Market Overview

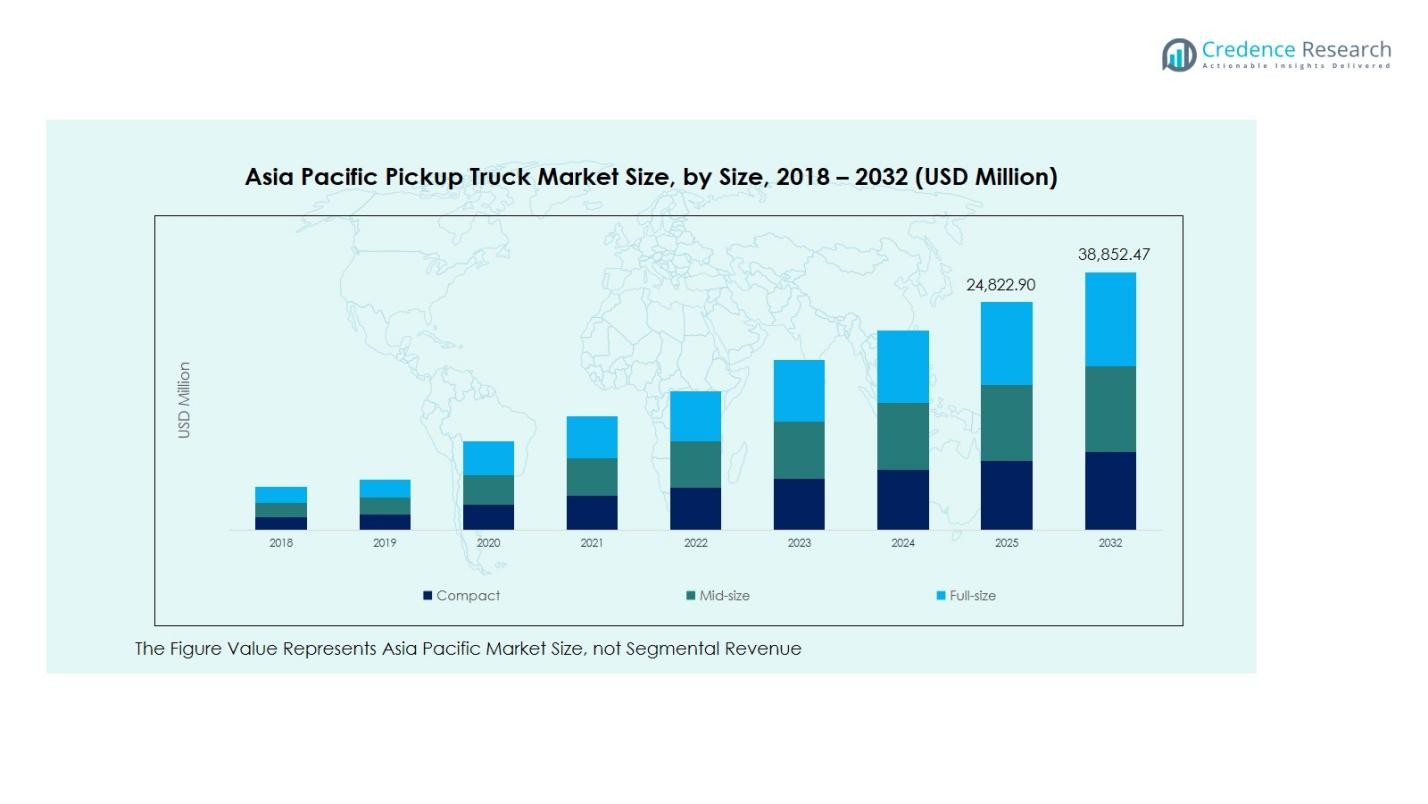

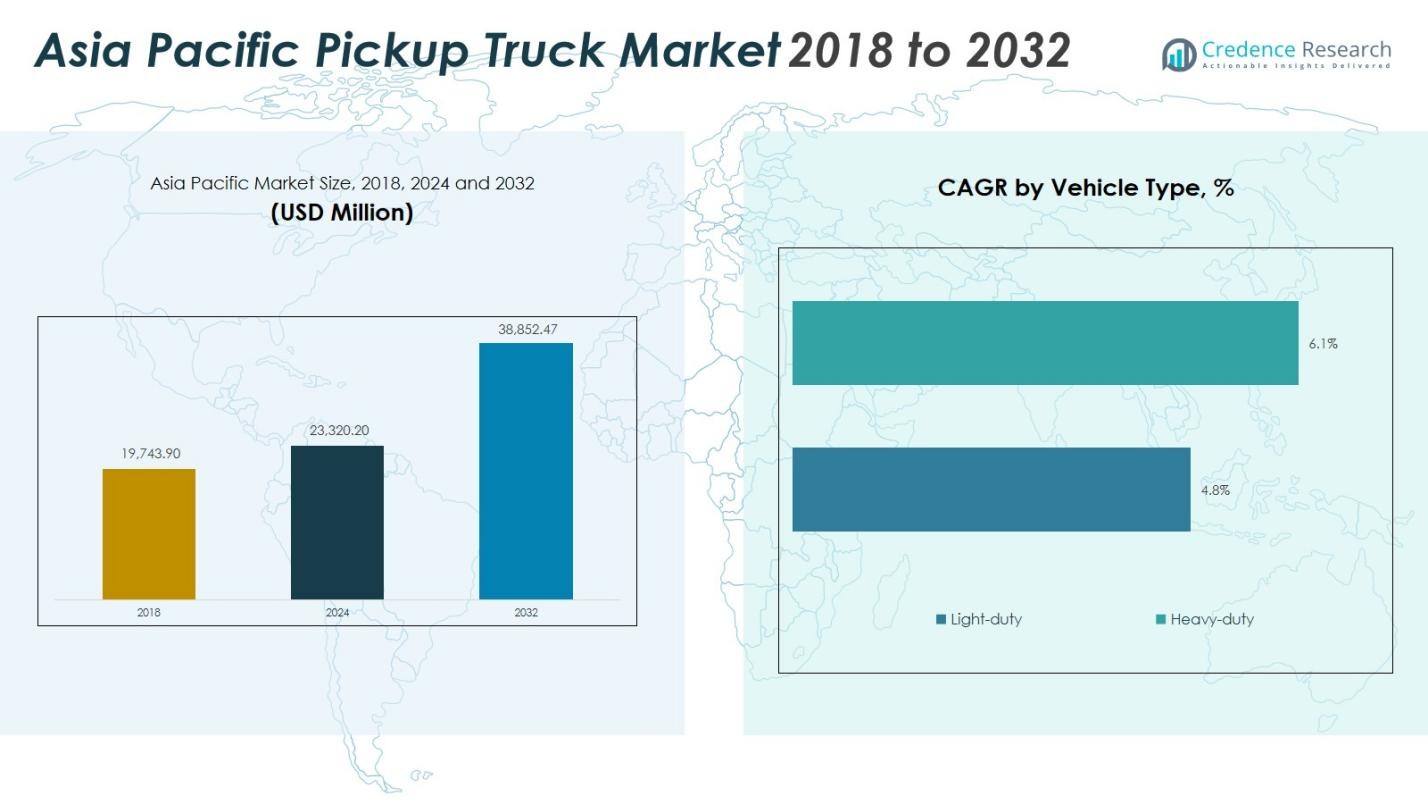

