Market Overview

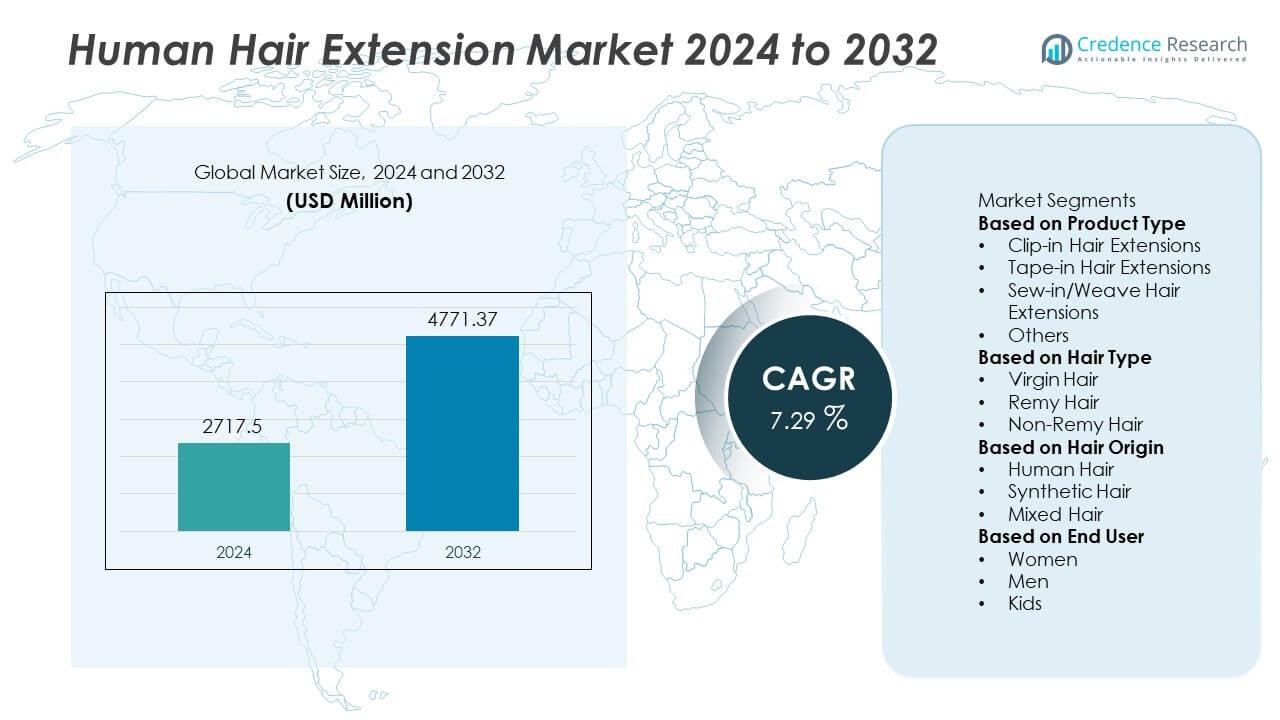

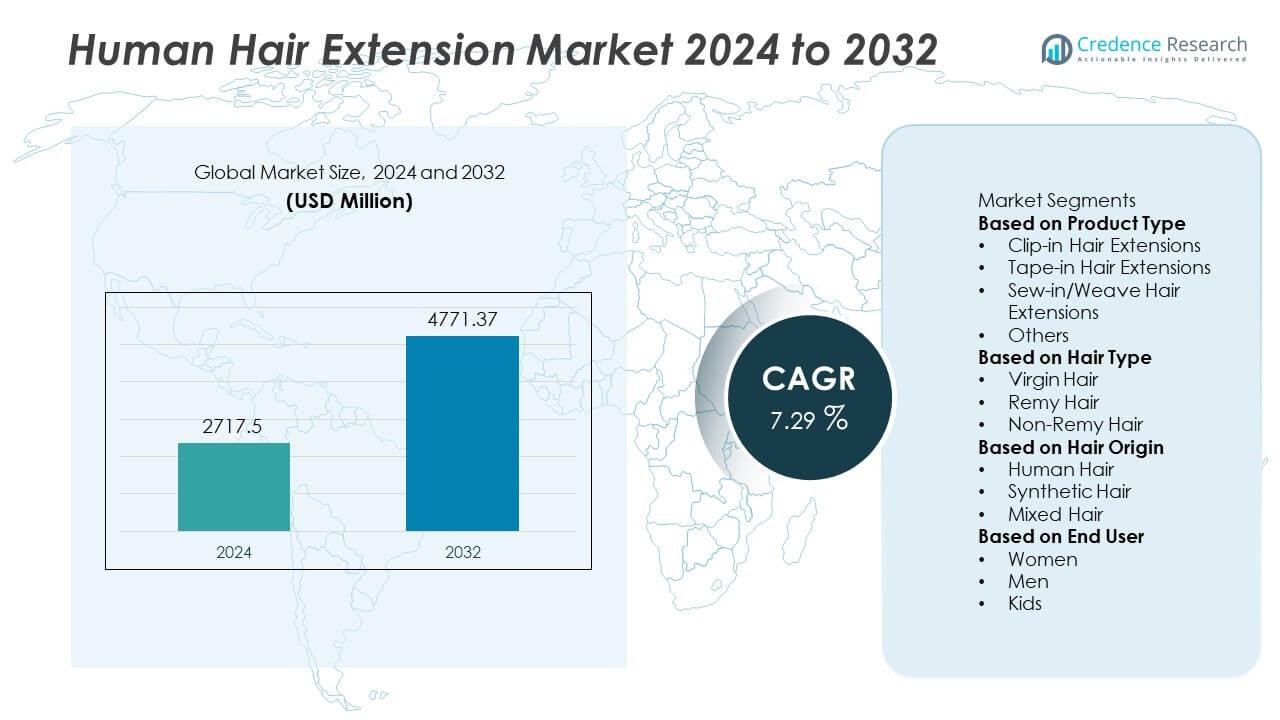

The Human Hair Extension Market reached USD 2,717.5 million in 2024 and is expected to rise to USD 4,771.37 million by 2032, reflecting a CAGR of 7.29% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Human Hair Extension Market Size 2024 |

USD 2,717.5 Million |

| Human Hair Extension Market, CAGR |

7.29% |

| Human Hair Extension Market Size 2032 |

USD 4,771.37 Million |

The Human Hair Extension market features strong competition among leading players such as Great Lengths, BELLAMI Hair, Indique Hair, Hairdreams, Mayvenn, Donna Bella Hair, BEVM, Evergreen Products Group, Klix Hair Extensions, and Cinderella Hair Extensions. These brands expand their reach through premium Remy and virgin hair offerings, salon partnerships, and strong online distribution. Asia Pacific stands as the leading region with a 32% market share, supported by large sourcing networks and strong manufacturing capacity. North America and Europe follow with 28% and 24% shares, driven by high beauty spending and strong adoption of premium, ethically sourced extensions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Human Hair Extension market reached USD 2,717.5 million in 2024 and will reach USD 4,771.37 million by 2032, recording a 7.29% CAGR during the forecast period.

- Rising beauty awareness and demand for natural-looking styles drive adoption across salons and personal users, with clip-in extensions holding a 42% share and Remy hair leading with a 51% share.

- Key trends include premiumization, ethical sourcing, and growth of texture-matched products supported by strong online retail expansion and influencer-driven styling culture.

- The market remains competitive with brands such as Great Lengths, BELLAMI Hair, Indique Hair, and Hairdreams focusing on premium quality, traceable sourcing, and strong salon partnerships; however, high prices and quality inconsistency restrain wider penetration.

- Asia Pacific leads regional performance with a 32% share, followed by North America at 28% and Europe at 24%, while Latin America holds 9% and the Middle East & Africa account for 7% of global demand.

