Market Overview

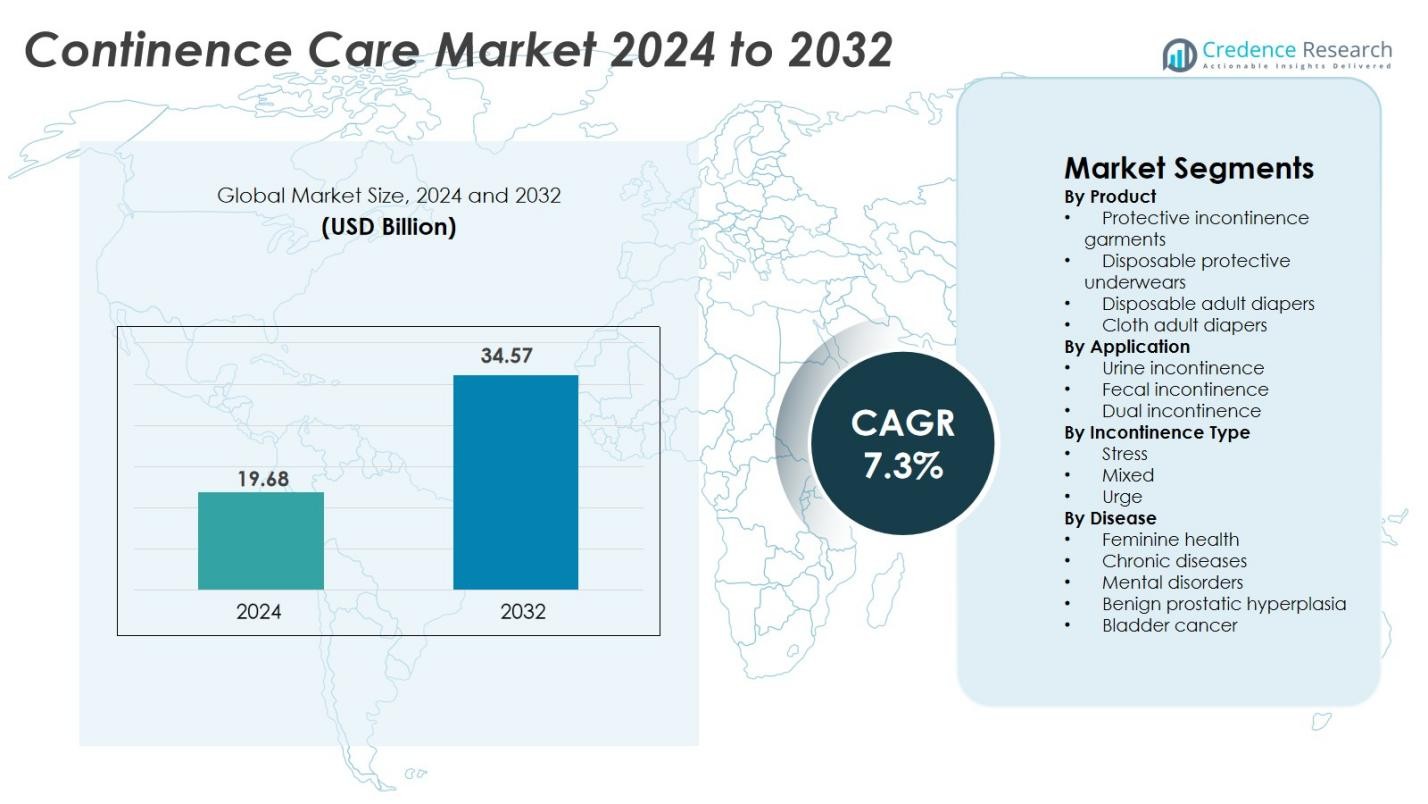

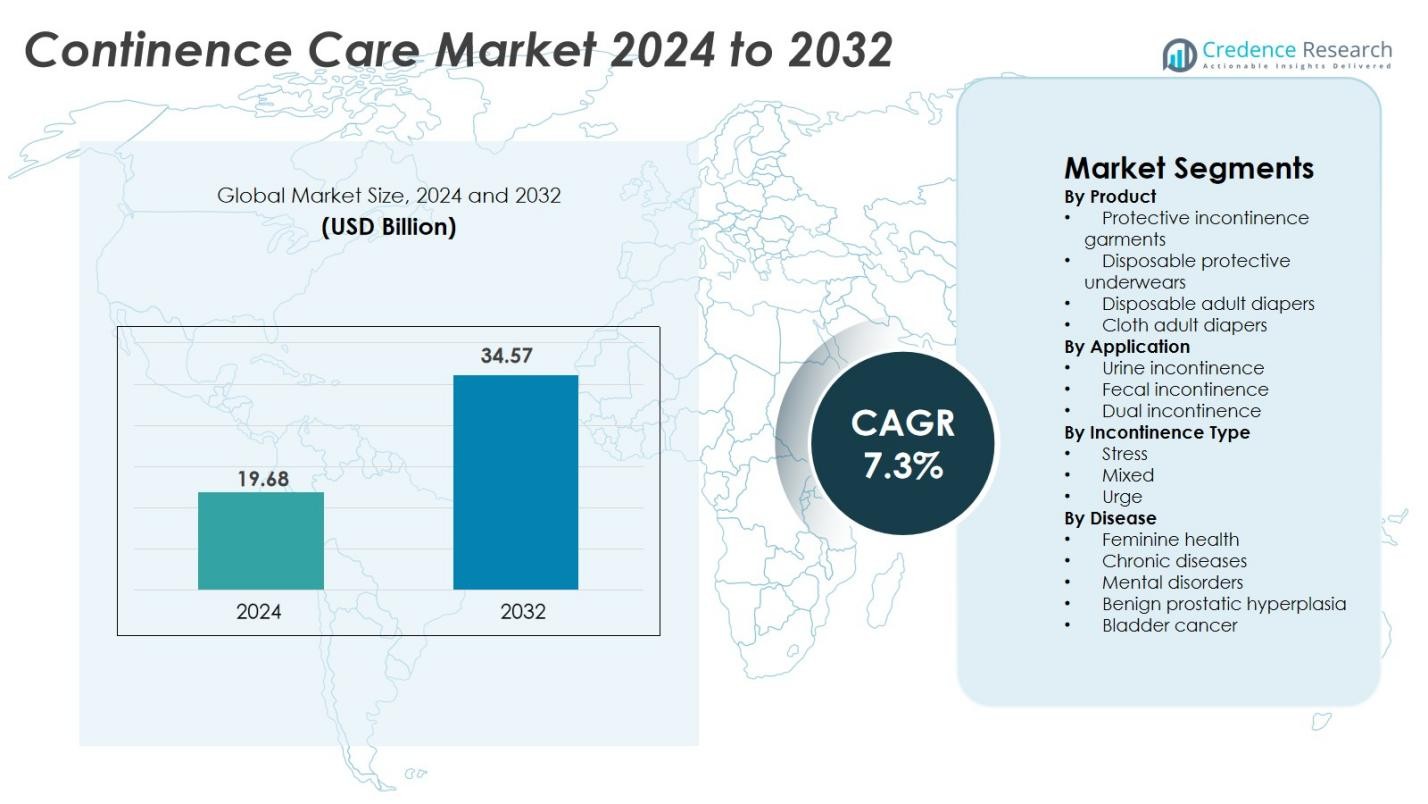

Continence Care market size was valued USD 19.68 Billion in 2024 and is anticipated to reach USD 34.57 Billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Continence Care market Size 2024 |

USD 19.68 Billion |

| Continence Care market , CAGR |

7.3% |

| Continence Care market Size 2032 |

USD 34.57 Billion |

The continence care market is led by major companies including Coloplast Group, Essity Aktiebolag, Hollister Incorporated, ConvaTec Group Plc, KCWW (Kimberly-Clark Corporation), B. Braun SE, Wellspect HealthCare, Salts Healthcare Ltd., Welland Medical Ltd., and BD. These companies dominate through strong global distribution, advanced absorbent technologies, and wide product portfolios covering adult diapers, pads, and protective underwear. Many players invest in skin-friendly materials, odor-control layers, and subscription delivery models for home-based care. North America remains the leading region with 34% market share, supported by robust reimbursement systems, high awareness, and strong adoption across hospitals, nursing homes, and home-care environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The continence care market was valued at USD 19.68 Billion in 2024 and will reach USD 34.57 Billion by 2032, growing at a CAGR of 7.3%.

- Rising geriatric population and improved incontinence diagnosis drive steady demand for adult diapers, protective underwear, and pads across hospitals, nursing homes, and home-care settings.

- Eco-friendly, ultra-thin, and breathable product designs gain traction, while smart moisture-alert systems help caregivers improve hygiene and reduce infections in long-term care facilities.

