Market Overview

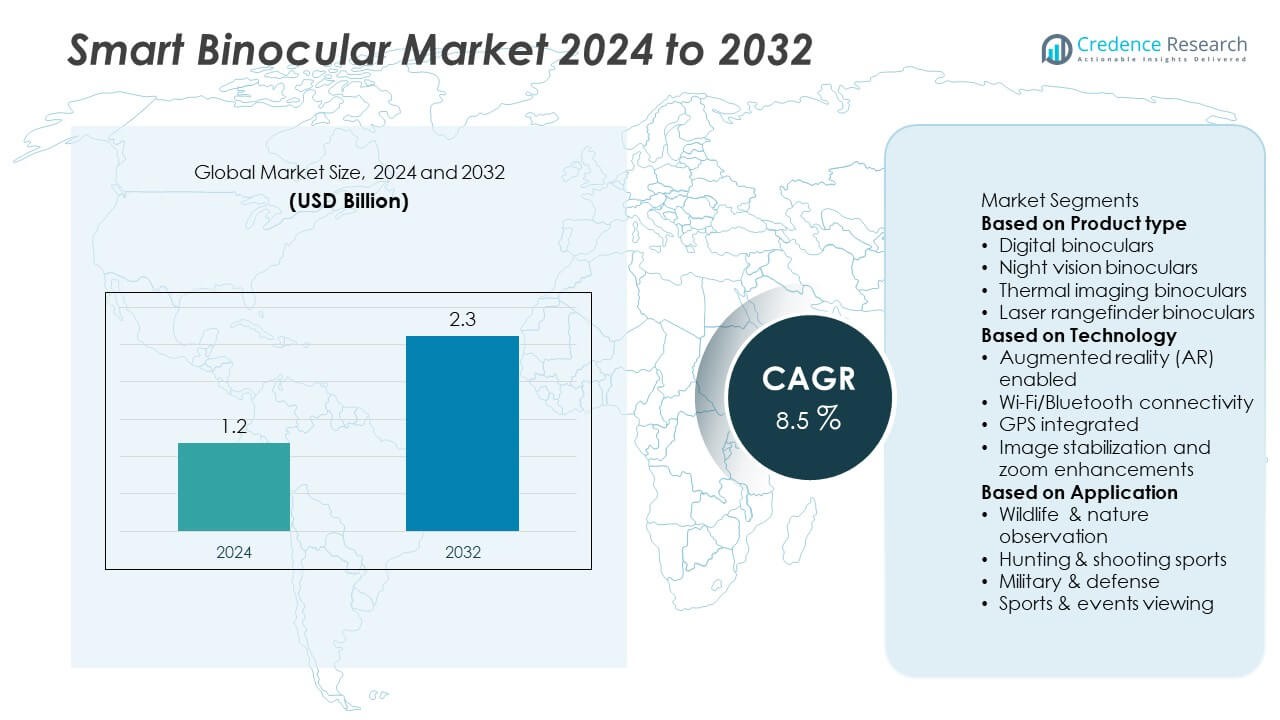

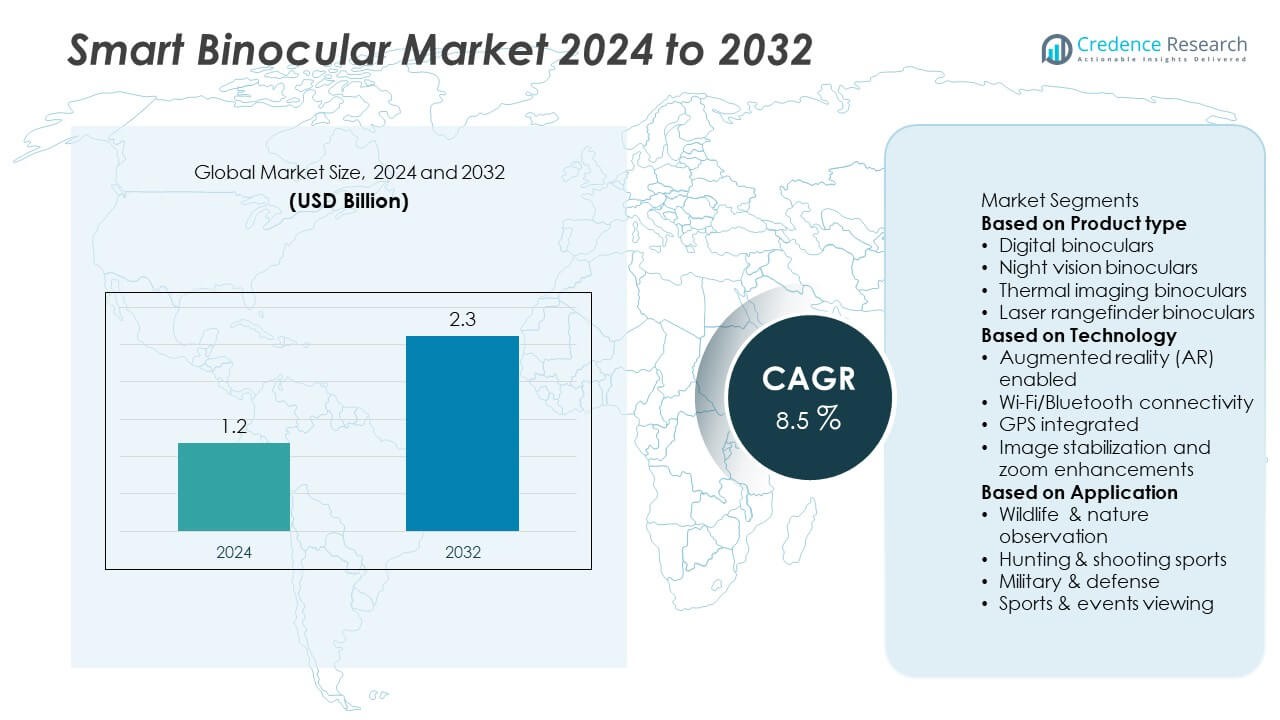

The Smart Binocular market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.3 billion by 2032, growing at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Binocular Market Size 2024 |

USD 1.2 Billion |

| Smart Binocular Market, CAGR |

8.5% |

| Smart Binocular Market Size 2032 |

USD 2.3 Billion |

The Smart Binocular market is led by prominent players such as Celestron, Nikon, ATN, Leupold & Stevens, Carl Zeiss, Bushnell, FLIR Systems, Hawke Optics, Barska, and Canon. These companies focus on integrating advanced technologies like augmented reality (AR), thermal imaging, AI-based object recognition, and image stabilization to enhance user experience and field performance. North America dominated the global market with a 38.4% share in 2024, driven by high defense investments and strong demand for outdoor and surveillance applications. Europe followed with a 27.6% share, supported by technological innovation and military modernization programs, while Asia-Pacific accounted for a 23.9% share, fueled by expanding defense budgets and rapid consumer electronics adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Smart Binocular market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.3 billion by 2032, expanding at a CAGR of 8.5% during the forecast period.

- Increasing demand for AI-integrated, AR-enabled, and GPS-supported binoculars in defense, surveillance, and wildlife applications is driving market growth.

- Technological trends such as image stabilization, thermal imaging, and digital recording are transforming user experience and expanding professional and consumer use cases.

- Key players including Celestron, Nikon, ATN, FLIR Systems, and Carl Zeiss are focusing on innovation, lightweight designs, and advanced optics to strengthen global competitiveness.

- North America led the market with a 38.4% share, followed by Europe (27.6%) and Asia-Pacific (23.9%), while digital binoculars held the largest 42.8% share and military and defense applications accounted for 44.1% of total market revenue in 2024.

