Market overview

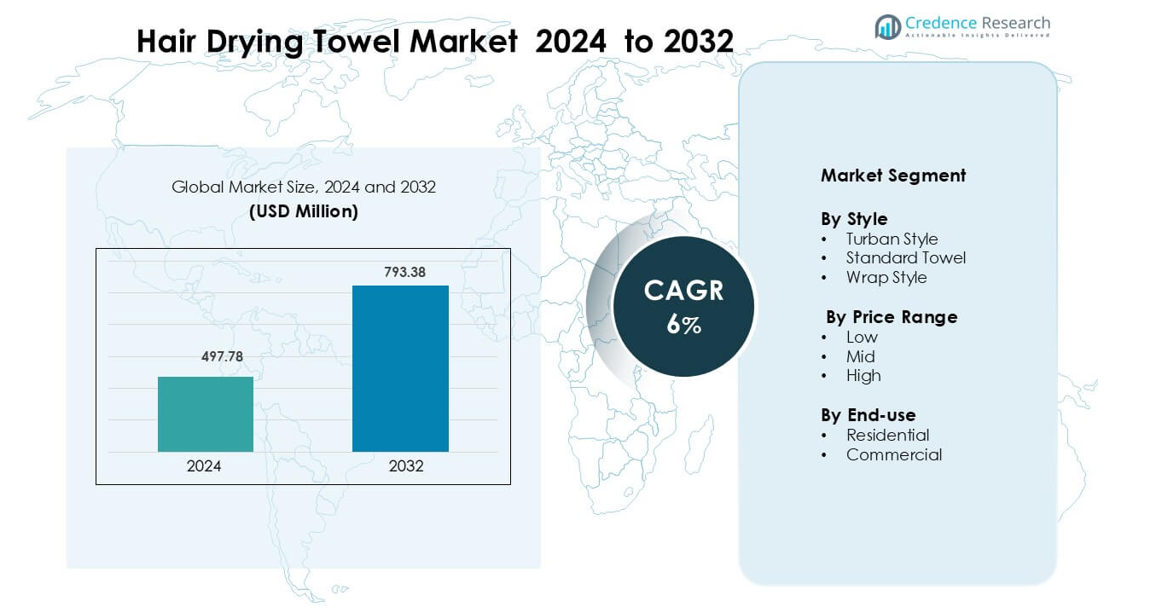

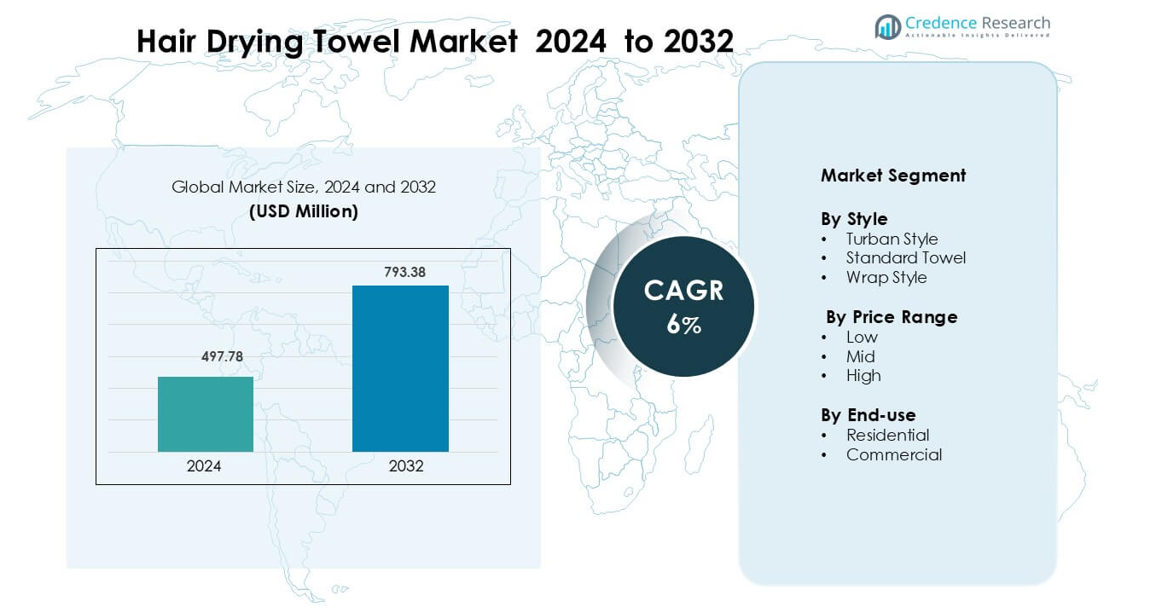

Hair Drying Towel Market was valued at USD 497.78 million in 2024 and is anticipated to reach USD 793.38 million by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hair Drying Towel Market Size 2024 |

