Market Overview:

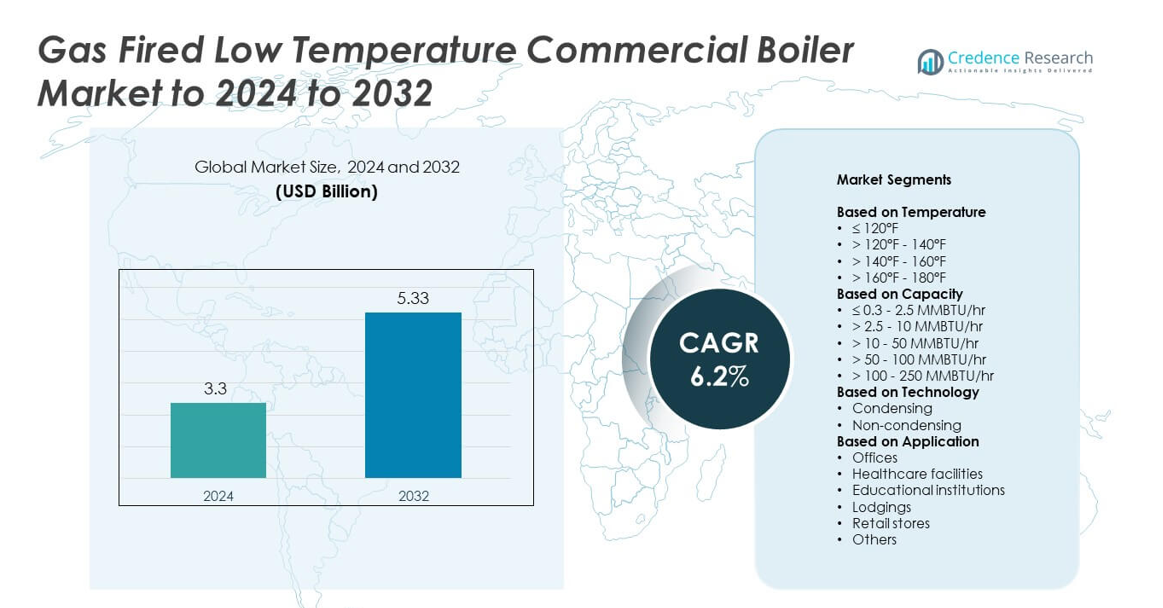

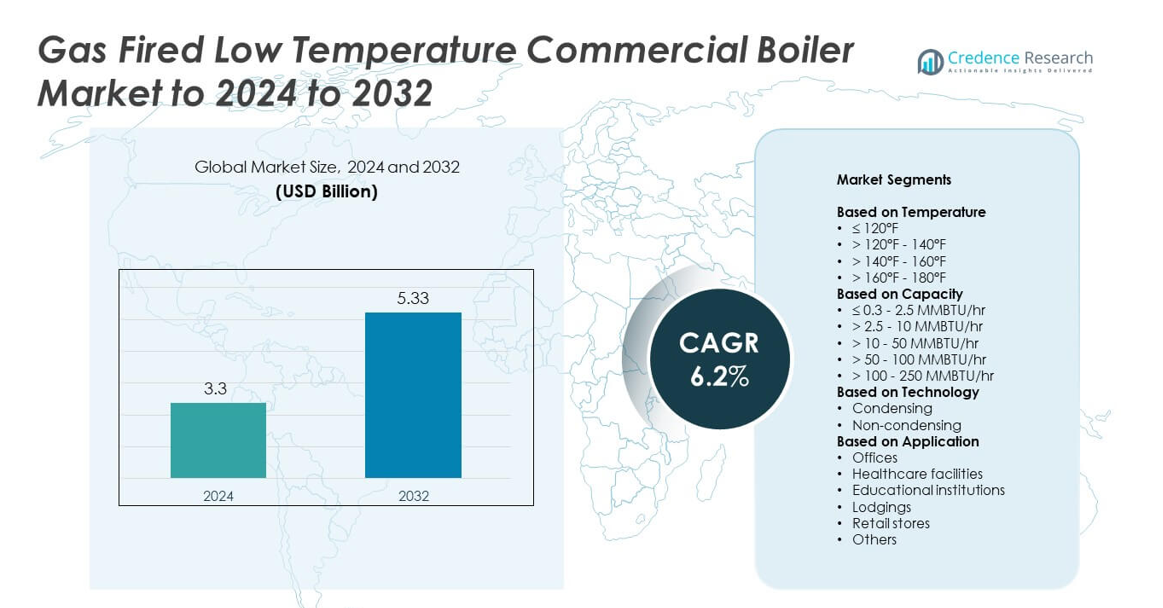

Gas Fired Low Temperature Commercial Boiler Market size was valued USD 3.3 Billion in 2024 and is anticipated to reach USD 5.33 Billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Low Temperature Commercial Boiler Market Size 2024 |

USD 3.3 Billion |

| Gas Fired Low Temperature Commercial Boiler Market , CAGR |

6.2% |

| Gas Fired Low Temperature Commercial Boiler Market Size 2032 |

USD 5.33 Billion |

The Gas Fired Low Temperature Commercial Boiler Market is highly competitive, led by companies such as Bosch Industriekessel, Hurst Boiler & Welding, Burnham Commercial Boilers, Ariston Holding, and Cleaver-Brooks. These players focus on delivering advanced condensing technology, modular systems, and smart control features to enhance energy efficiency and reduce emissions in commercial applications. North America leads the market with a 34% share, driven by stringent energy regulations and widespread adoption in hospitals, educational institutions, and office complexes. Europe holds 28% of the market, supported by environmental standards and retrofitting initiatives in commercial buildings. Asia Pacific accounts for 24%, fueled by rapid urbanization and industrial expansion, while Latin America and the Middle East & Africa capture 9% and 5%, respectively, with growth supported by infrastructure development and modernization projects. Strategic innovation and regional expansion remain key priorities for market leaders.

Market Insights

- The Gas Fired Low Temperature Commercial Boiler Market size was USD 3.3 Billion in 2024 and is projected to reach USD 5.33 Billion by 2032, growing at a CAGR of 6.2% during the forecast period.