- Leading companies such as Coloplast Group, Essity, Hollister, and Kimberly-Clark compete through premium comfort materials, odor-control technology, and strong global retail distribution.

- North America holds 34% share and remains the market leader, while protective incontinence garments dominate with 42% share due to ease of use, better leak protection, and wide retail availability.

Market Segmentation Analysis

By Product

Protective incontinence garments remain the dominant product category, holding 42% share of the continence care market in 2024. Their strong adoption comes from ease of use, discreet designs, and wide availability across retail and online channels. Manufacturers invest in odor control layers, breathable materials, and gender-specific fits to enhance comfort for long-term users. Demand grows in hospitals and elderly care facilities, where caregivers prefer quick-change garments to reduce infection risks. Rising geriatric populations and higher diagnosis rates of urine leakage continue to push this segment ahead of disposable adult diapers and cloth-based alternatives.

- For instance, Kimberly-Clark’s Depend Real Fit products incorporate advanced odor control technology and comfortable fits, enhancing user experience in long-term care settings.

By Application

Urine incontinence accounts for the largest market share at 65% due to its higher prevalence among aging adults and women post-childbirth or menopause. Healthcare practitioners emphasize early diagnosis and routine monitoring, encouraging regular use of pads, underwear, and diapers. Companies support this segment by offering products in multiple absorption levels for daytime and overnight protection. Growth also comes from awareness programs and reimbursement policies that support home-based care. Fecal and dual incontinence remain smaller segments but show steady growth, aided by improved hygiene materials and caregiver education programs.

- For instance, Essity Aktiebolag offers products with various absorption levels, including options specifically designed for daytime and overnight use, to meet diverse patient needs.

By Incontinence Type

Stress incontinence leads the segment with 38% share, driven by cases linked to pelvic-floor weakening after childbirth, surgery, or age-related muscle loss. Users prefer thin absorbent pads and protective underwear that fit discreetly under daily wear, supporting active lifestyles. Manufacturers design ergonomic products with fast-absorption cores to reduce leakage during coughing, lifting, or running. Mixed incontinence and urge incontinence follow, fueled by chronic conditions such as diabetes, prostate issues, and neurological disorders. Increasing diagnosis in women aged 40+ and men post-prostate treatments keeps demand high across all product types.

Key Growth Drivers

Rapid Growth in the Geriatric Population

The continence care market gains major momentum from the rising global elderly population, who experience higher rates of urinary and fecal incontinence due to muscle weakness, chronic illness, and mobility limitations. Aging individuals increasingly prefer home-based care solutions, which drives demand for disposable diapers, protective underwear, and hygiene management products. Healthcare systems promote early screening programs and continence clinics, improving diagnosis rates and product adoption. Assisted living facilities and nursing homes continue to expand their hygiene budgets and bulk procurement policies. Manufacturers also launch skin-friendly solutions with breathable fabrics and antibacterial linings to reduce rashes, pressure sores, and infections in older adults.

- For instance, Kimberly-Clark’s Depend product line includes advanced absorbent underwear with odor-control technology, providing discreet protection and improving quality of life for aging individuals.

Expanding Access Through Reimbursements and Insurance Coverage

Reimbursement policies for incontinence supplies play a direct role in market penetration. Many countries provide partial or full financial support for adult diapers, pads, and urinary collection devices, making products affordable for long-term users. Pharmacies and online platforms now integrate reimbursement processing, simplifying access for patients with chronic incontinence. Hospitals and home-health agencies procure essential hygiene products for post-surgery patients or individuals with neurological disorders, encouraging regular use instead of improvised methods that raise infection risks. Insurance-backed demand also encourages manufacturers to improve product quality, absorbency levels, and eco-friendly compositions. These policies support consistent product usage and higher monthly purchase volumes

- .For instance, in the Netherlands, HollandZorg public healthcare insurance reimburses costs for incontinence products through contracted providers as part of the basic health insurance package. However, this coverage is subject to the mandatory annual excess (eigen risico) set by the government, which is €385 in 2025.

Technological Advancements in Absorbent and Odor-Control Materials

Innovation in materials and absorbency systems fuels product differentiation and premium brand adoption. Companies invest in multi-layer cores, fast-wicking surfaces, leak-proof side barriers, and ultra-thin biodegradable sheets to enhance comfort and mobility. Smart continence products with moisture sensors and alert systems are gaining traction in nursing homes, helping caregivers monitor diaper changes and prevent skin breakdown. Breathable fabrics, pH-balanced linings, and plant-based materials reduce irritation for long-term users. Manufacturers also develop gender-specific fits, 3D contouring, and stretch-waist designs to improve confidence and reduce embarrassment, driving conversion from traditional pads to advanced disposable underwear and diapers.

