Market Overview

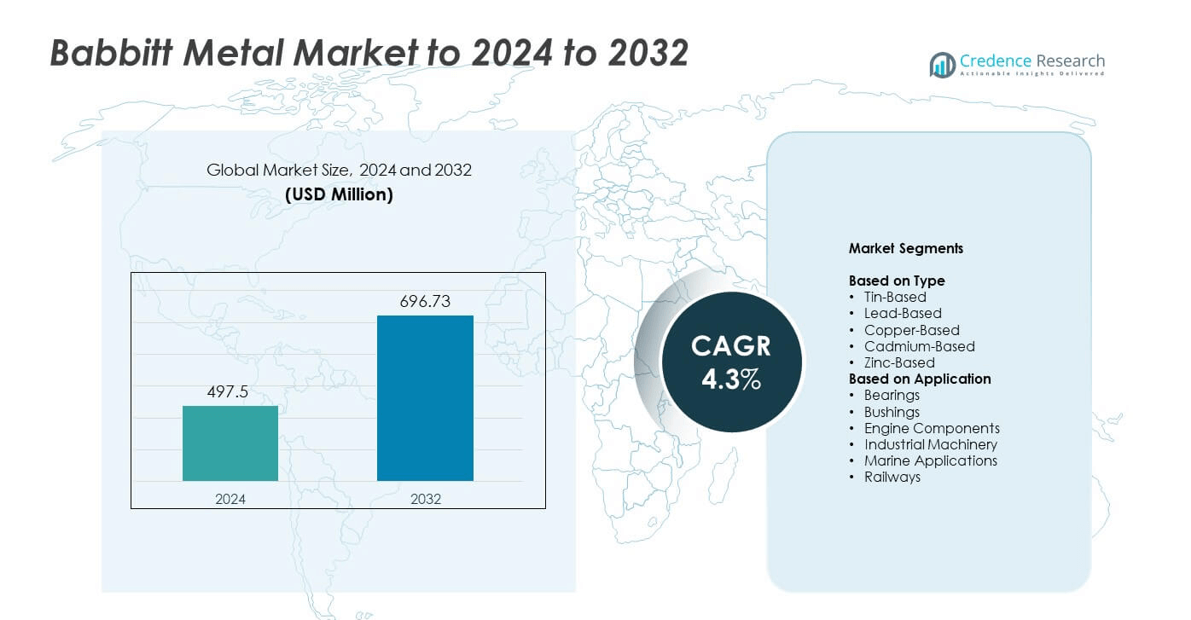

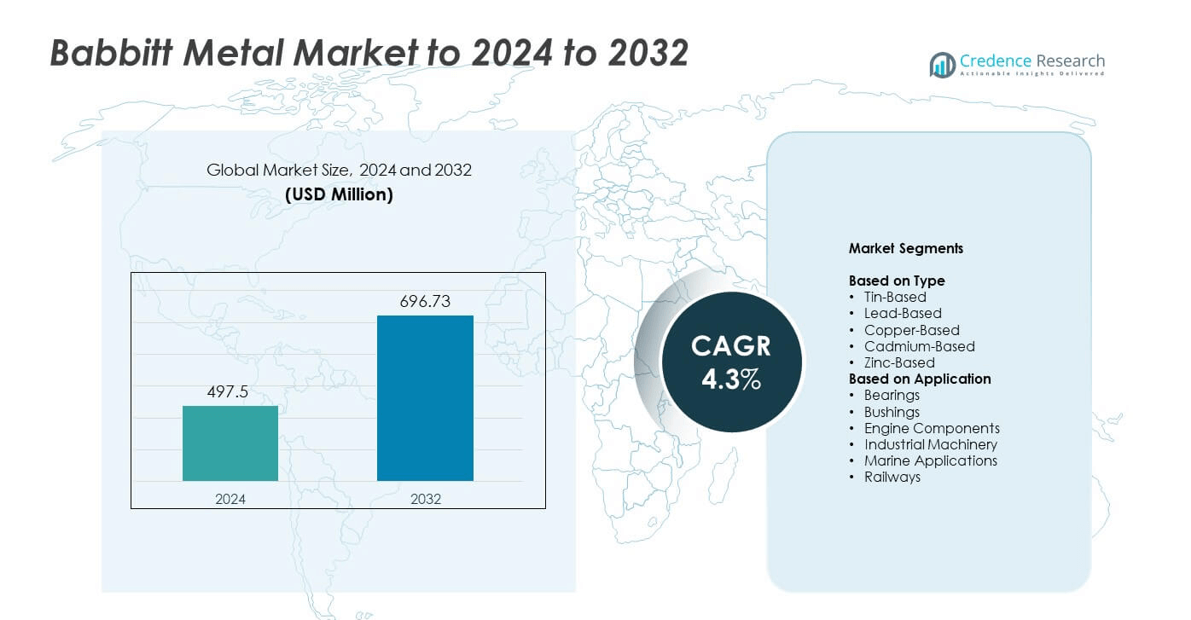

Babbitt Metal Market size was valued USD 497.5 million in 2024 and is anticipated to reach USD 696.73 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Babbitt Metal Market Size 2024 |

