Market Overview

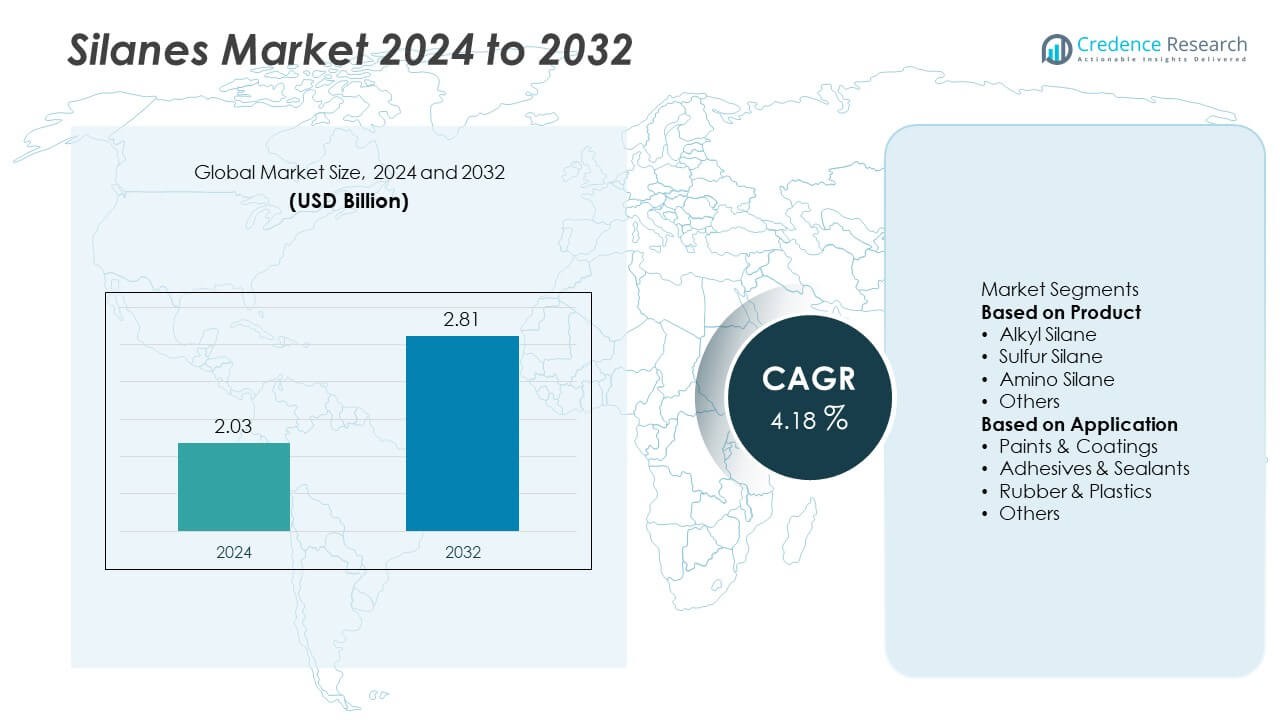

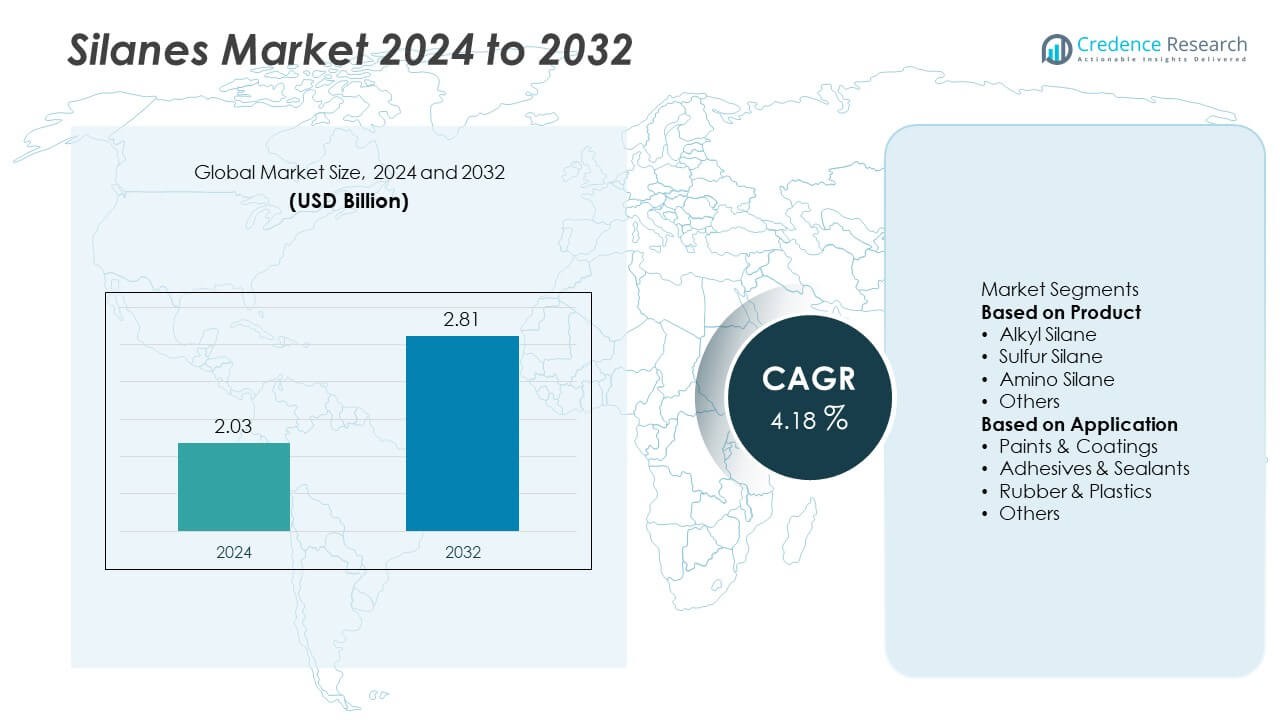

The Silanes Market was valued at USD 2.03 billion in 2024 and is projected to reach USD 2.81 billion by 2032, growing at a CAGR of 4.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silanes Market Size 2024 |

USD 2.03 Billion |

| Silanes Market, CAGR |

4.18% |

| Silanes Market Size 2032 |

USD 2.81 Billion |

The Silanes Market is led by major players including Evonik Industries AG, Shin-Etsu Chemical Co., Ltd., Dow Inc., Momentive Performance Materials Inc., Wacker Chemie AG, Gelest, Inc., Elkem ASA, Air Products and Chemicals, Inc., Nouryon, and Jingzhou Jianghan Fine Chemical Co., Ltd. These companies dominate through extensive product innovation, technological advancements, and strong global distribution networks. Asia-Pacific led the market in 2024 with a 30.6% share, driven by rapid industrialization and strong demand from construction and automotive sectors. North America followed with 32.5%, supported by advanced manufacturing and R&D investments, while Europe held 28.7%, driven by sustainability-focused chemical production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Silanes Market was valued at USD 2.03 billion in 2024 and is projected to reach USD 2.81 billion by 2032, growing at a CAGR of 4.18%.

- Rising demand from construction, automotive, and electronics industries is fueling silane usage in coatings, sealants, and surface treatments.

- The market is witnessing a shift toward eco-friendly and low-VOC silanes, driven by stricter environmental regulations and green chemistry advancements.

- Key players such as Evonik Industries, Dow Inc., and Wacker Chemie AG are focusing on technological innovation and strategic expansions to strengthen their global presence.

- Asia-Pacific led with a 30.6% share, followed by North America (32.5%) and Europe (28.7%), while the amino silane segment dominated with a 39.7% share due to its wide industrial applications and superior adhesion properties.

