Market Overview:

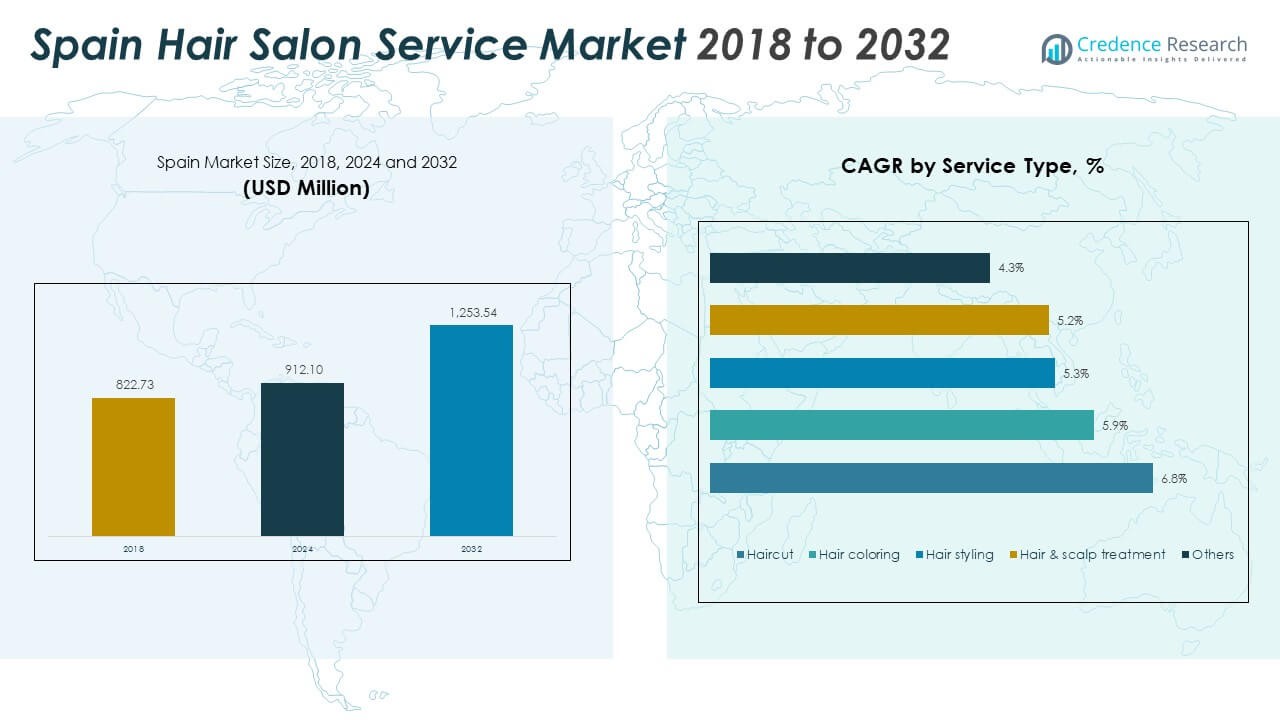

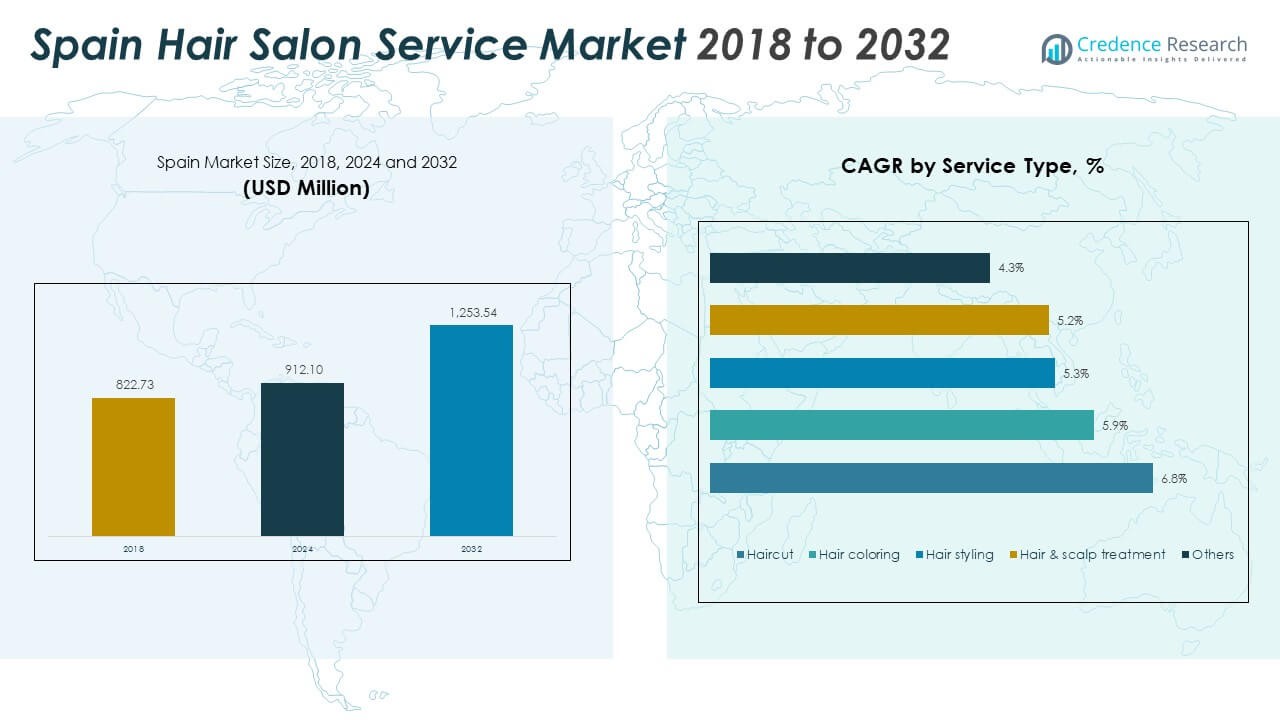

The Spain Hair Salon Service Market size was valued at USD 822.73 million in 2018 to USD 912.10 million in 2024 and is anticipated to reach USD 1,253.54 million by 2032, at a CAGR of 4.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Hair Salon Service Market Size 2024 |

USD 912.10 Million |

| Spain Hair Salon Service Market, CAGR |

4.05% |

| Spain Hair Salon Service Market Size 2032 |

USD 1,253.54 Million |

The Spain Hair Salon Service Market is driven by increasing disposable incomes and a growing focus on personal grooming among consumers. The demand for premium services like advanced hair treatments, coloring, and styling is rising. Technological advancements in hair care and salon management are also propelling growth. Consumers are increasingly opting for personalized experiences, which drives salons to adopt innovative solutions and high-quality products. As social media influences beauty trends, salon visits continue to rise.

Regionally, Spain’s major urban areas, including Madrid and Barcelona, lead the market, with high disposable incomes and a dense concentration of premium salons. These regions offer a strong customer base for luxury services, particularly among the working and affluent populations. Emerging regions like coastal areas benefit from tourism, which boosts salon demand. Smaller towns and rural areas are growing more gradually, with a growing interest in both traditional and modern beauty services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Spain Hair Salon Service Market was valued at USD 822.73 million in 2018, grew to USD 912.10 million in 2024, and is projected to reach USD 1,253.54 million by 2032, expanding at a CAGR of 4.05%.

- Central Spain, particularly Madrid, holds the largest market share due to its urban population and demand for premium services. The northern regions follow with consistent demand driven by both local consumers and tourism.

- The fastest-growing region is Southern Spain, particularly the coastal areas, with a strong boost from the tourism industry and increasing demand for beauty services among visitors.

