Market Overview:

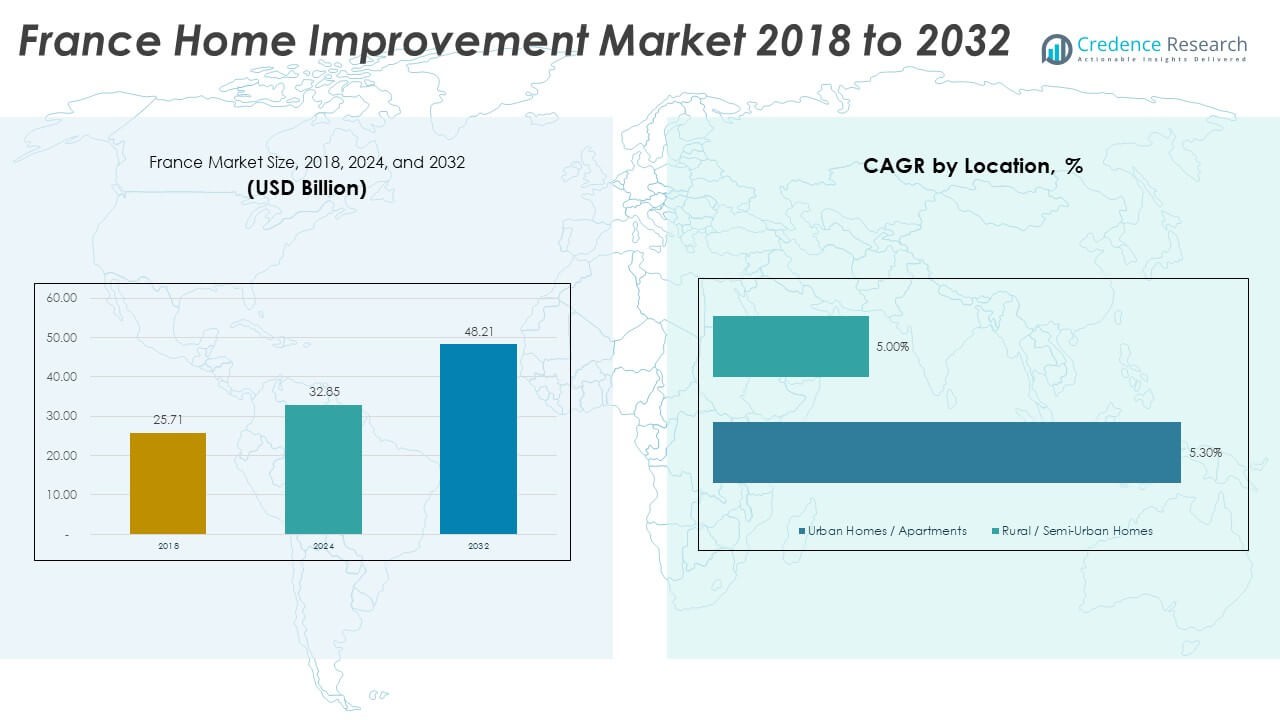

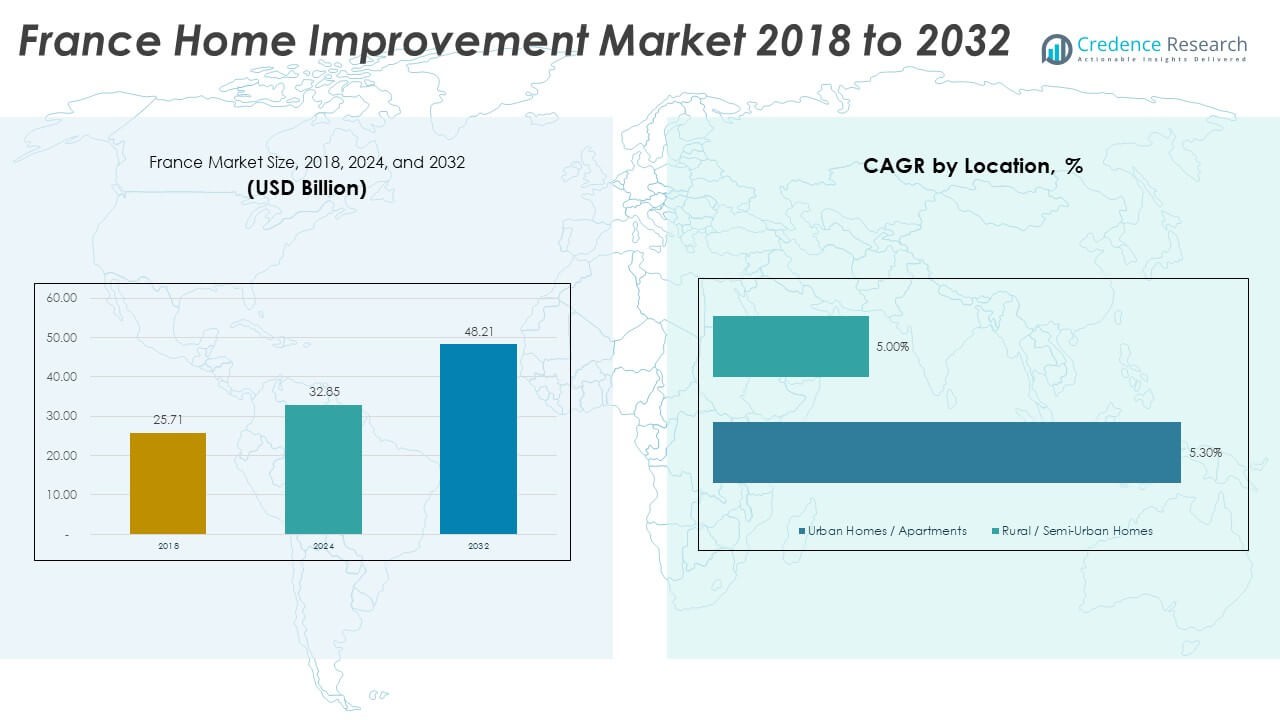

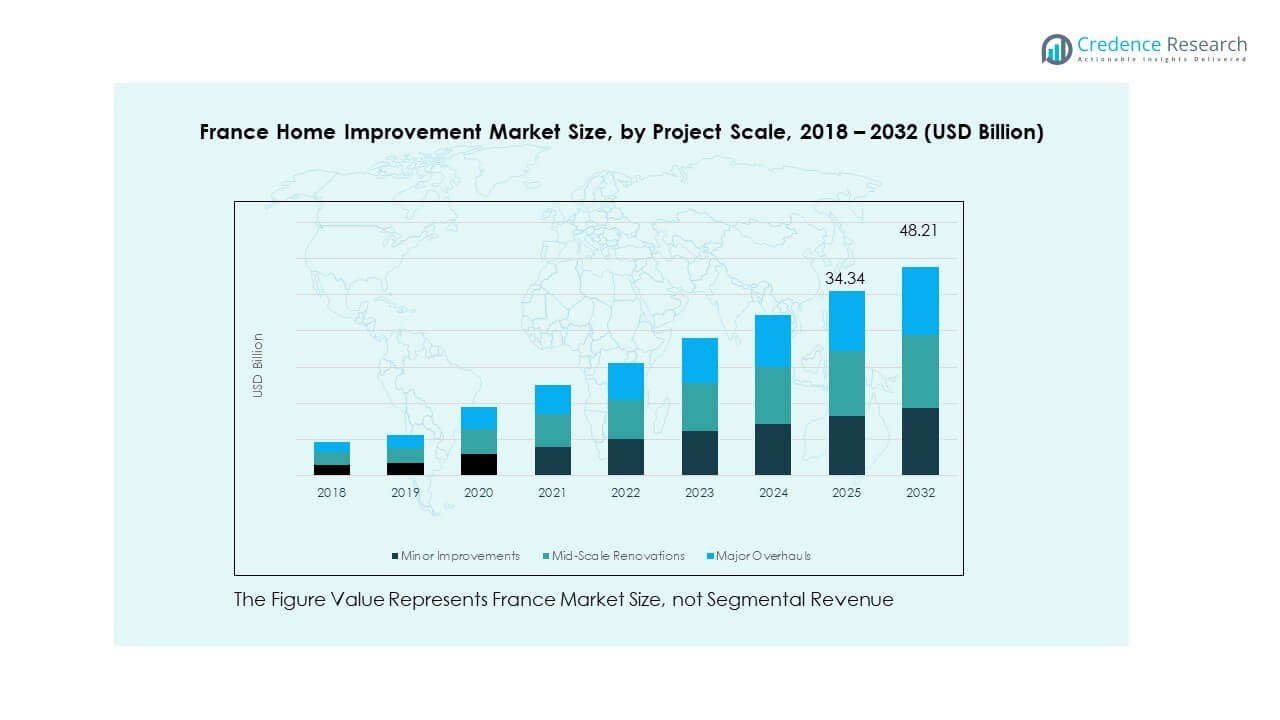

The France Home Improvement Market size was valued at USD 25.71 billion in 2018, increased to USD 32.85 billion in 2024, and is anticipated to reach USD 48.21 billion by 2032, growing at a CAGR of 4.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Home Improvement Market Size 2024 |

USD 32.85 Billion |

| France Home Improvement Market, CAGR |

4.93% |

| France Home Improvement Market Size 2032 |

USD 48.21 Billion |

Rising interest in home renovation is driven by growing urbanization, higher disposable incomes, and government incentives for energy-efficient housing. Consumers are investing in eco-friendly materials, smart