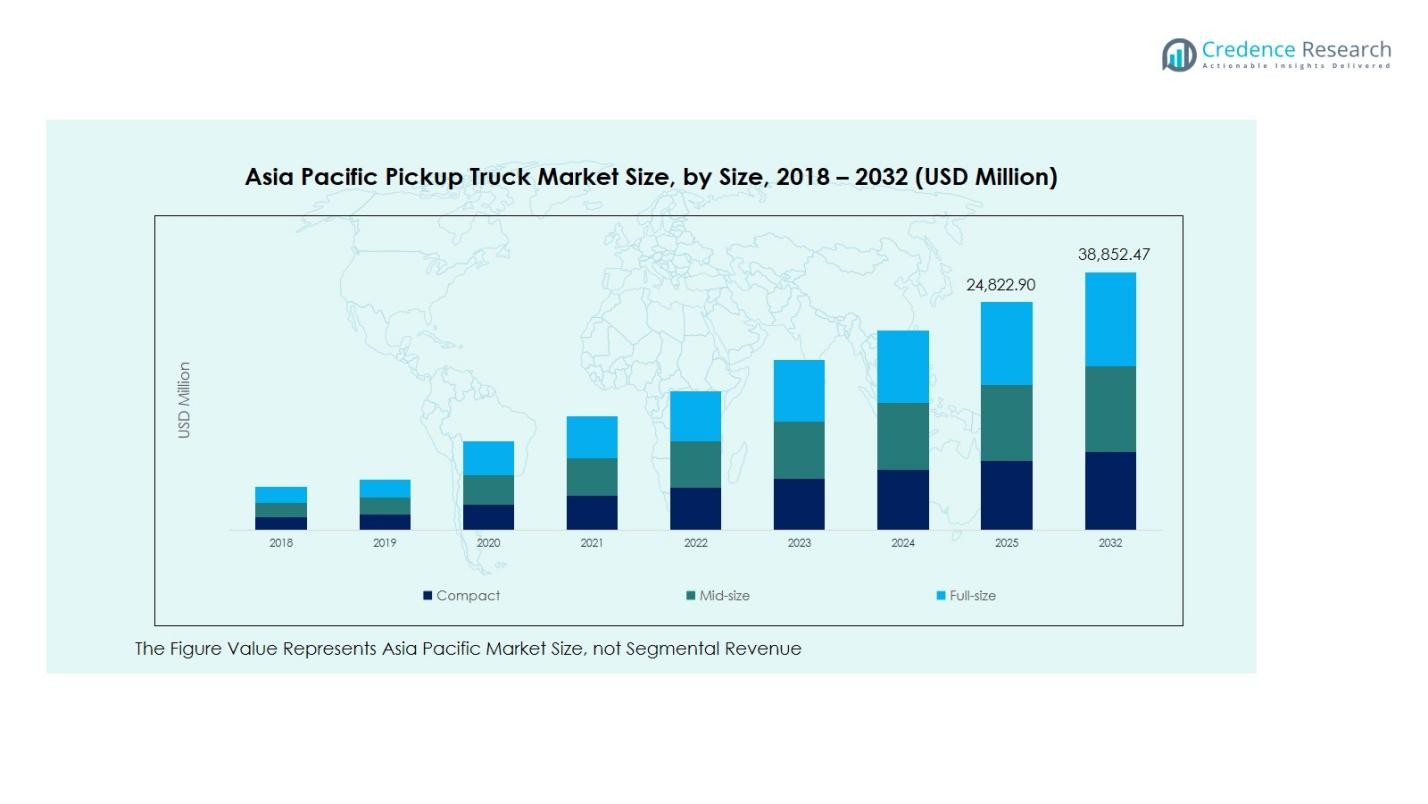

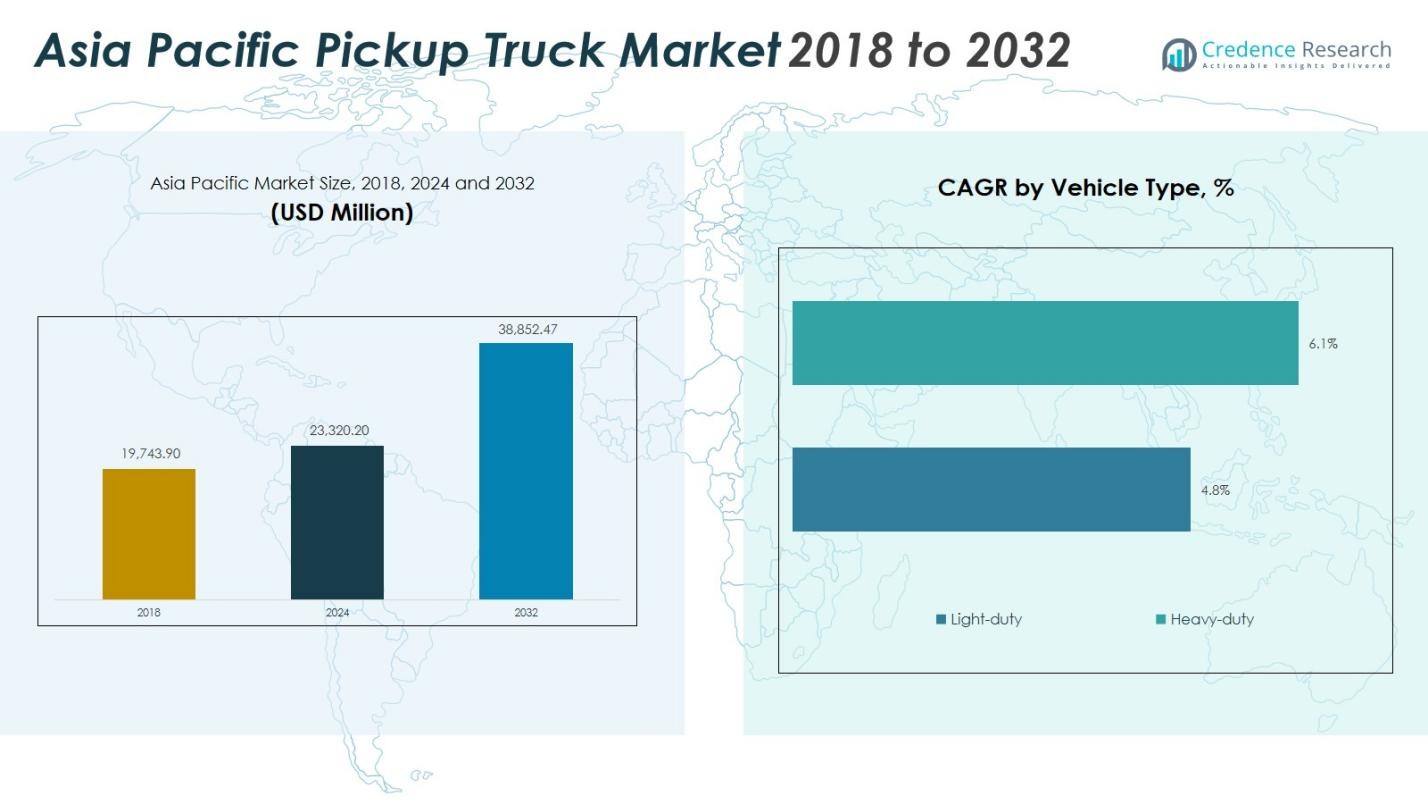

Asia Pacific Pickup Truck Market size was valued at USD 19,743.90 Million in 2018 to USD 23,320.20 Million in 2024 and is anticipated to reach USD 38,852.47 Million by 2032, at a CAGR of 6.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Pickup Truck Market Size 2024 |