Market Segmentation Analysis:

By Product Type

Clip-in extensions lead the segment with a 42% share due to simple use and quick styling. Tape-in formats grow as salons prefer light adhesive systems that blend well. Sew-in and weave extensions stay important in regions that favor long-wear looks. Other systems such as micro-link and fusion attract users seeking strong hold and smooth finish. Online creators increase product visibility and support higher adoption. Rising interest in instant volume, daily styling ease, and flexible looks drives overall growth.

- For instance, Great Lengths offers both clip-in and bonded lines built with 100% human strands. Their pre-bonded system uses organic hydrolyzed keratin bonds which are applied using either a thermal method (the 3200 system) or an ultrasonic cold-fusion method (the Ultrasonic 5000 system).

By Hair Type

Remy hair dominates the segment with a 51% share because users value cuticle alignment, smooth texture, and long service life. Virgin hair grows among premium buyers seeking untreated strands with strong durability and natural flow. Non-Remy hair supports price-sensitive users who switch styles often. Salons promote high-grade bundles for improved performance and better styling results. Wider online availability of verified products boosts adoption. Consumers lean toward higher-quality options to reduce tangling and maintain consistent appearance.

- For instance, Hairdreams processes Remy strands through a multi-step quality system that includes a 12-stage fiber inspection line using optical scanners capable of detecting strand defects smaller than 0.03 millimeters. The company’s laserbeamer technology attaches bonds within 4 seconds per strand. This approach helps stylists deliver uniform texture and long-lasting appearance.

By Hair Origin

Human hair holds the leading position with a 64% share, supported by demand for natural appearance and heat-styling flexibility. Synthetic hair grows as fiber quality improves and offers low-cost styling choices. Mixed hair appeals to mid-range users seeking balance between longevity and affordability. Social media trends push interest in premium human-hair extensions across key cities. Expanding e-commerce options help users compare quality and choose trusted brands. Rising beauty awareness and frequent style changes lift overall demand.

Key Growth Driver

Rising Beauty Consciousness and Styling Flexibility

Growing focus on personal appearance boosts demand for high-quality human hair extensions. Users adopt extensions to add volume, length, or color without chemical treatments. Social media trends increase awareness, as influencers showcase daily styling looks that rely on premium hair bundles. Salons promote extensions as quick solutions for events, professional use, and regular grooming. Rising disposable income in urban regions expands spending on premium Remy and virgin hair. Broader online access helps consumers compare quality and purchase authenticated products. These factors push steady market expansion across both personal and professional styling channels.

- For instance, BELLAMI Hair has spent over a decade testing, innovating, and perfecting solutions for every hair type and goal, employing rigorous manufacturing standards and meticulous inspection to ensure consistent texture, tone, and longevity across premium hair lines.

Expansion of Salon Services and Premiumization

Professional salons adopt advanced extension systems due to higher customer demand for natural-looking results. Tape-in, sew-in, and clip-in formats gain strong acceptance as stylists offer customizable solutions. Premium Remy and virgin hair see higher uptake because clients prefer durability and smooth texture. Salons also promote recurring maintenance visits, which drives steady revenue. Training programs improve application skills and increase consumer trust in salon-grade extensions. Premiumization strengthens as buyers shift from synthetic units to higher-grade human hair products. These developments expand the overall value and scale of the market.

- For instance, Great Lengths operates an ultrasonic bonding platform that forms attachment points using advanced technology. The company emphasizes high quality and a rigorous selection process to ensure fiber uniformity and performance, allowing salons to deliver natural texture and long-lasting results.

Growth of E-commerce and Global Sourcing Networks

Online platforms widen product access and help users purchase verified human hair bundles with transparent quality checks. Global sourcing networks support consistent supply of Remy and virgin hair, reducing shortages across high-demand markets. E-commerce brands use detailed product videos, customer reviews, and quality certifications to build trust. Faster delivery services increase adoption among younger consumers who follow rapid fashion cycles. Digital marketing campaigns raise awareness of new textures, shades, and installation methods. These advancements strengthen online sales and support global market penetration.