home systems, and modern interiors that enhance comfort and sustainability. DIY culture is also expanding, supported by e-commerce platforms and the availability of affordable, easy-to-install solutions, encouraging homeowners to personalize and upgrade their living spaces independently.

Regionally, Île-de-France leads the market due to dense urban housing and higher renovation budgets, followed by regions such as Auvergne-Rhône-Alpes and Provence-Alpes-Côte d’Azur, where tourism-related property investments drive demand. Northern and western regions show growing interest in sustainable materials and energy retrofitting, while rural areas are witnessing steady adoption of modern home improvement products, aided by expanding retail networks and digital accessibility.

Market Insights:

- The France Home Improvement Market was valued at USD 25.71 billion in 2018, reached USD 32.85 billion in 2024, and is projected to reach USD 48.21 billion by 2032, growing at a CAGR of 4.93% during the forecast period.

- Île-de-France holds the largest share of the market at approximately 28%, followed by Provence-Alpes-Côte d’Azur at 18%, and Auvergne-Rhône-Alpes at 14%. These regions dominate due to urbanization, high disposable incomes, and strong consumer demand for home renovations.

- The fastest-growing region is expected to be the northern and western parts of France, which combined have a market share of around 40%. The growth is driven by rural-to-urban migration, government incentives for energy-efficient homes, and expanding retail networks.

