Market Overview

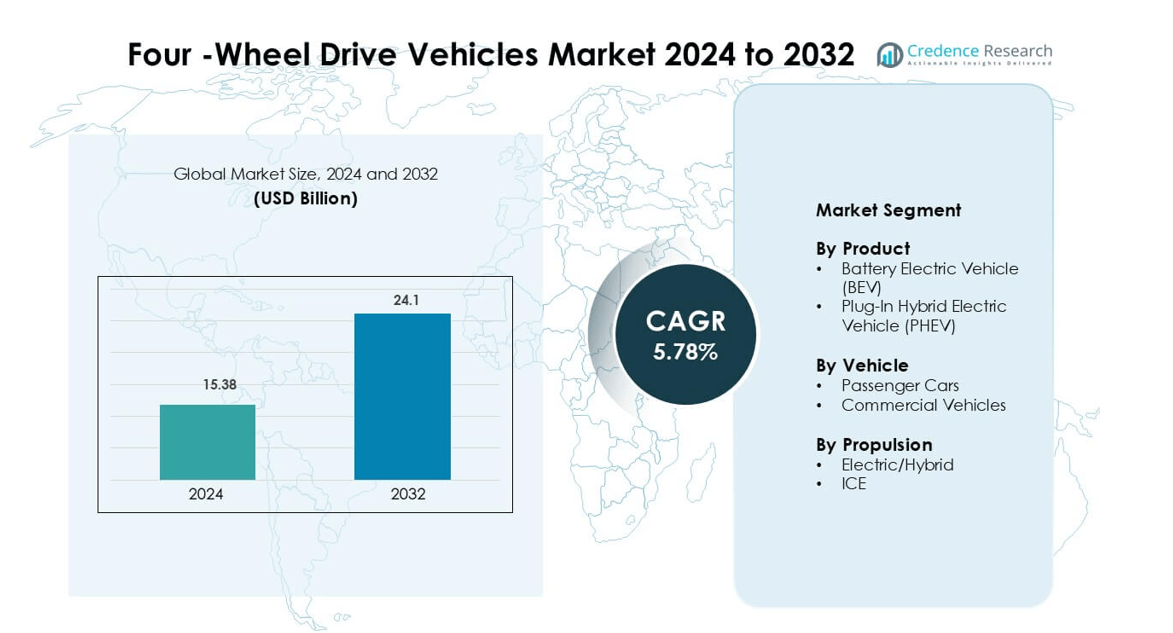

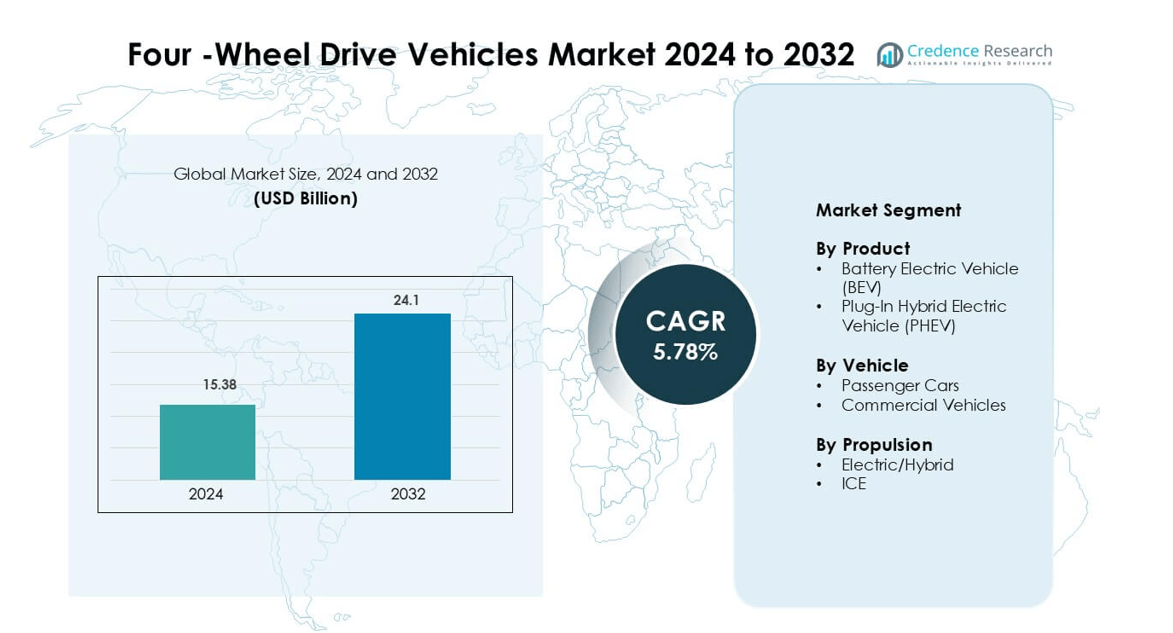

Four Wheel Drive Vehicles Market was valued at USD 15.38 billion in 2024 and is anticipated to reach USD 24.1 billion by 2032, growing at a CAGR of 5.78 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Four Wheel Drive Vehicles Market Size 2024 |

