Market Overview

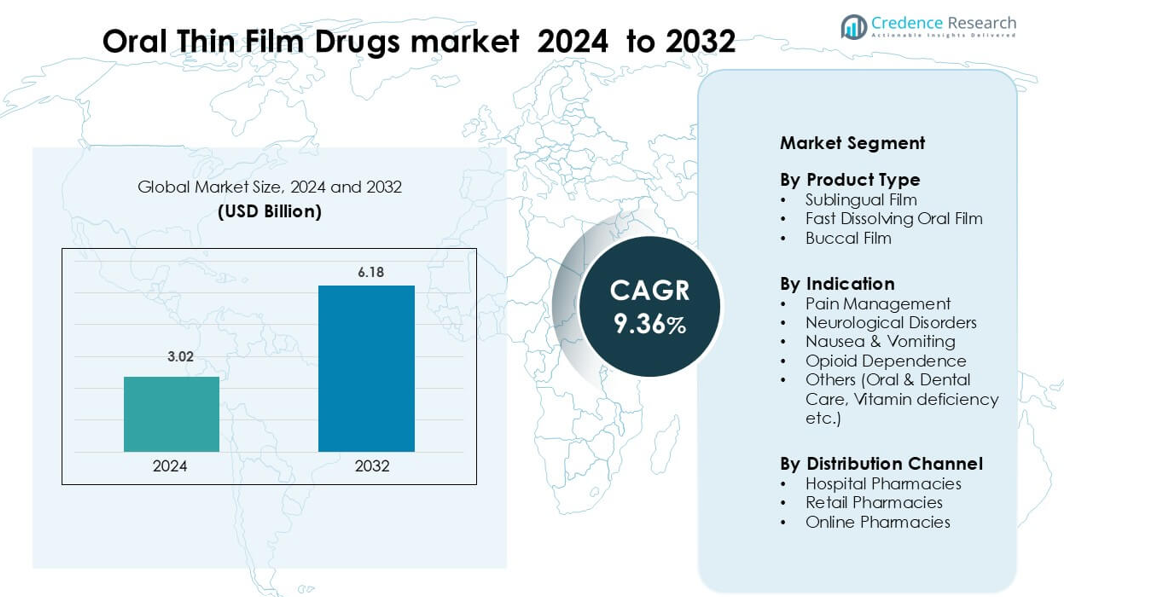

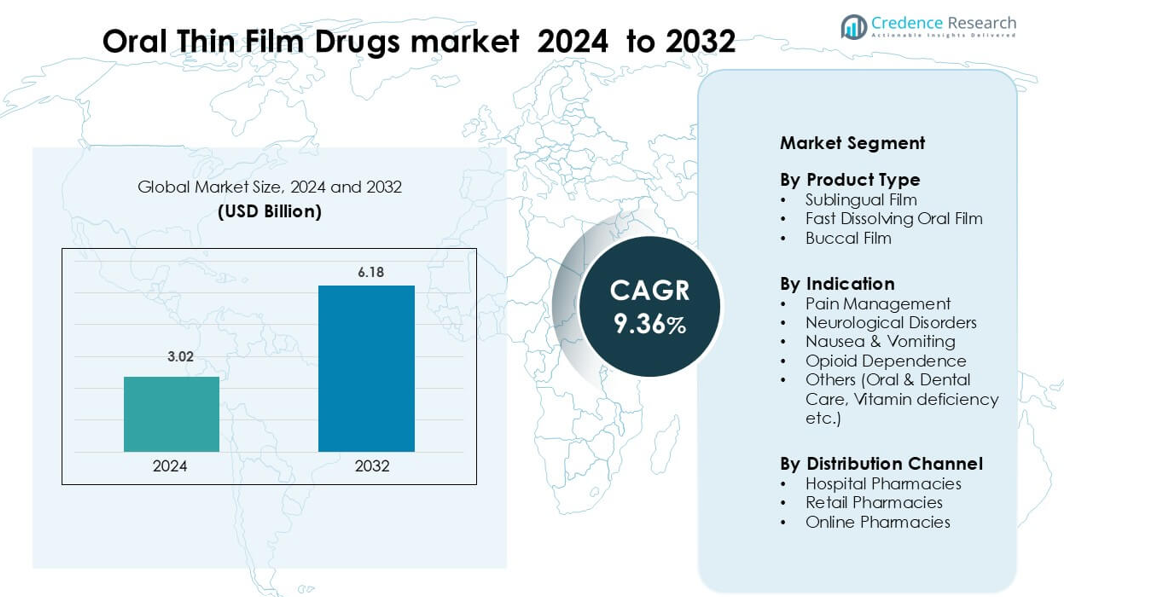

Oral Thin Film Drugs market was valued at USD 3.02 billion in 2024 and is anticipated to reach USD 6.18 billion by 2032, growing at a CAGR of 9.36 % during the forecast period.</p

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oral Thin Film Drugs Market Size 2024 |

USD 3.02 billion |

| Oral Thin Film Drugs Market, CAGR |

9.36% |

| Oral Thin Film Drugs Market Size 2032 |

USD 6.18 billion |

The Oral Thin Film Drugs market features leading companies such as Cure Pharmaceutical, Nova Thin Film Pharmaceuticals LLC, ARx LLC, Viatris Inc., C.L. Pharm, CD Formulation, Corium Innovations Inc., ZIM LABORATORIES LIMITED, Aquestive Therapeutics Inc., and LTS Lohmann Therapie-Systeme AG. These firms compete through advancements in rapid-dissolution technologies, improved bioavailability, and patient-centric formulations. North America remains the dominant regional market with 41% share, supported by strong adoption of sublingual and fast-dissolving films in pain, neurological, and opioid-dependence therapies, backed by mature regulatory systems and high innovation activity.

Market Insights

- The Oral Thin Film Drugs market was USD 3.02 billion in 2024, will reach USD 6.18 billion by 2032, growing at a 9.36% CAGR.

- Demand rises due to fast-acting sublingual and fast-dissolving films, with sublingual films holding 48% share in 2024.

- Key trends include reformulation of chronic-care drugs, strong uptake in pediatric and geriatric groups, and wider e-pharmacy access.

- Competitive activity centers on polymer upgrades, better taste-masking, and stronger stability control led by major players aiming for wider global reach.

