Market Overview:

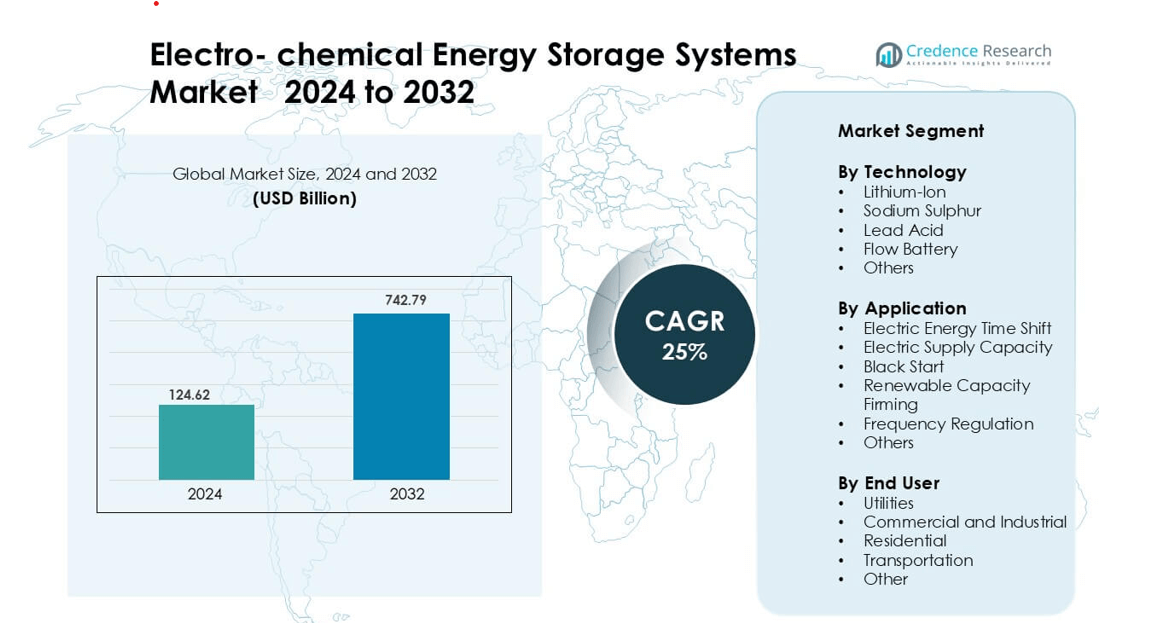

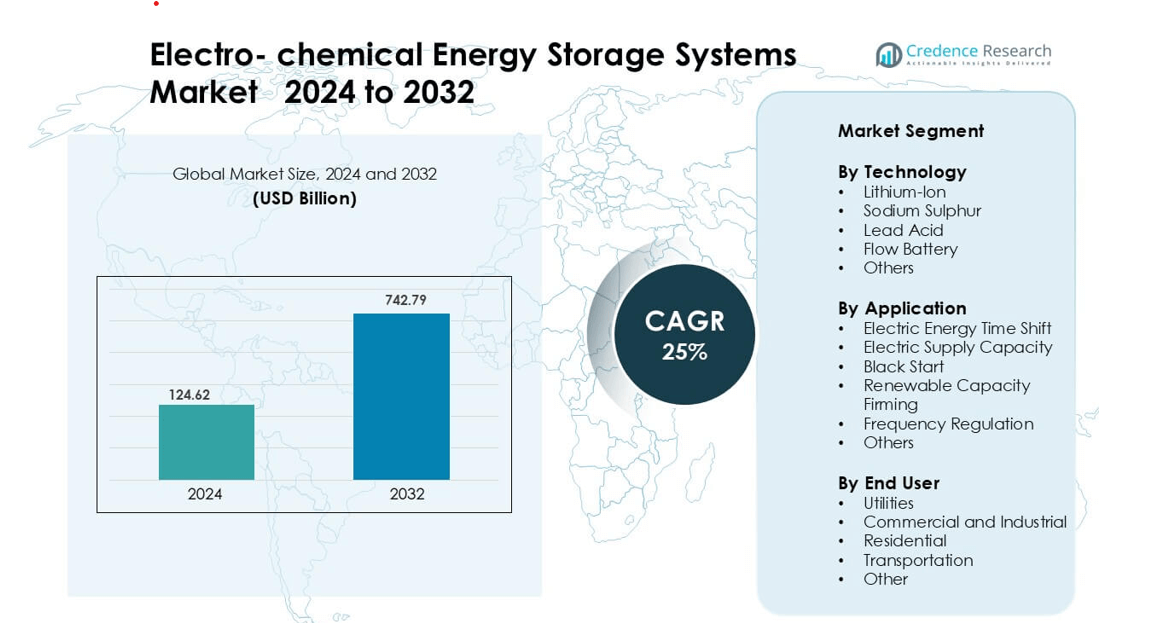

Electro- chemical Energy Storage Systems Market was valued at USD 124.62 billion in 2024 and is anticipated to reach USD 742.79 billion by 2032, growing at a CAGR of 25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electro-Chemical Energy Storage Systems Market Size 2024 |

USD 124.62 billion |

| Electro-Chemical Energy Storage Systems Market, CAGR |

25% |

| Electro-Chemical Energy Storage Systems Market Size 2032 |

USD 742.79 billion |

Leading companies in the Electro-chemical Energy Storage Systems Market include BYD Company Ltd., ABB, Hitachi Energy Ltd., A123 Systems, LLC, Exide Technologies, Durapower Group, Invinity Energy Systems, Furukawa Battery Co., Ltd., General Electric, and Duracell, Inc. These firms offer lithium-ion, flow battery, and sodium-sulfur solutions for grid support, renewable integration, and backup power. They focus on higher cycle life, faster charging, and advanced thermal control to enhance system reliability. Strategic partnerships with utilities and renewable developers strengthen market reach. North America is the leading region with 31% share, driven by strong EV adoption, large-scale storage projects, and supportive clean-energy incentives.

Market Insights

- The Electro-chemical Energy Storage Systems Market was valued at USD 124.62 billion in 2024 and grows at a CAGR of 25% between 2025 and 2032.

- Growing renewable energy adoption and peak-load management drive demand for lithium-ion storage, which holds 62% share due to high energy density and long cycle life.

- Flow batteries and sodium-sulfur systems gain traction as long-duration storage trends strengthen, enabling better grid flexibility and reduced curtailment for wind and solar power.

- Competition intensifies as BYD, ABB, Hitachi Energy, Exide Technologies, and A123 Systems expand capacity, introduce safer chemistries, and partner with utilities to secure large-scale projects.

- North America leads with 31% share, followed by Europe at 28% and Asia-Pacific at 26%, driven by renewable targets, EV infrastructure, and utility-scale installations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Lithium-ion leads the Electro-chemical Energy Storage Systems Market with 62% share. These batteries offer high energy density, long cycle life, and fast response. Renewable projects and grid operators adopt lithium-ion packs to support peak load and reduce curtailment. Lead-acid holds a smaller share because of shorter lifespan and lower depth of discharge. Sodium-sulfur and flow batteries grow in long-duration storage for utility plants and microgrids. Rising demand for electric vehicles and home storage systems continues to push lithium-ion ahead of other chemistries.

