Market Overview

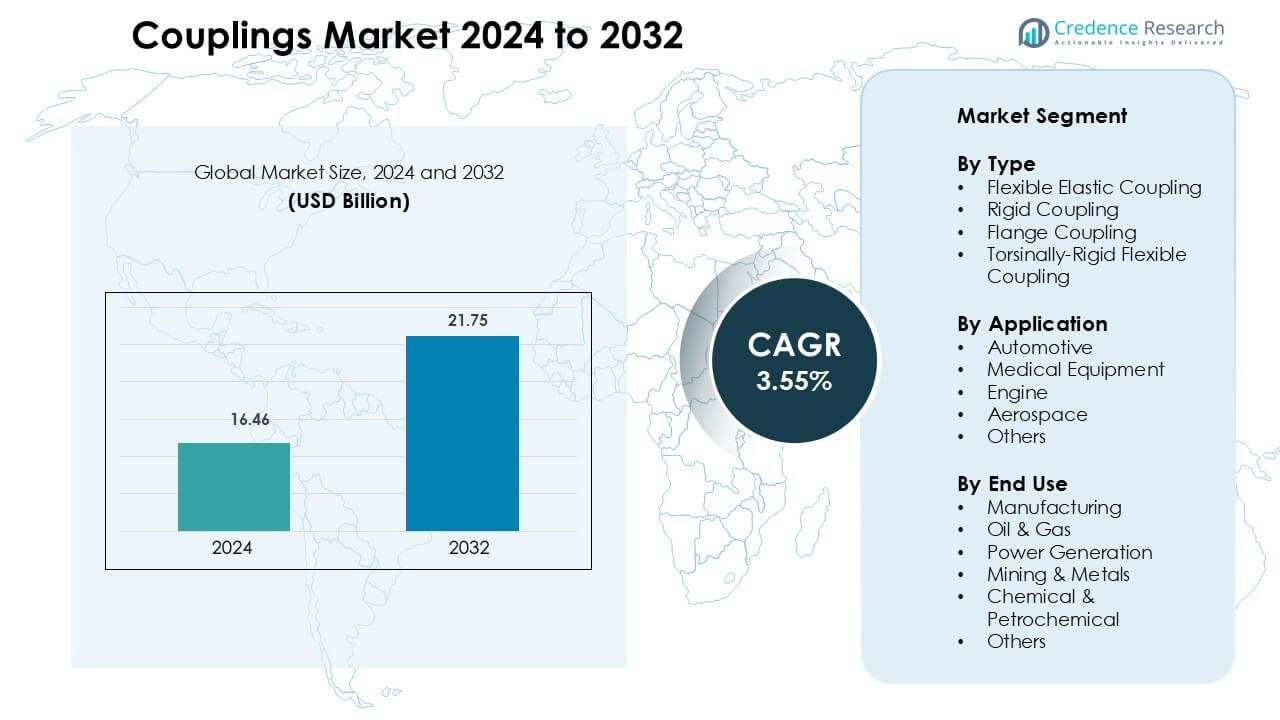

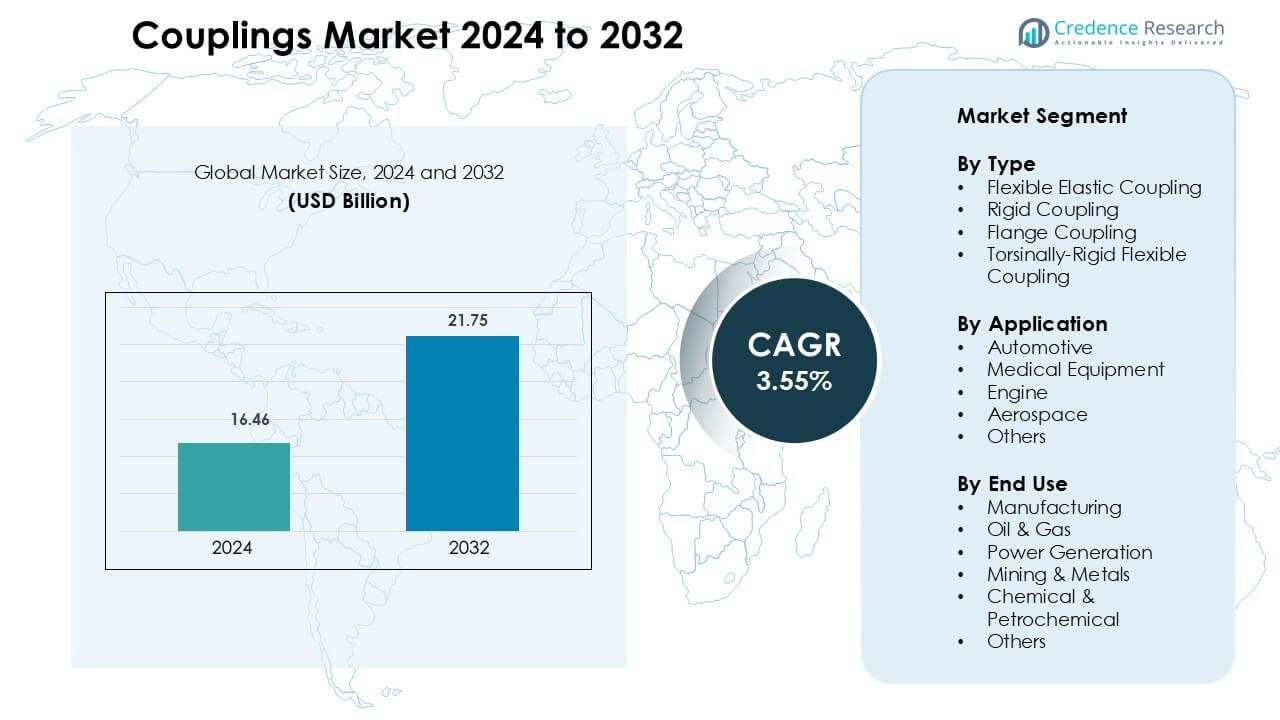

Couplings Market was valued at USD 16.46 billion in 2024 and is anticipated to reach USD 21.75 billion by 2032, growing at a CAGR of 3.55 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Couplings Market Size 2024 |

USD 16.46 Billion |

| Couplings Market , CAGR |

3.55 % |

| Couplings Market Size 2032 |

USD 21.75 Billion |

The Couplings market includes leading players such as AB SKF, Chr. Mayr GmbH, Daido Steel, DieQua Corp., Genuine Parts Co., Haudenschild Holding AG, Industrial Clutch Parts, KBK Antriebstechnik, KTR Systems, and MECVEL. These companies compete through high-torque couplings, corrosion-resistant alloys, maintenance-free designs, and performance features that support automation and heavy-duty equipment. Many suppliers expand production capacity and distributor networks to improve availability in industrial hubs. North America remains the leading region with a 32% market share due to strong manufacturing activity, oil & gas investments, and advanced power generation infrastructure that require durable and vibration-resistant coupling systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Couplings market reached USD 16.46 billion in 2024 and is expected to grow at a CAGR of 3.55% through the forecast period, supported by rising industrial automation.

- Strong demand from manufacturing and process industries drives adoption, with the manufacturing segment holding the largest share at 33% due to heavy use in conveyors, pumps, and rotating machinery.

- Key trends include growth of maintenance-free couplings, lightweight composite materials, and smart torque-monitoring systems that support predictive maintenance in power plants and petrochemical facilities.

- Competition remains strong among AB SKF, KTR Systems, Chr. Mayr, and Daido Steel as companies invest in corrosion-resistant alloys, high-torque products, and expanded distributor networks to serve global customers.

- North America leads the market with 32% share, driven by refinery upgrades and automation in factories, while Asia Pacific remains the fastest-growing region due to rising automotive production, mining activity, and power generation expansion.