- Rising demand for energy-efficient heating solutions in commercial buildings, hospitals, and educational institutions drives market growth, supported by regulatory incentives and sustainability initiatives.

- Adoption of condensing technology, integration with smart building systems, and retrofit projects in aging infrastructure are key trends creating opportunities for operational efficiency and lower emissions.

- The market is highly competitive, with leading players focusing on advanced boiler designs, modular solutions, regional expansion, and service networks to maintain market share and meet diverse commercial requirements.

- North America leads with a 34% share, followed by Europe at 28%, Asia Pacific at 24%, Latin America at 9%, and Middle East & Africa at 5%, with the ≤ 120°F temperature segment holding the largest share due to energy efficiency preferences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Temperature

The ≤ 120°F segment dominates the Gas Fired Low Temperature Commercial Boiler Market with a 42% share. Its growth is driven by widespread adoption in commercial buildings, schools, and hospitals where low-temperature heating ensures energy efficiency and occupant comfort. Facilities prefer this range to reduce heat loss and improve system longevity. Increasing focus on regulatory compliance and energy-saving initiatives further propels demand. The segment benefits from integration with advanced control systems, allowing precise temperature regulation and optimized fuel consumption, which enhances operational efficiency and lowers emissions across commercial and institutional installations.

- For instance, the A.O. Smith GBX is a discontinued residential gas-fired boiler series (models 70–195 MBH) which generally requires a bypass arrangement when system return water temperature is below 130°F (54°C) to prevent condensation damage.