Key Trend & Opportunity

Rising Demand for Premium and Ethically Sourced Hair

Consumers show stronger interest in ethically sourced human hair, especially virgin and Remy types. Transparent supply chains, donor tracking, and certified sourcing create trust and support premium pricing. Brands invest in ethical procurement programs to improve traceability and reduce counterfeit risks. Growing awareness of sustainability encourages users to choose long-lasting extensions instead of disposable synthetic units. This shift opens opportunities for premium suppliers offering quality consistency and verified origin. Ethical sourcing also enhances brand reputation and supports expansion in regulated markets.

- For instance, Great Lengths operates an ethical sourcing program audited under ISO 14001, where each hair batch is logged in a digital ledger using a 24-point traceability checklist. The company’s processing facility in Rome handles up to 3,600 kilograms of raw hair per year and uses water-purification units that filter contaminants down to 0.2 microns.

Advancements in Natural Texture Matching and Customization

Manufacturers introduce more texture-matching options to serve diverse hair types across global markets. Improved processing techniques maintain cuticle integrity and offer natural flow, even after coloring or styling. Customizable bundles, pre-colored options, and tailored lengths meet rising personalization demand. Salons also expand services for blended textures that match regional styling needs. These innovations support higher adoption in multicultural markets and open new segments in professional styling. Texture-focused development strengthens product differentiation and encourages users to shift from synthetic choices to premium natural hair alternatives.

- For instance, Indique Hair uses a special machine that draws hair strands to align the cuticles and prevent reversal issues. Its color-treatment process involves dyeing the hair to a uniform natural tone after machine alignment, especially for the Remix collection which uses hair from multiple sources.

Key Challenge

High Cost and Price Sensitivity in Emerging Markets

Premium Remy and virgin hair remain costly due to limited supply and complex processing. Many price-sensitive buyers in emerging regions choose synthetic or mixed-hair alternatives, slowing adoption of high-quality products. Fluctuation in raw hair availability further affects pricing stability. Counterfeit bundles also disrupt market trust, making consumers cautious about investing in premium segments. Manufacturers must balance affordability and quality to maintain competitiveness. Creating mid-range offerings helps address broader market needs but does not fully offset cost barriers for premium categories.

Quality Inconsistency and Supply Chain Fragmentation

Sourcing human hair requires complex multi-step processes involving collection, sorting, cleaning, and alignment. Unorganized supply chains create variability in quality, leading to mismatched textures, tangling issues, and reduced durability. Fragmented procurement networks also increase the risk of unethical sourcing practices, which damage brand credibility. Manufacturers face difficulties in standardizing quality across large batches. Regulatory oversight remains limited in many regions, making consistency even harder to maintain. These factors challenge long-term trust and create hurdles for global expansion.

Regional Analysis

North America

North America holds a 28% market share, supported by strong demand for premium Remy and virgin hair extensions across the United States and Canada. Consumers prefer natural-looking styles, driving higher adoption in salons and professional studios. Social media trends influence frequent styling changes, boosting recurring purchases. E-commerce platforms provide wide access to verified human hair bundles, strengthening online sales. Growing multicultural populations increase demand for texture-matched extensions across urban regions. Rising disposable income and strong beauty service networks further support market expansion across key cities.

Europe

Europe accounts for a 24% market share, driven by rising beauty awareness and interest in high-quality human hair extensions. Demand grows as salons promote tape-in and sew-in systems that deliver natural blends and long wear. Consumers prioritize ethically sourced European-grade hair, supporting the premium segment. The United Kingdom, Germany, France, and Italy remain major centers for professional installations. Expanding online retail channels increase access to verified products. Cultural preference for subtle, natural styles supports steady demand across both personal and professional users.

