Market Overview

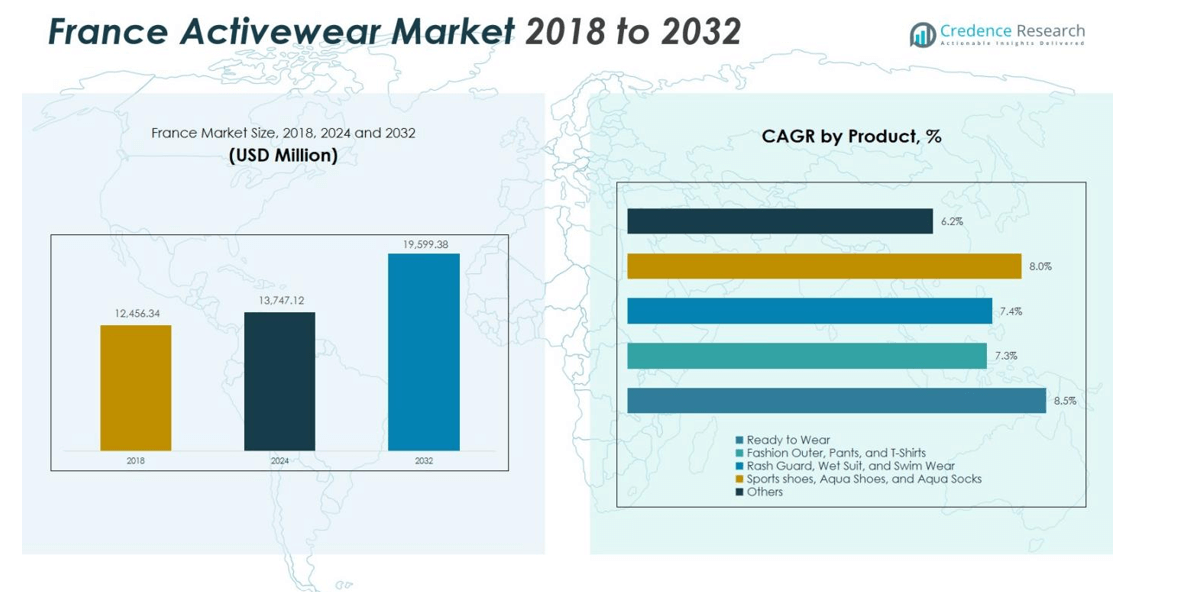

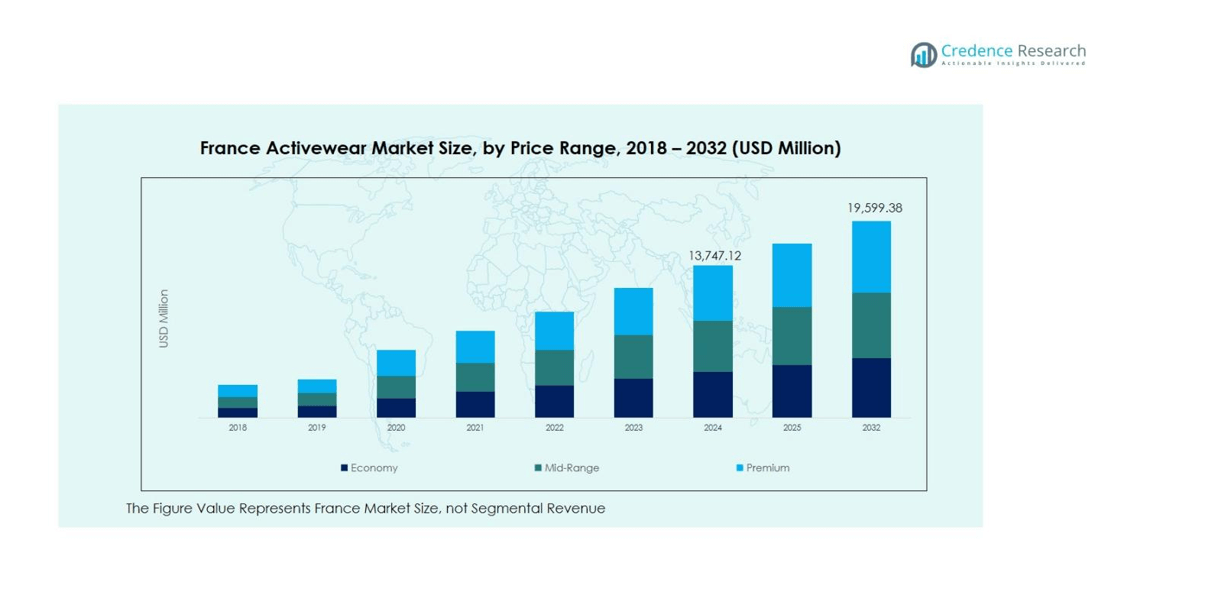

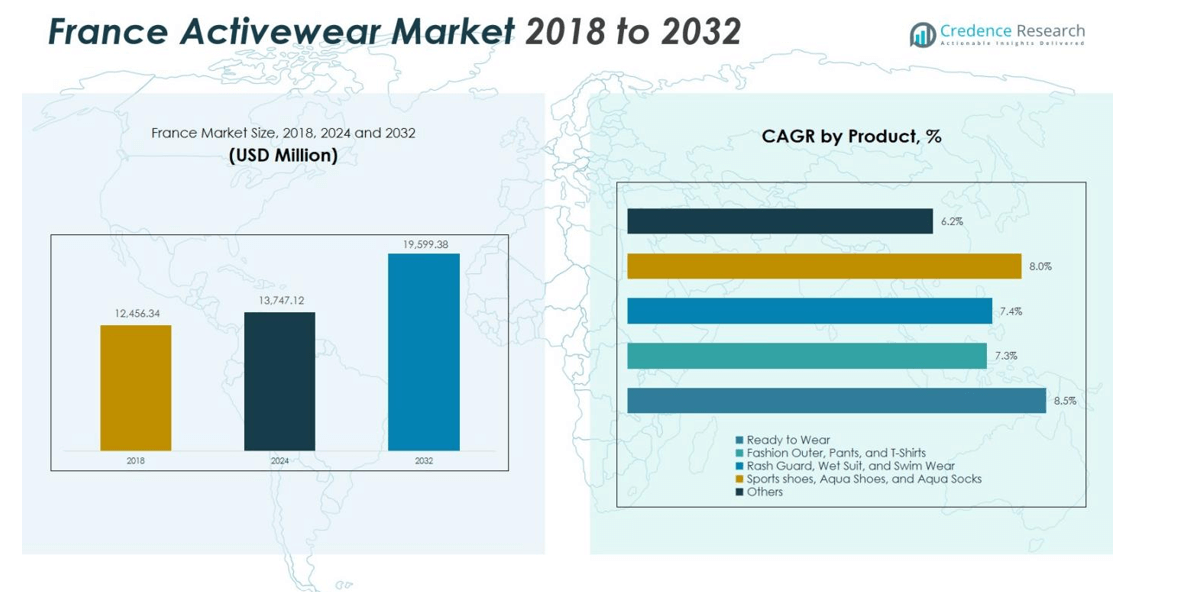

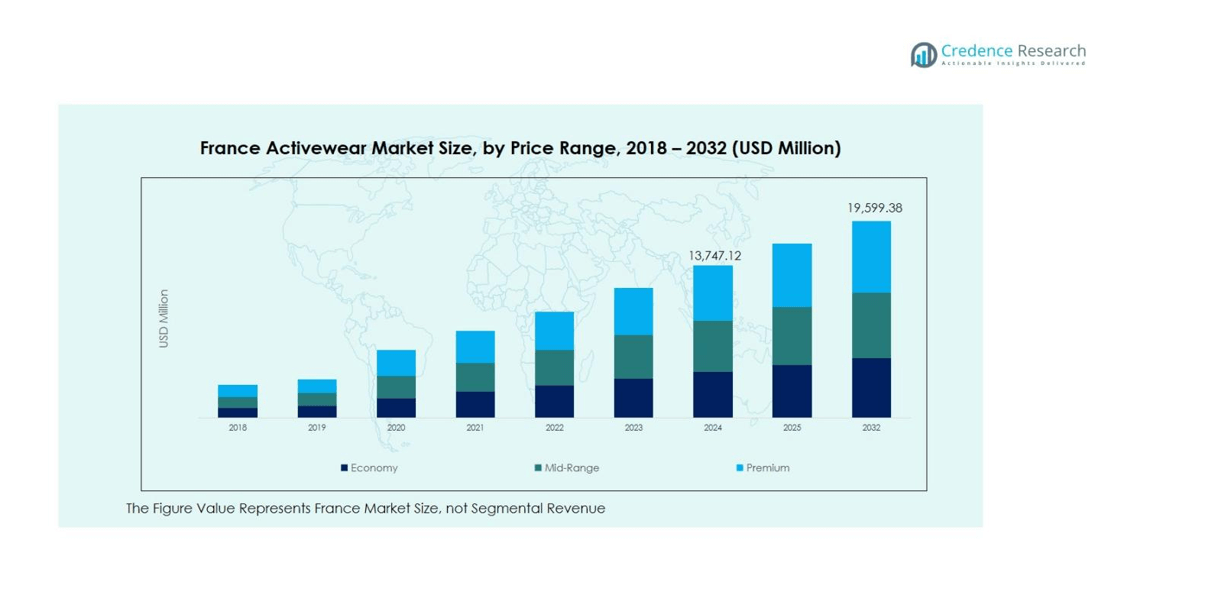

The France Activewear Market size was valued at USD 12,456.34 Million in 2018, increased to USD 13,747.12 Million in 2024, and is anticipated to reach USD 19,599.38 Million by 2032, at a CAGR of 4.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Activewear Market Size 2024 |

USD 13,747.12 Million |

| France Activewear Market, CAGR |

4.53% |

| France Activewear Market Size 2032 |

USD 19,599.38 Million |

The France Activewear Market features leading players like Nike, Adidas, Puma, Under Armour, Lacoste and Le Coq Sportif, performing strongly across national and regional channels. The market is predominantly concentrated in the Paris & Île‑de‑France region, which holds a market share of 45%, benefitting from high population density, strong retail infrastructure and a fashion‑forward consumer base. Provence‑Alpes‑Côte d’Azur follows with a 15% share, driven by active‑outdoor lifestyles and coastal climate. Auvergne‑Rhône‑Alpes accounts for 12%, buoyed by sports culture and winter‑sports demand, while Nouvelle‑Aquitaine commands 10%, shaped by a mix of urban and coastal activewear demand.

Market Insights

- The France Activewear Market is valued at USD 13,747.12 million in 2024 and is projected to reach USD 19,599.38 million by 2032, growing at a CAGR of 4.53%.

