Market Overview

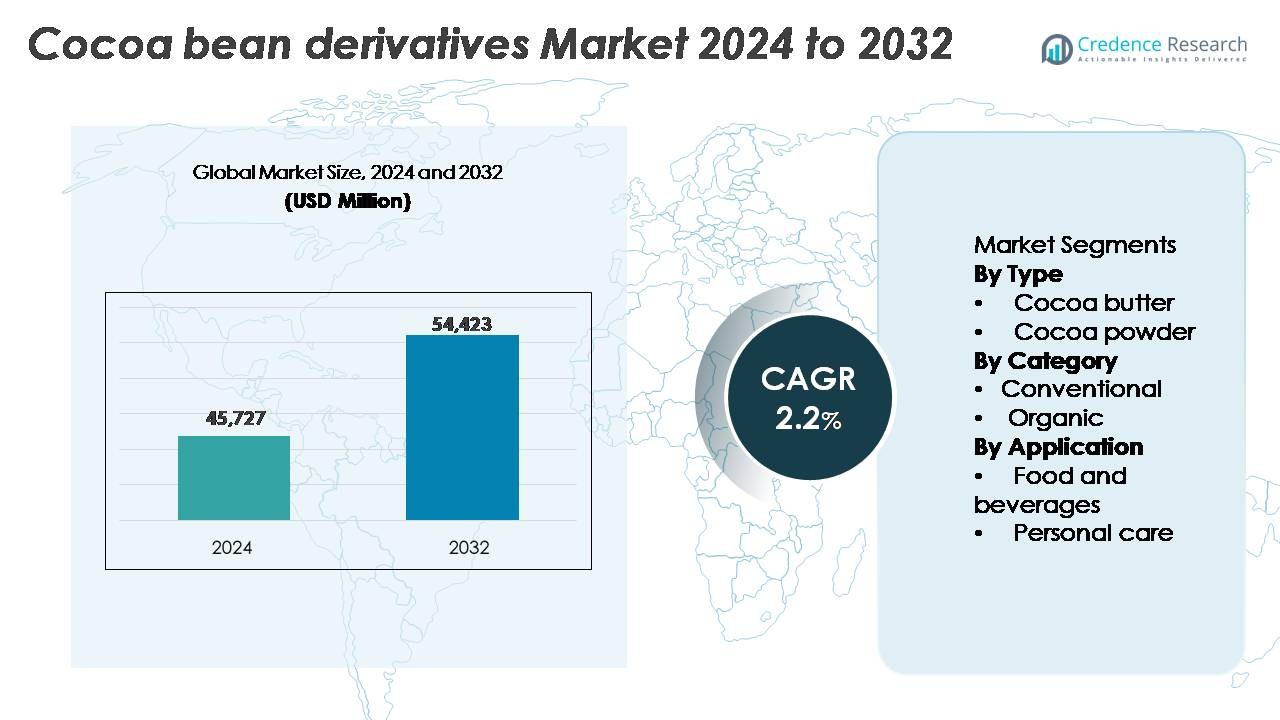

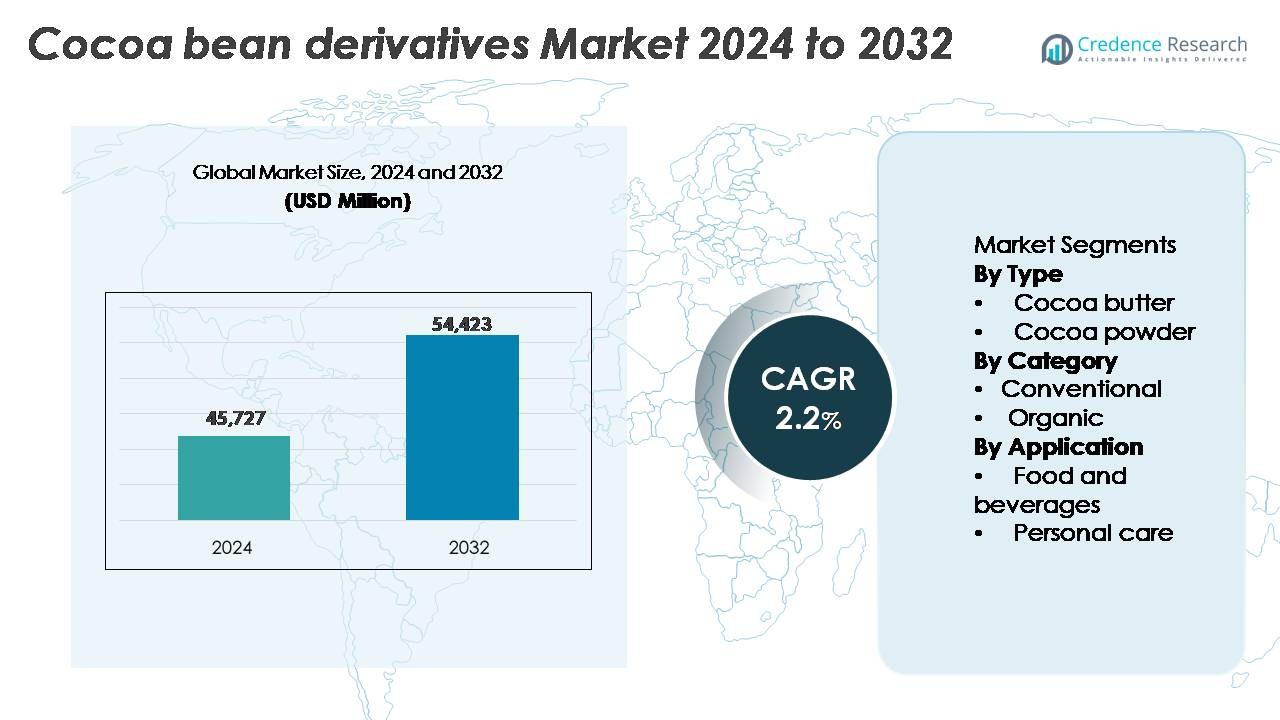

The cocoa bean derivatives market was valued at USD 45,727 million in 2024 and is anticipated to reach USD 54,423 million by 2032, registering a CAGR of 2.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cocoa Bean Derivatives Market Size 2024 |

USD 45,727 Million |

| Cocoa Bean Derivatives Market, CAGR |

2.2% |

| Cocoa Bean Derivatives Market Size 2032 |

USD 54,423 Million |

The cocoa bean derivatives market includes major processors and chocolate manufacturers that invest in large grinding capacities, product innovation, and sustainable sourcing. Leading companies operate strong supply chains across West Africa, Southeast Asia, and Latin America to ensure consistent bean procurement. Europe remained the dominant region with a 34% market share in 2024, supported by premium chocolate production, certified sourcing programs, and advanced processing facilities. North America, holding 27%, focuses on premium confectionery, bakery applications, and clean-label chocolate launches. Asia Pacific accounted for 23%, driven by rising chocolate penetration and bakery expansion. Across all regions, competition centers on traceability initiatives, high-quality cocoa butter production, and customized cocoa powder for beverages and desserts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Cocoa bean derivatives market was USD 45,727 million in 2024 and will reach USD 54,423 million by 2032 at a 2.2% CAGR.

- Demand rises due to strong chocolate, bakery, and dairy consumption, with cocoa butter holding 58% share and dominating confectionery formulations.

- Premium chocolate, clean-label snacks, and cocoa-based beverages drive new trends, while brands invest in sustainable and traceable sourcing to attract ethical consumers.