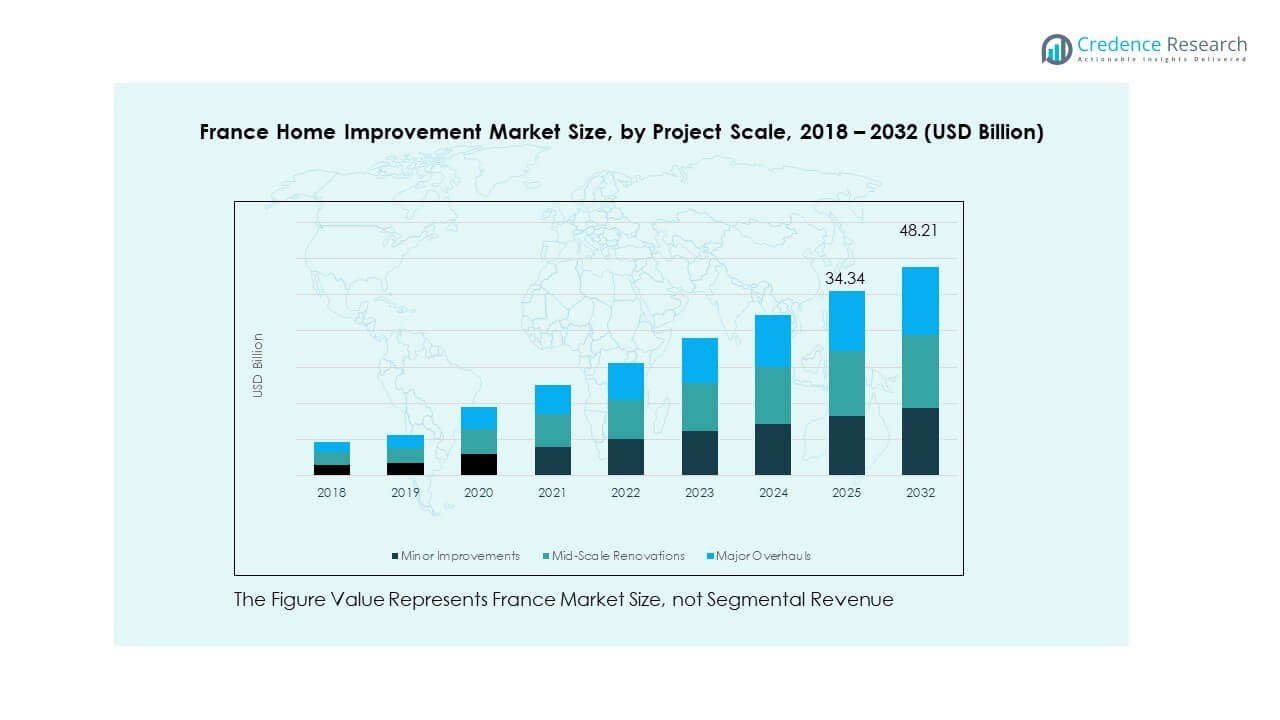

- In 2024, minor improvements account for the largest segment share, with approximately 45% of market revenue, followed by mid-scale renovations at 30%, and major overhauls at 25%.

- The distribution of project scales in the France Home Improvement Market shows a shift toward mid-scale renovations, with a steady increase in demand for major overhauls, reflecting greater investments in home upgrades and energy-efficient solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Spending on Home Renovation

The France Home Improvement Market is experiencing a surge in consumer spending on home renovation due to rising disposable incomes. Homeowners are investing in projects that enhance the aesthetics, functionality, and sustainability of their properties. Government incentives for energy-efficient upgrades are further driving this demand. The increase in middle-class households with higher purchasing power supports continued spending on remodelling. Furthermore, the popularity of smart home solutions is contributing to this market growth. As more individuals focus on improving their living spaces, the demand for advanced home improvement products is expanding. The DIY trend has also gained momentum, allowing homeowners to take on various renovation projects independently.

- For instance, Leroy Merlin recorded a 40 % growth in its online sales between 2020 and 2023, underlining homeowners’ appetite for renovation products. Homeowners are investing in projects that enhance the aesthetics, functionality, and sustainability of their properties. Government incentives for energy‑efficient upgrades further encourage this demand. A survey found that 45 % of French homeowners have carried out an energy retrofit since 2019 and 32 % intend to do so.

Government Support for Energy-Efficient Homes

Energy efficiency is a significant driver for the France Home Improvement Market, supported by various governmental initiatives. Programs offering financial support for sustainable construction materials and energy-saving appliances encourage homeowners to make environmentally-conscious renovations. The French government has set ambitious energy reduction goals, creating a favorable environment for energy-efficient home upgrades. This has led to an increased adoption of technologies like solar panels, efficient insulation, and smart heating systems. The market is witnessing significant interest in retrofitting older homes to meet modern environmental standards. As a result, demand for eco-friendly home improvement solutions continues to rise.

- For instance, the Ma Prime Rénov’ scheme extended in 2023 enables large subsidies for homeowners to upgrade insulation and install heat‑pumps. Programs offering financial support for sustainable materials and energy‑saving appliances encourage homeowners to make environmentally‑conscious renovations. The French government announced over €6.7 billion in public funding for building energy retrofits under its recovery plan, targeting older homes.

Growing Interest in Smart Home Technology

The growing interest in smart home technology is a key driver for the France Home Improvement Market. Homeowners are increasingly investing in automation systems that enhance security, convenience, and energy management. Products such as smart lighting, climate control systems, and security cameras are becoming integral to home renovation projects. Smart technology also plays a vital role in making homes more energy-efficient. The ability to control devices remotely or program them for optimized performance drives the adoption of these systems. This trend has significantly influenced home improvement purchases, as more consumers prioritize technology in their renovation plans.