Key Trends & Opportunities

Rising Demand for Eco-Friendly and Biodegradable Products

Sustainability gains attention as users, caregivers, and governments seek alternatives to plastic-heavy disposable diapers. Producers explore biodegradable back sheets, compostable liners, and water-soluble polymers to reduce landfill waste. Some brands introduce cotton-based reusable diapers with reusable inserts, appealing to environmentally conscious consumers and cost-sensitive buyers. Hospitals and elder care homes explore waste-segregation programs and eco-certified products to meet environmental standards. Companies that combine sustainability with high absorbency and odor control stand to gain market share as regulations tighten and consumers shift toward greener hygiene solutions.

- For instance, Indian brand SuperBottoms launched cotton-based reusable cloth diapers, featuring organic cotton inserts, which appeal to eco-conscious parents looking for chemical-free and cost-effective diapering solutions.

Adoption of Connected and Smart Continence Management

Digital health solutions create strong opportunities in hospital and elderly care environments. Smart wearable sensors embedded in adult diapers send alerts to caregivers when moisture levels rise, helping prevent urinary tract infections, rashes, or pressure ulcers. Cloud dashboards allow monitoring of fluid levels, change frequency, and patient hygiene compliance, improving workflow in nursing homes. Artificial intelligence supports personalized product selection based on usage patterns and leakage risk. This trend increases caregiver efficiency and supports remote patient management. Vendors offering digital and hygiene subscription solutions gain competitive advantage.

- For instance, Essity’s TENA SmartCare system uses wearable moisture sensors in adult briefs to automatically notify caregivers via a smartphone app when a change is needed, reducing instances of incontinence-related complications and streamlining staff workflows.

Key Challenges

Social Stigma and Low Awareness in Emerging Markets

Awareness remains limited in many developing countries, where individuals consider incontinence a private or shameful condition rather than a treatable medical issue. Many patients avoid seeking help, leading to low diagnosis rates and limited product adoption. Caregivers often rely on cloth pieces or improvised absorbent pads, resulting in discomfort, poor hygiene, and higher infection risks. Cultural sensitivities and lack of educational campaigns restrict market penetration. Manufacturers and healthcare providers must invest in awareness programs, physician training, and easy-access retail channels to overcome stigma and encourage dignified continence care.

High Cost of Premium Products and Limited Reimbursements

Advanced disposable underwear, odor-control products, and moisture-alert sensors increase overall cost, limiting adoption among price-sensitive users. In low-income regions and rural areas, lack of reimbursement or insurance support forces consumers to choose cheaper or reusable options that often provide lower absorbency and comfort. Elderly individuals requiring multiple products daily face significant monthly expenses, leading to reduced usage. Healthcare providers must balance affordability and product quality, while manufacturers explore budget-friendly product lines and bulk-pack offerings. Without improved subsidies and reimbursement policies, market growth remains restricted in cost-conscious regions.

Regional Analysis

North America

North America leads the continence care market with 34% share, driven by high awareness, strong reimbursement structures, and widespread adoption of advanced hygiene solutions. The United States sees high demand for disposable adult diapers, protective underwear, and moisture-control pads in hospitals, nursing homes, and home-care environments. Aging demographics and higher diagnosis rates support consistent consumption. Key manufacturers launch comfort-focused, gender-specific, and skin-friendly product lines through retail and subscription models. Digital monitoring and sensor-enabled products gain traction in long-term care facilities. Canada follows similar trends, with government support and insurance-backed access strengthening the product ecosystem.

Europe

Europe holds 29% share, supported by universal healthcare systems, favorable reimbursement policies, and strong elderly care infrastructure. Countries such as Germany, the UK, France, and the Nordics lead adoption of premium disposable diapers and protective underwear designed for mobility and discretion. Sustainability remains an important trend, encouraging the use of biodegradable materials and recycling programs. Hospitals and care homes purchase in bulk and request hypoallergenic solutions to reduce infection and skin complications. Product innovation around breathable fabrics and odor-control layers ensures consistent growth across both medical and home-care segments.