Market Segmentation Analysis:

By Product Type

Digital binoculars dominated the Smart Binocular market in 2024 with a 42.8% share, driven by their advanced imaging, recording, and real-time data transmission capabilities. They are widely used in consumer, defense, and wildlife observation applications due to their versatility and compact design. Night vision and thermal imaging binoculars are gaining traction for their use in low-light and surveillance environments. The growing demand for digital optics integrated with AI-based recognition and mobile app connectivity continues to strengthen the dominance of digital binoculars across both professional and recreational users.

- For instance, ATN introduced its BinoX 4K 4-16x binoculars featuring a dual-core processor capable of simultaneously recording 1080p video to a microSD card while streaming over Wi-Fi to a mobile device.

By Technology

Augmented reality (AR)-enabled binoculars held the largest 39.5% share in 2024, leading the market with enhanced user experience and situational awareness. These binoculars integrate real-time data overlays, mapping, and target tracking, making them highly valuable for defense, navigation, and exploration. Wi-Fi/Bluetooth connectivity and GPS integration follow closely, enabling seamless data transfer and geolocation tracking. Increasing innovation in image stabilization and zoom enhancement technologies further drives adoption among consumers and professionals seeking precision optics and smart performance.

- For instance, Nikon collaborated with Unistellar to launch AR smart binoculars capable of identifying over 200,000 celestial objects (plus over a million terrestrial landmarks) using onboard AI mapping.

By Application

The military and defense segment accounted for a 44.1% share in 2024, emerging as the largest application area for smart binoculars. Their demand is fueled by tactical surveillance, border security, and reconnaissance operations that require advanced imaging, rangefinding, and night-vision capabilities. Wildlife and nature observation follow, driven by the increasing popularity of eco-tourism and digital wildlife monitoring. Growing use in sports, events, and hunting also contributes to expansion. Rising government investments in smart optical systems continue to reinforce the defense sector’s dominance in overall market revenue.

Key Growth Drivers

Rising Adoption in Defense and Security Applications

The growing need for advanced surveillance, reconnaissance, and border monitoring is a major driver for the Smart Binocular market. Defense agencies are increasingly deploying AI-integrated binoculars with thermal imaging, night vision, and rangefinding capabilities for tactical operations. The ability to deliver real-time situational awareness and target recognition enhances mission efficiency. Governments worldwide are investing heavily in upgrading optical systems for their armed forces, creating strong demand for high-precision, ruggedized smart binoculars in military and law enforcement sectors.

- For instance, FLIR Systems developed the Recon V Ultra Lite binoculars equipped with a cooled midwave infrared sensor operating at 640×480 resolution. The device provides target detection at distances over 10,000 meters and integrates a laser rangefinder with ±5 m accuracy.

Advancements in Imaging and Sensor Technologies

Technological innovation in optics, sensors, and image processing is accelerating market growth. Integration of high-resolution digital cameras, infrared sensors, and augmented reality overlays is improving functionality and visual accuracy. Modern smart binoculars now feature GPS tracking, Bluetooth connectivity, and AI-based object detection, enhancing their usability across multiple applications. These innovations not only expand use cases in wildlife monitoring, sports, and research but also make devices more compact and energy-efficient, strengthening adoption among professionals and enthusiasts.

- For instance, Canon’s 10×42 L IS WP binoculars employ dual-gyro sensors and Vari-Angle Prism image stabilization technology that compensates for up to ±0.8° of angular shake.

Increasing Demand from Outdoor and Recreational Activities

The rising popularity of outdoor adventure, hunting, and wildlife observation is contributing significantly to market expansion. Smart binoculars equipped with image stabilization, Wi-Fi connectivity, and digital recording features offer an enhanced user experience. Consumers seek high-performance devices capable of long-range viewing and environmental adaptability. The growing number of eco-tourism projects, birdwatching communities, and nature exploration activities is creating steady demand for smart, portable, and durable binoculars in both developed and emerging markets.

Key Trends & Opportunities

Integration of AI and Augmented Reality (AR)

Artificial intelligence and augmented reality are transforming the capabilities of smart binoculars by enabling features such as facial recognition, target tracking, and real-time data visualization. These technologies allow users to identify objects, overlay navigational information, and share live feeds seamlessly. Manufacturers are leveraging AI-powered image enhancement and AR-based data projection to deliver next-generation binoculars for defense, sports, and exploration. The trend toward intelligent optics is opening new opportunities in professional surveillance, field research, and connected outdoor experiences.

- For instance, Nikon collaborated with Unistellar on the optics for their AR-powered “Envision” binoculars, which can identify over 1,000 astronomical targets of interest and more than 200,000 visible stars using an onboard orientation system and an extensive database accessible via a mobile app.

Growing Use of Connectivity and Cloud-Based Features

The increasing incorporation of Wi-Fi, Bluetooth, and cloud-based storage enhances user convenience and data management. Smart binoculars can now sync with smartphones and tablets for live streaming, remote control, and geotagging. This connectivity allows users to store, analyze, and share field data more efficiently. Manufacturers are focusing on integrating mobile apps and IoT-enabled platforms to improve device interactivity. The trend aligns with the growing consumer preference for connected optical devices with real-time communication and data-sharing capabilities.

- For instance, Bushnell developed its Forge LRF Connect series featuring integrated Bluetooth 5.1 connectivity and the Bushnell Ballistics mobile app. The binoculars transmit range and angle data to the app within 0.3 seconds, allowing automatic ballistic correction.

Key Challenges

High Cost of Advanced Smart Binoculars

The integration of advanced optics, sensors, and digital modules significantly increases production costs, making smart binoculars expensive for consumers. Military-grade and AR-enabled models involve sophisticated materials and precision engineering, limiting affordability in consumer markets. High pricing also restricts widespread adoption among recreational users. To overcome this challenge, manufacturers are focusing on modular designs and cost-optimized production techniques to balance innovation with accessibility, ensuring broader market reach across various user segments.

Limited Battery Life and Environmental Durability

Battery consumption remains a major limitation due to the power demands of digital displays, GPS, and sensor systems. Extended use in field conditions often results in reduced operational time, especially in harsh climates. Additionally, environmental factors such as dust, humidity, and extreme temperatures can affect optical clarity and system stability. Manufacturers are developing energy-efficient processors, solar-assisted charging, and ruggedized casings to enhance durability and extend device life, addressing reliability issues in outdoor and tactical applications.

Regional Analysis

North America

North America dominated the Smart Binocular market in 2024 with a 38.4% share, driven by strong adoption in defense, surveillance, and outdoor recreational activities. The United States leads regional demand due to heavy defense investments and widespread consumer interest in advanced optics for wildlife and sports applications. Government-funded modernization programs in tactical surveillance further support growth. Leading manufacturers in the region emphasize AI-enabled, AR-integrated, and GPS-supported binoculars, strengthening market leadership. The presence of major technology firms and advanced manufacturing infrastructure continues to accelerate innovation and commercialization across various applications.

Europe

Europe held a 27.6% share in 2024, fueled by growing use of smart binoculars in defense modernization and wildlife conservation projects. The U.K., Germany, and France are key markets, driven by technological innovation and rising demand for high-precision optical instruments. The region’s focus on sustainability and environmental monitoring supports adoption in research and exploration. Sports and tourism sectors also contribute to market expansion, supported by AR-enhanced and lightweight binoculars. Continuous R&D investments and collaboration between defense agencies and optical device manufacturers reinforce Europe’s position in global smart optics innovation.

Asia-Pacific

Asia-Pacific accounted for a 23.9% share in 2024, emerging as the fastest-growing regional market. Increasing defense spending by countries like China, India, Japan, and South Korea is driving demand for advanced surveillance optics. Expanding consumer interest in hunting, hiking, and wildlife photography further accelerates adoption. Rapid technological advancement and domestic production of smart optical devices support cost competitiveness. Government-backed programs for border security and digital defense infrastructure are boosting military-grade smart binocular procurement, positioning Asia-Pacific as a major hub for future market expansion and manufacturing capability.

Latin America

Latin America captured a 6.1% share in 2024, supported by increasing use of smart binoculars in security operations, eco-tourism, and sports observation. Brazil and Mexico lead demand, driven by government initiatives to enhance border surveillance and environmental monitoring. The growth of outdoor adventure tourism is also fostering consumer adoption. However, limited access to advanced optical technologies and high product costs hinder rapid expansion. Collaborations with global brands and regional distributors are helping improve affordability and awareness, creating potential opportunities for gradual market penetration across emerging economies.

Middle East & Africa

The Middle East & Africa region held a 4.0% share in 2024, driven by growing defense procurement and investments in surveillance technologies. The Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, are leading adopters due to defense modernization programs and smart border systems. In Africa, applications in wildlife conservation and anti-poaching operations are increasing demand for night vision and thermal imaging binoculars. Although limited by lower consumer affordability, regional partnerships with international defense suppliers are expected to strengthen technological adoption and enhance market presence over the forecast period.

Market Segmentations:

By Product type

- Digital binoculars

- Night vision binoculars

- Thermal imaging binoculars

- Laser rangefinder binoculars

By Technology

- Augmented reality (AR) enabled

- Wi-Fi/Bluetooth connectivity

- GPS integrated

- Image stabilization and zoom enhancements

By Application

- Wildlife & nature observation

- Hunting & shooting sports

- Military & defense

- Sports & events viewing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Smart Binocular market features leading players such as Celestron, Nikon, ATN, Leupold & Stevens, Carl Zeiss, Bushnell, FLIR Systems, Hawke Optics, Barska, and Canon. These companies focus on integrating advanced technologies such as AI-based image processing, augmented reality (AR) overlays, and thermal imaging to enhance optical precision and functionality. Market leaders are expanding their portfolios with digital, GPS-integrated, and Wi-Fi-enabled binoculars designed for defense, wildlife, and recreational applications. Strategic collaborations with defense agencies and outdoor equipment brands are strengthening global distribution networks. Continuous innovation in image stabilization, compact design, and battery efficiency is driving competition. Moreover, increasing investment in product miniaturization and ruggedization supports manufacturers’ efforts to meet the rising demand for lightweight, durable, and multifunctional smart binoculars across both professional and consumer markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Celestron

- Nikon

- ATN

- Leupold & Stevens

- Carl Zeiss

- Bushnell

- FLIR Systems

- Hawke Optics

- Barska

- Canon

Recent Developments

- In April 2025, Zeiss introduced the SFL 50 binoculars in India, highlighting an advanced optics offering though not explicitly labelled “smart.”

- In August 2024, Swarovski Optik joined forces with &beyond to introduce the AX Visio binoculars to nature lovers. The collaboration seeks to enhance nature observations through the use of AI technology in the binoculars.

- In June 2024, Nikon partnered with Unistellar to launch AR-enabled smart binoculars that overlay landmarks and celestial objects.

- In 2024, SWAROVSKI OPTIK launched AX Visio, the first binocular in the world to be assisted by artificial intelligence and the ultimate combination of best-performing analog long-range optics and digital.

Report Coverage

The research report offers an in-depth analysis based on Product type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase as defense and security sectors adopt advanced imaging and tracking systems.

- Augmented reality and AI integration will enhance visualization, navigation, and target identification features.

- Consumer demand for connected, portable, and multifunctional binoculars will drive product innovation.

- Manufacturers will focus on lightweight designs and improved battery efficiency for longer field performance.

- Expansion of eco-tourism and wildlife monitoring will create new growth opportunities.

- North America will maintain leadership due to strong defense investments and technological advancements.

- Asia-Pacific will experience the fastest growth driven by military modernization and outdoor recreation.

- Cloud-based data sharing and real-time communication features will redefine usability and field operations.

- Collaborations between optics manufacturers and tech firms will accelerate digital transformation in optical devices.

- Continuous R&D in sensor miniaturization and energy-efficient components will strengthen long-term market competitiveness.