By Capacity

The > 2.5 – 10 MMBTU/hr capacity segment holds the largest share at 38% in the Gas Fired Low Temperature Commercial Boiler Market. This range suits medium-sized commercial facilities, including hotels, manufacturing units, and office complexes, offering an ideal balance between performance and energy efficiency. Demand is driven by retrofitting older systems and expanding infrastructure that requires reliable, consistent heating. Manufacturers focus on modular designs and scalable solutions within this capacity, enabling easy maintenance and reduced operational costs. Integration with automation and monitoring systems further supports adoption by commercial operators seeking efficiency and regulatory compliance.

- For instance, the Parker TC Series of vertical condensing hot water boilers offers capacities up to 5.4 MMBTU/hr (5,443,000 BTU/hr) with verified efficiencies up to 98%.

By Technology

Condensing technology leads the Gas Fired Low Temperature Commercial Boiler Market with a 55% share due to superior energy efficiency and reduced carbon emissions. Condensing boilers capture latent heat from flue gases, significantly lowering fuel consumption compared to non-condensing units. Growth is fueled by stringent environmental regulations, rising energy costs, and increasing awareness of sustainable heating solutions. Facilities adopting condensing technology benefit from improved operational efficiency, extended equipment life, and lower maintenance requirements. These boilers are favored in retrofits and new installations across commercial and institutional sectors, where efficiency, cost savings, and environmental compliance are key decision drivers.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Systems

Commercial facilities increasingly adopt energy-efficient heating solutions to reduce operational costs and meet environmental standards. Gas fired low temperature commercial boilers deliver consistent heat at lower temperatures, minimizing energy waste while enhancing system lifespan. Advanced controls and automation allow precise temperature management, improving overall efficiency. Sustainability initiatives and green building certifications further drive installations in hospitals, hotels, and schools. Energy efficiency remains a primary growth driver as facility operators seek reduced fuel consumption, lower emissions, and long-term operational savings across diverse commercial applications.

- For instance, the Navien NFB-C commercial line of high-efficiency condensing boilers delivers a verified thermal efficiency of 97.5%, as listed in the AHRI Certification Directory.

Expansion of Commercial Infrastructure

Rapid growth of commercial buildings boosts demand for reliable heating solutions. Offices, educational institutions, hotels, and hospitals increasingly require low-temperature boilers for optimal indoor climate control. Medium- and large-capacity systems are preferred for their scalable performance and energy efficiency. Retrofit projects replacing outdated units also contribute to market growth. Manufacturers provide modular designs that simplify installation and maintenance. Expansion of commercial infrastructure remains a significant growth driver as the demand for modern, efficient, and compliant heating solutions rises globally.

- For instance, the HTP Elite Ultra residential boilers support cascaded systems of up to 8 units using the integrated digital control system. The commercial HTP Elite XL boilers also support cascaded systems up to 8 units using a separate cascade panel accessory.

Stringent Environmental Regulations

Regulatory mandates on emissions and energy consumption push commercial operators to adopt efficient boilers. Gas fired low temperature commercial boilers comply with environmental standards by reducing fuel use and flue gas emissions. Incentives and rebates for energy-efficient installations encourage upgrades and new system deployments. Condensing technology and smart monitoring solutions help facilities meet these standards while maintaining operational performance. Environmental regulations remain a crucial growth driver, influencing adoption patterns and driving manufacturers to innovate for compliance and efficiency in commercial heating solutions.

Key Trend & Opportunity

Integration with Smart Building Systems

Smart building adoption opens opportunities for low-temperature commercial boilers. IoT-enabled controls, predictive maintenance, and automated energy management improve fuel efficiency and reduce downtime. Real-time monitoring supports diagnostics and extends equipment lifespan. Intelligent integration attracts modern commercial facilities seeking energy savings, cost reduction, and streamlined operations. Manufacturers focus on compatible designs with advanced control systems. Smart building integration represents a key trend and opportunity, enhancing adoption of gas fired low temperature boilers in technologically advanced infrastructures.

- For instance, the Fondital Itaca CTN is a wall-hung standard (non-condensing), open-chamber gas boiler series (CTN models are ‘open chamber and natural draught’). It features low NOx emissions that comply with Class 6requirements (meaning less than 56 mg/kWh).