- Rising interest in athleisure and fitness‑led lifestyles is driving demand for the ready‑to‑wear product segment, which holds about 40 % share, and fabric innovations such as polyester (50 % share) are gaining prominence.

- Key trends include the expansion of online retail channels, increasing focus on women’s activewear, and growth in sustainable materials and eco‑friendly production across the market.

- Market restraint arises from heightened price sensitivity among consumers and intense rivalry among global and local brands, forcing margins and innovation pressures.

- Regional analysis shows the Paris & Île‑de‑France region as the dominant area with about 45 % share, followed by Provence‑Alpes‑Côte d’Azur at 15 %, Auvergne‑Rhône‑Alpes at 12 %, and Nouvelle‑Aquitaine at 10 %.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The France Activewear Market is dominated by the “Ready to Wear” segment, holding a significant share due to the increasing demand for comfort and style in everyday activewear. Ready-to-wear products are widely preferred for their convenience and versatility, contributing to a market share of 40%. This segment benefits from the growing trend of athleisure, where consumers seek clothing that can transition from workouts to casual outings. Other segments like Fashion Outer, Pants, and T-Shirts also hold strong shares as consumers look for functional yet stylish options.

- For instance, Le Coq Sportif, a major French sportswear brand, focuses on producing ready-to-wear performance and lifestyle apparel that caters to both athletic and casual wear needs.

By Fabric

Polyester remains the dominant fabric in the French activewear market, accounting for 50% of the total market share. The material is favored for its moisture-wicking properties, durability, and affordability. Additionally, the demand for spandex and nylon is also rising as these fabrics offer flexibility and comfort, contributing to the growth of performance-oriented activewear. While polyester continues to lead, the rising focus on sustainability has increased the adoption of eco-friendly fabrics like cotton, which also commands a solid share within the fabric segment.

- For instance, the brand Veja uses organic cotton and recycled plastic materials in its activewear and footwear lines, promoting sustainability without compromising performance.

By Material

The synthetic material segment leads the France Activewear Market, with a market share of 65%. This is driven by the superior performance characteristics of synthetic materials, such as moisture control, elasticity, and durability, making them ideal for activewear. Polyester and spandex, in particular, are popular choices due to their high stretchability and comfort. Natural materials are gaining attention for their sustainable properties, but they currently hold a smaller share as synthetic materials remain more dominant in the performance segment.