USD 23,320.20 Million |

| Asia Pacific Pickup Truck Market, CAGR |

6.59% |

| Asia Pacific Pickup Truck Market Size 2032 |

USD 38,852.47 Million |

Asia Pacific Pickup Truck Market features key players such as Ford Motor Company, Isuzu Motors Ltd., Mitsubishi Motors Corporation, Nissan Motor Co., Ltd., and Tata Motors Ltd., each focusing on expanding product portfolios and integrating advanced powertrain technologies. These manufacturers are strengthening their foothold through innovative designs, increasing electrification, and tailored offerings for commercial and personal use. China emerges as the leading region, commanding 38.2% market share in 2024, driven by its rapidly growing logistics sector, robust infrastructure development, and rising adoption of electric pickup models. Other key markets include Japan, India, and Australia, each contributing significantly to regional growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Asia Pacific Pickup Truck Market size reached USD 23,320.20 Million in 2024 and is projected to grow at a CAGR of 6.59% through 2032.

- Growth is driven by rising industrial uptake, expanding construction activities, and increased use for commercial logistics, particularly in emerging economies such as India, Indonesia, and Vietnam.

- Key trends include the growing adoption of electric and hybrid pickup models, integration of connected vehicle technologies, and rising demand for mid-size and light-duty pickups for dual-purpose use.

- Leading manufacturers like Ford, Isuzu, and Tata Motors are expanding portfolios and local production while facing challenges from high total ownership costs and inconsistent regulatory frameworks across countries.

- China accounts for 38.2% of regional market share, followed by Japan with 16.5% and India with 14.9%, while the light-duty segment dominates overall with 63.5% share due to versatility, fuel efficiency, and suitability for urban and semi-urban applications.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Vehicle Type:

The Asia Pacific Pickup Truck Market is primarily dominated by the Light-duty segment, accounting for 63.5% share in 2024. This dominance stems from widespread use in commercial and personal applications, particularly in urban and semi-urban areas where maneuverability and fuel efficiency are key. Light-duty models are favored for transportation, last-mile logistics, and small business operations across markets in India, Japan, and Southeast Asia. Additionally, rising trends in adventure tourism and lifestyle utility are supporting steady growth. The Heavy-duty segment, while smaller, is gaining traction with infrastructure development and mining projects driving demand.

- For instance, in South India, small commercial vehicles such as pickup trucks are preferred for last-mile deliveries due to their ability to navigate narrow streets and congested areas efficiently, with manufacturers like Tata Motors and Mahindra playing key roles in this segment.

By Application:

The Commercial segment leads the Asia Pacific Pickup Truck Market with 48.2% market share in 2024. Commercial users rely heavily on pickup trucks for logistics, construction, agriculture, and small business operations, especially in developing economies like India, Indonesia, and the Philippines. Industrial applications follow, driven by sectors such as mining and energy. The Personal segment is also expanding due to lifestyle shifts and the popularity of pickup trucks as dual-purpose vehicles for family and recreation. Growing e-commerce penetration is further propelling the commercial use of pickups across the region.

- For instance, in India, pickup models like the Mahindra Bolero Camper and Isuzu D-Max are widely used by small businesses and farmers for their reliable load capacity and affordability.

By Fuel Type:

The Diesel segment dominates the Asia Pacific Pickup Truck Market with a market share of 68.4% in 2024. Diesel pickup trucks are preferred for their superior torque, towing capabilities, and fuel economy, making them suitable for both commercial and heavy-duty applications. Petrol variants hold a smaller share, appealing mainly to urban consumers with light-duty needs. The Electric segment, though nascent with a modest share, is expected to grow rapidly due to regional emission regulations, government incentives, and increasing adoption of EV platforms by leading manufacturers in China and South Korea.

Key Growth Drivers

Urbanization and Infrastructure Expansion

Rapid urbanization and expanding infrastructure across Asia Pacific continue to drive demand for pickup trucks, especially in emerging economies like India, Indonesia, and Vietnam. Government-led construction projects, industrial zones, and improvements in rural connectivity are boosting the need for versatile vehicles capable of handling diverse terrains and workloads. Pickup trucks are increasingly used for transportation of goods and machinery in developing areas, making them essential for economic activities. The segment is benefiting from ongoing investment in logistics and road networks, enhancing mobility and boosting commercial vehicle adoption.