Shift Towards Condensing Technology

Condensing boilers lead adoption due to higher energy efficiency and reduced emissions. They recover latent heat from flue gases, lowering fuel consumption. Awareness of sustainability drives replacement of conventional non-condensing units in new and retrofit projects. Improved heat exchangers and automated controls increase efficiency and operational reliability. The shift toward condensing technology remains a key trend and opportunity, supporting commercial operators in meeting environmental goals and reducing operational costs while enhancing system performance.

- For instance, the Wolf CGB-75/100 wall-mounted gas condensing boiler series (which the CGB-100 belongs to) is verified to have an efficiency of up to 110% (Hi) or 99% (Hs) under specific test conditions

Growth in Retrofit and Replacement Projects

Aging heating systems drive demand for low-temperature boilers in retrofits and replacements. Facility operators seek modern units with higher efficiency, reliability, and lower maintenance. Modular designs enable easy integration with existing networks, reducing installation time and costs. Focus on long-term operational savings encourages upgrades. Retrofit and replacement projects represent a key trend and opportunity, expanding the market for gas fired low temperature commercial boilers while addressing the need to modernize aging commercial infrastructure.

Key Challenge

High Initial Capital Investment

Upfront costs of low-temperature commercial boilers can limit adoption. Condensing units, large-capacity systems, and advanced control features require significant investment. Smaller commercial facilities may delay purchases due to budget constraints or longer payback periods. Manufacturers offer financing options and modular designs, but initial cost sensitivity remains a key challenge. The high capital requirement impacts market penetration, particularly in developing regions where financial resources for infrastructure upgrades are limited.

Complex Maintenance and Technical Expertise

Low-temperature boilers require skilled personnel for operation and maintenance. Condensing systems and automated controls demand technical expertise for inspections, pressure and temperature monitoring, and safety compliance. Limited availability of trained technicians can lead to inefficiencies and reduced equipment lifespan. Manufacturers provide training and service support, yet maintenance complexity remains a key challenge. Ensuring adequate technical knowledge across commercial facilities is essential to sustain performance and reliability in the Gas Fired Low Temperature Commercial Boiler Market.

Regional Analysis

North America

North America leads the Gas Fired Low Temperature Commercial Boiler Market with a 34% share. The region’s growth is driven by rising adoption of energy-efficient heating systems in commercial buildings, hospitals, and educational institutions. Stringent environmental regulations and incentives for low-emission installations encourage the replacement of conventional boilers with modern low-temperature units. Advanced building automation and smart control integration further support market expansion. Increasing investments in retrofitting aging infrastructure and constructing new commercial facilities contribute to strong demand. Manufacturers focus on condensing technology and scalable solutions to meet North America’s efficiency and sustainability requirements.

Europe

Europe holds a 28% share in the Gas Fired Low Temperature Commercial Boiler Market. Strict energy efficiency and carbon emission regulations drive adoption across commercial and institutional sectors. Governments offer incentives for condensing boiler installations, encouraging facility operators to upgrade existing systems. The presence of established manufacturers and technological advancements in smart monitoring solutions enhance market growth. Demand is particularly high in Germany, the UK, and France due to rapid commercial infrastructure expansion and retrofit projects. Focus on sustainable heating solutions and long-term operational cost reduction further strengthens Europe’s position in the market.

Asia Pacific

Asia Pacific accounts for a 27% share of the Gas Fired Low Temperature Commercial Boiler Market. Rapid urbanization and industrial expansion in countries like China, India, and Japan drive demand for medium- and large-capacity boilers. Increasing awareness of energy efficiency, coupled with government incentives for green building certifications, encourages adoption in commercial facilities. Retrofit and replacement of aging infrastructure also fuel growth. Manufacturers focus on scalable, modular designs to address diverse facility requirements. Expansion in hospitality, healthcare, and educational sectors, along with rising investments in smart building integration, positions Asia Pacific as a key growth region.

