Market Overview

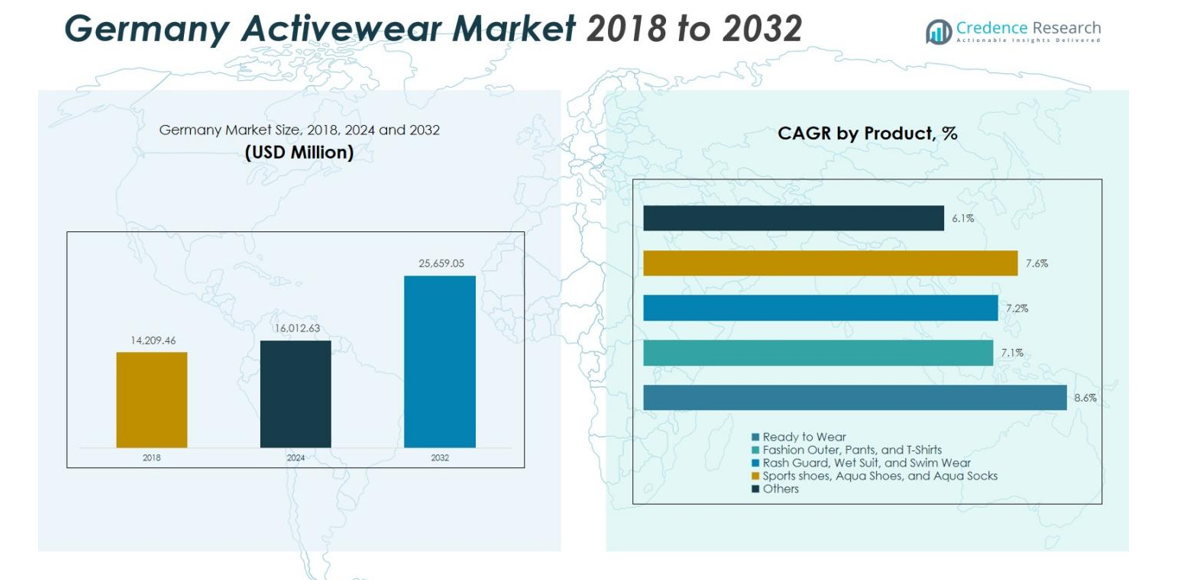

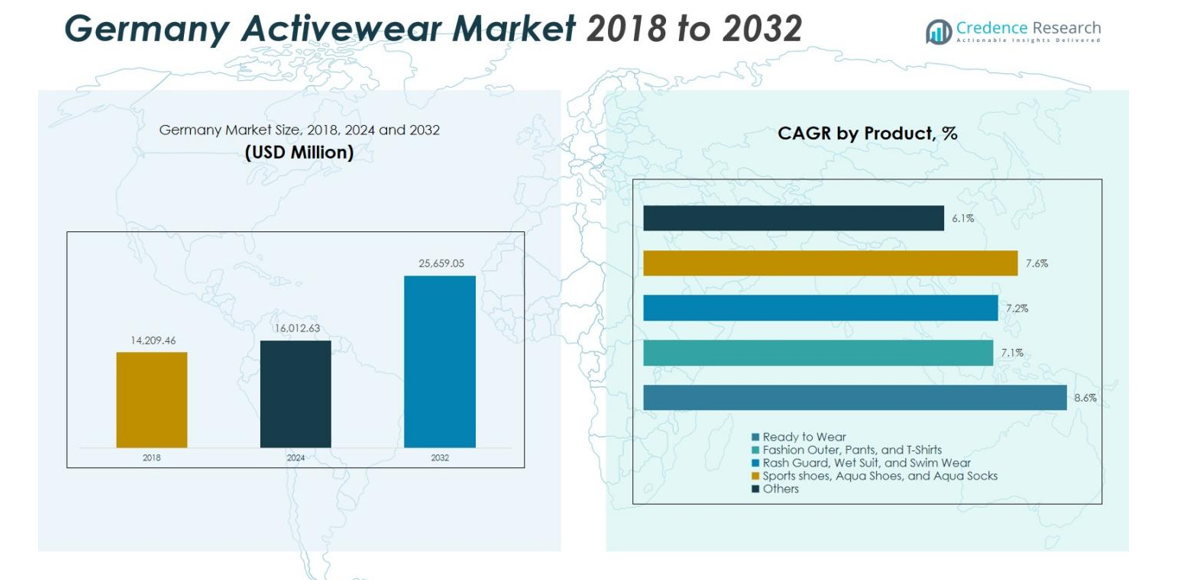

The Germany Activewear Market was valued at USD 14,209.46 Million in 2018, increasing to USD 16,012.63 Million in 2024. It is anticipated to reach USD 25,659.05 Million by 2032, growing at a CAGR of 6.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Activewear Market Size 2024 |