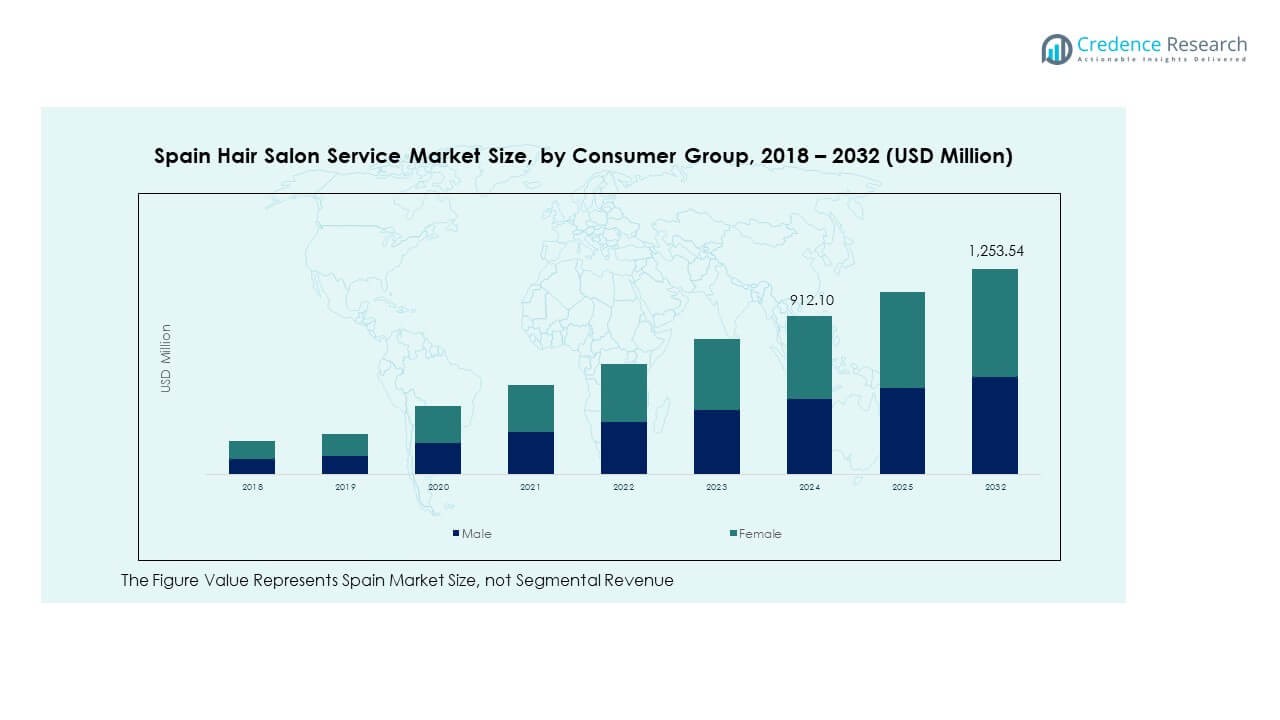

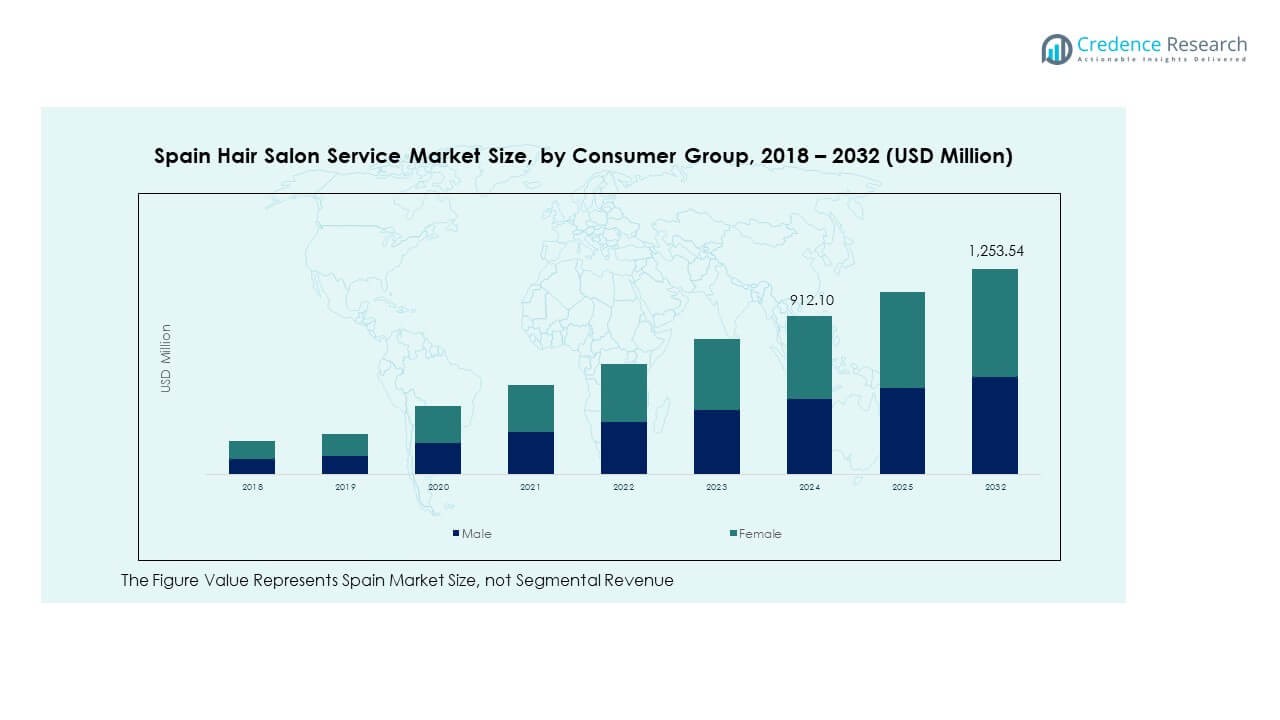

- The consumer group segment shows male clients contributing significantly to the market, while females dominate overall salon service demand, especially for premium and customized treatments.

- The service type segment is evenly split, with haircuts and hair coloring services holding the largest shares, while hair & scalp treatments are seeing a gradual increase in demand.

Market Drivers:

Market Drivers:

Increased Consumer Focus on Personal Grooming

The growing emphasis on personal grooming drives demand in the Spain Hair Salon Service Market. As disposable income rises, consumers are allocating more to beauty and self-care services. The trend of self-care and wellness continues to gain popularity across Spain, encouraging more frequent visits to salons. This increase in salon footfall boosts demand for various services, including haircuts, styling, and treatments. As people become more conscious of their appearance, the frequency of salon visits also rises. More consumers are investing in premium services, opting for advanced styling, hair colouring, and other specialized treatments.

- For example, Jean Louis David salons in Spain have consistently introduced new ammonia-free oil-based color services, such as INOA and DIA COLOR (by L’Oréal Professionnel). These services are actively promoted across all age groups, with a particular focus on their popularity in Madrid’s urban locations, reflecting the brand’s commitment to offering innovative and gentle hair coloring solutions in the Spain Hair Salon Service Market.

Technological Advancements in Salon Services