- For instance, Indonesia’s industrial zones and mining expansions require robust heavy-duty trucks for transporting goods and machinery, supporting growth in commercial vehicle adoption.

Growing Popularity of Lifestyle and Personal Use

Pickup trucks are gaining popularity among personal and lifestyle users in Asia Pacific, driven by rising disposable incomes, adventure tourism, and a shift toward multifunctional vehicles. Consumers are attracted to pickups for their combination of utility, comfort, and performance attributes. Countries like Australia and China are seeing an uptick in 4WD and off-road models among young buyers. Additionally, social media and online communities are promoting pickup culture as a symbol of rugged independence, further contributing to the growth of this high-margin personal-use segment.

- For instance, social media influencers and online communities are actively promoting pickup culture as a symbol of rugged independence and outdoor lifestyle, especially across markets like Australia and China, boosting interest and sales in this high-margin segment.

Government Incentives and Emission Norms Encouraging EV Adoption

Government policies aimed at reducing emissions and promoting cleaner mobility are accelerating electric pickup adoption in the region. Subsidies, tax benefits, and infrastructure development for EVs in markets like China and South Korea are encouraging manufacturers to diversify their portfolios with electric variants. Prominent OEMs are introducing hybrid and fully electric pickups to meet tightening environmental regulations. This shift is also supported by rising fuel costs and growing awareness of sustainability among fleet operators and consumers, positioning electric pickups as a promising growth frontier in the long term.

Key Trends & Opportunities

Expansion of Connected and Smart Technologies

The Asia Pacific Pickup Truck Market is witnessing increased integration of connected vehicle technologies, such as telematics, in-vehicle diagnostics, and personalized infotainment systems. Smart safety features like ADAS, IoT-enabled fleet management tools, and autonomous-ready functionalities are making pickups more appealing to both commercial and personal users. The adoption of these features not only enhances performance and safety but also creates opportunities for OEMs to differentiate offerings and command premium pricing. Digital platforms and connectivity are also enabling fleet optimization and predictive maintenance across regional logistics networks.

- For instance, Tata Motors became the first in India to introduce trucks equipped with Advanced Driver Assistance Systems (ADAS) in 2022, including collision mitigation, lane departure warning, and driver monitoring systems, certified by the Automotive Research Association of India.

Rise of Electric and Hybrid Pickup Models

Electrification is emerging as a major trend, with OEMs launching electric and hybrid pickup models to tap into evolving environmental and regulatory landscapes. Markets like China are leading, driven by strong government support for EVs, while Japan and South Korea are investing in fuel cell and hybrid technologies. The opportunity lies in creating affordable, high-range electric pickups tailored to regional needs, including rural logistics and agricultural applications. Battery swapping, fast charging networks, and fleet electrification initiatives present significant growth avenues for industry players.

- For instance, in China, companies like Great Wall Motors, Dongfeng, and Geely’s Radar brand have launched or announced electric pickup models addressing rural logistics and commercial uses.

Key Challenges

High Total Ownership Costs

Despite increasing demand, high initial costs and ongoing maintenance expenses remain major challenges in the Asia Pacific Pickup Truck Market. Pickup trucks, especially diesel and 4WD variants, are often more expensive to purchase and operate compared to conventional passenger vehicles. Small businesses and individual buyers in price-sensitive markets face affordability barriers. The lack of widespread financing options and high insurance costs further limit adoption in rural and emerging areas. Manufacturers must find ways to reduce costs through localized production and flexible financing to broaden market access.