USD 15.38 billion |

| Four Wheel Drive Vehicles Market, CAGR |

5.78% |

| Four Wheel Drive Vehicles Market Size 2032 |

USD 24.1 billion |

Major players in the four-wheel drive vehicles market include Toyota Motor Corporation, BMW AG, Mercedes-Benz Group AG, Tata Motors Limited, Jaguar Land Rover Limited, Hyundai Motor India, Mahindra & Mahindra Ltd., JSW MG Motor India Pvt. Ltd., Olectra Greentech Limited, and Audi AG. These companies compete across SUVs, pickups, luxury vehicles, and electrified 4WD platforms. Automakers invest in advanced traction control, dual-motor systems, and smart off-road modes to improve safety and performance across urban and rugged terrains. North America leads the global market with more than 35% share, supported by strong demand for utility vehicles, off-road models, and premium pickup trucks.

Market Insights

- The four-wheel drive vehicles market reached a multi-billion-dollar valuation at USD 15.38 billion by 2024 and is projected to grow at a steady CAGR of 5.78% through 2032.

- Rising demand for SUVs and crossovers acts as a major driver, supported by buyers seeking safety, stability, and off-road capability.

- Electrified 4WD platforms emerge as a key trend, with dual-motor EVs gaining traction in passenger cars and premium SUVs while mechanical systems continue in diesel and gasoline pickups.

- Competition remains intense as Toyota, Mercedes-Benz, BMW, Tata Motors, Mahindra & Mahindra, and others expand hybrid and electric 4WD portfolios, while cost and emission regulations create restraints for traditional ICE models.

- North America leads the market with more than 35% share, followed by Europe at nearly 28%, while Battery Electric Vehicles dominate the product segment and passenger cars hold the highest vehicle share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Battery Electric Vehicles (BEVs) lead the product segment with more than 65% market share in four-wheel drive electric platforms. Automakers use dual-motor setups to deliver higher torque and faster wheel response compared to mechanical AWD. Growth comes from performance SUVs, premium crossovers, and off-road EVs. Government incentives for zero-emission models support BEV dominance across Europe, China, and the U.S. Major manufacturers focus on higher-capacity batteries and advanced thermal management, which improve range while supporting high-load traction in snow, mud, and highway speeds.

- For instance, Tesla equips the Model X Dual Motor AWD with two independent drive units that produce 670 horsepower and deliver a 0–100 km/h time of 3.9 seconds, while active liquid-cooled battery modules stabilize cell temperature for sustained peak power.

By Vehicle

Passenger cars hold over 70% share in the four-wheel drive vehicle market due to rising demand for SUVs and crossovers. Families, fleet buyers, and urban users prefer 4WD for safety, comfort, and road stability. Automakers add intelligent torque vectoring, hill control, and real-time traction systems in compact and mid-size models, which expands adoption. Commercial vehicles gain traction in mining, construction, and logistics, yet remain smaller in volume. Growing leisure tourism and rural road connectivity further strengthen passenger-car leadership worldwide.

- For instance, Subaru equips its Forester AWD with an active torque split system linked to a 2.0-liter flat-four engine and Lineartronic CVT, delivering automatic torque transfer between front and rear wheels for slippery roads.

By Propulsion

ICE-based four-wheel drive vehicles remain the dominant propulsion type with nearly 75% share, driven by strong sales in pickup trucks, SUVs, and off-road models. Diesel and gasoline engines paired with low-range gearboxes and locking differentials offer proven power for towing and uneven terrains. However, electric and hybrid 4WD is rapidly expanding due to regulatory pressure and fuel-economy targets. Dual-motor electric drivetrains eliminate mechanical shafts and reduce maintenance. Automakers launch hybrid SUVs with electric rear-axle drive systems, which improve efficiency while maintaining 4WD capability.

Key Growth Drivers

Growing Demand for SUVs and Crossovers

The surge in SUV and crossover sales remains a primary driver for the four-wheel drive vehicle market. Buyers prefer these models for better ground clearance, long-distance comfort, and improved safety in wet or uneven road conditions. Automakers respond by offering 4WD as standard or optional in compact, mid-size, and premium segments. Urban families also adopt 4WD models for weekend travel and rural road connectivity. Developing regions with challenging road infrastructure strengthen the shift toward sport utility vehicles. Premium brands add advanced traction control, torque vectoring, and real-time wheel engagement, improving stability during cornering and off-road driving. This broad consumer appeal ensures steady demand from both personal and fleet buyers.