USD 16,012.63 Million |

| Germany Activewear Market, CAGR |

6.07% |

| Germany Activewear Market Size 2032 |

USD 25,659.05 Million |

The Germany Activewear Market features leading players including Adidas AG, PUMA SE and Nike, Inc., which dominate the competitive landscape with strong brand equity, extensive product portfolios and widespread distribution. These firms capitalise on Germany’s highest‑share region, Southern Germany, which holds about 30% of the market, followed by Western Germany with 25%, Northern Germany with 20%, Eastern Germany with close to 15%, and other rural and island regions contributing 10%. Through strategic marketing, omni‑channel expansion and innovation in athleisure and performance apparel, these players sustain leading positions while adapting to regional preferences and spending behaviour.

Market Insights

- The Germany Activewear Market was valued at USD 16,012.63 million in 2024 and is projected to grow at a CAGR of 6.07% through 2032.

- Rising health and fitness awareness among German consumers and the growing popularity of athleisure wear are driving segment gains, with the Ready to Wear category holding 35% and Sports Shoes/Aqua Shoes/Aqua Socks capturing 28%.

- Sustainability and smart activewear innovations are emerging trends as manufacturers introduce recycled materials and wearable‑tech garments, while synthetic materials account for 65% of usage compared with 35% for natural materials.

- Leading brands such as Adidas AG, PUMA SE and Nike Inc. dominate the market, leveraging strong retail and e‑commerce presence; Southern Germany leads regionally with 30% of the market share, followed by Western Germany at 25% and Northern Germany at 20%.

- Rising raw‑material costs and intense pricing pressure pose restraints on the market, particularly affecting mid‑tier brands and limiting margin expansion for players operating in the economy price range.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Ready to Wear segment dominates the Germany Activewear Market, holding 35% of the market share due to its widespread appeal and versatility. This segment includes everyday wear items that offer comfort, style, and functionality, making them a top choice for activewear consumers. Sports Shoes, Aqua Shoes, and Aqua Socks follow closely, capturing 28% of the market, driven by increasing demand for specialized footwear for fitness and water activities. The market is also growing in Fashion Outer, Pants, and T-Shirts, with this segment holding 22%. The “Others” category contributes 15% to the overall growth.

- For instance, Adidas has integrated 96% recycled polyester in its apparel, combining sustainability with comfort and modern design.

By Fabric

Polyester leads the fabric segment in the Germany Activewear Market, capturing the largest share of 40% due to its durability, moisture-wicking properties, and affordability. Nylon follows with a share of 25%, driven by its strength and flexibility, particularly in activewear. Spandex holds 18% of the market, favored for its elasticity. Neoprene accounts for 8% of the market, rising in popularity due to its use in wetsuits and performance garments. Polypropylene and Cotton together contribute 9%, with Cotton appealing to consumers seeking comfort wear. The “Others” category represents 6%.

- For instance, Nike’s Dri-FIT line also relies on polyester yarn, which dries quickly and maintains shape through repeated use, making it ideal for athletic performance.

By Material

In the Germany Activewear Market, Synthetic materials dominate with 65% of the market share, primarily driven by their superior performance, moisture-wicking abilities, and lightweight nature. Natural materials hold around 35% of the market share, appreciated for their comfort and eco-friendliness, particularly in sustainable activewear products. The demand for synthetic fabrics like Polyester and Spandex is growing as they offer better durability and flexibility, making them the preferred choice in activewear for high-intensity workouts and sports.

Key Growth Drivers

Rising Health and Fitness Consciousness

The growing health and fitness awareness in Germany is a key growth driver for the activewear market. Consumers are increasingly focused on maintaining a healthy lifestyle, contributing to higher demand for performance-oriented activewear. Fitness activities such as running, cycling, and gym workouts have become popular among all age groups. This shift in lifestyle has led to a surge in activewear purchases, as consumers seek clothing that enhances comfort, performance, and style during workouts. This trend is expected to continue, further boosting the market’s growth.

- For instance, Puma launched its new Studio48 creative hub at its Herzogenaurach headquarters, providing designers with advanced tools like 3D printing and athlete testing labs.