Asia Pacific

Asia Pacific leads the market with a 32% share, supported by large-scale hair sourcing networks and strong manufacturing bases in China, India, and Southeast Asia. Rising beauty consciousness and growing youth populations drive consumption of affordable and premium extensions. Japan, South Korea, and Australia show strong demand for natural-texture products, lifting the premium segment. Expanding urbanization and digital retail platforms increase access to diverse hair types. Regional suppliers benefit from cost advantages and broad texture availability, strengthening export activity and domestic consumption.

Latin America

Latin America holds a 9% market share, driven by increasing interest in fashion styling and beauty enhancement trends. Brazil and Mexico lead the region as consumers adopt extensions for volume, curl enhancement, and event styling. Growing salon networks promote tape-in and clip-in formats that suit regional hair textures. Rising social media influence supports the shift toward premium human hair products. Expanding e-commerce activity improves availability and comparison of quality standards. Urbanization and rising income levels encourage broader adoption across major cities.

Middle East & Africa

The Middle East & Africa region captures a 7% market share, supported by strong cultural preference for long-length and high-volume hair styling. The UAE and Saudi Arabia drive premium sales due to high spending on beauty services. Africa shows strong demand for sew-in and weave extensions, especially in Nigeria and South Africa, where styling frequency remains high. Growth in beauty salons and import channels increases access to human hair bundles. Social trends and rising income levels support premiumization. Expanding urban markets strengthen overall regional demand.

Market Segmentations:

By Product Type

- Clip-in Hair Extensions

- Tape-in Hair Extensions

- Sew-in/Weave Hair Extensions

- Others

By Hair Type

- Virgin Hair

- Remy Hair

- Non-Remy Hair

By Hair Origin

- Human Hair

- Synthetic Hair

- Mixed Hair

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Great Lengths, BELLAMI Hair, Indique Hair, Hairdreams, Mayvenn, Donna Bella Hair, BEVM, Evergreen Products Group, Klix Hair Extensions, and Cinderella Hair Extensions. These companies compete through product quality, ethical sourcing, advanced processing methods, and strong brand positioning. Leading brands focus on premium Remy and virgin hair, offering diverse textures, shades, and installation formats to meet global styling needs. Many players strengthen market presence through salon partnerships, training programs, and influencer collaborations. E-commerce platforms support wider reach by offering verified products with transparent quality grading. Companies invest in traceable supply chains to improve authenticity and reduce counterfeit risks. Continuous innovation in texture matching, lightweight bonding, and color-stable treatments enhances user experience. Rising demand for personalized and natural-looking styles encourages players to expand product portfolios and adopt customer-centric strategies.

Key Player Analysis

- Great Lengths

- BELLAMI Hair

- Indique Hair

- Hairdreams

- Mayvenn

- Donna Bella Hair

- Beauty Elements Ventures Manufacturing (BEVM)

- Evergreen Products Group

- Klix Hair Extensions

- Cinderella Hair Extensions

Recent Developments

- In April 2025, BELLAMI Hair launched its Textured Hair Collection built for curly and coily hair types.

- In December 2024, Great Lengths received investment from Deutsche Beteiligungs AG (DBAG) to expand its global presence and sustainable luxury offerings.

- In 2024, Donna Bella Hair unveiled a refreshed brand identity and redesigned its website to elevate its premium shopping experience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Hair Type, Hair Origin, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium Remy and virgin hair will rise as users prefer natural looks.

- Online platforms will gain stronger traction through verified grading and global delivery.

- Salons will expand advanced installation services, improving long-term customer retention.

- Ethical and traceable sourcing will become a key factor in brand differentiation.

- Texture-matched products will grow as companies target diverse global hair types.

- Heat-resistant and color-stable treatments will improve durability and styling results.

- Emerging markets will adopt higher-quality extensions as incomes rise.

- Influencer-driven styling trends will accelerate product visibility and faster fashion cycles.

- Innovations in bonding and lightweight materials will enhance comfort and wearability.

- Regional suppliers will strengthen export capacity to meet rising international demand.