Market Overview

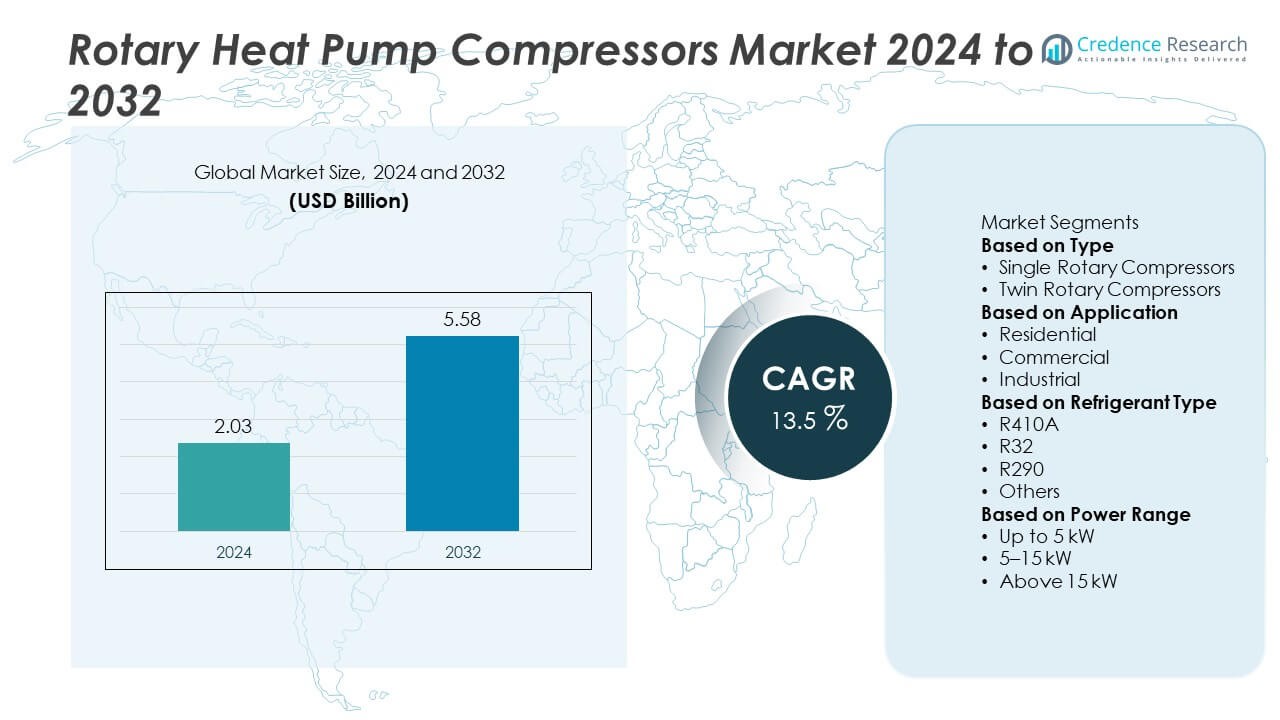

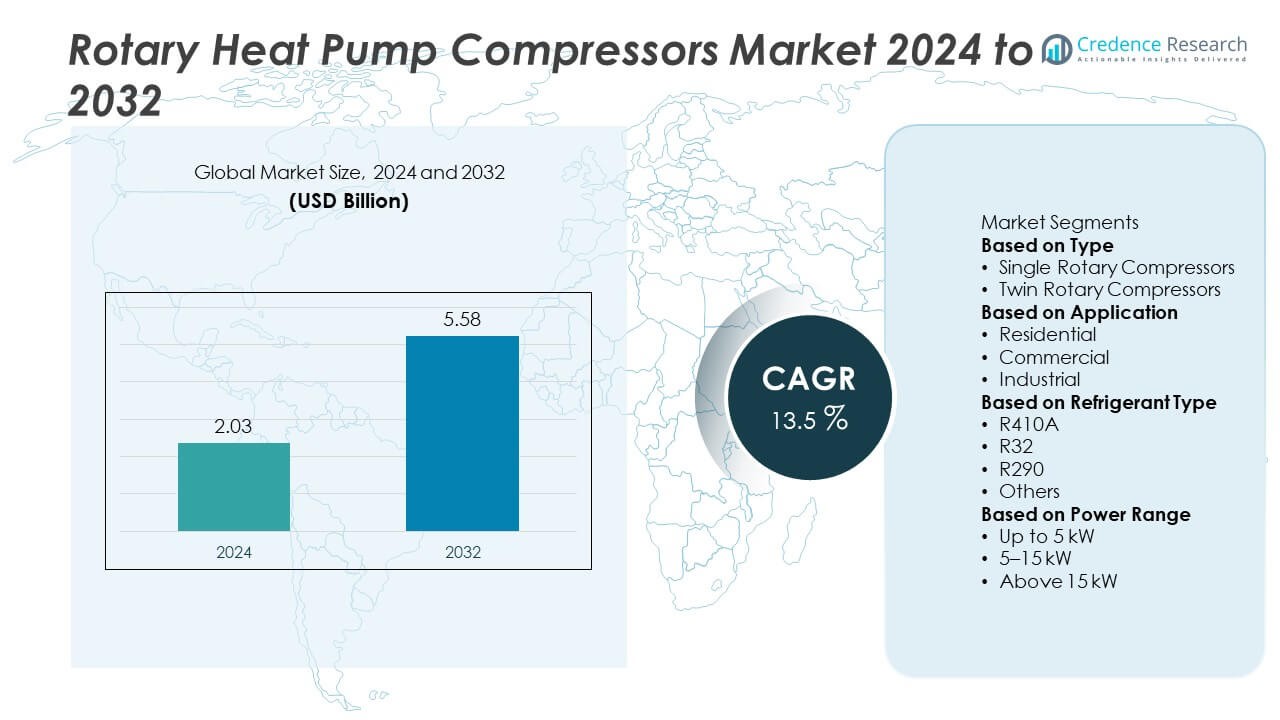

The Rotary Heat Pump Compressors Market was valued at USD 2.03 billion in 2024 and is projected to reach USD 5.58 billion by 2032, growing at a CAGR of 13.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rotary Heat Pump Compressors Market Size 2024 |

USD 2.03 Billion |

| Rotary Heat Pump Compressors Market, CAGR |

13.5% |

| Rotary Heat Pump Compressors Market Size 2032 |

USD 5.58 Billion |

The Rotary Heat Pump Compressors Market is led by key players including Johnson Controls, Midea, Glen, Panasonic, LG, Carrier, Mayekawa, Daikin, Danfoss, and Carel. These companies dominate through advanced product portfolios, global distribution networks, and continuous investment in energy-efficient compressor technologies. Asia-Pacific led the market in 2024 with a 31.6% share, driven by large-scale manufacturing, growing residential installations, and strong government incentives for clean heating solutions. North America followed with a 33.2% share, supported by rising adoption of inverter-based compressors, while Europe, holding a 27.4% share, maintained steady growth through regulatory support for low-carbon and sustainable HVAC systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rotary Heat Pump Compressors Market was valued at USD 2.03 billion in 2024 and is projected to reach USD 5.58 billion by 2032, growing at a CAGR of 13.5% during the forecast period.

- Rising demand for energy-efficient HVAC systems and government incentives promoting sustainable heating and cooling solutions are key drivers of market growth.

- Trends include the adoption of inverter-driven and low-GWP refrigerant compressors, enhancing performance and environmental compliance.

- The market is competitive, with major players such as Daikin, LG, Panasonic, Carrier, and Johnson Controls focusing on innovation, capacity expansion, and smart compressor technologies.

- North America held a 33.2% share, Asia-Pacific followed with 31.6%, and Europe accounted for 27.4%, while the twin rotary compressor segment dominated with a 58.3% share due to its superior efficiency and stability.