Regulatory Variability Across Regions

The region’s diverse regulatory landscape presents challenges for OEMs operating across multiple countries. Varying emission standards, safety requirements, import duties, and certification processes complicate product standardization and increase compliance costs. Emerging markets often lack harmonized regulations, forcing manufacturers to adapt models for specific markets, which affects economies of scale. In addition, sudden changes in policies—such as EV incentive alterations or fuel regulation shifts—can disrupt production planning and investment decisions. Harmonizing standards and anticipating policy changes will be essential for mitigating risks and ensuring sustained growth.

Regional Analysis

China

China leads the Asia Pacific Pickup Truck Market with a market share of 38.2% in 2024. The country’s rapidly expanding construction, logistics, and e-commerce sectors are driving high demand for pickup trucks, especially in tier 2 and 3 cities. Government support for rural mobility and commercial fleet electrification, coupled with rising middle-class aspirations for lifestyle vehicles, is bolstering market growth. Chinese manufacturers like Great Wall Motors and BYD are accelerating innovations in electric pickups to meet sustainability goals. Increasing availability of hybrid and electric models further strengthens China’s position as the region’s dominant pickup market.

Japan

Japan holds a 16.5% share of the Asia Pacific Pickup Truck Market in 2024, driven by advanced automotive engineering, strong export activity, and a growing focus on compact utility vehicles. While domestic demand remains modest compared to SUVs and minivans, the country’s manufacturing strength and technological leadership help drive high-quality exports across Asia and beyond. The shift toward low-emission vehicles and the adoption of hybrid and battery-electric pickup models is progressing, supported by national priorities for carbon neutrality. Japanese brands like Toyota, Nissan, and Mitsubishi continue to influence regional pickup trends through durability and technological innovation.

South Korea

South Korea accounts for 8.7% of the Asia Pacific Pickup Truck Market in 2024, fueled by rising consumer interest in versatile lifestyle vehicles and expanding rural logistics. The market is poised for further growth as domestic brands like Hyundai and Kia introduce advanced pickup models, including electric and fuel-cell variants. South Korea’s focus on hydrogen mobility and smart vehicle technologies, alongside government incentives for zero-emission vehicles, is shaping a modern pickup ecosystem. The country’s strong infrastructure and digital adoption also encourage integration of telematics and AI-driven features, reinforcing its strategic presence in the regional market.

India

India holds a 14.9% share of the Asia Pacific Pickup Truck Market in 2024, driven by rapid urbanization, infrastructure investments, and rising small business activity. Pickup trucks are increasingly replacing traditional light commercial vehicles in applications such as goods transportation, rural mobility, and last-mile delivery. Leading domestic manufacturers like Tata Motors and Mahindra are introducing compact and robust models tailored to price-sensitive buyers. Government initiatives for rural development, road connectivity, and emission standards are enhancing demand for both diesel and emerging electric models. India’s vibrant SME ecosystem continues to stimulate steady growth in this segment.

Australia

Australia commands a 10.3% share of the Asia Pacific Pickup Truck Market in 2024, reflecting its strong pickup culture and widespread use of 4WD utility vehicles. Pickup trucks are preferred for both commercial workloads and lifestyle use, including off-road recreation, towing, and rural transport. Models like the Ford Ranger and Toyota Hilux remain popular due to reliability and high towing capacity. The market is moving toward electrification, supported by rising environmental consciousness and infrastructure readiness. Australia’s vast geography and diverse terrain further strengthen demand for durable, high-performance pickups suited to tough conditions.

Southeast Asia

Southeast Asia contributes 7.8% to the Asia Pacific Pickup Truck Market in 2024, with growing demand centered in Thailand, Indonesia, and the Philippines. Pickup trucks are widely used for agriculture, construction, and small business logistics due to their adaptability and cost-efficiency. Thailand serves as a regional manufacturing hub, exporting models across ASEAN markets. Increasing urban logistics and e-commerce demand, coupled with developing road infrastructure, are driving adoption. While diesel dominates, there is growing interest in hybrid and electric pickups, especially in urbanized areas, as governments push for greater adoption of clean transportation technologies.