Asia Pacific

Asia Pacific accounts for 23% share and shows the fastest growth due to its expanding aging population and rising acceptance of continence products. Japan, China, and South Korea dominate consumption, fueled by urban lifestyles, improved healthcare access, and increasing female workforce participation where quick-change products are favored. Local and global brands expand production facilities, offering cost-efficient diapers, pads, and pull-ups for expanding mid-income groups. E-commerce and pharmacy chains accelerate availability in India and Southeast Asia. Awareness campaigns and doctor-led counseling programs help reduce social stigma and promote proper hygiene management.

Latin America

Latin America holds 8% share, led by Brazil, Mexico, and Argentina, where home healthcare adoption rises for elderly and post-surgery patients. Cost sensitivity drives demand for affordable disposable pads and hybrid reusable diapers. Retail pharmacies and online channels improve access, while hospitals recommend protective underwear for mobility-restricted patients. Manufacturers introduce plant-based or cotton-blend materials to reduce irritation in humid climates. Government aging-care programs and partnerships with healthcare distributors expand market reach, though limited reimbursement continues to slow premium product penetration.

Middle East & Africa

Middle East & Africa account for 6% share, with gradual adoption supported by improving healthcare infrastructure and rising investment in elder-care facilities. Gulf countries drive growth through hospital procurement and home-care services driven by chronic conditions such as diabetes and mobility disorders. Affordability remains a major factor, leading to interest in economical disposable and washable solutions. Global manufacturers enter through retail pharmacies and medical distributors, while awareness campaigns target caregivers and post-surgical patients. In Africa, rural access and stigma still limit uptake, but urban markets show steady demand for adult pads and protective garments.

Market Segmentations

By Product

- Protective incontinence garments

- Disposable protective underwears

- Disposable adult diapers

- Cloth adult diapers

By Application

- Urine incontinence

- Fecal incontinence

- Dual incontinence

By Incontinence Type

By Disease

- Feminine health

- Chronic diseases

- Mental disorders

- Benign prostatic hyperplasia

- Bladder cancer

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The continence care market remains moderately consolidated, with global leaders and regional manufacturers competing through product innovation, distribution reach, and brand reliability. Major companies such as Coloplast Group, Essity Aktiebolag, Hollister Incorporated, KCWW, and ConvaTec Group Plc dominate due to strong retail presence, healthcare partnerships, and advanced product portfolios. These players invest in breathable fabrics, antibacterial linings, and ultra-thin cores to enhance comfort for long-term users. Subscription-based home delivery, gender-specific designs, and eco-friendly materials support consumer loyalty. Regional firms such as Salts Healthcare, B. Braun, and Welland Medical focus on specialty pads, ostomy-linked solutions, and cost-effective diapers for hospitals and senior-care centers. Mergers, acquisitions, and capacity expansions help companies enter high-growth markets in Asia and Latin America. Manufacturers also collaborate with nursing homes and healthcare practitioners to develop better continence clinics and patient training programs, ensuring wider product adoption across both medical and home-care channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, Convatec launched a free digital app in the U.S. to assist new intermittent catheter users and their healthcare professionals.

- In July 2024, Convatec introduced GentleCath Air for Women, featuring FeelClean Technology, in the UK and Italy, following its successful launch in France.

- In May 2024, Coloplast launched the Luja Female intermittent catheter, designed for complete bladder emptying in one flow, reducing urinary tract infection (UTI) risks. It features Micro-hole Zone Technology, is eco-friendly, using 28% less plastic, and has a lower carbon footprint.

- In October 2023, Clinisupplies acquired the Aquaflush transanal irrigation (TAI) portfolio from Renew Medical, expanding its continence care offerings. This acquisition enhances support for patients with chronic bowel issues and broadens Clinisupplies’ product range.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Incontinence Type, Disease and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as life expectancy increases and more seniors rely on home-based care.

- Advanced absorbent materials will reduce thickness and improve comfort for daily wear.

- Smart moisture-alert systems will gain adoption in nursing homes and long-term care facilities.

- Eco-friendly and biodegradable diapers will accelerate as sustainability rules tighten.

- More brands will adopt subscription and doorstep delivery models for recurring users.

- Reimbursement expansion will improve access in developing healthcare systems.

- Gender-specific and body-contoured products will drive higher comfort and leak protection.

- Digital platforms will support personalized product selection and caregiver guidance.

- Emerging markets will adopt low-cost and hybrid reusable solutions for affordability.

- Manufacturers will expand partnerships with hospitals, pharmacies, and elder-care centers to increase penetration.