Key Growth Drivers

Increasing Popularity of Athleisure

The rise of athleisure has significantly contributed to the growth of the France Activewear Market. Consumers increasingly prefer activewear not only for physical activities but also for everyday wear, blending fashion with functionality. This trend has been fueled by the growing focus on fitness and wellness, along with the desire for comfortable yet stylish clothing that can transition seamlessly from workouts to casual settings. The athleisure movement, particularly among younger demographics, continues to drive demand, propelling the growth of the market.

- For instance, Nike showcased innovative national uniforms and footwear technology at their Paris event, highlighting the fusion of performance and fashion tailored for athletes and lifestyle consumers.

Focus on Sustainability

Sustainability has become a key growth driver in the France Activewear Market. With increasing awareness of environmental issues, consumers are prioritizing eco-friendly fabrics and ethically produced products. Brands are responding by incorporating sustainable materials like organic cotton, recycled polyester, and biodegradable fibers into their activewear lines. This shift is encouraging environmentally conscious consumers to invest in products that align with their values, contributing to the market’s expansion as demand for green alternatives rises.

- For instance, Adidas has partnered with Parley for the Oceans, creating shoes with uppers made from at least 50% ocean plastic waste, combined with recycled polyester.

Technological Advancements in Fabrics

Technological innovation in fabric development is a major growth driver in the France Activewear Market. Fabrics that offer enhanced breathability, moisture-wicking properties, and greater comfort are gaining popularity among consumers seeking high-performance wear. Technologies like moisture management, UV protection, and odor control are increasingly being integrated into activewear. These advancements not only improve the overall quality and functionality of activewear but also appeal to consumers who value performance-driven products, boosting the market’s growth.

Key Trends & Opportunities

Rise of Online Retail

The shift to online shopping presents a significant opportunity for the France Activewear Market. E-commerce platforms offer convenience and access to a wide variety of brands and products, making it easier for consumers to purchase activewear. The COVID-19 pandemic accelerated this trend, and as online shopping continues to gain traction, many activewear brands are investing heavily in their digital presence. This trend offers the potential for rapid market expansion, particularly in reaching tech-savvy and younger demographics who prefer online shopping over traditional retail channels.

- For instance, Nike has enhanced its digital presence through immersive experiences like the Nike SNKRS app, which uses augmented reality (AR) for exclusive sneaker releases, and the Nike Training Club (NTC) app, which offers personalized fitness plans.

Growth in Women’s Activewear

The women’s segment within the France Activewear Market is experiencing rapid growth, driven by the increasing participation of women in sports and fitness activities. Activewear brands are designing products that cater specifically to female consumers, focusing on fit, style, and performance. Additionally, the growing number of women adopting active lifestyles and the demand for stylish, functional clothing further propel this trend. As more brands target female consumers with specialized offerings, the market for women’s activewear is poised for continued expansion.

- For instance, French brand Marie Louise Paris has gained over 10,000 customers with sportswear combining elegance, comfort, and performance, catering to women seeking both style and functionality in their activewear.

Key Challenges

Price Sensitivity Among Consumers

Price sensitivity remains a challenge in the France Activewear Market, particularly as the demand for high-quality, branded activewear continues to grow. While consumers seek performance-driven clothing, many are also mindful of their budgets, especially in the face of economic uncertainty. This presents a challenge for brands, as they must balance offering premium, innovative products with affordable pricing options. In order to cater to a wider audience, brands must develop strategies to maintain product quality while keeping prices competitive in a crowded marketplace.

Intense Competition

The France Activewear Market is highly competitive, with numerous global and local brands vying for market share. Major players such as Nike, Adidas, and Puma face pressure from smaller, emerging brands that offer unique designs and often target niche segments. This intense competition results in a continuous need for innovation and differentiation, forcing companies to invest heavily in marketing, product development, and customer loyalty programs. Maintaining a strong brand identity and keeping up with consumer preferences are key challenges that brands must address to stay ahead in the market.

Regional Analysis

Paris & Île-de-France Region

The Paris & Île-de-France region dominates the France Activewear Market, holding the largest market share of 45%. As the most populous region in France, it benefits from a large consumer base, contributing significantly to activewear demand. The region’s fashion-forward culture and growing focus on fitness and wellness have led to a surge in athleisure and performance-oriented activewear. With a high concentration of retail stores and e-commerce platforms, Paris serves as the epicenter of the activewear market, driving growth and innovation in this sector.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur holds a strong market share of 15% in the France Activewear Market. The region’s active outdoor lifestyle, fueled by popular activities such as hiking, cycling, and water sports, makes it a key market for durable, high-performance activewear. The coastal climate and Mediterranean influences lead to an increased demand for lightweight and breathable activewear. As the trend for outdoor and fitness activities grows, the Provence-Alpes-Côte d’Azur region continues to contribute significantly to the overall market growth.