Increasing Adoption of Athleisure

Athleisure has seen significant growth in Germany, fueled by its appeal as both functional workout gear and stylish everyday wear. Consumers are increasingly opting for versatile clothing that transitions seamlessly from the gym to casual settings. This trend is being driven by the desire for comfort and convenience, with many preferring clothing that can be worn for both fitness activities and daily life. As a result, athleisure brands are expanding their product lines, targeting a broader consumer base and contributing to the overall growth of the activewear market.

- For instance, Adidas introduced a fashion-forward Sportswear line positioned between its Performance and Originals ranges, designed to appeal to style-conscious consumers who want comfortable, everyday athletic-inspired outfits rather than only technical training gear.

E-commerce Expansion

The rapid growth of e-commerce in Germany has played a significant role in driving the activewear market. Online shopping offers consumers greater convenience, access to a wide range of products, and the ability to compare prices. With an increasing number of activewear brands enhancing their digital presence, e-commerce platforms are becoming the preferred shopping channel for activewear consumers. The expansion of online sales channels, coupled with the rise of direct-to-consumer models, is expected to continue fueling market growth in the coming years.

Key Trends & Opportunities

Sustainable and Eco-friendly Activewear

Sustainability has become a major trend in the Germany Activewear Market, with consumers becoming more conscious of the environmental impact of their purchasing decisions. As a result, there is increasing demand for eco-friendly materials such as recycled polyester and organic cotton in activewear products. Brands are responding by incorporating sustainable practices in their manufacturing processes, including the use of recycled fabrics, eco-friendly dyes, and reducing waste. This trend presents an opportunity for brands to tap into the growing market of environmentally conscious consumers while meeting evolving consumer preferences.

- For instance, Puma launched its “Design to Be Recycled” collection in Germany, featuring mono-material garments made from recycled polyester designed to simplify future recycling.

Innovation in Smart Activewear

The integration of technology into activewear is emerging as a key opportunity in the German market. Smart fabrics and wearable technologies, such as fitness trackers and moisture-detecting fabrics, are becoming more prevalent. These innovations offer consumers personalized fitness data, enhancing their workout experience. As technology continues to evolve, activewear brands have the opportunity to introduce products with advanced functionalities that improve performance and health monitoring. This trend is poised to attract tech-savvy consumers and expand the market for high-tech activewear products.

- For instance, Noxon, a German company, has developed smart fabrics with bionic sensors that monitor muscle activation and health, offering personalized fitness guidance for athletes.

Key Challenges

Intense Market Competition

The Germany Activewear Market is highly competitive, with numerous global and local brands vying for market share. Established players such as Adidas, Nike, and Puma face competition from new entrants offering innovative products at competitive prices. Additionally, the increasing number of direct-to-consumer brands is intensifying price pressures. For brands to succeed, it is essential to differentiate themselves through innovation, product quality, and customer loyalty. The high level of competition could impact profit margins, posing a challenge for both established and emerging companies in the market.

Rising Production Costs

Rising production costs, particularly due to the increasing price of raw materials such as fabrics and labor, present a challenge to activewear manufacturers in Germany. The demand for high-quality, sustainable materials is further driving up production costs, which could affect the pricing of activewear products. While consumers are increasingly inclined towards sustainable options, the higher cost of these materials may limit the affordability of such products for price-sensitive segments of the market. Manufacturers need to balance sustainability with cost efficiency to maintain profitability and market competitiveness.

Regional Analysis

Northern Germany

The Northern Germany region captures an estimated 20% of the national activewear market. With strong metropolitan centres like Hamburg and Bremen, high disposable incomes and early adoption of fitness culture drive demand for stylish athleisure and performance wear. Retail infrastructure is well developed, and online channels further fuel growth. The consumer base leans toward urban professionals seeking lifestyle‑oriented activewear, while tourism and outdoor activity trends bolster demand for multifunctional apparel in this region.

Southern Germany

In Southern Germany the market share stands 30%, making it the leading regional contributor. This region benefits from affluent cities such as Munich and Stuttgart, strong brand presence of domestic players, and well‑established retail ecosystems. Consumers in Southern Germany show elevated demand for premium and innovative activewear due to higher spending capacity and active outdoor lifestyles. The mountainous terrain, hiking culture and winter sports season further boost demand for specific activewear categories. Brand loyalty and premium positioning are particularly pronounced here.