Technological innovations are significantly shaping the Spain Hair Salon Service Market. New tools and equipment improve service efficiency and quality, attracting more customers. High-definition colour treatments, scalp health analysis, and laser hair restoration are gaining popularity due to their enhanced results. This technological evolution allows salons to offer better, more personalized experiences, which resonates well with modern consumers. Technological advancements also enable salons to manage appointments, payments, and customer records digitally, improving operational efficiency.

Urbanisation and Changing Lifestyles

Urbanisation in cities like Madrid and Barcelona has contributed to the growing demand for hair salon services in Spain. As people migrate to cities, busy lifestyles lead to an increase in demand for quick, accessible beauty services. Salons in urban areas benefit from a larger customer base and higher consumer spending. The presence of more high-income households in urban locations has resulted in greater spending on premium hair services. Additionally, the increasing number of professional women in urban areas has further boosted salon visits.

- For example, Marco Aldany salons in urban centers like Madrid and Barcelona are known for their express services, including fast blow-dry and styling. Verified customer reviews consistently highlight the efficiency and high-quality of these services, particularly for professionals with tight schedules.

Rising Influence of Social Media and Beauty Trends

Social media platforms like Instagram and YouTube are a major influence on the Spain Hair Salon Service Market. Beauty influencers and celebrities often share haircare tips, new styles, and colour trends, encouraging followers to replicate those looks. Consumers are inspired to visit salons to achieve the latest hair trends seen online. With the rise of “selfie culture” and social media sharing, individuals are more concerned about their appearance, prompting higher salon footfall. The connection between social media trends and real-world beauty services is expected to drive continuous market growth.