Market Segmentation Analysis:

By Type

The twin rotary compressor segment dominated the Rotary Heat Pump Compressors Market in 2024 with a 58.3% share. Its dominance is driven by superior energy efficiency, smoother operation, and reduced vibration compared to single rotary models. Twin rotary compressors provide enhanced performance under varying load conditions, making them ideal for modern HVAC systems. Growing demand for high-capacity, low-noise, and reliable compressors in residential and commercial heat pumps continues to support this segment’s growth. Single rotary compressors remain popular in smaller units due to their compact design and cost-effectiveness.

- For instance, Daikin Industries Ltd. developed its R32 swing and rotary compressors with new technologies, operating efficiently in systems delivering heating outputs up to 18 kW. Their Altherma 3 H MT heat pumps, which use this technology, can achieve a Coefficient of Performance (COP) of 5.1 at an ambient temperature of 7 °C.

By Application

The residential segment held the largest share of 46.7% in 2024, supported by rapid adoption of heat pumps for home heating and cooling in urban regions. Increasing energy-efficiency regulations and government incentives for eco-friendly HVAC systems are driving installations of rotary compressors in household applications. Compact design, low noise, and easy integration with split air-conditioning systems further boost residential adoption. Meanwhile, the commercial segment is expanding quickly, driven by demand for efficient climate control solutions in offices, retail buildings, and hospitality facilities.

- For instance, LG Electronics introduced its new R454B scroll compressor, available in 45kW capacity, engineered for residential and light-commercial HVAC applications, which features advanced vapor injection technology and high-efficiency operation

By Refrigerant Type

The R32 refrigerant segment accounted for a 41.2% share of the Rotary Heat Pump Compressors Market in 2024. The dominance stems from its lower global warming potential (GWP), higher energy efficiency, and improved heat transfer characteristics. R32-based compressors are increasingly replacing R410A due to stricter environmental regulations and phase-out policies for high-GWP refrigerants. The R290 segment is also gaining traction as a natural refrigerant option, offering zero ozone depletion potential and strong performance in eco-friendly systems. Manufacturers are focusing on R32 and R290 technologies to align with global sustainability targets.

Key Growth Drivers

Rising Adoption of Energy-Efficient HVAC Systems

The growing emphasis on energy conservation is driving the adoption of rotary heat pump compressors. Governments worldwide are promoting energy-efficient heating and cooling technologies through incentives and regulatory standards. Rotary compressors deliver high efficiency, low noise, and compact design, making them ideal for modern residential and commercial systems. Increasing consumer awareness of sustainable energy solutions and the need to reduce operational costs are further fueling the shift toward advanced heat pump systems with rotary compressors.

- For instance, Danfoss A/S launched its TR Scroll and VZH inverter compressor line, achieving up to 25 kW heating capacity and seasonal performance factor values exceeding 4.5, optimizing energy efficiency for reversible air-to-water heat pumps across residential and light-commercial sectors.

Expansion of Residential and Commercial Infrastructure

Rapid urbanization and expansion of real estate developments are increasing the demand for efficient HVAC systems. Rotary heat pump compressors are being widely integrated into air-conditioning units, heat pumps, and water heaters to provide reliable climate control. The rising number of residential complexes, offices, and retail spaces in emerging economies supports strong market growth. Infrastructure modernization initiatives in developed nations also contribute to higher installation rates of rotary compressors.

- For instance, Carrier Global Corporation introduced its AquaSnap® 30AWH air-to-water heat pump system equipped with a full inverter twin-rotary compressor capable of operating at variable speed, delivering stable heating outputs up to 16 kW for residential and light commercial buildings.

Technological Advancements in Compressor Design

Continuous innovation in compressor technology is enhancing system performance and efficiency. Twin rotary compressors with variable-speed drives are gaining popularity for their precise temperature control and reduced energy consumption. Manufacturers are focusing on compact, lightweight designs with improved heat exchange capabilities. Integration of eco-friendly refrigerants and intelligent control systems further enhances operational reliability and environmental compliance. These advancements are positioning rotary heat pump compressors as a preferred choice in next-generation HVAC systems.