Market Segmentation Analysis:

By Type

Flexible elastic coupling holds the largest share at 36%, driven by high usage in machinery that requires vibration dampening and misalignment compensation. These couplings protect motors and connected equipment from shock loads, making them suitable for pumps, compressors, and conveyor systems. Rigid couplings remain relevant in applications demanding precise shaft alignment and zero backlash. Flange and torsionally-rigid flexible couplings serve heavy-duty and high-torque operations, especially in industrial drives and marine systems. As industries automate, demand rises for couplings with higher torque transmission, improved lubrication-free operation, and longer maintenance intervals, strengthening growth across flexible segments.

- For instance, Chr. Mayr’s ROBA-DS series is designed for backlash-free performance in servo drives, with certain models capable of running at speeds above 8,000 rpm (up to 32,000 rpm depending on size and type).

By Application

Automotive dominates this segment with 31% market share, supported by extensive use of couplings in drivetrains, steering systems, and engine assemblies. Manufacturers prefer elastic or torsionally-rigid types for noise and vibration reduction in fuel-based and electric vehicles. Medical equipment applications continue to expand due to lightweight couplings used in imaging devices, surgical tools, and precision robotics. Engine and aerospace applications require high-torque, corrosion-resistant designs capable of extreme temperatures and continuous load cycles. Growing investments in automation and mobility technology keep demand elevated across advanced coupling materials and compact configurations.

- For instance, Daido Precision’s couplings are often custom-designed for specific industrial machinery requirements and are not typically mass-produced standard components for integration into passenger vehicle engine assemblies on an original equipment manufacturer (OEM) basis.

By End Use

Manufacturing accounts for the largest share at 33%, driven by widespread adoption in conveyors, gearboxes, material-handling systems, and industrial motors. Couplings support high uptime by reducing wear and compensating for alignment errors in automated production lines. Oil and gas facilities rely on heavy-duty flange and torsionally-rigid couplings for compressors, drilling rigs, and pump units under harsh operating conditions. Power generation units require temperature-resistant couplings for turbines and generator assemblies. Mining, metals, chemical, and petrochemical industries depend on durable couplings to withstand high shock loads and corrosive environments. Growing industrial modernization and predictive maintenance adoption continue to support segment growth.

Key Growth Drivers

Rising Industrial Automation and Machinery Modernization

Automation across manufacturing, packaging, mining, and processing plants continues to drive demand for high-performance couplings. Modern production lines rely on precision shaft alignment, vibration control, and shock absorption to protect motors, pumps, and gearboxes. Flexible and torsionally-rigid couplings enable smooth torque transmission, reduce wear, and lower unplanned downtime. Automated conveyors, robotic arms, and CNC machines require maintenance-free or lubrication-free coupling designs that support continuous operation. As industries shift toward energy-efficient machinery and predictive maintenance, demand for advanced couplings with higher torque density and longer service life increases. Global investments in smart factories and Industry 4.0 initiatives further accelerate adoption.

- For instance, KTR Systems does offer the BoWex FLE-PA series of curved-tooth flange couplings, designed for short installation and use in applications like connecting internal combustion engines to hydraulic pumps.

Expansion of Power Generation and Oil & Gas Infrastructure

Power plants, refineries, and offshore rigs depend on durable couplings that withstand high torque, temperature fluctuations, and corrosive operating environments. Compressors, turbines, drilling pumps, and LNG facilities require rigid or flange couplings for stable power transfer and high load capacity. Growing electricity demand, renewable energy projects, and grid expansion support increased installation of turbines and large rotating equipment. Refurbishment of aging refinery assets and petrochemical plants also drives replacement demand. Couplings with corrosion-resistant alloys and improved fatigue strength are essential for long working cycles. The sector’s focus on reliability and safety keeps the coupling market strong across high-duty applications.

- For instance, AB SKF manufactures disc couplings engineered to handle torque loads up to 178,000 Nm in steam and gas turbines.