Market Segmentation Analysis:

By Product

The amino silane segment dominated the Silanes Market in 2024 with a 39.7% share. Its strong performance is driven by wide use in adhesives, coatings, and sealants, where it enhances adhesion and crosslinking between organic and inorganic materials. Amino silanes improve bonding strength and moisture resistance in construction and automotive applications. Rising demand for durable coatings and improved polymer performance further supports this dominance. The sulfur silane segment also shows steady growth due to its critical role in tire manufacturing, improving rubber reinforcement and fuel efficiency.

• For instance, Evonik Industries AG produces Si 69® bis-(3-triethoxysilylpropyl) tetrasulfide, a sulfur silane coupling agent with an annual global capacity exceeding 35,000 metric tons, enabling improved silica-filled tire tread formulations that reduce rolling resistance by up to 20 N/kN in standardized lab testing.

By Application

The adhesives and sealants segment held the largest market share of 35.2% in 2024, supported by growing demand in construction, automotive, and electronics industries. Silanes enhance adhesion, weather resistance, and durability in bonding applications across varied substrates. Increasing infrastructure projects and vehicle production are fueling adoption in high-performance sealant formulations. The paints and coatings segment follows closely, driven by the use of silanes for surface modification, corrosion protection, and improved coating flexibility, supporting growth in protective and architectural coatings markets.

• For instance, Wacker Chemie AG launched its GENIOSIL® STP-E 340 silane-terminated polymer for construction sealants, with a viscosity of 30,000 mPa·s and tensile strength of 2.4 MPa, offering tin-free, low-VOC formulations that enhance long-term elasticity and adhesion on concrete and metal surfaces.