- For instance, Saft delivered a containerised lithium-ion system built around 2.5 MWh standard blocks for grid flexibility applications.

By Application

Electric Energy Time Shift dominates the market with 35% share. Power companies use storage to shift excess solar and wind generation to peak hours. This reduces heavy dependence on thermal plants and lowers operating cost. Frequency regulation also grows fast due to grid stability needs. Black start and renewable firming gain traction as more countries expand wind and solar farms. Government incentives and grid modernization plans continue driving large-scale storage adoption in power networks.

- For instance, Southern California Edison commissioned a 100 MW/400 MWh lithium-ion battery installation to enable charging when solar output is high and discharging during evening peaks.

By End User

Utilities hold the largest share at 48%. Utility firms install large battery banks to improve load balancing, avoid outages, and reduce fossil backup plants. Commercial and industrial users add storage to cut demand charges and ensure backup during power cuts. Residential use rises due to solar rooftop growth and smart home systems. Transportation expands with battery-powered buses, trucks, and charging stations. Growing electrification of mobility and grid flexibility targets keep utilities as the leading customer group.

Key Growth Drivers

Rising Renewable Energy Integration

Large volumes of wind and solar power enter national grids every year. These intermittent sources need flexible storage to ensure stable supply during peak demand. Electro-chemical storage systems manage surplus production, prevent curtailment, and increase grid efficiency. Utilities deploy batteries to replace spinning reserves and improve islanding capabilities. Governments provide subsidies for renewable integration, which accelerates large-scale battery installations. Industries adopt storage to cut energy costs and maintain power quality. As more countries target carbon-neutral goals, grid operators rely on storage to meet renewable share targets and strengthen reliability in unpredictable weather conditions.