Key Trends & Opportunities

Shift Toward Low-GWP and Natural Refrigerants

The market is witnessing a clear transition toward low-global-warming-potential (GWP) refrigerants such as R32 and natural options like R290. Stricter environmental regulations and refrigerant phase-out mandates are accelerating this shift. Manufacturers are developing compressor systems optimized for these eco-friendly refrigerants to meet global sustainability goals. This trend presents opportunities for product innovation and differentiation, especially in markets emphasizing carbon neutrality and environmental responsibility.

- For instance, Mayekawa Mfg. Co. Ltd. developed the Unimo Eco-Cute heat pump system utilizing CO₂ (R744) as a natural refrigerant, featuring rotary compressors with a heating output of 45 kW and achieving water outlet temperatures up to 90 °C while maintaining near-zero direct GWP emissions.

Integration of Smart and Inverter-Based Technologies

Smart control and inverter-driven rotary compressors are reshaping the HVAC industry by offering precise control, energy savings, and enhanced comfort. These technologies allow compressors to adjust speed dynamically based on temperature demand, improving efficiency and reducing wear. Growing adoption of IoT-enabled and AI-assisted heat pump systems supports the development of advanced rotary compressor models. This trend is expected to strengthen product competitiveness and expand their application scope in both residential and commercial sectors.

- For instance, Johnson Controls International plc introduced its Smart Connected Heat Pump platform integrating variable-speed rotary compressors with IoT analytics capable of processing 50,000 data points per unit per day, enabling remote diagnostics, predictive maintenance, and energy optimization across large-scale commercial installations.

Key Challenges

High Initial Investment and Maintenance Costs

The installation and maintenance costs of advanced rotary heat pump compressors remain a key restraint, especially for small-scale users. High prices of variable-speed and twin rotary systems increase the upfront investment. Additionally, periodic maintenance, complex design, and skilled labor requirements add to operational expenses. These factors can hinder market penetration in price-sensitive regions, despite long-term energy savings.

Regulatory and Environmental Compliance Complexity

Manufacturers face increasing regulatory challenges concerning refrigerant standards, noise levels, and energy efficiency certifications. Compliance with evolving environmental laws, such as the EU F-Gas Regulation and U.S. EPA guidelines, requires frequent product redesign and testing. This increases development costs and slows product rollout cycles. Companies must invest in sustainable manufacturing and certification processes to remain competitive in this evolving regulatory landscape.

Regional Analysis

North America

North America held a 33.2% share of the Rotary Heat Pump Compressors Market in 2024. Growth is driven by strong demand for energy-efficient HVAC systems across residential and commercial buildings. The U.S. leads the region due to widespread adoption of heat pumps supported by tax credits and green building initiatives. Increasing replacement of conventional HVAC systems with inverter-based rotary compressors enhances market expansion. Furthermore, advancements in refrigerant technology and rising consumer awareness of carbon footprint reduction continue to fuel product adoption throughout the region.

Europe

Europe accounted for a 27.4% share of the Rotary Heat Pump Compressors Market in 2024. The region benefits from stringent energy efficiency regulations and ambitious carbon reduction targets. Countries such as Germany, France, and the U.K. are accelerating heat pump installations under clean energy transition programs. Demand for low-GWP refrigerant-based rotary compressors is growing rapidly due to environmental compliance requirements. Continuous innovation in heating technologies and government subsidies promoting sustainable building upgrades strengthen Europe’s role as a key contributor to market development and eco-friendly HVAC transformation.

Asia-Pacific

Asia-Pacific dominated the Rotary Heat Pump Compressors Market in 2024 with a 31.6% share, driven by expanding residential construction, industrialization, and climate control needs. China, Japan, and South Korea lead the regional market through large-scale heat pump production and strong export capabilities. Growing awareness of energy-efficient solutions, along with supportive government initiatives, boosts regional demand. The availability of low-cost manufacturing and local component suppliers enhances competitiveness. Rapid urbanization and adoption of inverter-driven systems are expected to sustain Asia-Pacific’s leadership position throughout the forecast period.