Market Trends:

Growth of Sustainable and Organic Salon Services

The Spain Hair Salon Service Market is witnessing a growing preference for organic and sustainable products. Consumers are increasingly concerned with the environmental impact of beauty treatments, and this has led to a surge in demand for eco-friendly salon services. Natural and organic hair care products, free from harsh chemicals, are becoming more popular. Many salons are responding by adopting greener practices, such as using biodegradable products and reducing waste. This trend is aligned with the global movement towards sustainability, influencing the local market dynamics.

- For instance, L’Oréal’s Professional Products Division reports that its iNOA and Dia Light color tubes are now made from 95% recycled aluminum. Additionally, the company has equipped 3,000 salons worldwide, including those in Spain, with recycling systems that divert 110 tons of waste annually. This initiative reflects L’Oréal’s commitment to sustainability within the hair salon service market.

Personalized Hair Treatments and Services

Consumers in the Spain Hair Salon Service Market are increasingly seeking personalized treatments tailored to their specific needs. Hair and scalp analysis technology enables salons to offer customized haircare solutions. Clients now expect salons to recommend products and treatments that suit their hair type and concerns, whether it’s hair thinning, dry scalp, or colour care. Personalization in service offerings, from haircuts to treatment plans, is becoming a key differentiator for salons. Salons providing tailored experiences are more likely to build loyal customer bases.

- For instance, Schwarzkopf Professional’s SalonLab Smart Analyzer uses a near-infrared sensor to measure the inner strength of hair, enabling hyper-personalized recommendations based on molecular data. The system is in commercial use across Europe, including Spain, offering features such as measuring product efficacy and tracking personalized results for clients. This award-winning technology has been adopted by leading salons, enhancing service quality and customer satisfaction in the Spain Hair Salon Service Market.

Integration of Wellness and Beauty Services

Salons in Spain are increasingly blending beauty services with wellness offerings, such as hair and scalp treatments, massage therapies, and relaxation zones. Consumers are looking for an all-encompassing beauty experience that includes stress relief and relaxation in addition to hair services. This integration of wellness into salon services is enhancing the customer experience and attracting a broader clientele. The rise of salon-spas that combine beauty and wellness is a growing trend in the Spain Hair Salon Service Market.

Growth of Mobile and At-Home Salon Services

Mobile salons are becoming more popular in Spain, especially in metropolitan areas, due to the convenience they offer. Many consumers prefer the option of at-home beauty treatments, especially for haircuts, styling, and colour services. The trend towards mobile and at-home salon services is particularly appealing to busy professionals, elderly clients, and those with limited mobility. With mobile services, consumers can enjoy high-quality treatments in the comfort of their own homes, offering salons an opportunity to expand their customer base.

Market Challenges Analysis:

High Competition and Market Saturation

The Spain Hair Salon Service Market faces significant competition due to a high number of salons, especially in urban centres. Many new entrants are providing similar services, making it difficult for established salons to differentiate themselves. Price wars, along with pressure on quality and customer service, intensify this competition. This oversupply of salons leads to challenges in attracting and retaining customers. Many salons need to innovate constantly to stay relevant and meet the evolving demands of consumers. Differentiation based on premium services, advanced technology, and exceptional customer experiences is essential for survival in this saturated market.

Rising Operational Costs

The increasing operational costs in Spain pose challenges for hair salons. Rent, staff salaries, and the cost of premium hair products have risen over the years. For salons in metropolitan areas, maintaining profitability while keeping prices competitive becomes difficult due to high overhead costs. Additionally, the need for continuous investment in staff training, technological upgrades, and salon maintenance adds to operational pressures. Salons must find ways to balance cost efficiency while maintaining service quality. This rising cost burden can discourage smaller or independent salons from thriving in a highly competitive market.