USD 497.5 million |

| Babbitt Metal Market, CAGR |

4.3% |

| Babbitt Metal Market Size 2032 |

USD 696.73 million |

The Babbitt Metal Market is shaped by major players such as Morgan Advanced Materials, Atlas Bronze, Timken, RotoMetals, MetalTek International, Tin Bronze, National Bronze Mfg., Concast Metal Products, Belmont Metals, and Bearing Bronze Limited. These companies compete through advanced alloy development, improved casting processes, and strong aftermarket service networks that support machinery refurbishment across heavy industries. North America leads the global market with about 34% share in 2024, driven by large-scale industrial operations and frequent maintenance cycles. Europe holds around 28% share, supported by strong marine, rail, and manufacturing activity, while Asia Pacific follows with nearly 24% share due to expanding industrial production.

Market Insights

- The Babbitt Metal Market reached USD 497.5 million in 2024 and is projected to hit USD 696.73 million by 2032, growing at a CAGR of 4.3%.

- Strong demand for high-performance bearing linings drives the market, with bearings holding about 52% share and tin-based alloys leading the type segment with roughly 46% share due to durability and reliability.

- Manufacturers adopt cleaner, lead-free alloys and improved casting technologies, while industries increase refurbishment of turbines, compressors, and marine engines, reinforcing steady aftermarket growth.

- Competition remains intense as global suppliers focus on enhanced alloy strength, fatigue resistance, and service capabilities to secure long-term OEM and maintenance contracts across heavy industries.

- North America leads with around 34% share, followed by Europe at about 28% and Asia Pacific at nearly 24%, while Latin America (8%) and the Middle East & Africa (6%) maintain consistent demand through industrial and marine maintenance activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Tin-based alloys lead this segment with about 46% share in 2024 due to strong fatigue resistance, low friction, and high load-carrying ability used across heavy industrial bearings. Manufacturers prefer tin compositions because these alloys provide stable performance under high speeds and fluctuating loads, which supports longer equipment life. Lead-based grades remain relevant in legacy systems, while copper-based, cadmium-based, and zinc-based variants serve niche uses where hardness or corrosion resistance is required. Demand for tin-based materials continues to grow as end users upgrade rotating equipment in power, steel, and chemical plants.

- For instance, Kapp Alloy & Wire Inc. lists its Grade 2 tin-based Babbitt with a density of 7.39 g/cm³ and a Brinell hardness of 24.5 at room temperature.

By Application

Bearings dominate this segment with nearly 52% share in 2024 as Babbitt metal remains the preferred lining material for hydrodynamic and journal bearing systems. The segment grows because these alloys deliver excellent conformability, embeddability, and wear resistance, which helps operators maintain reliable motion in turbines, compressors, pumps, and rolling mills. Bushings and engine components follow due to rising refurbishment activity in automotive and diesel engines. Marine, railway, and industrial machinery applications expand steadily as manufacturers replace worn components to improve uptime and reduce maintenance cycles.

- For instance, Kingsbury states its flooded tilting pad journal bearings run at speeds up to 70 m/s (13,790 ft/min). Its LEG (Leading Edge Groove) directed-lubrication design is rated for speeds up to 110 m/s (21,670 ft/min)

Key Growth Drivers

Rising demand for high-performance bearing materials

Growing use of turbines, compressors, and large rotating systems boosts demand for durable bearing linings. Babbitt alloys offer low friction, strong embeddability, and stable performance under heavy loads. Industries replace older linings to improve uptime and reduce failure risk. Power plants and steel mills upgrade machinery as part of reliability programs. These upgrades drive steady adoption of tin-based and copper-enhanced Babbitt metals. The push for longer service life strengthens interest in premium alloys. This factor stands as a primary growth driver.