USD 497.78 million |

| Hair Drying Towel Market, CAGR |

6% |

| Hair Drying Towel Market Size 2032 |

USD 793.38 million |

North America leads the Hair Drying Towel Market with about 34% share in 2024, supported by strong adoption of heat-free hair care and premium microfiber products. Key players such as Hair Repear, Ettitude, JML, BambooMN, Glamour Care, L’Oréal, Kitsch, Betsy Johnson, Aquis, and DevaCurl strengthen market growth through innovative fabrics, turban-style designs, and sustainability-focused product lines. These companies expand visibility through online retail, influencer-driven promotion, and salon partnerships. Strong consumer preference for quick-drying, frizz-reducing towels continues to boost regional demand, reinforcing North America’s leadership in the global market

Market Insights

- The Hair Drying Towel Market reached USD 497.78 million in 2024 and is projected to hit USD 793.38 million by 2032, growing at a CAGR of 6%.

- Rising demand for heat-free hair drying and growing preference for microfiber and bamboo-blend fabrics drive market expansion. Consumers choose turban-style towels for comfort and faster absorption, making this segment the leader with a strong share.

- Trends include increased adoption of eco-friendly materials, ergonomic wrap designs, and fast-drying fabrics supported by social media promotion and online beauty retail growth.

- Competition intensifies as Hair Repear, Ettitude, JML, BambooMN, Glamour Care, L’Oréal, Kitsch, Betsy Johnson, Aquis, and DevaCurl invest in premium fabrics, durable stitching, and sustainable packaging to retain market visibility.

- North America leads with about 34% share, while Asia Pacific follows closely at 31%. The residential end-use segment dominates with the largest share due to strong household grooming demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Style

Turban-style hair drying towels lead this segment with about 46% share in 2024. Buyers prefer the turban design because the shape stays fixed on the head and supports faster moisture absorption for long and thick hair. Demand grows as salons and home users shift toward lightweight microfiber fabrics that reduce frizz. Standard towels hold steady use among value buyers, while wrap-style designs gain traction due to rising interest in convenient post-shower routines. Growth in beauty care and travel grooming kits continues to boost turban-style adoption.

- For instance, Aquis’ Lisse Luxe hair turban uses its proprietary Aquitex microfiber fabric, which is split to around 1/100th the width of a human hair, enabling it to absorb up to9 times its own weight in water, and it dries hair in around 10-20minutes, according to lab tests.

By Price Range

The mid-price range dominates this segment with nearly 52% share in 2024. Consumers choose mid-range options because they offer strong absorption, durable stitching, and soft textures without premium-level pricing. Growth accelerates as brands expand microfiber and bamboo-blend lines in the mid tier. Low-range products attract cost-focused buyers, while high-range towels grow in boutique wellness stores and spa chains. Rising demand for long-lasting and skin-friendly fabrics continues to support mid-range leadership.

- For instance, AQUIS offers its Original Hair Turban made from AQUITEX microfiber, which wicks moisture such that it dries hair 50% faster than traditional towels, according to its product page.

By End-use

Residential use accounts for about 68% share in 2024, making it the leading end-use segment. Households drive demand as consumers seek quick-drying and gentle fabrics that reduce heat damage compared with electric dryers. Online retail expansion boosts household purchases, supported by multipack offerings and ergonomic designs. Commercial demand grows in salons, spas, and fitness centers where fast turnover and hygiene needs encourage microfiber towel adoption. The shift toward reusable, eco-friendly grooming accessories supports further expansion in both segments.

Key Growth Drivers

Rising Preference for Heat-Free Hair Care

Growing awareness of heat-related hair damage drives strong adoption of hair drying towels. Many users shift from electric dryers to microfiber and bamboo-blend towels because these fabrics reduce frizz, split ends, and moisture loss. The move toward heat-free styling supports consistent demand among consumers with color-treated and textured hair, who prefer gentle drying options. Salons also encourage towel-based pre-drying to protect hair shaft integrity before styling. Wider dermatology advice reinforces the shift toward low-friction drying tools. This preference aligns with broader wellness habits, encouraging repeated purchases and boosting market growth.