Key Growth Drivers

Expanding Demand in Construction and Infrastructure

The construction sector is a major driver of the Silanes Market, with growing use in sealants, coatings, and adhesives. Silanes improve adhesion, water repellency, and durability in concrete and surface treatments. Rapid urbanization and rising infrastructure investments in Asia-Pacific and the Middle East strengthen product demand. The push for long-lasting and weather-resistant building materials continues to boost silane adoption in both new construction and renovation projects.

• For instance, Momentive Performance Materials Inc. developed its Silquest™ A-187 epoxy silane technology, which serves as an adhesion promoter in various systems, such as concrete sealants. This technology is designed to improve both wet and dry adhesion to inorganic substrates and enhance water resistance.

Growing Automotive and Tire Manufacturing Sector

The automotive industry is increasingly adopting silanes, particularly sulfur silanes, to enhance tire performance and reduce rolling resistance. Their use improves traction and fuel efficiency, aligning with global emission reduction goals. Rising vehicle production and the shift toward sustainable materials further drive silane consumption. Additionally, silanes are used in automotive coatings and adhesives, supporting lightweight vehicle design and improved corrosion protection.

• For instance, a silane engineered for green tire applications enables 5.5% lower hysteresis loss and 7% higher abrasion resistance in silica-filled rubber compounds, meeting stringent EU tire label performance standards while improving overall tread durability.

Technological Advancements in Chemical Formulations

Continuous innovation in silane chemistry is improving product performance and environmental compatibility. Development of multifunctional and low-VOC silanes enhances adhesion, flexibility, and weather resistance across industries. Manufacturers are investing in hybrid silane technologies to meet growing regulatory demands for sustainable materials. These advancements are expanding applications in high-performance coatings, composite materials, and electronics, driving market growth.

Key Trends & Opportunities

Rising Adoption of Eco-Friendly and Low-VOC Silanes

Environmental regulations and sustainability goals are driving demand for eco-friendly silane formulations. Low-VOC and water-based silanes are gaining traction in coatings and adhesives to meet green building standards. Manufacturers are focusing on biodegradable and renewable silane derivatives to reduce environmental impact. This shift presents opportunities for innovation in cleaner, more durable materials that support circular economy goals in construction and industrial manufacturing.

• For instance, Evonik introduced its Dynasylan® SIVO 160 waterborne silane system, which is low VOC or VOC-free compared with solvent-based coatings, enhances adhesion and corrosion resistance (e.g., 1,000h salt spray), and aligns with EU REACH environmental compliance standards.

Expansion in Electronics and Renewable Energy Applications

The growing electronics and solar industries present emerging opportunities for silane applications. Silanes are essential in semiconductor coatings, photovoltaic encapsulants, and glass surface treatments. Rising investments in solar panel manufacturing and electronic component production are fueling demand for high-purity silanes. This expansion into advanced material processing enhances the market’s long-term growth prospects.

• For instance, Shin-Etsu Chemical Co., Ltd. produces trichlorosilane (HSiCl₃) as an intermediate in the manufacturing process for both solar-grade and semiconductor-grade polycrystalline silicon, with their final high-purity silicon reaching purity levels of up to 99.999999999% (11 N) for demanding semiconductor applications, supplying high-efficiency silicon wafers to fabrication facilities across the globe, including Japan and Southeast Asia.

Key Challenges

High Production and Raw Material Costs

The cost of producing silanes remains a significant challenge due to the complexity of synthesis and dependence on high-purity raw materials. Fluctuations in silicon and solvent prices increase manufacturing expenses. These cost pressures impact profit margins and restrict affordability for small-scale users. Manufacturers are focusing on process optimization and raw material sourcing strategies to maintain cost competitiveness.

Stringent Environmental and Safety Regulations

Silanes are subject to strict environmental and occupational safety regulations due to their reactive and sometimes toxic nature. Compliance with global standards such as REACH and EPA guidelines increases operational complexity and costs. The need for safer handling, storage, and disposal practices poses challenges for manufacturers. These regulatory pressures are pushing the industry toward greener alternatives and safer production technologies.

Regional Analysis

North America

North America held a 32.5% share of the Silanes Market in 2024. The region’s dominance is driven by strong demand from construction, automotive, and electronics sectors. The U.S. leads due to technological advancements and the presence of major chemical manufacturers. High adoption of silane-based coatings and sealants for infrastructure and industrial use supports growth. Additionally, increasing focus on energy-efficient buildings and sustainable materials continues to promote silane usage in green construction and specialty polymers. Continuous R&D investments further strengthen the region’s innovation capacity and product diversification.

Europe

Europe accounted for a 28.7% share of the Silanes Market in 2024. The region benefits from stringent environmental regulations promoting eco-friendly silane formulations in coatings, sealants, and adhesives. Germany, France, and the U.K. are key contributors, supported by a mature automotive and industrial manufacturing base. Demand for sulfur and amino silanes is increasing in tire manufacturing and construction. The region’s focus on energy-efficient infrastructure and lightweight materials in automotive production continues to enhance silane utilization, particularly in high-performance and low-emission applications.