Urbanization and Shifting Lifestyle Preferences

Urbanization continues to fuel the France Home Improvement Market as more individuals move into cities with limited space. The need for efficient use of smaller living spaces encourages the demand for multi-functional furniture, storage solutions, and compact home appliances. Shifting lifestyle preferences, including a greater focus on convenience and sustainability, further contribute to the market’s growth. Consumers are increasingly seeking products that combine design, functionality, and energy efficiency. These evolving preferences drive innovation in the home improvement sector, influencing both product offerings and renovation trends.

Market Trends:

Increasing Popularity of Sustainable Materials

In the France Home Improvement Market, there is a growing demand for sustainable materials. Homeowners are opting for eco-friendly alternatives such as recycled wood, bamboo flooring, and low-VOC paints. These materials offer a combination of aesthetic appeal and environmental responsibility. The focus on sustainability extends to home appliances, with consumers increasingly choosing energy-efficient models. This trend reflects a broader societal push toward reducing carbon footprints. Builders and manufacturers are responding by offering green alternatives that meet both consumer demand and regulatory standards. As sustainability becomes a core value, it influences purchasing decisions in home improvement.

- For instance, Leroy Merlin’s home‑automation platform “Enki” supports over 500 connected devices across 25 brands, facilitating energy‑saving controls and integration with low‑emission heating systems.

Rise in DIY and E-commerce Channels

The DIY trend is gaining ground in the France Home Improvement Market, with consumers preferring to handle renovations themselves. This shift is partly driven by the ease of access to online tutorials and resources. The rise of e-commerce platforms has also made it easier for consumers to purchase home improvement products at competitive prices. Online stores offer a wide range of products, from tools to materials, along with convenient delivery options. Many retailers have expanded their digital presence, providing an enhanced shopping experience for DIY enthusiasts. This trend is expected to continue as technology evolves and home improvement products become more accessible.

- For instance, the Mr Bricolage Group operates over 1,000 stores as of June 2024, supporting a strong network for DIY projects. The shift comes from easier access to online tutorials and resources. The rise of e‑commerce platforms has made it easier for consumers to purchase home improvement products at competitive prices.

Integration of Smart Home Devices

Another prominent trend in the France Home Improvement Market is the integration of smart home devices. Consumers are increasingly investing in home automation systems that provide greater control and energy efficiency. Smart thermostats, lighting systems, and security cameras are becoming standard in home renovations. These devices allow homeowners to monitor and control their homes remotely, enhancing convenience and security. The demand for seamless integration of these technologies with existing home infrastructure is increasing. Home improvement businesses are responding by offering comprehensive smart home solutions that cater to this growing demand.

Interest in Wellness-Oriented Home Improvements

There is a rising trend of wellness-oriented home improvements in France. Consumers are increasingly focusing on creating healthier living environments that promote physical and mental well-being. This includes the installation of air purification systems, water filtration systems, and the use of non-toxic materials in home renovations. The pandemic has further accelerated this trend, as people spend more time at home and prioritize comfort. Homeowners are also investing in outdoor spaces to create calming environments. As wellness becomes a key focus, the demand for products that contribute to a healthier home is expected to grow.

Market Challenges Analysis:

High Cost of Home Improvement Projects

One of the major challenges in the France Home Improvement Market is the high cost of renovation projects. While the demand for home improvements is growing, the expenses associated with construction, materials, and labor can be prohibitive for many consumers. This is particularly challenging in urban areas where property prices are already high. Despite the availability of financing options, many homeowners hesitate to invest in substantial renovations due to the financial burden. Additionally, the fluctuating prices of raw materials and supply chain disruptions add to the cost challenges. As a result, the market’s growth may be hindered for price-sensitive consumers who cannot afford large-scale home improvements.

Labor Shortage and Skill Gaps

The France Home Improvement Market is also facing a labor shortage and skill gaps, particularly in the construction and renovation sectors. The demand for skilled workers in home improvement projects, such as electricians, plumbers, and carpenters, is high. However, the industry is struggling to meet this demand due to a lack of skilled professionals. The aging workforce in the construction industry and insufficient training opportunities for younger generations exacerbate this problem. The shortage of skilled labor can delay project timelines and increase costs, ultimately impacting the growth of the market. It also limits the ability of homeowners to find affordable and qualified professionals for their renovation needs.