- For instance, general published specifications for tin-based Babbitt alloys that conform to the ASTM B23 Grade 3 standard typically show an ultimate compressive strength of approximately 17,600 psi (121.3 MPa or 121.4 MPa) and a compressive yield strength (at 0.1% permanent set) of around 6,600 psi (45.5 MPa), with a Brinell hardness of 27 at 20 °C.

Expansion of industrial machinery production

Manufacturers increase output of pumps, motors, and gear systems used across heavy industries. These machines depend on reliable Babbitt-lined bearings that handle vibration and continuous speed changes. Growing investment in manufacturing, mining, and refining sectors supports higher consumption of these alloys. Many facilities expand machine fleets to raise throughput. This trend strengthens material demand in OEM and replacement markets. Stable use in rotating assemblies helps secure long-term growth. This factor also acts as a key growth driver.

- For instance, Grundfos produces more than 16 million pump units per year worldwide and employed approximately 20,000 people across more than 60 countries as of its 2024 annual report and company statistics in 2025.

Maintenance and refurbishment of aging equipment

Many plants operate decades-old turbines, engines, and compressors that need frequent restoration. Babbitt metal is widely used during overhaul cycles to rebuild worn bearings and bushings. Companies extend asset life through planned shutdowns, creating recurring demand. Railways, marine fleets, and industrial mills rely on re-babbitting to avoid costly replacements. Service providers upgrade alloy grades to improve durability. This steady refurbishment cycle moves large volumes across the aftermarket. This remains a major growth driver for the market.

Key Trends and Opportunities

Shift toward tin-rich and environmentally safer alloys

Industries move away from lead-heavy formulations due to safety rules and emission norms. Tin-based alloys gain traction because they deliver clean handling and stronger fatigue resistance. Buyers prefer these grades to meet regulatory standards without losing performance. Alloy developers research new tin-copper blends for better stability. This shift improves long-term market potential for premium compositions. Suppliers promoting eco-compliant materials gain wider acceptance. This remains a significant trend and opportunity.

- For instance, ECKA Granules’ Tegostar 738 white-metal alloy is specified with an ultimate compressive strength of approximately 19,300 psi (133 MPa) at 20 °C, a compressive yield strength (at 0.1% permanent set) of approximately 12,660 psi (87.3 MPa) at 20 °C, a Brinell hardness of 26 at 20 °C, and a tin-based composition of about 81.3 % Sn, 12.0 % Sb, and 6.0 % Cu (with minor additions of zinc and silver).

Growth of predictive maintenance and digital monitoring

Industries adopt sensors and monitoring tools to track bearing temperature and vibration. Babbitt-lined systems benefit because operators detect wear early and plan timely relining. This approach improves reliability and reduces sudden breakdowns. Digital maintenance adoption raises demand for high-quality linings that work with modern systems. Many plants integrate monitoring into large rotating equipment fleets. This increases replacement frequency and material usage. This development stands as a key trend and opportunity.

- For instance, SKF’s QuickCollect sensor supports vibration time-waveform sampling rates from 256 Hz to 25.6 kHz with FFT analysis up to 10 kHz, and its built-in infrared sensor can measure bearing surface temperatures up to 100 °C for short periods, enabling condition-based monitoring of Babbitt-lined bearing housings in rotating equipment.

Rising adoption in marine and rail modernization

Marine engines and locomotives undergo phased modernization to improve fuel efficiency. These upgrades often include rebuilding main bearings, crankshaft supports, and propulsion systems. Babbitt alloys remain preferred due to strong conformability under dynamic loads. Shipyards and rail workshops invest in advanced casting and centrifugal bonding methods. Growing global cargo movement supports steady maintenance cycles. This widens opportunities for suppliers in heavy transport sectors. This also forms an important trend and opportunity.

Key Challenges

Volatility in raw material prices

Tin, copper, and zinc costs fluctuate due to mining output and global demand shifts. These swings affect production expenses and weaken pricing stability for manufacturers. Many small suppliers struggle to manage sudden spikes in alloy input costs. Fluctuation reduces margin predictability in long-term contracts. Buyers sometimes delay procurement during high-price cycles. This creates uneven demand across industrial segments. This issue remains a key challenge for the market.

Competition from advanced composite and polymer bearings

New composite and engineered polymer bearings gain adoption in moderate-load uses. These materials offer corrosion resistance and require little lubrication. Some industries shift toward these solutions to reduce maintenance complexity. This limits Babbitt metal use in selected light-duty systems. Manufacturers respond with stronger alloy grades, but competition stays firm. Growth in composite adoption may restrict certain applications. This factor stands as another major challenge.