Market Opportunities:

Expansion of Premium and Niche Services

There is a growing opportunity for salons in Spain to tap into the premium and niche service markets. As disposable incomes rise, more consumers are willing to pay for high-end services such as luxury hair treatments, scalp massages, and specialised colour services. Salons can also focus on specific customer segments, offering tailored services for people with particular hair types or concerns. By providing exclusive, personalised experiences, salons can differentiate themselves from the competition and attract a loyal customer base.

Increasing Demand for Men’s Grooming Services

There is an emerging opportunity in the Spain Hair Salon Service Market with the growing demand for men’s grooming services. Traditionally dominated by barbershops, men’s grooming is now a mainstream trend in high-end salons. As men become more concerned with their appearance, they seek professional grooming services, from haircuts to beard care. Salons can tap into this market by offering specialized services aimed at male customers. Providing gender-neutral or male-focused beauty services presents significant growth potential.

Market Segmentation Analysis:

By Service Type

The Spain Hair Salon Service Market is segmented by service type, with haircuts, hair colouring, and hair styling being key categories. Haircuts dominate as they are essential for most salon visits, catering to diverse customer preferences. Hair colouring has seen steady growth, driven by trends in vibrant and natural colour choices. Styling services, including blowouts and updos, continue to be popular, especially for events. Hair and scalp treatments are gaining popularity as consumers focus more on scalp health and overall hair wellness. Specialized services like keratin treatments and deep conditioning are also growing in demand.

- For example, Llongueras salons are renowned for their “Llongueras Method,” which incorporates geometric cutting and visagism training. The brand also operates a globally recognized educational system for hair professionals and is committed to incorporating sustainability practices in some of its locations.

By Salon Type

The Spain Hair Salon Service Market is divided into several salon types, including full-service salons, chain/franchise salons, barbershops, mobile/at-home salons, and salon-spas. Full-service salons lead the market due to their broad range of offerings. Chain and franchise salons are expanding rapidly across Spain, attracting consumers with consistent quality and brand recognition. Barbershops are still popular, especially for men’s grooming. Mobile/at-home salons are growing due to consumer preference for convenience. Salon-spas are gaining traction as they offer integrated beauty and wellness services, catering to customers seeking holistic treatments.

- For example, Marco Aldany is Spain’s largest salon franchise, known for its widespread presence and use of digital booking platforms. The company has been actively modernizing its services to enhance customer convenience and streamline operations, as confirmed through various public announcements and press coverage.

By Consumer Group

The market is also segmented by consumer group, with male and female consumers being the primary groups. While women historically account for the majority of salon services, the growing demand for men’s grooming has led to an increase in male clientele. Salons are adapting to cater to both genders, offering tailored services for each group. Women continue to drive market growth, particularly in services like colouring, styling, and advanced treatments. Male customers, however, are increasingly opting for premium haircuts, beard grooming, and skincare services.

By Price Range

The Spain Hair Salon Service Market offers services across different price ranges: premium, mid-market, and value/economy. Premium services attract high-income consumers looking for luxury experiences and high-end treatments. Mid-market services cater to the broader consumer base, offering a balance between quality and affordability. The value/economy segment appeals to budget-conscious consumers who seek essential services without added frills. The growing demand for premium services is noticeable in urban centres, while mid-market and value segments maintain strong demand in suburban and rural areas.

Segmentation

Segmentation

By Service Type

- Haircut

- Hair colouring

- Hair styling

- Hair & scalp treatment

- Others

By Salon Type

- Full-Service Salons

- Chain/Franchise Salons

- Barbershops

- Mobile/At-Home Salons

- Salon-Spas

By Consumer Group

By Price Range

- Premium

- Mid-Market

- Value/Economy

Regional Analysis

Northern Spain

Northern Spain, including regions like Galicia and the Basque Country, holds a significant share of the Spain Hair Salon Service Market, accounting for around 20%. The market in this region benefits from a mix of traditional and modern services, with a strong demand for quality and value. The population in cities like Bilbao and Santander is increasingly investing in both basic and advanced beauty services. While the region has a solid customer base, the growth rate in smaller towns is slower compared to larger urban centres. The focus remains on haircuts, styling, and scalp treatments, reflecting a more conservative yet steadily growing market.