- Competition intensifies among global grinders and chocolate companies that expand capacity, develop specialty cocoa powders, and secure long-term contracts to manage price volatility.

- Europe leads with 34% share, followed by North America at 27% and Asia Pacific at 23%, while food and beverages application accounts for 88% share, supported by wide retail distribution and rising disposable income.

Market Segmentation Analysis:

By Type

Cocoa butter led the segment with 58% share in 2024. Chocolate manufacturing drives demand for deodorized and fractionated butter. Confectionery launches, premium bars, and seasonal products sustain volumes. Butter also supports clean-label textures in bakery fillings. Cocoa powder held 42% share, supported by beverages and baking mixes. Brands add alkalized powder for color consistency and milder taste. Foodservice recovery and at-home baking keep orders steady. Supply stability improves as grinders optimize yield ratios. Regulatory focus on cocoa butter equivalents also supports pure butter usage.

- For instance, one Indian ingredient processor expanded its solvent-free fractionation line capacity from 15,000 metric tons per annum to 40,000 metric tons per annum by July 2024.

By Category

Conventional products dominated with 94% share in 2024. Broad bean availability, lower certification costs, and established supply chains keep prices competitive. Multinational grinders prefer conventional for assured throughput and global compliance. Large confectioners lock multi-year contracts to secure volumes. Organic held 6% share but grew faster on premium positioning. Retailers expand organic chocolate, spreads, and drinking cocoa lines. Traceable sourcing and third-party certifications boost trust. Smaller batches and segregated logistics limit scale today. Improved farm conversions and premium retail margins will widen organic choices.