Western Germany

Western Germany accounts for 25% of the activewear market. With dense population centres in the Rhine‑Ruhr metropolitan area, strong industrial base and robust retail penetration, this region appeals to mass‑market activewear brands. The demand is driven by both functional workout apparel and fashion‑forward athleisure. E‑commerce adoption is high, supported by effective logistics and urban connectivity. The competitive environment in Western Germany pushes brands to invest in local marketing, omnichannel distribution and value‑added features to capture share.

Eastern Germany

Eastern Germany holds close to 15% of the national market. While growth lags somewhat behind other regions due to lower average incomes and slower retail expansion, improvement in infrastructure and rising fitness awareness are narrowing the gap. There is growing traction for budget‑friendly activewear and domestic brand penetration in this region. Growth opportunities lie in tier‑II/III cities and online channels, as consumers increasingly seek comfort, style and functionality at accessible price points in this region.

Other Regions (including rural & island markets)

The remaining regions (including rural markets and island territories) represent about 10% of the total market. These areas show emerging but slower adoption of premium activewear categories. Demand tends toward economy and mid‑range activewear, supported by entry‑level brands and value‑for‑money propositions. Growth in these regions is expected to stem from improved distribution reach, mobile commerce uptake and increasing health awareness outside major urban hubs.

Market Segmentations:

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swim Wear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material :