Rest of Asia Pacific

The Rest of Asia Pacific region holds a 3.6% share of the Asia Pacific Pickup Truck Market in 2024, driven by emerging demand in countries like New Zealand, Pakistan, and smaller South Asian economies. These markets are gradually adopting pickup trucks as essential vehicles for agriculture, tourism, and infrastructure projects. Limited local manufacturing presents opportunities for imports from China, Japan, and Thailand. While growth is steady, challenges include affordability, limited financing options, and evolving regulatory frameworks. However, increasing economic development and trade activity across these countries is expected to contribute modestly to market expansion over the forecast period.

Market Segmentations:

By Vehicle Type

By Application

- Commercial

- Industrial

- Personal

- Others

By Fuel Type

By Size

- Compact

- Mid-size

- Full-size

By Towing Capability

- Light towing (Up to 7,500 lbs)

- Medium towing (7,501–12,000 lbs)

- Heavy towing (12,001+ lbs)

By Region

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Competitive Landscape

The competitive landscape of the Asia Pacific Pickup Truck Market is shaped by leading players including Ford Motor Company, Isuzu Motors Ltd., Mitsubishi Motors Corporation, Nissan Motor Co., Ltd., Tata Motors Ltd., Mahindra & Mahindra Ltd., BYD Auto Co., Ltd., Dongfeng Motor Corporation, SAIC Motor Corporation Limited, and Suzuki Motor Corporation. These manufacturers compete based on product differentiation, brand strength, and regional adaptability. Japanese and American brands remain strong in mid-size and light-duty categories, while Chinese players are gaining traction in electric pickups and value-oriented offerings. Domestic companies in India and Southeast Asia are focusing on cost-effective, rugged models for commercial use. Increasing investments in electrification, connected technology, and safety features are reshaping the product landscape, with a rising emphasis on sustainability and regulatory compliance. Strategic partnerships, local manufacturing, and after-sales support are central to maintaining competitiveness as customer preferences shift toward modern, multifunctional, and fuel-efficient pickup models across the region.

Key Player Analysis

- Ford Motor Company

- Isuzu Motors Ltd.

- Mitsubishi Motors Corporation

- Nissan Motor Co., Ltd.

- Tata Motors Ltd.

- Mahindra & Mahindra Ltd.

- BYD Auto Co., Ltd.

- Dongfeng Motor Corporation

- Foton Motor Group

- SAIC Motor Corporation Limited

- Jiangling Motors Corporation (JMC)

- Suzuki Motor Corporation

Recent Developments

- In March 2025, KG Mobility (South Korea) officially launched the electric pickup truck “Musso EV”.

- In January 2025, Dongfeng Nissan (via its Zhengzhou Nissan JV) introduced the Z9 pickup truck (ICE version) in China, production from January 2025.

- In March 2024, Toyota Motor Corporation announced that it plans to mass-produce a battery-electric version of its Hilux pickup truck by the end of 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Fuel Type, Size, Towing Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Asia Pacific Pickup Truck Market will continue to grow, driven by demand in both commercial and personal segments.

- Electrification will accelerate as manufacturers introduce more hybrid and electric pickup models.

- Government regulations on emissions will push automakers to adopt cleaner powertrain technologies.

- Digital connectivity and smart vehicle systems will increasingly influence consumer preferences.

- Light-duty pickup trucks will dominate due to versatility in urban and semi-urban regions.

- Expansion of rural infrastructure will boost demand for pickups in agricultural and construction sectors.

- China will maintain its leadership as innovation and production hub for electric pickups.

- Increasing interest in lifestyle and recreational pickup use will support mid-size and full-size segment adoption.

- Growing investment in hydrogen and alternative fuels will present new growth opportunities.

- OEMs will focus on localized production, strategic partnerships, and warranty services to enhance market presence.

Market Segmentation Analysis:

Market Segmentation Analysis: