shorten recruitment timelines. These technology-enabled workflows are particularly effective for chronic diseases requiring continuous monitoring, boosting enrollment efficiency and retention rates across complex, long-duration respiratory trials.

- For instance, ICON plc’s proprietary Lumos decentralized trial platform integrated remote respiratory monitoring devices that transmit up to 60 spirometry curves per patient per day, enabling real-time lung-function trend analysis in global COPD and asthma studies.

Increased Investment in Novel Respiratory Therapies

Growing R&D investments in biologics, gene-based therapies, anti-inflammatory molecules, and long-acting inhalation products fuel rapid expansion of respiratory trials. As companies pursue targeted therapies for severe asthma, rare pulmonary disorders, and post-viral complications, recruitment needs intensify due to the requirement for phenotype-specific and biomarker-defined cohorts. Regulatory incentives for orphan and breakthrough respiratory drugs further accelerate trial initiation. This expanding therapeutic pipeline increases collaboration between hospitals, CROs, and digital recruitment platforms to secure specialized patient groups and improve enrollment speed.

Key Trends & Opportunities

Rising Use of Digital Recruitment and AI-Based Screening

AI-enabled recruitment platforms, electronic health record (EHR) mining, and predictive analytics create major opportunities for precise patient targeting in respiratory trials. Automated identification of airway obstruction patterns, sleep apnea indicators, or inflammatory biomarkers helps match participants to protocol criteria quickly. Digital outreach through patient registries and mobile apps improves engagement and reduces screening failures. As sponsors emphasize real-world evidence and genotype-phenotype mapping, technology-driven recruitment becomes integral to building diverse respiratory trial populations across both urban and remote regions.

- For instance, IQVIA launched its One Home for Sites™ platform, which aggregates over 100 site-software systems into a single sign-on dashboard used by more than 100 site personnel to pilot streamlined trial operations.

Growth of Connected Respiratory Devices and Remote Monitoring

Increasing adoption of connected inhalers, cloud-linked spirometers, and wearable oximeters strengthens the feasibility of remote participation in respiratory trials. These devices generate continuous, high-resolution data that support adherence tracking, symptom trend analysis, and early exacerbation detection. Their integration with decentralized trial platforms enhances patient retention and enables recruitment from broader geographical regions. The trend opens opportunities for hybrid designs that combine home-based monitoring with periodic clinical assessments, making respiratory trials more scalable and patient-centric.

- For instance, WuXi AppTec’s Medical Device Testing Center reports having operated in over 200 medical-device clinical trials and working closely with 1,000 Chinese hospital clinical trial centres.

Opportunity in Post-Infectious and Long-COVID Research

The rise of post-infectious respiratory conditions and long-COVID symptoms creates new avenues for targeted clinical trial recruitment. Persistent breathlessness, reduced lung capacity, and inflammatory airway responses expand the eligible patient pool for studies testing anti-inflammatory agents, pulmonary rehabilitation tools, and digital respiratory health platforms. Governments and research institutions continue funding long-COVID programs, offering opportunities for multi-country recruitment and accelerated trial initiation. This evolving disease landscape positions respiratory trials for substantial growth through diversified and newly emerging patient cohorts.

Key Challenges

Recruitment Delays Due to Narrow Eligibility Criteria

Many respiratory trials require strict lung-function parameters, biomarker validation, or phenotype-specific enrollment, creating challenges in identifying suitable participants. High screen-failure rates in COPD, asthma, and sleep apnea studies slow recruitment timelines. Patients with multiple comorbidities or inconsistent inhaler adherence often fail protocol requirements, further limiting cohort size. These constraints place pressure on sponsors and CROs to expand multi-site networks, incorporate digital pre-screening tools, and adopt adaptive recruitment strategies to meet enrollment targets without compromising data integrity.

High Participant Burden and Retention Issues

Respiratory trials often involve frequent spirometry tests, polysomnography assessments, inhaler technique evaluations, and prolonged monitoring periods, resulting in high participant burden. Travel requirements, complex dosing protocols, and device-handling expectations contribute to dropout risks, especially among elderly and chronic respiratory patients. Retention becomes challenging in long-duration trials where symptom fluctuations and comorbidities impact patient engagement. Sponsors increasingly rely on hybrid trial models, home-based assessments, and remote monitoring devices to enhance retention while reducing physical and logistical burdens on participants.

Regional Analysis

North America

North America leads the Clinical Trial Recruitment in Respiratory Market with around 38% share, driven by a high prevalence of COPD, asthma, and sleep apnea, as well as strong adoption of decentralized and hybrid trial models. The region benefits from extensive clinical research infrastructure, advanced respiratory diagnostic tools, and large academic–industry partnerships that accelerate patient identification. The U.S. contributes the majority of recruitment volume through integrated health networks, EHR-linked trial registries, and strong CRO presence. Increased funding for biologics, inhalation therapies, and long-COVID programs continues to reinforce North America’s leading position.

Europe

Europe accounts for approximately 32% share, supported by well-established clinical research frameworks, large chronic respiratory disease populations, and strong regulatory guidance promoting trial transparency and cross-country collaboration. Countries such as Germany, the U.K., and Spain lead recruitment due to advanced pulmonary care systems and access to centralized patient databases. Growing investments in digital recruitment tools and AI-based screening further enhance enrollment efficiency. The region’s emphasis on precision medicine, phenotyping of asthma and COPD, and biomarker-driven trial protocols attracts sponsors seeking diverse patient cohorts across multiple healthcare environments.