Market Opportunities:

Demand for Energy-Efficient Upgrades

The France Home Improvement Market presents significant opportunities in the area of energy-efficient home upgrades. As more consumers become aware of environmental issues and the financial benefits of energy-saving solutions, there is a growing demand for energy-efficient windows, insulation, and heating systems. Government incentives and rising energy costs further support this demand. Companies offering energy-efficient products that reduce energy consumption are poised for success in the market. This trend presents a strong growth opportunity for businesses focusing on green technology and energy-efficient home improvements.

Potential in Smart Home Integration

There is considerable market opportunity in the integration of smart home technologies into home improvement projects. As consumers seek greater control over their homes, the demand for smart devices continues to grow. From automated lighting systems to intelligent security features, the market for smart home products is expanding. Home improvement businesses that can integrate these devices into their offerings are positioned to capture a growing segment of tech-savvy consumers. The continued advancement of smart home technology presents an ongoing opportunity for innovation and market growth in France.

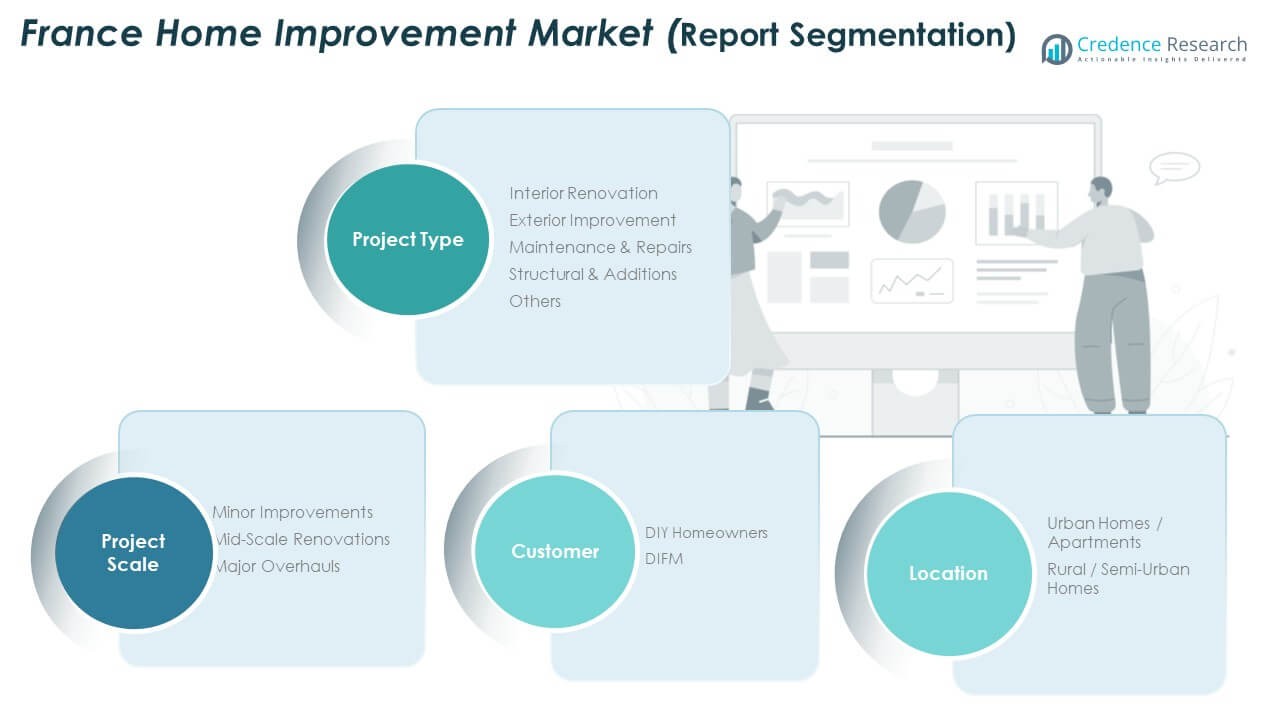

Market Segmentation Analysis:

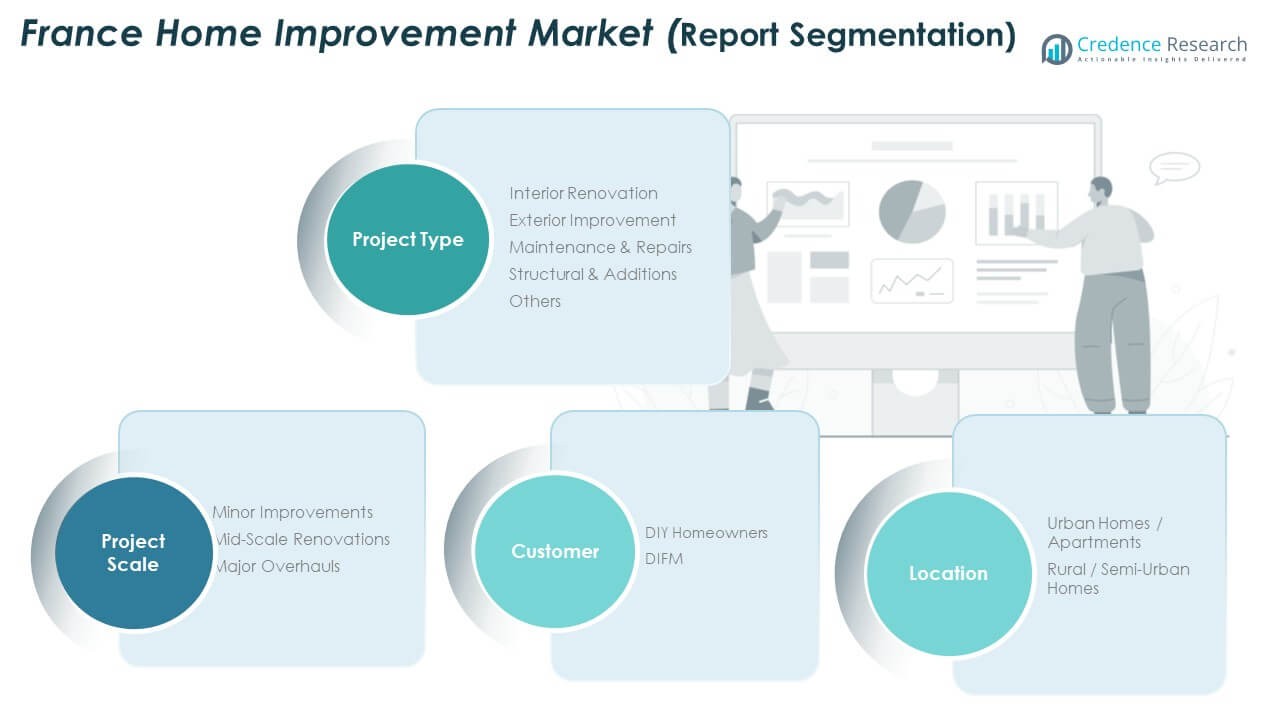

By Project Type

The France Home Improvement Market is segmented by project type, including interior renovation, exterior improvement, maintenance & repairs, structural & additions, and others. Interior renovations, such as remodeling kitchens and bathrooms, continue to be a significant contributor, driven by consumer demand for modern, energy-efficient designs. Exterior improvements, including landscaping and façade upgrades, have also gained traction as homeowners focus on curb appeal and sustainability. Maintenance & repairs, essential for property upkeep, form another key segment. Structural & additions, involving major renovations, are often driven by the need for more living space, while other segments cater to specialized needs like home automation.

By Project Scale

The market is further segmented by project scale into minor improvements, mid-scale renovations, and major overhauls. Minor improvements, including small updates or repairs, make up the largest portion of the market. Mid-scale renovations, such as partial room redesigns, show steady growth as homeowners seek more significant enhancements. Major overhauls, involving extensive structural changes, are less common but often bring high-value investments in the market.

- For instance, Castorama in France operates 94 stores and introduced an online platform that achieved over one million drive‑through orders in 2020, offering packages suited for mid‑scale renovation projects.

By Customer Type

The customer base is divided into DIY homeowners and DIFM (Do-It-For-Me). DIY homeowners, empowered by the internet and availability of materials, are driving the demand for affordable, small-scale renovations. DIFM customers prefer professional services for more complex projects, fueling demand for renovation companies and contractors.

By Location

Geographically, the market is divided into urban homes/apartments and rural/semi-urban homes. Urban areas, with higher disposable income, drive demand for premium home improvement products and services. Rural and semi-urban areas experience steady growth due to increased access to home improvement resources and the desire to enhance property value.