Latin America

Latin America held a 4.5% share of the Rotary Heat Pump Compressors Market in 2024. The region’s growth is fueled by rising adoption of energy-efficient HVAC systems in residential and commercial projects. Brazil and Mexico remain key markets due to expanding construction sectors and climate adaptation needs. However, high initial installation costs and limited awareness of heat pump technology restrain faster growth. Increasing foreign investments, coupled with government support for sustainable energy programs, is expected to improve regional penetration of rotary heat pump compressors over the coming years.

Middle East & Africa

The Middle East & Africa accounted for a 3.3% share of the Rotary Heat Pump Compressors Market in 2024. Growth is supported by expanding infrastructure projects and rising demand for advanced cooling systems in hot climate zones. The United Arab Emirates and Saudi Arabia are key contributors, focusing on sustainable building design and energy efficiency. Industrial and commercial adoption is growing as part of broader decarbonization goals. Meanwhile, Africa is gradually adopting rotary compressors in emerging residential and industrial developments, supported by rising electrification and renewable energy initiatives.

Market Segmentations:

By Type

- Single Rotary Compressors

- Twin Rotary Compressors

By Application

- Residential

- Commercial

- Industrial

By Refrigerant Type

By Power Range

- Up to 5 kW

- 5–15 kW

- Above 15 kW

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Rotary Heat Pump Compressors Market is highly competitive, featuring leading players such as Johnson Controls, Midea, Glen, Panasonic, LG, Carrier, Mayekawa, Daikin, Danfoss, and Carel. These companies are focusing on technological innovation, product efficiency, and environmentally sustainable designs to strengthen their global presence. Manufacturers are investing in inverter-driven and variable-speed compressor technologies to enhance energy performance and meet low-emission standards. Strategic partnerships, mergers, and expansions into emerging markets are key approaches to increasing market share. Furthermore, players are emphasizing the use of eco-friendly refrigerants such as R32 and R290, aligning with international sustainability goals. Continuous R&D initiatives aimed at improving compressor reliability, noise reduction, and compactness further intensify competition within the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson Controls

- Midea

- Glen

- Panasonic

- LG

- Carrier

- Mayekawa

- Daikin

- Danfoss

- Carel

Recent Developments

- In August 2025, Panasonic Corporation began operations at a new Czech factory building to increase annual air-to-water heat-pump production from 150,000 units to approximately 700,000 units, supported by automated assembly with 80 robots.

- In July 2025, Daikin introduced a high-temperature option for its EWWH-VZ water-cooled inverter heat pump series capable of delivering heating up to 90 °C and working capacity from 400 kW to 1,900 kW.

- In January 2025, LG Electronics Inc. unveiled a 27-ton capacity compressor design with R454B refrigerant aimed at large-capacity commercial HVAC systems, featured ahead of the AHR Expo 2025.

- In November 2024, Daikin Industries, Ltd. announced a joint venture with Copeland (Emerson Climate Technologies) to bring Daikin’s inverter single-screw rotary compressor technology to the U.S. residential heat-pump segment.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Refrigerant Type, Power Range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for rotary heat pump compressors will rise with the global shift toward energy-efficient HVAC systems.

- Technological innovations will enhance compressor performance, reliability, and noise reduction.

- Adoption of eco-friendly refrigerants like R32 and R290 will accelerate across major regions.

- Twin rotary compressors will maintain dominance due to high efficiency and operational stability.

- Manufacturers will expand production capacities to meet increasing demand in residential and commercial sectors.

- Asia-Pacific will continue leading the market with strong manufacturing capabilities and policy support.

- Europe will see steady growth driven by strict environmental regulations and green building standards.

- Integration of inverter and smart control technologies will improve system flexibility and energy savings.

- Strategic collaborations between compressor manufacturers and HVAC system providers will boost innovation.

- Continuous investment in R&D and sustainable production will shape long-term competitiveness in the market.