Asia-Pacific

Asia-Pacific holds around 22% market share, expanding rapidly due to rising asthma and COPD prevalence, large untreated populations, and growing participation in multinational respiratory trials. China, India, South Korea, and Australia drive the region’s growth with increasing site capacity, improved regulatory harmonization, and expanding investigator networks. Cost advantages and strong government support for clinical research encourage sponsors to conduct large-scale recruitment across varied demographic groups. The adoption of decentralized models, remote spirometry, and mobile-based participant engagement continues to strengthen Asia-Pacific’s presence in early- and late-phase respiratory studies.

Latin America

Latin America captures roughly 5% market share, supported by rising enrollment in COPD, asthma, and infectious respiratory disease trials. Brazil, Mexico, Argentina, and Colombia act as primary recruitment hubs due to growing trial infrastructure and favorable patient availability. The region offers high responsiveness to investigator-led outreach and strong engagement through public health systems, which enables rapid recruitment for studies requiring large, treatment-naïve populations. Despite regulatory variability, sponsors leverage Latin America for accelerated enrollment timelines and improved diversity in global respiratory trials, strengthening its role in late-phase studies.

Middle East & Africa

The Middle East & Africa region accounts for around 3% market share, driven by increasing awareness of respiratory disorders and expanding clinical research initiatives in countries such as Saudi Arabia, the UAE, and South Africa. Growing investments in pulmonary diagnostics, telehealth adoption, and partnerships with global CROs enhance site readiness. Access to diverse patient populations supports biomarker-based and observational studies, particularly in asthma and infectious respiratory conditions. Although infrastructure limitations persist in certain markets, targeted capacity-building efforts and improved regulatory engagement are gradually strengthening the region’s contribution to respiratory trial recruitment.

Market Segmentations:

By Type:

- Therapeutic Devices [Positive Airway Pressure (PAP) Devices

- Airway Management Devices

By Application:

- Chronic Obstructive Pulmonary Disease (COPD)

- Sleep Apnea

By End User:

- Hospitals & ASCs

- Specialty Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Clinical Trial Recruitment in Respiratory Market includes leading global CROs and biopharmaceutical organizations such as SYNEOS HEALTH, Eli Lilly and Company, SGS SA, ICON plc, PAREXEL International Corporation, Chiltern International Ltd, IQVIA, Wuxi AppTec, Inc, Charles River Laboratories International, Inc., and Pharmaceutical Product Development, INC. the Clinical Trial Recruitment in Respiratory Market reflects a rapidly evolving mix of global CROs, biopharmaceutical sponsors, decentralized trial platforms, and technology-driven recruitment providers. Competition intensifies as organizations invest in AI-enabled patient identification, predictive enrollment analytics, and EHR-integrated screening systems to reduce recruitment delays for COPD, asthma, sleep apnea, and infectious respiratory trials. Companies strengthen capabilities through hybrid and decentralized frameworks that enable remote spirometry, connected inhaler monitoring, and telehealth-based assessments. Strong clinical networks with pulmonary clinics, academic centers, and large hospital systems enhance access to diverse patient cohorts across multiple disease-severity levels. Rising focus on biomarker-defined respiratory phenotypes and real-world data collection encourages collaboration between sponsors, device makers, and digital health firms. As regulatory agencies support technology adoption and cross-regional trial harmonization, competition centers on accelerating enrollment timelines, reducing screen-failure rates, and improving retention in long-duration respiratory trials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SYNEOS HEALTH

- Eli Lilly and Company

- SGS SA

- ICON plc

- PAREXEL International Corporation

- Chiltern International Ltd

- IQVIA

- Wuxi AppTec, Inc

- Charles River Laboratories International, Inc.

- Pharmaceutical Product Development, INC.

Recent Developments

- In October 2025, Precision BioSciences activated its first U.S. clinical trial site at Massachusetts General Hospital for the Phase 1 ELIMINATE-B study of PBGENE-HBV. The trial evaluates in vivo gene editing therapies for chronic hepatitis B patients.

- In October 2025, SeaBeLife secured in pre-Series A funding led by iXLife and new investors, supporting development of drug candidates for dry AMD and severe acute hepatitis. The first clinical trial is set to begin in 2026.

- In March 2025, PATH launches clinical trial on the use of artificial intelligence in primary health care. The Nairobi-based trial aims to build evidence for whether AI can improve quality of care, by reducing instances of incorrect or missed diagnoses, spare patients unnecessary repeat visits, and ensure guideline-based treatment plans.

- In March 2025, IQVIA Laboratories, a leading global drug discovery and development laboratory services organization, announces the launch of Site Lab Navigator, an advanced suite of solutions that automates and streamlines lab workflows for clinical trial sponsors and investigator sites

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt decentralized and hybrid trial models to improve accessibility for respiratory patients.

- AI-driven patient matching will streamline eligibility screening and reduce recruitment timelines.

- Connected respiratory devices will expand remote monitoring capabilities and support broader geographic enrollment.

- Demand for phenotype-specific and biomarker-defined cohorts will rise as precision therapies advance.

- Long-COVID and post-infectious respiratory conditions will create new recruitment opportunities across global sites.

- Sponsors will intensify partnerships with pulmonary clinics and academic networks to strengthen patient access.

- Digital outreach and EHR-integrated platforms will enhance recruitment efficiency and reduce screen-failure rates.

- Regulatory support for technology-enabled trials will accelerate adoption of remote assessments.

- Emerging markets will gain prominence due to large patient pools and improving research infrastructure.

- Real-world evidence integration will become essential in designing and optimizing respiratory recruitment strategies.