Latin America

Latin America captures a 6% share in the Gas Fired Low Temperature Commercial Boiler Market. Growth is driven by rising commercial infrastructure in Brazil, Mexico, and Argentina and increasing investments in energy-efficient heating solutions. Retrofit projects in older facilities and the adoption of condensing technology contribute to market expansion. Government incentives for environmentally friendly installations encourage facility operators to replace outdated systems. Market growth is also supported by the focus on reducing operational costs in hotels, hospitals, and office buildings. Manufacturers are expanding service networks and technical support to meet regional demand and strengthen market presence.

Middle East and Africa

Middle East and Africa hold a 5% share of the Gas Fired Low Temperature Commercial Boiler Market. Commercial growth in hospitality, healthcare, and industrial sectors drives demand for efficient heating systems. Retrofit projects in older commercial buildings and the adoption of condensing technology support market expansion. Energy efficiency initiatives and government policies promoting sustainable infrastructure further encourage boiler upgrades. Manufacturers focus on providing scalable, low-maintenance solutions that suit regional climate and operational requirements. Investments in smart monitoring and control systems enhance operational efficiency, positioning the region for gradual market growth despite limited overall share compared to North America, Europe, and Asia Pacific.

Market Segmentations:

By Temperature

- ≤ 120°F

- > 120°F – 140°F

- > 140°F – 160°F

- > 160°F – 180°F

By Capacity

- ≤ 0.3 – 2.5 MMBTU/hr

- > 2.5 – 10 MMBTU/hr

- > 10 – 50 MMBTU/hr

- > 50 – 100 MMBTU/hr

- > 100 – 250 MMBTU/hr

By Technology

- Condensing

- Non-condensing

By Application

- Offices

- Healthcare facilities

- Educational institutions

- Lodgings

- Retail stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Bosch Industriekessel, Hurst Boiler & Welding, Burnham Commercial Boilers, Ariston Holding, Cleaver-Brooks, Bradford White Corporation, Fulton, Ferroli, Precision Boilers, Lochinvar, Fondital, Immergas, Hoval, and Babcock & Wilcox are leading competitors in the Gas Fired Low Temperature Commercial Boiler Market. These companies compete through technological innovation, offering advanced condensing boilers, modular designs, and smart control systems to enhance energy efficiency and operational reliability. Continuous investment in research and development drives improvements in heat recovery, emissions reduction, and fuel optimization. Firms focus on expanding regional presence, establishing service networks, and providing tailored solutions for diverse commercial applications. Competitive strategies also include strategic partnerships, retrofit projects, and targeted product launches to capture market share in both mature and emerging markets. The overall landscape remains highly competitive, with companies striving to differentiate through efficiency, sustainability, and cost-effective solutions while addressing evolving regulatory and customer demands across the commercial heating sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Ariston Holding has focused on innovation in compact, modular boiler designs that simplify installation and maintenance, tailoring their products for diverse commercial building types

- In 2025, Babcock & Wilcox has been involved in projects to replace older fossil-fueled boilers, including coal boilers, with modern biomass and natural gas-fired boilers.

- In 2025, Hurst Boiler & Welding has emphasized sustainable energy solutions, showcasing advanced industrial boiler expertise at the AHR Expo.

Report Coverage

The research report offers an in-depth analysis based on Temperature, Capacity, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of energy-efficient boilers will drive market growth globally.

- Expansion of commercial infrastructure will create steady demand for low-temperature systems.

- Condensing technology will dominate due to higher efficiency and lower emissions.

- Integration with smart building systems will enhance operational efficiency and remote monitoring.

- Retrofit and replacement projects in aging facilities will boost equipment sales.

- Government incentives and regulations will encourage adoption of sustainable heating solutions.

- Emerging markets in Asia Pacific and Latin America will offer significant growth opportunities.

- Focus on reducing operational costs will increase demand for advanced control features.

- Manufacturers will invest in modular and scalable designs for diverse facility needs.

- Environmental compliance and carbon reduction initiatives will continue shaping market trends.