Segmentation:

By Project Type

- Interior Renovation

- Exterior Improvement

- Maintenance & Repairs

- Structural & Additions

- Others

By Project Scale

- Minor Improvements

- Mid-Scale Renovations

- Major Overhauls

By Customer Type

- DIY Homeowners

- DIFM (Do-It-For-Me)

By Location

- Urban Homes / Apartments

- Rural / Semi-Urban Homes

Regional Analysis:

Île‑de‑France Region Dominance

The Île‑de‑France region captures a commanding share of the France Home Improvement Market, accounting for approximately 28 % of national revenue. Its high population density, elevated incomes and concentration of urban housing units drive substantial renovation and improvement activity. Consumers in this region invest heavily in premium upgrades, smart‑home systems and exterior façade enhancements. Housing units in the region often require modernization, which keeps demand strong. Contractors and retailers focus their efforts here to capitalise on the budget levels and market activity. Urban regeneration projects around Paris also boost spending on structural additions and major overhauls.

Southern & Eastern France Growth Hubs

Regions such as Provence‑Alpes‑Côte d’Azur and Auvergne‑Rhône‑Alpes hold roughly 18 % and 14 % of the market respectively. These areas benefit from tourism‑driven real estate upgrades and second‑home renovations. Homeowners in these regions focus on exterior improvements, pool installations and holiday‑home make‑overs. Local climate and lifestyle preferences fuel demand for energy‑efficient windows, outdoor living spaces and improved insulation. These regions present robust mid‑scale renovation opportunities due to older housing stock and seasonal residence usage.

Rural, Semi‑Urban and Western France Segment

The combined share for rural and semi‑urban homes in western and northern France stands near 40 % of market value. In these areas, homeowners invest in maintenance & repairs and structural additions to increase living space without relocating. Smaller towns and semi‑urban zones show rising interest in DIY projects and budget‑friendly renovations. Infrastructure improvements and retail expansion make home‑improvement products more accessible. Homes in these regions often undergo incremental upgrades, presenting steady demand but with lower average spend than major urban zones.

Key Player Analysis:

- GM Renovations

- French Connections HCB

- GLF SpA

- Crane Renovation Group

- HappyBart

- BMFrance Home ImprovementE France

- FRANCE RENOVATION

- HHI

- Moore Renovation

- Other Key Players

Competitive Analysis:

The France Home Improvement Market is highly competitive, with key players focusing on innovation and regional expansion. Leading players such as Leroy Merlin, Castorama, and Mr. Bricolage dominate the market by offering a wide range of products including construction materials, smart home devices, and renovation tools. These companies leverage strong retail networks, e-commerce platforms, and localized offerings to maintain their market positions. Smaller players also target niche segments, providing personalized services and specialized products. Intense competition drives continuous innovation in product offerings, pricing strategies, and customer service. Companies are also forming strategic partnerships to expand their product portfolios and reach new consumer segments. As consumer preferences shift toward energy-efficient and smart home solutions, market players are increasingly investing in these technologies to stay ahead.

Recent Developments:

- General Motors entered a strategic partnership with Hyundai Motor Company for co-development of electric vehicles, confirmed by reputable sources including Reuters, PR Newswire, and TechCrunch between August and October 2025.

- GM announced investment and joint ventures with Lithium Americas and Redwood Materials regarding EV battery supply and recycling, verified by Reuters and Recycling Today in 2024–2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on project type, customer type, and location. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France Home Improvement Market will continue to benefit from increased consumer spending on home renovations.

- Demand for energy-efficient and sustainable products will drive future growth in the market.

- Smart home technologies will become more integrated into home improvement products, offering greater convenience and security.

- Urbanization will remain a key factor, particularly in high-density areas like Paris, boosting renovation demand.

- The DIY segment will grow, driven by increased access to online resources and affordable products.

- Home improvement companies will continue expanding their e-commerce presence to capture more online sales.

- Renovation projects in rural and semi-urban areas will increase due to greater access to home improvement products.

- Maintenance and repair projects will remain a significant segment, driven by the aging housing stock.

- The rise of green building initiatives will increase demand for eco-friendly materials and retrofitting solutions.

- Regulatory frameworks focused on sustainability will foster innovation in energy-efficient products and solutions.