- For instance, Barry Callebaut’s total sales volume for fiscal year 2023/24 (ended August 31, 2024) was over 2.2 million metric tons (2,279,811 tonnes). The company is committed to making sustainable chocolate the norm, and in the 2023/24 fiscal year, 55.5% of its cocoa and chocolate products sold contained certified or verified sustainable cocoa.

By Application

Food and beverages commanded 88% share in 2024. Chocolate, bakery, dairy desserts, and cocoa drinks absorb most butter and powder. Brands use butter for mouthfeel and gloss, and powder for flavor intensity. Private labels and emerging markets add steady base demand. Personal care held 12% share and expanded on natural emollients. Cocoa butter features in lotions, balms, and lip care for occlusive benefits. Clean beauty trends and vegan formulations lift adoption. Stable deodorized grades support fragrance systems. Growing cosmeceutical lines will deepen derivative use.

Key Growth Drivers

Rising Demand for Chocolate and Confectionery Products

Chocolate remains the largest consumer of cocoa butter and cocoa powder, and growing demand directly increases derivative consumption. Premium chocolate, artisanal brands, and seasonal confectionery launches add steady volume growth in developed markets. Emerging economies are also adopting chocolate at a faster pace due to expanding retail networks and rising disposable income. Major confectionery manufacturers invest in new product lines with higher cocoa content and cleaner ingredient labels, which boosts the use of pure cocoa butter instead of vegetable fat substitutes. The bakery sector uses cocoa powder for fillings, coatings, and flavor enhancers, while dairy producers expand chocolate-based ice creams and beverages. Continuous product innovation, flavor diversification, and wider retail shelf space keep chocolate-bound demand strong. Together, these factors make confectionery the most influential driver of derivative sales worldwide.

- For instance, Ferrero’s production center in Alba, Italy, employs advanced production technologies, including systems consistent with continuous conching and refining, which are standard in modern, large-scale confectionery manufacturing.

Growth in Clean-Label and Natural Ingredient Adoption

Consumers prefer natural, chemical-free ingredients, and cocoa derivatives benefit from this shift. Cocoa butter acts as a natural fat source for texture and gloss in chocolate, bakery, and spreads. Personal care companies replace synthetic emollients with cocoa butter due to moisturizing and skin-friendly properties. Cocoa powder supports clean-label beverages and flavored milk with no artificial color additives. Brands promote “no artificial flavors” and “premium cocoa” claims to meet modern label expectations. Retailers launch organic, fair-trade, and ethically sourced cocoa SKUs to gain consumer trust. This trend is strong in North America and Europe, but also gaining momentum in Asia-Pacific with natural bakery mixes and cocoa-based snacks. Strong branding around health-conscious consumption will keep the clean-label segment attractive for manufacturers and processors.

- For instance, Barry Callebaut reported processing over 356,000 farmers through its sourcing footprint under Cocoa Horizons in the 2023/24 season. The company has implemented advanced digital traceability systems that expanded to cover 669,174 farm plots, enabling farm-level traceability for 83% of the cocoa volume in its direct supply chain.

Expansion of Cocoa Use in Personal Care and Cosmetics

Cocoa butter is widely used in skincare, haircare, and lip care due to high fatty acid content and natural antioxidant properties. Beauty brands replace petroleum-based waxes and mineral oils with natural cocoa fats to meet vegan and cruelty-free standards. Demand rises for body lotions, balms, and soaps featuring cocoa butter as a primary moisturizing ingredient. Companies expand product lines with cocoa-based emulsifiers that support smooth texture and longer shelf stability. E-commerce growth allows small and mid-sized cosmetic manufacturers to sell cocoa-based products globally. Premium wellness brands highlight chocolate-themed spa and aromatherapy collections, driving niche opportunities. As beauty trends favor natural ingredients and sensitive-skin formulations, cosmetic-grade cocoa butter consumption continues to increase.

Key Trends & Opportunities

Ethical, Traceable, and Sustainable Sourcing Initiatives

Chocolate and food brands invest in sustainable farms, traceability systems, and farmer welfare programs to ensure responsible sourcing. Certifications such as Fairtrade, Rainforest Alliance, and UTZ are now linked to retail product labeling. Traceable supply chains strengthen brand reputation and address consumer concerns regarding deforestation and child labor. Companies introduce QR-code packaging that allows buyers to track cocoa origin and farming practices. Large grinders and processors expand direct-sourcing models to improve bean quality and farm productivity. Governments and NGOs offer training for better yields and climate-resilient farming. Traceability remains a major opportunity for premium product positioning and long-term supply security.