- For instance, Turbie Twist’s microfiber towel reportedly absorbs 7 times its own weight in water, enabling significant water removal in under 30 minutes and minimizing the need for heat-based drying, thereby reducing friction-induced damage.

Growth of Online Beauty and Personal Care Retail

Expanding e-commerce platforms accelerate market growth by offering a wide range of hair drying towels across various price tiers. Online channels help consumers compare patterns, fabric technologies, and absorption levels, increasing product visibility and conversion rates. Influencer-driven tutorials highlight benefits such as faster drying, lightweight use, and reduced frizz, which increases interest among young buyers. Subscription beauty boxes also add microfiber towels to grooming kits, supporting higher penetration. Global logistics and digital promotions allow new brands to scale quickly. This digital-driven accessibility strengthens sales across urban and semi-urban regions.

- For instance, Nykaa, one of India’s largest online beauty retailers, lists its Matra microfiber hair wrap for ₹238 on its platform.

Increasing Adoption in Salons, Gyms, and Wellness Centers

Commercial establishments boost demand as salons, spas, and fitness centers adopt microfiber towels for their quick absorption and reduced drying time. These facilities prioritize materials that remain lightweight even when wet and withstand repeated washing. Hair drying towels help reduce waiting time between clients, supporting efficient operations. Gyms and wellness centers favor compact, fast-drying designs that improve hygiene and turnover. Rising investments in premium spa experiences also support adoption of bamboo-blend towels known for softness and antibacterial properties. This commercial shift enhances bulk orders and strengthens overall market growth.

Key Trend & Opportunity

Expansion of Eco-Friendly and Sustainable Fabrics

Sustainability trends create strong opportunities for brands offering bamboo, organic cotton, and recycled microfiber towels. Consumers increasingly prefer low-impact fabrics that offer softness, quick drying, and reduced environmental footprint. Brands highlight biodegradable packaging and chemical-free dyes to appeal to eco-conscious buyers. This shift expands the premium and mid-range segments as users associate sustainable materials with better skin and hair health. Retailers introduce “green grooming” collections that feature eco-friendly drying towels, supporting higher visibility. The opportunity remains strong as governments and retailers promote sustainable textile choices.

- For instance, Coyuchi uses 100% GOTS-certified organic cotton, and its supply chain documentation shows that producing one of its organic cotton towels avoids roughly 1,700 liters of water compared to a conventional cotton alternative (based on GOTS life-cycle analysis).

Innovation in Absorption and Ergonomic Designs

Product innovation shapes new opportunities through enhanced microfiber density, anti-slip fasteners, and ergonomic turban shapes. Manufacturers add features such as button locks, stretch-fit designs, and ultra-fine fibers to improve comfort and drying speed. Travel-friendly, lightweight towels gain traction among frequent travelers and gym users. Brands also launch specialized towels for curly, long, or color-treated hair to target niche needs. These innovations support differentiation in a crowded market and allow premium pricing. As users seek convenience, upgraded designs help brands achieve stronger loyalty and repeat purchases.

- For instance, HyDreez produces a microfiber turban wrap in a waffle-weave with a double-button system; its product specs list the size as 65 × 25 cm and the weight at 100–120 g, which makes it both absorbent and lightweight for travel or gym use.

Key Challenge

Fabric Durability and Quality Variations

Quality inconsistency across low-cost products presents a major challenge. Some low-range microfiber towels shed fibers, lose absorption ability after repeated washing, or cause friction that damages hair cuticles. These issues reduce user trust and affect brand reputation. Market fragmentation with many unregulated manufacturers increases the presence of substandard products. Retailers face returns and complaints that disrupt supply chains and reduce margins. Ensuring material quality and maintaining consistent production standards becomes critical for long-term growth in both online and offline channels.

Competition from Conventional Cotton Towels and Electric Dryers

Traditional cotton towels and electric dryers still hold strong household presence, restricting faster market expansion. Many users rely on conventional towels due to familiarity and low replacement urgency. Electric dryers remain preferred for quick styling despite concerns about heat damage. This creates resistance among some consumers to adopt microfiber-based alternatives. Brands must invest in education and marketing to highlight benefits such as reduced frizz, quicker absorption, and hair-safe drying. Overcoming this behavioral inertia remains a significant challenge for sustained market penetration.