Auvergne-Rhône-Alpes

The Auvergne-Rhône-Alpes region captures 12% of the France Activewear Market share. Known for its diverse landscape, this region caters to both outdoor and urban activewear demand. Cities like Lyon and Grenoble are hubs for sports enthusiasts, where fitness activities and winter sports like skiing fuel the market. The region’s growing fitness culture, along with increasing participation in wellness activities, has contributed to the rise in demand for performance-driven activewear. This trend positions Auvergne-Rhône-Alpes as a significant player in the market’s expansion.

Nouvelle-Aquitaine

Nouvelle-Aquitaine represents 10% of the France Activewear Market share. This region benefits from a balanced mix of urban and rural populations, with diverse consumer preferences for activewear. The active lifestyle in cities like Bordeaux, combined with coastal areas encouraging water sports, boosts demand for versatile activewear. Additionally, the increasing interest in sustainable and eco-friendly products is driving growth in the activewear segment. As fitness culture becomes more mainstream, Nouvelle-Aquitaine’s market share is poised to expand further, contributing to the overall market development.

Market Segmentations:

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swim Wear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material :

By Price Range :

- Economy

- Mid-Range

- Premium

By Distribution Channel

By Region

- Paris & Île-de-France Region

- Provence-Alpes-Côte d’Azur

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

Competitive Landscape

The France Activewear Market is highly competitive, with major players such as Nike, Adidas, Puma, Under Armour, Lacoste, and Le Coq Sportif leading the way. These global brands dominate the market through extensive product portfolios, strong brand recognition, and a deep connection with fitness and sports culture. In addition to these established players, local brands like Salomon, Aigle, and Hopaal also hold significant shares by catering to the specific preferences of French consumers, including a growing demand for eco-friendly products. The competition in this market is intense, with companies constantly innovating to offer products that combine fashion, performance, and sustainability. Technological advancements in fabric and design, along with an increasing focus on online retail, further fuel the rivalry. Pricing strategies, product differentiation, and brand loyalty are crucial in maintaining a competitive edge, as each player strives to appeal to a wide range of demographics, from fitness enthusiasts to fashion-conscious consumers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lacoste

- Le Coq Sportif

- Salomon

- Aigle

- Hopaal

- Airness

- Nike

- Adidas

- Puma

- Under Armour

Recent Developments

- In November 2025, Decathlon launched the “EuroSuit” space‑suit prototype in partnership with CNES, Spartan Space and MEDES, designed for use on the European Space Agency’s ISS missions.

- In October 2025, Alo Yoga announced that it will open a flagship store on the Champs‑Élysées in Paris in 2026, signalling a major push into France for the international activewear brand.

- In November 2025, Inditex announced its intensification of efforts in the activewear market across France and Europe through its label Oysho, repositioning it toward technical‑activewear lines and launching new workout‑community initiatives

Report Coverage

The research report offers an in-depth analysis based on Product, Fabric, Material, Price Range, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Activewear Market is expected to continue its steady growth driven by increasing consumer demand for fitness and wellness products.

- Athleisure will remain a dominant trend, with more consumers seeking versatile activewear that transitions seamlessly from workouts to everyday wear.

- Sustainable and eco-friendly activewear will see growing demand as consumers prioritize environmentally responsible purchasing decisions.

- Technological advancements in fabric and wearables will enhance product performance, driving further innovation in the market.

- The rising popularity of outdoor activities like hiking, cycling, and water sports will fuel demand for durable, high-performance activewear.

- Online retail will continue to play a crucial role, with more activewear brands enhancing their e-commerce strategies to reach a broader consumer base.

- Women’s activewear will see significant growth, with increasing participation of women in fitness and sports activities.

- The integration of smart fabrics and wearable technology in activewear will open up new opportunities for performance-enhancing products.

- The demand for premium activewear will rise, as consumers seek higher-quality, long-lasting products that offer superior performance and comfort.

- Local and emerging brands will increasingly compete with global players by focusing on niche segments, such as sustainable or locally produced activewear.