- North America leads the market with 41% share, while Europe holds 28% and Asia-Pacific follows with 22%, supported by rising use in pain and neurological care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Sublingual film holds the dominant position in the Oral Thin Film Drugs market with about 48% share in 2024. This format leads because sublingual delivery offers faster absorption and higher bioavailability than conventional oral routes. The segment grows due to rising demand for rapid-onset therapies in pain and neurological care. Fast dissolving oral films gain steady traction for pediatric and geriatric patients, while buccal films expand in chronic disease treatment. Growth across all formats is driven by better patient compliance and improved polymer-based film technologies.

- For instance, Orexo, a company specialising in sublingual tablet, leveraged its sublingual platform to commercialise Abstral, which delivers fentany via a sublingual route.

By Indication

Pain management remains the leading indication with nearly 40% share, driven by the need for fast relief and convenient dosing options. Thin-film formats help avoid swallowing difficulties, which supports their preference in acute and chronic pain cases. Neurological disorders show solid adoption due to improved onset time and reduced first-pass metabolism. Nausea and vomiting treatments benefit from easy administration during active symptoms. Opioid dependence films rise with the wider use of buprenorphine-based therapies, while other categories expand through vitamin and dental-care formulations.

- For instance, Abstral is a fentanyl sublingual tablet used in the management of breakthrough pain in adult cancer patients who are already receiving and are tolerant to around-the-clock opioid therapy. It is available in multiple strengths, ranging from 100 µg to 800 µg, including a 200 µg tablet, and is formulated for rapid onset of pain relief.