- For instance, Land Rover’s Defender AWD system uses an 8-speed automatic gearbox and twin-speed transfer case, pairing with an electronic active differential to distribute torque across wheels for steep climbs and uneven trails.

Rapid Technological Advancements in Drivetrain Systems

Constant improvements in driveline electronics, lightweight axle construction, and multi-mode control boost the appeal of modern 4WD platforms. Electronic Limited Slip Differential and torque-on-demand technologies allow instant power transfer without the mechanical drag of older systems. Electric SUVs now use dual-motor or tri-motor layouts to achieve precise wheel control and high torque output within milliseconds. Hybrid models combine electric rear-axle drive with ICE front-wheel drive for better traction and fuel economy. Automakers also integrate predictive traction software that analyzes road surface, throttle input, and steering angle to deliver efficient power distribution. These innovations make 4WD vehicles more efficient, lighter, and responsive for highway, city, and recreational use.

- For instance, Audi’s e-tron quattro uses two asynchronous motors producing a combined 300 kW and distributes torque electronically within milliseconds, supported by a software-controlled differential that optimizes wheel grip.

Rising Off-Road Recreation and Adventure Tourism

Adventure travel, camping, and overlanding activities are growing across North America, Australia, Europe, and emerging Asian markets. Consumers want vehicles capable of handling rocky trails, sand dunes, snow-covered roads, and river crossings. Manufacturers introduce factory-built off-road editions with enhanced suspension, reinforced underbody protection, and advanced crawl-control functions. Pickups and SUVs with 4WD systems support towing of caravans and sports equipment, driving demand among recreational buyers. Rental and tourism operators add rugged fleet vehicles for safaris and mountain tourism. The lifestyle shift toward outdoor leisure reinforces long-term adoption of capable 4WD vehicles across multiple price ranges.

Key Trends and Opportunities

Shift Toward Electrified 4WD Platforms

A key trend involves migration from mechanical linkages to electric-based 4WD systems. Electric SUVs use motor-driven axles with independent wheel control, enabling stronger torque and smoother acceleration. Vehicle weight reduces because prop-shafts and differential units are eliminated. Automakers are developing tri-motor powertrains that deliver sports-car performance with zero tailpipe emissions, attracting performance-focused buyers. Governments offering EV incentives accelerate consumer shift. Suppliers also design compact e-axles that fit smaller vehicles and commercial vans, opening new adoption opportunities.

- For instance, Tesla equips its Model S Plaid with a tri-motor AWD setup delivering 760 kW and channeling power to each axle independently, helping the sedan achieve a 0–100 km/h time of 2.1 seconds under controlled conditions.

Integration of Smart Software and Predictive Traction Control

Advanced driver-assistance systems now manage traction, wheel slip, and braking in real time. Four-wheel drive vehicles feature terrain modes such as mud, snow, sand, and rock, optimizing torque distribution with one button. Sensor-based predictive software analyzes steering angle, slope, throttle input, and road roughness, helping prevent skidding or wheel spin. Connected vehicles link traction systems with navigation to prepare for upcoming weather or elevation changes. This trend creates opportunities for chipset makers, AI developers, and drivetrain suppliers.

- For instance, Ford’s Terrain Management System in the Bronco uses G.O.A.T. modes paired with an electronic locking differential and transfers torque within milliseconds to prevent spin on sand or rock trails.

Key Challenges

High Vehicle and Ownership Costs

One major challenge for the four-wheel drive market is cost. Multi-axle architecture, reinforced suspension, and advanced traction electronics raise manufacturing expenses. Premium EVs with multi-motor layouts also increase pricing. In developing markets, buyers often choose cheaper front-wheel or rear-wheel drive options. Higher maintenance, fuel consumption, and insurance make long-term ownership costly for price-sensitive customers. These factors limit mass adoption unless companies introduce budget-friendly models with simpler electronic 4WD systems.

Regulatory Pressure and Emission Compliance

Stringent emission regulations across Europe, China, and North America push automakers to reduce fuel consumption and CO₂ output. Traditional ICE-based four-wheel drive vehicles face efficiency concerns due to increased drivetrain weight. Manufacturers must invest heavily in electrified axles, hybrid systems, lightweight materials, and aerodynamic designs to meet targets. Compliance adds engineering and sourcing challenges, particularly for diesel-based 4WD markets. Without electric transition, conventional 4WD models risk restricted sales in future urban zones, tightening long-term growth potential.