- For instance, the state of Tamil Nadu approved the deployment of 1,500 MWh of battery storage capacity across seven substations to bolster wind-solar integration and grid resilience.

Rapid Growth of Electric Mobility

Electric vehicles, buses, and charging infrastructure boost battery demand. Lithium-ion technology supports fast charging, long range, and extended cycle life, making it suitable for EV fleets and smart transportation. Transport authorities install charging points connected to storage banks to reduce pressure on distribution networks. Logistics firms use battery-powered trucks and forklifts for clean operations. Airlines and ports also adopt electric ground vehicles to meet emission limits. Falling battery prices and local manufacturing policies further enhance adoption. Public incentives for EV purchases and strict emission norms reinforce electro-chemical storage as a core part of future mobility.

- For instance, SVOLT’s Dragon Scale Armor battery, specifically models utilizing the 5C ultra-fast charging technology, can be charged from 20% to 80% state of charge in approximately 12 minutes. This charging rate applies to the entire 65 kWh capacity of the Dragon Scale Armor II pack.

Grid Modernization and Decentralized Power Systems

Aging power grids require advanced balancing tools and backup solutions. Batteries ensure frequency control, peak shaving, and uninterrupted service during faults. Microgrids in remote areas use storage with solar and wind to maintain stable local supply. Industrial plants integrate storage to manage high demand charges and secure continuous operations. Smart meters and digital monitoring improve energy trading and real-time optimization. Utilities invest in grid-scale storage to avoid building new fossil plants. As distributed generation grows, electro-chemical systems offer scalable and modular designs that support flexible expansion without major infrastructure upgrades.

Key Trends & Opportunities

Shift Toward Long-Duration Storage

Investors and utilities focus on batteries that store power for several hours. Flow batteries and sodium-sulfur chemistries serve long-duration use such as peak shifting and renewable firming. They allow deeper discharge and longer lifespan than conventional packs. Remote grids and industrial clusters adopt these systems to replace diesel units. Emerging technologies attract venture capital and pilot projects in large cities and offshore zones. This trend opens opportunities for new vendors who provide high-capacity chemistries with low degradation rates and enhanced safety.

- For instance, Sumitomo Electric Industries, Ltd. completed a deployment of a vanadium redox flow battery system rated at 1 MW for 8 hours (i.e., 8 MWh) in Kashiwazaki, Japan.

Growth of Residential and Community Storage

Homeowners install storage with solar rooftops to reduce electricity bills and gain backup. Smart energy systems connect homes to virtual power plants that trade stored energy and stabilize demand. Urban communities adopt shared storage with solar carports and charging hubs. Energy-as-a-service providers offer subscription models that reduce upfront cost. This model expands adoption among small businesses, apartments, and schools. As energy prices rise and outages increase, residential storage becomes a mainstream opportunity.

- For instance, the project at Mosaic Gardens at Pomona comprised a 33.66 kW (kilowatts direct current) solar array paired with a 60 kWh (kilowatt-hours) battery-storage unit for the affordable housing community

Key Challenges

High Upfront Cost and Limited Recycling Infrastructure

Large batteries require expensive materials and advanced manufacturing. The initial investment remains high for utilities, industries, and homes. Many regions still lack strong recycling systems, leading to disposal concerns and environmental impact. Companies must expand recycling plants, recover metals, and follow safe handling rules. Limited recycling restricts circular economy growth and slows adoption in cost-sensitive markets.

Safety Concerns and Thermal Management Issues

Electro-chemical storage systems face risks like fire, thermal runaway, and leakage. High-capacity lithium-ion packs need strong cooling, fire suppression, and monitoring. Poor maintenance or faulty cells may trigger failures. Utilities and industries demand strict safety standards and certified components. Safety rules raise installation cost and require advanced engineering. These risks create hesitation among new users and delay deployment in dense urban spaces.

Regional Analysis

North America

North America leads the Electro-chemical Energy Storage Systems Market with 31% share. Utilities deploy grid-scale lithium-ion installations to support wind and solar integration. The United States invests in peak-shaving projects, microgrids, and electric vehicle charging hubs. State-level incentives and federal clean-energy targets boost demand across commercial and residential sectors. Canada adopts energy storage in remote communities to replace diesel generators and stabilize off-grid power. Growing EV adoption and smart grid modernization further strengthen regional growth.