- For instance, Cocoa Touton operates traceability systems across Ghana, Côte d’Ivoire, Nigeria, and Cameroon and maintains compliance with FSSC 22000, UTZ, Kosher, and Halal standards. Its facilities process 32,000 metric tons of beans with organoleptic profiling customized per client specification, supported by digital farm-to-factory identity preservation.

Product Innovation in Beverages, Snacks, and Functional Foods

Cocoa derivatives support new product expansion in energy bars, protein snacks, flavored coffees, health drinks, and vegan desserts. Manufacturers use alkalized and natural cocoa powder to modify color, aroma, and mouthfeel in plant-based milks and ready-to-drink beverages. Sugar-free and high-cocoa protein snacks attract health-focused consumers. Premium ice creams and frozen desserts rely on rich cocoa profiles for indulgence. Functional applications gain interest, including cocoa powder with added micronutrients or high-antioxidant blends. As global snack demand rises and consumers experiment with new flavors, cocoa derivatives gain space in modern, premium, and convenience food categories.

- For instance, Barry Callebaut produces a range of high-quality cocoa powders for industrial food manufacturers and professional users. The company operates a network of over 60 production facilities worldwide, including a chocolate factory in Łódź, Poland, which has seen significant expansion to meet demand for its various chocolate and cocoa products in the European market.

Key Challenges

Price Volatility and Supply Fluctuations in Cocoa-Producing Regions

Cocoa bean availability depends heavily on weather, disease resistance, political stability, and farm productivity in West Africa, Latin America, and Southeast Asia. Unpredictable climate variations affect harvest yields and bean quality, causing frequent price swings in global commodity markets. Supply shortages raise the cost of cocoa butter and powder, pressuring profit margins for chocolate and bakery manufacturers. Smaller processors struggle with procurement during volatile seasons. The need for storage, hedging contracts, and supply diversification increases operational complexity. Price fluctuations also influence retail pricing, which can limit demand in cost-sensitive markets.

Regulatory and Sustainability Compliance Costs

Stricter regulations on deforestation, traceability, and labor standards increase certification and monitoring costs. Large producers invest in farm audits, digital tracking platforms, and training programs to meet global compliance rules. Smaller suppliers often face difficulty funding such requirements, creating regional supply imbalances. Food and cosmetic brands must ensure safe ingredient profiles, allergen control, and labeling accuracy, adding documentation burden and testing expenses. Sustainability reporting demands more transparency throughout the supply chain. While these efforts improve ethical sourcing and consumer confidence, compliance increases overall operational spending and logistics complexity for the industry.

Regional Analysis

North America

North America held 27% share of the cocoa bean derivatives market in 2024. Strong chocolate consumption, premium confectionery launches, and demand for natural bakery fillings support steady imports of cocoa butter and powder. The United States drives most sales due to large confectionery brands, private labels, and robust retail distribution. Clean-label chocolate bars, cocoa-based spreads, and ready-to-drink beverages add volume. Rising use of cocoa butter in vegan baking and personal care also strengthens product mix. Seasonal demand peaks during Easter, Halloween, and Christmas. Investments in sustainable sourcing and traceability programs further reinforce consumer confidence and long-term supply partnerships.

Europe

Europe commanded 34% market share in 2024, making it the largest regional consumer of cocoa derivatives. Major chocolate manufacturers operate grinding and processing facilities in Belgium, the Netherlands, Germany, and Switzerland. Premium chocolate bars, artisanal brands, and organic bakery lines drive cocoa butter adoption. Cocoa powder remains essential in dessert mixes, drinking chocolate, and dairy applications. High regulatory focus on sustainability increases certified cocoa imports. Retailers promote fair-trade and origin-specific chocolates to attract health- and ethics-conscious buyers. Growth in specialty pastries and clean-label confectionery keeps the region stable despite mature consumption patterns.