By Distribution Channel

Retail pharmacies dominate this segment with around 52% market share, supported by high patient footfall and broad accessibility of prescription and OTC thin-film drugs. Hospital pharmacies follow due to strong use in acute care and emergency settings where rapid-action dosing is needed. Online pharmacies grow at a faster pace as users shift toward home-delivery and subscription-based medication models. The rise of e-pharmacy regulation and digital prescriptions boosts adoption. Overall demand is driven by greater patient awareness and expanding availability of thin-film formulations across channels.

Key Growth Drivers

Rising Demand for Rapid-Onset Drug Delivery

Growing demand for fast-acting therapies drives strong adoption of oral thin film drugs. Patients prefer these films because they dissolve quickly and deliver active molecules directly into systemic circulation. This bypass of first-pass metabolism improves therapeutic effect and reduces dose load. The benefit supports wide use in pain, migraine, allergy, and nausea treatment. Healthcare providers value predictable onset time and ease of administration in non-hospital settings. Growth also comes from rising need for effective options for patients with swallowing issues. These advantages help thin film formats outperform many traditional oral dosage forms.

- For instance, Aquestive Therapeutics’ PharmFilm® platform supports rapid-onset delivery, demonstrated by Sympazan®, an oral film delivering 5 mg, 10 mg, and 20 mg clobazam, engineered to achieve therapeutic plasma levels without swallowing tablets.

Expanding Use in Chronic Disease Management

Chronic conditions require adherence, and thin film drugs improve patient compliance. The format supports simple dosing, which helps long-term treatment. Buccal and sublingual films serve neurological disorders, opioid dependence, and hormonal therapy with better accuracy. Their portability strengthens adoption among active adults. Growth also rises from wider integration of thin film versions of established molecules. Drug makers reformulate trusted drugs to enhance patient experience and extend brand value. Continued innovation in polymer design boosts stability, allowing films to suit complex molecules. This strengthens long-term growth across chronic care.

- For instance, Endo Pharmaceuticals’ BELBUCA® buprenorphine buccal film (using BEMA® technology) was titrated in a long-term safety study across 506 chronic pain patients up to a dose of 900 µg every 12 hours, and 158 patients (36.3%) completed 48 weeks with stable pain scores around 3–4/10.

Growing Pediatric and Geriatric Patient Need

Pediatric and elderly groups face difficulty swallowing tablets, which strengthens thin film use. Fast dissolving films remove the need for water and reduce choking risk. Caregivers prefer controlled dosing, simple handling, and better taste masking. These benefits increase adoption in vitamins, antiallergy drugs, antiemetics, and neurological therapies. Hospitals use thin films for patients with reduced mobility or severe nausea. Manufacturers design age-friendly formulations with improved mouthfeel and stable packaging. Global aging boosts demand for practical dose formats. Combined, these factors push strong growth in patient-centric medicine.

Key Trend & Opportunity

Expansion of High-Potency and Biologics-Compatible Films

Thin film technologies advance toward high-potency molecules and small biologics. New polymer blends improve loading capacity and maintain drug stability. This allows delivery of complex APIs that previously required injections. Companies explore peptide and small-protein films for chronic diseases. Increased interest in non-invasive alternatives supports these innovations. Research teams test bioadhesive designs that enhance residence time and improve absorption. These improvements open opportunities for competitive drug reformulation. The trend encourages partnerships between film specialists and major pharma companies. Wider acceptance from regulators supports growth.

- For instance, CD Formulation has developed an oral thin film protein/peptide delivery platform capable of incorporating fragile biologics: they report using solvent-casting or 3D printing to embed peptides or proteins in films while maintaining structural stability, even for macromolecules of dozens of amino acids.