Central Spain

Central Spain, particularly Madrid and the surrounding areas, dominates the Spain Hair Salon Service Market with a market share of approximately 40%. Madrid, being the capital, is the primary hub for premium salons and advanced beauty treatments, attracting both locals and international clientele. The urban population’s high disposable income contributes to the demand for specialized hair treatments, organic products, and personalized services. Central Spain also benefits from a high concentration of chain salons and salon-spas, which offer both convenience and luxury. The region is expected to continue its upward trend, with innovation and service differentiation playing a key role in its growth.

Southern Spain

Southern Spain, including Andalusia, accounts for 25% of the Spain Hair Salon Service Market. Cities like Seville, Málaga, and Cádiz are experiencing steady growth due to their vibrant tourism industries, with many visitors seeking beauty services. The region’s customer base consists largely of middle-income households, who favor affordable yet quality hair care services. Hair salons in Southern Spain are increasingly adopting new trends such as eco-friendly and organic treatments, aligning with consumer preferences for sustainable beauty services. As tourism continues to rise, salons in these regions are diversifying to meet the demands of both locals and tourists.

Key Player Analysis

- L’Oréal Professionnel / L’Oréal S.A.

- Jean Louis David

- Llongueras

- Raffel Pages

- Carche

- Toni & Guy

- Rizos Peluqueros

- Oh My Cut!

- Cebado

- Luis & Tachi

Competitive Analysis

The Spain Hair Salon Service Market remains highly competitive, with several large and small players battling for market share. Chain salons such as Jean Louis David, Toni & Guy, and Saloons are major players, dominating both urban and suburban markets. These brands offer a wide range of services, from basic haircuts to advanced treatments, and are recognized for their consistency in service quality. Independent salons still play a crucial role, especially in smaller cities and rural areas, where personalized services and local customer relationships drive loyalty. Mobile and at-home services, such as those offered by companies like The Glam App, are gaining traction, appealing to busy professionals and those seeking home convenience. Regional competitors also cater to specific consumer preferences, including eco-friendly and organic beauty services. The rise in mobile bookings and online consultations is reshaping the competitive dynamics, with salons increasingly leveraging technology to streamline operations. The continuous need for innovation, cost management, and customer satisfaction keeps competition intense across the Spain Hair Salon Service Market.

Recent Developments

- In November 2025, L’Oréal announced the acquisition of Kering Beauté, a major deal facilitated in part by a €3 billion bond sale. The acquisition aims to enhance L’Oréal’s global beauty portfolio, including professional hair care services in Spain. The move underscores L’Oréal’s continued expansion and influence in the Spanish salon industry, where their Professional Products Division has also reported sustained sales growth and driven market innovation this year.

- In June 2025, L’Oréal S.A. signed an agreement to acquire Color Wow, a rapidly growing premium haircare brand known for its innovative solutions specifically tailored for colour-treated hair. The acquisition was made through L’Oréal’s Professional Products Division and reflects the Group’s commitment to strengthening its leadership and expanding its professional-grade product portfolio for the hair salon service sector in Italy and globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Salon Type, Consumer Group and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Spain Hair Salon Service Market is expected to see continued growth driven by increasing consumer investment in personal grooming.

- Premium services will dominate, with consumers gravitating towards high-quality and personalized hair treatments.

- Mobile and at-home services will likely expand, reflecting the demand for convenience and on-demand beauty services.

- Eco-friendly and organic treatments will continue to gain popularity, as consumers become more eco-conscious.

- Technological advancements such as AI-driven consultations and online booking systems will reshape how salons operate.

- Regional markets will see differentiated growth, with urban areas leading and smaller regions gradually catching up.

- Hair and scalp treatments will see strong demand, as consumers increasingly focus on hair health and wellness.

- Salons will adopt more sustainable practices, reducing their environmental footprint and aligning with consumer preferences.

- The competitive landscape will become more fragmented, with both large chains and independent salons vying for market share.

- Partnerships between beauty brands and salons will be crucial, with new collaborations expected to enhance service offerings.

Market Drivers:

Market Drivers: Segmentation

Segmentation