Growth in Automotive and Electric Vehicle Manufacturing

Automotive systems depend on couplings for steering systems, drivetrains, transmission shafts, braking units, and auxiliary components. Noise and vibration reduction remain critical for vehicle comfort and fuel efficiency. The rise of electric vehicles increases demand for compact, lightweight couplings with high torsional stiffness and low backlash. Production lines and EV battery-assembly machinery also require precision couplings to maintain alignment and efficiency. As automakers upgrade plants with robotics and automated testing equipment, consumption of torsionally-rigid and flexible couplings rises. Increased vehicle output in Asia, Europe, and North America ensures steady long-term demand.

Key Trends & Opportunities

Shift Toward Maintenance-Free and Smart Couplings

Industries adopt maintenance-free couplings to reduce lubrication needs, minimize downtime, and lower operating cost. Composite and polymer-based designs offer high wear resistance without frequent servicing. Smart couplings with torque monitoring, vibration sensors, and data-logging help detect shaft misalignment or overload conditions before failure occurs. These features support predictive maintenance programs in power plants, petrochemical facilities, and factories. As equipment moves toward remote diagnostics and IoT-enabled monitoring, smart coupling solutions create a growing opportunity for manufacturers. Companies benefit by offering customized variants for industrial automation and high-speed rotating machinery.

- For instance, AB SKF integrates vibration and temperature sensors into its SKF Insight bearings, enabling real-time diagnostics at rotation speeds above 3,600 rpm.

Rising Preference for Lightweight and High-Performance Materials

The use of stainless steel, advanced alloys, carbon-fiber composites, and engineering polymers continues to increase. These materials reduce weight, resist corrosion, and maintain torque capacity under extreme temperatures. Aerospace, marine, defense, and renewable energy applications rely on lightweight couplings to improve efficiency and reduce load stress. Compact coupling designs support space-constrained engines, turbines, and EV propulsion units. As sustainability goals expand, industries prefer long-life couplings that reduce wear and replacement frequency. Material innovation provides a strong opportunity for manufacturers targeting specialized, high-performance segments.

- For instance, KTR is a world leader in manufacturing couplings and braking systems for wind turbines, with products used in over 70,000 wind turbines.

Key Challenges

Operational Failure from Misalignment and Overload Conditions

Incorrect shaft alignment, excessive torque, and vibration overload can lead to premature coupling failure, equipment shutdown, and costly repairs. Industries with continuous operation—such as petrochemical plants or power stations—face high risk when couplings fail unexpectedly. Many older facilities lack proper alignment practices or monitoring systems. Thermal expansion, improper installation, and bearing wear increase failure rates. While advanced flexible and torsional-rigid couplings reduce risk, operators still require skilled maintenance and accurate monitoring. Balancing cost with performance remains a challenge for price-sensitive industrial users.

Competition from Cheap, Low-Quality Imports

Growing availability of low-cost couplings creates price pressure for established manufacturers. Budget equipment suppliers often select cheaper couplings, sacrificing durability and reliability. These products cause higher wear, misalignment issues, and frequent replacement cycles. High-quality coupling makers must justify premium pricing by offering material certifications, testing standards, and longer service life. Intense pricing competition limits margins, especially in developing regions. To stay competitive, global brands must focus on technological innovation, after-sales support, and customized solutions instead of pure pricing strategies.

Regional Analysis

North America

North America holds the largest regional share at 32%, driven by extensive industrial automation, oil & gas infrastructure, and power generation projects. Manufacturing plants in the U.S. and Canada use flexible and torsionally-rigid couplings to reduce vibration and protect motors in high-duty production lines. Investments in shale gas, LNG terminals, and refinery upgrades strengthen demand for high-torque and corrosion-resistant designs. The region also benefits from a mature automotive sector and growing electric vehicle production. Strong adoption of predictive maintenance and smart monitoring solutions supports long-term usage of advanced coupling technologies.

Europe

Europe accounts for 28% of the market, supported by strong engineering standards, automation adoption, and advanced power generation facilities. Germany, France, Italy, and the U.K. deploy couplings in wind turbines, industrial robots, and high-efficiency engines. Renewable energy expansion drives demand for lightweight and fatigue-resistant couplings. Strict maintenance and safety regulations encourage the use of premium, certified components in factories and petrochemical plants. Upgrades of existing manufacturing lines and aerospace developments also contribute to steady coupling consumption across the region.