Asia-Pacific

Asia-Pacific captured a 30.6% share of the Silanes Market in 2024, emerging as the fastest-growing regional market. Expanding construction, automotive, and electronics industries in China, India, and Japan are major growth drivers. Rising infrastructure investments and growing awareness of surface treatment benefits are supporting strong demand. The shift toward renewable energy and solar applications further increases silane consumption in photovoltaic materials. Local production capacity and lower manufacturing costs are attracting global players, strengthening Asia-Pacific’s role as a key production and consumption hub for silane-based products.

Latin America

Latin America held a 5.2% share of the Silanes Market in 2024. The region’s growth is supported by expanding construction and industrial sectors, particularly in Brazil and Mexico. Increasing demand for high-performance coatings and adhesives in infrastructure projects fuels silane adoption. However, limited technological advancement and high import dependence restrain faster market expansion. Growing awareness of product benefits and collaboration with international suppliers are expected to improve market accessibility. Government-led infrastructure initiatives also support steady consumption of silane-based sealants and treatment agents.

Middle East & Africa

The Middle East & Africa accounted for a 3.0% share of the Silanes Market in 2024. Market growth is fueled by rapid industrialization and ongoing construction projects in Gulf nations. The United Arab Emirates and Saudi Arabia lead due to infrastructure expansion and rising adoption of durable, weather-resistant materials. Demand for silane-based coatings and adhesives is increasing in oil, gas, and building applications. In Africa, emerging economies are gradually incorporating silane formulations in construction and automotive sectors. Expanding investment in industrial development supports moderate market growth across the region.

Market Segmentations:

By Product

- Alkyl Silane

- Sulfur Silane

- Amino Silane

- Others

By Application

- Paints & Coatings

- Adhesives & Sealants

- Rubber & Plastics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Silanes Market is highly competitive, featuring key players such as Evonik Industries AG, Shin-Etsu Chemical Co., Ltd., Dow Inc., Momentive Performance Materials Inc., Wacker Chemie AG, Gelest, Inc., Elkem ASA, Air Products and Chemicals, Inc., Nouryon, and Jingzhou Jianghan Fine Chemical Co., Ltd. These companies focus on expanding their product portfolios, improving silane synthesis efficiency, and developing environmentally sustainable formulations. Strategic initiatives such as mergers, acquisitions, and capacity expansions are common to enhance global reach and production capabilities. Leading players emphasize research and development to create multifunctional silanes with improved adhesion, durability, and chemical stability for high-performance applications. Additionally, collaborations with end-use industries and regional distributors strengthen supply chains and customer networks. Growing competition from Asian manufacturers offering cost-effective solutions further intensifies market rivalry, pushing global companies toward technological differentiation and value-added innovations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

• Evonik Industries AG

• Shin-Etsu Chemical Co., Ltd.

• Dow Inc.

• Momentive Performance Materials Inc.

• Wacker Chemie AG

• Gelest, Inc.

• Elkem ASA

• Air Products and Chemicals, Inc.

• Nouryon

• Jingzhou Jianghan Fine Chemical Co., Ltd.

Recent Developments

• In June 2025, Gelest, Inc. completed a new 50,000-square-foot production facility at its Morrisville, Pennsylvania headquarters dedicated to specialty organosilanes and supporting microelectronics and medical-device applications.

• In May 2025, Wacker Chemie AG commenced production of hybrid polymers (silane-terminated) at its Nünchritz site, creating 50 new jobs and substantially increasing output capacity.

• In March 2025, Wacker Chemie AG introduced its new generation silane technology “α³” and showcased the binders GENIOSIL® STP-E 140 (viscosity 10,000 mPa·s) and STP-E 340 (viscosity 30,000 mPa·s) for tin-free sealants.

• In January 2025, Evonik Industries AG announced the launch of a new business unit “Smart Effects,” merging its Silica and Silanes business lines into one entity comprising approximately 3,500 employees.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

1. Demand for silanes will grow with increasing use in construction, automotive, and electronics.

2. Development of eco-friendly, low-VOC silanes will strengthen their role in sustainable industries.

3. Hybrid and multifunctional silane technologies will expand applications in advanced coatings and composites.

4. Leading companies will invest in capacity expansion and R&D for high-performance silane formulations.

5. The amino silane segment will maintain dominance due to its strong bonding and adhesion properties.

6. Asia-Pacific will remain the fastest-growing region, supported by industrial expansion and local production.

7. Partnerships between global and regional players will enhance supply chain efficiency.

8. Demand from renewable energy and electronics manufacturing will create new market opportunities.

9. Rising production costs may push companies to adopt cost-efficient synthesis methods.

10. Continuous innovation and regulatory compliance will shape long-term competitiveness in the silanes industry.