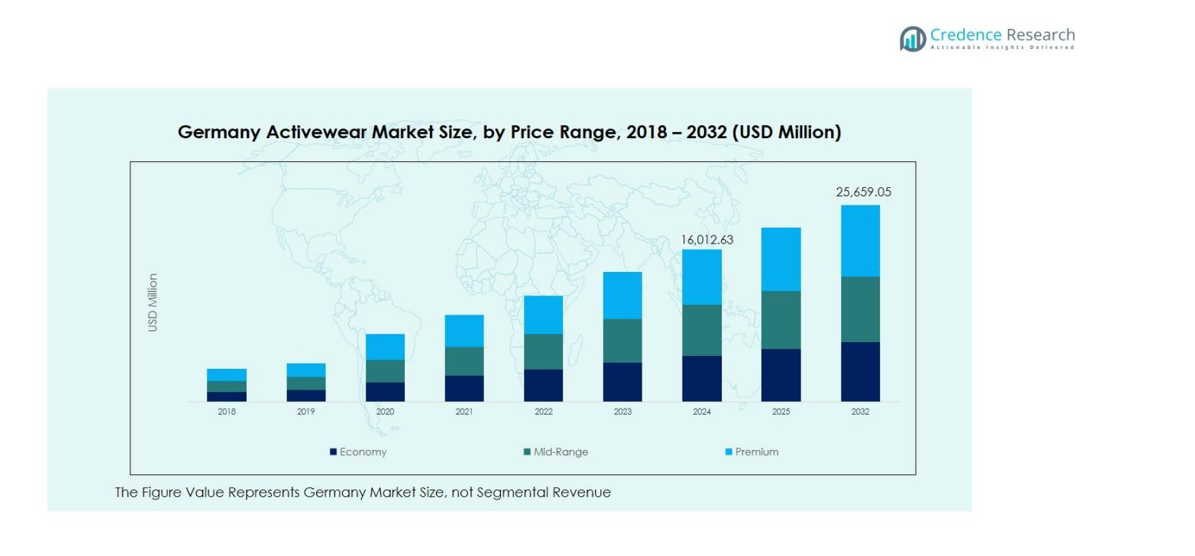

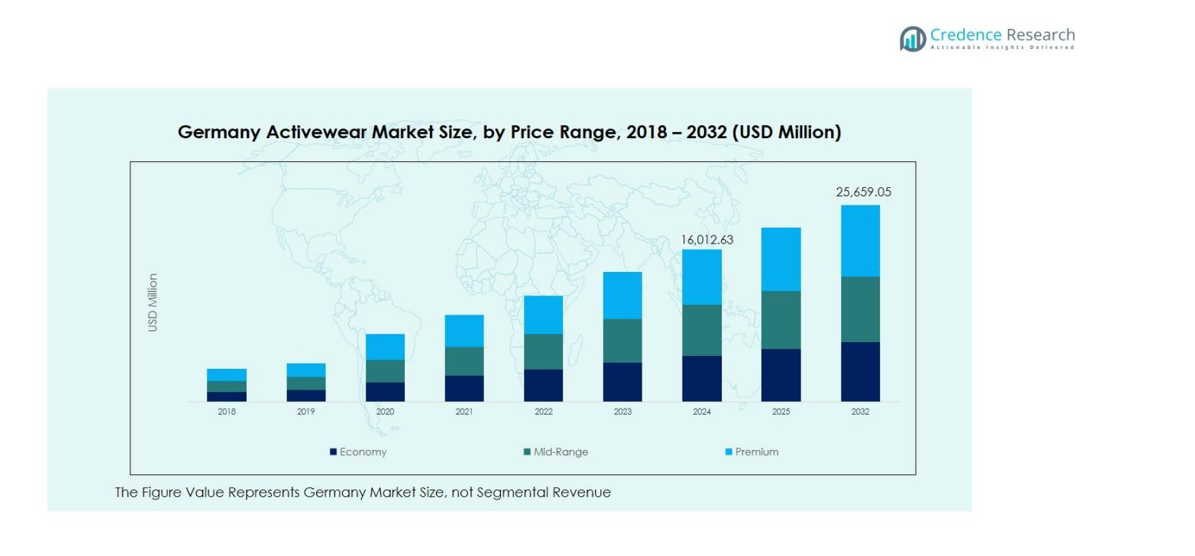

By Price Range :

- Economy

- Mid-Range

- Premium

By Distribution Channel

By Region

- Northern Germany

- Western Germany

- Southerner Germany

- Eastern Germany

- Other Regions

Competitive Landscape

The competitive landscape in the Germany activewear market features major players such as Adidas AG, PUMA SE and Nike Inc., each leveraging brand heritage and innovation to secure leadership positions. Adidas, with its strong German roots, emphasises product performance and sustainability to maintain dominance, while Puma focuses on fashion‑forward collaborations and direct‑to‑consumer expansion to gain traction. Nike, a global powerhouse, applies premium positioning and digital engagement to appeal to urban and younger consumers in Germany. To compete effectively, brands are intensifying investment in omni‑channel distribution, leveraging e‑commerce growth and retail footprint optimization. Further, differentiation through sustainable materials, smart activewear technology and lifestyle‑driven product lines is becoming essential as market saturation deepens. Smaller and niche brands attempt to capture specialist segments such as outdoor/fashion activewear or budget performance wear, intensifying price and feature competition. Consequently, profit margins face pressure and staying ahead demands continuous innovation, strong branding and agile supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Adidas

- Puma

- Nike

- Under Armour

- Reebok

- Lululemon

- Jack Wolfskin

- Salomon

Recent Developments

- In June 2025, adidas launched the RS15 Avaglide—the company’s first women’s‑specific rugby boot built for performance and anatomical fit for female players.

- In December 2024, Puma SE inaugurated Studio48, a new creative hub at its headquarters in Herzogenaurach, Germany, to advance design of performance and sport‑style apparel.

- In November 2024, Adidas Sportswear launched its first‑ever collaboration with Moon Boot (based in Italy), combining activewear, outerwear and footwear with street‑style and winter ski‑heritage design codes; the drop launched worldwide on 7 November 2024

Report Coverage

The research report offers an in-depth analysis based on Product, Fabric, Material, Price Range, Distribtuion Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth will be driven by escalating health and fitness awareness among German consumers, prompting higher demand for performance‑oriented activewear.

- The sustained rise of athleisure, blending workout apparel with casual everyday wear, will open broader market segments and amplify adoption across demographics.

- Online retail channels will expand further, with brands strengthening their direct‑to‑consumer e‑commerce models and leveraging omnichannel integration to capture digital shoppers.

- Sustainable and eco‑friendly material innovation will become a key differentiator, as German consumers increasingly seek ethical and environmentally conscious activewear options.

- Smart and connected apparel (e.g., moisture‑sensing fabrics, integrated wearable tech) will provide new product opportunities, especially among tech‑savvy fitness‑enthusiasts.

- Premium‑priced product tiers will exhibit faster growth, as discerning consumers invest in high‑quality, brand‑led activewear for performance as well as lifestyle use.

- Mid‑ and economy‑price tiers will also grow steadily, particularly in non‑metropolitan and value‑sensitive segments, widening market penetration.

- Regional expansion into tier‑II/III cities and rural areas will unlock moderate growth, driven by rising fitness culture and improved distribution in less urbanised zones.

- Brands will face margin pressure from raw‑material cost inflation and intense competition, pushing greater emphasis on supply‑chain efficiency and product differentiation.

- Partnerships and collaborations with influencers, fitness platforms and sports organisations will increase to enhance brand visibility and engage younger consumer cohorts.