Asia Pacific

Asia Pacific holds 25% market share and remains the fastest-growing region due to rapid industrialization, automotive production, and large-scale infrastructure expansion. China, India, Japan, and South Korea invest heavily in manufacturing automation, mining equipment, and power generation units that require flexible and flange couplings. High demand for cost-efficient, maintenance-free designs supports wide adoption in factories and transport systems. Growth in EV production and renewable energy projects further increases consumption of precision and high-torque couplings.

Latin America

Latin America represents 9% of the market, supported by oil & gas exploration, mining projects, and steady manufacturing activity. Brazil and Mexico install couplings in pumps, compressors, and heavy-machinery systems for industrial processing. Refineries, chemical plants, and power stations require durable couplings to operate under high load and harsh environments. Expansion in steel production, automotive assembly, and urban construction drives replacement demand. Although price sensitivity remains high, gradual modernization of facilities supports long-term growth.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the market, driven by refinery expansions, LNG terminals, and power generation investments. The UAE and Saudi Arabia lead adoption of high-torque flange and rigid couplings for turbines, pumps, and drilling systems. Mining operations in South Africa and copper production in Central Africa require vibration-resistant and corrosion-protected designs. Infrastructure development in desalination plants and industrial parks increases demand. Although the market is smaller than other regions, continuous investment in energy and heavy-industry projects creates steady growth potential.

Market Segmentations:

By Type

- Flexible Elastic Coupling

- Rigid Coupling

- Flange Coupling

- Torsionally-Rigid Flexible Coupling

By Application

- Automotive

- Medical Equipment

- Engine

- Aerospace

- Others

By End Use

- Manufacturing

- Oil & Gas

- Power Generation

- Mining & Metals

- Chemical & Petrochemical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Couplings market remains highly competitive with global manufacturers, specialized engineering companies, and regional suppliers offering a wide portfolio of shaft, rigid, flexible, and torque-transmitting coupling solutions. Leading companies such as AB SKF, Chr. Mayr GmbH, Daido Steel, DieQua Corp., Genuine Parts Co., Haudenschild Holding AG, Industrial Clutch Parts, KBK Antriebstechnik, KTR Systems, and MECVEL focus on durability, misalignment tolerance, and vibration control to support industrial machinery. Many players invest in maintenance-free designs, advanced alloys, and corrosion-resistant materials to meet demanding applications in oil & gas, power generation, mining, and automation. Strategic initiatives include distributor partnerships, aftermarket service programs, and expansion of manufacturing sites in Asia and Europe to improve delivery timelines. Innovation in sensor-integrated couplings for predictive maintenance and IoT-enabled monitoring is gaining momentum, allowing companies to differentiate through reliability and equipment safety. As industries upgrade machinery and shift toward automation, competition intensifies around high-torque, lightweight, and long-life coupling solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, DieQua Corp. Published a technical brief on zero-backlash, maintenance-free line shafts (−30 °C to 100 °C).

- In January 2024, Haudenschild Holding AG’s HA-CO Group relocated its HA-CO GmbH coupling site to a new building and inaugurated the new premises, as part of an expansion in Kleinwallstadt, Germany.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for maintenance-free and lubrication-free couplings will increase in automated factories.

- Smart couplings with torque and vibration monitoring will support predictive maintenance programs.

- Lightweight composite and alloy materials will gain adoption in aerospace, EVs, and high-speed machinery.

- High-torque and corrosion-resistant designs will remain essential for oil & gas and power generation assets.

- Compact coupling formats will expand as industries adopt space-efficient and modular machinery.

- Replacement demand will rise as older industrial equipment upgrades to higher-efficiency drive systems.

- Renewable energy projects will boost usage in wind turbines, hydro units, and biomass plants.

- Asia Pacific will show long-term growth due to rapid industrialization and rising automation.

- Distributor partnerships and aftermarket service programs will strengthen competitive advantage.

- Manufacturers will invest in customization to meet sector-specific torque, speed, and environmental requirements.