Market overview

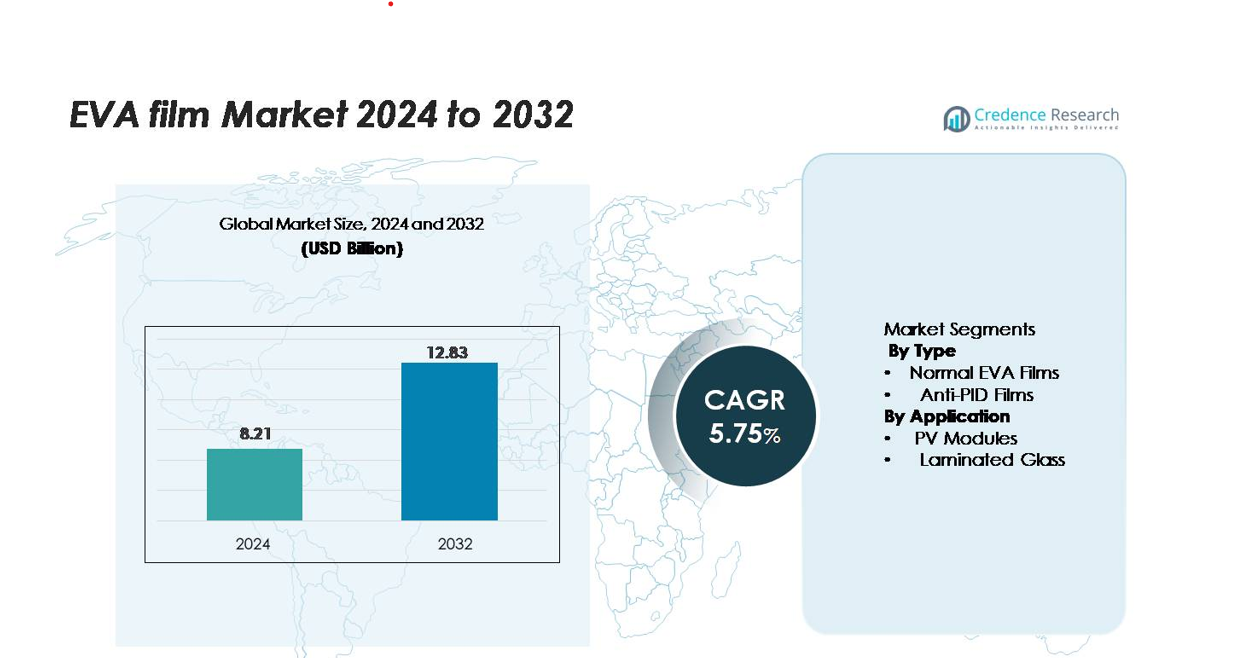

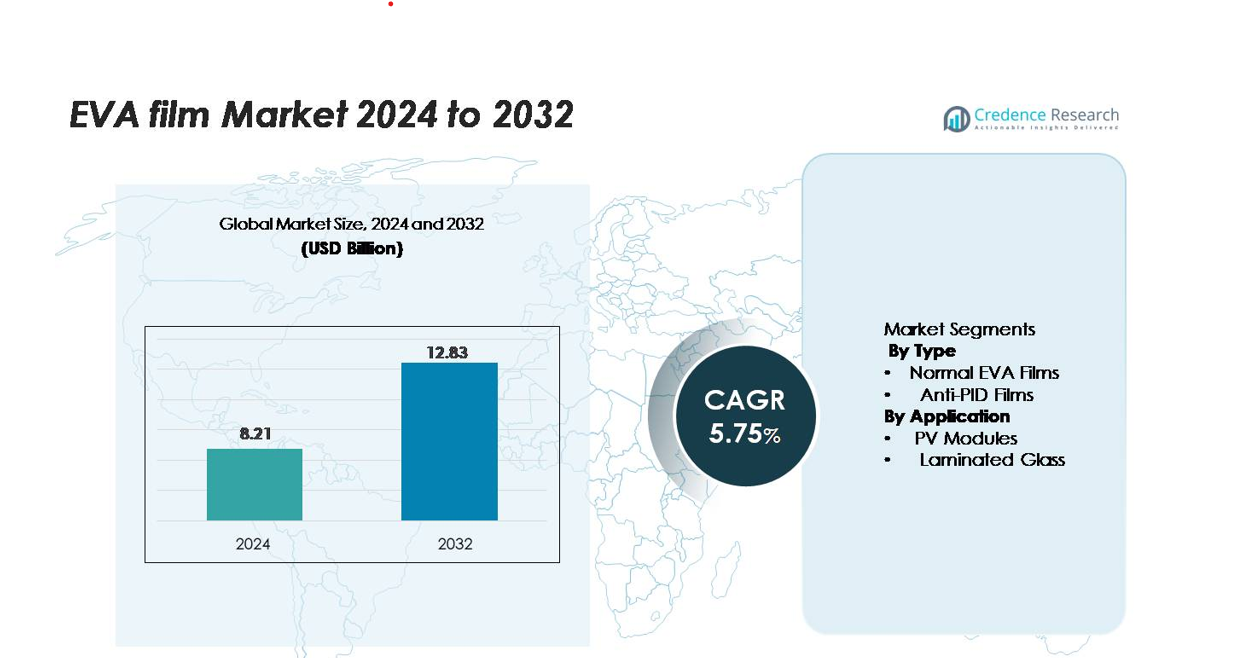

The EVA film market was valued at USD 8.21 billion in 2024 and is anticipated to reach USD 12.83 billion by 2032, growing at a CAGR of 5.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EVA Film Market Size 2024 |

USD 8.21 billion |

| EVA Film Market, CAGR |

5.75% |

| EVA Film Market Size 2032 |

USD 12.83 billion |

The EVA film market is led by established manufacturers such as Hangzhou First Applied Material, Changzhou Sveck Photovoltaic New Material, Hanwha Solutions, Bridgestone Corporation, Mitsui Chemicals, 3M, Sekisui Chemical, and SKC. These companies compete through large-scale production, advanced encapsulation grades, and long-term supply agreements with major solar module producers. Asian suppliers hold a strong cost advantage and dominate global output, while European and U.S. players focus on premium formulations with higher durability and optical performance. Asia Pacific remains the leading region, holding 52% of the global market share, supported by massive solar module manufacturing capacity, expanding renewable installations, and integrated resin production across China, India, Japan, and South Korea.

Market Insights

- The EVA film market was valued at USD 8.21 billion in 2024 and is anticipated to reach USD 12.83 billion by 2032, registering a CAGR of 5.75% during the forecast period.

- Rising solar photovoltaic installations remain the strongest growth driver, as EVA films serve as the primary encapsulation layer in PV modules, supporting long-term durability, optical clarity, and resistance to moisture and UV exposure.

- A key trend is the increasing adoption of anti-PID EVA grades in high-efficiency modules such as TOPCon and bifacial designs, while demand for laminated glass in automotive and architectural applications continues to expand.

- The market is moderately consolidated, led by Hangzhou First Applied Material, Changzhou Sveck, Hanwha Solutions, Bridgestone, and Mitsui Chemicals, each focusing on advanced formulations and large-scale supply agreements with module manufacturers.

- Asia Pacific holds 52% of global share, driven by large manufacturing bases in China and India; North America accounts for 17%, Europe 19%, while PV modules dominate usage with the largest segment share compared to laminated glass and other applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

Normal EVA films hold the dominant share in this segment, accounting for the majority of global demand due to their proven compatibility with photovoltaic encapsulation, cost-effectiveness, and wide adoption in mass-produced solar modules. Manufacturers prefer normal EVA films because they offer strong adhesion, optical transparency, and reliable weather-resistance for long-term outdoor installations. Growing solar capacity additions across utility-scale and rooftop projects support continuous uptake of standard EVA grades. Although Anti-PID films are gaining traction, their share remains comparatively lower. Adoption is rising in high-efficiency modules as these films help reduce power loss caused by potential-induced degradation, enhancing long-term module performance.

- For instance, Hangzhou First Applied Material supplies standard EVA films with verified light transmittance of 91.2% at 1 mm thickness and a certified gel content of 75% after cross-linking, meeting the durability and optical requirements of Tier-1 PV module producers.

By Application

PV modules represent the leading application segment, holding the largest market share as EVA films are widely used as encapsulation layers to protect solar cells from moisture, dust, and mechanical stress. Demand continues to rise with expanding solar installations and increased investments in renewable energy. The laminated glass segment is growing steadily, driven by architectural glazing, safety glass, and automotive applications that require shock-resistant transparency and UV stability. However, PV modules remain the primary revenue contributor because large-scale solar projects and continuous technological upgrades in module manufacturing reinforce consistent consumption of EVA films.

- For instance, Hanwha Q CELLS utilizes high-quality EVA encapsulation sheets that undergo rigorous testing for properties such as optical clarity and long-term durability under UV exposure, which is critical for ensuring module reliability in various deployments.

Key Growth Drivers

Surge in Global Solar PV Installations

The rising adoption of renewable energy is one of the strongest growth drivers for the EVA film market. Solar developers continue to increase capacity installations for utility-scale and rooftop PV systems, which boosts demand for EVA films used as cell-encapsulation layers. These films protect cells from moisture, ultraviolet radiation, and mechanical load, ensuring long-term power efficiency. Government incentives, net-metering programs, declining module prices, and private investments in clean energy strengthen the installation pipeline in major markets such as China, India, the United States, and Europe. As manufacturers expand production of mono- and bifacial solar modules, the need for high-clarity, weather-resistant EVA films increases further. The transition toward solar-powered industrial complexes and commercial facilities adds another growth channel, ensuring that EVA demand scales in parallel with PV growth worldwide during the forecast period.

- For instance, High-quality solar panels often use Ethylene-Vinyl Acetate (EVA) sheets with a typical nominal thickness ranging between 0.4 mm to 0.6 mm, chosen to provide a consistent and protective layer for the solar cells.

Expansion of Automotive and Architectural Laminated Glass

EVA films are also gaining momentum in laminated safety glass, especially in automotive windshields, sunroofs, and architectural façades. Growth in urban infrastructure, smart buildings, and premium vehicle production supports higher consumption of laminated glass, which uses EVA for strong bonding, optical clarity, and resistance to delamination. The construction sector increasingly adopts laminated glass for noise insulation, impact resistance, and UV protection in hospitals, offices, and airports. EV and luxury car manufacturers add laminated glass to enhance cabin comfort, reduce sound, and improve safety standards, further driving EVA use. Continuous adoption of green construction norms and rising demand for energy-efficient glass systems ensure steady opportunities for EVA film manufacturers supplying the glazing market.

- For instance, Folienwerk Wolfen GmbH confirms that its evguard® EVA film, produced in a nominal thickness of 0.45 mm, is certified under EN 16613 and tested for glass adhesion using standardized Pummel Test procedures, achieving a measured adhesion level between 7 and 9 at -15 °C—performance required for safety-critical façade and balustrade glazing.

Technological Advancements in Encapsulation Films

Innovation in EVA formulations, such as UV-resistant grades, fast-curing products, and anti-PID films, is creating new demand across solar and industrial applications. Manufacturers now offer EVA with improved transparency, enhanced cross-linking, and higher mechanical strength, improving module reliability and lifespan. These advancements help reduce energy loss, increase module durability in harsh climates, and optimize manufacturing cycle times for high-volume module production. The shift toward high-efficiency solar cells—and emerging module types like TOPCon, heterojunction, and bifacial—supports rapid adoption of advanced EVA grades. As industry standards evolve, module makers prefer encapsulation solutions that improve energy yield and long-term output, strengthening the market outlook for technologically upgraded EVA films.

Key Trends & Opportunities

Rising Adoption of Anti-PID EVA Films

A key trend is the increasing use of anti-PID (Potential-Induced Degradation) EVA films, particularly in high-efficiency solar modules. These films prevent power loss caused by voltage stress in humid or high-temperature environments, making them essential for coastal and desert solar farms. Developers and EPC companies increasingly choose anti-PID encapsulation to ensure higher energy output and long-term reliability. As global PV installations shift toward premium module formats, anti-PID EVA film suppliers gain a strong advantage. Opportunities also emerge for manufacturers offering specialized grades tailored for bifacial and HJT modules, where minimizing PID impact is crucial to maintaining performance.

- For instance, Hangzhou First Applied Material reports that its anti-PID EVA sheet model FA-303 achieves a volume resistivity of 1.6 × 10¹⁵ Ω·cm at 25 °C and maintains insulation performance after 1,000 hours of damp-heat testing under IEC 61215 conditions, confirming suitability for TOPCon and bifacial module designs.

Growth of BIPV and Smart Glass Markets

Building-Integrated Photovoltaics (BIPV) and smart architectural glass are creating new revenue streams for EVA film producers. Commercial buildings now integrate solar modules into façades, windows, and skylights, requiring transparent and durable encapsulation layers. EVA films with improved optical transmission and UV stability are well-suited for these next-generation applications. Demand for noise-reduction, safety, and aesthetic glass products further expands opportunities. Governments promoting green building codes and net-zero construction accelerate smart glazing investment, encouraging more laminated glass adoption and supporting EVA sales in the architectural sector.

- For instance, Folienwerk Wolfen GmbH confirms that its evguard® EVA film for architectural glazing is supplied in a nominal thickness of 0.45 mm, reaches light transmission levels up to 91% according to internal optical testing, and holds certification under EN 16613 for laminated safety glass—performance required in BIPV façades, balustrades, and overhead glazing systems.

Key Challenges

Growing Competition from Alternative Encapsulation Materials

EVA faces competition from materials such as polyolefin elastomers (POE), thermoplastic polyurethanes (TPU), and ionomers, which offer higher moisture-barrier properties and stronger PID resistance. Large solar manufacturers are gradually shifting to POE in certain premium module designs, particularly for high-humidity or high-voltage installations. While EVA remains dominant due to cost advantages, alternative materials challenge its share in specialized applications. Suppliers must improve film durability, curing speed, and mechanical stability to remain competitive, pushing the market toward higher-performance EVA blends and hybrid encapsulation solutions.

Volatility in Raw Material Prices and Supply Chains

EVA production depends on ethylene-based raw materials that experience price fluctuations linked to crude oil and petrochemical supply dynamics. Sudden spikes in resin prices raise manufacturing costs and pressure margins for film converters and solar module makers. Global supply chain disruptions, logistics delays, and regional shortages further complicate procurement. These challenges encourage manufacturers to diversify sourcing, establish regional production plants, and explore lower-cost formulations. Stable and flexible supply strategies are critical for maintaining competitiveness in the growing solar module and laminated glass sectors.

Regional Analysis

Asia Pacific

Asia Pacific holds the dominant share in the EVA film market, accounting for 52% of global revenue due to large-scale solar module manufacturing and expanding renewable energy deployments in China, India, Japan, and South Korea. The region also has a strong architectural glass industry supported by rapid urbanization and infrastructure spending. China remains the largest producer and consumer, benefiting from integrated polymer production, competitive labor costs, and high solar installation rates. Government subsidies for clean energy and capacity additions by Tier-1 solar manufacturers further reinforce Asia Pacific’s leadership during the forecast period.

Europe

Europe captures 19% of the EVA film market, driven by strong solar policies, green building standards, and rising adoption of laminated safety glass in automotive and construction industries. Germany, Spain, and Italy lead solar capacity additions, while France and the UK expand rooftop PV programs. In laminated architectural glass, European demand is supported by energy-efficient building codes and advanced glazing requirements. The region also has several specialized EVA producers focusing on low-PID and fast-curing grades, strengthening supply reliability. As the EU targets higher renewable energy penetration, EVA consumption continues to rise across utility and residential applications.

North America

North America accounts for 17% of the EVA film market, supported by strong solar deployment in the United States and steady uptake of laminated glass in commercial construction and automotive manufacturing. Federal clean energy incentives, state-level solar mandates, and rising interest in distributed rooftop power support EVA demand in PV modules. The automotive industry contributes additional growth as EV and premium vehicles adopt laminated windshields and panoramic roofs. Domestic production capacity expansion by solar module manufacturers helps reduce imports and boosts regional supply chain resilience, positioning North America as a growing contributor to global EVA film consumption.

Latin America

Latin America holds 7% of global EVA film demand, led by Brazil, Mexico, and Chile, where solar farms and commercial building upgrades drive usage. Utility-scale PV projects in desert and high-radiation zones increase demand for durable encapsulation materials, including anti-PID EVA grades. Construction spending on airports, shopping complexes, and high-rise buildings also supports laminated glass adoption. Although the region depends heavily on imported EVA film and resins, rising investments in solar manufacturing and clean energy programs are expected to reduce supply gaps. Continued renewable energy auctions and commercial solar deployment strengthen market prospects.

Middle East & Africa

The Middle East & Africa region holds a 5% share, with demand primarily driven by large solar power projects in the UAE, Saudi Arabia, Egypt, and South Africa. Harsh climatic conditions, characterized by high heat and humidity, encourage the adoption of advanced EVA grades with high UV resistance and low degradation rates. Growing interest in solar parks, desalination plants powered by renewable energy, and smart city development fuels consumption. Laminated glass applications also expand in modern infrastructure, including airports and commercial buildings. Although the market is smaller in size, strong future solar pipelines present long-term growth opportunities.

Market Segmentation

By Type

- Normal EVA Films

- Anti-PID Films

By Application

- PV Modules

- Laminated Glass

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The EVA film market is moderately consolidated, with global and regional manufacturers competing through product quality, technology innovation, and strong relationships with solar module and laminated glass producers. Leading companies focus on advanced EVA grades with improved cross-linking, enhanced weather resistance, and anti-PID performance to meet the needs of high-efficiency solar modules. Expansion activities include capacity additions, backward integration in resin supply, and long-term contracts with PV manufacturers to secure consistent demand. In the laminated glass sector, players emphasize optical clarity, UV stability, and fast-curing films that support high-volume processing. Asian manufacturers dominate production due to cost-efficient operations and proximity to large solar module factories, while European and North American suppliers focus on premium grades and customized solutions. Competitive strategies also include automation in film extrusion, R&D investment, and partnerships with downstream glass processors. Growing adoption of bifacial, TOPCon, and HJT modules continues to intensify competition for high-performance encapsulation films.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Celanese Corporation

- Folienwerk Wolfen GmbH

- wha Solutions/Chemical Corporation

- Folienwerk Wolfen GmbH

- Arkema

- Changzhou Bbetter Film Technologies Co., Ltd.

- Brentwood Plastics, Inc.

- Mitsui Chemicals Tohcello, Inc.

- Dietrich Müller GmbH

- Allied Glasses

Recent Developments

- In August 2024, Folienwerk announced its participation in the glasstec 2024 exhibition and showcased advanced laminating films including their EVA-based evguard® products for architectural and safety glass.

- In August 2023, Betterial reported the operation of five production bases and introduced a high-transmittance anti-PID encapsulation film under its B601 series, designed to improve solar module durability.

- In June 2023, Mitsui Chemicals announced the corporate restructuring of Tohcello’s ICT and packaging-solution businesses, preparing the firm to accelerate development of high-performance films including EVA or alternative encapsulants

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for EVA films will continue rising as global solar installations expand across utility, commercial, and rooftop segments.

- Advanced EVA grades with higher cross-linking and UV resistance will gain adoption for high-efficiency solar modules.

- Anti-PID EVA films will see stronger demand from bifacial, TOPCon, and heterojunction technologies.

- Manufacturers will increase automation and capacity expansion to meet higher production volumes.

- Laminated glass usage will grow in automotive, architectural, and smart building applications.

- Asia Pacific will maintain its leadership due to strong manufacturing bases and supportive renewable policies.

- Strategic partnerships between film suppliers and module makers will strengthen long-term supply chains.

- Research and development will focus on faster-curing, transparent, and weather-stable EVA grades.

- Competition from POE and other encapsulation materials will push companies to innovate higher-performance EVA blends.

- Governments promoting clean energy and green construction standards will support steady market growth.