Regional Analysis

North America

North America holds about 34% share in 2024 and leads the market. Strong demand comes from power plants, steel mills, and marine repair yards. Many facilities run large rotating machines that need frequent bearing relining. Maintenance teams prefer tin-based and copper-enhanced alloys for reliability. The U.S. drives most purchases due to its large industrial base. Canada contributes steady demand from mining and pulp mills. Replacement of aging machinery supports recurring consumption across service workshops.

Europe

Europe accounts for nearly 28% share in 2024 and remains a key region. Demand rises from marine engineering, rail workshops, and heavy industrial plants. Germany, Italy, and the U.K. show strong refurbishment cycles for turbines and compressors. Regulatory pressure encourages the shift toward lead-free alloys. Industrial operators focus on long equipment life and fewer failures. European service centers upgrade casting and bonding methods to improve durability. Steady modernization in manufacturing supports alloy usage.

Asia Pacific

Asia Pacific captures about 24% share in 2024 and shows strong growth. China, India, Japan, and South Korea expand machinery production each year. Rising industrial output increases demand for high-performance bearing linings. Many factories run continuous processes that rely on stable Babbitt alloys. Marine engine overhaul activity supports demand in coastal regions. Expanding steel and power capacity boosts consumption in replacement cycles. OEM and aftermarket sectors both expand across the region.

Latin America

Latin America holds around 8% share in 2024 with steady expansion. Demand comes from mining, marine transport, and heavy industrial repair. Brazil and Mexico lead regional usage due to large machinery fleets. Many operators invest in refurbishment instead of full equipment replacement. This raises the need for reliable Babbitt-lined bearings and bushings. Service workshops upgrade alloy quality to improve durability. Growth remains moderate but consistent across key industries.

Middle East and Africa

Middle East and Africa represent nearly 6% share in 2024 with stable demand. Oil and gas plants generate recurring needs for bearing relining. Power stations and desalination facilities also rely on Babbitt alloys. Gulf countries invest in industrial machinery upgrades each year. Africa shows demand growth from mining operations in key regions. Service providers supply tin-rich grades for high-load applications. Market expansion remains linked to infrastructure and industrial development.

Market Segmentations:

By Type

- Tin-Based

- Lead-Based

- Copper-Based

- Cadmium-Based

- Zinc-Based

By Application

- Bearings

- Bushings

- Engine Components

- Industrial Machinery

- Marine Applications

- Railways

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Babbitt Metal Market features strong competition from leading manufacturers such as Morgan Advanced Materials, Atlas Bronze, Timken, RotoMetals, MetalTek International, Tin Bronze, National Bronze Mfg., Concast Metal Products, Belmont Metals, and Bearing Bronze Limited. The competitive landscape is shaped by continuous upgrades in alloy formulations, improved centrifugal casting techniques, and rising demand for high-performance bearing materials across heavy industries. Producers focus on enhancing fatigue resistance, load capacity, and durability to meet the needs of power plants, marine fleets, and industrial machinery operators. Many suppliers expand service capabilities, including rebabbitting, machining, and custom alloy development to strengthen customer retention. Companies also invest in cleaner, lead-free compositions to align with global regulations and environmental standards. Growing adoption of predictive maintenance encourages buyers to choose high-quality materials that reduce failure risks. Competition remains intense as both global and regional players work to secure long-term contracts in OEM and aftermarket sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Morgan Advanced Materials sold its global Molten Metals Systems business, which provided crucibles and melting solutions for non-ferrous metals production, to Vesuvius plc.

- In 2024, Timken unveiled a new line of babbitt-bearing inserts designed for high-load marine and energy sector applications

- In 2023, National Bronze Manufacturing continues its operations as manufacturers and distributors of bronze bushings, custom bronze bearings, and non-ferrous alloys.

- In 2022, RotoMetals offers Babbitt Bearing Alloys in various grades including lead-free high tin and lead-based grades.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as industries upgrade rotating equipment.

- Tin-based alloys will gain wider adoption due to stronger performance and regulatory compliance.

- Demand for advanced bearing materials will rise in power generation and steel production.

- Marine and rail refurbishment programs will support long-term consumption.

- Digital monitoring systems will increase replacement frequency for worn linings.

- Alloy suppliers will invest in improved casting and bonding technologies.

- Eco-friendly and lead-free alloy development will accelerate across major regions.

- Aftermarket services will expand as operators extend the life of aging machinery.

- Industrial expansion in Asia Pacific will drive new OEM opportunities.

- Competition from composite materials will push producers toward higher-performance formulations.