Regional Analysis

North America

North America holds about 34% share of the Hair Drying Towel Market in 2024, driven by strong adoption of heat-free hair care and rising demand for microfiber and bamboo-blend fabrics. Consumers prefer fast-drying, frizz-reducing towels that support healthy hair routines. Growth rises through beauty retail chains, salon partnerships, and strong online promotions. Fitness centers and wellness studios also boost usage due to compact and hygienic designs. The U.S. leads the region as brands expand sustainable and premium towel lines, supported by high spending on personal grooming products.

Europe

Europe accounts for nearly 28% share in 2024, supported by high demand for eco-friendly and dermatology-approved fabrics. Buyers in Germany, France, and the U.K. favor bamboo and organic cotton options due to strict textile safety norms. Salon and spa chains contribute to steady adoption, prioritizing microfiber towels for efficient drying and reduced hair friction. E-commerce growth strengthens cross-border sales, especially in the mid-price segment. Sustainability awareness encourages brands to launch recyclable packaging and long-lasting fabrics, reinforcing Europe’s preference for premium grooming accessories.

Asia Pacific

Asia Pacific leads with about 31% share in 2024, driven by large consumer bases in China, India, Japan, and South Korea. Strong beauty care spending, rising salon chains, and fast expansion of online marketplaces support rapid growth. Microfiber turban towels gain popularity among young users who follow K-beauty and J-beauty routines. Urban households prefer lightweight, quick-drying towels for daily grooming needs. The region benefits from strong textile manufacturing, enabling competitive pricing and frequent product innovation. Demand continues to grow across residential and commercial segments.

Latin America

Latin America holds around 4% share in 2024, supported by rising grooming awareness and expanding beauty retail networks. Brazil and Mexico drive demand as consumers shift toward microfiber towels that offer faster drying and reduced heat exposure. Salons and fitness centers increase adoption due to better hygiene and durability. Growth in online shopping improves access to mid-range and affordable towel options. Despite lower penetration compared with major regions, rising disposable income and growing interest in wellness products support steady expansion across key markets.

Middle East & Africa

The Middle East & Africa region captures nearly 3% share in 2024, driven by increasing demand for premium grooming products in the UAE, Saudi Arabia, and South Africa. Salons, spas, and hotels support adoption of high-absorption microfiber towels due to high hygiene and quick turnover needs. Urban consumers show rising interest in heat-free drying methods suited for textured and long hair. Imported bamboo and premium microfiber towels gain traction through specialty stores and e-commerce. While the market remains small, expanding beauty tourism and retail modernization drive gradual growth.

Market Segmentations

By Style

- Turban Style

- Standard Towel

- Wrap Style

By Price Range

By End-use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hair Drying Towel Market features strong competition driven by brands such as Hair Repear, Ettitude, JML, BambooMN, Glamour Care, L’Oréal, Kitsch, Betsy Johnson, Aquis, and DevaCurl. Companies focus on microfiber density, bamboo-blend fabrics, anti-slip fasteners, and ergonomic turban designs to differentiate their offerings. Many brands expand product lines into sustainable and hypoallergenic materials to meet rising demand for eco-friendly grooming solutions. Online retail remains a core battleground where enhanced visibility, influencer partnerships, and customer reviews guide purchase decisions. Premium players emphasize durability and salon-grade performance, while value-focused brands target high-volume sales through multipacks and competitive pricing. This mix of innovation and pricing strategy intensifies competition across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2023, Kitsch Satin-Wrapped Microfiber Hair Towel Turban in shades like Blush and Aura appeared on global e-commerce platforms such as iHerb, adding a satin-lined, frizz-control variant to the brand’s quick-dry towel lineup.

- In 2022, Welspun India Limited has revealed that they will enlarge their export market base while diversifying domestic market growth factors.

Report Coverage

The research report offers an in-depth analysis based on Style, Price Range, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as more consumers shift to heat-free hair drying.

- Microfiber and bamboo-blend materials will gain wider use due to better absorption.

- Sustainable and recyclable fabrics will attract eco-conscious buyers across regions.

- Turban-style towels will remain popular because of secure fit and quick-drying performance.

- Brands will introduce advanced ergonomic designs with improved fastening systems.

- Online beauty retail will continue to drive higher product visibility and global reach.

- Salons, gyms, and wellness centers will increase bulk adoption for better hygiene and efficiency.

- Premium towel lines will expand as consumers seek soft textures and long-lasting durability.

- Personal grooming trends will boost multipack and travel-friendly towel sales.

- Asia Pacific will show strong expansion as grooming habits evolve in urban markets.