Growth of Digital and Home-Based Treatment Models

Digital health adoption expands use of oral thin films across home-care settings. Patients prefer films that enable self-management without complex dosing steps. Online pharmacies promote film-based drugs through subscription plans. Growth in telemedicine boosts remote prescription volume. Drug makers explore smart packaging for adherence tracking. This trend supports personalized treatments with flexible dosage control. Home therapy demand rises in nausea, neurological disorders, and opioid dependence care. Stable shelf life and portable design help thin films fit digital-first healthcare ecosystems. These shifts strengthen long-term market opportunity.

- For instance, Indivior launched a mobile app to support patients on SUBOXONE® Film, offering education, medication reminders, and tracking the film itself is packaged in unit-dose child-resistant pouches, aiding safe home administration.

Reformulation Strategy to Extend Product Lifecycle

Pharma companies reformulate existing APIs into thin films to extend market value. This strategy helps reduce development risk because the safety profile is known. Fast development cycles make thin films attractive for competitive markets. Many firms use this approach for pain, allergy, and antiemetic therapies. Reformulation supports product differentiation while meeting patient-centric care needs. New films with improved taste and rapid onset help brands gain loyalty. Increased investment in polymer engineering supports this opportunity. Growth continues as companies shift focus toward lifecycle management.

Key Challenge

Limited Drug Load and Molecular Compatibility

Thin film technologies face constraints on drug load capacity. Some molecules require higher strength than films can safely carry. Large biologics and unstable compounds struggle with rapid degradation in film matrices. These limits slow development for high-dose therapies. Manufacturers work on advanced polymers, yet progress remains gradual. Compatibility issues increase formulation cost and time. Small firms find these steps expensive, reducing innovation pace. These barriers make thin film use more suitable for potent low-dose drugs. This challenge restricts adoption across several therapeutic classes.

Stringent Quality, Packaging, and Stability Requirements

Thin films require strict control of moisture, temperature, and packaging to maintain stability. Small changes affect dissolution, strength, and dose uniformity. Regulatory authorities demand extensive analytical testing and stability data. These requirements slow approvals and raise production costs. Packaging design also adds complexity because films need protection from humidity. Manufacturers must invest in specialized machinery and controlled environments. Small producers struggle with this expense. These factors limit new entrants and reduce overall market speed. The challenge affects global scalability of new thin film drugs.

Regional Analysis

North America

North America leads the Oral Thin Film Drugs market with about 41% share due to strong uptake of sublingual and fast-dissolving formulations in pain, neurological, and opioid-dependence care. High prescription volume, mature reimbursement systems, and broad acceptance of patient-centric dosage forms support regional leadership. The U.S. dominates because of strong innovation activity, early adoption of reformulated drugs, and rising demand in pediatric and geriatric groups. Canada adds stable growth through expanding hospital and retail pharmacy usage. Overall demand strengthens with increased focus on rapid-onset therapies and home-based care.

Europe

Europe holds nearly 28% share in the Oral Thin Film Drugs market, driven by rising preference for non-invasive dosage forms and strong adoption in chronic disease management. Germany, the UK, and France lead regional demand due to advanced pharmaceutical R&D and strong regulatory support for patient-friendly formulations. Aging population trends push thin-film use in neurological and pain-management therapies. Retail pharmacies account for major distribution, while hospital pharmacies expand use for acute-care settings. Growing acceptance of buccal and sublingual films supports steady market expansion across Western and Northern Europe.

Asia-Pacific

Asia-Pacific accounts for roughly 22% share and represents the fastest-growing region in the Oral Thin Film Drugs market. Rising healthcare access in China and India, along with growing pediatric and geriatric populations, strengthens demand for easy-to-administer dosage forms. Japan leads regional adoption due to early acceptance of fast-dissolving films in allergy, nausea, and neurological care. Expanding e-pharmacy penetration accelerates uptake across emerging markets. Local manufacturers increasingly produce cost-effective thin films, improving availability. These factors position Asia-Pacific as a high-growth region with strong long-term potential.

Latin America

Latin America holds about 6% share, supported by rising demand for simple, rapid-acting formulations in pain, nausea, and vitamin deficiency management. Brazil and Mexico dominate the regional market due to wider pharmacy networks and improving access to chronic-care treatments. Adoption strengthens as thin films serve patients with swallowing challenges and support home-care routines. Increasing distribution through retail and online pharmacies supports growth. Although regulatory pathways remain slower than major regions, investment from international drug makers is expanding availability of sublingual and fast-dissolving film products.

Middle East & Africa

The Middle East & Africa region holds nearly 3% share in the Oral Thin Film Drugs market, driven by growing investment in healthcare modernization and better access to chronic-disease therapies. Gulf countries such as the UAE and Saudi Arabia show stronger adoption due to improved healthcare spending and rapid procurement of innovative dosage formats. Demand rises in pediatric and geriatric care, where thin films offer easier administration. In Africa, growth remains gradual but improves with expanding pharmacy networks and international partnerships. The region shows long-term potential as awareness of patient-friendly formulations increases.

Market Segmentations:

By Product Type

- Sublingual Film

- Fast Dissolving Oral Film

- Buccal Film

By Indication

- Pain Management

- Neurological Disorders

- Nausea & Vomiting

- Opioid Dependence

- Others (Oral & Dental Care, Vitamin deficiency etc.)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Oral Thin Film Drugs market includes key participants such as Cure Pharmaceutical, Nova Thin Film Pharmaceuticals LLC, ARx LLC, Viatris Inc., C.L. Pharm, CD Formulation, Corium Innovations Inc., ZIM LABORATORIES LIMITED, Aquestive Therapeutics Inc., and LTS Lohmann Therapie-Systeme AG. These companies compete by advancing polymer science, enhancing drug-loading capacity, and improving taste-masking technologies to strengthen patient compliance. Many firms invest in reformulating high-value APIs into sublingual, buccal, and fast-dissolving films to extend product lifecycles and gain regulatory traction. Strategic partnerships with major pharmaceutical manufacturers help expand portfolios and global reach, while R&D efforts focus on chronic-disease products and pediatric-friendly formulations. Growing emphasis on manufacturing automation, stability control, and moisture-resistant packaging further shapes competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Aquestive Therapeutics, Inc. announced that the U.S. Food and Drug Administration (FDA) had accepted the company’s New Drug Application (NDA) for Anaphylm (epinephrine) Sublingual Film for the treatment of Type 1 allergic reactions, including anaphylaxis, and has assigned a Prescription Drug User Fee Act (PDUFA) target action date of January 31, 2026.

- In April 2025, ZIM Laboratories Limited entered into Dossier License, Product Supply, and Technology Know-How License Agreement with Globalpharma Co. (L.L.C.). As per the agreement terms, ZIM labs agreed to license its proprietary Oral Thin Film technology platform, ThinOral with Globalpharma, under which the latter firm would register and sell 10 OTF-based Pharmaceutical and Nutraceutical products suitable for GCC region patient needs.

- In September 2024, Viatris Inc. launched (Pr)Viagra ODF in Canada, introducing a new sildenafil oral dissolving film formulation that offers an alternative to conventional tablets for erectile dysfunction and expands the commercial use of ODF technology.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Indication, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of thin film formulations will rise as demand grows for fast-acting therapies.

- Sublingual and buccal films will gain wider use in chronic disease care.

- Advances in polymer technology will support higher drug-loading capacity.

- Pediatric and geriatric treatments will expand due to improved ease of use.

- More pharmaceutical companies will reformulate existing drugs into thin film formats.

- Digital health and online pharmacies will accelerate home-based medication use.

- Taste-masking and stability improvements will strengthen product acceptance.

- Emerging markets in Asia-Pacific will drive strong new demand for thin films.

- Regulatory approval pathways will become clearer, enabling faster product launches.

- Strategic partnerships between film specialists and major pharma firms will increase global reach.