Market overview

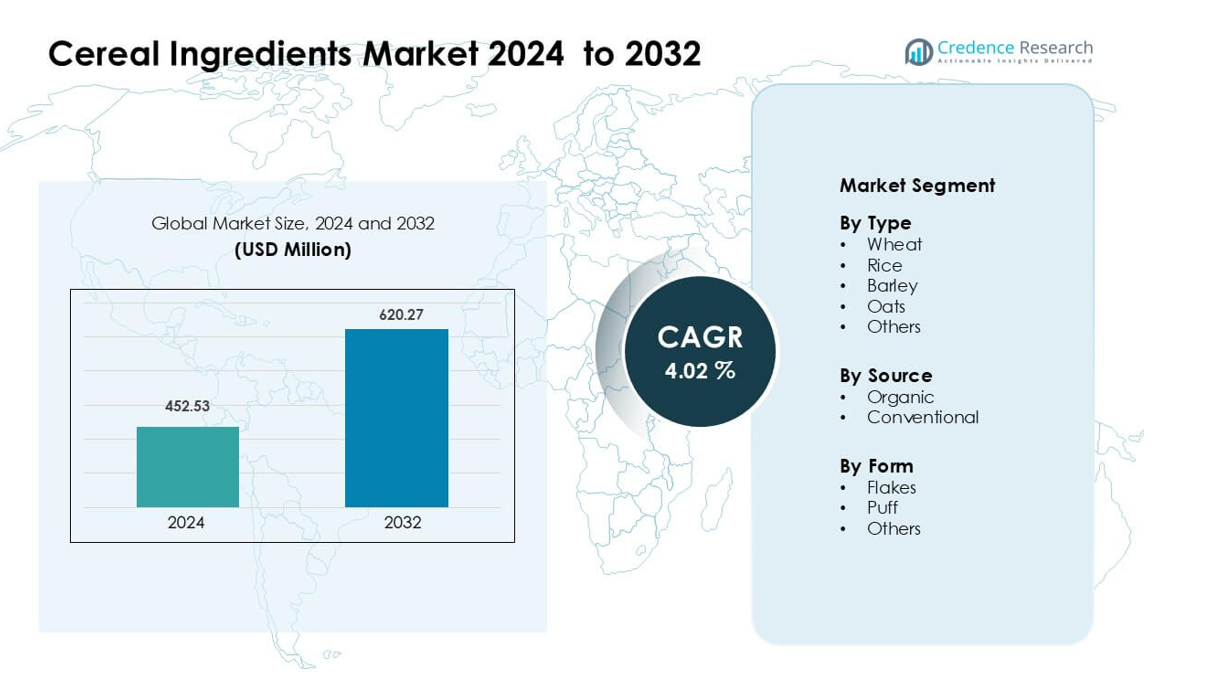

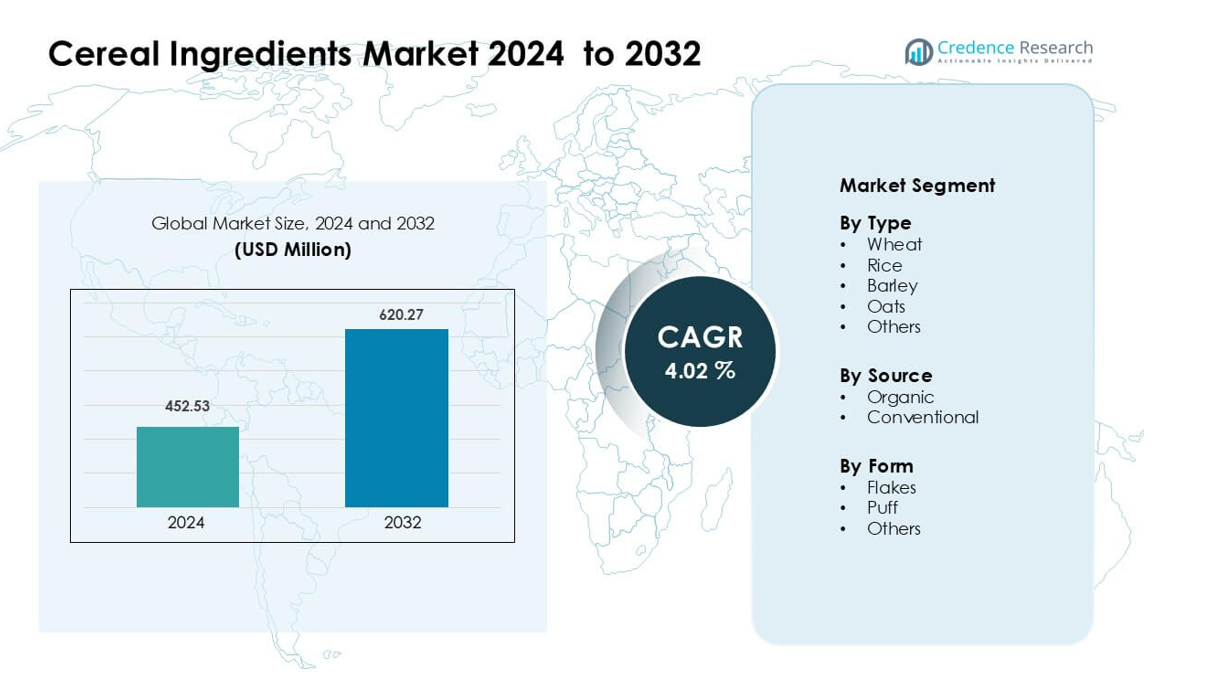

Cereal Ingredients Market was valued at USD 452.53 million in 2024 and is anticipated to reach USD 620.27 million by 2032, growing at a CAGR of 4.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cereal Ingredients Market Size 2024 |

USD 452.53 million |

| Cereal Ingredients Market, CAGR |

4.02% |

| Cereal Ingredients Market Size 2032 |

USD 620.27 million |

The Cereal Ingredients Market is shaped by major players such as Cll Foods, General Mills, Bunge Limited, SunOpta Inc., ADM, Associated British Foods Plc, Cargill Inc., RiceBran Technologies, and Kellogg’s. These companies compete by expanding whole-grain, high-fiber, and organic ingredient portfolios while investing in sustainable sourcing and advanced processing technologies. North America remains the leading region, holding about 34% share in 2024, supported by high demand for ready-to-eat cereals, strong retail penetration, and growing preference for fortified and clean-label grain ingredients across mainstream and premium product categories.

Market Insights

- The Cereal Ingredients Market reached USD 452.53 million in 2024 and is projected to grow at a CAGR of 4.02% through 2032, driven by rising demand for nutritious and convenient grain-based products.

- Growth is supported by strong consumer interest in high-fiber, whole-grain, and clean-label formulations, pushing demand for wheat, oats, and rice ingredients across breakfast cereals and snack applications.

- Key trends include rapid expansion of organic and fortified cereal ingredients, increasing use of ancient grains, and innovation in functional blends enriched with protein, probiotics, and natural antioxidants.

- Competition intensifies as major players such as Cll Foods, General Mills, Bunge Limited, SunOpta Inc., ADM, Associated British Foods Plc, Cargill Inc., RiceBran Technologies, and Kellogg’s invest in sustainability, advanced processing, and supply-chain traceability.

- North America leads the market with about 34% share, while flakes dominate the form segment with nearly 58% share; Asia Pacific shows the fastest growth due to rising urban consumption and affordable instant cereal launches.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Wheat leads this segment with about 42% share in 2024 due to wide use in breakfast cereals and bakery-linked blends. Producers choose wheat because it offers strong texture, high fiber, and stable processing behavior. Rice follows as a key option in gluten-free lines supported by rising clean-label demand. Barley and oats grow as brands promote beta-glucan benefits for heart health. Other grains gain steady traction in niche protein-rich mixes targeted toward fitness-focused buyers.

- For instance, Bühler supplied a new wheat-milling plant that adds 300 tonnes per day of milling capacity for a commercial mill, demonstrating the scale at which modern wheat processing plants increase output and enable broader bakery supply.

By Source

Conventional ingredients dominate this segment with nearly 78% share in 2024, driven by large-scale supply chains, stable pricing, and strong use across major cereal manufacturers. Organic sources expand as consumers seek chemical-free grains and higher transparency in sourcing. Growth accelerates through organic-certified farming programs in North America and Europe. Rising awareness of pesticide-free cultivation also supports organic grain penetration in premium cereal lines.

- For instance, General Mills is working with Gunsmoke Farms (via its Organic Grain Initiative) to convert 34,000 acres of conventional farmland to organic by 2020, securing long-term supply for its organic wheat lines.

By Form

Flakes hold the dominant position with about 58% share in 2024 due to strong acceptance in ready-to-eat cereals and wide product availability. Producers rely on flakes because they offer crisp texture, easy fortification, and long shelf life. Puffs grow in nutritious snack blends favored by young consumers who prefer light and low-calorie formats. Other forms, including granules and crushed mixes, gain demand in instant bowls and functional cereal bars promoted for on-the-go consumption.

Key Growth Drivers

Rising Demand for Functional and Nutritious Breakfast Options

Global consumers increasingly prefer cereal products enriched with fiber, vitamins, whole grains, and plant-based proteins. This shift pushes manufacturers to use high-quality cereal ingredients such as oats, barley, and fortified wheat blends that support digestive health and weight management. Younger buyers seek clean-label options with natural grains, fewer additives, and recognizable ingredients, which boosts demand across ready-to-eat cereals and instant mixes. Health-driven marketing, especially around heart health and beta-glucan benefits, strengthens the appeal of functional cereals. As lifestyles become busier, demand rises for convenient yet nutritious products, directly increasing consumption of high-value cereal ingredients in both mass and premium food segments.

- For instance, Quaker (PepsiCo) rolls out its 40 g serving of traditional rolled oats containing 1.4 g of beta-glucan per serving, leveraging the cholesterol-lowering benefits of soluble fiber for heart-health claims.

Expansion of Clean-Label and Organic Product Portfolios

The clean-label movement drives strong adoption of minimally processed cereal ingredients sourced from chemical-free farming. Organic wheat, rice, and oats gain traction as consumers pay closer attention to farming methods, soil quality, and pesticide residue levels. Food companies respond by expanding organic cereal lines, investing in certified suppliers, and reformulating existing products with clearer ingredient declarations. Retailers also promote organic cereals through private-label brands, increasing accessibility across mainstream markets. This shift supports steady growth for organic cereal ingredients within snacks, breakfast foods, and infant nutrition. As regulatory bodies tighten food safety and labeling norms, brands rely more on traceable and transparent ingredient sourcing, accelerating demand for premium organic cereals.

- For instance, Bob’s Red Mill, a leader in whole-grain foods, produces over 200 different products, many using certified-organic grains, including organic oats, flours, and ancient grains boosting its clean-label credibility.

Rising Penetration of Ready-to-Eat and On-the-Go Food Formats

Consumption of ready-to-eat (RTE) and portable breakfast solutions continues to rise due to long working hours, urbanization, and shifting household structures. Manufacturers use cereal ingredients such as flakes, puffs, and granules to produce convenient bowls, bars, and instant mixes designed for quick preparation. Growth in single-serve packs, travel-friendly pouches, and fortified snack bites boosts ingredient demand across multiple food categories. Companies also introduce high-protein and low-sugar cereal snacks to target fitness-oriented consumers. Expansion of e-commerce, subscription breakfast kits, and modern retail formats enhances product visibility. Together, these factors position cereal ingredients as essential components of evolving convenience-driven diets worldwide.

Key Trend and Opportunities

Increasing Use of Ancient Grains in Premium Cereal Products

Brands integrate ancient grains such as quinoa, millet, and amaranth into cereal blends to meet rising demand for nutrient-dense and exotic ingredients. These grains offer higher protein and mineral levels compared with conventional wheat or rice, which strengthens their appeal in premium healthy breakfast products. The trend grows as consumers explore new flavors, global cuisines, and plant-based diets. Manufacturers promote ancient-grain cereals as clean-label alternatives with sustainable farming origins. This shift creates opportunities for suppliers specializing in diversified grain cultivation and value-added processing across niche health-focused segments.

- For instance, Millets like ragi and jowar are considered rich sources of protein. Other similar products on the market, such as those from Health Sutra, list their ragi flakes at 11g of protein per 100g and jowar flakes at 10g per 100g.

Innovation in Fortified and Functional Cereal Ingredients

Manufacturers develop cereal ingredients enriched with probiotics, omega-3, antioxidants, and botanical extracts to meet demand for multifunctional foods. This trend aligns with consumer interest in immunity, energy management, and digestive wellness. Companies invest in extrusion, micronization, and gentle-processing technologies to preserve nutrient integrity. Functional blends also support growth in kids’ cereals, adult wellness lines, and specialized dietary products. The opportunity expands as brands differentiate through advanced nutrition claims and hybrid cereal formats that combine grains with seeds, nuts, and natural sweeteners.

- For instance, Nestlé filed a patent for omega-3 fortification in extruded cereals using crushed flaxseed. Their patent describes a formulation with 4–8 g of alpha-linolenic acid (ALA) per 100 g of cereal pieces, plus antioxidants (e.g. vitamin E) to stabilize shelf life.

Key Challenge

Volatility in Grain Prices and Supply Chain Disruptions

Unpredictable weather conditions, geopolitical tensions, and global trade fluctuations significantly impact the availability and pricing of wheat, rice, oats, and other grains. Input costs rise due to transportation issues, energy price swings, and crop-yield variability, forcing manufacturers to manage frequent pricing adjustments. Smaller food producers struggle to secure stable long-term contracts, which affects product consistency and profitability. Supply chain disruptions also delay procurement of specialty grains such as organic or ancient varieties. These issues create operational pressure for brands that rely heavily on continuous and predictable ingredient flows.

Rising Regulatory Pressure on Quality, Labeling, and Sustainability

Global regulators impose stricter standards related to pesticide limits, allergen labeling, organic certification, and sustainability disclosures. Cereal ingredient suppliers must invest in robust testing, documentation, and traceability systems, raising compliance costs. Meeting these requirements is difficult for small farms and processors, which rely on traditional practices and limited capital. Sustainability expectations—such as reduced carbon footprints and responsible water use—add further complexity. As the regulatory landscape evolves, companies face challenges in reformulating products, improving sourcing transparency, and maintaining competitive pricing while adhering to new food-safety and environmental norms.

Regional Analysis

North America

North America leads the Cereal Ingredients Market with about 34% share in 2024, supported by high consumption of ready-to-eat cereals and strong demand for fortified breakfast products. Major brands in the U.S. and Canada invest in whole-grain blends, clean-label sourcing, and organic ingredients to match shifting consumer preferences. Growth accelerates as manufacturers introduce functional products enriched with fiber, probiotics, and plant proteins. Expanding retail distribution, including private-label offerings, further strengthens regional demand. Rising interest in low-sugar and gluten-free cereal options also boosts use of oats, rice, and specialty grain ingredients across the region.

Europe

Europe holds nearly 29% share in 2024, driven by high adoption of clean-label, organic, and minimally processed cereal ingredients. Countries such as Germany, the U.K., and France lead demand for oat- and barley-based blends due to strong focus on digestive health and sustainable diets. Regulatory emphasis on food transparency encourages brands to use traceable and pesticide-free grain sources. Growth increases as consumers shift toward premium muesli, granola, and functional breakfast formats. Expanding vegan and high-fiber diets further supports the use of diverse grains, driving steady ingredient consumption across the region’s mature cereal market.

Asia Pacific

Asia Pacific accounts for about 27% share in 2024 and remains the fastest-growing region due to rising urbanization, expanding middle-class populations, and increasing adoption of Western-style breakfast habits. Demand for rice-, wheat-, and oat-based ingredients strengthens as brands launch affordable instant cereals and fortified children’s products. China, India, and Japan lead consumption, supported by strong retail growth and online distribution. Health-focused buyers also favor whole grains and low-sugar cereal blends. Growing interest in functional foods and nutrition-driven snacks accelerates the use of multi-grain ingredients across both mass-market and premium cereal categories.

Latin America

Latin America holds around 6% share in 2024, supported by rising consumption of ready-to-eat cereals and expanding availability of value-priced grain blends. Brazil and Mexico drive demand through strong retail penetration and growing adoption of fortified breakfast options among young consumers. Manufacturers increase use of corn, wheat, and oat ingredients to produce affordable cereals suited to local taste preferences. Awareness of high-fiber and whole-grain diets is rising, encouraging gradual shifts toward healthier formulations. Regional growth remains steady as companies strengthen distribution networks and introduce flavored and functional cereal products.

Middle East & Africa

The Middle East & Africa region captures about 4% share in 2024, supported by increasing interest in packaged breakfast foods and expanding urban populations. Demand rises in the UAE, Saudi Arabia, and South Africa as consumers adopt convenience-driven diets and seek fortified food options. Manufacturers use wheat, corn, and oat ingredients to produce culturally aligned cereal products and snack blends. Growth improves with modern retail expansion, improved cold-chain logistics, and rising awareness of nutrient-rich grains. Although consumption remains lower than other regions, the market shows strong potential for premium and functional cereal ingredient products.

Market Segmentations

By Type

- Wheat

- Rice

- Barley

- Oats

- Others

By Source

By Form

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cereal Ingredients Market features a mix of global grain processors, food companies, and ingredient specialists that compete through product quality, large-scale sourcing, and innovation in functional grain solutions. Leading players such as ADM, Cargill Inc., Bunge Limited, Associated British Foods Plc, General Mills, SunOpta Inc., RiceBran Technologies, Kellogg’s, and Cll Foods focus on expanding high-fiber, whole-grain, and organic ingredient portfolios to meet rising clean-label demand. Companies invest in advanced milling, extrusion, and fortification technologies to improve texture, nutrient stability, and flavor across cereal applications. Strategic partnerships with farmers and contract growers help secure consistent supplies of wheat, oats, rice, and specialty grains. Several firms also strengthen sustainability programs through reduced carbon footprints, regenerative agriculture, and traceable supply chains. With growing interest in functional cereals, market participants emphasize R&D to develop blends enriched with protein, probiotics, and natural antioxidants, intensifying competition across both mainstream and premium product segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Bunge realigned its reporting structure after the Viterra combination, creating a Grain Merchandising and Milling segment that consolidates wheat and corn milling activities supplying cereal and snack ingredient customers.

- In 2025, General Mills announced it will remove all artificial colors from its U.S. cereals and foods by 2027, and from K-12 cereals by summer 2026, shifting cereal ingredient profiles toward cleaner labels

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for functional grains will rise as consumers seek high-fiber and nutrient-rich cereal options.

- Adoption of organic and clean-label cereal ingredients will accelerate across major food categories.

- Use of ancient grains such as quinoa, millet, and amaranth will grow in premium cereal formulations.

- Manufacturers will increase investments in extrusion and fortification technologies to enhance product quality.

- Sustainability programs and regenerative farming partnerships will shape long-term sourcing strategies.

- Expansion of ready-to-eat and on-the-go cereal formats will boost demand for flakes, puffs, and multi-grain blends.

- Brands will introduce more low-sugar and high-protein cereal products to meet health-driven preferences.

- Digital retail and e-commerce channels will improve global accessibility of value-added cereal ingredients.

- Asia Pacific will emerge as a major growth engine supported by rising urbanization and changing dietary habits.

- Companies will strengthen traceability and transparency to meet strict labeling and safety regulations.