Market Overview:

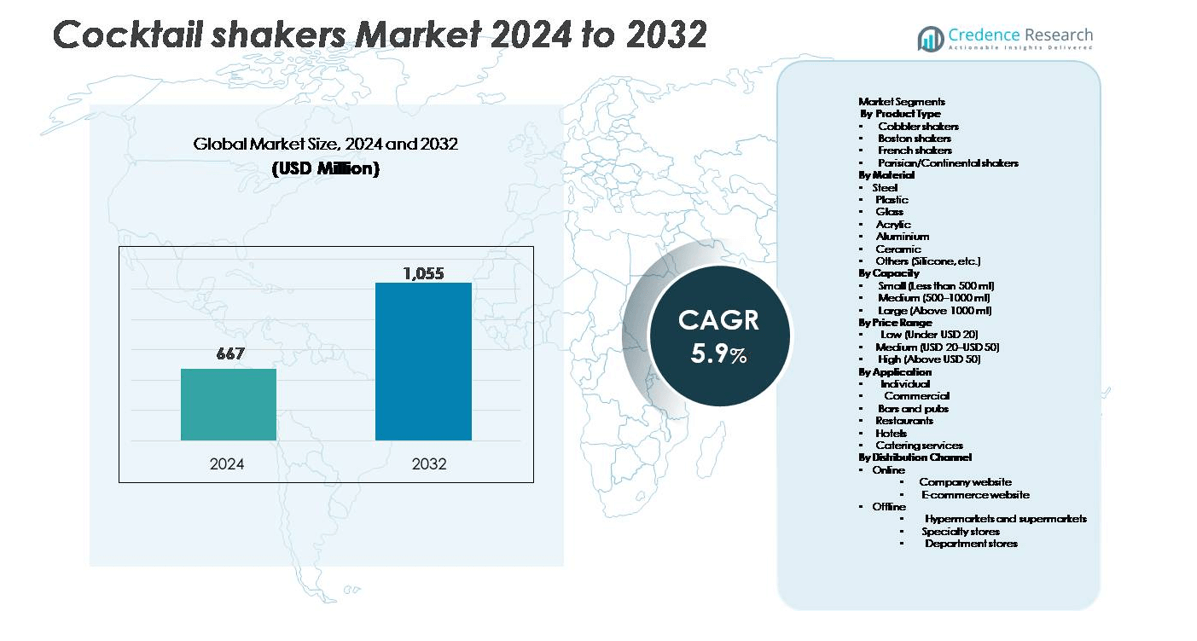

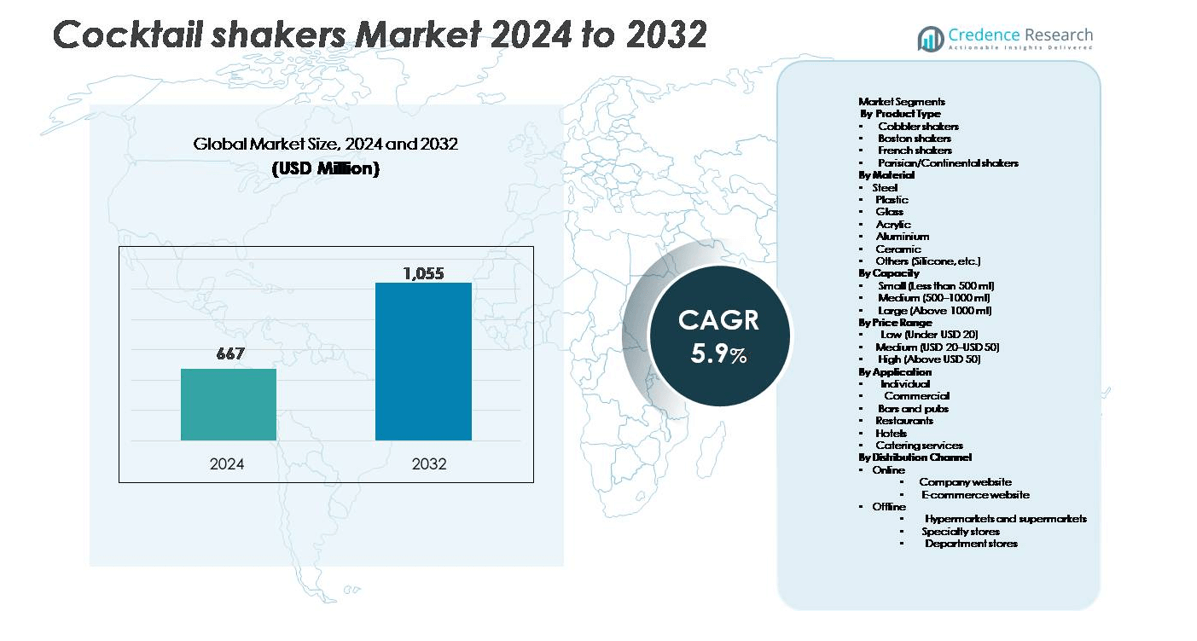

The cocktail shakers market was valued at USD 667 million in 2024 and is projected to reach USD 1,055 million by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cocktail Shakers Market Size 2024 |

USD 667 million |

| Cocktail Shakers Market, CAGR |

5.9% |

| Cocktail Shakers Market Size 2032 |

USD 1,055 million |

The cocktail shakers market includes key players such as OXO, Cocktail Kingdom, Barfly Mixology Gear, Cresimo, Aozita, Viski, and TableCraft. These companies compete through premium stainless-steel designs, leak-proof lids, ergonomic shapes, and bundled bar sets tailored for home and commercial use. Many brands focus on customization, matte finishes, copper coatings, and dishwasher-safe construction to attract both casual and professional bartenders. North America is the leading region with 32% market share, supported by strong cocktail culture, high spending on premium barware, and expanding e-commerce distribution. Europe follows with widespread hospitality demand, luxury barware sales, and rising home mixology trends.

Market Insights

- The cocktail shakers market was valued at USD 667 million in 2024 and is projected to reach USD 1,055 million by 2032, growing at a CAGR of 5.9% during the forecast period.

- Rising home bartending, DIY cocktail culture, and gifting trends drive consumer adoption, while bars, pubs, hotels, and catering services increase bulk purchasing for professional use.

- Medium-capacity shakers (500–1000 ml) hold the largest segment share due to suitability for standard cocktail volumes and widespread use in both home and commercial settings.

- Competition involves brands such as OXO, Cocktail Kingdom, Barfly Mixology Gear, Cresimo, and Viski, which differentiate through stainless steel designs, leak-proof lids, and bundled bar tool kits.

- North America leads the market with 32% share, followed by Europe at 28% and Asia Pacific at 25%, supported by strong hospitality sectors and growing home entertainment culture across key economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Cobbler shakers dominate the market with the highest share due to their simple three-piece design and strong adoption by home users and beginner bartenders. The built-in strainer and ease of use drive demand among individuals and small bars. Boston shakers gain traction in professional bartending because of faster shaking and higher volume handling. French and Parisian shakers serve a niche luxury segment with premium aesthetics and stainless-steel finish, appealing to gifting and high-end hospitality. Growing cocktail culture and rising home mixology trends continue to strengthen Cobbler shaker sales.

- For instance, OXO offers various shakers, including a standard 24-ounce cobbler shaker with a single-wall stainless-steel body that includes a built-in strainer and a cap with measurement markings. While the 24-ounce model is not insulated and may form condensation during shaking, OXO also manufactures an 18-ounce ‘Press & Pour’ model that features double-wall insulation designed to prevent condensation.

By Material

Steel shakers hold the largest market share because stainless steel provides durability, temperature retention, corrosion resistance, and professional-grade performance. Bars, pubs, and restaurants prefer steel due to long service life and hygiene benefits. Plastic and acrylic shakers attract budget-conscious users and are common in outdoor events or entry-level consumer sets. Glass and ceramic serve premium, eco-friendly or designer product categories, while silicone and hybrid materials support portability. Increased demand for dishwasher-safe and rust-free products continues to fuel adoption of stainless-steel variants.

- For instance, Barfly by Mercer manufactures stainless-steel shakers using 18/8 food-grade steel, a common specification for the brand’s professional barware designed to resist corrosion and maintain a secure seal during repeated commercial use.

By Capacity

Medium-capacity shakers between 500–1000 ml command the dominant market share because they meet standard drink preparation volumes for both individual and commercial use. This size allows efficient mixing of multi-ingredient cocktails without overflow, making it the preferred choice for bars, restaurants, and home users. Small shakers meet travel and personal usage needs, while large shakers above 1000 ml cater to high-volume serving in pubs, catering services, and events. Growing popularity of multi-serve recipes and professional-style hosting supports steady demand for medium-capacity shakers.

Key Growth Drivers

Growing Home Bartending and DIY Cocktail Culture

Home mixology has become a mainstream trend as consumers invest in premium barware and attempt craft-style cocktails without visiting bars. Social media tutorials, cocktail influencers, and beverage brands promote easy recipes that encourage users to purchase shakers as part of home bar kits. E-commerce platforms offer affordable sets paired with jiggers, strainers, muddlers, and recipe cards, making entry-level adoption easy. Gift packaging and promotional bundles also support retail sales, especially during festive seasons and celebrations. Rising disposable income, growth of urban households, and a shift toward at-home entertainment continue to accelerate demand for high-quality cocktail shakers in both budget and premium ranges.

- For instance, Cresimo markets a 24-ounce (710 ml) stainless-steel shaker set that typically includes a double-jigger calibrated in ounces (such as 0.5 oz and 1 oz or 1 oz and 2 oz), a built-in or separate Hawthorne strainer with a tight coiled spring, and a step-by-step recipe booklet featuring over 10 cocktails.

Expansion of Bars, Restaurants, and Event Catering

Commercial consumption remains a major market driver as hospitality businesses focus on improving bar operations and drink presentation. Bars and pubs require durable, professional-grade shakers capable of quick cooling, spill-free shaking, and rapid service during peak hours. Hotels, cruise ships, and catering services invest in standardized bar tools to serve classic and signature cocktails with consistent quality. Growth in premium nightlife, tourism, weddings, and themed events encourages bulk purchases and replacement cycles. Brands collaborate with hospitality chains to supply branded barware, strengthening institutional demand. Commercial expansion, along with rising global alcohol consumption and seasonal events, supports consistent and recurring demand.

- For instance, Barfly by Mercer produces shakers using 18/8 stainless steel with a 0.9-millimeter wall thickness, designed to withstand repeated high-volume use without warping, and its Koriko-style tins form a tight seal that can be opened with a measured strike for speed bartending.

Product Innovation and Customization Trends

Manufacturers introduce ergonomic designs, insulated walls, leak-proof locking, and dishwasher-safe materials to improve user experience and performance. Stainless steel shakers with copper finishing, matte textures, and scratch-resistant coatings appeal to high-end consumers and bar professionals. Custom engraving and personalized branding create opportunities in gifting and corporate merchandise. Some brands integrate measurement markings, non-slip grips, and improved strainer systems to suit modern recipe needs. Eco-friendly materials and sustainable packaging attract environmentally conscious buyers. These innovations elevate functionality, aesthetics, and consumer engagement, helping brands differentiate in a competitive market and strengthen repeat sales.

Key Trends & Opportunities

Rising Demand for Premium and Aesthetic Barware

Consumers increasingly view cocktail tools as lifestyle products rather than basic kitchen equipment. This trend drives demand for visually attractive shakers with elegant finishes used in home display bars, gifting, and social content creation. Luxury hospitality chains prefer high-quality stainless steel or designer finishes to match bar themes. Social media and home décor trends also encourage aesthetic purchases. The opportunity lies in creative colors, textures, engraving, and curated barware gift sets targeted toward both casual and premium buyers.

- For instance, Viski manufactures copper-plated Parisian shakers using food-grade stainless steel and applies a high-shine, mirror-polished copper finish to enhance visual appeal for premium bars and gifting.

Growth of E-commerce and Global Online Distribution

Online channels expand product visibility through customer reviews, mixology guides, and bundled bar kits. E-commerce platforms allow brands to target global buyers without physical retail presence. Subscription cocktail boxes, influencer partnerships, and recipe-based marketing attract younger consumers who explore new cocktail trends. Companies have opportunities to scale through digital storefronts, fast shipping, flexible pricing, and customization. The shift toward online retail also enables smaller brands to compete with established manufacturers using direct-to-consumer strategies.

· For instance, Aozita distributes its 24-ounce stainless-steel shaker set through Amazon, and specific products often record tens of thousands of customer reviews (including those identified as ‘verified purchase’ by Amazon) for a single SKU. This is supported by Amazon’s logistics network, which is capable of shipping eligible products to customers in over 100 countries through the optional Fulfillment by Amazon (FBA) Export program.

Key Challenges

Intense Price Competition and Low Product Differentiation

A large number of small manufacturers and private-label brands compete in the low and mid-price segments, leading to commoditization. Many products appear similar in design, material, and function, making price a primary purchasing factor. As retailers push low-cost imports and discounted bundles, premium brands struggle to justify higher pricing. Limited brand loyalty and frequent imitation increase competitive pressure. Companies must invest in design, branding, and user experience to differentiate and protect margins.

Durability and Quality Concerns in Low-Cost Variants

Low-priced plastic and thin-metal shakers often face leakage, denting, rusting, and weak sealing, which affects customer satisfaction and discourages repeat purchases. Negative reviews from poor-quality products harm market reputation and raise return rates on e-commerce platforms. Commercial users require hygienic materials, long service life, and consistency under heavy use; failure to meet these standards limits acceptance. Manufacturers must focus on quality control, safe materials, and durable construction to maintain consumer trust and expand into professional markets.

Regional Analysis

North America

North America holds the largest market share of 32%, driven by strong cocktail culture, large hospitality networks, and rising demand for premium barware. The United States leads consumption due to established bar industries, high household spending on home bar setups, and strong gifting trends during festive seasons. Bars, pubs, and event catering companies prefer stainless steel and medium-capacity shakers for performance and durability. E-commerce platforms offer wide product choices with fast delivery and easy customization. Growth in home entertainment and craft cocktail trends continues to support steady market expansion across both commercial and residential user segments.

Europe

Europe accounts for 28% of the global market, supported by long-standing bar traditions, tourism, and luxury hospitality. Countries such as the United Kingdom, France, Italy, and Germany have strong demand for stainless steel and designer shakers, especially premium French and Parisian styles. Home bartending gained popularity through cocktail workshops, social media, and do-it-yourself recipe trends. Hotels, cruises, restaurants, and bars adopt professional-grade shakers with durability and aesthetic appeal. Growth in wine-cocktail serving, seasonal festivals, and gifting trends continues to support regional consumption alongside an expanding e-commerce network.

Asia Pacific

Asia Pacific holds 25% share and represents the fastest-growing region due to rising urban nightlife, premium bars, and increasing disposable income. Countries including China, Japan, South Korea, and Australia experience strong demand in both commercial and household segments. Home entertainment trends and global spirit brands promote modern cocktail culture. Affordable product availability on e-commerce platforms accelerates adoption among younger consumers. Restaurants, pubs, and hotel chains standardize barware for efficiency and branding. Expanding tourism, social events, and emerging specialty cocktail bars further boost demand across urban markets.

Latin America

Latin America captures 8% market share, driven by a strong cocktail tradition in countries such as Brazil, Mexico, Colombia, and Argentina. Bars and resorts focus on tropical and fruit-based cocktails, increasing demand for durable stainless steel and medium-capacity shakers. Home consumption grows as consumers experiment with international cocktail styles. Retailers and online platforms offer affordable imports and promotional bundles that support household sales. Large tourism hubs and beachside resorts expand commercial usage. Growth continues at a steady pace with rising adoption among catering services and premium restaurant chains.

Middle East & Africa

The Middle East & Africa region accounts for 7% of the market, supported by growing hospitality and tourism sectors. Countries such as the UAE, Saudi Arabia, and South Africa see rising demand from luxury hotels, fine dining bars, and catering events. Non-alcoholic mocktails drive demand for shakers used in premium restaurants and social gatherings. Retail growth in premium kitchenware and gifting also contributes to market expansion. E-commerce penetration improves access to both budget and premium shakers. Growth remains steady as high-end hospitality investments and tourism projects continue across major urban centers.

Market Segmentations:

By Product Type

- Cobbler shakers

- Boston shakers

- French shakers

- Parisian/Continental shakers

By Material

- Steel

- Plastic

- Glass

- Acrylic

- Aluminium

- Ceramic

- Others (Silicone, etc.)

By Capacity

- Small (Less than 500 ml)

- Medium (500–1000 ml)

- Large (Above 1000 ml)

By Price Range

- Low (Under USD 20)

- Medium (USD 20–USD 50)

- High (Above USD 50)

By Application

- Individual

- Commercial

- Bars and pubs

- Restaurants

- Hotels

- Catering services

By Distribution Channel

- Online

- Company website

- E-commerce website

- Offline

- Hypermarkets and supermarkets

- Specialty stores

- Department stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cocktail shakers market features competition among global and regional manufacturers offering a wide range of designs, materials, and price points for both household and commercial users. Companies focus on stainless steel, copper-finished, and insulated variants to attract premium buyers, while value brands offer plastic or acrylic shakers for entry-level consumers. Many firms package shakers with jiggers, muddlers, and strainers to increase sales through bundled bar kits. E-commerce platforms enable new brands and private labels to scale quickly through direct-to-consumer sales, strong customer reviews, and influencer marketing. Custom engraving, color variants, and gifting sets create further differentiation. Hospitality suppliers target bars, restaurants, and catering companies with bulk pricing and durable construction. The market remains highly competitive with low switching costs, encouraging companies to innovate in design, branding, and product quality to maintain consumer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Libbey

- Final Touch

- Barfly by Mercer

- Houdini

- Crafthouse by Fortessa

- Bormioli Rocco

- Cocktail Kingdom

- Blomus

- Alegacy

- Alessi

Recent Developments

- In December 2024, Bar Tools Express launched premium bar equipment which represents a significant development in the market, emphasizing the growing demand for high-quality, professional-grade barware. This initiative reflects the increasing consumer interest in enhancing their cocktail preparation experience, both at home and in professional settings.

- In April 2024, Chamberlain Coffee collaborated with 818 Tequila which marked a notable development in the market, highlighting the increasing synergy between premium beverage brands and lifestyle accessories. This partnership highlights the rising trend of aligning product offerings with the cocktail culture, potentially driving demand for complementary tools like shakers.

- In March 2024, MG Destilerías expanded its ready-to-drink (RTD) portfolio by acquiring Coppa Cocktails, strengthening its position in the premium cocktail market and supporting diversification and market reach in the growing RTD segment.

Report Coverage

The research report offers an in-depth analysis based on Product type, Material, Capacity, Price range, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as home bartending and DIY cocktail culture continue to grow.

- Premium stainless-steel and designer shakers will gain stronger adoption in luxury hospitality.

- E-commerce platforms will drive faster product expansion and global reach.

- Brands will offer more bundled bar kits to boost gift sales and beginner purchases.

- Personalization, engraving, and aesthetic finishes will attract lifestyle-focused consumers.

- Commercial bars and catering services will replace low-quality tools with durable professional models.

- Sustainable materials and eco-friendly packaging will influence purchasing decisions.

- Smart bar tools with measurement markings or anti-slip designs will improve user convenience.

- Growth in tourism, events, cruise lines, and restaurants will support bulk purchasing.

- Emerging markets in Asia Pacific and Latin America will record strong adoption through online retail and rising cocktail culture.