Europe

Europe holds 28% share, driven by strict emission policies, renewable targets, and carbon pricing mechanisms. Countries such as Germany, the U.K., and France install battery storage to support large solar and offshore wind farms. Regulators promote grid flexibility and frequency response programs, which increases utility-scale projects. Residential storage adoption rises due to high power tariffs and solar rooftop incentives. The region also supports recycling of battery materials, strengthening supply chain sustainability.

Asia-Pacific

Asia-Pacific commands 26% share because of rapid urbanization, rising electricity demand, and expansion of renewable energy. China leads in lithium-ion manufacturing and large-scale energy storage parks. India and Japan deploy storage to stabilize grids with growing solar installations. South Korea invests in advanced chemistries and smart grid pilot projects. Strong government policies, EV promotion, and industrial electrification continue to boost demand across the region.

Latin America

Latin America accounts for 8% share, supported by renewable-rich countries such as Chile, Brazil, and Mexico. Solar and wind developers install battery banks to manage variable output and enhance grid reliability. Remote mining sites and islands adopt storage to reduce diesel consumption. Investment grows as governments promote clean energy auctions. Commercial users adopt storage for backup power and demand charge reduction.

Middle East & Africa

The Middle East & Africa hold 7% share, with rising adoption in utility projects and desert-based solar plants. Countries like UAE and Saudi Arabia install large storage units to support ambitious renewable plans. Africa uses batteries for rural electrification, telecom towers, and microgrids in remote villages. Falling battery prices encourage broader use in commercial and industrial facilities. Government-backed solar initiatives and energy diversification goals support steady market penetration.

Market Segmentations:

By Technology

- Lithium-Ion

- Sodium Sulfur

- Lead Acid

- Flow Battery

- Others

By Application

- Electric Energy Time Shift

- Electric Supply Capacity

- Black Start

- Renewable Capacity Firming

- Frequency Regulation

- Others

By End User

- Utilities

- Commercial and Industrial

- Residential

- Transportation

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electro-chemical Energy Storage Systems Market includes established battery manufacturers, power technology firms, and utility solution providers competing on performance, cost, and safety. Companies such as BYD Company Ltd., ABB, Hitachi Energy Ltd., A123 Systems, LLC, Exide Technologies, Durapower Group, Invinity Energy Systems, Furukawa Battery Co., Ltd., General Electric, and Duracell, Inc. invest in high-density chemistries, advanced cooling systems, and smart energy management platforms. Vendors expand global production capacity and enter strategic partnerships with utilities, microgrid operators, and renewable developers. Many companies strengthen recycling and second-life battery programs to reduce raw material dependency. Product portfolios now include lithium-ion packs, flow batteries, and sodium-sulfur systems for grid-scale, industrial, EV charging, and residential use. Firms compete through long warranty offerings, safety certifications, predictive maintenance software, and modular containerized storage units. Continuous R&D in extended cycle life and lower degradation positions leading players to win upcoming large renewable tenders and virtual power plant projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Durapower Group

- ABB

- Invinity Energy Systems

- Furukawa Battery Co., Ltd.

- A123 Systems, LLC

- Hitachi Energy Ltd.

- BYD Company Ltd.

- Exide Technologies

- Duracell, Inc.

- General Electr

Recent Developments

- In October 2025, Durapower Group, signed a Memorandum of Understanding (MoU) with Kıvanç Enerji (Turkey) to explore a gigawatt-hour scale battery cell and pack manufacturing facility supplying the U.S. market.

- In May 21 2025, ABB Launched a “Battery Energy Storage Systems-as-a-Service” (BESS-as-a-Service) offering, enabling customers to deploy energy storage with zero upfront capital expenditure and full-service suppor

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as more countries add wind and solar plants.

- Long-duration storage technologies will gain wider commercial use.

- Battery recycling and second-life programs will expand across major markets.

- Utilities will deploy more grid-scale systems for frequency control and peak shaving.

- Residential storage adoption will grow with smart home energy management.

- EV charging hubs will integrate battery banks to reduce grid stress.

- Flow batteries and sodium-sulfur chemistries will see higher adoption for industrial and remote sites.

- Digital platforms will improve monitoring, predictive maintenance, and energy trading.

- Governments will increase incentives for clean storage and carbon-neutral targets.

- Local manufacturing and safer chemistries will reduce supply chain risk and improve market stability.