Regional Analysis

North America

North America holds the largest share of the four-wheel drive vehicles market at over 35%, driven by strong demand for SUVs, pickups, and off-road models. The U.S. leads due to high personal vehicle ownership, wide road networks, adventure tourism, and preference for large utility vehicles. Automakers offer 4WD as standard in premium trucks and sport utility models, while electric brands expand dual-motor variants for improved traction. Canada shows rising adoption for snow-prone regions. Fleet and agricultural buyers also contribute to steady replacement demand. Continuous model launches and advanced drivetrains reinforce the region’s leadership.

Europe

Europe accounts for nearly 28% of the global market share, supported by premium SUV sales, strong safety regulations, and consumer preference for all-weather driving capability. Germany, the U.K., France, and Nordic countries lead due to wet, icy, and mountainous road conditions. Luxury brands continue to introduce hybrid and electric 4WD versions, which comply with emission rules while maintaining performance. European customers value vehicle stability, advanced driver assistance, and smart traction control. Growth in electric 4WD SUVs and compact crossovers supports long-term regional demand.

Asia Pacific

Asia Pacific holds close to 30% share and remains the fastest-growing region. China, Japan, South Korea, India, and Australia drive adoption, supported by rising income levels, expanding SUV sales, and rural connectivity needs. China promotes electrified 4WD through subsidies, while Japan and South Korea expand hybrid 4WD across compact and mid-size segments. Australia’s off-road culture and mining industry create consistent demand for rugged trucks and utility vehicles. Regional production capacity from global and domestic automakers strengthens supply availability and competitive pricing, boosting market penetration.

Latin America

Latin America represents around 5% of the four-wheel drive vehicles market, led by Brazil, Mexico, Argentina, and Chile. Dirt roads, uneven terrain, and expanding agriculture and construction sectors create stable demand for pickups and utility SUVs. Off-road editions and diesel 4WD models remain popular for rural transport and fleet usage. Economic challenges limit premium adoption, yet mid-range SUVs with electronic traction control gain traction. Local manufacturing and import policies influence pricing and availability. Adventure tourism in Chile and Argentina also contributes to niche growth.

Middle East & Africa

The Middle East & Africa region holds nearly 4% market share, driven by desert terrain, oilfield operations, and preference for high-performance SUVs. The UAE and Saudi Arabia show strong sales of luxury 4WD models for off-roading and highway travel. Africa’s mining, agriculture, and logistics operations need durable pickups and commercial 4WD fleets. However, limited charging infrastructure restricts electrified 4WD. Brands focus on diesel and gasoline models with reinforced suspension and high ground clearance. Growing road development and tourism support gradual long-term expansion.

Market Segmentations:

By Product

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

By Vehicle

- Passenger Cars

- Commercial Vehicles

By Propulsion

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the four-wheel drive vehicles market includes global automakers and regional manufacturers competing across SUVs, pickups, premium sedans, and electric platforms. Companies focus on drivetrain efficiency, smart traction control, and electrified 4WD systems to meet emission norms and customer performance expectations. Premium brands invest in dual-motor and torque-vectoring technologies to deliver faster wheel response and improved off-road capability. Mid-segment manufacturers offer budget-friendly 4WD SUVs and utility vehicles for rural and commercial use. Partnerships with battery suppliers, software developers, and autonomous technology firms strengthen long-term portfolios. Companies also expand localization of production to reduce costs and increase market reach. Frequent product launches, hybrid 4WD adoption, and off-road special editions keep competition active across developed and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Toyota Motor Corporation unveiled the ninth-gen Hilux, adding a fully electric version while retaining 4×4 options. Global rollout begins in December 2025.

- In October 2025, Mahindra & Mahindra Ltd. launched the Thar facelift at ₹9.99 lakh, keeping 4WD and RWD drivetrains. The refresh strengthens Mahindra’s off-road SUV line.

- In January 2025, BMW AG introduced the all-new X3 with xDrive all-wheel drive in India. Bookings opened immediately; deliveries started April 2025

Report Coverage

The research report offers an in-depth analysis based on Product, Vehicle, Propulsion and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electrified 4WD systems will expand as dual-motor and e-axle technologies mature.

- Hybrid SUVs will gain wider adoption to balance power and fuel efficiency.

- Premium brands will introduce more torque-vectoring and predictive traction software.

- Compact and mid-size SUVs will feature affordable electronic 4WD options.

- Adventure tourism and off-road recreation will continue to drive demand.

- Pickup trucks will retain strong market presence for towing and commercial use.

- Lightweight materials and thermal management advances will improve drivetrain efficiency.

- Autonomous and ADAS features will integrate deeper with traction and stability control.

- Charging infrastructure growth will support electric 4WD adoption in emerging regions.

- Manufacturers will expand localization to reduce cost and improve supply chain resilience.