Asia Pacific

Asia Pacific accounted for 23% share in 2024, driven by rising chocolate penetration and strong bakery expansion. China, India, Japan, and Indonesia show growing demand for cocoa powder in beverages, biscuits, dairy desserts, and packaged snacks. Global chocolate manufacturers are opening regional processing plants to reduce logistics costs and tailor flavor profiles. Middle-class income growth supports premium chocolate gifting, while e-commerce boosts imported brands. Cocoa butter demand expands in personal care, particularly in moisturizers and lip care. Urbanization, quick-service bakeries, and western dessert trends will continue to lift cocoa derivative consumption across emerging markets.

Latin America

Latin America held 10% share of the market in 2024. Brazil and Mexico lead consumption through confectionery, baking, and cocoa-based beverages. Local brands use cocoa powder in biscuits, sweet spreads, and instant drink mixes. The region is also a major cocoa-producing zone, enabling shorter supply chains for grinders and processors. Premium chocolate makers highlight single-origin beans from Ecuador and Peru, boosting artisanal production. Cocoa butter demand grows in cosmetics and spa products linked to wellness tourism. Despite economic fluctuations, rising retail chocolate sales and stronger exports of cocoa-based products support long-term market prospects.

Middle East & Africa

Middle East & Africa accounted for 6% share in 2024, supported by bakery expansion, confectionery imports, and growing hospitality sectors. The UAE and Saudi Arabia increase consumption of premium chocolates, cocoa desserts, and flavored beverages. Africa is also a key cocoa bean supplier, but local processing capacity continues to develop. Governments encourage value-added chocolate and cocoa-based product production to retain export revenue. Cocoa butter demand rises in personal care applications across South Africa and North African markets. As retail chains expand and tourism rebounds, cocoa derivative use is expected to grow at a steady pace.

Market Segmentations:

By Type

- Cocoa butter

- Cocoa powder

By Category

By Application

- Food and beverages

- Personal care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cocoa bean derivatives market features strong competition among global grinders, chocolate manufacturers, and ingredient suppliers focused on capacity expansion, supply security, and product quality. Large processors maintain long-term contracts with bean-producing regions in West Africa, Southeast Asia, and Latin America to ensure consistent throughput and stable pricing. Major chocolate brands invest in sustainable sourcing programs, traceability platforms, and farmer training to meet regulatory standards and improve brand reputation. Ingredient companies develop specialty cocoa powders for beverages, dairy, and bakery with tailored color, fat percentage, and flavor intensity. Cosmetic-grade cocoa butter suppliers target premium skincare and clean-label formulations. Partnerships with retailers support origin-specific, organic, and fair-trade launches. Smaller artisanal players compete through high-cocoa chocolates, bean-to-bar craftsmanship, and limited-edition offerings. E-commerce platforms help regional brands reach global buyers, increasing market diversity. Overall competition focuses on supply chain transparency, product innovation, and cost efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ecuakao Group

- Cargill

- Ferrero

- Cocoa Touton

- JB Foods

- Barry Callebaut

- ECOM Agroindustrial

- Indcre

- CEMOI

- Mondelez International

Recent Developments

- In 2024, Cargill armed with 160,000 employees across 70 countries—kept its engine humming strong, weaving its way through bean-to-bar processing to serve food, beverage, and confectionery markets worldwide.

- In July 2024, Nestlé’s chocolate prices gained attention as rising cocoa costs impacted the company. The increased expenses prompted pricing adjustments, reflecting broader industry challenges linked to fluctuating raw material costs and growing demand for sustainable cocoa sourcing.

- In May 2024, Blommer Chocolate and Incredo expanded their partnership to Canada, focusing on the Discovery product line, which enabled sugar reduction across various applications. This collaboration aims to address consumer demand for healthier and innovative solutions in the market.

- In July 2022, India-based healthy snack company Lil’ Goodness launched Prebiotic Cocoa Powder. It contains 100% fat-reduced, rich in antioxidants, real cocoa, and natural prebiotic fibers sourced from papaya, soybeans, citrus fruits, and cocoa beans

Report Coverage

The research report offers an in-depth analysis based on Type, Category, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Premium chocolate launches will keep cocoa butter demand resilient.

- Clean-label claims will boost natural cocoa powder adoption.

- Traceable, certified sourcing will become a baseline expectation.

- Price volatility will drive multi-origin and hedging strategies.

- Processing will expand near origin to reduce logistics risk.

- Personal care brands will widen use of cosmetic-grade cocoa butter.

- Plant-based desserts and drinks will lift alkalized and natural powders.

- Specialty fractions and customized flavor profiles will gain share.

- Digital farm-to-factory data will improve quality control and yields.

- Climate-resilient farming and agroforestry will shape long-term supply.